Imagine being able to accurately predict the future, being able to answer those Google questions for which the answers are not yet known, and most importantly, being able to get tangible results from this skill. Augur, a decentralized prediction market, will easily allow us to do this. Using a scientific principle known as the “wisdom of the crowd,” Augur offers the experience of being a clairvoyant.

What is a prediction market?

Before diving into the details of the Augur token and its project, it is first necessary to understand what a prediction market is. Essentially, a prediction market is an exchange designed to predict the outcome of events. Traders buy and sell stocks that are tied to some event. Conventionally, it turns out like this: if “this” happens, then my asset will cost “this much”; if “this” doesn’t happen, my asset will be worth “this much.” A 2011 study suggests that prediction markets are every bit as reliable as institutions that predict similar outcomes through some panel of experts. These markets rely on the predictive accuracy of the collective, based on the wisdom of the crowd hypothesis. The fundamental principle is that the average answer from many votes is more accurate than any expert or small group. This is what allows for the creation of forecasting tools, where it is possible to create confident forecasts of future outcomes and act accordingly.

This is not as profanation as it might seem at first glance. In the past, even Google used internal prediction markets to gauge the potential of new products. Employees were encouraged to place bets using “Goobles,” Google’s imaginary currency.

What is Augur?

Augur is a project that calls itself “the future of predictions.” Currently in beta, it is a decentralized prediction market that rewards participants for their knowledge and ability to accurately predict future events.

As with many other industries where blockchain technology is thriving, the fundamental problem with existing prediction markets is their centralization. These are standard problems: the market is easy to close, manipulate or compromise. Of course, another negative aspect of centralized prediction markets is that only one person guesses the outcome of an event, thereby compromising the entire process. This authority is also subject to mistakes, accidents, blackmail, and defamation. Augur decentralizes the platform for prediction markets. With Augur, anyone can create a marketplace dedicated to absolutely any topic: from sporting events, election results, even to the gender of a celebrity's child. The market maker asks the question, and once the market opens, thousands of people can buy shares tied to the outcome of the event.

What is Augur cryptocurrency

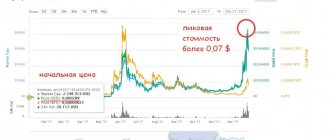

Cryptocurrency Augur (REP) is a very interesting project that has the opportunity to take a place in the gambling industry. Augur is a decentralized platform based on the Ethereum blockchain, with the help of which any network participant can make predictions on the outcome of any event in the world. In the future, the Augur platform may make a splash in the world of online gambling, in particular among bookmakers, among which there are many “offices” with dishonest thoughts, let alone online casinos.

The idea of the platform is to place bets on events within the Augur network, where the margin is several times less than the bookmaker’s, and network control is impossible due to decentralization. It is also worth noting the fact that the platform will have its own cryptocurrency, which has the ticker REP, and the use of fiat currencies is excluded. This arrangement of affairs excludes the possibility of influence by the state or other entities that want to cover up these activities.

Mechanism

Augur's documentation details the principles behind the project and also explains how the platform will work. Augur is built as an extension to Bitcoin Core. Augur intends to use a sidechain to ensure compatibility with the Bitcoin chain. A transaction is created that “locks” a certain number of tokens on the first blockchain, then creates a second transaction on the sidechain, making a link to the first transaction with the corresponding proof. Augur uses three crypto coins: BTC, ETH and its own ERC20 token, abbreviated REP. Augur's current settlement currency is Ether, which means that bets on the outcome of an event are made through the Ethereum blockchain. The internal REP token is used to reward people who provide accurate predictions and is not used for betting.

What determines the price of reputation coins?

When it comes to the cost of the Augur, the most significant thing in this case is the price of those very reputation tokens, since they are the ones that are in the possession of the participants and bring them profit. With them you can enter exchange trading and, in addition, they give you the right to receive part of the commission fee, as mentioned above. That is, REP holders automatically become owners of some part of Augur, but not the company, but only the business model. Therefore, it is important to understand which factors are important for determining the value of tokens:

- Prospects of the project. And he is really promising. To clear all doubts, just imagine the vastness of the global betting market. Its sports sector alone (betting on the results of sporting events) is estimated at $3 trillion. And if Augur becomes a popular platform for prediction markets (which he strives for), decentralized and open, allowing companies to create their own projects on its basis, then holders of reputation tokens will only be envious.

- Ecosystem development. The project we are considering exists in the Ethereum ecosystem, where it is among the leaders in terms of potential. And since Ethereum also does not shepherd its tail in the Blockchain space, it has already attracted and continues to attract a fair number of investors, business representatives, and simply enthusiasts of crypto development, then our application is not without the attention of this entire public.

True, this situation also contains risks, because Ethereum has many serious competitors among other decentralized platforms.

- Relations with regulatory authorities. Despite all the decentralization and openness, Augur is not guaranteed against attacks from various government regulators. You don't need to look far for an example. The company is working on creating a Prediction Fund, but has still not been able to obtain permission from US government agencies (it is in this country that the fund is located) to create the appropriate software. Of course, there is hope, because the company has very qualified lawyers and they are ready to engage in dialogue, but at the moment the issue is still not resolved. And this is a serious risk factor.

- The number of “judicial corps” (oracles). Now their number is approximately 2 thousand, which means that this is exactly how many people are making efforts to develop and promote Augur. Moreover, among these thousands there are well-known investors and prominent business representatives.

- Integrity of judges. The risks that are present in the “judicial” case may become a ticket to a brighter future for someone. In other words, an unscrupulous attitude towards their duties (fraud, loss of access, negligence) of some will cause the redistribution of tokens in favor of others. That is, sooner or later some of the coins will change their owners.

Prediction period

The forecasting market can be divided into two key phases: before and after an event occurs. The first is called the “prediction phase” and the second is called the “reporting phase”. Ethereum smrt contracts allow users to create any market to ask any question. The market maker provides a small amount of initial funding and then receives a commission from those who buy the shares. The so-called “trading fee” is essentially a transaction fee.

Reporting stage

After the event has occurred and the forecasting phase is completed, the reporting period begins. REP owners are strictly required to report the results of randomly selected events to Augur every time the network does a “reality check.” The default rate at which this occurs is every eight weeks, although this interval is configurable.

The reporting period is divided into two more phases. At the outset, the participant “forecasters” are assigned markets for which they must give their opinion. 30 days are allocated for preparing the report. During this period, reports from participants are transmitted securely and confidentially to the network. The truth is determined. Then those who made bets receive a corresponding profit or lose, and the “predictors” receive 50% of the trades. The higher the reputation, the higher the trust and the percentage received from the commission.

REP token

Augur REP is a digital token that represents the reputation of each participant in the Augur network. Its number is limited to 11 million. All of them were created during the Augur ICO. 80% of the total was sold to investors (8.8 million REP), and the remaining 20% (2.2 million REP) was divided between the Augur developers and the Forecast Foundation.

You do not need to own REP to use Augur. In fact, most Augur users will never use REP. As mentioned earlier, bets are placed on Bitcoin and Ethereum. It is important to mention that REP is not a value in itself, but rather an important component of the Augur platform. REP is used exclusively by users who report true event results. The Augur team makes it clear:

REP is a token that shows responsibility and reward; This is not a currency

Contrary to this statement, REP has real monetary value because it is the only way to access 50% of all trading fees on the Augur network. However, investing in a token can be considered a very high risk at this stage. Some people predict that trading fees will be around one percent.

At this time, it is difficult to determine the market potential for prediction markets, and as a result, REP's market capitalization is unclear.

Description of the main features

Augur is a crypto platform for making forecasts for specific events.

Often the collective wisdom is more accurate than market research.

On the site, forecasts are made on events in all areas of human activity, from politics to betting on football matches and forecasts for the delisting of one of the cryptocurrencies on the trading platform.

The Augur platform, unlike other sites for collective forecasts, has more extensive functionality, is completely decentralized, and always pays participants with good intuition. Clients can bet on any event absolutely confidentially.

Team

Augur cryptocurrency was released on November 17, 2014 and is one of the first projects on the Ethereum platform.

The team consists of 13 specialists, led by Jack Peterson and Joe Krug , who previously took part in the creation of the BTC Sidecoin .

Augur's advisors include Ethereum founder Vitalik Buterin .

In 2020, the Coinbase administration included Augur in the top five cryptocurrency projects.

Until 2020, the system was in beta testing.

After the release of the main network, the team eliminated the closed part of the program code, which allowed control of the project in emergency situations.

After this, the platform became completely decentralized.

Augur economic system

The augur platform is based on ethereum, which reliably protects the network from attacks by intruders.

Anyone who has access to the Ethereum blockchain can access Augur because this project is a set of smart contracts that exist on the ETH blockchain.

Augur itself is not a forecasting market; it is a cryptocurrency software that allows you to create your own platforms.

Any network user can use the services of the augur ethereum protocol.

via a desktop client application.

You can download the latest version of Augur App for Windows, Linux or Mac OS on GitHub https://github.com/AugurProject/augur-app/releases.

Users of the Augur protocol place bets at their own risk.

If you find Augur Desktop difficult to use, there is a link to the web application on the official website https://www.augur.net.

The Augur platform provides two ways to earn money:

- Creation of a forecast market.

- Forecast stock trading.

To create a market, a certain amount of ETH is required.

The forecast can be on any topic, for example, Will Bitcoin be above $10000 at the end of November 22nd ? The user who opens the survey issues a certain number of shares (shares), which will be purchased by other market participants.

It also specifies the creator's commission, which can range from 0/50% of the total reward to the survey winners.

The lower the commission percentage, the more actively other users will participate in the survey.

But at the same time, the commission fee must cover the costs of securing the issued shares.

To trade shares, you need to choose an interesting topic and buy a certain number of voting shares.

The price is within 0/1 ETH and is not fixed, but may change during the process.

You can bet on both positive and negative results.

A " yes " voter pays 60% and a " no " voter pays 40% of face value.

The participant is not obliged to keep his share until the end of the survey and can sell it if he considers such a deal profitable.

The buyer of shares can make money on resale or hold the shares until the end and, if successful, receive a win.

The award amount is calculated according to the formula:

Payout = total number of shares * price/number of marks

Marks are the price points between the lowest and highest cost of shares of a given survey. The winners pay a commission to the market creator and the decentralized oracle system.

The system's internal token is called REP.

Cryptocurrency Reputation is not needed to place bets, but is used by arbitrators during Augur's market dispute phases to confirm voting results.

REP holders must bet their tokens on the correct outcome of a specific market in order to receive a portion of the commission fee.

Passive REP holders who do not use their tokens in the Augur protocol to bet on disputes and forks are penalized financially.

When creating a new survey, the owner selects a “designated reporter,” that is, an oracle reporting the fact of the event.

The source of verification is indicated by the market creator.

He also pays a deposit, which will be returned to him after the outcome of the vote, regardless of the results.

Unless, of course, he created a deliberately false topic, which should be recognized by the general consensus of the oracles.

The amount of the debt obligation varies depending on the market created.

In addition, insurance is provided in case of inactivity of the selected reporter.

Upon the fact of the event, the chosen oracle publishes a preliminary result within 3 days. The inactivity deposit is then returned.

Otherwise, the deposit goes to pay for a public oracle, which will be the first to publish the fact of the event.

The results may be challenged by other arbitrators.

During the discussion of the event, each of the arbitrators makes his own bets, and if, upon reaching a consensus, it turns out that one of the arbitrators bet on a false result, he will lose his money.

You can get more complete information about the principles of operation of the augur platform by reading the whitepaper.

Launching a project - exiting beta

Augur is finally live. This happened on June 10.

The public beta version of the platform appeared the following year after the ICO.

Now, the Forecast Foundation, Augur's non-profit organization, has announced the launch of the long-awaited platform, accompanied by the release of the final version of the Augur application as open source software.

The multi-year delay unnerved token holders, but allowed the platform to be tested. Notably, Augur offered $200,000 for bugs that qualified as “critical” (although the team did not announce rewards greater than $5,000). This is a complex blockchain application, so problems can indeed arise.

Kyle Samani, co-founder and managing partner of investment fund Multicoin Capital, which he said does not currently own REP but is keeping a close eye on the project, told CoinDesk that the Augur team wants a “slow and steady” launch, nothing “loud and crazy.” "

REP migration completed successfully. The new release of REP tokens occurred on all 56,338 unique accounts that held tokens at 11:01 PM PT on July 9, 2020.

The new REP token contract address can be found on the Ethereum network: 0x1985365e9f78359a9B6AD760e32412f4a445E862

Exchanges, wallet providers, blockchain researchers and other services that interact with REP will update the REP contract address throughout the day.

The new REP token source code can be found in the Augur Core GitHub repository located here.

Augur App Release v1.0.0 is available for desktop. The application integrates the Augur user interface and the Augur node. With it, you can use Augur locally by connecting to the Ethereum network.

System overview

The developers consider the Augur platform to be the future of the prediction market. This is a decentralized platform on the Ethereum blockchain with open source code, all actions of which are controlled by smart contracts. Augur is not owned by anyone - users interact directly with each other here.

Predictions on Augur are not a new industry. We have always tried to predict events. There is a whole industry of sports betting, which amounts to billions of dollars in turnover. Analysts express their views on how events will develop; traders are also constantly trying to predict where the price of assets will go.

What Augur did new was to deploy its platform on the blockchain. With its help, he allows you to predict, using the so-called “wisdom of the crowd,” how certain events will develop, what trends will emerge in various industries, including financial ones.

Those who guessed correctly receive a reward, those who made a mistake lose money.

Augur can be used to predict events in various fields:

- political forecasts;

- weather forecasts;

- forecasts of all kinds of events such as disasters, sporting events, market crashes, etc.

- forecasting the activities of companies - the number of sales, project completion time, etc.

The developers suggest predicting, for example, the outcome of the next election, shorting cryptocurrency, or insuring against possible natural disasters.

Some examples of open markets:

- Will Ethereum price reach $500 by the end of 2020?

- Will Donald Trump be re-elected in 2020?

- Will Tesla file for bankruptcy in 2020?

Moreover, Augur itself is not a prediction market - it is just a protocol on which separate prediction markets are created for different events.

How it works

1 – The user selects the event on which bets will be placed.

2 – Checks whether the event is no longer present in the list, and if not, creates the corresponding market.

3 – Next, community members, also called traders, begin to place bets on the outcome of the event in this market. For example, a trader sends a request to the order book to buy 10 shares for the “Yes” outcome. If there are counter offers, his application is immediately executed.

4 – When an event occurs, the stage of reporting and summing up the results begins - this is done by the owners of REP. In this case, they are the link between the real world where the event occurred and the platform’s blockchain, since they provide information about the outcome of this event. The community then compares the reports and selects the most accurate ones.

5 – Owners of winning bets receive the required amount of money - the funds are distributed by smart contracts. And commissions go to the market creators and REP token holders who provided reliable and accurate information in their reports.

You can make money on bets not only by betting on one outcome or another and waiting for the end of the event. Also, bets can be purchased at a low price and then sold when (and if) they rise in price.

You can access the platform either through a browser or using a special application. It is available for Windows, Linux and MacOS platforms at github.com/AugurProject/augur-app.

Download, install, select which Ether node we want to connect to. Next, the application synchronizes with the specified network node. We link the wallet to the software and can start working on the platform - viewing markets, placing bets

The project team

The Forecast Foundation is supporting the project and developing tools, but Augur does not belong to this organization. It does not control the markets created, cannot cancel transactions carried out on the platform, censor or limit the actions of users.

The organization's goal is to ensure that the service operates under the control of the entire community and is self-regulating.

Project co-founders:

- Jack Peterson – chief developer;

- Joy Krug is a senior front-end developer.

Development of the platform began back in 2020. From August to October, the startup team conducted an ICO - then 8.8 million tokens were sold at 60 cents each - this is 80% of the entire issue. 20% is left for the needs of the team. We managed to raise about $5 million. At the beginning of spring 2020, the platform entered the beta testing stage.

In July 2020, Augur was migrated to new smart contracts written in the Solidity language, since system-critical errors were discovered in the previous ones.

In the same month, the service was criticized for the fact that it began to massively create so-called “murder markets”, which accepted bets on the death of famous personalities such as Jeff Bezos, Warren Buffett, and John McCain. Donald Trump has not been ignored either - they are trying to predict whether he will be killed before the end of his presidential term.

Already in August, the number of created markets on the site exceeded 1 thousand. And in November, against the backdrop of the midterm elections in the United States, the volume of active bets on the service amounted to a record 2.8 million dollars - users tried to predict which party would receive a majority in the Senate and House of Representatives. Moreover, judging by the results, market participants managed to predict the correct results.

Project currency

The platform uses the Ethereum cryptocurrency ETH, in which bets are mainly made, as well as REP (short for Reputation). The latter is an ERC-20 token, and therefore there is no mining on the network . Augur coin REP is used primarily during the reporting and finalization stage of completed markets.

REP owners - they are also called reporters - must periodically, at least once every few weeks, submit correct reports on the results of events on which bets are placed on the site. In other words, track the outcome of this or that event and inform the system about it.

If the report was inaccurate or completely false, owners lose part of the REP. If they do not take part in a major dispute that breaks out on the site, they lose 5% of the available funds. Passive coin owners who do not participate in disputes at all are fined by the system.

Thus, a token is a kind of reputational asset that can not only be gained, but also lost. Its main goal is to encourage users to be active and, most importantly, honest on the platform and make money from it.

The more tokens a user has at his disposal and the more accurate reports he makes, the more commissions he receives.

Where can I buy

You can buy Augur on the following exchanges:

| Name | Couples |

| ABCC | ETH, BTC |

| Bibox | ETH, BTC, USDT |

| Binance | ETH, BTC, USDT, BUSD |

| BitMart | ETH, BTC |

| BitTrex | ETH, BTC |

| Bitfinex | ETH, BTC, USD |

| Bitsane | ETH, BTC |

| Codex | ETH, BTC |

| CoinEx | ETH, BTC, USDT |

| EtherDelta | ETH |

| Ethermium | ETH |

| Ethfinex | ETH, BTC, USD |

| ExtStock | ETH |

| Gateio | ETH |

| HitBTC | ETH, BTC, USDT |

| IDEX | ETH |

| IQFinex | ETH, BTC |

| Kraken | ETH, BTC, USD, EUR |

| LAToken | ETH, BTC |

| Liqui | ETH, BTC, USDT |

| LiveCoin | ETH, BTC, USD |

| Novaexchange | ETH, BTC |

| Poloniex | ETH, BTC, USDT |

| Switcheo | ETH |

| Upbit | ETH, BTC, KRW |

| chaoex | ETH |

| uniswap | ETH |

| zebitex | ETH, BTC, USDT |

| Abucoins | BTC |

| BTER | BTC |

| BitBay | BTC, PLN, USD, EUR |

| CoinBene | BTC |

| CoinTiger | BTC |

| Coinbase | BTC, USD |

| CryptoBulls | BTC |

| Cryptopia | BTC |

| EXRATES | BTC, USD |

| Gatecoin | BTC |

| Liquid | BTC |

| Nuex | BTC |

| Qryptos | BTC |

| RightBTC | BTC, USDT |

| Zecoex | BTC, USDT |

| bitasset | BTC |

| crex24 | BTC |

| gopax | BTC, KRW |

| zloadr | BTC, USDT |

| Bitforex | USDT |

| probit | USDT, KRW |

| binanceusa | BUSD,USD |

| IndependentReserve | USD |

| Simex | USD |

| Bithumb | KRW |

| Coinone | KRW |

| coinzest | KRW |

| coinfield | XRP |