How Stop Limit works on Binance

There are three transaction options on the exchange: Market, Limit and Stop Limit. A Market type transaction sells or buys the number of coins you need at the current market price. A more interesting point is Limit. It allows you to set a limit from which to start buying or selling. To understand the stop limit on the binance exchange, you need to understand the usual Limit.

Let's look at an example. Let’s say the market value of NEO is now $86. I think that the coin will rise to 150 and at this price I want to sell it to take profit.

Then I set Limit to sell at 150 USD. Once the coin price reaches this level or higher, my coins will be automatically sold.

Another option is that you are looking for a profitable entry point for a purchase. For example, you analyzed the chart and think that the price of NEO will fall to 50 USD and at this price you need to buy it. Then you place a buy order at 50 USD and as soon as the price drops to this value or lower, the coins are bought.

This is a regular Limit, it is immediately posted on the exchange as soon as you submit an application. This is its main disadvantage, which is corrected in the Stop Limit option. In essence, this is the same limit, only the order is placed on the exchange not immediately after registration, but when the price reaches the required value. You can use Stop Limit to hide your orders from others for the time being or to sell coins in case of an unexpected drop.

Let's take an example, let's say you bought NEO at 86 USD and expect the coin to rise, but there is a possibility that the price will fall to 75-60 or even lower. Then you set a Stop Limit for sale, in which your transaction appears on the exchange when the price drops to 75 and the coins are sold at 75, if there are no longer anyone willing to buy at 75, then at 74 and 73, but not lower, since the Limit on the minimum price is triggered sales. If you placed such a trade without a stop limit, in the usual way, then your coins would be bought immediately at the current market price, since the exchange algorithm works that way. But we need to sell these coins only if there is a risk that they will fall in price, otherwise we expect them to rise.

Another example of using a stop limit on Binance is buying coins. You can use this limit to buy coins only if their price breaks through certain levels or simply to hide your plans to buy coins. You, of course, can place orders to buy coins at a price higher than they are, but I don’t see any practical sense in this. Now let's talk about how to use Stop Limit on Binance.

Stop loss in cryptocurrency trading: should it be set and how to do it correctly?

I am often asked a question about my margin positions that I post on the channel - why do I often have fewer stops than open trades?

My answer is that not all feet are equally useful and they are not needed everywhere. I don’t think that stops should always be placed. This is a useful tool for limiting losses, but you need to know how to work with it, otherwise the stop turns into a way to get those same losses.

Perhaps my words that stops should not always be placed contradict everything you have heard before? But I am not a theorist, but a practitioner, and the tactics of working with stops are based on personal successful experience (many years in Forex and the third year in the crypto market).

When I traded on the foreign exchange market, Forex trading services in the Russian Federation and post-Soviet countries were provided by “dealing centers” - companies that played against the client and were interested in his losses. However, all the training courses of these companies (primarily market leaders, such as Alpari, Teletrade and Forex Club) taught that stops should be set all the time.

This is where I first started thinking: is a stop loss limitation, or a sure way to get it? Based on the logic, “if Teletrade teaches something, then it is definitely not in the interests of the client.” And then one of my friends, who works at Teletrade for VIP clients, gave me some insider information. All client losses for the month are 78% triggered stops. And only 22% are leaked deposits. The theory turned out to be confirmed by practice. The stop, which should be a protection against a loss, actually becomes the main tool for obtaining that loss.

There are no companies on the crypto market that work against the client. Classic exchanges don’t care whether you make a profit or a loss when trading with other clients (we’re not talking about margin trading with leverage yet, that’s a separate topic). But everyone in the know knows that often the price deliberately goes into the stop zone, knocks them down, and then reverses. Stops are often targeted by large players, here is one of the latest examples: I was on the Bitstamp exchange.

I was in the market then, and if I had a stop then, losses would have been inevitable. And after a couple of days the price returned to 8000. Since I didn’t have a stop, and there were pending buy orders at the bottom, instead of a loss, I made a good profit. So think about whether this is what we were taught.

But how can you limit losses if you don’t set stops? Mistakes in the market are inevitable and happen to everyone, how to protect your deposit in this case?

To do this, you need to understand when it is necessary to place stops, when it is possible, and when it is not necessary to do this. And what other ways are there to limit trading risks?

It is necessary and mandatory to place stops in the following cases:

- You are trading against the main trend. For example, now you are opening short positions on Bitcoin. Why do this is a different question and I don’t have an answer to it. But if you do it, be sure to use a stop.

- You bought a coin with low capitalization and liquidity (below the top 100). Here, too, a stop is required, otherwise you can stay in it forever, or get X's, but a loss.

- You saw that the coin has updated its maximum or is near it and decided to buy it, counting on further movement. Even if this coin is from the TOP-30 and the market is growing, it is also better to place a stop.

- The market has been in a flat for a long time, the direction of the main trend is missing. As it was in February-March 2020 for Bitcoin, for example. You are trading from the boundaries of the channel, which have been relevant for a long time. The feet should stand outside the boundaries of the canal.

I don’t do items 1-3 listed above at all and I don’t recommend them to you. Even with feet. Item 4 is a completely working option, I often use it; in this case, feet are necessary.

Article by the author of the channel “Chief in Crypt” Pavel Gromov. https://t.me/TOPCRYPTOMAIN

Publication date 11/02/2019 Share this material on social networks and leave your opinion in the comments below.

Rate this publication

The latest news on the cryptocurrency market and mining:

Cloud mining of Bitcoin in 2020 - how to choose a reliable and profitable service?

Kraken Report: Bitcoin on the verge of “great adoption”, BTC price will rise by 50-200%

Bitcoin enters mega bull phase with over 93% of BTC addresses showing profits

Anatoly Aksakov commented on the adopted law on cryptocurrency in Russia

Platform for centralized management of the cryptocurrency mining process CoinFly

The following two tabs change content below.

- Author of the material

- Latest news from the world of cryptocurrencies

Mining-Cryptocurrency.ru

The material was prepared by the editors of the website “Mining Cryptocurrency”, consisting of: Editor-in-Chief - Anton Sizov, Journalists - Igor Losev, Vitaly Voronov, Dmitry Markov, Elena Karpina. We provide the most up-to-date information about the cryptocurrency market, mining and blockchain technology.

News Mining-Cryptocurrency.ru (go to all news feed)

- Cloud mining of Bitcoin in 2020 - how to choose a reliable and profitable service? — 08/14/2020

- Kraken Report: Bitcoin is on the verge of “great adoption”, BTC price will rise by 50-200% - 08/14/2020

- Bitcoin Enters Mega Bullish Phase, Over 93% of BTC Addresses Show Profit - 08/14/2020

- Anatoly Aksakov commented on the adopted law on cryptocurrency in Russia - 08/14/2020

- Platform for centralized management of the cryptocurrency mining process CoinFly - 08/14/2020

Cryptocurrency exchangesCryptocurrency trading

How to use stop limit Binance

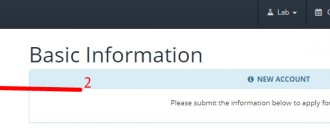

To open the trading window, log in to your account, then select Exchange in the top menu, then Basic:

Next, select the desired cryptocurrency pair in the right column:

Scroll down a bit. Below the chart there will be two forms Buy coin_name and Sell coin_name. Since the sale is more interesting, let's look at it first. There are three tabs above the forms, go to the Stop Limit :

The form now contains three fields:

- Stop — the price at which the order will be placed on the exchange;

- Limit — the price at which the coin will be sold;

- Amount — number of coins for sale;

- Total - how much you will receive as a result;

Let's take the same example that we looked at above. we bought NEO at 86 and are waiting for the cryptocurrency to rise, but we do not want to lose money if it falls. Therefore, we set the price in the Stop field to 75, and in the Limit field to 73:

Then click the Sell NEO button and the order will appear below. Let's look at another purchasing option. For example, you think that NEO will grow if it breaks the level of 100, then set the Stop field to 100 and the Limit field to 105. As soon as the coin grows to 100, you will buy it at a price from 100 to 105 and the coin will continue to grow, if, of course, you were right in your assumptions.

Now you know how the stop limit works on binance.

Examples of using Sell stop limit and Buy stop limit

Since the topic is a little complicated, let's give a few examples that will more fully reveal the essence of trading such limited positions. So, let’s assume that we opened a trading position, the volume of which is at the level of ten lots for the Euro/Bucks currency pair, all this was opened at a price of 1.17875, we highlighted this point on the chart with a green horizontal line, then the price made an upward movement to the level mark 1.18143, while from the chart you can see that the price gives pretty good hints that it will continue its upward movement. In this situation, it would be a little unreasonable to take profits, but I would still pay attention to the fact that in a short period of time important macroeconomic indicators will be released that can change the balance of market forces.

In order to protect existing profits from a possible reversal in the price trend, we place another limit order, but this time on the principle of a limit order of the “Stop Limit” type for opening a short position, with the following parameters;

- Stop price - marked with a red horizontal level, it is located at 1.18093

- Limit price - marked with a yellow horizontal level, it is at around 1.17976

- Volume - set exactly the same as in the previous transaction at the level of ten lots

Example of opening limit orders (1)

Above is an example of how we opened positions using the above values. As a result, if the price reverses and reaches the level of the red horizontal line, a Sell-type trading position will be opened, and its volume will be equal to exactly the same volume that was used in the previous transaction, that is, ten lots.

Let's look at another example, which is shown in the figure below,

Second example of opening limit positions

Here we will open a trading position not with ten, but with five lots, the price at which the “limit” was set is at the level of 1.18295, we have highlighted this place with a green horizontal level. Suppose that in the future the quotation rate has decreased to the red horizontal level, which is at around 1.178, while the speculator expects that the price will decrease again, then in order to protect such a position, the trader needs to place a “buy” limit order, with parameters that will correspond to the following variables;

- Stop price is at the level of the red horizontal line, at a price of 1.17823

- Limit price - highlighted in yellow, at a price of 1.18170

- At the same time, set the number of lots on five lots