Timur Danilov 02/17/2018

Many investors interested in the potential of investing in cryptocurrency are interested in what exchange rate volatility is.

The fact is that well-known personalities in the world of investment and financial speculation note the high volatility of the cryptocurrency market.

The article discusses a feature in the digital money industry.

What is volatility

This is the volatility of the exchange rate of an asset. The calculation is made based on historical price fluctuation statistics and expectations expressed in measurable units. In simple words, volatility is a reflection of exchange rate stability.

The lower it is, the more stable this or that asset will be. Accordingly, the higher the volatility, the less stable the exchange rate will be.

Volatility can also be defined as the deviation of prices from some average.

Let's say that during the week, the price of an asset decreased by 2 percent.

Average daily changes amounted to 1-2 percent.

We can say that the volatility of the asset was insignificant.

If the decline was 10 percent or more, such an asset is said to have been traded with high volatility.

There are several types of volatility:

- Historical – the coefficient of deviation of real price fluctuations from the average value for the analyzed period of time.

- Expected - in fact, this is also a ratio, only used for calculations in the future. With its help, you can predict the levels of risks from transactions with certain assets.

Volatility of cryptocurrencies. Peculiarities

The term “cryptocurrency volatility” usually refers to the degree of fluctuation in the prices of various decentralized tokens.

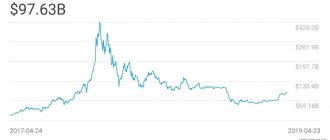

On the chart of any digital token, you can notice constant drops and spikes. The volatility level of a particular cryptocurrency is the difference between its minimum and maximum quotes. Calculating the level of volatility of cryptocurrencies is best considered using a specific example. Let’s say that at the end of the month the minimum price of the selected token was $10, and the maximum was $20. Thus, the volatility level of the asset in question is 50%.

The volatility level of cryptocurrencies is usually calculated for a specific period. In this case, the period under consideration can be almost any (year, month, week, day). Typically, experts calculate the volatility level of a specific token for a period of at least one month. This is because cryptocurrency quotes can rise or fall during the week.

Quote forecasts or the formulation of rules for a new trading system are usually performed based on the level of volatility, at least several months in advance. A more optimal option is to use the annual volatility level for these purposes.

An indicator that deserves special mention is the level of volatility of the selected asset over the entire period of its existence. This indicator is called “historical volatility”.

Professional speculators quite often use such an indicator as expected volatility. The term “expected volatility” usually means a forecast of the range in which the quotes of the asset in question will change in the future. To calculate this indicator, both historical volatility and the current liquidity and value of the token in question are taken into account.

What affects exchange rate volatility?

An increase in volatility rarely occurs on its own. Most often, it is accompanied by some important political or economic events that dramatically change the ratio of players on the stock exchange.

At the same time, in anticipation of such events, volatility can be significantly reduced.

And as soon as they happen, volatility increases. But this applies to those events or statistics that were planned.

If some unplanned event occurs, volatility may increase even more significantly.

For those familiar with Forex trading, such events are nothing new. The fact is that there are so-called economic calendars in which certain data are published, as well as expected important events such as summits or meetings of central banks. Accordingly, using the data from these calendars, you can monitor periods of change in volatility.

go

Fluctuations and risks

It is characteristic that volatility (a quality inherent in any financial instrument - stocks, conventional money or commodity assets) in relation to cryptocurrencies becomes the object of criticism. It can be assumed that this is due not only to the fact that here it is not just “high”, but also to the concern that the new product causes among traditionalist financiers, who are probably ready to deliberately discredit it in order to protect their own, now familiar, tools and assets.

More risky players, on the contrary, see great opportunities behind the abrupt fluctuations in the rates of digital currencies. These are the considerations given by private investor Roman Kuznetsov: “I trade in the short and medium term, so I see for whom volatility is a problem, and for whom it is happiness. Volatility is an opportunity for speculators and a risk for investors. If we are talking about the path of reliable investments, then a conservative investor will never buy a volatile instrument, preferring greater stability. However, there are times when even the most reliable securities lose several percent per day. In Russia, this happened with Federal Loan Bonds during the 2014 crisis. At the same time, as many remember, the dollar exchange rate rose from 37 rubles to 80 rubles in just a few days. This was a very good moment for all sorts of speculators who entered into positions and received super profits in such a short time. Doesn't this remind you of what's happening with cryptocurrencies now? The fact is that a return of 20%, 50%, 100% or more means that the market in which it is possible is dangerous for ordinary people. I am very glad that many are considering such returns and are ready to invest. But do they do this because they see it as a real asset or because, in their opinion, everyone will make money from it? No one can predict what will happen next. I believe that tomorrow or in five years some kind of crisis in cryptocurrencies will certainly occur: too many random people are crowded into this train, while for conservative investors and those who have no previous investment experience, increased volatility is a much greater risk than an opportunity . At the same time, it must be recognized that for speculators and riskier investors, periods of high volatility are a very good time to make money.”

Supply and demand

The average daily turnover of the Forex market is more than 5 trillion US dollars.

It is expected that in the next few years, this figure will grow to 10 trillion US dollars.

The most liquid currencies are the US dollar, euro, British pound, Japanese price. Their rates can be called relatively stable. Why?

This is due to the fact that they have high liquidity. Trade between Europe, the USA and Asia is ongoing. Accordingly, the demand for such currencies from companies is high. In addition, in order to enter the stock markets of the USA, Europe or Japan, foreign investors also have to buy USD, EUR, JPY. And this is an additional stimulating factor in demand.

Demand for fiat currencies and securities is also high because they serve as a tool for saving and investing.

Naturally, currencies to a lesser extent, but they, as noted above, play an intermediary role in the purchase of securities on the stock exchange.

Finally, the demand for currencies is high due to the fact that they are an integral part of the real economy and serve as a means of payment both within one state and on a global scale.

As for cryptocurrencies, they cannot yet boast of such achievements . Their use in the real economy is limited.

Since not all online stores are ready to accept electronic money as payment for goods and services, what then can we say about earthly ones, which are still visited by a large number of the population.

Cryptocurrencies do not participate in international trading activities.

Accordingly, there is no demand for them from large companies that purchase equipment, goods or raw materials. Although attempts are already being made.

Before 2020, investor demand for cryptocurrencies was also insignificant. And only with a sharp jump in the Bitcoin rate, people began to pay attention to this coin and other cryptographic units as an investment opportunity.

go

Mr Jozza

Mr. Jozza () is a well-known Bitcoin trader who writes extensively about market trends and also shows charts explaining his short-term predictions. Mr. Jozza has over 16,000 followers on Twitter and his predictions mainly focus on BTC/USD trends.

Closed my long here, repurchase bids below $3500. Run up on low volume, seen on OBV and volume oscillator. Smells like a short stop-run and bull trap before the holiday season.

— MrJozza (@MrJozza)

Mr. Jozza is a longtime Bitcoin advocate and trader who frequently shares his price TA for Bitcoin and other cryptocurrencies.

Public perception

This is another difference between regular fiat money and cryptocurrencies. Society perceives conventional currency as a means of payment and trusts it.

The central bank is responsible for the issue; it also maintains the proper level of liquidity and ensures that the exchange rate is relatively stable.

People are accustomed to the fact that someone is monitoring something and controlling the circulation of funds, even if this is fundamentally wrong.

Fiat money is accepted everywhere, and if we are talking about US dollars or euros, they can be exchanged in any country and purchase goods and services with local currency. Besides. Classic money can be cashed out at any time using banks or ATMs and, thus, you can pay even where there are no payment terminals in stores.

As for cryptocurrencies and Bitcoin, there is no such trust in them yet. They cannot be cashed out as easily and not all stores accept such coins.

Although many progressive countries have already installed ATMs, some restaurant and store chains accept crypto-assets, but in comparison with the global turnover of fiat funds, these are still negligible achievements.

In addition, society still treats cryptocurrency with a certain degree of caution.

Some even believe that Bitcoin is just another financial pyramid.

In addition, the principle of the emergence of new cryptocurrency units is not clear to most.

If with fiat money everything is more or less clear - the decision on their issue is made by the central bank, then the decentralization inherent in bitcoin and altcoin somewhat frightens the average person.

It was once correctly noted that people are afraid of what they do not understand.

Finally, today quite often you can hear the opinions of truly iconic figures in the world of economics and finance who predict a not very rosy future for cryptocurrencies.

This also discourages potential investors.

A wary attitude towards Bitcoin and other cryptocurrencies significantly affects the liquidity of this industry, which so far cannot boast the same indicators as Forex or stock exchanges. Accordingly, in the near future, the volatility of cryptocurrencies will remain quite high.

What does the future hold for stablecoins?

It’s too early to say that stablecoins will be able to take the cryptocurrency industry to a new level. No team has yet been able to implement this concept without losing privacy, decentralization or security. Stable cryptocurrencies are at the beginning of their journey, but if a coin is developed that is not tied to fiat and can provide a stable exchange rate, the cryptocurrency industry will take a huge step in development and will be able to directly compete with state currencies.

conclusions

The most volatile currency pairs in Forex allow for maximum profit, but a trader must understand that volatility only has trading significance if it is supported by actual trading volumes. Correct use of volatility is a necessary element of a successful trading system; special technical indicators such as CCI, Bollinger Bands, ATR or more complex options are offered for this purpose. Keep in mind that asset volatility changes with market trends and the global economy. To earn consistently, be prepared to switch to more profitable trading instruments.