Image: Unsplash

A year ago, the Russian Central Bank canceled the licenses of five large forex dealers. Among them were the well-known in our country, “Teletrade Group” and “Forex Club”.

In the new article we will talk about why this had to happen, and how the real foreign exchange market differs from what many unscrupulous companies offer.

Note

: any investment activity on the stock exchange is associated with a certain risk, this must be taken into account. In addition, to use the methods described in the article, you will need a brokerage account, which can be opened online. You can study the trading software and practice performing transactions using test access with virtual money.

How Unscrupulous Forex Companies Really Work

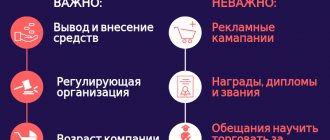

The regulator's main complaint against Russian Forex dealers was that they did not actually conduct any activities other than advertising to attract new clients.

These clients were then “redirected” to companies registered in offshore jurisdictions. And with the help of software from these companies, clients made transactions with currencies. According to statistics published by RBC, companies that lost their licenses attracted only 2 thousand clients, and no more than 470 of this number are active. At the same time, the main expense item for Russian subsidiaries of foreign dealers is advertising. As a result, year after year, companies officially attracted an insignificant number of users, declared large-scale losses, but continued to work stubbornly. Why is such a business possible?

Because in fact, the business of Forex dealers is not at all similar to how companies that provide access to trading on the exchange earn money. They do not bring customer requests to external markets, but only imitate such activities, in fact being a type of casino.

It works like this: on a real exchange, transactions are concluded between two counterparties who need this or that currency for a specific purpose. In the case of Forex dealers, the second party to the transaction is most often the company itself. The system is usually explained to clients something like this:

The risk management system of the company (registered in the BVI or Cayman Islands) calculates risks and sends not all client orders to the real over-the-counter market, but only their aggregated component exceeding a certain size. And the company combines the remaining orders with opposite orders received from other clients. That is, if a client has an order for 10 thousand dollars, then it will be executed within the Forex broker itself, if for 100 thousand dollars, then it will be executed by its counterparty, a large international bank, which will take this order for its position . But if a client has an order for $1 million, then it will certainly be sent “to the exchange” and executed only there.

Differences between stock and foreign exchange markets

Once upon a time, an acquaintance of mine (a representative of a brokerage house that provides access to the American exchanges NYSE and AMEX) very actively encouraged me to switch to trading on the stock market (stocks, options or indices). His main argument was the fact that everything is transparent on the stock exchange. And if you lose money, then, unlike Forex, you will know who your counterparty is and who made money on you. But tell me, please tell me, what difference does it make to me (and to you too) whether you know your “robber” by sight or not?

His second argument was that the exchange will not cheat you and will always pay you the money you earned. This issue can also be resolved by choosing a reliable and honest Forex broker. You know my opinion, I prefer to trade through banks and sleep peacefully, without worrying about the safety of my money and timely payments. This is where my friend and I ended the argument.

In terms of their speculative essence and methods of making profit, the stock and foreign exchange markets are very similar. But there are still differences.

- As you know, the standard leverage provided by a broker on the foreign exchange market is 1:100. If desired and with the consent of the broker, it can be increased to 1:500. Of course, I don’t recommend you do this for money management reasons. Moreover, this leverage is provided completely free of charge.

The situation on the stock market is different. A trader, as a rule, trades without any leverage at all, or with a leverage of 1:3, 1:5. Moreover, this is not leverage in our understanding, but a loan provided by a broker, for which he will charge you additional interest, thereby increasing your trading costs.

To be fair, it must be said that with a small leverage, the trader will have lower risks per transaction, but also lower potential income. Of course, one can argue with this... It depends on who has what trading approaches. But let’s not go deeper into the analysis of tactics and strategies. This is the topic of a separate article. This leads to the first difference between the stock and foreign exchange markets - the size of the initial capital . The entry threshold for forex trading is much lower than for stock trading.

- the number of trading instruments in the stock market is an order of magnitude greater than in the foreign exchange market. There are about 7-8 thousand shares listed on the stock exchange alone.

But a certain specification also exists among stock speculators. Some stock traders trade stocks, some trade indices, and some only work with options.

In this regard, it is easier for currency traders. There are 50-60 currency pairs (including cross rates) with which the trader works. Of course, each pair has its own character, but the overall correlation between them is higher than when trading stocks. It’s hard to say whether this is a plus or a minus.

Currency speculators who practice medium-term and day trading sometimes have to wait several days for the intended entry point. And here the time factor comes into play, which tests the strength of a trader’s nerves and endurance. Forcing him to wait in a disciplined manner for the implementation of the intended trading plan. While a stock trader, thanks to a greater variety of instruments, will always find a use for his trading activity.

Another advantage of the large selection of instruments on the stock market is the possibility of wider diversification and hedging of open positions.

- Whatever stock traders say, their round-trip costs For fund traders, in addition to paying a commission for opening + closing (per circle) a position, a monthly fee is added for using the trading terminal, additional services and services. Add to this the interest for using leverage, and you will get an amount higher than the spread we are used to on the foreign exchange market.

- The forex market operates around the clock for 5 working days. This allows traders to trade at a time convenient for them and structure their working day in accordance with their personal preferences.

The opening hours of stock exchanges are limited to certain business hours. Be prepared for the fact that if you decide to trade on the American exchanges NYSE and AMEX, your working day will begin at approximately 16-00 Central European Time and end late at night. And if you also analyze transactions and analyze trades, you will soon turn into a vampire who sleeps during the day and goes hunting at night.

How suitable this lifestyle is for you again depends on personal preferences and the strength of the body.

- If we take it as an axiom that the global financial market is not predictable in principle, then it is quite difficult to determine which market - the currency or stock market - is easier to analyze .

Currency speculators mainly focus on technical analysis. For many of them, the fundamental component fades into the background and is of secondary importance. Especially for those who scalp or trade intraday.

While for stock traders, the financial and economic indicators of a single company or the industry as a whole (if indices are traded) are of primary importance.

Stock market traders have a huge advantage over currency speculators. They can see trading volumes, open interest and, by creating a market profile, determine who has the upper hand and who is winning - bulls or bears.

Currency traders, at best, can see trading volumes on a separate ECN platform, and not the entire market as a whole. This significantly narrows the speculator’s ability to assess the balance of power and make a correct and informed decision about the market situation.

As you can see, dear readers, there are not so many differences between the stock and foreign exchange markets and they are not that significant. Of course, I could have missed some points, but I hope you will correct me by leaving your comments.

What is the problem with this scheme

In reality, no orders are placed on any exchange; the money is accounted for in the dealer's account and converted at changing exchange rates.

The second party to transactions becomes the Forex dealer himself. As a result, it turns out that if the client makes money, the dealer will lose; he is not at all interested in this. It is no coincidence that the Central Bank’s list of complaints against Forex companies includes falsification of client data transmitted to trading terminals. All this with the sole purpose of quickly showing them that they suffered losses due to “bad” investments.

Does the client have a chance to earn money?

Another distinctive feature of Forex dealers is the provision of significant leverage, that is, the ability to trade using borrowed funds.

Clients are explained that with a conditional leverage of 100, to make transactions worth $1 million, you will need to have only $10 thousand. As a result, much greater income is possible than using only $10 thousand. But this is in theory, but in reality, using leverage on Forex leads to inadequately increasing risks. Let's imagine that you used leverage and bought a million dollars worth of currencies. At the same time, a simple glance at the quote chart of the euro/dollar currency pair shows that daily fluctuations in quotes, either positive or negative, can range from 0.1% to 0.5%. In the case of a million dollars, even 0.1% is $1 thousand. That is, you can lose all your money in just a few days of unfavorable price movements. In this case, the client's position will be forcibly closed.

It is not surprising that, according to statistics, clients of Forex brokers lose their money at a rate of 60-80% per quarter. This means that about 70% of the funds brought by clients within 3 months migrate to the pockets of the owners of Forex brokers. Even in a casino, the chances of earning money are higher.

In fact, using the services of Forex dealers, clients do not participate in investment activities. Their orders are not displayed on any external exchange; no one selects a counterparty for them. Dealers make transactions within their systems using opaque schemes, acting as the second party to these transactions, and providing huge leverage only accelerates the loss of clients’ money.

There is no investment, no real currency trading. This is essentially a betting game where people simply bet on the exchange rate. It’s just that this bookmaking is presented in the form of submitting a trading order.

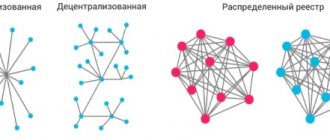

How to distinguish stock, foreign exchange and derivatives markets from each other

Often people have to radically change their lives, because we live in an era of serious changes and changes in technology. What yesterday brought income, and with it the possibility of a comfortable existence, no longer works today. It is necessary to constantly look for new forms of income and areas of application of your professional services. Or even completely relearn.

Let's talk about this. Some people with a mobile mindset go into the field of trading, but not simple trading, but trading in securities, currencies, etc. Naturally, they have to understand from scratch what the stock market is, what futures and options are, than traders on the Moscow Interbank Market currency exchange traders are different from forex traders.

Let's start with the basic concepts. The stock market is the place where its subjects build the entire set of economic relations regarding the issue, purchase and sale of securities between its participants.

At the same time, you need to understand that the stock and foreign exchange markets are not the same thing. Although currency is a security for which you can buy certain goods, currency trading relations arise in another market, which is called the foreign exchange market. This market is a financial institution where one currency is exchanged for another in order to make a profit. Accordingly, you can find out the constantly changing (depending on the dynamics of transactions) current US dollar exchange rate and trade it only on the foreign exchange exchange.

In addition, there is another market, which is called the derivatives market, where, as the name implies, derivatives contracts are concluded, including futures, forwards and options.

A forward is a binding futures contract under which the buyer and seller agree to supply goods of an agreed quality and quantity or currency at a certain date in the future at the price of the goods, exchange rate and other conditions fixed at the time of conclusion of the contract.

But a futures contract differs from a forward contract in that the latter is a one-time over-the-counter transaction between purchase and sale entities, while the former can be in the nature of a recurring exchange offer.

An option, in turn, is a contract where a potential buyer or seller of a product, security, etc. acquires the right, but not the obligation, to purchase or sell a given asset at a predetermined price at a strictly defined point in time in the future or during a certain period.

Of course, in one article it will not be possible to consider even the basic concepts of traders. However, there is a wonderful https://forum-traders.rf, where you can not only find out everything you learned about in this article, but also more: about exchange rates, oil prices, etc., but also get valuable experience gained by forum participants directly in practice.