What is a discount rate

Discounting is the determination of the price of future cash flows as of today. To estimate what income a company will have in the future, you need to have a forecast for revenue, investments, expenses, know the capital structure, property price, discount rate, etc.

From an economist's point of view, the discount rate is the rate of return on the capital invested by the investor.

That is, the discount rate will show the investor how much he must pay today in order to receive the predicted income “tomorrow”. The discount rate is a determining factor influencing the choice of an investment project.

Let's give an example. The first project can bring the investor 600 rubles. at the end of the year for 3 years. Having invested money in the second project, he will receive 400 rubles at the end of the 1st and 2nd years, and at the end of the third - 1200 rubles. The investor's task is to choose where to invest his money. Let the discount rate be 26% per annum.

The current NPV value of the project is calculated using the formula:

- where Pi – cash flows in periods from 1 to i;

- r – discount rate, in our case 26%;

- S – initial investment, 500 rubles.

Let's calculate the cost:

Conclusion : it makes sense to choose the second project.

Let the investor now increase the interest rate to 35%.

The values in this case will be:

In this case, the first project is preferable.

Discounting and accretion operations

Build-up is a probable estimate of the cost of finance that will be possible to obtain after some time.

The essence of this process can be most easily understood by remembering the popular expression Time is money. In simple terms, the longer your deposit is open, the greater the amount you can get out of it after a certain period of time.

Discounted Cash Flow Method (DCF)

Without discounting, it is impossible to predict the effectiveness of the project and future profits from it.

Discounting methods take into account the regularity of income, profitability and risk.

Coefficient

Finance has a law called falling value . In other words, money loses its purchasing power after some time , that is, it becomes cheaper. This feature is the basis of the discounting method.

Consequently, in order to make correct calculations, it is necessary to take into account the assessment for the present period of time , and continue to correlate all cash movements in the future with today .

The calculation formula for bringing potential profit to current value looks like this:

where: r is the rate, and i is the time period.

DCF calculation formula

Using the discount rate, you can calculate the profit that an investor can expect when investing in certain projects.

Depending on the investment object, the discount rate necessarily consists of an inflationary component, a financial assessment of the invested budget, the level of income and risks, as well as parts of other components.

Obviously, no one will invest more in the project than they plan to get from it. As well as selling a business for less than what is expected to be received from it in a couple of years.

Weighted average cost of capital

Sometimes investors in their calculations determine the discount rate as the weighted average cost of capital (WACC, weighted average cost of capital). This economic value takes into account the price of “native” capital and the cost of funds borrowed “outside”. This method is the most objective, but not all companies can use it.

How to calculate the cost of your capital? To do this, you need to use a long-term asset pricing model (called CAPM, capital assets pricing model).

You can calculate the discount rate for your capital as follows:

Let's understand the notation in this expression. For example, Rf denotes the risk-free rate of return, B is a ratio that determines how a firm's stock performs relative to its competitors.

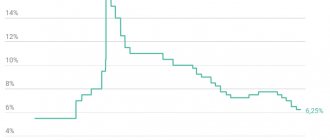

Risk-free assets are, as a rule, government securities. In the Russian Federation, these are Russia-30 bonds with a maturity of 30 years.

The B number characterizes how sensitive the company's shares are to changes in market risk. When B = 1, the price of shares of this enterprise will fluctuate synchronously with the value of securities of competitors. With B = 1.2, we conclude that if there is a general rise in the market, the price of these shares will rise 20% faster than the price of shares of firms in the same business segment. In the same way, and vice versa: with a general decline in stock prices, the value of the company's securities will fall 20% faster.

You can find out the B coefficient for the most liquid companies on the website of the AK&M rating agency.

The B value is also calculated by large consulting firms and investment companies. One of them is Deloitte & Touche CIS.

The difference between Rm and Rf is a kind of “premium” for the risks associated with doing business. This value shows the excess of the “weighted average” rate of return on the stock market over the return on risk-free securities. The difference is calculated based on analytics data over a long period of time. The American agency Ibbotson Associates calculated that the risk premium in the US stock market from 1926 to 2000 was 7.76%. This value can also be used by Russian companies.

Rm is the average rate of return for the stock market as a whole.

Complex calculation methods

In economics, more than 10 different types of rate calculations are used. To do this, new variables are introduced into them, such as:

- Expected, market and risk-free returns . They are used in calculations using the Sharpe formula to take into account market risks.

- The modified Sharpe model introduces the study of the influence of market factors, such as price fluctuations, changes in resource costs, and government policy.

- The specifics of the industry and the volume of capital investments . These indicators are used in the advanced version developed by Fama and French.

- The change in the asset price was added by economist Carhart.

- The issue of shares and dividend payments are used in analyzing the value of joint stock companies and studying the stock market. Gordon proposed this scheme.

- Weighted average price. It is necessary before determining the discount rate for the project using the cumulative method, taking into account the use of borrowed amounts.

- Profitability of property . A fairly simple calculation that is necessary to assess the financial performance of enterprises whose assets are not traded on stock markets.

- Subjective factor . This term is introduced in cases where the company’s activities are studied by third-party experts based on multifactor analysis.

- Market risks . Used if you need to calculate the rate based on the ratio of risky and risk-free investment.

Even the Russian government in 1997 released its own methodology for calculating risky discount rates. According to government experts, the risk fee at that time was 47%. If it is not used for the usual formula, then such figures must be taken into account when investing in foreign companies.

How is the weighted average cost of capital calculated?

If a company uses not only its own capital, but also borrowed capital in its activities, then the income from projects must cover not only market risks, but also the costs of attracting investor funds. To take these two factors into account, there is such an economic value as the weighted average cost of capital, or WACC.

To calculate the indicator, use the following expression:

- where Re is the rate of return on your capital, calculated using the formula above;

- E is the price of share capital, it can be calculated by multiplying the number of shares by the cost of one security;

- D is the price of borrowed capital, defined as the amount of the company’s loans;

- V – the total amount of own and borrowed capital;

- Rd is the return on borrowed capital, which is defined as interest on bank loans and corporate bonds.

The cost of employed capital must be adjusted taking into account the current income tax rate. The fact is that the company attributes interest on loans to the cost of its products, thereby reducing the tax base, tc - income tax.

How is cash flow discounting used?

Determining the fair value of a company using the discounted cash flow method is quite difficult. But the reason for this is not due to time-consuming mathematical calculations, but because forecasting free cash flow requires taking into account many drivers of growth and decline. For example, dynamics of product costs, changes in dividend policy, etc.

Therefore, such calculations are usually carried out by analysts of large investment houses. Numerous forecasts of the value of a particular stock in the future are often based on precisely this approach.

A beginner in investing can do his own calculation based only on the assumption that the company's free cash flow will change at approximately the same pace as it has in recent years. But this method is only applicable to mature businesses. In addition, the obtained figures may be completely incorrect if management decides to increase capital expenditures or if any other events occur that affect the issuer's profitability.

I also recommend reading:

How can an investor find out the real value of a company? We calculate EV

The cost of any company: how to calculate it yourself

Calculating the discount rate using WACC

Let's calculate the discount rate for the Norilsk Nickel Corporation, taking into account current conditions in the Russian economy. Risk-free rate of return Rf = 8.5%. The B coefficient for the company is 0.92 (we took the data from the AK&M rating agency). (Rm – Rf) = 7.76%, according to a popular American agency.

Let's substitute the values into the above formula Re = Rf + B(Rm – Rf), we get: Re = 8.5% + 0.92*7.76% = 15.64%.

- E/V = 81% percentage of your capital in total assets;

- Rd = 11% – costs of attracting capital from investors;

- D/V = 19% – share of attracted capital;

- tc = 24% – income tax.

Now we have all the data to calculate the weighted average cost of capital: WACC = 81% × 15.64% + 19% × 11% × (1 – 0.24) = 14.26%.

The disadvantage of the method is that it cannot be applied to all organizations.

Firstly, the weighted average cost of capital cannot be calculated for firms that are not open joint stock companies. Secondly, the method is not suitable for firms that, for one reason or another, cannot determine the B factor. Therefore, in these two cases, you will have to familiarize yourself with alternative methods for estimating the discount rate.

Risk premium estimation method

An alternative to the weighted average cost of capital method is the risk premium method. This method is based on two postulates: if every investment were risk-free, then investors would expect a risk-free return on invested capital; The higher the risk of the project, the greater its profitability should be.

In this case, the discount rate has a formula:

- where Rf is the risk-free income rate,

- R1, ….Rn – premiums for certain factors.

The premium values for each risk factor can be determined expertly.

In this case, a personal assessment of the market situation is used: the expert himself determines which profitability is sufficient for the project and which is not.

Due to the notorious “human factor”, the expert method is the least accurate.