If you are finally ready to start your own cryptocurrency business, then trading crypto coins is exactly what you need. This is beneficial, because in a short time you can make a significant profit or simply make a monetary investment. But trading crypto money is not such a simple task. In particular, because cryptocurrency exchanges are intended for professionals, and many do not even have a Russian-language interface. In addition, it is difficult for beginners to understand the terminology that professional traders use in their work.

So, before making money on the cryptocurrency exchange, you have to undergo at least superficial training. This is necessary so as not to get lost in an unfamiliar environment. In addition, do not forget that we are dealing with finances. Therefore, learning the basics of crypto-exchange trading is a mandatory element in achieving success in this area.

How profitable is cryptocurrency trading?

Trading cryptocurrency on an exchange is profitable, and many take this as a fact. But is this really true? Let's figure out why trading digital coins can be profitable, and are all crypto coins highly rated?

When learning news about cryptocurrencies, first of all we hear about Bitcoin. But there are other cryptocurrencies that are no less actively quoted on exchanges and bring significant profits every day. This creates a couple of undeniable advantages compared to conventional trading:

- Crypto coins are global in nature . The coins are not tied to any state. Thus, digital currencies are considered independent. But the question is different: is it possible to make money on them by trading on a cryptocurrency exchange? The answer is unequivocal - yes. Governments do not control coins; in many countries, Bitcoins and other crypto coins are not even considered money or property of value. Based on this, they are not subject to tax. Having earned several Bitcoins on the exchange platform, the trader will not need to pay for them.

- Cryptocurrency cannot be controlled or tracked . Crypto exchanges may provide trade history or trading volume to the public, but unless traders are verified, they cannot be tracked. And there are a lot of sites on the Internet that offer complete anonymity. Owners of large accounts paid attention to cryptocurrency precisely because it cannot be controlled. Exchanges try to preserve this feature of virtual money, of course, as long as it is not prohibited by law.

- Earning cryptocurrency from trading is not tied to time . Most exchanges operate 24/7, so you can learn new trading pairs at any time of the day or night. There are no official opening hours like fiat exchanges. This makes the conditions for arbitration ideal.

- Cryptocurrencies are characterized by high volatility . Last but not least, frequent and strong exchange rate fluctuations help you make money by trading cryptocurrency. As soon as the price falls, crypto coins are bought, and when it rises, they are sold. And they put the exchange rate difference in their pocket. The good news is that such fluctuations can occur ten times a day. Moreover, the next price fluctuation is influenced by anything - from gossip started by an enterprising trader to the financial collapse of a country.

- Before trading cryptocurrency, keep in mind that a lot depends on the coins . Among the currencies being traded there must be coins that are in demand, otherwise you won’t be able to earn much. It doesn’t matter whether cryptocurrencies are expensive or not. It doesn’t make a significant difference whether these are old coins or whether they have just appeared.

Of course, if you look at how cryptocurrency trading on the stock exchange goes step by step, it turns out that to succeed you need to use a whole set of tools and tactics. But all this comes with experience. The main thing is that trading is really profitable.

Basic principles of cryptocurrency trading

The basics of trading cryptocurrencies are not much different from the same transactions on standard exchanges. Let's take a closer look at these principles:

- Think about the behavior of the course chart, not about how much you can earn. Money is, of course, good, but since the cryptocurrency market is very unstable, you need to calculate all possible scenarios. And only after that can you calculate the benefits. This will allow you to not be so upset if you didn’t get the expected profit;

- In the cryptocurrency market, everything is connected. Therefore, the main principle of cryptocurrency trading is to study the news of the cryptocurrency market before making any serious step. Even a casual remark made by some significant person in the cryptocurrency world can collapse or raise the rate of the coin you are interested in. Not to mention new laws or the like;

- The cryptocurrency market is very unstable. It depends on the demand for cryptocurrencies. The higher it is, the more actively the value of coins increases and the more profitable it is to trade them. And if interest decreases, then coin prices drop;

- The principle of decentralization also plays an important role in cryptocurrency trading. These assets are not controlled by anyone or anything, but this does not mean that the rate cannot be artificially raised. To avoid becoming a victim of such a deceptive maneuver, you should not randomly buy and sell coins. Form a strategy that is convenient for you and follow it in your work.

And if you make a guide on how to trade cryptocurrency, then the main principle of such trading is: sell more expensive and buy cheaper.

Terminology

To understand cryptocurrency exchange trading, you cannot do without knowing the terminology. Nobody expects a beginner to learn all this by heart. But it is necessary to know the minimum concepts in order to be able to understand the exchange.

The main components used by participants in trading on the cryptocurrency exchange are the following concepts:

- Fiat . These are the currencies we all use in real life. These include dollars, rubles, euros, etc.;

- Charts.

This is the history of the exchange rate of one crypto coin to another coin or to fiat funds. The chart is the basis of the game on the cryptocurrency exchange. Typically, charts are presented in the form of Japanese candlesticks. This allows you to monitor the development of coins as objectively as possible. When looking at charts, you need to know what a spread is. This is the difference between ask (the best offers to sell) and bid (the best offers to buy). Candles are divided into bullish (when the rate is rising) and bearish (when it is falling). They are painted red and green, respectively. There are also doji candles. This is what candles with a missing body are called. Tops are candles that have a body, but it is poorly formed; - Sell, buy orders . Any trader should know what an order is on a cryptocurrency exchange. These are buy and sell orders. A glass is formed from them. This is a table or list that lists user requests to buy or sell cryptocurrency in exchange for fiat or other digital coins. They are close to the price at which the pair is currently trading. Orders can also be divided into passive and aggressive. Passive orders are traded at a price set not at the current rate, but taking into account the fact that the cryptocurrency will be supported. And aggressive orders are quoted at the current rate and are intended for trading;

- History of concluded transactions.

When studying how a cryptocurrency exchange works, this component cannot be ignored. From it you can see the total trading volumes as a whole or for a particular pair. Thanks to this, people’s interest in a particular price for an instrument is assessed; - Short and long . Shorts, that is, short positions, are designed to make a profit over short periods of time on sharp price movements. Long – these are long positions, the profit from which is expected in a week, month or even a year;

- Trading volumes . Cryptocurrency trading volumes are reported as the total number of currencies that are listed on that exchange. For this purpose, used orders are taken into account. Vertical and horizontal volume data are often used. Based on trading volumes, trends are formed (general price movement);

- Growth and drainage . A sharp rise and fall in the exchange rate;

- Hamster and whale . A newcomer to the stock exchange is called a hamster. The title “Whale” is given to an experienced stock market player. These two players are associated with concepts such as haircut (situations where money goes from the hamster to the whale) and pump. A pump is a situation where volume transactions are formed in order to shape the reactions of uninformed players. They must support the artificially created trend. It is usually followed by a dump, that is, a collapse of the rate;

- Wanging . This is an attempt to predict important levels, in other words, a forecast with a high degree of implementation.

In general, study the terminology of the exchange, this will help you trade the Bitcoin/ruble (or other) pair with the highest possible profit. And all thanks to the fact that you can understand the tools and get the necessary information.

Psychology of Trading

Exchange trading requires knowledge of technical analysis and fundamental processes. The psychological characteristics of people are no less important. The human factor influences the success of trading. They study the basic principles and adhere to them while working on the stock exchange.

Everything is good in moderation

It is strictly forbidden to give in to greed. If the rate has been growing steadily for a long time, but has reached the closing level of the transaction, the trade must be completed. The principles of Murphy's Law apply, which states that anything that can go wrong will happen.

Patience is the most important thing

If the price moves in a flat, you should not be content with crumbs. They wait for the chart to turn in a certain direction and act according to the circumstances. Lateral movement lasts for several hours, days, weeks and even months. In such conditions it is difficult to earn a lot; all you have to do is wait. Searching for a new currency pair is not always good, since “throwing” from one to another leads to negative consequences.

Depth of orders

The order book is a table of supply and demand for the purchase and sale of currency. Before opening an order, they look at the data. If there is a predominance of sellers and a lack of buyers, it may not be possible to sell the currency at the chosen price.

Capitalization and trade turnover

The trading volume of an asset demonstrates the current demand in the selected exchange, and capitalization is an indicator of global interest in the cryptocurrency. The higher the investment in digital currency, the greater the chance that the rate will rise.

To trade on cryptocurrency exchanges, one does not borrow large sums of money. To get started, a few thousand rubles are enough. With a competent approach, careful analysis and a little luck, a modest amount can be used to make good capital. To implement their plans, they study the basics of stock trading, choose a platform and work several hours a day.

Features of the cryptocurrency market

Since the emergence of cryptocurrencies, a completely unique market with its own conditions and rules of existence began to form around them. At the same time, it was quite different from the foreign exchange markets:

One of the main features of the cryptocoin market is the initially low price of almost all assets listed here. On ordinary exchange platforms, the price of familiar instruments has real reinforcement, but not in the blockchain. The growth of Bitcoin and altcoins begins with a relatively small base price. Thanks to this, investors' profits reach hundreds and even thousands of percent per annum.- There are many risks in the cryptocurrency trading market. In particular, frequent “overheating”. Overheating occurs when interest in a certain cryptocurrency rises sharply in certain regions. For example, investors buy cryptocurrency at a high price in large volumes, thereby raising its price even higher. And then the rate drops sharply again. Such jumps reach 70%. This is especially noticeable in the example of December last year, when in a short time the price of Bitcoin almost doubled.

- Cryptocurrencies are the most promising asset for investment. This is the main advantage, since the stable increase in the price of coins makes cryptocurrency trading profitable.

- The openness of this market is also its feature. If trading with ordinary finance requires deep knowledge, then even beginners can trade cryptocurrency.

In the long term, the demand for crypto coins will remain consistently high.

Trading Basics

Trading on cryptocurrency exchanges seems simple for dummies, especially when we have studied the basic concepts and highlighted the main features of the market in question.

But cryptocurrency trading exchanges also have basics that must be followed in order to make a profit. The principles of trading on cryptocurrency exchanges are not much different from the principles of operation on exchanges trading fiat or securities. You need to buy cheaper and sell more expensive. As a result, the trader will make a profit.

If you understand the basics of Forex trading, you can easily figure out how to trade here. Let's review the rules of trading on the cryptocurrency exchange:

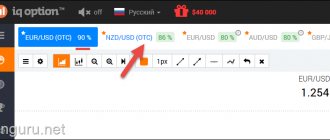

- Cryptocurrency rate chart . On the stock exchange, charts of different rates can be presented on different time axes. For example, for beginners to trade on the cryptocurrency exchange, it will be convenient to view the rate chart for 15 minutes, for a day and for longer periods. Particular attention is paid to candles and their formation. But you need to look not only at the body of the candle, but also at the shadows. These are thin lines that extend from the body. They show the highs and lows of the candle formation. When a candle does not have an upper shadow, its top is cut off, and when there is no lower shadow, its base is cut off. Typically, such charts are used on currency and stock exchanges due to their information content.

. It shows at what rate most users are willing to buy and sell cryptocurrency. When a trade is made, the current price in orders is adjusted taking into account the new data. When a user places a sell order, the system itself automatically looks for counter offers that could cover it (at the same price or slightly more than indicated). If the automatic search was not successful, the order remains in the list until it is claimed. This is how we learn how to trade on the cryptocurrency exchange.

Buy and sell orders- History of completed transactions . The main part of the course movement can be traced here.

- Trading volumes . Based on the trading volume, you can judge whether to start trading or wait. Thus, this tool is one of the most important for profitable trading. Depending on the exchange platform, you can use vertical or horizontal volumes. But still, most popular sites use the vertical option.

It should be taken into account that large trading volumes do not always indicate further active price movement.

Of course, increased volumes of quotes do not just appear, but aggressive orders still have a greater impact. Is there any point in trading on a cryptocurrency exchange without knowing the basics?

Of course, you can try, but even with knowledge of the basic nuances, a beginner remains a “hamster”, led by more active traders. And if you study in more detail the specifics of trading on a cryptocurrency exchange, the chances of making a profit increase significantly.

How to trade on a cryptocurrency exchange

There are many different strategies for trading on cryptocurrency exchanges, some of them were adapted from traditional exchange trading, some were completely created from scratch, but the author of each of them is confident that his strategy is the best. In our article, we will look at two examples of strategies that do not require specific knowledge and are easy to understand.

Scalping strategy

One of the simplest strategies, which will not allow us to earn huge sums, but which will give us the opportunity to practice well and study the market. Its essence is to place orders to buy and sell an asset according to the highest in the corresponding order books, taking into account the costs of the commission charged by the exchange.

For example, consider the ETH/USDT pair, as we see in the screenshot, the minimum market price for selling 6 units of Ethereum is ~$276,895, and the maximum price for which they agree to buy is ~$274,189. Thus, we can immediately buy ourselves, for example, 1 ETH for $276,895, in order to make a profit we must sell the same 1 ETH for a price of no less than $276,895 x 1,002 = $277,449 (subject to a commission of 0.2% per transaction).

The disadvantage of this strategy is low earnings, but it is compensated by relative stability, because The rate changes within 1-5% almost daily.

Trading strategy using support levels

To explain the principle of this strategy, we will use the help of Traidingview.com. For example, let’s select the ETH/USD rate chart on the Binance exchange and select the display of the Swim Trading indicator in the templates. A grid of resistance levels (R1-R5) and support (S1-S5) will be superimposed on our chart.

Levels three to five are considered strong, i.e. For beginners, it is worth buying when the price falls to the S3 level and selling when it reaches the R3-R5 levels. As you can see from the screenshot, this doesn’t happen every day, especially in a calm market. Most often, the trend changes when weak levels 1-2 are reached. However, it is levels 3-5 that give a higher chance of not making a mistake with the forecast.

Where is the best place to trade - popular exchanges

You can make money on the cryptocurrency exchange under one condition – if you choose the right resource. To do this, you need to pay attention to several factors:

- Crypto exchange location. Most cryptocurrency exchanges are located in China and the USA. But for a Russian-speaking user it is more convenient to use resources that are located in Russia or Ukraine;

- Regulation and trust. If you combine these concepts, the exchange must have a good reputation;

- The interest that the crypto exchange takes for transactions carried out on it;

- Is it possible to work with fiat currencies, or are only crypto coins listed on the exchange?

Taking all this into account, we were able to compile a list of popular crypto exchanges:

- EXMO. This is the best crypto exchange in Russia. Very convenient and reliable. In addition, it accepts and withdraws money to the following payment systems: Qiwi, Yandex.Money, Advcash, Payeer and more. It is not surprising that users prefer to work on this trading platform.

- Binance. One of the largest Chinese cryptocurrency exchanges. This resource has long occupied the first position in terms of trading volume in the world. Not least thanks to working with many cryptocurrencies. In addition, here you can quickly exchange and withdraw coins.

- Kucoin. This exchange was founded in 2020, but despite its youth, the resource is among the Top exchanges in Asia. The peculiarity of the site is low commissions and support for a large number of cryptocoins. It’s difficult to say anything more specific yet, but the resource is very promising.

- Bter

. Another "Chinese". Its advantage is thirty cryptocurrency pairs and a commission of 0.2%. The commission is withdrawn from each transaction. - tradingview. And this is already a Russian crypto exchange, that’s why we included it in the Top. It is very convenient to work with it thanks to the Russian interface and well-thought-out functionality.

- Bitfinex. One of the largest exchanges. You can trade only three pairs of currencies. In addition to trading, you can engage in brokerage, as well as carry out margin trading.

- Bitstamp. This exchange is different in that here you can exchange Bitcoins for dollars. In addition, it is easy to trade while maintaining anonymity, since full registration will only be needed if you work with large sums.

- WEX. Perhaps this exchange is the most popular in the world, and all thanks to the fact that Bitcoins here can be exchanged for dollars, rubles or euros. It does not require verification, so you can trade almost anonymously. To get an account, you only need a work email.

- Kraken. Crypto exchange for digital and fiat money. Not the largest, but reliable.

- Poloniex. A very promising resource. Today, this exchange is only gaining popularity, and has every chance of overtaking the recognized leaders.

- LiveCoin. Exchange with a Russian-language interface.

Rules for safe trading on the stock exchange

- Buy cryptocurrencies during periods of decline.

- Do not buy one currency with all your money. The market is not stable and may collapse in a short time. It makes more sense to divide investments into several areas. E

- Do not store all accumulated funds in one place. It is worth reserving several wallets on various sites. Despite multi-level levels of protection, all crypto wallets are susceptible to attacks by hackers.

- Invest part of the profit received in other currencies, rather than withdraw everything at once.

- Take the time to study the topic of crypto, without this you won’t earn a lot of money.

- Review of earning Bitcoin on the Bter exchange

How to make money on the cryptocurrency exchange - bter strategy

Scalping strategy

Technical analysis and earning strategies

To figure out how to make money on cryptocurrency exchanges, you need to study earning strategies, conduct technical analysis and forecast the market situation.

Basically, technical analysis is done in order to predict the future of the market using data from its history. Many experts argue that searching for patterns when trading on a cryptocurrency exchange is even more important than working with trading tools. Based on this, you can at least try to make a forecast. This is not difficult to do, given that the field is young and there are not many factors that can influence it.

Three main technical analysis tools:

- Trend lines are lines that connect the highest points on a chart (ceiling/resistance) to the lowest points (support/floor). When, after connecting the lines, another maximum is formed, followed by another, it means that a new trend ceiling has appeared. Moreover, there is a pattern that when a new point appears on the line on the graph, the graph bounces or contracts.

- RSI (Relative Strength Index). This indicator is considered one of the most effective when it comes to learning how to trade cryptocurrency profitably.

(flags, double bottom/top, head and shoulders, etc.). Let's look at flags - a bullish indicator. They are very similar to flags and appear every time after a large spike and breakout of the triangle. But keep in mind that sometimes flags are not in the form of a triangular figure, but resemble a canvas.

Figures or models

If a trader learns to read all these tools and conduct technical analysis, then nothing will be impossible for him when trading cryptocurrency.

But still, analysis alone is not enough to achieve success - you need a strategy on how to trade on a cryptocurrency exchange. As an example, let’s look at one of the popular online strategies for working on the stock exchange:

. It is advisable to choose pairs with rubles to make it more convenient to deposit and withdraw money. We choose BTC/RUB, since it comes first, and therefore is the most popular;

Select the pair you will trade with- Calculate the percentage for earnings . Use this formula to calculate several cryptocurrency pairs to find out which ones are most profitable to work with. You don't have to jump straight into Bitcoin. To do this, use the formula

(Max price/(min price/100)) - 100 - percentage of income.

- Having selected the pairs, you need to calculate the average price at which the cryptocurrency was sold today. To calculate, use the formula:

(max+min)/2 = average figure

- It is not advisable to buy cryptocurrency above the resulting figure . Go to the glass to see how much the selected cryptocurrency is currently selling for. Make a purchase;

- When the cryptocurrency is in the account, it needs to be sold . The formula is also used for this:

((max+your purchases)/2)*1.004 = how much to sell for

Everything is very simple, the main thing is to stick to the formulas and follow the current trend in the market by conducting technical analysis. That’s why we put strategy and technical analysis in one section. If you don't combine them, it's difficult to make a profit.

Safety precautions when working on the stock exchange

When we talk about how to trade on cryptocurrency exchanges correctly, we do not forget about safety precautions. So, before you start working on the cryptocurrency exchange, you need to learn the following rules and follow them:

- The first and main rule is to play on a crypto exchange only with money that you don’t mind losing. If you're a beginner, you probably won't be able to hit the jackpot. If you lose all your savings, you won’t be able to try again, and the desire is unlikely to appear.

- Sell crypto coins only when their price rises, and buy when it falls. But keep in mind that following this strategy, you can fall into the traps of manipulators. Sell assets when the rate rises past half of its expected peak.

- Professional cryptocurrency traders usually play on rebounds, so beginners should not meddle there. The chances of incurring losses are high.

- Do not catch the maximum or minimum quotes. It is better to fix profits at a level above average so as not to fall under the panic that so-called manipulators sow. And fixing will allow you to sell money at the right time and replenish your assets.

It is better not to play on the stock exchange when trading volumes are low, especially if you want to trade short distances. When trading is minimal, this means that only bots play on the resource. Even a minimal purchase can correct the course, so it is better for short sellers to watch, waiting for a better moment. This is the main thing a newcomer to the cryptocurrency exchange needs to know. After all, a lack of volatility can lead to unpleasant consequences.- Never play in one direction, using the entire available bank - 80% will burn out. Once you make a purchase for the full amount, you will immediately be eliminated from the game. But only on the condition that you are not a long-term investor. Experts consider a win-win option to play in 4-8 directions.

- Each trader uses his own strategies and processes orders. So, they must be written down. This will allow you to formulate an effective trading strategy specifically for your case.

- Don't believe everything they write in the stock chat. The “forecasts” made there very rarely turn out to be even approximately true. Often this is a set of personal expectations that are not supported by anything serious. And don’t forget about the big millionaire players who can raise or lower the rate by 20% in 45 minutes.

But even after studying all these rules, we must not forget about one thing - be sure to undergo training on how to work on the cryptocurrency exchange.

Step-by-step instructions on how to get started on a cryptocurrency exchange

To start working on a cryptocurrency exchange, you need:

- Complete training and gain at least basic knowledge. Trading on the stock exchange is a serious test for a beginner. You shouldn’t start trading without preparation - it will almost certainly end in the loss of your deposit.

- Register on the exchange. Registration typically requires you to enter your email address, password, and phone number. But for full operation, most exchanges require you to undergo additional verification: either upload scanned copies of documents, or pass two-level Google authentication. After this, you can use all the features of the exchange, including withdrawal of funds.

- Make a deposit on the exchange. Some exchanges (for example, EXMO, Yobit) allow you to purchase rubles or currency through payment systems (MoneyPolo, OKPay). But most crypto exchanges only accept cryptocurrency deposits. That is, you first need to buy Bitcoin (ether), transfer it to the exchange and then start trading. Also on exchanges there is a USDT token - essentially a digital analogue of the dollar.

- Monitor signals. You can predict the growth or fall of the exchange rate using technical and fundamental analysis. Technical analysis reveals patterns of price changes and, based on them, predicts price changes in the future. Fundamental analysis methods are based on studying the news background. In the cryptocurrency market, fundamental analysis is used to a greater extent: the market always rises or falls depending on the news. If an investor does not understand this on his own, you can trade using signals given by experienced traders.

- Place applications (orders) for the purchase or sale of currency. In anticipation of an increase in the exchange rate, you need to buy cryptocurrency at drawdowns in order to sell it at a higher price. It’s not worth buying cryptocurrency when it’s taking off. For example, if an investor buys a digital token for 0.01 btc and expects it to grow by 20%, he can immediately place a sell order for 0.012 btc + exchange commission. When the rate increases, his application will be processed automatically. You can also set a stop-loss in case the rate falls - if the cryptocurrency starts to fall, the system will automatically put it up for sale when it reaches a critically low rate, which was set by the trader himself.

- Upon completion of each transaction, the invested funds are automatically credited to the balance, from where the trader can withdraw them.

Each exchange charges commissions - for depositing funds (not always), for exchange, for withdrawal.

Before you start trading, you need to know the amount of commissions and take them into account in your calculations. The formula for making money on a cryptocurrency exchange seems simple, but not everyone manages to make money in this niche. When the market is rising, any beginner can make a profit, but only experienced traders receive a stable income on the exchange in any conditions (even in a falling market). Beginners lose money over time, even if they make money at first. The stock exchange is not a place for non-professionals. Before you start bidding, you must first complete training.

Cryptocurrency Arbitration

Arbitrage is a critical part of how to trade on cryptocurrency exchanges. Arbitrage refers to earnings on a cryptocurrency exchange, received by a trader from the difference between the price of one asset, but used on different exchanges. The scheme of such a process is very simple:

- A trader buys currency on one crypto exchange (where it is sold relatively cheaply);

- He goes to another crypto exchange, where the coin is quoted at a higher price, and sells it there. That is, you need to withdraw money from one exchange to another. Without intermediaries in the form of a wallet;

- He returns to the first exchange (or looks for another, where the price is also low), and repeats the procedure in a circle until he receives the desired profit.

It takes a minimum of time, and brings stable profits. In addition, people who say: “Teach me how to trade on the cryptocurrency exchange,” will also be able to take advantage of arbitrage. It does not require deep knowledge from the trader, and the risk of going broke is minimal. Moreover, the difference in rates is significant, because each exchange has its own price. It depends on the decentralization of the exchange, whether transactions are fast or slow, how many assets are used, etc.

Cryptocurrency arbitrage is divided into:

. It remains relevant in 2020. Its peculiarity is that transactions are carried out through identical financial instruments. Classic remains an almost risk-free way to make money. To begin with, the trader monitors quotes and looks at the exchanges with the highest and lowest quotes (it is desirable that the difference between rates be at least 2%). Calculate your profit, but don't forget to take into account the commission. If everything suits you, make an exchange.

Classic or simple arbitrage- Statistical . In this case, the trader does not buy the coins that are already popular, but the most promising altcoins. In this case, there is a risk that the coins will not only not bring profit, but the trader will suffer losses. In essence, this is almost the same exchange trading, so you need to calculate the possibility of profit. The goal of the trader is to find a pattern in the correlation in order to use it as a trading tool.

Arbitration remains the most promising area of trading in the cryptocurrency market. It was once used for fiat funds, but over time it has lost its relevance.

Cryptocurrency price volatility

The volatility rates of cryptocurrency rates are tens of times higher than the volatility on Forex or stock exchanges. For example, the Bitcoin rate in 2020 increased 20 times in one year. Such indicators enable traders to earn money with small initial investments. However, there is a possibility of the opposite situation - the cryptocurrency rate may fall several times in a short period of time and the trader will suffer financial losses.

Ways to make money on the cryptocurrency exchange. There are several ways to make money on cryptocurrency trading platforms.