Martin Weiss , founder of Weiss Ratings, does not support Warren Buffett's stance on cryptocurrencies. He believes that they could well become the basis for the digital monetary system of the future. His agency has already compiled a rating of promising digital assets in 2020 and those in which they are not advised to invest.

At the Berkshire Hathaway shareholders' meeting , Martin Weiss stated: "Many investors and financial experts seem to underestimate the benefits that cryptocurrencies can provide in terms of speed, security and decentralization of payments ." According to Weiss, cryptocurrencies can provide value on 3 levels :

- Intrinsic value. Users can take advantage of platforms and projects, and miners receive rewards.

- Exchange value. Cryptocurrencies are increasingly used in transactions - both for exchange for fiat currency and for goods and services .

- Monetary system. Cryptocurrencies could become the basis for a new digital monetary system that is more stable and less susceptible to government manipulation.

Analysis of the prospects of digital assets

Weiss Ratings has presented a new cryptocurrency rating. Experts are optimistic about the future of EOS, Cardano, NEO, but are against all Bitcoin forks . The real problem with these tokens, according to experts, is that too few people use this cryptocurrency. According to the latest data, no more than 20,000 transactions per day are processed on their network, so forks are completely pointless. Analysts also did not rate the DigiByte cryptocurrency , despite the intensive growth over the past month. Analysts explained that behind this project is Rhett Creighton , who likes to create new cryptocurrencies based on Bitcoin in order to make a quick profit. His projects also include Bitcoin Private, ZClassic and Bitcoin Prime.

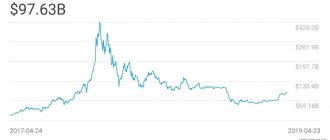

Bitcoin, as expected, received a low rating from Weiss Ratings . Analysts explain this decision by the high volatility of the token and its gradual displacement from the market by more promising competitors (Ripple, Ethereum, etc.). The creator of the rating, Martin Weiss, notes that only a digital currency that rarely experiences sharp and serious drops the highest score .

Earlier on this topic in the news:

Ripple (XRP) and Bitcoin (BTC): Conflicting ratings from Weiss Ratings

The American rating agency Weiss Ratings published a widely anticipated report in which it gave an investment grade to 74 of the most popular cryptocurrencies. The release of the report left many in shock. Thus, the leaders in capitalization, included in the top three cryptocurrencies, Ripple (XRP) and Bitcoin (BTC), did not receive the highest rating A. Although none of the existing cryptocurrencies received an A rating, they are mostly C.

According to Weiss, Bitcoin received a “fair” rating of C+ (“satisfactory”) because the cryptocurrency “is experiencing severe congestion on its own network, causing delays and high fees.” “Despite intensive efforts to address these issues, which have already achieved some success, Bitcoin does not have a ready mechanism for immediately updating its software code,” the report says.

Regarding the rating of Ripple, the agency gave a special explanation on its website weisscryptocurrencyratings.com: “Why doesn’t Ripple get a higher grade? Like Bitcoin, it scores A fundamentals, but it scores poorly on our Risk Index due to repeated price failures. Its technology index was lowered due to strong centralization and control by its creators."

The agency gave Ethereum a B rating because it "benefits from faster technology upgrades and better speed, despite some bottlenecks." In addition to Ethereum, a B rating was assigned to four other cryptocurrencies: Cardano, EOS, NEO and Steem.

Scores range from A to D. Weiss explains that “A grade of A or B is an investment rating of Strong Buy.” At the same time, investors shouldn't be too wary of a C grade either; it represents a passing grade, and for investors it means a "hold," the Weiss report states.

A C+ grade is considered "fairly good" by Weiss. A large majority of the assets assessed received C, C+ and C-, including big names such as Ripple, NXT, Peercoin, NEM, Monero, Stellar, Zcash, Zcoin and Verge. A D rating is equivalent to a sell recommendation, which was awarded to, for example, Novacoin and Salus.

According to The New York Times, Weiss is always reluctant to give an A rating to insurance stocks, mutual funds and other securities, apparently to play it safe.

A full subscription to Weiss Cryptocurrency Ratings costs $936, although the company offers discounts. The rankings were released by Weiss on January 24 to its paid subscribers, although the results were soon leaked online. Along with the real one, a fake list is also being circulated, suspiciously providing Tron (TRX) with an “A++” result.

Not everyone was satisfied with the presented assessments. On Wednesday, the agency said it had been “fighting DDoS attacks from Korea all night,” and calls for joint attacks on the Weiss website were found on Korean social media. Subsequently, hackers hacked the site and began distributing the information that fell into their hands online, the company said, pointing out that genuine reports can only be found on the official website.

Convenient calculation of swaps, commissions, margin and much more? Yes! Trader's calculators are here.

FxTeam Analytics on Telegram – read news and analytics first!

TOP 3 altcoins of this week:

- Fork of ZCL and BTC. The announcement of the creation of a new altcoin, Anonymous Bitcoin, was made by the developers back on April 28, but due to a conflict of interest, a lot of conflicting information appeared on the network. The developers spoke about all the details of the project at a conference in Miami and Los Angeles and on CNBC. Sam Abbassi, the lead developer, is also set to speak at MIT, and project founder Jake Greenbaum will be attending the Consensus conference. Anonymous Bitcoin will include the anonymity features of ZCL and masternode technology. This approach should encourage users to hold cryptocurrency rather than just trade it.

- Engin. Today, this altcoin is actively promoted at Unity . Unity is a platform known in the gaming industry . It is actively used to develop video games for mobile devices and various consoles. This week the Unity conference will take place in Tokyo and perhaps the token will receive new features. The ENJ cryptocurrency will be integrated into gaming platforms . Today the price of ENJ is $0.17 . If negotiations in Asia are successful, the price of the altcoin will increase sharply.

- Digibyte. The DGB team announced that the blockchain authentication protocol will be released . This means that account security will be improved, and it will be possible to do without passwords, usernames and even 2FA. Now for 1 DGB they give $0.048 . Improving the project should have a positive impact on the price. Let us recall that in January the cost of DGB was $0.12.

Full news

The Weiss Rating agency has published a rating of cryptocurrencies, BTC and ETH top the list

In the latest report, financial ratings agency Weiss Ratings downgraded Litecoin and Cardano, while Monero's ratings were upgraded.

The ratings of Litecoin and Cardano dropped from “C+” to “C”. Litecoin's risk/reward score remains at "D", both rated "weak", while technology/adoption remains at "B+", with the former rated "fair" and the latter rated "excellent". Cardano has a D- for risk and reward, but a B+ for technology and adoption.

Last time LTC and ADA were in 4th and 5th place, respectively, now both coins have dropped in the ranking of cryptocurrencies. BTC and ETH top the list with their B grades, followed by four coins with a C+ grade.

One of them is Monero, which has been upgraded from a C to a C+. The cryptocurrency's risk and reward were rated as "weak" and received a "D+" rating. The Technology and Adaptation grades are "B", so both are "Good".

Weiss ratings assign cryptocurrencies grades from A to F, while a plus or minus sign indicates the top or bottom third of the rating range.

The agency recommends “keeping in mind that Weiss Crypto Ratings reflect not only long-term, relatively stable factors such as technology and adoption, but also short-term, volatile factors such as investment risk and reward. Therefore, they can change with a certain frequency.”

Publication date 09/20/2019 Share this material on social networks and leave your opinion in the comments below.

5 / 5 ( 1 voice )

The latest news on the cryptocurrency market and mining:

Cloud mining of Bitcoin in 2020 - how to choose a reliable and profitable service?

Kraken Report: Bitcoin on the verge of “great adoption”, BTC price will rise by 50-200%

Bitcoin enters mega bull phase with over 93% of BTC addresses showing profits

Anatoly Aksakov commented on the adopted law on cryptocurrency in Russia

Platform for centralized management of the cryptocurrency mining process CoinFly

The following two tabs change content below.

- Author of the material

- Latest news from the world of cryptocurrencies

Mining-Cryptocurrency.ru

The material was prepared by the editors of the website “Mining Cryptocurrency”, consisting of: Editor-in-Chief - Anton Sizov, Journalists - Igor Losev, Vitaly Voronov, Dmitry Markov, Elena Karpina. We provide the most up-to-date information about the cryptocurrency market, mining and blockchain technology.

News Mining-Cryptocurrency.ru (go to all news feed)

- Cloud mining of Bitcoin in 2020 - how to choose a reliable and profitable service? — 08/14/2020

- Kraken Report: Bitcoin is on the verge of “great adoption”, BTC price will rise by 50-200% - 08/14/2020

- Bitcoin Enters Mega Bullish Phase, Over 93% of BTC Addresses Show Profit - 08/14/2020

- Anatoly Aksakov commented on the adopted law on cryptocurrency in Russia - 08/14/2020

- Platform for centralized management of the cryptocurrency mining process CoinFly - 08/14/2020

Research and reportsCryptocurrency market

04/27/2018: Tom Lee prefers to invest in Bitcoin rather than Bitcoin Cash

Founder of Fundstrat Global Advisors and crypto investor Tom Lee said that he prefers to invest in Bitcoin rather than Bitcoin Cash , considering the hype around the latter to be unfounded and far-fetched.

Lee commented on his decision: “I don’t pick winners and losers. I think both Bitcoin and Bitcoin Cash have their merits . But if I were investing new funds, I would be more interested in buying something that is lagging that can attract capital, rather than a potentially overbought currency .” Lee believes that Bitcoin Cash is “overbought” amid the upcoming hard fork, which will increase the block size to 32 MB and introduce improvements to the network.

According to Lee, investors are specifically fueling interest in Bitcoin Cash, which is what is causing the sharp fluctuations in rates. Not long ago, the manager of the investment company VKSM, Brian Kelly, urged investors to buy Bitcoin Cash. He believes that the high volatility of altcoins will allow you to make money faster . Tom Lee is a long-time supporter of Bitcoin and has previously stated that by the end of 2020 this cryptocurrency will reach a new level and will cost $25,000.

Full news