What is a fork and how does it happen?

Fork is translated from English as a fork and is a change in program code that not only changes the structure of a block, but also makes it possible to use those blocks that could not be used before. These changes are being made in order to speed up transactions and solve other issues.

In fact, it is impossible to do without forks. If this is not done, then a large number of problems will appear in the system, it will freeze and a whole bunch of other problems will appear that no one wants. How exactly to carry out these changes is another matter. Today there are 2 types: soft fork and hard fork.

- A soft fork is a soft change in which a rollback occurs over several blocks, where the code changes. In this case, the user does not observe any fundamental changes.

A hard fork is a fundamental change in the operation of algorithms and the code itself. Most often, new technologies are introduced that lead to the bifurcation of the blockchain and the creation of a new cryptocurrency.

Let's look at these two concepts in more detail.

What is a fork?

The chain of transactions is continuous and straightforward. This means that it usually does not branch. The word fork literally means “fork”. This is the name of a phenomenon in a system in which one large chain branches into two, and after separation they continue to work independently of each other.

How does the system work after this?

After a fork (branching) has occurred, one cryptocurrency becomes two, since there are now two chains of transactions. This happened in 2020 with the largest cryptocurrency in the world – Bitcoin. The chain was straightforward, but at the beginning of the year it received a branch. This does not mean that Bitcoin itself no longer exists. He continues to work independently of anyone, according to the same rules as before. However, now another independent cryptocurrency has appeared, which is called “Bitcoin Cash”. Thus, the translation of the word fork very well characterizes the essence of this phenomenon.

What are the types of forks? There are two main types of forks: soft forks and hard forks. The first can be called a “soft” modification of the source code, the second - a “hard” modification.

What is a soft fork?

In the case of a soft fork, changing the rules does not require updating the client (software) to implement the new rules. If some nodes in the network do not accept the new rules, such nodes will still be able to interact with nodes that use the new rules.

For a better understanding, we can draw an analogy with languages: if before the fork all nodes spoke American English, and the new rules require a transition to the British version, then nodes that continue to use the American version will still be able to understand the British one. At the same time, nodes that use British English will find the American version easy to understand.

Thus, a soft fork is a reversible change to the code that does not break the consensus regarding the protocol itself.

What is a hard fork?

In the case of a hard fork, the new rules contradict the old ones so much that the nodes that did not accept them do not perceive information from the nodes that accepted them. If we follow the same analogy with languages, the old nodes speak English, and the new ones speak Chinese. A hard fork involves changing the consensus mechanism itself, in which case the entire network is split into two parts that can never interact again. This happens because blocks that are considered valid in one part will not be considered valid in another.

How does this work in cryptocurrencies?

In the case of cryptocurrencies, a fork may mean a change in the rules of operation associated with the need to make changes to the protocol. In other words, sometimes in order to make Bitcoin better and safer, you have to resort to one of the varieties of fork. Although in some cases the fork issue is a security issue.

Difference between soft fork and hard fork

To better understand this difference, let's return to the example of Bitcoin. What happened in 2020 is called a hard fork. This implies that after the chain split, a new, completely independent cryptocurrency emerged, which was completely separated from its “parent”. Bitcoin and Bitcoin fork have completely different rates, different technical characteristics and different development teams. In addition, this currency has different clients and wallets, which is fundamentally important in the crypto industry.

If we talk about a soft fork, the separation here is softer, and its purpose, as a rule, is to correct the operation of the system. Cryptocurrency technologies are evolving, and developers sometimes decide to upgrade their system. To do this, they specially create a fork, which is a more advanced clone of their currency. In this case, the user does not need to install a new client, and the system does not change the basic principles of operation. This is simply a technical modernization of the Network.

Reasons for the fork

It is impossible to understand what a fork is and why it is needed unless you know the specifics of how the Network works. The main reason for the occurrence of both hard forks and soft forks is, of course, the development of technology. As a rule, branches are already more advanced from a technical point of view. They have a larger block size, higher throughput, lower fees. However, in some cases, conflict arises between developers. One part believes that the system should be left unchanged, the other insists on technical transformation. This happened with the second most popular cryptocurrency in the world – Ethereum.

A large number of developers and Internet users were dissatisfied with the new characteristics of the system after its update in 2016. The cryptocurrency fork has become more convenient for smart contracts and crowdfunding projects, but has lost a number of advantages that it had before.

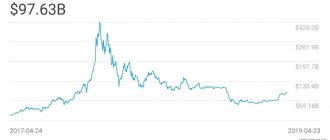

The new Ethereum was very successful and began to gain momentum quickly. However, the developers decided to carry out a hard fork in order to please all users and leave the old system unchanged. Thus, the Ethereum Classic currency was born. The Bitcoin fork appeared for the same reason, but the essence of the transformation was that the new currency received an expanded block size and greater throughput.

What does this mean for miners?

In fact, whether a new fork will be successful or not depends to a very large extent on the miners. They decide whether to support the new cryptocurrency or not. As for Bitcoin Cash, it started quite successfully, and many miners devoted their power to maintaining its operation. However, its prospects today are a moot point.

This is an indicative situation for all currencies, because although the new Bitcoin received a larger block size, it also received greater Network complexity, which means extra costs for miners. Thus, in the future, they will only support currencies that will generate income. And how much a fork will help in this, no one knows until the sale of tokens begins and the rate is established.

Hard fork

A hard fork is the introduction of a new rule that protects the system from falling, which requires a software update because it is not compatible with the old software.

To understand what a hard fork is and why it is needed, you need to understand what exactly happens. In fact, it turns out that if you run the old program, it will consider all new transactions invalid, since the changes made violate the essence of the protocol.

If the entire community is ready to accept it, then an update occurs, and everyone works as before, but on new software. If there is a group of people who are against these changes, then the community splits. This means that based on one company, two different ones appear with a similar name, but with different currencies, exchange rates and ideals.

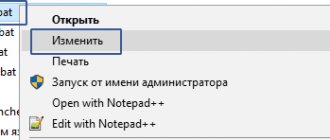

Custom soft fork

The idea behind user-activated software is that it happens with the help of investors, exchanges and holders, rather than with pools of miners. In this case, the software changes on those nodes that decide to take part in the division of the chain in a soft way.

However, all this is only in plans. No one has yet been able to implement this fork idea, as it has several disadvantages:

- Preparing users and writing code will take quite a lot of time.

- If miners do not want to accept the new rules, the network will be divided into 2 parts.

What is a Bitcoin hard fork?

A hard fork is a necessary branch in the Blockchain network in the event that blocks are no longer verified and nodes are no longer updated. This branching is necessary because maintaining and storing the blockchain database requires terabytes of free memory, and this is not available to every user. A hard fork is irreversible and is needed to provide new players with access to the functions of crypto wallets through the formation of a new currency as a result of a branch from the main cryptocurrency.

The hard fork has nothing to do with the Segwit2x process, which is aimed solely at increasing the scale and throughput of the main cryptocurrency. It must be said that Segwit was launched in May 2017, but the goal was never achieved, since it was not possible to increase the throughput of blocks then. The next attempt was expected to take place in November 2020.

Jack Liao (Hong Kong) was the first to think about dividing Bitcoin; he is also the ideological inspirer of the project and the head of a corporation for the production of professional mining equipment. A hard fork is necessary to break the monopoly of a single group of miners that has conquered the whole world. It is also important for the creator of the project to increase the competitiveness of Bitcoin Cash and other cryptocurrencies.

Consequences of hard forks in the cryptocurrency world

When a system hard fork occurs, two branches are formed. If one of them does not have enough hashing power, then it dies. Moreover, the more power a given branch has, the greater the chance that they will survive, especially if they host new forks.

For example, after a hard fork occurred on the Ethereum network, two chains appeared. The new one retained the same name and abbreviation ETH, but the old one turned out to be quite independent, continued to work on the original code and was called Etherium Classic (ETC).

How to prepare for a hard fork?

Most experts see Bitcoin as “digital gold”, which will continue to generate income for investors for a long time even if it is divided into two cryptocurrencies. The strengths of Bitcoin should remain security, independence from the political process, and irreversibility.

However, some experts see an expansion of Bitcoin's capabilities in the deployment of the Lightning Network as an online payment system based on off-chain transactions.

Funds stored on the exchange cease to belong to the copyright holder in the event of a hard fork. This is why it is recommended to store your own crypto coins in a personal wallet, which is controlled using private keys.

Thus, bitcoins will be freely available on different blockchains. This will provide access to BTU through Bitcoin Unlimited, the tokens of which will be visible and can be managed from any wallet. However, it is still worthwhile to protect yourself in case the decision is not made in favor of investors. It is recommended to store part of your bitcoins in an electronic wallet and the other part offline.

Are all cryptocurrencies forks of Bitcoin?

Some people believe that essentially all cryptocurrencies are forks of Bitcoin.

But is it? In fact, this opinion is not erroneous. The fact is that Bitcoin is one of the first cryptocurrencies, and any clone of the program is, in fact, considered a fork. Thus, even you can create your own cryptocurrency based on Bitcoin.

Since the source code of Bitcoin is open, it costs you nothing to copy it to your PC, rename it, create a specialized program and come up with rules according to which the emission will occur. You will also need to issue (in ordinary language, mine) a couple of million coins, and then invite your friends and acquaintances to participate in their mining.

The idea is quite simple and sometimes a really large project comes out of such a banal copying.

Summary

Cryptocurrencies are in constant dynamics and are regularly updated, and often these changes are dramatic. Therefore, users should not only know what a hard fork is, but also be able to benefit from this event in the form of free airdrops.

I hope that my article helped you not only understand all these cryptocurrency intricacies, but also bring practical benefit.

Denis HyipHunter Knyazev

Blog creator. Private investor. He has been making money in highly profitable investment projects and cryptocurrencies since 2014. Consults partners. Join the blog's Telegram channel and our chat.

Don't miss other articles from this section:

- 10.06.20201528

Cryptocurrency BIP (Minter) – detailed review

- 09.06.202037029

How to create a Bitcoin wallet in Russian for free

- 10.06.202015980

Exmo me – cryptocurrency exchange | Eksmo - reviews and reviews. How to trade and withdraw money

- 10.06.202087999

Bitrix - cryptocurrency exchange | Bittrex com – reviews and reviews. How to use and how to withdraw money

- 10.06.202012452

What is a cryptocurrency ICO and how to make money from it

- 10.06.2020908

What is blockchain in simple words?

Altcoins and forks - how not to get confused

In order not to get confused in forks and altcoins, I propose to start by defining what they are.

As we just said, any clone of the source code with changes made there is a fork. At the same time, Altcoin is any cryptocurrency other than Bitcoin. That is, an ordinary clone of a cryptocurrency that has already been created, without significant technical changes made to it, and uninterested in the global singularity, will not be considered an altcoin.

In fact, the same project can be called an altcoin or a fork, regardless of what it is. However, there is still a difference. Thus, Ethereum, NXT, Dash and MaidSafe should be called altcoins, since their differences from Bitcoin are significant. But the forks are Dogecoin (from Litecoin), Expanse (from Ethereum) and Stellar (from Ripple).