In conditions of an unstable economic situation or crisis, people often talk about inflation and deflation. The term “inflation” can be heard in the market and in public transport, in a store and office; it is used in their speech by everyone: from an advanced economist to a simple factory worker. We can only guess what meaning different people give to the concept of inflation. Most often you hear that it is the “culprit” of almost all the troubles in the country’s economy. Is it so?

What is deflation? Is it good or bad? What is better for economic development? This is what we have to understand in this article, where the concepts of these processes, their types, causes and consequences, components of inflation will be revealed.

Inflation. What it is?

Inflation is the process of loss of value of money, i.e. a decrease in its purchasing power. Simply put, if last year you could buy 5 loaves of bread with 100 rubles, then this year you can buy only 4 loaves of the same bread with the same 100 rubles.

At different periods of time, this process may concern different industries and different groups of goods. The process of inflation consists in the fact that the total amount of money in circulation and in the possession of the population turns out to be greater than it can be used to buy goods in circulation. This leads to an increase in prices for these goods, while the income of the population remains the same. As a result, a specific amount of money can buy fewer and fewer goods over time.

The essence of the concepts of “inflation” and “deflation”

Definition 1

Inflation is an economic phenomenon characterized by a general increase in prices for goods and services over a long period.

The essence of inflation is that over time the purchasing power of the same amount of money decreases. That is, the same amount of finished products can no longer be purchased, since money has depreciated. The market economic model is characterized by an open form of inflation associated with rising prices. If the state intervenes in economic processes, then inflation may become suppressed. With it, prices do not rise, but there is a shortage of goods.

It is necessary to clearly distinguish between inflation and one-time price increases. Inflation is always a trend characteristic of a long period. At the same time, inflation does not lead to an increase in prices for all existing goods and services. Some of them may become more expensive, while others may become cheaper. Experts talk about inflation if there is a change in the general price level. This trend can be tracked through the gross domestic product deflator. In essence, it is a price index that allows you to measure the general price level for the period under review.

Finished works on a similar topic

- Coursework Deflation and inflation, causes and consequences 470 rub.

- Abstract Deflation and inflation, causes and consequences 220 rub.

- Test work Deflation and inflation, causes and consequences 220 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Note 1

Deflation is the opposite of inflation. It leads to a decrease in the price level. This phenomenon is not typical for a market economy, so it occurs very rarely, and, as a rule, in the short term. An example of long-term deflation is the deflation in Japan, where in recent decades there has been an overall decline in prices of 1%.

Types of inflation

Economists and financial analysts identify many gradations of inflation according to various criteria. Here are some of them:

1. According to the level of regulation by the state, inflation can be hidden or open.

Hidden - there is strict state control over the price level, which results in a shortage of goods, since manufacturers and importers cannot sell their goods at the prices dictated by the state. As a result, people have money but nothing to buy. Scarce goods are sold “under the counter” at inflated prices.

Open - there is an increase in prices for resources used in production, as a result of which the prices for manufactured goods increase.

2. Based on growth rates, moderate inflation, galloping and hyperinflation are distinguished.

Moderate – price increases do not occur sharply, but slowly (up to 10% per year), but wage growth grows even more slowly.

Galloping – high growth rates (11-200%). Such inflation is a consequence of serious violations on the part of the monetary system. Money depreciates very quickly.

Hyperinflation is an extremely high rate, almost uncontrollable situation (from 201% per year). Causes extreme distrust of money, the transition to barter transactions, to the payment of wages not in cash, but in kind.

3. Depending on the degree of foresight, there are expected and unexpected inflation.

Expected is the predicted level of inflation based on last year’s experience and the prevailing prerequisites for the current period.

Unexpected – the value of which turned out to be higher than predicted.

4. In everyday life, inflation is also divided into official and real inflation. Official inflation is like the “average temperature in a hospital.” To calculate the difference in price levels with an annual interval, data is taken from different sectors of the economy in all regions of the country, and then a weighted average is derived. So it turns out that goods and services that make up the bulk of the consumer basket (food, housing and communal services, education, leisure, medicine, etc.) increased in price by 20%, oil by 2%, gas by 3%, the price of timber fell by 7%, etc. As a result, official inflation was 4.5%. It is this value that will be taken into account when indexing wages. Real inflation is the one that is reflected in people's wallets. Based on this example, it would be 20%.

Causes of inflation

Studying and analyzing the causes of inflation is a complex economic process. As a rule, the onset of an inflationary process is caused not by one reason, but by several at once, and one can flow from the other, as if in a chain. They can be external (consequences of state actions in the international arena) and internal (intrastate economic processes). The main ones include:

1. Reducing the refinancing rate.

It is known that the Central Bank of the state lends money to credit organizations at a certain percentage. This percentage is the refinancing rate. And if the Central Bank reduces this rate, then credit organizations can give money to the population in the form of loans, also at a lower interest rate. The population takes out more credit, which increases the amount of money in circulation. This is an internal reason.

2. Devaluation of the national currency.

This is a process when a country's domestic currency begins to depreciate relative to stable currencies. Over the long term, it has been the US dollar and the euro. When the ruble exchange rate falls, the cost of purchasing imported goods inevitably increases, which means their price for the consumer increases. Even if the country’s domestic markets have an offer for partial replacement of imported goods, their price will only temporarily remain at the same level. This is due to the fact that imported raw materials, fuel, and components are often used to produce domestic goods. Therefore, prices for domestic goods will also rise. This is an external reason.

3. Imbalance of supply and demand in the domestic market of the state.

An excess of aggregate demand leads to the fact that production does not have time to meet supply, a shortage of goods arises, and hence the price increases. Also, an excess of aggregate demand may be a consequence of a reduction in the production of goods, and this, in turn, is a consequence of an increase in the cost of imported raw materials, and the cost has increased due to the devaluation of the ruble. Thus, the external cause of inflation influenced the emergence of the internal one, and further their consequences will have a complex development.

4. Emergency situations or martial law in the state.

This entails unplanned unproductive expenses and irrational spending of national income. Nothing is invested in the development of production and the state, and free money in circulation increases without an increase in the goods that can be bought with it.

5. State budget deficit.

If a situation arises when a state's expenses exceed its income, the state, in order to cover this deficit, begins to print money or sell debt securities to banks or the public. This leads to an increase in the amount of money in circulation, while the amount of goods remains unchanged.

Deflation

What is deflation? In essence, this is the opposite of inflation.

In simple terms, deflation is a decrease in the general level of prices for goods.

If during inflation goods and services become more expensive and the purchasing power of money falls, then during deflation, on the contrary, prices for goods fall and the purchasing power of money increases. That is, with 100 rubles yesterday you could buy 4 loaves of bread, but today with the same 100 rubles you can buy 5 loaves.

It would seem, so what’s bad? This is very good for the population. Most people perceive deflation as a positive and very desirable process.

Causes of deflation

1. Imbalance of supply and demand.

In a healthy economic situation, demand always generates supply. If the opposite happens, then a situation arises when more goods are produced and imported than the country's population can buy, therefore, prices for goods decrease.

2. The wait-and-see attitude of the population.

This reason is a direct consequence of the first reason. People are in no hurry to spend money, especially on large purchases, because they are waiting for the price to fall further. This leads to an even greater decrease in demand against the background of unchanged supply.

3. A sharp decrease in working cash in the fight against inflationary processes.

In simple words, this is deflation replacing inflation. This situation arises when too stringent or excessive measures were taken by the state to contain the growth of inflation. For example, a suspension of wage and pension growth, an increase in taxes and the Central Bank discount rate, and a reduction in public sector spending.

Consequences of inflation

Negative:

- Depreciation of savings, loans, securities, which leads to distrust in the banking system and investment activities.

- Money ceases to perform its functions, barter appears, and speculation increases.

- Decrease in employment.

- A decrease in the population's demand for certain goods and services, which inevitably leads to a deterioration in living standards.

- Devaluation of the national currency.

- Decline in national production.

Positive impacts include stimulating economic activity and business activity, leading to economic growth. However, this is a temporary phenomenon that can only persist with a controlled target level of inflation.

Definition of the term “deflation”, examples

Deflation is a state of the economy in which capital and consumer prices fall over time. At first glance, falling prices might seem like a great thing for buyers, except that the cause of deflation is a long-term decline in demand.

This could mean a recession is in full swing. This phenomenon will entail massive job cuts and lower wages.

As the recession worsens, deflation is gaining momentum.

Entrepreneurs lower prices in a desperate attempt to get people to buy their products.

Causes of deflation

There are three main reasons why deflation is a greater threat than inflation in the 21st century.

First, cheap goods from China keep prices low. In this country, the standard of living is quite low, so ordinary workers receive wages lower than Europeans. In addition, the exchange rate of China's national currency remains pegged to the US dollar. This way, Chinese exported goods remain competitive.

Secondly, the development of technology in the 21st century, namely the computer industry, maintains labor productivity at a high level. Most information can be obtained from the Internet in a matter of seconds. Workers spend less time searching for needed materials. Also, the massive transition from regular mail to electronic mail has optimized business communication.

Third, the booming birth rate and massive aging of the population have led large corporations to keep wages low. Many people continue to work even after retirement because they cannot live on the income they receive.

Why is deflation bad?

Deflation reduces economic growth. When prices fall, people postpone their purchases. They hope that after some time they will be able to buy the necessary goods even cheaper. You've probably done this yourself when you were thinking about buying a new phone or TV. You could even wait until next year to buy a new smartphone model for a lower price.

Massive deflation helped turn the 1929 recession into America's Great Depression. As unemployment continued to rise, the demand for goods and services fell. Prices are down 10 percent over the year. As prices fell, companies began to go bankrupt in droves. More and more people became unemployed.

Japan is a modern example of deflation

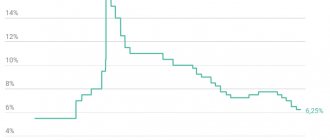

Japan's economy has been in a deflationary spiral for the past 30 years. This process began in 1989, when the National Bank of Japan raised interest rates and, thus, the financial bubble in the national real estate market burst.

During that decade, the economy grew at less than 2 percent a year as companies stopped paying off debt and cut their spending. Japanese culture is against suspending employees from work, so the excess of workers reduced productivity.

Experts have identified the following five factors in the development of the deflation process:

- the ruling political party has not taken the necessary steps to revive the economy;

- raised taxes in 1997;

- banks continued to hold unprofitable deposits in their accounts; this practice led to the fact that the necessary capital for economic growth was occupied;

- Trade in national currencies supported consumer purchasing power at a high level relative to the dollar and other world currencies. The Bank of Japan tried to create inflation by lowering interest rates. But entrepreneurs took advantage of this situation by buying cheap yen and exchanging it for more expensive foreign currencies and thus making a profit.

- The Japanese government spent large sums buying dollars to combat the yen's declining purchasing power, which led to rising government debt.

Consequences of deflation

Negative:

- Decrease in consumer demand, or deferred demand. When people expect an even greater reduction in prices and are in no hurry to purchase goods and services. Thus, prices fall even lower.

- A drop in production, which inevitably occurs following a drop in demand. What's the point of producing a product that people don't buy?

- Closing of companies and factories that cannot “stay afloat” due to falling demand.

- Massive increase in unemployment due to bankruptcies of companies and downsizing of those remaining. This results in a fall in household incomes.

- Massive outflow of investment, which further aggravates the situation in the country's economy.

- Many assets are depreciating.

- Banks stop lending to businesses and households or provide money at incredibly high interest rates.

The result is a vicious circle and chaos in almost every area of economic activity; any state will need a lot of time and effort to get out of this state and balance the economy.

The only positive aspects include temporary short-term euphoria from lower prices for goods and services.

Reliable investments on the Internet

Views: 457

About deflation

If everyone is more or less familiar with the concept of “inflation,” then what is “ deflation ”? I will look at this concept in more detail in this article.

In fact, everything is quite simple. Deflation is the opposite of inflation . That is, this is a situation when the purchasing power of money increases, and the cost of goods and services, on the contrary, falls. Despite the apparent optimism of this phenomenon, the purchasing power of the population does not increase and, on the contrary, decreases. The impact of deflation on the economy directly depends on how long this process has been. As a rule, it does not last long. Deflation can be calculated by analyzing prices over a short period. For example, per month or per quarter. Even so, a year's price survey still usually reveals inflation.

Causes of deflation

In fact, there may be several reasons. I will give only the main ones.

- Increasing demand for funds, both cash and non-cash. This situation leads to the fact that people strive to increase the volume of their savings , and therefore their volume in circulation decreases, which is why their value increases.

- Decrease in the number of credit loans. This situation also reduces the amount of money in circulation, which can lead to deflation.

- Increased production volume. If the money supply and income stability of the population are maintained, this can lead to deflation.

- Control of the money supply by the state. When trying to reduce inflation, such measures may have the opposite effect.

Consequences of deflation

Even though deflation seems to be an extremely positive development, it is not so simple. In fact, deflation can have a very negative impact on the economy, and even more negatively than inflation.

Deflation means that a country's economy is going through a period of recession. In this regard, the consequences may be as follows -

- A decrease in demand due to the population's expectations of an even greater reduction in prices for goods and services.

- Pent-up demand provokes a further reduction in prices, resulting in a vicious circle.

- Decrease in production volumes.

- Bankruptcy and closure of enterprises.

- Reduction of staff.

- Decrease in income of the population.

- Decrease in purchasing power.

Conclusion

Even though it seems that deflation is a positive situation, what could be better than falling prices? However, everything is not so simple. Prolonged deflation can lead to serious economic problems. However, short-term deflation generally does not have a negative impact on the economy. Therefore, we can conclude that for stable economic development, slight inflation .

(Visited 21 times, 1 visits today)

Please rate the article and leave your opinion in the comments

[Total: 1 Average: 5]

This might be interesting:

The best credit cards with cashback

The best debit cards with cashback

SecretDiscounter reviews and review | up to 40% cashback in more than 1800 stores

Investments in the Non-State Pension Fund | Deposits in NPF Sberbank

Alfa Travel debit card review and reviews

Investment in Credit 911

Inflation | Types and causes of inflation | Consequences of inflation in Russia and the world economy

Sberbank investments reviews and review | Online investments in stocks, bonds, funds and precious metals

Conclusion

When comparing inflation and deflation, we can clearly say that the consequences of both of these processes are equally negative for the economy of any state if their level exceeds the predicted controlled indicators. According to many economists, the consequences of deflation are even more disastrous. And this is obvious.

Last year, 2020, inflation in Russia, according to official data from Rosstat, was only 2.5%, despite the fact that the planned indicators included in the budget were 4%. On the one hand, low inflation is good for the population, ordinary consumers of goods and services. Since prices increased slightly, and this theoretically did not affect the budget of the average Russian. However, from the point of view of the impact on the development of the country's economy, a low inflation rate is a signal of low economic activity, which, of course, has a negative impact on the development of the country in the current period, and without appropriate corrective measures in future periods.

As a rule, the processes of inflation and deflation can alternate with a certain periodicity, the main thing is that their fluctuations do not go beyond acceptable limits and are controlled.

For the successful development of the state’s economy, a small percentage of inflation is necessary, but only if it is at the level of the predicted positive indicator.

Various economic terms

Inflation and deflation are economic swings that throw the economy from one side to the other. If inflation is traditionally perceived as a negative phenomenon for the average citizen and the country's economy as a whole, does this mean that deflation, as a process inverse to inflation, is a good thing?

"Deflation" is Latin for "to deflate." According to the laws of economics, supply must be created as a result of demand. During deflation in a country, a situation arises when a specific supply of a product or service is several times greater than the demand for this product or service on the market. As a result, price tags in stores change downwards.

At first glance, it seems that deflation is a plus for the average citizen. After all, prices in stores are constantly falling, and for the same amount of money tomorrow you can buy more goods than yesterday. But not everything is as simple as it seems at first glance. The pitfalls lie in the reasons that directly provoke the emergence of deflation.

Conventionally, two types can be distinguished: “good” and “bad” deflation.

- The first appears against the backdrop of increasing production efficiency and reducing production costs. In this case, competition increases, and manufacturers lower prices to attract more customers, while maintaining jobs and increasing employee wages.

- “Bad” deflation is born due to the following factors:

- growth in labor productivity combined with a decrease or maintenance of household incomes at the same level. For example, if an enterprise increases production, increases profits and the supply of its goods on the market, reduces costs, but workers’ wages do not increase.

- reduction in lending volumes. If banks lend less money, this can trigger deflation because there is less cash in circulation.

- increasing demand for money.

Causes

If the population saves more than it spends (hoards cash), then the value of money increases, and the demand for it increases, which provokes the emergence of deflation. A situation arises in which the buyer, seeing a drop in prices, does not spend his money, expecting an even greater reduction in the cost of the product.

Enterprises, in turn, seeing a drop in demand, lower prices and reduce production volumes. The logic is simple: if they buy less, it means they need to produce less. And a decrease in production volumes leads to a decrease in trade turnover, tax deductions, wages and, as an option, an increase in unemployment.

An effective method of combating “D” is a moderate increase in cash in circulation by reducing interest rates on loans by the Central Bank. Businesses and individuals take out more loans, which increases demand for goods and services, and prices in stores stabilize.

In order to save the economy from “D,” the state can increase sales of government securities or resort to tax cuts. Here, the main thing with rescue measures is not to “overdo it” and carry them out until inflation reaches a level of 3%, since this level is considered a sign of a stable economy.

How are things going with us?

Long-term deflation is dangerous for the country: lasting more than six months. In Russia, inflation has been recorded every year since 1991, i.e. price growth (on average about 9%). The population is accustomed to the upward movement of prices. Many people remember the inflation of the last decade of the 20th century (1991-1993, 1998), as well as 2008.

“D” in Russia at present, if observed, is in a single industry and for a short period of time. The first and only long-term (over 2 months) price decline to date was recorded in August-September 1997. The recent decline in prices in Russia, mainly for seasonal vegetables and fruits, amounted to only 0.5% at the end of summer 2020, and this is the maximum figure for the Russian economy since 2003! We have the cold summer of 2020 to thank for such a drop in prices (deflation). Then, due to fears that the harvest would not be harvested, prices rose in June.

Even taking into account the August fall in prices, according to forecasts for the end of 2017, inflation in Russia is expected to be at the level of 2.4-2.5%. In this situation, we can safely say that the ruble is not threatened with deflation in the near future.