Author: Yango.Pro

income bonds for themselves . If you still want to make money on your investments rather than just save against inflation , you'll have to increase your bond risk . To this end, the Russian bond market offers to the private investor . We tell you how to use them while maintaining control over the risks of your portfolio.

READ IN THE ARTICLE: ✔ Credit risk

✔ Market risk

✔ Liquidity risk

✔ Risk of non-receipt of income and partial loss of investments

© When using site materials and quoting - a link with a URL is required

Credit risk

What is the risk?

When you buy bonds from an issuer, you are actually providing them with a loan or, more simply put, lending them money at interest. However, not all borrowers are equally reliable. Your portfolio could easily contain securities of an issuer that, for some reason, simply refuses to repay its debts to investors.

This is credit risk , that is, the risk that the issuer who issued the bonds will not be able to fulfill its obligations to pay coupons, put the offer or return the principal amount.

The higher the credit risk, the higher the yield that the bond issuer is willing to pay the investor.

Government bonds ( OFZ have the lowest credit risk . Therefore, in a normal market situation, the yield on them is usually slightly higher than on ruble deposits in banks.

The highest credit risk is for bonds issued by small, growing companies. To borrow money from investors, they typically have to pay double-digit yields .

Source: Cbonds

Why will the credit risks of your portfolios increase?

Just a year ago, private investors could earn up to 30% per annum by investing in the most reliable government bonds. Today, market rates are so low that it is becoming increasingly difficult for investors to earn (and not just save) with the help of highly reliable bonds: simply by investing money in conservative instruments (OFZ, bonds of quasi-state companies ), you can get a return that is hardly slightly higher than the deposit. This forces investors to seek higher yields in securities of lower credit quality and take on greater credit risk.

How to control credit risk

- Look at the issuer's rating: credit ratings are an indicator of a company's reliability and its ability to pay off its debts. Depending on the risk level of a particular issuer, rating agencies assign certain reliability ratings . The lower the rating, the higher the risk and return.

- Not all companies, in principle, have a credit rating, especially when it comes to third-tier issuers who offer investors the most interesting bond yields. To understand what is happening with the issuer’s business and how this may affect its bonds, it is better to remember it not only on coupon payment dates, but try to regularly follow the news and publication of financial statements of companies from your portfolio.

- Diversify your portfolio by industry and name: you should not invest all your funds in the securities of 1-2 issuers, even if they have a good rating and acceptable profitability. It is better to have bonds of 8-10 companies in your portfolio. This way the portfolio will be more balanced.

- If you decide to increase the profitability of your portfolio by increasing credit risk by purchasing high-yield bonds , still try to follow the rule: do not invest more than 10% of your funds in high-risk assets .

What it is

A corporate bond is a security issued by Russian issuers to attract financing from a wide range of people.

Corporate bonds are presented in non-documentary form. For companies, such bonds are an alternative to obtaining loans from banks. Previously, bonds were issued with very simple characteristics; in fact, they were securities for which there was an obligation to pay interest on a specified future date, and when the bond's circulation period expired, the par value was returned.

Now corporate bonds are much more complex and can vary in a large number of ways. I'll talk about each of these differences a little further.

Emission

The concept of issuing a corporate bond includes the placement of securities itself. It can be carried out either by closed subscription (only for a certain circle of people) or by open subscription, when any participant in the stock market can become a creditor of the company.

To issue corporate bonds, the issuer must approve the decision to issue, conduct state registration and fully report on the results of the process.

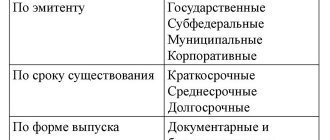

Types of corporate securities

According to their characteristics, corporate bonds can be:

- With a fixed or floating rate. In the first case, the percentage does not change throughout the entire circulation period of the bonds, and in the second case, the rate is tied either to the yield relative to the OFZ, or is adjusted depending on inflation and the key rate.

- Convertible and non-convertible bonds. The attribute establishes the possibility in the future to exchange corporate bonds for a certain number of ordinary shares.

- With constant and changing terms. This refers to the right to call the bond early.

- Secured and unsecured securities. With bonds without collateral, it is impossible to seize the organization’s property in the event of non-payment of obligations.

There are other differences between corporate bonds, but these are the main and most important.

Market risk

What is the risk?

Bonds are a market instrument based on the market interest rate ( the Central Bank key rate ). bond rates also change .

That is why, when buying bonds, an investor always takes on the risk associated with a sharp change in interest rates. The fact is that bond prices and interest rates are inversely related, that is, when interest rates fall, the prices of bonds traded in the market rise. Conversely, when interest rates rise, bond prices tend to fall.

Why is this happening? When interest rates decline , investors tend to buy or hold the bonds with the highest rates in their portfolios. An increase in the supply of money (that is, an increase in demand for bonds from investors) leads to a decrease in rates (and, accordingly, an increase in prices - in an inverse relationship). Conversely, if market interest rates rise, investors will naturally begin selling bonds with lower interest rates, causing bond prices to decline.

The main measure of interest rate risk for an investor is duration. The longer the duration (that is, the time it takes to get your investment back), the higher the interest rate risk (that is, the risk of incurring losses due to changes in market rates).

Source: Cbonds

Why are market risks increasing?

Today on the Russian bond market you can find instruments with almost any duration. But in a climate of declining interest rates, it is securities with long duration : the longer the duration, the higher the investor’s expected return, but also the higher the risk. For example, having bought a perpetual bond (that is, in fact, a bond with an infinite duration) of a bank in the hope of increased profitability, you should be prepared for the fact that in the event of a reversal in the movement of rates on the market, such securities could easily lose a quarter of their face value in one moment in price.

How to control market risk

- Don’t forget to check the market’s expectations for rates: you should definitely choose bonds for your portfolio at any given time with an eye on the market’s forecast for rates. If the Central Bank itself, as well as most economists and analysts, point to high risks of rate increases, it would be very reckless to make a decision to buy bonds with a long duration, since it is their price that will fall the most in an environment of rate increases.

- One way to minimize your interest rate risk is to hold both short-term and long-term bonds in your portfolio, thereby spreading the risk along the entire interest rate curve .

Advantages and disadvantages

Pros include advantages associated with certain characteristics, such as the ability to convert some debt notes into the issuer's common stock.

Other advantages of corporate bonds:

- high profitability

- variety of choice

- often good liquidity and ease of acquisition.

Disadvantages include increased risks and the need to pay taxes.

Top 5 most reliable

According to the Acre rating, the top reliable corporate issues include:

- exchange bonds of FSUE Russian Post, series BO-001P-07, ISIN RU000A1008Y3

- JSC Russian Railways, series 001P-14R, ISIN RU000A1008D7

- PJSC Sberbank, series 001Р-78R, ISIN RU000A100758

- VEB.RF, series PBO-001R-15 (RU000A1004U0)

- PJSC Gazprom, series BO-23 (RU000A0ZZET0).

Top 5 most profitable

It is important to understand that the most profitable will always be debt receipts from issuers in a pre-default state. The possible yield on them reaches thousands of percent due to the reduction in the cost of the security, but the probability of receiving payments on such bonds tends to zero.

The leaders in overall yield among corporate securities are now:

- O1 Group Finance LLC, series BO-001P-01 ISIN RU000A0JXQM8 (yield 7916344.32% per annum)

- Prime Finance LLC, series BO-01 ISIN RU000A0JVYD5 (yield 7742912.5% per annum)

- REGION-INVEST LLC, series 01 region ISIN RU000A0JUUB9 (yield 5761500% per annum)

- Prime Finance LLC, series 01 ISIN RU000A0JU179 (yield 2,028,000% per annum)

- “Siberian gift”, series BO-001P-01 ISIN RU000A0JWLX8 (yield 503950.78% per annum).

Where can I buy

Since corporate securities are listed on the Moscow Exchange, it is better to buy them through Russian brokers. However, this can also be done at the office of the issuing company.

Best brokers

The best brokers are considered to be the top representatives of the list. Along with conservative fees, they are committed to providing high reliability and a first-class level of customer service.

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Liquidity risk

What is the risk?

The liquidity of a bond is the ability of an investor to buy or sell a security at a market price in a short time and without losses.

The liquidity of bonds depends on the volume of a particular issue in circulation and on the number of buyers and sellers for a particular bond on the market: the more securities are traded on the market and the more investors make transactions with it, the greater the chances of finding the volume you need at an attractive price.

Why has liquidity risk increased?

Nowadays, fashion in the Russian bond market is dictated by sellers - they are the ones who determine which bonds to place and at what rates. Under these conditions, it becomes much more difficult for the buyer to buy bonds at the effective market price, and this affects the final return on the investment.

How to control liquidity risk

- When buying a bond on the secondary market , take into account information about how the paper was placed on the primary market : who the organizers of the placement were, how many investors bought the bonds at the primary placement, whether the issue was market-based.

- Pay attention to the average daily turnover of securities on the secondary market. The more transactions for a particular security take place on the exchange during the day, the easier it will be for an investor to find a good quote to buy or sell in a short time. Accordingly, the more days on which securities are not traded, the less liquid the bond is.

- When assessing the liquidity of a particular security, give preference to issues where there are market makers - specially hired intermediaries, professional market participants who support two-way quotes on the market, bring together buyers and sellers and thereby ensure transactions are completed at a price favorable to all parties.

Source: Moscow Exchange

About the concept

Corporate bonds are widely used among instruments on the stock market both in Russia and abroad. If government bonds are issued by the Ministry of Finance, then the issuers of corporate bonds are corporations - legal entities.

The latter will have a higher profitability, but, as it happens, the risks increase significantly.

Let me briefly remind you what bonds are in general, and why this or that company issues them.

A bond is a debt security issued by an issuer to raise funds to finance a specific activity.

When an investor buys a bond, he lends his funds to the company, municipality or state, equal to the price of the purchased paper. During the entire term, the issuer (who issued the bonds) pays the investor interest - coupon payments, and at the end of the term returns the debt itself.

The procedure for paying interest and its amount are known to the investor in advance.

What are the advantages of corporate bonds as an investment instrument?

- The reliability of individual securities is not much lower than bank deposits, and the profitability significantly exceeds deposits due to coupons and discounts.

- High liquidity: bonds can be quickly sold on the secondary market or converted into shares.

- The maturity dates and yield are known in advance.

- In the long term, this instrument outperforms deposits whose rates are constantly changing. By purchasing bonds, you can lock in guaranteed profits for a long time.

Risk of non-receipt of income and partial loss of investments

What is the risk?

In recent years, in addition to traditional classic bonds, many new investment products have appeared on the Russian market, which individual brokers and banks have begun to actively offer to private investors. We are talking primarily about structured bonds , which are a type of structured products.

A structured product is a non-standard financial instrument where traditional financial instruments such as stocks and bonds are combined with derivatives, most often options.

And although it turns out that a structured bond is also based on a bond, at its core this instrument has a much more complex nature and structure and potentially carries higher risks for a private investor that he simply did not encounter when investing in classic bonds :

- The return on structured bonds is not guaranteed. Essentially, you are buying a product with a floating coupon , which is calculated using a special formula (as a rule, the yield is tied to the dynamics of an asset). If during the life of the structured bond the asset does not grow by a given amount, then the investor simply will not earn anything, that is, he will receive zero return.

- In addition to the risk of lost profits (that is, the risk of receiving a zero coupon ), when buying a structured bond, you take on the risk of non-repayment of the face value (even in cases where we are talking about products with 100% capital protection; we wrote about this in detail here ), what can we say about structured bonds without capital protection , which do not officially guarantee the investor a return on the invested funds.

- Do not forget that in a structured bond (as in a classical one) there is always also the credit risk of the issuer of the product. If the issuer of a structured bond is a large bank with state participation, then the risk of default of such an issuer tends to zero. And if a structured bond is issued to an SPV (subsidiary) of a Russian broker registered in Cyprus, then this is a completely different level of credit risk for the issuer.

- In some cases, issues of structured bonds can be structured in the form of several tranches (A, B, C, etc.). In this case, holders of senior tranche bonds generally have a priority right to receive payments from the issuer over holders of junior tranche bonds. If the issuer of such bonds defaults, holders of junior bonds are effectively at the end of the line to receive payments. That is, there is one issuer, but the level of credit risk is different depending on the tranche.

How to control risk

- The most important condition that allows you to control the risk of investing in structured bonds is accurate knowledge and understanding of the essence of the product you are buying. Before deciding to invest in structured bonds, carefully study the instrument's prospectus . At the entrance, you must clearly understand how much you are investing, when your funds will be released, what level of capital protection the bond has, which assets provide “guaranteed protection”, what is the formula for calculating profitability (what is the coupon attached to) and what commission you pay the seller of the structured bond.

TOP ↑

Conclusion

Is it worth starting to invest in KOs? Here you initially need to understand whether this type of asset is suitable for you. Compared to federal loan bonds, this type requires greater immersion in the analysis of the issuer itself; an informed choice among a large list of offers is especially important here. Experience in studying and analyzing the market situation will not be superfluous. At the same time, it cannot be said that corporate bonds are not suitable for a novice investor. If you work with first- and second-tier assets, they have insignificant risks of default, quite good liquidity, as well as low costs relative to the size of the spread.

To reduce risks, it is recommended to improve financial literacy, you also need to carefully choose a broker and study the features of diversifying your investment portfolio.

Share your experience of investing in corporate bonds on our forum.

170

More on the topic:

How not to lose money on Forex

Theoretical training of traders

Traders are not born, they are not even taught in colleges...

Business automation

How to automate more efficiently

A highly competitive market requires quick decisions, performing multiple tasks simultaneously, remote…

Business automation