What features does the online Forex market have? Why is it so important to analyze the Forex market? How much can you earn by trading on news?

Good day, dear readers! With you on HeatBeaver is Alexey Morozov, expert and author of a series of articles about Forex.

Today in this article I will talk in detail and in detail about making money on the Forex market.

I don’t like long introductions, let’s get straight to the point!

The Wealth Gene: 4-Day Free Online Training

In 4 days you will learn the millionaire thinking method, which will help you increase your income, close your debts, and find a business you like.

Participate

What is Forex and how does it work?

In the article “How to play on the stock exchange,” we talked about three segments of the financial market, one of which is the currency exchange – Forex. It has many unique characteristics, the main ones of which we list below.

Forex is not located in any specific place, like, for example, stock exchanges, its destiny is the Internet space. Therefore, trading is allowed around the clock, five days a week. The market is closed on Saturday and Sunday, as well as on international holidays.

If you go to the trading terminal, you will find that the trading instruments are currency pairs, for example, USD/CAD (American/Canadian dollar), EUR/USD (Euro/Dollar) and so on.

When one currency falls, the other in the pair will begin to rise. This allows you to trade both up and down markets.

You can make money from stock speculation, for example, only when the market is growing.

The real price of the instrument is called “Bid”, but we open or close transactions at a different price – “Ask”. The difference between the first and second is called the spread. Spread is the broker's earnings.

The volume of a position opened during trading is called a lot.

If we have a dollar account and we opened a position with a volume of 0.01 lot, then if the price changes by one point, we will earn/lose 1 cent. If we have 1 lot – 1 dollar.

Since every trade you open will be closed sooner or later, you can trade in Forex using leverage. We wrote about what this is in Forex Brokers.

We discussed other important concepts in previous texts; we will not repeat them.

How much can you earn on Forex – TOP 5 factors influencing profit

The ability to trade correctly according to the chosen strategy is far from the only factor influencing success. There are a number of other important points that we will describe below.

Factor 1. Initial deposit size

According to the rules of money management, in each transaction a trader has the right to risk no more than two percent of his capital. Warren Buffett generally does not recommend putting more than 0.1% of all funds in your account at risk.

What is it for? In order for the loss of this money to leave in reserve the opportunity to open another 49 to 1000 transactions and “win back”.

Ideally, the ratio of possible loss to potential profit is 1:3, that is, each transaction should give three times the possible loss.

Example

We traded Forex using wave analysis with a capital of $1000. For the month, the profit was about $250. If we had a million in the account, we would earn $250,000 in 30 days.

If we have a hundred dollars in our account and we risk 2%, the risk is two dollars. If we get a profit (ideally) three times larger, it will be 2*3 = $6. If you have a million dollars in your account, then one transaction will bring not $6, but $60,000.

Hence the conclusion: the fundamental factor is the amount of capital. The bigger it is, the better. Don’t be afraid of huge numbers: money can be taken under management, there are even companies like FxStart or United Traders that provide deposits for trading.

Factor 2. Efficiency (profitability) of the trading system

Profitability is determined simply - we open 10 trades on a demo account according to the chosen strategy and analyze how many were profitable and how many were unprofitable. Closing transactions is carried out under clear conditions: if Take Profit is set, we do not move it.

The ratios may be different. If out of three transactions two are closed with a profit, this is quite normal. Much depends on the magnitude of risk and profit.

By the way, our risk was twice as high as the possible profit, but it was not spontaneous, but conscious.

Trade your strategy for about a month on demo, and if the results are positive, you can move on to real trading.

Factor 3. Well-chosen strategy

It is necessary to choose strategies that, first of all, will be convenient for you and will not cause psychological discomfort. It is advisable to start with medium-term trading, although short-term transactions attract beginners with the opportunity to quickly make money.

We have already given a clear classification of trading strategies in the material “Forex training from scratch.” To make the right choice, you must master basic knowledge about Forex. Fortunately, there is plenty of information on the Internet.

Factor 4. Psychological stability

All newcomers consider themselves psychologically stable. They think that the exchange is not capable of turning their heads and forcing them to open transactions under the influence of emotions. Alas, the first days of real trading convince absolutely everyone of the opposite.

Forex is not the only way to make money. If, after seriously familiarizing yourself with this work, you realize that you don’t really want to do it, move on to something else, such as blogging or freelancing.

The currency exchange attracts huge amounts of money, but it scares off those already “lured” by high risks. The riskiness of financial trading does not decrease or disappear. There is always a possibility of losing money.

Factor 5. Variability of the market environment

In Forex (as in other markets) there is a concept of volatility. The higher it is, the more sharp fluctuations exchange rates can make. Volatility varies depending on the trading session and news.

Before the release of important news, the market usually freezes, there are practically no movements, but 1-2 minutes before the news is published, very sharp fluctuations begin.

You can make good money here, but you can also lose huge amounts due to slippage.

If you want to trade on the news, it is better to do it in the options market, not in Forex.

Trading sessions are the operating hours of the largest exchanges. We describe them in the table.

Forex trading sessions (GMT):

| № | Session name | Exchange | Opening | Closing | Volatility |

| 1. | European | Frankfurt, Zurich, Paris (London) | 06.00 (07.00) | 15.00 (16.00) | High |

| 2. | American | New York (Chicago) | 13.00 (14.00) | 22.00 (23.00) | High |

| 3. | Pacific | Wellington (Sydney) | 20.00 (22.00) | 05.00 (07.00) | Low |

| 4. | Asian | Tokyo (Hong Kong, Singapore) | 23.00 (00.00) | 08.00 (09.00) | Low |

Exchanges are located in different cities; due to time differences, the beginning and end of sessions can be determined differently; we have noted possible options in parentheses.

Many traders do not like to trade during the Pacific and Asian sessions because prices move very sluggishly.

It is imperative to take volatility into account, otherwise you can forget about successful trading.

What you need to make money on Forex - 7 useful tips for a beginner

We will indicate tips that we ourselves have followed and that professional stock speculators advise us to follow. This material was partially covered in “Stock Trading for Beginners,” let’s look at it from a different angle.

Tip 1. Choose the right trading strategy

When choosing a strategy, it is advisable to talk with a professional, attend a practical webinar or master class. The wrong strategy always leads to money loss. There is a lot to take into account: the size of the deposit, trading time, risks, type of analysis, and so on.

Interesting material on trading strategies is presented in the video below:

We wrote about two areas of analytics: technical and fundamental – in the article “Forex for Beginners”; you can refer to it to immediately understand which direction is best to move.

But what if you have mastered the basics, but are afraid to risk money? Do this. Go to the ]Alpari[/anchor] website, register and create a “Nano” account, also known as a “Cent” account.

Nano accounts are practically no different from regular ones, but if on a Standard account you need 200-300 dollars for a successful start, then on a cent account 2-3 will be enough. The balance is reflected in cents, you will see amounts of 200-300 USC.

The result is that we kill two birds with one stone - we don’t risk a lot of money, but at the same time we make real investments and get used to watching the balance change, as in a real account.

Tip 2. Practice trading on a Demo account

The exchange will not escape you, therefore, if you start working on it after a month or a year of “training trading”, absolutely no profitable opportunities will be lost.

A demo account is a great way to avoid a lot of annoying mistakes that make amateurs burn out.

Tip 3. Analyze the Forex market regularly

No matter how good the strategy is, the trader must always be aware of what is happening in the market. Each trading day begins with viewing the economic calendar - if serious news is planned for a certain currency, we refrain from trading.

Tip 4. Don’t invest large sums at once

If you become a master of the stock exchange game, people themselves will want to invest in you in order to receive interest. Therefore, do not rush into investing your own money, especially large sums.

Tip 5. Work on your emotions

If you wish, you can learn to control yourself even in the most difficult situations. Again, strategy helps with this.

If the price goes against us, you must analyze the market and determine whether the deal was opened as planned. If yes, we wait and don’t change anything; if not, it’s better to close.

Tip 6: Keep a trading journal

A trading journal can be an ordinary notebook where you paste printouts of charts with marked actions: where the trade was opened, where it was closed, when the trade was profitable or unprofitable, and so on.

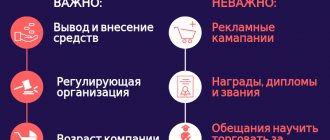

Tip 7. Choose your broker for trading wisely

There are a lot of brokerage firms; we analyzed them in detail in the article “Forex Brokers”. We will point out a number of other interesting companies.

1) Alpari

The largest brokerage firm. There are excellent training programs, daily webinars on market analysis, master classes from professionals. There are many currency instruments available for trading, the conditions are quite favorable.

No other broker has as many high-quality licenses as Alpari, so only Finam can compare with this company in terms of reliability.

2) BCS Forex

This broker also has a training program and well-developed analytics. You can trade more than 420 financial instruments on a wide variety of conditions.

The spreads are low, so not only mid-term traders, but also fans of pips can make good money. The company holds interesting promotions for beginners, and competitions with huge prize funds for professionals.

3) Alfa-Forex

The company provides earning opportunities for traders, professionals who can work in the analytical department, as well as partners who are ready to attract new clients.

In our opinion, Alfa-Forex is the best option for opening long positions for a period of a week or more. Because in analytics, forecasts are built precisely on the weekly timeframe.

4) InstaForex

The service is suitable for beginners because it gives huge bonuses: you can get 250% on deposited funds. You don’t have to have a lot of experience to trade: the analytics section contains forecasts for all existing analysis methods.

The positive side of forecasts from InstaForex is the indication of specific actions for various scenarios.

5) Forex Club

The broker has been working in the market for a long time, offering excellent customer support, training, and high-quality analytics. Trading conditions can vary widely, so both beginners and professionals will find the best options for themselves.

In addition to these companies, there are many others - smaller ones, but with quite favorable and interesting conditions.

How can you trade without risk with a no deposit bonus of $1,500 from InstaForex

The new no deposit bonus from InstaForex is a great opportunity to start trading on Forex. Your way into the world of the largest and most liquid market in the world, which has become the main source of stable income for many traders around the world.

With a $1,500 trading bonus, you will be able to evaluate the quality of order execution in real trading conditions without investing your own funds and without risk. When you receive a bonus, this amount will be instantly credited to your account and available for trading.

Test your trading skills! Create trades virtually before you start risking your money. Practice trading strategies so that when you are ready to enter the real market, you have the practice you need. Try the $1,500 no deposit bonus from InstaForex today!

Get a no deposit bonus of $1,500 from Instaforex

The main risks of Forex trading and how to avoid them

80 percent of all risks in trading are associated with human psychology. There are others, three of which we will briefly describe below.

Unfortunately, there is almost no way to avoid them:

- Internet Risks – Because we trade online, power outages or slow speeds can cause you to lose money. To avoid them, you need to set Stop Loss and Take Profit at the time of opening a transaction.

- Slippage is a situation when a transaction is opened/closed at a price other than planned. To prevent slippage from being particularly sensitive, you should not trade on news and small time frames.

- Widening spreads - if you look at the 1 Minute chart, you can see that the spread fluctuates - it either narrows or widens. In medium-term trading, its change is not critical.

Traders become familiar with other risks when trading directly

Other types of foreign exchange markets

When classifying foreign exchange markets, we should also highlight the markets for Eurobonds, Eurocurrencies, Euroloans, Eurodeposits, “gray” and “black” markets.

The Eurocurrency market is an international market for Western European currencies, where transactions take place in the currencies of these countries. Its functioning is due to the fact that currencies are used in deposit and loan non-cash transactions outside the issuing states. In the Eurobond market, financial relations take place in Eurocurrencies on debt obligations in the case of long-term loans issued as bonds of borrowers.

In the Eurodeposit market, financial relations are carried out on deposits of commercial banks of various countries in foreign currency at the expense of funds that circulate in the Eurocurrency market. Accordingly, in the Eurocredit market there are stable financial relations and credit ties for the provision of various international loans by commercial banks of states in foreign currency.