Financial literacy

Many novice investors are interested in how to choose a mutual fund. There are a large number of companies represented in this area and each specializes in a specific industry.

There are funds:

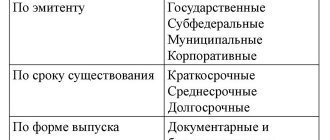

- shares

- bonds

- mixed investments

- index funds

- mortgage

- credit

There are also organizations that invest in artistic assets.

Don't compare mutual funds from different categories

When investing, it is important to consider the risk-return ratio. Aggressive high-yield trading strategies always have an increased level of risk. If you want to significantly increase your capital, then you need to be mentally prepared for large drawdowns in the event of an unfavorable market situation.

Stock funds are considered to be more risky than bond funds because it is almost impossible to predict how the price of a stock will change in a few years. The optimal period for such investments is 3-4 years, but there is no guarantee that the value of the shares will not fall or remain at the same level, but will increase over this period.

To get an accurate picture, it is advisable to compare mutual funds that invest in the same types of assets. You can choose a different period for analysis: from 1 month to 5 years, but it is better to take 1 year if the company has recently been operating.

At what time distance should profitability be analyzed?

Any investment is like good wine: the longer you work, the higher the degree. In this case, profitability. Therefore, in order to understand which mutual fund is really more profitable, it is better to analyze its profitability over a long distance. Usually they take 3 years, but I suggest 5 years. During this time, in principle, all the sins and achievements of the fund will be visible.

And here’s another interesting article: Bank deposits for Victory Day on May 9: how much you can earn

As of 2020, the rating of mutual funds by profitability over 5 years is as follows (a few more tables):

| Name of the management company | Name of mutual fund | Fund type | Profitability |

| April Capital | Shares of commodity companies | Stock | 349,18% |

| April Capital | Stock | Stock | 205,04% |

| Raiffeisen Capital | Primary sector | Stock | 201,80% |

| VTB Capital | Metallurgy Foundation | Stock | 197,40% |

| April Capital | Second tier shares | Stock | 184,65% |

| Uralsib | Growth stocks | Stock | 182,65% |

| Raiffeisen Capital | USA | Stock | 182,51% |

| Agidel | Stock | Stock | 176,59% |

| System Capital | Reserve Foreign Exchange | Bonds | 176,41% |

| Leader | Stock | Stock | 174,11% |

| OLMA-Finance | USA | Funds | 167,03% |

| Opening | USA | Funds | 163,98% |

| VTB | Eurobonds | Bonds | 160,12% |

| Capital | Global sports industry | Stock | 157,28% |

| RSHB Asset management | Shares | Stock | 155,51% |

Focus not only on mutual fund returns

Common mistakes:

- When choosing a mutual investment fund, you cannot focus only on its historical returns, because... this does not at all guarantee that you will receive the same returns in the future.

- It is impossible to analyze the profitability of a mutual fund, as well as the profitability of any security, apart from the risks that accompany any investment.

- impossible not to pay attention to the constraining circumstances that accompany the service, for example, the inability to redeem their share on any day convenient for the client, as happens in closed-end funds.

Correct comparison of mutual investment funds can be carried out exclusively within one category. 7 criteria that must be taken into account when choosing a mutual fund.

Pros and cons of investment funds

The main disadvantages of mutual funds are their limited flexibility and profitability:

- Open-end types of funds do not pay dividends or coupons to their shareholders. Nobody guarantees income.

- High barrier to entry into closed-end funds.

- There are higher costs relative to ETF funds.

- Low liquidity due to the fact that mutual funds are mostly not traded on the stock exchange.

- There is always a risk that a company's license will be revoked. In the event of such cancellation, the activities of the management company are suspended, shareholders have to look for a new manager, which entails a revision of the documentation, the amount of remuneration, and work regulations.

To be fair, it is worth paying attention to the advantages of mutual funds:

- Small barrier to entry.

- Depending on the strategy, the return on mutual funds may exceed the return on deposits and bonds.

- It does not require time spent studying and analyzing the market, or calculating risks.

- Legal protection. The activities of the management company are controlled by a specialized depository, which monitors all transactions for suspicion. The Central Bank, in turn, has the right to demand that the management company justify its actions.

- There is no need to pay taxes, fines and penalties: the management company takes care of all this.

- Fixed costs. The commission fee is documented.

Focus not only on mutual fund returns

What should you pay attention to when choosing a mutual fund?

Main characteristics:

- Mutual Fund investment territory (stock fund, bonds, real estate, second-tier shares, closed, open, index, etc.)

- Minimum investment amount

- Historical profitability, quality of asset management

- Reputation, tenure of the management company

- Reliability, rating indicators of mutual funds

- The size of the management company’s commission, the availability of discounts, surcharges; the possibility of exchanging shares

Is it worth buying shares of the most profitable mutual funds?

The profitability rating is, of course, cool, but it is nothing more than a measuring stick. So two boys came out into the yard and one said: “I have a bigger gun!”, and the other: “No, I have it!” - and start throwing sand at each other