What is Forex in simple words

Forex (“Forex”, from the English FOReign EXchange - “foreign exchange”) is the world’s largest trading platform for interbank international currency exchange at market prices.

Forex is often referred to as “FX” for short. Sometimes you can come across the term “international Forex”, but this is not correct, since the definition already implies that the exchange takes place in the world, which means it is international.

The main participants in the Forex market are central banks. They are also the biggest players (at least so stated). Their turnover and influence is so great that they move prices in the right directions. But as the Central Banks themselves claim, they only maintain the necessary ratio of the balance of several currencies in their reserve. Commercial banks, funds, financial corporations, private investors and traders also trade in Forex.

For the average person, Forex is an exchange where you can speculate with currencies (buy/sell) with the sole purpose of making money on the difference between the purchase and sale prices (how to make money on the difference in exchange rates). There is no other purpose for keeping your savings on Forex.

When is the Forex market open?

Now let's figure out when the Forex market works . The Forex currency market operates without interruption 24 hours a day from Monday to Friday. It is decentralization that allows the international foreign exchange market to operate around the clock. Let's take a closer look at this.

As we said above, Forex trading involves many financial centers located around the world. And as you know, there are many time zones on our planet. That is, in one part of the world it is morning, and in another it is already evening.

The earliest morning comes in Japan is around 3 a.m. Moscow time. This means that Japanese banks are the first to begin their operations in the Forex market. They continue their work until approximately 11 o'clock. This trading time period in Forex is called the Asian session.

Around 10 am Moscow time, daylight begins in Europe and European banks begin trading on Forex. They continue their work until approximately 18 o'clock. This trading time period is called the European trading session.

At 16:00 the day begins in America and, accordingly, American banks begin operations on the Forex market. They continue trading until approximately 1 a.m. Moscow time. This time period in Forex is called the American trading session.

At 00:00 another world financial center comes into operation - Australia. Trading there continues until 9 a.m. Moscow time. And this continues all weekdays. This allows the Forex market to operate around the clock .

Useful article: How to quickly create a task on SeoSprint?

To summarize, the Forex market starts working on Monday morning at approximately 3 o'clock, and ends on Friday at about 1 am. Below are the main Forex trading sessions with time intervals according to Moscow time.

- Asian session — 03:00 – 11:00.

- European session — 10:00 – 18:00.

- American session — 16:00 – 01:00.

What is traded on Forex

3.1. Currencies

All currency pairs on Forex can be divided into three groups:

- Majors. The presence of an American dollar is required

- Minors or Crosses. Currencies of the world's leading countries, but without the American dollar.

- Exotics. Weakly volatile pairs

The first currency in the name pair is called “base”.

The main instruments for trading are currencies involving the American dollar USD. This is the so-called “major” sector. There are also many other pairs, but, as a rule, the most volatile pairs are those involving USD.

The most popular currency pairs are (majors):

- EURUSD (euro to US dollar)

- GPBUSD (British Pound to US Dollar)

- USDJPY (US Dollar to Japanese Yen)

- USDCHF (Swiss franc to US dollar)

- USDCAD (US dollar to Canadian dollar)

- AUDUSD (Australian dollar to US dollar)

- etc.

They account for more than 95% of the turnover of all trades (the first pair EURUSD - 60%).

There is a huge group of minors (or, in other words, cross-pairs). They do not contain the American dollar:

- AUDCAD (Australian dollar to Canadian dollar)

- AUDJPY (Australian Dollar to Japanese Yen)

- EURAUD (Euro to Australian Dollar)

- EURCHF (Euro to Swiss Franc)

- EURGBP (Euro to British Pound)

- EURJPY (Euro to Japanese Yen)

- etc.

3.2. Metals

There is also the opportunity to play on gold and silver futures on Forex:

- XAUUSD (gold)

- XAGUSD (silver)

Some brokers also have the ratio of gold and silver to other currencies:

- XAUEUR (gold to euro)

- XAUGPB (gold to British pound)

- XAUCHF (gold to Swiss franc)

- XAUAUD (gold to Australian dollar)

- etc.

3.3. World indices

Futures on world stock indices are also among the possible trading instruments. The most popular indices are:

- SPX500 (American Standard & Poors 500 Index)

- NQ100 (American NASDAQ 100 Index)

- FTSE100 (British index)

- DAX30 (German index)

- CAC40 (French index)

- NIKK225 (Japanese index)

Many brokers also have a stock futures section.

3.4. Cryptocurrencies

With the development of the cryptocurrency market, options with pairs for Bitcoin, Litecoin, and Ethereum began to appear:

- BTC/USD

- ETH/BTC

- LTC/BTC

- ETH/USD

- LTC/USD

Unlike traditional cryptocurrency trading on crypto exchanges, a commission is charged here for transferring a position (swap). Also this market is closed on weekends. As history shows, this can be very fraught, because... A young and turbulent cryptocurrency market can go far in some direction in 2 days.

Unfortunately, cryptocurrencies are still not very liquid on Forex and therefore you will also have to pay a considerable spread for buying and selling digital money.

Is it really possible to make money?

Figure 15 – Is it really possible to make money?

The answer to this question is yes. You can actually earn money, and quite decently at that. The specific amount of earnings depends on many factors:

- investor skill;

- trading style;

- the correctness and accuracy of its forecasts;

- the amount of the deposit and leverage (if it is used for trading);

- general market condition, etc.

The more professionalism a trader’s actions are, the greater the chances of making a profit.

Beginners should understand that trading on Forex, as on any exchange, is not betting in a casino or bookmaker.

Without an in-depth study of the laws of price movement, even the most brilliant trader will not be able to trade profitably. Therefore, the first thing every trader who is new to Forex should do is take a training course. And the deeper and more extensive this course is, the more chances a beginner has for profitable trading.

It should be noted that only a few can trade extremely profitably, increasing their deposit hundreds and thousands of times in a few months, on Forex. There is a pattern: the more aggressive the trading, the greater the risk of losing the deposit. This style of trading, if you’re lucky, helps to quickly disperse the deposit, but few traders manage to make a stable profit - an aggressive trading style a priori implies concluding risky transactions.

Read more: Strategies and risks of correlation of Forex currency pairs

Successful investment funds consistently earn profits of 30-40% per annum. This indicator can also be considered a guideline when trading on Forex - if we are talking about trading with your own funds, without using leverage.

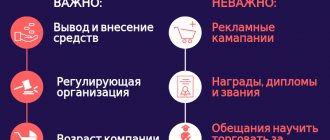

Unscrupulous brokers can also interfere with successful trading. Outright scammers, who, under various pretexts, refuse to withdraw money earned by a trader, are now relatively rare, mostly among new “offices” that have just opened.

But unscrupulous brokers can and often resort to these and other tricks, especially if trading is carried out inside a dealership center, without bringing them to the interbank market. Therefore, when choosing a broker, it is better to give preference to “old people” who have been working in the market for many years.

What are the trading turnovers on Forex?

The turnover on Forex is simply colossal and continues to grow from year to year. Below are the average daily trading turnovers (data from Wikipedia):

- in 1977 - $5 billion

- in 1987 - $600 billion

- at the end of 1992 - $1 trillion

- in 1997 - $1.2 trillion

- in 2000 - $1.5 trillion

- in 2005-2006, the volume of daily turnover on the FOREX market fluctuated, according to various estimates, from $2 to $4.5 trillion

- in 2010 - $4 trillion

- in 2013 - $5.3 trillion

- in 2020 - $5.1 trillion

Earnings on Forex

In Forex, as in a regular currency exchange, there are two prices: buying and selling. There is a special concept of spread - this is the difference between the purchase price (Ask) and sale price (Bid). For example, you can buy EURUSD at 1.12015 and sell at 1.12005. In this case, the spread is 10 points. In fact, a point is the accuracy of a pair for a particular broker (some have 5 decimal places, some have 4).

Since the difference between the purchase and sale prices is minimal, and the speed of transaction execution is hundredths of a second, Forex is an ideal place for the average person to speculate with currencies. Here you can quickly make decent money. Moreover, due to the huge turnover, it is possible to trade for a lot of money.

In general, the stock market is similar to Forex. For those who make money exclusively on fluctuations, there is no difference. What difference does it make what you make money from? In principle, none. Moreover, no tax is charged on profits received from currency speculation.

The difference between the stock market and Forex is that on the stock exchange everything is extremely transparent and regulated. In Forex, everything happens behind the scenes. There is no way to even see the real trading turnover (there are only tick volumes, but this is not the turnover on securities that we are used to).

Any Forex broker has the opportunity to take leverage without any commissions. For example, if you have $5,000 in your account, you can trade $10,000 or even $50,000. Naturally, the larger the leverage, the greater the risks. Therefore, experienced traders trade strictly according to strategies, adhere to the rules of money management and always set stop losses. If the price does not go in your direction, then automatically close the transaction at a predetermined level in order to protect losses.

I recommend studying:

- Investing in securities - simply about complex things

- What to invest in

- Stock trading for beginners

- How to make money from stocks

- Investment portfolio

Where should a beginner start trading Forex?

In order for an ordinary person to start making money on Forex, they need to register with a broker. At the moment there are a lot of them and there is plenty to choose from. There are few large companies, I strongly recommend working only with them and not dealing with small brokers, even if they offer exorbitant bonuses.

- How to choose a Forex broker

- Forex broker rating

I would highlight the top reliable Forex brokers with whom I work:

- ALPARI

- ROBOFOREX

- FOREX4YOU

- NORDFX

- AMARKETS

I also recommend reading:

- Forex for beginners

- The main rules of trading on Forex

- Forex technical analysis figures

- Candlestick models and patterns with examples

- Support and resistance levels

Peculiarities

The main goal of Forex is to form a market price for any currency in the world. Among its other features, one can highlight its functionality, the diverse composition of trading participants and the lack of a strict geographical connection to the trading platform.

Figure 8 – Figures on Forex charts.

Growth and decline

You can trade Forex when the market is rising or falling. In the first case, a position is opened at a low price of an asset, and the rise in price determines the trader’s profit. When a certain amount of profit is reached, the position is closed.

But you can make money not only from rising prices, but also from falling prices. In this case, you must first sell the asset at a higher price and then buy it at a cheaper price. The difference between buying and selling will be the trader’s profit.

The first option, when the price is rising, is called a long position (buy), and the second, when the price is falling, is called a short position (sell). Names determine only the direction of price movement and do not in any way affect the duration of holding open positions.

Leverage

Figure 9 – Forex leverage

Leverage (leverage, margin trading) is a trading tool provided by a broker, allowing a trader to enter into transactions whose volume is several tens or even hundreds of times greater than his own capital.

This trading option is very popular among traders, but it does carry certain risks.

The profit received from such trading completely becomes the property of the trader, but in the event of an erroneous forecast, the trader is forced to cover the loss from his own funds.

Spreads

Figure 10 – Spread Spread

in Forex is the difference between the purchase price and sale price of currency pairs.

When opening a trade, a trader automatically receives a loss equal to the spread.

In fact, the spread indicator is a kind of commission charged by the broker to the trader when opening a transaction.

The spread is also often called an indicator of the liquidity of a currency pair: the higher its value, the less liquidity.

The main currency pairs in Forex have a small spread. The spread can be fixed or floating, the value of which changes depending on the current state and volatility of the market.

Interbank

The essence of interbank trading is that central banks of different countries buy different currencies at market value.

Figure 11 – Interbank Forex

This segment of trade itself emerged as a result of the urgent need to regulate the exchange of various currencies at market prices by both state and private banks.

With the advent of Forex, other players also had the opportunity to participate in interbank trading: investment funds and large private investors.

The emergence of brokers theoretically made it possible for small private investors to take part in trading on the interbank market.

Theoretically, because the broker is obliged to bring all transactions of its clients to the interbank market. Honest brokers do this. But there are also those who believe that it makes no sense for brokers to bring many transactions of several hundred and even thousands of dollars to the interbank market with one standard lot of $100,000.

Therefore, they enter the interbank market in large sums, but do not take out small bets on interbank trading, preferring to pay the profit on them from their own funds. In this case, the broker is more interested in draining the client’s deposit than in his profitable trading: in the first case, not only does he not need to pay anything, but the client’s money also becomes his property.

Read more: Wolfe waves: construction, application features and choice of strategy

24/7 service

Forex is designed in such a way that trading on it can be carried out around the clock, 5 days a week. This is due to the presence of several trading sessions in it: Asian, European, American and Pacific, therefore the cessation of trading on one trading platform is compensated by trading on another.

Figure 12 – Forex opening hours

The Forex trading week begins with trading on the Wellington trading floor (New Zealand).

Then the Sydney and Tokyo stock exchanges join the trading.

After the opening of the London Stock Exchange, the center of trade moves to it.

Then the stock exchange in New York joins the trading, after which Wellington takes the initiative again, and so on in a circle.

24/7 Forex trading gives its traders the opportunity to trade at a time convenient for them. Some people prefer to trade during the London and New York stock exchanges when the market is most volatile, while others prefer to trade during the less volatile and more predictable Asian session.

It is worth considering that the market can change greatly from one trading session to another. However, interest in various currencies varies greatly when it comes, for example, to the US and Asian markets. However, it is impossible to compare trading volumes in this example, because the USA has the highest liquidity. This factor necessarily affects market quotes.

Tick volumes

Tick volume is an indicator of the change in the price of an asset per unit of time. The minimum indicator is 1 tick.

Figure 13 – Tick volumes

Experienced traders can even calculate the approximate trading volume using this indicator.

But still, tick volume is not a direct indicator of trading volume; rather, it is an indicator of market volatility.

In other words, if regular trading volumes give the trader information about the size of orders from sellers and buyers, then tick volumes characterize the current state of the market and make it possible to see what interest participants are showing in trading at the moment.

How is tick volume analysis useful for a trader? Imagine a situation where your tried and proven trading strategy began to fail. In most cases, the “culprit” for this is the changed volatility of the asset. Tracking tick volumes allows you to timely identify such periods and make appropriate adjustments to trading.

Swaps

Figure 14 - Swaps

In the financial world, this term refers to an agreement that allows the parties to temporarily exchange some assets or liabilities.

For clarity: if two minds agreed to exchange their cars for a while, then this can be considered a swap.

All swaps consist of two stages:

- Actually an exchange.

- Reverse exchange (refund).

The following swaps are found in financial markets:

- currency;

- precious metals;

- promotional;

- interest.

Swap can be positive, negative or zero. It is better to understand how a swap works using the example of the EUR/USD currency pair. To open a position, a trader just needs to click the “open order” button. But in fact, at this moment the trader takes out a loan from the US Central Bank and pays the appropriate interest on the use of the loan. Then he exchanges dollars for euros at the Central European Bank, and leaves it there as a deposit - with interest accruing on deposits.

If, for example, the rate on a loan taken in an American bank is 0.5%, and the rate on a deposit in a European bank is 1%, then the swap will be positive - + 0.5%. If it's the other way around, it's negative. If both interest rates are equal, the swap will be zero.

The swap is accrued at 00:00 GMT, or at 2:00 Moscow time. This indicator has no effect on intraday trading. But even if the position is kept open for several days, the impact of the swap in the vast majority of cases is compensated by fluctuations in the exchange rates of the traded pair. Only if you keep a forex position open for more than a week can a swap significantly affect the size of your profit or loss.

FAQ: answers to frequently asked questions

6.1. Forex kitchen - what is it?

There is such a thing as “Forex kitchen”. This means that all traders’ transactions do not go out to the interbank market, but are carried out within the broker. Is this a scam? In general, yes, but for a market trader this should not affect trading results. Essentially, we are playing with a broker, but using the same quotes as real ones. If we win money, then it is a loss for the broker; if we lose money, then it is his profit.

A large broker will honestly pay you your profit in any case, so whether this transaction was inside the broker or not, we will never know.