Everyone suddenly agreed that considering Bitcoin as a currency is normal

Remember the Nash equilibrium, Gresham's law, the Stasi rules? So the banking system is similar to the Stasi. But first, about something else. Why did cryptocurrency become a currency in the first place?

A Nobel laureate in economics would answer you something like this: “At some point in time, the market fell into a Nash equilibrium, where everyone suddenly agreed that it was okay to consider Bitcoin a currency.”

Why do men wear trousers and women wear skirts? Although this was not the case in Scotland at one time. It’s just that at some point everyone agreed that it should be like this. Nash equilibrium.

In general... What is currency?

Currency is a medium of indirect exchange. Once upon a time, the medium of exchange was pheasant feathers, which were previously worth nothing. But then there was a demand for feathers and people said: “The feather will be a currency, a means of indirect exchange.” Gradually, general requirements for currency were formed: it should be easy to divide into parts, while its value does not change; it is easy to carry; and it should have a long shelf life.

And most importantly, people must be ready to use currency as a means of exchange. The same thing happened with cryptocurrency: people became READY to use it.

Right now I’m ready to exchange my phone for bitcoins. It is clear that cryptocurrency meets all other criteria, perhaps even better than any other fiat currency (it is much easier to store, transfer, divide, and it is eternal).

Why did cryptocurrency appear?

One of the main reasons, in my opinion, is the enormous anger of people towards the banking system with all its rules, which are promoted under the auspices of the mythical fight against scammers and other scoundrels. So, the current banking system is like the Stasi, to which I have to explain why I walk this way and not another, and why I take this route to work and not another. And then, will two-meter fences stop real criminals? When criminals need to hack a banking system, they simply buy the bank.

All these safety rules are essentially useless. Therefore, there is global irritation of people with the banking system. This is visible everywhere - and in businesses of any size, too, from small to large.

The irritation created a request for some analogue to the current system. Cryptocurrency has appeared. And the process cannot be stopped—cryptocurrency will take its place in the global economy. Which one is still a question.

The problem is that cryptocurrency today is not really used as a medium of exchange. The phenomenon is called Gresham's law: when no one wants to pay with a currency that is constantly and greatly increasing in price. Everyone has heard the story of two pizzas that were purchased for 10 thousand BTC in 2010.

Who wants $15 million pizza? Or would you want to drive a Toyota car you bought today for 30 BTC if you find out a year later that you paid $3 million for it? Therefore, cryptocurrency is used as a means of savings and speculation.

At the same time, the process of continuous growth leads to the fact that basic cryptocurrencies are losing their properties as a means of payment - stability. They turn into something like shares of a rapidly growing company. And who would want to sell or exchange rising shares for goods and services today if they will cost more tomorrow? This is problem.

In this topic I will try to collect a list of all cryptocurrencies that exist on the network. There will only be their names and a brief overview. In the future, I will consider each of them separately. The more popular the currency, the faster a review of it and a separate section for tracking the exchange rate and news will appear. Therefore, I advise you to bookmark this page, as it will be constantly updated.

Bitcoint (BTC) – The very first and main cryptocurrency. The new decentralized electronic means of payment are digital coins - a cryptographic entity that meets certain requirements. Used to pay for goods and services. The most likely candidate for the role of a new world currency. The hashing algorithm is SHA256. Number of coins – 21,000,000.

Litecoin (LTC) – The second most popular cryptocurrency. The founder of the alternative crypto method and the most serious competitor of Bitcoin. The hashing algorithm is Scrypt. The main differences of this algorithm are that LiteCoin is easier to mine and the power of a home computer is quite enough to mine it. Number of coins – 84,000,000.

DodgeCoin (DOGE) is the most popular fork of LiteCoin. The coin was intended as a joke and was named after the Internet meme Doge, but it blew up the cryptocurrency market. The coin attracted a huge number of users and showed a confident and unprecedented increase in value in a record short time. The hashing algorithm is Scrypt. The number of coins is unlimited.

NameCoin (NMC) is one of the few Bitcoin forks that has practical value. Created for maintenance and cryptographic protection of the .bit domain zone. The cryptocurrency is based on Bitcoin and can be settled together with BTC (many pools do this by default). The coins are intended for registering domains in the .bit zone. Thanks to the cryptographic subsystem, such domains are protected from changes from outside, except for their owner. NameCoin is designed to turn domain names into an independent decentralized system. Hash algorithm SHA-256. The number of coins is 21,000,000.

Peercoin (PPC) is a serious alternative to Bitcoin. It features a much more energy-efficient hybrid proof-of-stake/proof-of-work system, which first appeared in this currency. This means that generating coins is possible in two ways - generating coins with equipment and generating coins with coins already on the wallet. The hashing algorithm is SHA-256. The number of coins is unlimited.

PrimeCoin (XPM) is another fork of Bitcoin, but unlike other crypto coins, PrimeCoin has a very payload when generating new coins. As a result of mining, new prime numbers are searched in parallel, which then serve as the basis for other cryptographic algorithms. The issue of coins is unlimited.

Feathercoin (FTC) – Aka “feathercoin” in Russian. One of the younger brothers of LightCoin and is no different from him in anything special. In essence, this is the same LiteCoin with very minor changes that are difficult for the average miner to feel. The only major change that clearly stands out is the release of 336,000,000 coins. But this is unlikely to be an advantage of the coin. The hashing algorithm is naturally Scrypt.

Nextcoin (NXT) is a truly revolutionary and very unusual cryptocurrency. Although it is based on the principles of Bitcoin, it was still written from scratch. There is no such thing as maning. All coins were created in the first block and now those who create new blocks receive rewards from commissions. The coin's capitalization is growing rapidly. Number of coins – 1,000,000,000 (1 billion).

Stablecoins

Cryptocurrency volatility has been the subject of a long-standing debate, with the words “bubble” and “speculative instrument” often heard. The problem is being solved, among other things, by the launch of special settlement cryptocurrencies, so-called stablecoins. It is a cryptocurrency whose value is determined not only by demand for it, but also by more established methods.

There have been several attempts around the world to create similar stablecoins. As a rule, they were tied either to the value of fiat currencies - the dollar, the euro - or to raw materials (commodities) - oil, gold, and so on. But for various reasons, they have not become widespread.

First of all, because the creators of such currencies violated the blockchain principle - distribution and independence. They issued cryptocurrency, sold it, and used the proceeds to buy collateral. And the fact that the collateral was kept and controlled by the issue organizers did not inspire confidence in the community.

Now more advanced projects are appearing. In general, there is a hypothesis that the future lies with “stablecoins” tied to commodities.

It is based on the fact that in society in general and in the economy in particular, the so-called fatigue of the material of fiat classical unsecured money has appeared. At the same time, we see that the same dollar, euro, yuan, Brazilian real and all other classical currencies are also subject to volatility. And all this against the backdrop of a global rise in the price of money.

The economy is looking for alternatives. But will the social demand for blockchain commodities be critically higher than for classical money? Not sure. But it is most likely that it will be larger than now.

There are several interesting stablecoin projects in the world right now:

- There is a project called Tether , which is consistently in the TOP 50 in terms of capitalization (currently just over $300 million). Tether is the coin of the dollar, 1 to 1.

- A startup has been launched in Israel that is trying to make a cryptocurrency tied to oil . True, they are not doing very well yet, because they cannot solve the problem of storing oil - it is difficult to store it.

- There are projects that are trying to tie cryptocurrency to computing power, to electricity, such as SONM .

Of course, real estate has great potential. All developers - both in the USA and in Russia - are trying to integrate into the world of blockchain. Switzerland, Singapore and other countries have allowed to maintain a real estate register using blockchain. I'm waiting for the next breakthrough - pegging cryptocurrency to square meters.

Agree, it would be great if a grandmother from Perm could use blockchain to invest part of her pension in a business center under construction in Saratov , without the risk that her investment would be stolen.

Our fund currently has just one client from the real estate industry. We help him prepare for the ICO. This is a multi-million dollar business. I don't want to go into details because I don't want our client to be taken away by competitors. Now a legal scheme is being finalized on how blockchain technologies can be used in terms of debt financing for classic companies (in our case, a developer), and so that this process is regulated by the Russian authorities.

Bitcoin (Bitcoin, BTC)

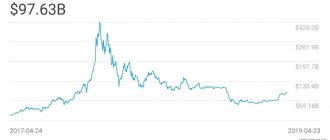

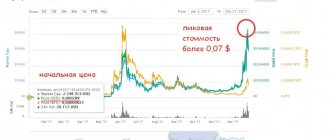

The first and most liquid digital unit. Year of creation – 2009. Forms more than 50% of the total value of cryptocurrencies. The capitalization of the military-technical cooperation is about $255 billion (all figures are correct as of the beginning of January 2020). Used as a means of payment and an instrument for investment (including long-term).

Bitcoin has an excellent exchange history. From 2010 to 2013, its rate increased 10 thousand times (from $0.1 to $1000), then lost ground for some time, returning to the $200 mark, after which in 2020 it began to gain momentum at a record pace. Today the cost of 1 BTC is $15,173. None of the more than a thousand currencies can yet repeat this success. Experts believe that with proper calculation of risks on Bitcoin, you can receive up to 30% of your monthly income.

You can easily explain to your mom about cryptocurrency tied to gold

But I haven’t talked about the main (yet) and most obvious commodity - gold. Gold is a commodity that everyone understands. Gold occupies approximately 5-10% of the global investment market. Gold is a naturally limited natural resource. According to open data, the gold reserves of governments are about 30 thousand tons, and citizens have the same amount of products, coins and bars in their hands. Total about 60 thousand tons. About 3 thousand tons of gold are mined annually in the world.

This is a stable figure that cannot change sharply in any direction due to distributed production in different countries and established technologies. Therefore, the value of gold, expressed in goods and services, remains virtually unchanged.

All this makes gold the ideal equivalent of payment. Actually, this has been the case throughout the history of human development. Even the first money was tied to gold until governments decided to replace the process of gold mining with the simpler process of printing paper money.

Well, and most importantly: you can easily explain to your mom about cryptocurrency tied to gold. And she will understand you.

Now there are several “gold” crypto projects. There are not many of them, but they all have a different concept:

- An impressive project is Dubai-based OneGram , which plans to raise $500 million in an ICO that began on May 27 and is scheduled to end on September 24. To date, 22% of the 12,400,786 tokens have been sold, selling for $43.18 each. “Dubai” and “gold” sound somehow impressive, you’ll agree. OneGram is tied to stored physical gold. They have a rather strange feature, in my opinion: they position themselves as a project specifically for Muslims. In the world of blockchain, any artificial limitation raises questions because it contradicts the very concept of technology. True, according to the founders themselves, now the majority of the project’s investors are not Muslims.

- There is also a project by the British Royal Mint Royal Mint Gold , in which one token is tied to one gram of gold. The project raises questions from a decentralization point of view.

- Another ambitious project is the American-Australian OZCoin . It is backed by 100 thousand ounces (a little more than 2.8 tons) of 24-karat gold.

- For me, the most interesting of the “golden” projects is the “Russian” Goldmint .

I put “Russian” in quotes because there is an international team working there, and it is interesting to me for two reasons. First of all, he's from Russia (and that's great). Secondly, we invested in it. The project plans to hold an ICO in September, and in May it held a pre-ICO and raised $600 thousand in a couple of days. We have a piece of paper hanging in our office that says that so many Goldmint tokens belong to the entire DTI team .

I put “Russian” in quotes because there is an international team working there, and it is interesting to me for two reasons. First of all, he's from Russia (and that's great). Secondly, we invested in it. The project plans to hold an ICO in September, and in May it held a pre-ICO and raised $600 thousand in a couple of days. We have a piece of paper hanging in our office that says that so many Goldmint tokens belong to the entire DTI team .

Our investment logic is simple. Imagine that there is a gold bar that can be quickly and cost-effectively transported to any point on the planet and has the property of being impossible to steal. How much more expensive is such an ingot than a classic ingot? Obviously, significantly more expensive. Of course, there are a lot of other risks, the project may not take off, but at least we had the opportunity to get to know and study the team.

Usually, team verification removes 9/10 of the risk - the likelihood of a “scam” or some kind of illegal actions is equal to zero. I have always said that the Whitepaper, the business plan in the ICO world is secondary to the team. It doesn't matter what you do, but what matters is who you are. If Elon Musk raises cows tomorrow, investors will believe in his project. All that remains is the business risk: whether the project will take off or fail.

Goldmint is made by the team of the Lot-Gold project, which over the year of its existence was able to grow from zero to 5.5 billion rubles. revenue. We made sure that they were able to do a good classic business, now they want to turn the gold market upside down. Whether it will work out or not is difficult to say in advance. The project is complex, including from a hardware point of view. The company is developing a special proof-of-gold box - a safe with a gold verification system, constantly connected to the Internet. It is understood that such devices can be installed in banks, pawnshops, and jewelry stores (all that remains is to convince the banks themselves of this).

The safe will evaluate gold items, and special software will make it possible to issue GoldCoin in real time. A person can come to a bank, put a piece of jewelry in this safe, and it automatically evaluates the metal, identifies the individual, and then issues GoldCoin. The value of GoldCoin is tied to the price of gold on the exchanges of New York, Great Britain or China. It sounds promising.

Review of the TOP 15 cryptocurrencies

Now about cryptocurrency in general. On the Internet you can easily find sites where you can see the capitalization of each cryptocurrency that is traded on a crypto exchange, its current price in dollars, a chart of price changes, and the amount of currency traded on the market. Such statistics will not help novice investors understand much, but will at least give a general idea of what is happening.

I will briefly talk about several cryptocurrencies included in the TOP 50 by capitalization: what is their essence, advantages and disadvantages. And although I have invested in many of them, I will not give any specific investment advice here.

Bitcoin

A real world analogy is gold.

I will talk about Bitcoin in more detail than about other cryptocurrencies, because in the crypto industry Bitcoin has become the standard by birthright. In other words, this currency appeared first on the market, and therefore ranks (for now) first in popularity, capitalization and exchange rate against the dollar. All other currencies that appeared later began to be called altcoins, and Bitcoin still remains the benchmark that everyone uses as a starting point.

Bitcoin is a cryptocurrency that can only be sent, received, and stored. At the same time, it has many disadvantages inherent in the architecture itself: it is slow, difficult to scale, requires a lot of power for mining, a lot of storage space, its transactions are expensive, and the cryptography can be hacked if desired.

Here are some more disadvantages:

- Bitcoin is slow – this means that Bitcoin transactions occur once every 10 minutes. To confirm a transaction, you need to mine, which is a very energy-intensive process. In order for the number of users to increase (scalability), the computing power of computers must increase.

- For the Bitcoin network to work, huge amounts of information need to be stored.

- Bitcoin turned out to be not such a decentralized system as it was announced at the very beginning. In theory, miners could join together in huge pools and control the network.

- The maximum number of bitcoins that can be issued is 21 million. To date, 16.75 million have already been mined. What will happen when the total volume reaches the limit? Obviously, there will be a so-called hard fork, when a decision is made to create a new version of the Bitcoin network. This means a big vote, a referendum if you will, among Bitcoin holders. Chinese cryptocurrency holders advocated holding such a referendum as early as September. After it, the “constitution” of Bitcoin may change. And we know how constitutions change easily and quite quickly in different countries...

Most likely, as a result of the hard fork, the cost of the transaction will be reduced several times, because its verification will be simplified. The restrictions regarding mining will also change. Perhaps it will be removed altogether. But there are still too many unknowns. And most importantly, there are other currencies that are technically more advanced. For now, Bitcoin remains the gold standard of the cryptocurrency world.

Will the situation ever change? I’ll ask a counter question: is it possible to write a social network better than Facebook? Definitely. The simplest thing remains - to get 2 billion users to switch to this new social network. Is it possible to write a better cryptocurrency than Bitcoin? The fourth position in terms of capitalization - Litecoin - is better in all respects. It appeared almost simultaneously with Bitcoin, but still a little later.

Bitcoin in the world of cryptocurrencies is a kind of analogue of the classic store of value, to which everyone is already accustomed.

Ethereum

An analogy from the real world is the new Microsoft or the new Amazon.

Ether is beginning to overtake Bitcoin in terms of popularity. Perhaps this currency has more prospects. If Bitcoin can only act as a means of exchange and storage, then Ethereum has a number of advantages. The main thing is the ability to create smart contracts. Now this platform is the most popular in the world for building a blockchain economy, and is used in numerous ICOs.

Ethereum inherited almost all the diseases of Bitcoin. Yes, it is faster - it updates every 10 seconds (that is, 60 times faster), but it has the same problems with scaling (the recent case with SONM is a case in point), power consumption and storage.

It may well challenge Bitcoin’s leadership in the near future.

Ripple

A real world analogy is the new VISA.

The project team is trying to create a new payment system so that it can be used to make payments in all currencies. The advantage of this currency is that it is used by banks. However, it is not decentralized. Coins are not mined, that is, their number does not increase. Ripple has a huge speed advantage over BTC and ETH, but the transactions are not as transparent. This is normal for the classical banking system - anonymity has never been welcomed there.

Litecoin

A real world analogy is platinum, which is cheaper than gold.

An absolute analogue of the cue ball. Faster, cooler in all respects - but just ended up second. It is worth buying it from the point of view of diversifying investments in the same bitcoin. But in terms of innovation there is nothing there.

Ethereum Classic

A real world analogy is Alibaba (not Amazon).

Alibaba is the largest online store with a multi-billion dollar turnover. But they still understand that it is still not as cool as Amazon. Classic may even turn out to be more expensive than regular Ethereum, but it has its own nuances. ETC appeared after the Ethereum hard fork, which occurred last fall, and still does not inspire confidence in the crypto community. The main attention is still paid to ETH, and all significant projects are carried out on this platform.

Dash and NEM

An analogy from the real world is “it’s unclear who.”

To be honest, I don’t come across these currencies very often. NEM is primarily traded in Japan, where it is officially legal to buy and sell goods with cryptocurrency. The number of coins is always one less than 9 billion; additional emission is not provided, so there is no mining here, but there is so-called harvesting.

A major jump in the NEM rate occurred in May, when a closed platform, Mijin, was created based on NEM, through which Japanese banks can conduct secure transactions. NEM is built following the example of Bitcoin, but there are no fundamental differences in the architecture.

Dash is a cryptocurrency whose transactions are completely anonymized. Many people talk about this as an advantage, but think about it: why does an ordinary person need complete anonymity during transactions? Also, all decisions on changes to the “constitution” occur through general voting, that is, the Dash network is completely decentralized.

Naturally, both currencies work faster than cue ball and have a number of other software advantages.

IOTA

A real world analogy is the new Google.

A true innovation in the world of cryptocurrency. Offers a fundamentally new paradigm that can change everything. IOTA is also called the “cryptocurrency of the Internet of things.” It appeared five years ago, but it literally just became popular. As soon as it entered the stock exchange, it immediately broke into the Top 10 cryptocurrencies.

What's innovative about it? The very principle of operation. IOTA is built like a web and is infinitely scalable.

How does Bitcoin work? In order to make a Bitcoin transaction, the miner must do some work to confirm the transaction. Spend time, a huge amount of energy and allocate storage space. In the case of IOTA, you can confirm the transaction yourself using your device - for example, a regular phone. Your smartphone confirms two other people's transactions. Those transactions are confirmed by your two. And so on. The more users, the faster and better the network works.

Now IOTA users have reached a critical mass and the currency has become very popular. There is no limit to scalability, no miners are needed, so transactions are free. You don't have to pay a commission to miners, you don't waste computing power.

In general, this is a real bomb that threatens to make a revolution. IOTA generally solves all the problems inherent in Bitcoin (limited limitations, high requirements for computing power, pseudo-decentralization, data growth and storage problems, slow speed).

Monero

An analogy from the real world is AFK Sistema.

Briefly, unlike Bitcoin, the emission of Monero is not limited, but transactions take up several times more space than Bitcoin. But that's not the most interesting thing. Russian ears stick out here. In general, inexpensive transactions, good transfer speed, good mining. But you have to be careful - some kind of AFK Sistema could happen to them...

EOS

An analogy from the real world is the Empire State Building.

EOS is the evolution of the currencies of BitShares and Steemit (which, by the way, were seriously criticized, which does not prevent BitShares from being close to the top 10 in terms of capitalization). It is based on a breakthrough technology that can be compared to the advent of blockchain. In theory, they can replace Ethereum or enter into synergy with it.

From a technology point of view, the project is better than Ethereum. The developers have created a new language, and now an operating system is being created on the EOS platform, on which it will be possible to build individual applications.

The logic is this: all databases, all web programming will be transferred to the blockchain. New technologies will allow different applications to be launched asynchronously, which will seriously increase the speed of the EOS-based OS.

The team expects that the whole world will eventually work on EOS. In general, to be honest, this is already the world of “Crypto 3.0”, which is too much even for me. Too grandiose and incredible. But this could well happen in five years.

BitShares

Analogy from the real world - didn’t come up with it

The point is that the value of any fiat currency is replicated here on the blockchain. A useful tool to avoid losing on conversions and not to depend on the laws of different countries, taxes, etc. There is also a similar currency, Tether, which is pegged to the dollar 1 to 1.

If you want to sell or buy dollars on the blockchain, this is the place for you. These are not speculative instruments. (Here you need to understand that BitShares itself, as a unit of account, also “floats”.

It is used as a currency to collect fees on fiat currency transactions. You can speculate on it. But if we want to operate fiat money on the blockchain, then we can do this within the BitShares system).

Cryptocurrencies

Total capitalization: $29,455,379,228,831,852

Last updated - 14 August 2020 14:08 UTC

| Coin | Price $ | Price | Per day $ | Capitalization | Trading volume 24 hours | |

| 1 Bitcoin BTC | $ 11 718,8 | 855 682,9 | 1,84% | $ 216 337 235 613 | $ 26 881 947 555 | |

| 2 Ethereum ETH | $ 426,69 | 31 156,4 | 8,55% | $ 47 865 764 010 | $ 17 282 354 572 | |

| 3 XRP XRP | $ 0,29742 | 21,716 | 6,40% | $ 13 359 744 375 | $ 2 156 542 201 | |

| 4 Tether USDT | $ 1,0084 | 73,635 | − 0,28% | $ 10 082 833 788 | $ 43 075 492 525 | |

| 5 Chainlink LINK | $ 16,711 | 1 220,2 | − 1,10% | $ 5 849 101 047 | $ 2 628 330 202 | |

| 6 Bitcoin Cash BCH | $ 293,05 | 21 398,1 | 3,62% | $ 5 418 501 813 | $ 1 899 136 925 | |

| 7 Bitcoin SV BSV | $ 212,2 | 15 494,9 | 3,77% | $ 3 923 336 655 | $ 1 009 394 158 | |

| 8 Litecoin LTC | $ 56,564 | 4 130,1 | 3,73% | $ 3 690 196 164 | $ 2 712 056 484 | |

| 9 Cardano ADA | $ 0,139696 | 10,2 | 1,85% | $ 3 621 915 455 | $ 402 678 138 | |

| 10 Binance Coin BNB | $ 23,149 | 1 690,2 | 8,72% | $ 3 342 895 641 | $ 365 129 546 | |

| 11 Crypto.com Coin CRO | $ 0,164005 | 11,975 | 2,92% | $ 3 089 662 387 | $ 73 202 226 | |

| 12 Tezos XTZ | $ 4,1112 | 300,19 | − 2,50% | $ 3 041 453 589 | $ 336 071 190 | |

| 13 EOS EOS | $ 3,142 | 229,42 | 3,46% | $ 2 938 428 625 | $ 2 554 933 758 | |

| 14 Stellar XLM | $ 0,104978 | 7,6652 | 5,22% | $ 2 156 684 569 | $ 270 746 062 | |

| 15 TRON TRX | $ 0,024111 | 1,7605 | 17,30% | $ 1 727 787 862 | $ 1 119 631 318 | |

| 16 Monero XMR | $ 92,117 | 6 726,1 | 3,50% | $ 1 627 245 188 | $ 78 947 027 | |

| 17 Cosmos ATOM | $ 6,3692 | 465,06 | 12,07% | $ 1 284 440 075 | $ 479 949 892 | |

| 18 UNUS SED LEO LEO | $ 1,2577 | 91,841 | − 1,46% | $ 1 257 168 427 | $ 14 010 161 | |

| 19 USD Coin USDC | $ 1,0012 | 73,111 | − 0,06% | $ 1 203 693 585 | $ 429 418 698 | |

| 20 VeChain VET | $ 0,020573 | 1,5021 | 3,69% | $ 1 140 870 769 | $ 241 707 818 | |

| 21 IOTA MIOTA | $ 0,389208 | 28,418 | 3,79% | $ 1 081 814 883 | $ 29 579 460 | |

| 22 Neo NEO | $ 15,214 | 1 110,9 | 8,83% | $ 1 073 217 128 | $ 409 888 752 | |

| 23 Huobi Token HT | $ 4,7328 | 345,57 | 4,20% | $ 1 021 297 105 | $ 113 989 261 | |

| 24 Dash DASH | $ 91,661 | 6 692,9 | 3,13% | $ 884 772 636 | $ 301 717 818 | |

| 25 Zcash ZEC | $ 84,151 | 6 144,5 | 3,71% | $ 825 731 507 | $ 463 317 871 | |

| 26 Ethereum Classic ETC | $ 6,8946 | 503,42 | 2,12% | $ 801 938 409 | $ 682 933 976 | |

| 27 Maker MKR | $ 739,62 | 54 005,6 | − 5,62% | $ 743 751 070 | $ 74 522 766 | |

| 28 Ontology ONT | $ 0,826966 | 60,383 | 4,61% | $ 578 074 168 | $ 169 350 456 | |

| 29 Algorand ALGO | $ 0,731539 | 53,415 | 23,23% | $ 564 613 955 | $ 511 464 544 | |

| 30 NEM XEM | $ 0,062286 | 4,5479 | 2,39% | $ 560 570 508 | $ 9 979 851 | |

| 31 Aave LEND | $ 0,43031 | 31,42 | 2,53% | $ 559 402 346 | $ 75 720 736 | |

| 32 HedgeTrade HEDG | $ 1,8755 | 136,94 | 1,89% | $ 540 553 041 | $ 1 187 317 | |

| 33 Compound COMP | $ 205,59 | 15 012 | 1,75% | $ 526 586 609 | $ 185 305 410 | |

| 34 Synthetix Network Token SNX | $ 5,4929 | 401,08 | 7,74% | $ 511 393 014 | $ 65 250 578 | |

| 35 BitTorrent BTT | $ 0,000479 | 0,034962 | 6,91% | $ 472 452 168 | $ 35 256 200 | |

| 36 Dogecoin DOGE | $ 0,003493 | 0,255084 | 1,53% | $ 439 573 645 | $ 67 586 886 | |

| 37 DigiByte DGB | $ 0,031407 | 2,2932 | 2,18% | $ 422 300 691 | $ 14 524 873 | |

| 38 Dai DAI | $ 1,0095 | 73,713 | − 1,59% | $ 419 870 442 | $ 54 101 939 | |

| 39 Basic Attention Token BAT | $ 0,271191 | 19,801 | 2,67% | $ 404 955 642 | $ 167 492 122 | |

| 40 Cyber Network KNC | $ 1,9673 | 143,65 | 12,39% | $ 384 662 161 | $ 244 606 489 | |

| 41 Waves WAVES | $ 3,5812 | 261,49 | 14,53% | $ 367 915 493 | $ 449 433 188 | |

| 42 Energy Web Token EWT | $ 12,024 | 877,96 | 1,60% | $ 361 469 655 | $ 1 685 159 | |

| 43 OKB OKB | $ 5,9359 | 433,42 | 7,83% | $ 356 156 547 | $ 93 154 894 | |

| 44 THETA THETA | $ 0,395283 | 28,862 | − 2,35% | $ 344 094 657 | $ 44 635 658 | |

| 45 0x ZRX | $ 0,467675 | 34,148 | 5,28% | $ 334 852 483 | $ 84 012 676 | |

| 46 FTX Token FTT | $ 3,4997 | 255,54 | 5,30% | $ 330 190 510 | $ 7 341 269 | |

| 47 Hyperion HYN | $ 1,0338 | 75,486 | 6,43% | $ 327 475 800 | $ 21 220 668 | |

| 48 ICON ICX | $ 0,535718 | 39,116 | 18,32% | $ 300 366 154 | $ 59 447 333 | |

| 49 Qtum QTUM | $ 3,0973 | 226,16 | 13,28% | $ 300 264 840 | $ 513 279 829 | |

| 50 Elrond ERD | $ 0,022115 | 1,6147 | 1,35% | $ 294 646 970 | $ 28 748 737 | |

| 51 Band Protocol BAND | $ 14,038 | 1 025 | 2,56% | $ 287 707 997 | $ 149 616 920 | |

| 52 OMG Network OMG | $ 1,9712 | 143,93 | 14,82% | $ 276 460 903 | $ 171 011 715 | |

| 53 Swipe SXP | $ 4,1146 | 300,44 | − 7,86% | $ 271 497 495 | $ 419 498 636 | |

| 54 Zilliqa ZIL | $ 0,025818 | 1,8851 | − 1,24% | $ 267 296 943 | $ 80 836 521 | |

| 55 Hedera Hashgraph HBAR | $ 0,051982 | 3,7955 | 4,85% | $ 262 099 571 | $ 35 436 845 | |

| 56 Ren REN | $ 0,284549 | 20,777 | 4,27% | $ 247 057 441 | $ 28 160 062 | |

| 57 Paxos Standard PAX | $ 1,0028 | 73,224 | − 0,10% | $ 245 645 775 | $ 181 018 600 | |

| 58 August R.E.P. | $ 21,229 | 1 550,1 | 2,26% | $ 233 526 371 | $ 18 693 168 | |

| 59 Aragon ANT | $ 6,775 | 494,69 | − 0,57% | $ 223 062 853 | $ 62 826 802 | |

| 60 Lisk LSK | $ 1,7645 | 128,84 | 3,85% | $ 220 934 636 | $ 24 004 231 | |

| 61 Loopring LRC | $ 0,182669 | 13,338 | 25,76% | $ 208 527 221 | $ 27 850 585 | |

| 62 TrueUSD TUSD | $ 1,0044 | 73,345 | − 0,40% | $ 207 200 620 | $ 102 551 291 | |

| 63 Decred DCR | $ 16,826 | 1 228,6 | 4,05% | $ 199 795 429 | $ 9 846 542 | |

| 64 Terra Luna | $ 0,515328 | 37,627 | − 5,24% | $ 198 624 809 | $ 26 566 812 | |

| 65 Bitcoin Gold BTG | $ 10,856 | 792,72 | 1,31% | $ 190 142 570 | $ 10 058 361 | |

| 66 Binance USD BUSD | $ 1,0042 | 73,325 | − 0,16% | $ 190 045 478 | $ 270 064 286 | |

| 67 Ampleforth AMPL | $ 0,708522 | 51,734 | − 10,14% | $ 183 581 619 | $ 22 040 952 | |

| 68 Nervos Network CKB | $ 0,008878 | 0,648255 | 11,59% | $ 180 116 404 | $ 24 159 517 | |

| 69 Enjin Coin ENJ | $ 0,213097 | 15,559 | − 1,18% | $ 174 995 602 | $ 21 745 873 | |

| 70 Ravencoin RVN | $ 0,025386 | 1,8536 | 12,72% | $ 173 007 107 | $ 85 204 408 | |

| 71 Blockstack STX | $ 0,294318 | 21,49 | 10,05% | $ 169 177 390 | $ 4 703 848 | |

| 72 JUST JST | $ 0,070941 | 5,1799 | − 2,43% | $ 160 350 226 | $ 493 764 147 | |

| 73 Ocean Protocol OCEAN | $ 0,452483 | 33,039 | 0,51% | $ 159 698 014 | $ 8 704 547 | |

| 74 Nano NANO | $ 1,1732 | 85,67 | 4,62% | $ 156 339 418 | $ 12 389 245 | |

| 75 Bancor BNT | $ 2,2554 | 164,68 | − 3,86% | $ 155 963 074 | $ 97 858 652 | |

| 76 THORChain RUNE | $ 0,964968 | 70,459 | 9,31% | $ 152 881 920 | $ 7 951 534 | |

| 77 iExec RLC RLC | $ 1,9004 | 138,76 | − 6,70% | $ 152 174 024 | $ 19 426 636 | |

| 78 Bitcoin Diamond BCD | $ 0,814842 | 59,497 | 1,64% | $ 151 962 310 | $ 6 536 023 | |

| 79 yearn.finance YFI | $ 5 026,1 | 366 995,4 | − 1,96% | $ 150 557 551 | $ 21 939 314 | |

| 80 Flexacoin FXC | $ 0,005154 | 0,376304 | − 5,00% | $ 147 522 262 | $ 941 846 | |

| 81 Kava.io KAVA | $ 4,3319 | 316,3 | 4,22% | $ 145 056 180 | $ 43 421 660 | |

| 82 Balancer BAL | $ 20,68 | 1 510 | 7,62% | $ 143 601 649 | $ 22 584 917 | |

| 83 Holo HOT | $ 0,000859 | 0,062722 | 1,33% | $ 142 525 859 | $ 12 452 029 | |

| 84 Bytom BTM | $ 0,107265 | 7,8322 | − 1,74% | $ 142 131 114 | $ 34 413 807 | |

| 85 Siacoin SC | $ 0,003317 | 0,242196 | 0,73% | $ 138 705 220 | $ 3 636 822 | |

| 86 Decentraland MANA | $ 0,095529 | 6,9752 | − 1,99% | $ 137 630 388 | $ 41 617 748 | |

| 87 HUSD HUSD | $ 1,0056 | 73,432 | − 0,30% | $ 137 389 081 | $ 31 359 992 | |

| 88 Divi Divi | $ 0,070118 | 5,1198 | − 2,91% | $ 128 975 756 | $ 244 661 | |

| 89 Numeraire NMR | $ 46,277 | 3 379 | − 14,72% | $ 127 914 941 | $ 3 368 311 | |

| 90 MonaCoin MONA | $ 1,9179 | 140,04 | 3,37% | $ 126 065 064 | $ 6 984 629 | |

| 91 Verge XVG | $ 0,007374 | 0,53846 | 2,16% | $ 120 509 746 | $ 5 706 606 | |

| 92 ZB Token ZB | $ 0,247916 | 18,102 | 1,44% | $ 114 856 878 | $ 6 293 032 | |

| 93 XinFin Network XDCE | $ 0,00926 | 0,676156 | − 1,16% | $ 112 955 823 | $ 4 451 473 | |

| 94 The Midas Touch Gold TMTG | $ 0,025481 | 1,8605 | − 4,06% | $ 112 133 368 | $ 10 790 285 | |

| 95 Quant QNT | $ 9,267 | 676,65 | 11,89% | $ 111 878 410 | $ 3 057 194 | |

| 96 DxChain Token DX | $ 0,002227 | 0,162643 | 2,25% | $ 111 372 742 | $ 1 274 670 | |

| 97 Reserve Rights RSR | $ 0,016171 | 1,1808 | 32,48% | $ 110 774 605 | $ 23 368 847 | |

| 98 Kusama KSM | $ 13,025 | 951,08 | − 4,21% | $ 110 326 972 | $ 7 826 067 | |

| 99 Status SNT | $ 0,03089 | 2,2555 | 6,39% | $ 107 203 787 | $ 11 697 422 | |

| 100 Matic Network MATIC | $ 0,027818 | 2,0311 | 5,72% | $ 104 672 392 | $ 57 247 788 | |

Next 100

Total capitalization: $29,455,379,228,831,852

Last updated - 14 August 2020 14:08 UTC

And 5 more cryptocurrencies from the top 50

If you look further, there are several more noteworthy projects in the top 50 cryptocurrencies. I'll list a few.

Waves

An analogy from the real world is the Russian Tesla.

In fact, this is a crowdfunding platform. Serious claims, aggressive marketing. But they may turn in the wrong direction and “chichvarkin” will happen.

Dogecoin

Real world analogy – question...

I don't know much about them, but I like them because my friends at Google buy them. And that's why I buy them too.

Bancor

An analogy from the real world is the stock exchange.

At its core, it is an exchange: a platform on Ethereum on which you can exchange different crypto tokens (but all of them must be of the ERC20 standard - this is the most common Ethereum standard on which most projects are developed). Everything is regulated by smart contracts. This is a new economic tool in the blockchain world. Essentially, they brought derivatives to the blockchain, something that had never been done before. It seems to me that this is a niche product, which, however, can grow 5-10 times.

Decred

A real world analogy is McDonalds.

A good, fashionable currency, I see prospects in them. Fast, cheap to transact, profitable to mine. Miners love it—in other words, market providers love it. And it's like McDonald's - it doesn't belong to anyone. 99.9% of McDonald's shares are publicly traded, but the largest shareholder owns only 2% of the shares. That is, the possibility that they will do something bad with Decred, that there will be some kind of conspiracy, is extremely small. Decred like McDonalds.

Aragon

A real world analogy is Netflix.

Fantastic project. Moreover, by “fantastic” I do not mean “cool”, but precisely the original meaning of the word. The business model is unclear, but the team is good. They are trying to work in the event prediction market.

For example, I can say that in 2020 Vladimir Putin will lose the presidential election (ahem). And I am ready to trade this forecast for some amount. Let's say for a dollar. No, for a ruble. And you can join me...

While the project is in the alpha stage and no one is putting real money into it, the team really knows how to correctly analyze the data. Aragon could become a crypto-Netflix. How they will do this, I have no idea. But let me just remind you that Netflix was unprofitable for 7 years.

TOP 7 most popular and reliable cryptocurrencies

As we have already found out, the list of cryptocurrencies is quite impressive. It is extremely difficult to consider all types of electronic currency, so we will consider only those that are in demand and trusted by experts and clients today.

The list of cryptocurrencies that we will describe below includes:

- Bitcoin;

- Ethereum;

- Litecoin;

- Ripple;

- Bitcoin Cash;

- EOS;

- Cardano.

Let's take a closer look at these types of cryptocurrencies.

Bitcoin

Bitcoin is one of the first and most famous cryptocurrencies. A notable feature of this digital crypto-unit is the openness of the software shell. Thanks to this, every person who is familiar with the work and functioning of the currency can create their own electronic currency using the source code.

The value of this coin is in constant dynamics. It rises and falls, which automatically causes anxiety among the owners of such capital. Sometimes the price of 1 bitcoin reaches 22 thousand dollars, then rapidly “flies” down, stopping at 6 thousand. And enterprising users of virtual finance have learned to make quite good money from these fluctuations.

Ethereum

This is another one of the most popular cryptocurrencies that currently exist in the virtual financial market. It was created in 2020, and in terms of popularity it ranks second after Bitcoin.

Note. Despite the fact that Ethereum is one of the most popular cryptocurrencies, its value is significantly lower than what Bitcoin is bought and sold at today. For 1 Ethereum coin they pay around 660 US dollars.

The cryptocoin was created and released on July 30, 2020. Its developer is a Canadian programmer with Russian roots, Vitalik Buterin. He started his work on the creation of this cryptocurrency back in 2013, when his so-called “white paper” was published. Why the man chose this name for his development remains a mystery.

What is the difference between the two cryptocurrencies - BC and Ethereum? Bitcoin was created for the purpose of transferring funds. But the creators of Ethereum, with the help of their innovation in the virtual financial market, tried to make it possible to conclude so-called smart contracts. What it is? These are special programs with the help of which you can carry out processes for exchanging currencies, shares or assets between partners without involving third parties - intermediaries - in such operations.

Ripple

The list of well-known cryptocurrencies also includes the electronic coin Ripple. If you translate this word into Russian, it will sound like “ripples on the water.”

This type of CF is in third place after Bitcoin and Ethereum. The cost of one coin is approximately 67 cents. In 2018, there were about 39 billion Ripples in circulation, and the capitalization volume is $26 billion. Based on this, we can clearly conclude that this currency is trusted, and this is completely justified.

Interesting fact. Initially, the creators of Ripple did not set themselves the goal of creating a separate cryptocurrency - everything happened completely by accident. One of the developers, Jed McCaleb, developed an exchange interface for the purpose of exchange transactions carried out with currency. In addition, he created a platform for buying and selling services and/or goods. And already at a time when the development process of Ripple was in full swing, its creators nevertheless decided to create a new digital currency.

Today, Ripple is rightfully included in the list of the best cryptocurrencies. This is a reliable platform for making currency transactions with minimal commission. Using this platform, you can transfer virtual funds to any corner of the world. To begin with, finances are converted into XRP, and after reaching the destination they are transformed into the desired currency. And all these operations are carried out without extra cash costs due to exchange rate fluctuations.

Litecoin

Litecoin is the fourth most important cryptocurrency. It was developed in 2011. Its creator is Charlie Lee, who with his development wanted to make transactions more accessible and commissions lower. Litecoin was created based on Bitcoin, but there are some significant differences between these cryptocurrencies.

Today, there are more than 84 million of these digital coins in circulation. The main advantage of this type of electronic currency is that one transaction takes the user no more than 3 minutes.

Bitcoin Cash

One type of cryptocurrency is Bitcoin Cash. This is a new development that saw the world in 2020. The emergence of this coin was facilitated by a process called “hard fork”. In programming parlance, it means circuit splitting.

Many experts tend to unanimously agree that the existence of Bitcoin Cash is supported by its “progenitor” - Bitcoin. This digital coin follows almost all the ups and downs of the Sun, although it has a slightly different value and a lower value on the virtual foreign exchange market.

EOS

This is another cryptocurrency that exists on the modern digital money market. It was created for the purpose of developing and operating programs for doing business. The main and important feature of this virtual coin is the speed of transactions. In addition, using this platform, you can significantly expand the functionality for the successful implementation of business projects.

It is noteworthy that EOS was developed based on Ethereum. But, despite the fact that technologies from one of the largest cryptocurrencies were used to create it, it is significantly different from it.

Cardano

This digital coin closes the TOP 7 of our cryptocurrency review. The developers of this type of currency have set themselves a serious goal, which is to create a completely new, extraordinary generation of blockchain.

To date, this virtual currency is still in the active development phase. This is explained by the fact that its creators are going to introduce innovative mechanisms to overcome the most common difficulties and problems that users encounter when operating classic virtual money blockchains.

So, we reviewed the list of major cryptocurrencies that are popular and in demand today. But, as we noted earlier, there are a number of other digital coins that you can also make good money on the Internet.