Previous articles on bonds:

| • Bonds and their properties • Long-term • US Bonds • OFZ • Eurobonds • Bond ETFs • VDO • Convertible • Perpetual • Exchange-traded |

What is duration: definition

In simple terms: the duration of a bond shows how quickly an investor will recoup the funds invested in it .

This indicator was introduced to compare different bonds: the one that shows a lower duration value as of the current date carries less risk. The name of the term is borrowed from the English word “duration”, which means “duration”. Russian bonds, unlike Western ones, on average have a shorter life, so the duration of domestic securities is calculated in days.

In general, this indicator, which is close to the payback period, is often found on the market. For example, P/E shows the ratio of a stock's price to its earnings per share. For the US market, the normal value of the indicator is 16-18. This means that in the hypothetical case of a constant share price and profit on it, the company will generate a profit equal to the share price (recoup it) in 16-18 years. To do this, it needs to bring in an average of 6% profit per year.

An even more obvious example is real estate rent. The value of real estate can be expressed in rental payments - it is considered that an apartment is worthy of attention if its price does not exceed 100-150 monthly rental payments. This means that if you can rent out your apartment for 60 thousand, then a reasonable purchase price will not exceed 9 million rubles. Of course, there are a lot of nuances here, from a specific location to the condition of the house and apartment - but on average this is the case. The payback period for the apartment is 12.5 years.

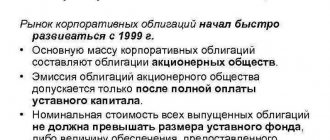

Bond concept

Much fewer investors want to invest their free cash in bonds than, for example, in stocks.

Moreover, the bond market is much larger in volume than the stock market. Definition 1

A bond is a debt security, which de facto represents a promissory note of a company or state

Bonds are bought and sold, like all financial instruments, on the exchange market. Bonds can have different characteristics - issuer, interest on the bond, circulation period, procedure for receiving payments, par value currency, etc.

If you look at bonds superficially, they occupy a certain place between a bank deposit and shares. Bonds can provide a permanent fixed income - essentially you are lending money to the issuer under pre-agreed terms, just as if you had deposited your funds with a bank. By lending them to the bank. From another point of view, bonds, unlike deposits, are constantly traded on the stock exchange - it is possible to sell or purchase them at any time.

Finished works on a similar topic

- Coursework Formula for bond yield, interest on bonds, duration of bonds 420 rub.

- Abstract Formula for bond yield, interest on bonds, duration of bonds 240 rub.

- Test work Formula for bond yield, interest on bonds, duration of bonds 190 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Note 1

Important: if the company goes bankrupt, you will in any case receive your money back, unlike the situation with a deposit in a bank (for amounts over 1,400 thousand rubles).

So, a bond is a debt security that mediates the loan relationship between the issuer and the investor, characterized by minimal risks and receiving a stable fixed income in the form of interest.

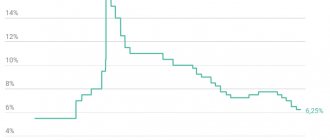

What makes up duration?

The size of the indicator is influenced by two parameters: the duration of the bond and the coupon value. The formula for calculating duration seems quite complicated:

D – duration;

C – coupon rate;

r—yield to maturity;

N – paper denomination;

t – term to maturity;

P – market price of the bond.

Let's make an approximate calculation. Let's say we have an annual bond with an interest rate of 12% per annum (payments monthly) and a nominal value of 1000 rubles. How can I find out its duration at the time of issue? Let's see what cash flow we expect from coupons in, say, 10 months. DP = 10/12 × 12% = 10% of the bond face value or 100 rubles. At the same time, although the bond's face value is returned at the end of the term, we consider it equivalent to the time that we hold the paper. In this case, this is 10 months out of 12, i.e. 83.3% of the time or 833.33 rubles. Add: 100 + 833.33 = 933.33. Close to par. Calculation based on 11 months gives 1026 rubles. This means that the duration is approximately 10 months and three weeks - and will decrease every day.

But in practice, there is no need to calculate the exact value yourself - it is usually configured in the trading terminal:

In addition, duration can be viewed in open sources, for example on the website rusbonds.ru. For example, let's look at the current duration of the last bond from the list above:

Examples of duration

1. Let's take two bonds: discount and regular coupon. The first one is purchased at a discount (for example, for 700 rubles), and at the end of the bond’s validity period the face value is returned (1000 rubles). Until the end of the discount paper's validity period, the investor receives nothing - therefore, the duration in this case is equal to the period after which the issue will be repaid.

An ordinary bond pays coupons, i.e. returns to the investor part of the invested amount before its repayment. If you imagine, both bonds were issued for a period of 10 years and declared a default after 5 years, then in the case of an issue with a discount, the investor will not receive anything, and in the second case, he will compensate part of the invested funds with coupons. For example, with a coupon of 10% per annum, after 5 years the investor will return half of the investment. In other words: in the case of a coupon bond, the duration is always less than its circulation period.

2. Another situation: two coupon bonds with the same coupon, but different maturities: 3 years and 10 years. It is clear that in the first case the investor will receive the deposit back faster - so the duration in the first case is lower.

3. Another case: the validity period and yield to maturity of bonds are the same, but the coupon rate on them is different: for example, 3 and 6%. In this case, you can expect a lower duration from a paper with a higher coupon, since it speeds up the payback.

4. In addition, you can consider the case of a perpetual bond, which may never return the deposit, but promises to regularly pay the coupon. Here the indicator can be calculated only from coupons - for example, at an annual rate of 10%, an investor will need 10 years (3650 days) to recoup his investment.

Duration of the bond portfolio

Let's consider how duration affects a bond portfolio and how you can protect your invested funds from interest rate risks. Let's take two different baskets of securities with durations of up to 3 and 5 years. As an example, consider two special indices of the Moscow Exchange, which are calculated taking into account the criteria of the subsidiary.

The RUGBITR3Y index includes government securities with a maturity period of 1-3 years, the total duration of this index is 808 days (approximately 2.2 years). The indicated total profit indices are calculated taking into account price fluctuations of bonds and the coupon profit received on them. They show the real dynamics of funds invested in the bond basket.

The total duration of these indices differs by almost two times. This means that they respond differently to fluctuations in average market interest rates. A bond index with a shorter duration provides greater price consistency. When the discount rate increases, the value of short-duration paper decreases at a much slower rate. In turn, an index with a longer duration will experience increased volatility and more noticeable declines when interest rates rise.

More on the topic How to return your license after deprivation, application form for the return of a driver’s license after the expiration of the deprivation period

The process discussed above is called bond portfolio immunization. Its meaning lies in the greatest reduction/limitation of the influence of interest rate fluctuations on the movement of the bond portfolio in a predetermined period.

Thus, to minimize the impact of interest rate fluctuations on a bond portfolio, you should use securities with a shorter duration, and vice versa. However, the duration value is not a determining criterion when investing in bonds, since it shows narrow interest rate risks, but does not reflect other investment features.

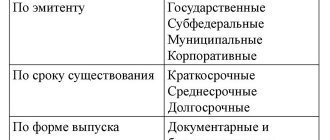

Dependence of duration on interest rate

A bond is a market instrument. Its quotes change, and also depend on the level of interest rates. The relationship is inversely proportional: if interest rates rise, bond quotes fall, and if rates fall, they rise. I explained in detail why this happens here. What does this mean for duration?

Let's say the interest rate is high now and you expect it to decrease. What to do in this case? Here, paper with a higher duration (i.e., a longer circulation period) turns out to be beneficial. Why? A fall in rates will increase the price of the bond. If we assume that before the rate cut it was trading at par, it will now trade at a premium. For example, 105% of the nominal value. And the higher the duration, the greater the growth can be.

Accordingly, in the opposite situation, waiting for the rate to rise, a bond with a shorter duration will be beneficial (which, recall, generally carries less risk). If the rate rises, the price of the bond falls. But a paper with a short duration will return to par faster, since it will be redeemed, and will compensate for the fall.

Modified duration

Modified duration is related to the previous point and shows the “sensitivity” of the bond to a change in the key rate by 1 percent. Above is a screenshot of the OFZ-26209 issue with a duration of 984 days, i.e. 2.7 years. And right below it, the modified duration indicator is calculated at 2.51%. The market price of the security should change by this amount if the rate changes by 1%. With a larger duration value, the value of the modified indicator will be larger, with a smaller duration, it will be smaller. Since the duration of any term bond decreases over time, its modified counterpart (interest rate effect) will also decrease.

Duration as a criterion for the riskiness of investing in bonds

Calculations on investment indicators in most cases are carried out for the temporary assessment of money. Investors always take risks when investing in securities. And the longer the investment period, the higher the uncertainty and degree of risk. At the current moment, the conditional value is “more expensive” than a similar value in the future, since the latter is subject to various risks, for example:

- inflation or devaluation;

- instability of the geopolitical situation;

- volatility of interest rates;

- inflating “market bubbles”;

- signs of a global crisis.

This is precisely what determines the mechanism for discounting the flow of money in the future - discounting the expected cash flow in proportion to possible risks in the corresponding period of time.

More on the topic Reduced working hours according to the Labor Code of the Russian Federation

Duration shows the time of return of invested capital, taking into account discounting of a given cash flow. The discount rate is taken as the discount rate of the Central Bank, which has the greatest influence on the price fluctuations of the bond. With a longer bond duration, the impact of rate changes on discounting payments increases and the security's sensitivity to changes in market interest rates increases.

Experienced investors always take into account the bond duration coefficient to calculate interest rate risks (fluctuations in average market rates). The interest rate affects the bond through its price if the coupon on the security is not floating and is not tied to the RUONIA or discount rates. When the discount rate increases, the value of the bond decreases and the yield increases to a changed, increased discount rate.

The longer a bond's duration, the more susceptible it is to interest rate fluctuations. The higher this sensitivity, the more noticeably the value of bonds changes as a result of fluctuations in the discount rate. The price movement of a bond is directly dependent on the shift in the discount rate in relation to the duration of the security.