Bookmarked: 0

What is the consumer price index? Description and definition of the concept.

The Consumer Price Index is an index that expresses the percentage of prices of goods purchased by average citizens between the index year and the base year. Only retail goods can be assessed. Transactions are carried out by the statistical office and are published monthly. Approximately 130 thousand product names are subject to consumer price indexing. This index is one of the main indicators of inflation rates, as it shows the increase in prices compared to the base year. The base year is taken as 100, and the index shows the percentage of increase or decrease in the level of retail prices.

The consumer price index (inflation index, CPI, English Consumer Price Index, CPI) is one of the types of price indexes that was created to measure the average level of prices for services and goods (consumer basket) in the economy for a certain period.

Properties

- The main tool for calculating inflation in the United States

- Based on a fixed price level for many services and goods in the consumer basket

- It is a Laspeyres index, since the base year consumer basket is used when calculating the CPI

- Common measure of cost of living changes

The Federal State Statistics Service in Russia publishes consumer price indices that characterize the level of inflation. The base period is the last month or December of last year.

In the US, base period: 1982-84 = 100. Frequency: Published monthly (usually the 15th at 8:30 am ET) by the US Bureau of Labor Statistics and has data for the past month. The core consumer price index, which reveals the trend of hidden inflation, is calculated without taking into account unstable prices for electricity and food.

What is the consumer price index in simple words

Consumer Price Index (CPI) is an indicator that displays price changes for a group of goods during the billing period. Most often measured as a percentage.

The price index characterizes changes in price dynamics or changes in space (territorially).

In Russia it publishes consumer price indices that characterize the level of inflation. The base period is the previous month or December of the previous year.

In the USA, the base period chosen is 1982-1984 = 100. New data is released monthly, somewhere around the 15th.

The formula for calculating the consumer price index looks like the ratio of the sum of the products of the prices of the current year and the base year's output by the sum of the products of the price level and the base year's output:

CPI = ∑(Qi × Pit) / ∑(Qi×Pi0) × 100%

Where

- Qi is the release of the i-th product in the base year

- Pit — price of the i-th product in the current year

- Pi0 is the price of the i-th product in the base year

Consumer Price Index vs. GDP Deflator

Both the CPI and the GDP deflator are tools for calculating a country's inflation rate; the two indices differ significantly. The GDP deflator, firstly, unlike the CPI, is based on the size of the current consumer basket (the current, not the base year), that is, it is the Paasche index. The consumer price index also includes only final consumer goods, while the deflator includes all final services and goods that are included in GDP. It should be noted that the CPI overestimates the level of inflation, while the GDP deflator, on the contrary, underestimates. When calculating the CPI, imported goods are taken into account, and the deflator only takes into account services and goods that are produced in the territory of this country. The GDP deflator also does not have the same drawback as the CPI, namely, it includes changes in prices for new services and goods, unlike the latter.

The concept of consumer price index in economics

To contents

CPI is a calculation of changes in prices for goods and services relative to the base period. It shows how much, on average, prices have increased compared to the previous month, the same month last year, or since the end of December of the previous year. From the name it follows that exclusively consumer goods are considered, namely the “consumer basket”

The consumer basket in Russia includes 136 items of goods and services - the minimum set necessary for a person to maintain life. It consists of three categories:

- 1/2 Products;

- 1/4 Non-food products (clothing, shoes, equipment, medicines);

- 1/4 Services (housing and communal services, transport, medicine, recreation).

In addition, the basket is adjusted for different categories of citizens. Thus, pensioners consume less food than working citizens, and there is more fruit in the children's basket. The calculation is carried out by the Rosstat branch in each region, then all the indicators are added together.

The existing set was created in 2013, by law it must be revised every 5 years (Federal Law No. 227-F3 “On the consumer basket as a whole for the Russian Federation”, ed. 421-F3), but by the beginning of 2020 this is still not the case was done. Therefore, the relevance of the calculations remains questionable. Typically, the consumer does not change the main categories of expenses for several years, but over time, corrections still occur.

Problems of methodology

The most controversial point is the methodology for determining the composition of the consumer basket, both in terms of change and content. The basket includes, in a certain proportion, the average consumption of clothing, food, electrical energy, maintenance of vehicles and living quarters, medical care, education and recreation. To adequately reflect changes in the level of consumer spending, the basket must be oriented towards the real structure of consumption. Then it can change over time. For example, in 1992, mobile communications were not an item of mass consumption and could not be included in the basket. For the modern consumer, ignoring mobile phone costs is absolutely absurd. At the same time, when you add only wired telephone communications to the basket, it will be essentially comparable, but not comparable in terms of volume of use. Any change in the composition of the basket: a change in proportions, the introduction of new goods makes the previous data incomparable with the current ones. The consumer price index is distorted. If you compare the indicators obtained on the basis of the new basket with the indicators based on the unchanged basket, they may differ, sometimes by a very large amount.

On the other hand, if the basket is not changed, then after some time it will no longer correspond to the real structure of consumption. It will give comparable results, but these results will not correspond to changes in real consumption costs and will not reflect their real dynamics.

We briefly reviewed the consumer price index: calculation, properties, methodology problems. Leave your comments or additions to the material.

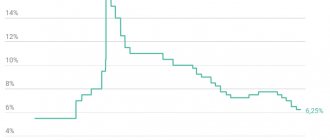

Consumer Price Index in Russia 2020

How are things going with the price index in our country at the beginning of 2019?

According to official data from Rosstat, in February 2020, the overall CPI was 100.4%!, including for goods - 100.5%!, for services - 100.2%!, since the beginning of 2020 - 101.0%!

As an example, let’s look at how the composite index changed in the Russian Federation from 2014 to 2020.

Data not only for years, but also for months is publicly available on the website of the Federal State Statistics Service. You can view the history of values from 1991 to the current month, not only relative to the previous year, but also to the last month.

Capital investments in accounting are...

| Reporting period | CPI compared to December of the previous year | ||

| For goods and services | For food and non-food products | Consumer price index for services | |

| 2014 | 111,4 | 115.4 and 108.1 | 110,5 |

| 2015 | 112,9 | 114 and 113.7 | 110,2 |

| 2016 | 105,4 | 104.6 and 106.5 | 104,9 |

| 2017 | 102,5 | 101.1 and 102.8 | 104,3 |

| 2018 | 101,7 | 103.3 and 101.1 | 100,4 |

It's no secret that statistical offices around the world regularly produce a lot of calculations and studies. Some of them are so important that they can determine the direction of domestic and foreign policy and become guidelines for financial institutions and major enterprises.

Consumer price index as indexation. Profitable or not.

I previously wrote that Indexation in the Lease Agreement is a way for the Owner of the Premises to protect himself from negative inflation factors. Actually, the consumer price index (hereinafter referred to as the CPI) is an inflation index, estimated by the ratio of average prices for goods and services from period to period.

How indexation according to the CPI is prescribed in the Agreement.

Some Landlords do not want to indicate a specific indexation amount, linking them to Rosstat data on the CPI as the level of the next indexation. In the Lease Agreement, indexation according to the CPI is prescribed as follows:

“The cost of the Services may be increased by the Contractor unilaterally, but not more often than once a year, and not earlier than after 12 (Twelve) calendar months after signing the Lease Agreement No.__ dated “__” ____ 201_ to this Agreement, to the indicator of the Consumer Price Index (expressed as a percentage) of the Russian Federation published by the Federal State Statistics Service (hereinafter referred to as “Rosstat”) or its successor or other authorized organization in the event of changes in legislation or reorganization of Rosstat for the previous calendar year. In this case, the Parties undertake to sign the corresponding additional agreement within 21 (Twenty-one) days from the date the Contractor sends to the Customer a notification about the corresponding increase in the cost of the Services.”

Why indexing by CPI is inconvenient.

My personal opinion is that the Consumer Price Index as an indexation in the Lease Agreement is inconvenient for both Parties. There is a lot of confusion about how to correctly calculate the indexation size in %. Even in large companies, ordinary lawyers and managers often do not know how to use Rosstat data and do not know how to calculate indexation according to the CPI. It’s one thing if you need to take the period from January 01 of the current year to January 31 of the current year (or December to December). At least this data is publicly available. But the situation is completely different when you need to calculate the amount of indexation, for example, from April 17 of one year to April 17 of another year. Errors are possible here.

In addition, you can never be sure by what exact percentage the rent will be increased. There are favorable years when indexation according to Rosstat can be 3-4%. But there are such years as 2008, 2014, 2020, when indexation according to Rosstat reached 11-13% per year.

It is clear that an increase in rent by 12% per year can have an extremely negative impact on business and, in addition to other negative factors, serve as a “point of no return.” Probably, if we lived in some other country, Japan for example, we would not be puzzled by this question.

Conclusion.

But, to summarize, in modern Russian realities, I would prefer an agreed indexation level of 6-7% rather than indexation by the CPI.

If you still take the risk, I recommend using calculators that can be found on the Internet to calculate the % indexation by CPI.

Where is the consumer price index used?

The consumer price index is a very important and informative indicator.

What is the difference between a payment terminal and an ATM?

Based on the CPI value, it is easy to understand how citizens’ expenses have changed, provided that the list of purchased goods remains the same.

For example, it is on the basis of the price change index that decisions are made on the recalculation of social benefits, wages, and so on.

The CPI affects interest rates on loans and credits, the refinancing rate, and the cost of bonds. Traders actively monitor the CPI, as they can be used to predict Central Bank rates and the strengthening or weakening of the currency.

Monthly index values ultimately affect exchange rates, since it can be used to determine the purchasing power of the population and predict government policy.

Basic meaning

In addition to the core CPI number, the CPI Core number, which is released at the same time as the core CPI result, represents the change in prices of goods and services purchased by consumers, excluding energy and food expenditures.

Due to the fact that food and energy costs account for more than a quarter of the CPI, these prices tend to show higher levels of volatility, and in many cases, their fluctuations will distort the underlying inflation trend.

For this reason, many economists, currency traders and the FOMC tend to pay more attention to the CPI Core number than the usual CPI number that is widely reported by news outlets.

Consumer Price Index Release Dates Core inflation and CPI values are typically released approximately 16 days after the end of each reporting month, although the actual release date may vary between the 14th and 20th of each month.

CPI data is commonly tracked by forex traders and is the percentage change in the average cost of a basket of goods and services purchased by consumers compared to the previous month's sample.