What are defensive assets?

The defensive category includes assets that are not directly dependent on market fluctuations. As a rule, such investment instruments are not influenced by economic or geopolitical factors, which makes them the most attractive investment opportunity during a crisis.

Protective or safe haven assets must meet the following requirements:

- remain liquid under any conditions;

- protect savings from depreciation;

- have stable quotes when stock indices fall.

Protective investment vehicles generally do not provide high returns for investors. It is enough for the profitability of these investments to cover inflationary losses. If, against the backdrop of a general decline in quotes, the cost of individual instruments is growing, this does not mean that they can be classified as reliable. Prices and liquidity levels of protective assets should not depend on external factors.

Protective assets were exposed

The record losses that key US stock indices suffered last week did not come as a big surprise. Stocks, as high-risk assets, should have reacted to the current chaos. They are always the first candidate for sales when investors are fleeing from risk.

However, there was no influx of capital into “safe havens” such as gold, silver or Bitcoin. Instead, their prices also fell, leaving analysts and investors confused. Gold unexpectedly rolled back from 7-year highs; the capitalization of the cryptocurrency market also showed a double-digit drawdown.

In theory, this shouldn't have happened. Now, these dynamics have led players to question whether these assets, including Bitcoin, are truly defensive. A number of market analysts believe that Friday's aggressive sales of gold could have been triggered by numerous margin calls amid an acute cash shortage in a number of funds.

What assets will protect a portfolio during a crisis?

Traditionally, there are several groups of financial instruments that will help maintain investments during periods of stagnation. Among them:

- bonds;

- gold;

- protective actions;

- currency;

- mutual funds and ETFs;

- real estate;

- bank deposits.

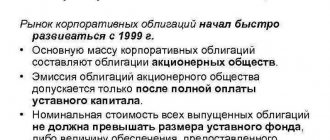

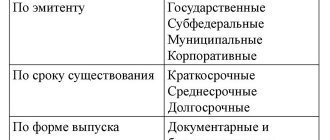

The attractiveness of bonds as a protective asset lies in the fact that they are characterized by a minimal level of risk. The yield, as a rule, exceeds the rate on bank deposits. Government bonds of developed countries can be used as safe haven assets. In particular, US treasury bills, which are recognized by world rating agencies as the most reliable asset, are in demand.

Gold is considered the most classic anti-crisis instrument. Unlike securities and currency, the reliability of this asset is not in doubt. There are many ways to purchase precious metal - opening a compulsory medical insurance, purchasing bars and coins. On the other hand, such investments in gold have a number of disadvantages, namely:

- lack of profitability;

- problems with liquidity - physical metal is quite difficult to sell;

- high exchange rate difference between purchase and sale prices;

- taxation (when purchasing gold products, VAT is withheld).

As an alternative, you can consider other investment options - buying shares of gold miners or investing in gold ETFs (the value of ETF assets is almost 100% tied to the price of the precious metal). There are also gold futures, but this instrument should not be used as a defensive asset, since it still belongs to the category of high-risk investments.

Another anti-crisis tool is protective actions. These are securities of companies that produce goods of strategic importance (food, electricity, medicines). The demand for their products is not subject to stock market volatility, so a massive drop in quotes will not affect the value of this asset.

Adding foreign currency to your investment portfolio will help you avoid devaluation of your savings. The US dollar is traditionally considered as a safe haven, less often the euro and the Swiss franc. The function of a protective asset can be performed not only by capital converted into foreign currency, but also by exchange-traded investment instruments denominated in dollars (for example, Eurobonds).

ETFs and mutual funds that hold dividend-paying stocks and bonds of large corporations can also be included in a portfolio to protect savings. Such investments will generate income and in most cases will be resistant to market conditions. But with a sharp drop in indices, you need to be prepared for a possible drawdown of these assets.

Real estate is consistently popular among Russians in times of crisis. Very often such purchases are made in panic in anticipation of future price increases. However, real estate cannot be fully considered a defensive asset due to its low liquidity.

Bank deposits have the lowest return compared to other anti-crisis instruments, but with the right product selection you can still protect your savings from inflation. In addition, this type of investment poses absolutely no risk. The main rule is not to open a deposit worth more than 1.4 million rubles in one bank.

Investor's protective assets

The first thing to remember is that there is no ideal recipe for protection from all ills. If they were, then everyone would be rich. The market shows the opposite situation - during a crisis, people become poorer, but the number of billionaires grows. Therefore, you need to understand that the key point is to realize the impending economic slowdown; it is at this moment, when panic has not yet begun, that it is convenient to transfer your savings. But what to put them in should be decided based on your preferences and capabilities. So, let's start in order from the most popular to the almost exotic:

1. Currencies . A simple, common way to store money both in cash (or in a bank account) and at the same time be protected. Indeed, what could be simpler than regular conversion? Probably nothing, except perhaps some restrictions associated, for example, with a limited list of available currencies in a particular bank. Russia, as well as Belarus and Ukraine, belongs to the category of developing countries, so our markets feel any crisis very acutely, and such assets are disposed of first. This directly applies to the ruble; besides, the state does not need a strong ruble. As for the currency itself, the choice is approximately the following:

- U.S. dollar. Despite the fact that it is usually perceived as a reserve currency, it is far from the leader in terms of the scale of movement during a crisis. Many currency pairs with the dollar show its growth, that is, to a certain extent, it is a full-fledged protective asset in a crisis. In addition, over the past almost two years, the dollar has shown a steady upward trend, although not very strong in scale. That is, it is as if there is no crisis, and at the same time it is growing. This phenomenon is associated with the attractiveness of the carry trade, since the US interest rate is relatively high compared to the rate of the European Central Bank, and the Bank of England too.

But there is another side to the coin. The US itself is not interested in a strong dollar, so its exchange rate may be influenced in the future. Another thing is that this will not have very serious consequences if a new large-scale crisis really breaks out on the market, since trillions will flow into the dollar. Well, don’t forget about the American national debt, which is also an issue in a state of permanent tension. However, the US dollar can be considered as a protective asset for an investor in a crisis. Next we have a less popular option, but more interesting in terms of income. - Swiss frank. A very popular currency that is an excellent protective asset in a crisis. The economy of this country is stable, and the country itself is one of the most prosperous. In this regard, the franc is bought when uncertainty arises. Moreover, they are buying not even for the purpose of speculation, but in order to preserve their assets and protect capital. It is curious that the country has been struggling with the strengthening of the national currency for many years, conducting interventions, reducing rates, and so on. But it practically does not reduce the volume of interest in the franc, as evidenced by the constantly growing foreign exchange reserves of the Swiss National Bank. In general, they bought, are buying and will continue to buy, the reliability of the currency beyond any doubt.

A logical question arises: what to do if suddenly the country’s central bank decides to weaken the franc and keep it at a certain level, as has happened in the past? Unfortunately, this cannot be predicted. They suddenly pegged the franc to the euro and then just as suddenly untied it. There was widespread confusion in the market. Therefore, the franc is suitable for those who are considering a long-term investment, that is, until the echoes of the crisis disappear. To some, such a risk will seem unjustified; accordingly, you can take a closer look at the same dollar, it is unlikely to easily move by 10%. But it is worth remembering that during a crisis the dollar falls against the franc , that is, the franc is more “defensive”. - Japanese yen. Another historical example of a good export economy, a country with advanced technology and significant financial resources. There is, however, a relatively large debt, but at the same time Japan holds more than $1 trillion in American bonds. The yen is in as much demand as the franc. And the country's central bank also struggled with the strengthening of the currency against the dollar. Large-scale measures were taken that led to a significant weakening of the currency at a time when markets were in a strong growth phase. At the moment we have a neutral picture, which makes the yen attractive for purchases if the situation in the world worsens.

These three currencies are most in demand as protective assets on the Russian market. If the dollar can be easily purchased at almost any exchanger, and even more so in Internet banking, then with the franc and the yen everything is much more complicated - these currencies are not very common in Russia, and not all banks work with them. The easiest way is for those who have accounts with Forex brokers - you can open positions even without leverage, this will be equivalent to a real conversion. By the way, speculators know very well that a crisis is the best time to make money on defensive assets , so in the acceleration of the movement there is a significant share of precisely this kind of positions, which causes a sharp rebound after the dollar, yen and franc reach their maximums.

2. Gold . Historically, people trust most what has a specific value. It was the same with money until the gold standard was abolished. Now money is just paper. Gold, as an investor’s protective asset, is in significant demand during periods of instability. It could be a small, local military conflict, or it could be a financial apocalypse - gold always reacts. If you look at the price of gold during periods of instability and financial turmoil, you can notice an increase in each of these moments. The movements are usually quite significant, so in the event of a crisis, the investor will have enough time to calmly gradually sell the purchased gold.

You can buy in different ways. The most popular methods of investing in gold are quite numerous, but we will consider it specifically as a protective asset, so the following is possible:

- Buying physical gold . It’s not very relevant now, but when VAT on transactions with physical gold is abolished, it will become a very simple matter.

- Metal bills . Fast, easy, convenient. Almost all large banks offer such a service as compulsory medical insurance; assets are stored as if in metal, but at the same time in a bank account, so there are no hassles or tax worries.

- Trading with a broker . By analogy with what was said regarding protective assets - currencies.

3. Protective assets in the stock market . The stock market reacts very sensitively to the situation in the world. As soon as some not-so-favorable reporting slips through, sales immediately begin. This could be a single security, an industry, or the entire market. Therefore, it is important to track stock indices and look at how they behave around the world. For example, if indices in the United States fell today, then we look at how the trading session goes the next day in Asia and then in Europe. Crisis phenomena are manifesting themselves all over the world, so negative dynamics will be everywhere. In this case, if there is no desire to deal with currency or there is no opportunity to withdraw money from the market (so as not to lose tax benefits with IIS, for example), you should take a closer look at the following instruments, which can be characterized as protective assets in the Russian market, and not only Russian:

- Bonds . Debt obligations that are extremely reliable. It can take out bonds of large corporations, as well as government bonds, but the income from them will be less. You can immediately insure yourself against currency risks and take American treasury bonds; they are considered practically the best protective assets in the stock market. There is, of course, a debt bubble in the US economy, but investor confidence is very high, therefore, in case of instability, huge amounts of money will flow into these bonds.

- Stock . If there is a need to hold shares, then you should take a closer look at the securities of companies that operate in industries that do not react so strongly to crises. For example, utility workers. The oil and gas sector, and the energy sector in general, usually falls due to a decrease in the cost of raw materials and consumption. But such protective assets on the Russian market will not give results comparable to bonds or reliable currency. In a falling stock market, everything usually falls.

4. Cryptocurrency . This option may seem surprising, but let's look at the facts. This is an unsecured means of payment that shows interesting dynamics - sometimes it grows at a good pace, sometimes it falls. The fact that Bitcoin has not fallen to zero, and trading volumes are growing, tells us about the attractiveness of this financial instrument. The most valuable thing is that there is no dependence on the economy, except perhaps the cost of electricity, but this is more relevant for miners. It is impossible to definitely include cryptocurrency as a protective asset during a crisis, but it can be considered as one of the options for capital distribution. Especially if you have patience. This way you can not only save, but also earn.

The listed options differ in effectiveness. For example, if you buy a franc, you can expect a very good income during a crisis. It is income, not conservation. This looks like going into defensive assets, but in fact it’s just buying an asset that will rise in price against the backdrop of investor nervousness. True, currency volatility may scare off some, but no one forbids exiting assets after strong movements and then re-entering them. True, this applies to a greater extent to the electronic system. You can’t run around with cash like that, and you shouldn’t forget about the spread - the difference between the buying rate and the selling rate at the exchanger. In general, it works. That the ideal option is to have an account with a broker and simply manage your portfolio. Even better - two accounts, stock and currency.

Share of protective assets in the investment portfolio

Defensive assets should be present in any portfolio. In the absence of signs of crisis in the economy, the classical structure of investment capital should have the following form:

- 10-15% - high-risk investments (stocks with potentially high returns);

- 20-25% - hard financial instruments (government bonds, gold and foreign exchange assets);

- 60-70% - assets with an average level of risk (stock indices, shares and bonds of large companies).

If we talk about balancing a portfolio during a crisis, then a lot depends on the investor’s strategy, in particular, on the expected level of profitability. The higher the share of protective assets, the lower the risk. But at the same time, the opportunity to earn money decreases. It is believed that a portfolio in which the share of hard assets exceeds 70-80% is highly likely to preserve capital.

Model anti-crisis portfolios

Next, I present to your attention several models of anti-crisis portfolios compiled using the service https://www.portfoliovisualizer.com/. You can go there yourself and “play around” with different types of asset allocation.

The portfolios compiled are not recommended specifically for you; you must assemble your own portfolio depending on your capabilities and preferences.

In addition, all charts are compiled based on past data, and the portfolios shown do not guarantee 100% protection from the crisis. I'm simply explaining the logic behind asset allocation. Indeed, during a crisis, the profitability of your portfolio depends 99% on the distribution of assets, and not on the specific choice of assets and not on the point of entry and exit from assets.

By the way, in anticipation of the crisis, I recommend investing not in individual stocks and bonds, but in ETFs. Due to diversification within the fund, risks are reduced - if you select individual assets, you may lose them altogether or receive a significant drawdown on individual instruments and will have a long and painful time getting out of it. And everything inside the index is already balanced.

On the other hand, a crisis is a time of opportunity. When stocks fall, they can be picked up for much less than they cost now. And here it’s worth taking a closer look at individual issuers.

Classic anti-crisis portfolio

This is what I conventionally called a portfolio that includes the following asset allocation:

- 25% – shares (US Stock Market);

- 25% – short-term bonds (Short Term Treasury);

- 25% – long-term bonds (Long-Term Corporate Bonds);

- 25% – gold.

And here’s another interesting article: The most profitable Russian bonds with a monthly coupon in 2020

It is perfectly balanced and theoretically should be profitable in any market situation.

In the chart, I compare this portfolio with the performance of the Vanguard 500 Index Investor mutual fund, one of Vanguard[/anchor]'s most successful and profitable funds.

It can be seen that the classic anti-crisis portfolio is growing gradually, without sharp drawdowns (which cannot be said about the fund), but the final return leaves much to be desired. Our portfolio gives an average annual return (CAGR) of only 8.49%, while the Vanguard portfolio gives 11.11%. For comparison, at the same distance, Buffett's Berkshire Hathaway fund gave an average annual return of 15.58%.

However, this portfolio copes with its task - to protect against a crisis - with a bang. If you need to wait out the storm, this is a great option.

But this asset allocation looks too simple. Let's compare this portfolio with more complex ones and see what happens.

Ray Dalio's Weatherproof Briefcase

First, let's analyze the so-called “all-weather portfolio” of Ray Dalio, which is also essentially anti-crisis. Its structure is as follows:

- 40% – long-term treasuries;

- 30% – US shares;

- 15% – medium-term treasuries;

- 7.5% – gold;

- 7.5% – other goods.

Let's compare this portfolio with the “classic”. The blue graph is Ray Dalio's portfolio, the red one is the classic one. Data – from 2007 to 2020.

As you can see, there is not much difference between them. The classic anti-crisis portfolio turned out to be even a little more profitable.

"The Lazy Briefcase" by David Swenson

Here is the asset distribution:

- 30% – US shares;

- 20% – REITs (real estate);

- 15% – shares of developed countries (except the USA);

- 15% – short treasuries;

- 5% – shares of developing countries.

Let's compare it with the “classic” anti-crisis portfolio. The blue graph is a “lazy” portfolio, the red one is an anti-crisis portfolio. Data from 2001 to 2020.

The conclusion is obvious. With almost equal final average annual returns – 7.17% and 7.16%, the “lazy” portfolio turned out to be more volatile. The maximum drawdown reached 41.63% - not every investor in a crisis can bear the nerves to look at such losses. So draw your own conclusions.

Real estate portfolio

Let's try to include real estate in a classic portfolio - after all, the demand for it is not elastic, therefore, it does not fall and grow as rapidly as stocks or long-term bonds. Let's displace the main assets and add real estate (in the form of REITs, of course):

- 20% – shares (US Stock Market);

- 20% – short-term bonds (Short Term Treasury);

- 20% – long-term bonds (Long-Term Corporate Bonds);

- 20% – gold;

- 20% – real estate (REIT).

Let's look at the charts. Blue is our new real estate portfolio, red is the “classic”. Data from 1994 to 2020.

As you can see, the portfolio has become more volatile - the maximum drawdown was 23.1% versus 16.72% for the “classic”, but at the same time the average annual return increased: 7.68% versus 6.94%.

And here’s another interesting article: Tatneft dividends in 2020: what to expect from the main oil company of Tatarstan?

Global diversification

For the purity of the experiment, let's look at another portfolio - with global diversification of everything. The entire world economy cannot collapse at the same time (but this is not certain). Perhaps such a portfolio will be more stable.

A maximally diversified (let’s call it “global”) portfolio might look like this:

- 10% – shares (US Stock Market);

- 10% – short-term US bonds (Short Term Treasury);

- 10% – long-term US corporate bonds (Long-Term Corporate Bonds);

- 10% – US high yield bonds;

- 10% – gold;

- 10% – real estate (REIT);

- 10% – European shares;

- 10% – shares of developed countries (except the USA);

- 10% – shares of developing countries;

- 10% – stocks all over the world (except the USA).

Let's compare with the classics. The blue graph is the global portfolio, the red graph is the classic one. Data from 1995 to 2020.

Alas, our hypothesis did not come true. Yes, in general, the global portfolio turned out to be more profitable - CAGR 7.58% versus 7.32% for the classic one, but its volatility more than doubled compared to its “analogue”. This portfolio serves its purpose – to protect against a crisis – worse.

Gold, bonds or currency?

All of these tools are equally relevant in the context of the 2020 crisis. First of all, it should be noted gold, which in March of this year became one of the most popular safe-haven assets among investors around the world. Naturally, such a stir led to a sharp increase in prices for this precious metal. Therefore, it was necessary to increase the share of gold in your investment portfolio even before the rise in quotes.

Ideally, during a crisis, the share of investments in gold should be from 10 to 25% of the total investment. If you were unable to buy this precious metal before the economic downturn, you should wait for a more favorable moment to enter this position. The most acceptable ways to invest in this protective asset are gold ETFs and shares of gold mining companies.

As in the situation with gold, it is categorically inappropriate to buy currency after the devaluation of the ruble. Such a decision will be justified only if we are talking about long-term investments. In addition, even if there is a favorable exchange rate, you should not completely abandon the ruble, since the national currency is necessary for everyday spending.

As for bonds, at the moment the most attractive in terms of protecting the investment portfolio are dollar government bonds issued by the Ministry of Finance of the Russian Federation. The conditions for investing in these securities are as follows:

- yield to maturity - 3.3%;

- denomination - $1,000;

- maturity date: June 24, 2028;

- The frequency of coupon payments is 2 times a year.

You can also consider short-term Eurobonds of reliable Russian companies (Norilsk Nickel, Gazprom, Lukoil) as a protective asset. Against the background of the devaluation of the national currency, ruble bonds are significantly inferior to debt securities issued in US dollars, euros, Japanese yen and Swiss franc.

Recommendations for a novice investor

To reduce the overall level of portfolio risks during a crisis, you must adhere to the following tips:

- Always have a certain share of protective assets in your portfolio. Even in a stable economic situation, you should invest about 20-25% of your savings in reliable instruments.

- At the first signs of a crisis, optimize the portfolio, gradually reducing the percentage of high-risk investments towards safe-haven assets.

- When forming a protected portfolio, diversify investments by industry and currency.

- Do not panic and do not transfer capital to protective assets at the peak of their growth, when the crisis has already arrived. In the current situation, this advice will be valid for gold and foreign currency. It is likely that the value of these assets will soon decline, so buying these instruments to protect your investment is likely to have the opposite effect.

Every saver should understand that, in principle, it is impossible to name any one asset that is guaranteed to protect investments during a crisis. You can protect yourself only through optimal diversification of investments between several reliable instruments.

Even the most experienced investor will not be able to imagine a universal investment portfolio that will be 100% relevant in any crisis. After all, the causes of each economic downturn are unique, so at different times, protective tools will behave differently.

Experts do not recommend relying entirely on those safe-haven assets that worked during the last crisis. Each time it is necessary to focus on the current state of affairs and analyze the causes of the crisis, identify the most affected sectors and take into account the measures taken by the state.

Best income cards 2020

№1 Ultra

Eastern Bank

Debit card

- 6% on balance

- up to 7% cashback

- 0₽ for service

More details

VISA Gold

Bank Neiva

Debit card

- 6.25% on balance

- up to 3% cashback

- 0₽ for service

More details

IT'S TIME

UBRD

Debit card

- 6% on balance

- up to 6% cashback

- 0₽ for service

More details

Follow the news on our telegram channelGo