About the exchange

| Country and site | Japan, Japan Exchange Group, Inc. |

| Year founded and owner | 1878, Akira Kiyota |

| Capitalization | $6.22 trillion. |

| Number of listed companies | 3,635 companies |

| Indexes | NIKKEI, TOPIX |

| Official site | www.jpx.co.jp |

| Opening hours (Moscow time) | From 10:00 to 13:30 and from 14:30 to 20:00 |

History of the Tokyo Exchange

The history of Tokyo Stock Exchange began in the 19th century. At that time, the country had just begun to open up to the West and the economy did not know which model to adopt: market or planned. Japan hesitated about its economic course. The one who is now called the “father of Japanese capitalism” opened the Tokyo Stock Exchange and, as it were, put an end to this issue.

His name is Shibusawa Eiichi. The Prime Minister helped him. They opened the doors of the Japanese Stock Exchange on June 1, 1878.

Soon the company absorbed 10 similar sites across the country. The Tokyo Stock Exchange operated until the bombing of Nagasaki in 1945, which brought Japan's economy to a standstill.

4 years after the tragedy, a new securities law was issued. This is how the stock market was revived in the country. Moreover, in the period from 1983 to 1990, the growth was incredible: the government’s efforts paid off handsomely. And today the Tokyo Stock Exchange ranks third in capitalization in the world.

Exchange structure

Any major stock exchange is divided into separate markets for large and small companies. If the shares of holding companies and start-ups were traded in one place, there would be confusion. Therefore, the Tokyo Stock Exchange has three separate markets.

| First section | Japanese Blue Chip Stocks |

| Second section | Smaller companies that did not make it to the top |

| Third section | Promising startups |

Since Japan is a leader in the production of technology, there is a separate market for the IT industry. It's called JASDAQ and it includes highly specialized indexes.

Features of the Tokyo trade mechanism

Like all things Japanese, the stock market in Tokyo has remained unchanged since its inception. Even Tokyo auctions are held here the same way as 150 years ago. Only since 2000 has trading been done through a computer.

The procedure is simple. An accredited stockbroker or institutional investor submits the order. It is located in the trading terminal of the Tokyo site and is registered. The settlement is made after 3 days (regular transaction) or on the day of the transaction (cash transaction).

History of the exchange

The beginning of the way

In May 1878, the first building of a new financial institution for Japan, the stock exchange, was opened in Tokyo. The first owners and managers of the Tokyo Stock Exchange were the Japanese Minister of Finance of those years, Okuma Shigenobu, and a corporate lawyer, Shibusawa Eiichi. At first, stock traders who gathered at the stock exchange wore exclusively national clothes - kimonos.

In the mid-90s of the 19th century, the exchange moved to a new building, its structure changed - from a partnership of two partners to a joint-stock company with a limited number of owners. Over time, more and more government bonds appear - as in many countries of that time, the Japanese government became concerned about its military power and began to increase defense budgets by attracting funds from large capitalists.

Post-war years

By the beginning of World War II, 11 exchanges were operating in Japan. However, after the first war years, it became clear that having so many separate platforms trading securities was ineffective. In 1943, it was decided to unite all exchanges into one based on the Tokyo one. Although, as the near future showed, this could not have been done - the united exchange closed shortly after the bombing of Hiroshima and Nagasaki in August 1945.

The Tokyo Stock Exchange building was occupied by the American military. Until January 1948, it was the headquarters of the occupation forces, which ruled the country until the transfer of all power to the Japanese government in the early 1950s. At the same time, trading in securities in the country continued, although all transactions were concluded not publicly on a common exchange platform, but between specific investors and owners of shares and bonds.

The post-war Asian miracle - the rapid growth of the economic and financial systems of the largest countries in the region - naturally affected Japan. The country began to become a leader in the world economy due to its technological developments and progressive innovations. And although at the exchange itself there were not even electronic displays until 1974 and prices for all securities were written with ordinary chalk on a black board, the value of shares of Japanese companies has been constantly growing since 1968. It was at this time that the Japanese government introduced the necessary restrictions on the activities of brokers and some new rules for conducting exchange transactions.

The growth of securities became especially noticeable in the period from 1983 to 1990 - during these seven years, the Tokyo Stock Exchange became the first in the world in terms of market capitalization of companies listed here (60% of the volume of the world stock market was concentrated in the capital of Japan). The successful strategy of competitors from New York soon changed the situation, but second place was firmly entrenched in the Tokyo Exchange.

Electronic era

On April 30, 1999, the era of “live” trading ended on Japan’s largest stock exchange—the platforms where brokers were located to conduct transactions were closed. All trade has moved to the electronic market.

On several occasions, the use of electronic systems has led to serious disruptions in trading processes. So, on November 1, 2005, the exchange was able to work only for an hour and a half. 90 minutes after the opening of trading, the computer trading system installed the day before, developed by Fujitsu, failed. The operation of the stock exchange stopped for four and a half hours, which was a record downtime in the recent history of the Tokyo Stock Exchange. Another unpleasant incident occurred due to the fact that during the IPO of J-Com on December 8, 2005, an employee of Mizuho Securities, which provided technical support for the placement of shares, entered erroneous data when putting securities up for sale. Instead of setting the price for one share at 610,000 yen, he offered 610,000 shares for 1 yen. In the very first seconds of trading, the most resourceful and fast brokers began to buy J-Com shares for next to nothing. The exchange administrators realized the mistake and tried to cancel the completed transactions. However, despite the efforts made, J-Com's losses amounted to $347 million - this amount was reimbursed equally to the issuer by the Tokyo Stock Exchange and Mizuho Securities. The last major failure occurred on the Tokyo exchange in January 2006, when the number of transactions carried out on it reached 4.5 million and trading stopped for 20 minutes. The Japanese government ordered the exchange owners to prepare a program to improve the computer system, which would prevent such failures in the future.

How to list on the stock exchange

For listing on the Tokyo Stock Exchange, the examination checks the company's success over the last 2 years. From the moment of application to the placement of the company, at best, 3 months pass.

From the very beginning, the company selects a market for listing; this is like the first filter. For example, blue chips in the first section must have at least 2,200 shareholders. The bar is high, but all Tokyo investment companies hold it; they do not fall into the same market as startups.

But the examination looks not only at numbers. Among the requirements of the Tokyo Stock Exchange there are abstract points. For example, the candidate must conduct business “in a spirit of honesty and fairness.” And no wonder: Japan even has a Fair Trading Commission. She keeps an eye on the stock exchanges.

Stock indices NIKKEI and TOPIX

The main indicators of the state of affairs on the Tokyo Stock Exchange are two main indices: NIKKEI 225 and TOPIX. Of these, the most popular among investors and brokers is, of course, NIKKEI, which is calculated as a weighted average of the share prices of the 225 most actively traded companies on the Tokyo Stock Exchange. On September 7, 1950, this index was first published under the name TSE Adjusted Stock Price Average, and since 1970 it has been calculated by the Japanese newspaper Nihon Keizai Shimbun. The new name of the indicator - NIKKEI - came from the abbreviated name of the newspaper.

The TOPIX index is calculated by the Tokyo Stock Exchange itself as a weighted average of the prices of shares of all publicly traded companies in the First Section of the exchange. This indicator was first published on July 1, 1969 with a value of 100 points[6]. Today TOPIX is calculated every 15 seconds[7].

Pros and cons of the Tokyo Stock Exchange

A plus is the TSE's respect for foreign investors. For them, the Tokyo listing examination checks the business's compliance with the laws of the issuing country. That is, the American company will be judged under both Japanese laws and US laws.

In addition, a joint venture with the London LSE - Tokyo AIM Stock Exchange - has appeared for foreigners. And this is only the first step of Tokyo TSE towards globalization.

A significant disadvantage of the Tokyo Stock Exchange is the relatively large number of malfunctions. There were seven of them in total, and they brought billions of losses to traders.

And if we talk about Russian investors, they will miss instruments based on Japanese indices. For example, FinEx only issues ETFs based on MCSI Japan. In addition, on the St. Petersburg stock exchange they trade only securities of large American companies; there are no Asian ones among them (and no Tokyo ones, respectively).

The most famous stocks traded here

Japan is famous for its cars. Toyota, Nissan, Mazda, Mitsubishi, Honda - all these companies are registered on the TSE and delight investors with their success.

The Japanese have always influenced world capital through the production of high-tech goods. Popular gadgets are also made here. Sony, Canon and Nikon are buying all over the world: both in products and in securities.

Exchange indices

Each exchange gets 50% of its income from stock indexes, because the index is an economic indicator for which analysts are well paid. And TSE has many such indicators, but the most popular are Tokyo’s NIKKEI 225 and TOPIX.

Nikkei 225 includes the richest and most reliable companies from the first section. As the name suggests, there are 225 brands in total. They have nothing in common except success in the market: fishing companies and high-tech holdings are on the same list.

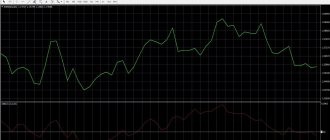

NIKKEI 225 quotes from TradingView

But there are also very specific indices on the Tokyo Stock Exchange. For example, the TOPIX 150 Shariah Index includes 150 of Japan's largest companies that conduct business in accordance with Islamic Shariah rules.

Prospects for investing in these indices

Japanese business and stock trading are going through a transformation. This is because the Eastern philosophy of keiretsu - honest partnership - leaves Japanese companies behind progressive startups. And they, by the way, raised $1.9 billion in 2020. For comparison: Russia received only $293 million from startups.

Therefore, now it is very profitable to invest even in the Tokyo third sector - the preferential sector for small businesses. There is no need to talk about the first two: Japanese goods have always been in demand.

In addition, only Japan stays away from political storms: its economy suffers little from the trade war.

Nikkei derivative indices

There are more than 15 different indices in the Nikkei family, which differ in the number of companies included in them, the level of risk, and the coverage of only individual industries. Here are the most popular of them in investor circles:

- Nikkei 500 Its calculation principle is similar to Nikkei 225 with the only difference that it includes 2 times more companies and does not include mortgage funds and ETFs. The start date of calculation is considered to be 1972;

- Nikkei JASDAQ. The calculation formula is the same as the Nikkei 225, but the Bank of Japan and investment funds are not included in the list. Appeared in the spring of 1985;

- Nikkei All Stock Index. The calculation principle is a weighted average of the current market price of securities of the largest companies registered on the 5 largest Japanese stock exchanges.

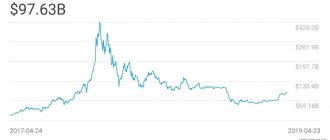

Prospects for investing in Nikkei

Over the past 5 years, the Nikkei 225 stock index has brought investors more than 140%, rising from 8,534.12 (as of 10/12/2012) to 20,690.71. For comparison, the growth of other leading stock indices over the same period was:

- S&P500 - about 75% (from 1,428.59 to 2,549.33);

- NASDAQ - about 115% (from 3,044.11 to 6,590.18);

- Dow Jones - about 70% (from 13,328.85 to 22,773.67);

- DAX - about 80% (from 7,232.49 to 12,955.94);

- Shanghai Composite - about 60% (from 2,104.93 to 3,348.94).

I also recommend reading:

What is premarket and postmarket on the stock exchange?

Premarket: be in time before others

The Nikkei 225 index has become one of the most profitable for investors in comparison with the US and European indices. And although the structure of the companies included in the Nikkei 225 index is often compared with the American industrial index Dow Jones, the Japanese index has overtaken its American counterpart by 2 times over the past 5 years. The secret to such high profitability is simple: the mortgage crisis in the US in 2009 hit Japan much harder than the US and EU. And while the other indices recovered quite quickly, the Nikkei 225 from the beginning of 2009 to the beginning of 2013 was almost in the same place and only after 2013 began to grow rapidly.

The prospects for investing in Nikkei 225 and its family are assessed by most experts as positive, but with the need to diversify risks. If you compare the charts of all indices, you will notice that the main American and European indices are now at their historical highs. Their growth was relatively smooth, not counting sharp drawdowns in 2002 and 2009. Therefore, even if a correction is expected in the US and European stock markets soon, it will not be deep. The situation with Nikkei 225 is more complicated:

- The index chart has a wave-like shape with historical highs in 2000, 2007 and 2020. Now the chart is gradually approaching the 2020 high and it is far from certain that it will be able to break through this level;

- growth is followed by a recession, from which the index was chosen with much greater difficulty than the American and European indices. The drawdown depth of the Nikkei 225 is greater than the drawdown depth of competitive assets (with the exception of 2009);

- As the Nikkei 225 gradually approaches its all-time high, a reversal with a deep drawdown is possible.

However, this is a pessimistic scenario based on graphical analysis. From the point of view of fundamental analysis, there are no prerequisites for a trend reversal. The world economy is growing, the Japanese economy is also far from being saturated (despite negative rates), therefore further growth can be predicted, albeit not at the same speed.

I also recommend reading:

Why is the Russian stock market so cheap?

Why is the Russian stock market so undervalued in the world?

Interesting facts about the Tokyo Stock Exchange

- In the 80s, when other stock exchanges switched to digital terminals, the democratic Japanese wrote down quotes with chalk on a blackboard. They only modernized the process in 1999.

- In 2005, a trader mistakenly recorded the share price of a successful company at 1 yen. Work had to be suspended, and the company lost $371 million.

- The currency in Tokyo is the yen, but during stock trading, quotes are also converted into dollars, euros and pound.