Cryptocurrency market: technical analysis

Cryptocurrencies are distinguished by the fact that their value is growing at an accelerated pace. Bitcoin is especially active in this regard. His periodic ups and downs are simply amazing. As a result, the market is constantly filled with new players. Trading on cryptocurrency exchanges takes place in hyperactive modes. The high volatility of electronic money allows traders with relevant competence to make good money. This is possible, but on the condition that luck or the so-called intuition fades into the background.

An inexperienced trader can easily lose a lot if he cannot adequately assess the situation. You need to understand the direction of trends and be able to analyze promising cryptocurrencies selected for purchase or sale. It is better if the necessary information is received before you actually encounter exchange trading. There are many analysis methods, so you just need to choose the best one.

Let's consider a popular analysis of cryptocurrencies, characterized as technical. Some people are satisfied with it, while others see many shortcomings in it. At the same time, its effectiveness has been confirmed, so there are more of the former than the latter. Other types of analysis are of little use in the cryptocurrency market, which is characterized by high volatility and a large volume of news.

If a trader uses a method that takes into account news for analysis, then in relation to cryptocurrencies he does not receive any advantages. Changes in the market occur very quickly, and news about this is announced by the media very late. The situation is different with technical analysis, which makes it possible to more sensitively monitor the situation, which leads to the correct response to price changes.

Support and resistance level

Crypto market analysts often refer to terms such as support and resistance levels. These levels play a crucial role in the functioning of cryptocurrencies.

Think of support and resistance levels as “battle lines” between bears and bulls.

A support level is the lower trend level at which a price rebound is expected.

The resistance level is the upper trend level at which the price is expected to fall.

For example, Bitcoin may have resistance at $10,000, which causes the price of Bitcoin to continually rise up to that level, but never beyond it. Meanwhile, it may receive support at 6000, causing the price to fall to but not above that level.

When the price of a crypto asset reaches a certain support or resistance level, it is said to test that level. Sometimes the level stays the same. In other cases, it breaks through.

Looking at the price history of Bitcoin, we can also see cases where the price level broke through a resistance level and then this new resistance level became a support level. Let's say Bitcoin breaks the 10,000 level and rises to 11,500. Suddenly, $10,000 could become a new resistance level and 12,000 could become a new support level.

Likewise, when price falls below a support level, the support level may become a new resistance level. For example, if the price falls below $6,000, then the 6,000 limit could become the new resistance level, and the lower limit, such as 4,500, would become the new support level.

In a fluctuating industry such as cryptocurrencies, support and resistance levels rarely remain for long.

Dow theory

Each method by which the behavior of electronic money is studied has a basis. It is based on concepts that determine the implementation of the task, for example, making a cryptocurrency forecast for 2020 with a greater probability of fulfillment. Let's consider technical analysis based on the Dow theory.

The concepts in this case are as follows:

- There are no factors that the market ignores. Events of any period of time affect the value of the asset at the current moment. Demand over time (yesterday, today, tomorrow) determines the price of a cryptocurrency. Changing regulatory rules regarding electronic money are reflected in the value of assets.

The price now is information whose existence is determined by the current moment. This includes the awareness and expectations of everyone operating in the cryptocurrency market. To analyze the future price, you need to analyze the value established today.

- Price changes occur with a certain pattern. Short-term and long-term trends influence the dynamics of asset prices. After a trend has formed, we can say with a greater degree of confidence that the movement will continue in the chosen direction. This is what traders are trying to capture. They make cryptocurrency forecasts based on technical analysis aimed at recognizing emerging trends.

- It is important to change the price from the point of view of the historical aspect, not the content. Through technical analysis, it is determined how the price has changed. The parameters influencing this change are of little interest. The trader takes more into account the dynamics of supply and demand.

- History is a spiral, that is, it repeats itself, which also applies to the cryptocurrency market. Traders' reactions to certain events are usually the same. The market is quite predictable. As an example, consider the news regarding the recognition of electronic money in any country. Such information inevitably leads to an increase in the value of assets.

Technical analysis of cryptocurrencies: basics of technical analysis using Dow theory

- The market takes everything into account: the price of cryptocurrency changes depending on current, past, and future demand. In addition, it is sensitive to any changes in the regulation of digital money.

- Price dynamics are not chaotic: price changes clearly follow trends.

- Technical analysis focuses on historical changes in price dynamics, rather than on the parameters that influenced this transformation. In technical analysis, only changes in supply and demand are important.

- History always repeats itself. Market behavior is predictable: most often traders react in the same way to certain events. For example, they demonstrate bullish sentiment as a reaction to news about the recognition of Bitcoin.

Identifying trends

Trends mean where the price of an asset is moving. However, it is quite difficult to recognize this kind of dynamics. Cryptocurrencies are characterized by high volatility, which is characterized by sudden changes in exchange rate. This is demonstrated by the same Bitcoin.

Volatility spikes are not something that should be taken seriously in technical analysis. Rising highs and lows indicate an increasing trend. This statement is also true in reverse. A decrease in highs and lows confirms the onset of a downward trend. If the exchange rate is stable, that is, its noticeable change is not recorded, the trend is defined as sideways. All mentioned trends have different durations.

Technical analysis of cryptocurrencies

Speculative trades by traders are rarely based on fundamental factors. A chart that displays all past price changes combined with volume analysis is the ideal, and perhaps the only necessary tool for a short- to medium-term trader.

Most brokers sign their advertising materials with the phrase “No past performance guarantees future performance,” and this is true. The second part of the truth is that history does, in fact, tend to repeat itself, which gives a trader the ability to calculate a statistical advantage based on past performance. Using this advantage, you can predict price behavior and profit from it. This is precisely the purpose of technical analysis.

Setting up charts

How to properly set up a chart in order to read information from it for technical analysis as efficiently as possible?

You should start by choosing a timeframe. The simple truth is that the older the timeframe, the more reliable its signals are due to the fact that it is on them that it is easiest to track the mood of major players. The smaller the timeframe, the more “noise” it contains—small price fluctuations that do not in any way affect the overall trends.

Some people opt for Japanese candlesticks, others set up bars based on the traded volume, or even prefer something exotic like tic-tac-toe. If you wish, you can study them all if you feel the need.

The easiest and most convenient to read is a chart built on simple bars, where every 5 minutes, hour, day, week (this is the given time frame) is displayed with a vertical line - a bar. The bar size is determined by the distance from the lowest to the highest price of an asset for that time period. Most often, the opening and closing of the bar are also marked on it (a notch on the left is the opening, on the right is the closing). When the specified time interval expires, the construction of a new bar begins.

Correctly selected chart scale is extremely important. On a chart used for technical analysis, the distance between bars should not create voids, but each bar should be clearly visible. If you want to see a longer period of time on one monitor, it’s better to switch to a higher timeframe.

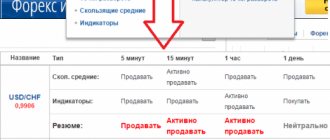

Indicators

Beginners are usually full of enthusiasm regarding the practical application of indicators. Stochastics, moving averages, bollinger – all of this looks very nice when plotted on a chart and creates the illusion of market predictability. The authors of numerous courses that appear like mushrooms after rain often like to take advantage of this feature with names like “Trading on the cryptocurrency exchange for dummies.”

In fact, such indicators lag behind price movements to one degree or another, i.e. they cannot bring any tangible benefit to the trader in assessing the current state of the market. Moreover, they clutter your schedule, preventing you from focusing on what really matters.

Volume

But in fact, indicators that help to better visualize the distribution of traded volume, such as clusters in the Volfix platform, or a market profile, can be useful.

It is volume analysis that helps a trader understand the balance of supply and demand that underlies pricing, identify accumulations of positions of large players and answer the question of when and where these players intend to move the price.

Accumulation and distribution is a constantly repeating market cycle, and it is quite important for a trader to learn how to determine when and at what stage the market is. The cycle is said to begin with accumulation, where a large volume of an asset is traded within a narrow price range. The accumulation is followed by an impulse movement, ending with distribution at the peak of the impulse. Often a distribution is followed by a pullback.

To better understand this cycle, consider the analogy of a spring. The more the spring is compressed (the more trading volume has passed in a narrow range), the stronger the impulse will be when the spring is released.

Volume analysis methodology is a topic too broad to be fully covered in one article. However, the next chapter will help you deepen your understanding of accumulation and distribution in technical analysis a little more.

Trend VS flat

The market is alternately in two different phases, which are called flat and trend.

Flat

, sideways, pro-trading, corridor, or consolidation - these are all different names for a situation when the price moves for a long time in a certain price range, without going beyond it. This is how volume accumulates, and this is how it can be seen on the chart without resorting to additional indicators.

The best trading strategy in a flat is to sell from its upper border and buy from its lower border with take targets on the opposite side. If the flat is wide enough, the profit potential will significantly exceed your stop.

The sooner a trader recognizes a flat, the more likely he will be able to profit from his observation. Here it is worth remembering that the price cannot be in a flat forever, and sooner or later it will come out of it, making an impulse movement (the longer the flat, the stronger the impulse). On the other hand, the general rule that it is easier for the price to move within the boundaries of an already designated corridor than to leave it is also true.

Trend

– this is a unidirectional price movement. It is often accompanied by pullbacks, but the general trend of market growth or decline is visible quite clearly. During this phase, it is best to trade in the direction of the trend, using pullbacks to enter at the best price.

Cryptocurrency trading can be difficult for beginners due to the fact that the market is often in a strong trending phase, requiring a lot of patience to wait for a profitable trade. Many novice traders, seeing a large unidirectional movement, begin to catch up with the market, buying and selling where the movement potential has almost been exhausted. This is mistake! People don't believe in kickbacks, but they happen regardless of belief. Trade with the trend, but wait for profitable entry points. The main thing here is to notice in time when the pullback has developed into a trend change.

Support and resistance levels

Cryptocurrency trading for beginners is often seen as a game of roulette, flirting with luck. Anyone who has managed to go through the entire thorny path to stable earnings on the stock exchange states a fact: mistakes are inevitable, but if the statistical advantage is on the side of the trader, then the income will exceed these losses, and luck has nothing to do with it.

Being able to identify strong support and resistance levels is one of the things that gives you a statistical edge in the market. Essentially, these are places where large buyers/sellers gather. There is a high probability of a rebound, or at least a price stop after some kind of impulse movement.

The rule of working with them is simple: above the level we buy, below - we sell. In most cases, the price moves from one strong level to another, and its fluctuations between are market noise, difficult to analyze.

Often newcomers to trading ask: “Why should we, having set a certain take profit, sit out all the drawdowns and wait for the price to come from point A to point B? Can’t someone who truly understands the market catch all these price movements in different directions with greater profit?”

More experienced colleagues smile when they listen to such suggestions. The fact of the matter is that the statistical advantage of a trader lies precisely in the fact that he can, with a certain degree of probability, assume that the price will come from point A to point B. Attempts to make a profit, forgetting about this basis, as a rule, lead not only to a reduction in income, but also to the emotional instability of a trader playing with chance.

For a flat and a trend, the levels will be different. It is more difficult to work in the trend phase, since to work from really strong levels you need to wait for serious pullbacks. These pullbacks do not always happen, so working in a trend requires, firstly, the ability to determine the beginning of a new trend, secondly, the ability to wait for your price, and thirdly, great humility (in particular with the fact that you could not enter the market on a pullback).

Flat levels, especially from higher timeframes, form very strong support and resistance. Working from these levels is beneficial not only in terms of signal strength, but also due to the ability to place a short stop on a trade. This means that in the event of unfavorable developments, you will be risking relatively little capital. A risk-to-reward ratio greater than 1 to 3 will, in turn, also increase a trader's chances of long-term success.

The bad news is that to make consistent money in the market, a trader must learn not only to mark support and resistance on the chart, but also understand the market context. When exactly can you work from the level, and when will the signal be weakened by other factors? How to compare signals on different timeframes? What does the appearance of large volumes mean and where is it important to track them? How to set stops and reduce risks? Where to take profit? The good news is that all of this can be learned.

Cross-timeframe analysis

Flat and trend constantly replace each other and require a different approach to making transactions. The difficulty is created by the fact that the chart of the same instrument, but at different periods of time, can have a different phase. For example, the last day, considered on a five-minute timeframe, may be flat, but the entire last week as a whole is trendy.

A good habit can be to look at the chart from different points of view, starting with higher time frames, such as daily bars, and continuing on four-hour, hourly, five-minute bars. The lowest timeframe of this nesting doll will be the one on which the trader can determine the desired stop loss level and place orders. There is no point in digging deeper down to the tick data, otherwise you will simply get lost in the market noise.

Cross-timeframe technical analysis is quite complex, but it gives the best result, as it helps to put together a more complete picture of the market, correctly determine entry points, stops and targets, and avoid making transactions in controversial situations with a small statistical advantage.

The ability to track exactly the current market mood is extremely important for traders. Having this skill, they can notice a change in trend in time and avoid transactions based on outdated information about the state of the market, such as “the trend is up, so we buy.”

To reach the strong support found on the hourly timeframe, the price will have to break through many supports from the minute chart. Learn to evaluate the nature of price movement along this path: how quickly do counter supports break through, how many of them were there, and how strong were they? Could it be that the current market mood has already changed, but on the higher timeframe it is simply not noticeable yet?

You can't go wrong if you buy only a rising market and sell a falling one. This does not mean that you should buy at the high of the move or sell at the low! The best tactic is to wait for strong support and resistance levels from higher time frames, and also make sure that a rebound has already begun on a smaller time frame near these levels.

“Living in the present” is good not only from the point of view of Buddhist monks. By supporting the current market mood with his positions, the exchange player receives a huge advantage and the opportunity to catch a barely emerging trend or close previously opened transactions with maximum profit.

Read more:

The difference between trading cryptocurrencies and traditional financial instruments

Buying and safe storing cryptocurrencies Choosing an exchange for trading cryptocurrencies Cryptocurrency trading tools: types of coins, tokens and derivatives Trading strategies on cryptocurrency exchanges Liquidity of cryptocurrencies Exchange trading cryptocurrencies: terminology Fundamental analysis in trading cryptocurrencies Volatility of cryptocurrency instruments Trading system for cryptocurrencies

Balancing the forces of supply and demand

Raising the price to a certain level leads to a decrease in interest in purchasing. The maximum is reached. Buyers are losing activity and sellers are gaining. After which the price begins to move down. In the same way, everything happens in the opposite direction. In the first case we can talk about resistance, and in the second – about support. When supply increases, a downward trend occurs. While the increase in demand forms a growing trend.

On the chart, you can draw lines connecting price peaks, both positive and negative, differing in approximately the same values. These are levels characterized by support or resistance. It is necessary to identify them through technical analysis. Specific levels determine the prospects for cryptocurrencies , which leads to the issuance of buy or sell orders. As a result, the value of assets is adjusted. A competent analysis of such moments allows you to successfully respond to exchange rate fluctuations in the short term.

Support level is the value of an asset that suits most traders. They are ready to buy. There is only one justification here - the real cost is higher than the declared one. Achieving this level greatly increases the number of buyers of assets on the exchange. The low price attracts, which stimulates demand. Let's consider a conditional altcoin. Let's say it cost $500 for a while, then went up and reached $800, where it stopped for a relatively long time. What will happen if the price periodically returns to $500? Of course, players will flock to exchanges to buy this currency.

Resistance level – the value of the asset is overvalued, which forces traders to start dumping the currency. A similar situation arises as with the support level, but with a minus sign. The currency was stable in terms of price. Then its value dropped to a certain point, where it froze for a long time. A return to the previous value will force most traders to start placing sell orders.

Changes in the value of assets are sensitive to the market. Using support and resistance levels, a kind of price channel is created. Successful traders actively use it. They understand that reaching the bottom requires buying currency, and reaching the top requires selling.

In the case when the price breaks through the price channel, that is, existing levels are overcome, it collapses. For example, the price of an altcoin rises above a resistance level. If this happens, then this level becomes the support level of the newly formed corridor. The same situation, but on the contrary, looks like this: the price tends to go down and overcomes the support level, which turns it into the resistance level of another channel.

Geometry of technical analysis

The most basic patterns for use in technical analysis are simple figures. The patterns of changes in the value of currencies are built by these very figures.

What do we call a figure? A figure is a specific pattern that describes price fluctuations in the cryptocurrency market. By looking at several of these repeating patterns, you can make assumptions about what will happen to currencies tomorrow.

Head and shoulders

This figure occurs quite often after a powerful and long-term trend has passed. In this figure you can see three peaks in a row. The one in the middle is the highest of all, and the other two, which are on the sides, are lower, which is why they are called shoulders.

Let's look at the basic operating principles associated with this figure.

- Determining the trend. First you need to see a strong uptrend. As a rule, it precedes the shoulders and head.

- Left shoulder. It is necessary to wait until it is formed at the figure - it represents a maximum with its subsequent adjustment. Often, the lowest point of the correction is located no lower than the current trend line.

- Head. Next comes the head, it looks like a large price impulse, the direction of which coincides with the direction of the current trend. The head determines a new high, but the price rapidly falls to the same level that was before the impulse began to form.

- Right shoulder. Then we again observe an upward trend, the price is rapidly rising. But, due to insufficient buying intensity, the price is not able to rise again to the maximum and therefore falls, thus forming the right shoulder of the figure. It is also worth noting that the shoulders are not always symmetrical.

- Neck line. After the price rollback, we observe its approach to the “neck” line, located at the level of the minimum of the left shoulder and “head”. The “neck” can be tilted down or up, and can also be positioned strictly horizontally. A drop in the neck line signals that it is time to sell.

- The amount of target profit. It is reasonable to leave this trading position after the price overcomes the distance, which is equal to the distance from the maximum of the “head” to the level of the “neck”. You should not think that this is the only possible option; you need to go into details, conduct a thorough analysis, taking into account various lines, Fibonacci proportions, etc.

Double bottom

A double bottom is one of the most common patterns that appear after a downward trend, a double top appears after an upward trend, which is quite logical.

“Bottom” and “top” are very similar; in fact, they are the same thing. These figures are mirror images of each other. Most often, a double bottom is a harbinger of a trend change.

Rectangle

The rectangle is immediately visible on the graph. It plays the role of a kind of pause in the trend, during which equality of sellers and buyers reigns. Typically this figure is characterized by straight lines of resistance and support. In this case, the sides passing through the vertical axis always remain arbitrary. This is a figure that shows the confrontation between sellers and buyers. It is worth understanding that it comes into effect after the price overcomes one of the horizontal sides.

Graphical models of technical analysis

Price volatility creates a chart in the form of a picture. Regular return to certain levels draws figures, as it were. They are similar to each other and are constantly repeated. In this regard, it becomes possible to make predictions about where the price will go based on graphic models.

Let's look at the most common of them:

- Head and shoulders. The formation of this figure occurs as a result of a stable trend of sufficient duration. Visually, these are three consecutive peaks, where the middle one forms a kind of head, and the two on the sides form the shoulders. There is a direct figure - the peaks point upward and a reverse figure, characterized by a minimum rate. With the help of such figures, analysis of cryptocurrencies , defined as technical, is available. Recognizing the patterns formed on the chart allows you to make a forecast regarding the expected price movement.

- Double top (bottom). A pattern with two tops that is created after an uptrend. Double bottom – downward trend. These figures are identical in relation to each other. The only difference is that they are opposites. This chart display is used in technical analysis as a signal about an upcoming change in trend direction.

- Rectangle. A figure demonstrating the rivalry between buyers and sellers. Such opposition leads to stagnation in the trend. Both sides have equal chances of making a profit. Those who buy and those who sell can count on success. It is important to pay attention to exactly how the price changes. If it moves in accordance with one of the horizontal sides of the rectangle, then the figure works. Otherwise, the chances of success tend to zero.

- Flag and pennant. A graphical model of this type appears after a sharp movement in the value of an asset in any direction (up or down). It is created during the pause of such a jump. The formation of such figures serves as a signal that we should expect a sharp change in the value of the cryptocurrency in the near future.

- Japanese candles. Candlestick figures appeared on the Japanese stock exchange. This happened in the seventeenth century. That's why they are called Japanese candles. The body of the candle is a distance that starts at the opening price point and finishes at the closing price point. At the same time, shadows of the candle are still formed, extending from the opening and closing prices to the peak price values. An increase in the upper shadow serves as a signal that the value of the asset is expected to increase. The lower shadow indicates a fall in the exchange rate. This method divides time into periods, which greatly simplifies tracking trends.

Technical analysis figures

One of the most accessible ways to understand exchange rate charts is to use simple figures of technical analysis of cryptocurrencies. A figure is nothing more than a simple pattern that is formed on charts when prices change regularly. The figures are basically repeated over and over again and are very similar to each other, so over time you can learn to make fairly accurate forecasts of future price movements.

Let's write down the most common of them in the form of a list and briefly describe their properties:

This pattern is very common after a long, stable trend. It consists of three consecutive peaks and, as the name suggests, the middle one is higher than those on the sides, and they, in turn, are approximately equal. There is also an inverse figure, which, in essence, is no different and is characterized by the same behavior, the main difference being that the head of the figure demonstrates not the maximum of the exchange rate, but its minimum. Technical analysis of the cryptocurrency market very often uses this figure, as it allows you to quite accurately predict further price changes.

Head and shoulders.- Double top or double bottom . The second figure in the extensive list of elements of technical analysis. A double bottom is often drawn on a chart after a downtrend, and a double top, on the contrary, after an uptrend. Like the previous figure, these two representatives of the cryptocurrency technical analysis program are also no different from each other, except that they are opposites. Typically, this figure signals a change in the future direction of the trend.

- Rectangle. This figure symbolizes a pause in the trend. During this event, buyers and sellers have equal chances of success. The rectangle is a fairly common figure in technical analysis. It shows the intense struggle between those who want to buy and those who want to sell. This pattern only works when the price passes through one of the horizontal sides of the pattern.

Flag and pennant . This pattern represents a period of consolidation within a changing trend. The formation of such a figure usually foreshadows a sharp change in the value of the currency.- Japanese candles. Shaped candles were invented in Japan back in the seventeenth century. However, despite this, even now they are one of the most popular ways to display market data. In this method, time is divided into periods, which greatly simplifies the ability to monitor trends and changes in trends. In Japanese candlesticks, the green and red rectangles change depending on whether the opening price was higher than the closing price or vice versa. A candlestick consists of a thick body (colored column) and a shadow (thin line). This method displays the minimum and maximum prices. A long upper shadow indicates a possible price increase, and a lower shadow, accordingly, indicates a fall in the exchange rate.

Technical indicators

Moving averages serve as an indicator that helps track the rate during high volatility. To calculate a moving average, defined as a simple one, the average value of the asset price for a particular period is taken. Cryptocurrency analytics are available here based on technical analysis of several moving averages depending on a specific period of time, which is important when indicators are unable to respond in time. Consider a situation where the 5-day moving average falls below the 20-day. If this is the case, then you should count on the bearish mood of traders. Otherwise, when the 5-day line exceeds the 20-day line, bullish sentiment is expected.

Moving averages are not the only indicator. There are others. But the considered method of implementing technical analysis is more popular. It is well received by techies as it has a mathematical basis that makes it possible to accurately track the market. There are also no complaints from humanities scholars. The analysis process is easy without difficulties of understanding, putting prudence rather than luck at the forefront.

Top 3: best indicators for cryptocurrency

Summary:

RSI indicator: description and application

Online volume indicator: description and application

Ichimoku trading system: description and application of the cloud

Even the best cryptocurrency indicators are not investment or financial recommendations and guidelines that can bring a guaranteed income from trading digital coins. However, with the help of these useful tools you can supplement your technical analysis when working with Bitcoin and other electronic finance.

Recommendations for working with indicators

If indicators for cryptocurrency interest you for the first time, remember a few simple tips:

- Stop working with a huge number of tools. Many successful players in the world of digital coin trading use one or two indicators, but as fully and competently as possible. This approach brings the best results.

- Apply cryptocurrency strategies with standard indicators as a basis for technical analysis. You should not consider our or anyone else’s recommendations a 100% guide to action. Please remember that indicators are sensitive to usage conditions and may lag.

Now you will learn which indicators for intraday cryptocurrency trading you can apply immediately. Positions in the TOP are arranged in random order.

RSI indicator: description and application

Before we tell you how to use the RSI indicator or “relative strength index,” let’s talk about what it actually is. So, we are talking about a leading indicator - an impulse oscillator, oscillating in a zone limited by the minimum and maximum price values, measuring the speed of its movements and demonstrating it at levels from zero to 100. The tool demonstrates points of possible reversal of the price trend.

Using the RSI indicator (we’ll tell you how to use it a little further), you can get an idea of the oversold and overbought conditions of a particular digital coin.

Why did we include RSI in our list of "Best Intraday Cryptocurrency Indicators"? The reasons are as follows:

- The ability to receive a lot of useful information to generate various trading signals;

- Ease of use – even a novice trader will find it easy to work with this indicator;

- Gives an idea of the possibilities of a trend without adding numerous oscillators of a different nature to the chart. RSI can be called an “all-in-one” indicator.

Features of use

The indicator can be used in different ways:

- Divergence is one of the most “bright” signals of a change in the course of a trend (divergence in the direction of movements of the RSI indicator and minimum-maximum value indicators). Bearish divergence is formed when the indicator displays decreasing highs and when rising price highs appear on the chart. Bullish divergence occurs when there is pessimistic sentiment on the crypto market (price lows are going down) and when RSI lows are rising.

Note! Even the most popular indicators (cryptocurrency is not characterized by stable value) must be confirmed by price movement.

- Fine tuning of outputs. In reality, oscillators do not move on a scale from zero to one hundred. In an upwardly moving crypto market, the RSI moves between 40-90. When the crypto market is down, the index fluctuates between 60-10. Determine your ideal entry and exit points in advance. then seek an exit if the RSI is overbought in higher time frames; and look for when it is oversold in lower time frames to enter.

Important! Don't base all your trades just on when an indicator is oversold or overbought. You must be able to identify the best entry and exit zones: exit the selected range when the asset is overbought and enter the range when it is oversold.

If you are interested in the RSI indicator strategy for cryptocurrency, you can get a closer look at it by studying our video lesson with practical examples :

Online volume indicator: description and application

Before you use volume analysis indicators, you must understand what “volume” itself is. Volume in the trading world refers to the amount at which a cryptocurrency was traded during a specific time period. The number of transactions (purchase and sale) over a certain period can also be used in calculations.

Important! Do not confuse the Volume indicator (amount of transactions) with the volumes reflected on exchanges and showing volumes in digital coins or fiat per day.

The best volume indicator has, in our opinion, the following advantages:

- Informative and easy to use;

- The ability to complement the interpretation of price action.

If you have never used a candle volume indicator or other similar tools, learn how to use them right now.

How to use the volume indicator for cryptocurrency?

In particular, you can also use the volume indicator Volumes, focusing on two main points:

- Confirming the correctness of the diagram. Where can I view cryptocurrency volumes? The answer is: chart templates, as a rule, always have a volume indicator. You need an Indicators button and the word Volume. You can check the volume to evaluate your own assumptions.

- Determining the presence/absence of violations in the main zone of resistance/support. If the price of an asset tries to break through a key resistance level, watch for a significant increase in buying volumes and support the trend by entering into buy trades. If the price, on the contrary, tries to break through a key support level, watch for a significant increase in sales volumes and support the trend by concluding sell transactions.

Using volume levels (you can find the indicator on our website), you will find out whether there are enough buyers and sellers on the crypto market to break the key support/resistance level.

A rapid increase in volumes can be observed, for example, after the completion of a large-scale correction and the emergence of enthusiasm among buying investors or when excellent news is released on a crypto project. Buy digital coins after the correction of their rates is completed.

If you are interested in the volume indicator strategy for cryptocurrency, you can get a closer look at it by studying our video lesson with practical examples :

Ichimoku trading system: description and application of the cloud

The Ichimoku cloud for cryptocurrencies (we’ll tell you how to use it a little later) is a complete indicator. We drew your attention to the Ichimoku signals because they demonstrate everything necessary for technical analysis:

- Information about resistance and support levels;

- Value momentum data;

- Information about the direction of the trend.

The Ichimoku Cloud is an indicator (every experienced and professional trader should know how to use it), which can confidently be called a more complete and informative version of EMA and MA (exponential moving averages and moving averages, respectively). The latter can also show you, for example, likely resistance and support zones. However, what will you learn with Ichimoku? Trend, possible areas of resistance and support, and many other information necessary for technical analysis, including goals for opening short-term or long-term positions when trading “edge to edge.”

How to use?

When working with the Cloud, first of all, the trader adjusts the indicator input data to 20/60/120/30 (do not forget that the crypto markets are open without breaks and weekends). But since there are not yet enough historical prices for some (especially new) digital coins, we recommend changing the parameters specifically for them to 10, 30, 60 and 30.

If the price is located between the Cloud lines, the market is not in a trend, the edge Cloud zones form resistance and support levels. In this case, you can conduct, for example, margin trading (not forgetting about stop orders, trade inside the Cloud both short and long).

You can use the indicator using the following methods:

- To track the macro trend. Look at the value in relation to Cloud Kumo in a high period of time, say 1 D. You will learn to determine the current trend, its strength, start time and changes.

- Determine the confluence with the resistance and support lines. First of all, draw your own resistance and support lines, then put a Cloud on them, and evaluate whether any of your lines with an indicator, for example, will have a support line corresponding to the Kijun line. If the answer is yes, you will have confidence in holding the support level (in the example of a resistance line corresponding to the upper Kumo line, you will have confidence in the corresponding line).

The further the price is from Cloud, the greater the strength of a particular trend. The closer it is to it, the greater the chances that a trend reversal will be observed soon. You should work with the Cloud in conjunction with other indicators (those that we confidently recommend: EMA, volume indicator and RSI).

Note! Cloud is considered a difficult technical analysis tool. However, you should definitely understand the features of its application: you will learn to correctly determine market sentiment and correctly predict them by watching our video lesson with practical examples :

Thank you for studying our article. We hope you found it useful and you find it to good use.

Trading volumes

If you take a look at cryptocurrencies , you will see that electronic money is selling very well. The size of trading volumes affects the formation of price trends. An increase in sales leads to their strengthening, and a decrease leads to a weakening. When a cryptocurrency rapidly rises or begins to lose its positions just as actively, this serves as a signal to pay attention to trading volume.

If the value of an asset rises for a long time and then falls, then trading volumes can help determine the characteristics of this dynamics. It's easy to understand what's going on. A prolonged fall or just an adjustment. Basically, an increase in price leads to an increase in trade volumes. Otherwise, when the price rises but the volume does not, we can say that this trend will not last long.

Different perceptions of technical analysis

Through technical analysis, the cryptocurrency market can be effectively researched to help identify trends. Some support this approach, while others oppose it.

Quite a lot of traders are confident that information about an asset is reflected in its price. If you adhere to this judgment, there is no need for technical analysis. This perception of stock trading has a right to exist, but it lacks flexibility, which causes a lot of criticism.

Another part of traders builds their trading strategy taking into account world news regarding cryptocurrencies. If information of this type is positive, then buy orders are issued, and if negative, sell orders are issued. This method of trading can be justified only in the long term. It has shortcomings and there are many of them. At a short distance it is minimally effective.

Technical analysis of cryptocurrencies. Peculiarities

The term “technical analysis of cryptocurrencies” usually means an assessment of the movement of the price level of digital tokens, which allows one to make a forecast of changes in quotes. Technical analysis of the selected asset is carried out on the basis of patterns that are characteristic of it and the entire cryptocurrency market.

Thus, technical analysis of cryptocurrencies makes it possible, based on historical data on changes in quotes of the selected asset, to determine how its price will change in the near future.

The first technical analysis techniques appeared long before the foreign exchange and cryptocurrency markets. They were originally used in the Japanese rice market. At the beginning of the twentieth century, a journalist from the United States, C. Dow, who specialized in finance, described the patterns of changes in stock market quotations. His work formulated key principles that later became the basis of modern technical analysis.

Modern technical analysis is based on three fundamental principles:

- There are no accidents in the market, since any change in quotes is caused by any reasons. Therefore, if you identify the reason that led to a change in quotes, then when this reason reappears, you will be able to predict the behavior of the price level.

- Market situations repeat themselves over time. If any situation has occurred in the market, then after a certain period of time it may repeat itself. Identical situations usually have similar consequences.

- The patterns work. For example, a trend present in the market usually maintains its direction. In this case, only a factor equal in strength to the observed trend can change the direction of movement of the price level. If the factor is weaker than the trend, it will cause only small fluctuations in the trend.

The fact that at the beginning of the 20th century, technical analysis of the market situation was carried out using drawings and tables deserves special mention. After the first computers appeared, the process of performing technical analysis became much easier. At this time, various tools began to appear that made the job of a speculator easier and more comfortable.

Due to the growing popularity of the digital coin market, technical analysis has begun to be widely used to predict changes in the price of various tokens.

Conclusion

Researching the cryptocurrency market from the perspective of technical analysis currently looks like a promising direction in trading. This is the most effective tool at short distances. If you are interested in such speculation, then use it. Although we should not forget about other methods. Try to connect them together. Take an integrated approach. Refer to the fundamental method, read articles from experts and follow news on cryptocurrencies. This way, you can always keep the market situation under control, which will allow you to accurately identify successful moments.

Cryptocurrency rates from WinOptionSignals

Candlestick analysis

Japanese candlesticks are a commonly used method of displaying price. The candle shows the minimum, maximum, and opening and closing prices of the time interval. Certain combinations of candles, as well as their appearance, are used to predict the future development of the situation on a cryptocurrency asset.

Let's move on to consider candlestick patterns. They work on charts of popular coins.

Hammer. A common candlestick pattern. Occurs at the turning points of the coin exchange rate chart. It looks like a hammer with a long downward handle and a small body. In this case, the upper tail of the candle should be absent or small. This pattern gives strong trading signals to enter a trade.

Falling star. This is a mirror image of the Hammer pattern. It also indicates a price reversal, but appears at the top of the trend, and not at its bottom, as is the case with the Hammer. The candle has a long wick pointing upward and a small body. When such a candle appears, it makes sense to open a bearish trade and make money on the fall in the token rate.

Bullish and bearish engulfing. Simple and effective models for making money on crypto exchanges. If a large growing candle appears, which overlaps the previous falling one, covering it with its body and wicks, we can talk about the appearance of a bullish engulfing.

In the opposite situation, when a falling candle completely covers the previous growing one with both body and tails, investors know that this is a bearish engulfing and trade to reduce the value of the cryptocurrency.

Three soldiers and three ravens. Trend continuation models. If you see three large growing candles on the chart, it means there are “three soldiers” in front of you. Most likely, quotes will begin to rise, so it makes sense to buy cryptocurrency if this model appears.

The opposite formation for decline is “Three Crows”. It appears on a downtrend and looks like 3 large, approximately identical, falling candles. If you see this pattern, know that the price of the coin will fall - make money on it.

Doji. Candle of uncertainty. At the moment a candle with a small body and small identical tails (wicks) appears, it is better to move away from the exchange terminal and wait several time intervals. The waiting time depends on the timeframe. So, for example, when trading on H1 you will have to wait 3-4 hours or temporarily switch to another asset.