When coming to trade binary options, many traders wonder whether it is possible to really make money here, and whether this market is something like a financial pyramid. How to figure this out? Yes, very simple. If the system really allows you to earn money consistently, then each of its participants should be able to receive their own income.

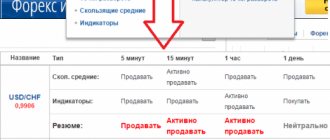

A lot has been written about how a trader earns his income. But, in general, it all comes down to the fact that you need to guess where the price will go in the near future, make the correct forecast and purchase the appropriate option. And here everything is really transparent. But how does a broker offering binary options make his money?

It must be said right away that binary options brokers, as a rule, make money in a non-standard way. To better understand this, let’s first look at the standard way of making money as a “classic” broker.

Some brokers work only with classic transactions, others only with options, and still others with both. But the main thing is that the broker provides those opportunities that will be most interesting to you specifically.

How does a binary options broker actually make money?

If you come to trade, for example, on Forex or the stock market, then most brokers will openly tell you how they make money. Because, in general, there is nothing complicated or secret about this, and any trader can himself notice the source of income of such a broker.

The principle here is the same as at a currency exchange office. As a rule, exchange rates are always posted near such a point: for example, buying dollars for 28 rubles, selling for 29 rubles. In total, for every dollar that passes through the system, the exchanger receives a ruble. It is not difficult to understand that if there is a queue of people wanting to exchange their money at such a window all day, then the profit can be quite substantial.

It's absolutely the same with brokers. For example, if you want to buy euros, you will find that the purchase is at 1.2010, while the sale is at 1.2015. Most often, the difference between the cost of buying and selling (called the spread) ranges from 3 to 10 points. And no matter what you do, you will still have to pay this spread, because any operation involves two transactions: first a purchase, then a sale, or vice versa. And regardless of whether you receive income yourself or not, you will bring it to the broker.

A classic broker is almost not interested in clients' winnings, but is only interested in them making as many transactions as possible and bringing in new traders. “Almost” - because, of course, a successful trader will make transactions constantly and for a long time, and an unsuccessful one, who loses all the time, will eventually give up and leave. For this reason, many brokers offer training, advice, bonuses and many other things that can somehow improve a trader's trading profitability and encourage him to make trades and refer friends. But the main goal of the broker still remains the same: to ensure that as many transactions as possible pass through the “exchanger”.

Most traders have noticed that in the first seconds after purchasing a currency or stock, as a rule, your potential profit is not 0 points, but somewhere around -5. This just means that you paid a spread that set you back a little.

Does a binary options broker need a license?

Do binary options brokers or forex brokers need a license? This is a controversial issue, we have our own opinion, of course it may not be correct...

More than 10 years of experience have shown and proven to us that having a broker’s license does not guarantee high quality of service or honest behavior towards the trader. This can be seen by going to the “Black list of brokers”. Please note that it contains brokers with different licenses. Let’s also not forget that, for example, the broker Binex, who had several licenses, turned out to be a scammer.

At the same time, there are many brokers who do not have licenses, and they occupy top positions on rating sites.

This is due to the fact that in the Russian Federation, Ukraine and the CIS countries there is no normal, full-fledged regulator. At the end of 2020, large brokers lost their licenses: Forex Club, Fix Trade, TrustForex, Alpari Forex and Teletrade Group. This happened due to incorrect regulation and unrealistic requirements from the government.

Broker Olimo, IQ and others simply left Russia. Without there being complaints or lawsuits against them. It just became difficult for them to work. Although these binary options, Forex and CFD brokers were the best in Russia.

In Russia, in order for a broker to obtain a license, the Bank must fulfill many conditions. However, these conditions do not protect the trader, but force the broker to pay more money. Perhaps this is why binary options and forex brokers often stop working with the Russian Federation and move their offices abroad.

Moreover, the majority of traders prefer to work with European brokers that have Russian-language support. Even if they don't have a license.

Broker licenses do not protect traders from the Russian Federation. Therefore, a broker's license does not actually give anything to the trader. Only in certain cases, but they almost never help the trader.

Who licenses an options broker?

- CFTC - Commodity Futures Trading Commission. The Commodity Futures Trading Commission is the central government body of the United States of America that oversees the implementation of the Commodity Exchange Act.

- CySEC - Cyprus Securities and Exchange Commission. The Cyprus Securities and Exchange Commission, better known as CySEC, is the financial regulatory authority of Cyprus. As an EU member state, CySEC's financial rules and operations are compliant with the European financial harmonization law MiFID.

- FCA - Financial Conduct Authority. The Financial Conduct Authority is the financial regulator in the United Kingdom, but operates independently of the UK government and is funded by levying fees on participants in the financial services industry.

- FSCL - New Zealand Financial Markets Regulator

- FSP - Financial Service Providers. New Zealand Financial Markets Regulator

- FSPR - Financial Service Providers Register. New Zealand Financial Markets Regulator

- KROUFR - Commission for regulating relations between participants in financial markets. Claims against brokers

- RAUFR - (Russian Association of Financial Market Participants) is a non-profit organization

- FFMS - Federal Service for Financial Markets. The Federal Service for Financial Markets is a abolished federal executive body that exercised functions of legal regulation, control and supervision in the field of financial markets, including control and supervision in the field of insurance activities and credit cooperation

- TsROFR - Center for regulation of relations in financial markets.

- TsRFIN - Center for regulation of over-the-counter financial instruments and technologies.

- Financial Commission - FinaCom PLC LTD and its affiliates, including FINACOM LTD, is the first neutral and independent dispute resolution organization that specializes in the Forex/CFD, digital currencies and blockchain markets.

As you can see, not one Russian regulator does not protect traders from the legislative side. All organizations in Russia are either “or “Commission” and “non-profit organizations”. No single organization has power over brokers and their control. At most, they can write a bad review about an options or forex broker. But they cannot influence the broker. All these bodies and commissions require the broker to pay “Membership fees and registration fees”.

Tricks of binary options brokers

Do binary options brokers charge spreads? As a rule, no. Most of these brokers advertise as one of their advantages that they do not charge any spread. If there was a spread, it would look like an offer to buy a Call option, for example, for $101, and a Put option for $99. But in practice this does not happen. Brokers who take something like this without warning traders about it (and this happens) are clearly unscrupulous, and it is best not to work with them.

In addition to the spread, some brokers may also charge a swap, that is, a fee for transferring an open position (in this case, an option) to the next time period, for example, to a new day. However, large advanced brokers, as a rule, do not accept swaps either, which is also notified to traders.

But commissions for depositing and withdrawing funds can bring some additional income to the broker. On the one hand, such commissions are undesirable for a trader. But on the other hand, often input and output operations require the broker to pay a commission in favor of the system with which the exchange takes place. If a broker takes a commission within the limits of his own break-even from such operations, then it is quite understandable.

However, all these income items, with the exception of the spread, cannot be the main source of earnings. Therefore, the conversation about how binary options brokers really make money is still ahead. And here there are two options.

The main differences between binary options brokers:

- A simple web-terminal for trading and applications for mobile devices.

- The choice of long-term expiration - from several days to several months.

- Possibility to withdraw your bet with a 50% loss.

- Additional options for increasing the rate, or hedging it (locking in binary options).

- You can use several types of binary options - from simple Above/Below , to complex ones - “ Range ”, “ Spread ”, “ Touch ”, etc.

To the listed differences, let’s add one advantage - the ability to place bets on several forecasts (checks) , with a multiplied reward coefficient. This allows you to increase your reward by 10 times.

Brokers - bookmakers

In fact, many brokers are not brokers at all, but are essentially bookmakers. The difference is that they do not bring clients' trades to the market, but play purely on the difference between the number of wins and losses. Bookmakers don't care how they make money, but price charts are a really great solution for them for several reasons.

Firstly, price charts are constantly moving, at least 5 days a week, while interesting sports competitions do not occur every day.

Secondly, most novice traders, of course, lose because they frankly do not know how to analyze the market and rely on luck, essentially turning options trading into a casino. In any casino there are always more losers than winners, and this is exactly what allows such a “broker” to make money. If we talk about buying an option for a period of 5 minutes in the hope that its price will become higher/lower by 1-2 points, then this is a pure casino, because it is simply impossible to make a normal forecast for such periods. And this is exactly what brokers often actively offer.

At the same time, a good broker-bookmaker does not deceive anyone. If you win fairly, he will pay you your money fairly. If you lose, he will take it honestly. There are no direct ways to find out whether a particular broker is a bookmaker, because outwardly everything looks exactly the same. You can only rely on indirect signs.

As a rule, there is no refund of part of the money if you lose. It is not profitable for bookmakers to do this, because this is an additional huge expense item.

Having analyzed the website of the broker-bookmaker, you can see that it is very much “tailored” to attracting new clients. Promises (often groundless) of quick success for everyone, a powerful affiliate program with very high returns. For a bookmaker, a large number of inexperienced traders is always preferable to several dozen professional ones, since the latter can ruin him, and newcomers will always bring profit.

Often such brokers offer especially successful traders an affiliate program on especially favorable terms. That is, they suggest switching from trading to searching for new clients. This suggests that this is definitely a bookmaker, since professional traders will never interfere with a real broker either.

Finally, the bookmaker always offers very small amounts to get started, a minimum deposit size, because, as already mentioned, the most important thing for him is to attract many players and create excitement.

A broker-bookmaker can exist quite comfortably, because in most cases the ratio of winning and losing transactions in such a market is 3:7, or even less.

True Binary Options Brokers

A true broker is one who uses his clients' money to make his own trades in a particular market. That is, if you bet on the rise in price of gold, he takes your money and enters the commodity market with it. If you play on stocks, then, accordingly, the broker works on the stock market, if on currencies, then on Forex.

Binary options are convenient for a broker because you immediately give him your money in the form of the option cost. The moment you buy an option, you are immediately charged, for example, $100. And only after the option expires, you will either receive $160-180 back, or you will receive $0-15 in compensation for losses. The ability to use your money is exactly what the broker needs all this for. The mechanism at work here is as follows.

Having collected, for example, $100,000 from 1,000 traders, the broker can use this amount to make his own trade on the underlying asset on which these traders are working. For example, in the gold market. With this large amount, the broker can make a solid trade with a large potential profit. Naturally, decisions regarding the purchase or sale of an asset are made by the most experienced traders who are part of the broker’s company staff.

Then the situation unfolds as follows

If the broker wins his trade, he shares the profit with those traders who correctly identified the price movement. According to statistics, such traders are almost always less than 50%. At the same time, the money of traders who made an incorrect forecast becomes the full property of the broker. Whether he pays them a portion in the form of compensation or not, this does not significantly affect the broker’s profit. If the broker wins a deal of this level, then he receives a profit that is not comparable to what traders receive.

If he loses his trade, he loses less than he would have received if he had won. This is the law of managing your finances. In this case, he also pays the winnings of the first category of traders and receives money from the second. Most brokers plan their trading in such a way that if they lose, they will receive a loss that would be completely or almost completely compensated by the money of the losing traders.

From all this we can say that a broker who offers options ultimately receives extremely favorable trading conditions for himself in a particular market, because he always has a powerful “safety cushion”: no matter which way the price goes, some traders will be losers and their money can be received as compensation.

In addition, brokers can use the following techniques

- Firstly , there is an offer to make a transaction only in one direction. These are One Touch options. At each moment, the broker offers, of course, those options that are in one way or another related to his plans. For example, if he wants to bet that the price will rise to the 1.80 level, then he will invite traders to bet that the price will reach 1.85. If the broker loses, he will take ALL the traders’ money down to the last ruble and will not owe anyone anything.

- Secondly , it’s a game both ways. For example, one position is opened to sell euros, and another to buy.

Whatever direction the price goes, one of the transactions will be won, and the second will be compensated by the money of the losing traders.

As you can see, a true broker also has very good opportunities for earning very large amounts.

There are several indirect signs of such a broker.

Such companies encourage traders to place large bets. The higher the value of each option, the more of the underlying asset the broker will be able to buy or sell.

In addition, they are characterized by constant updating of the “range” of options. As already stated, this has to do with what the broker is going to do. For example, now there is an offer to buy an option to increase the euro level by 50 points, and tomorrow, instead of such an option, it is already offered to buy an option to decrease the franc by 70 points. All this indirectly reflects the broker’s own activities.

Criteria for selecting the best binary options broker

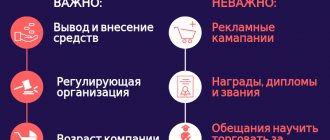

The binary options market is constantly evolving, with new players appearing on it. The following criteria will help you understand how reliable a broker is:

- certification;

- platform;

- managers;

- cash payments.

You can recommend a broker if the specified conditions are met. We will study in detail what exactly you should pay attention to with each of them.

Certification

After binary options were officially banned in Russia, this criterion is not paramount, but has not lost its relevance. The following types of certificates are distinguished:

- TsROFR - brokers are licensed by a Russian non-profit company. Its competence is questionable - the Center for Financial Markets is not controlled by the state and has no leverage. Despite the high cost of $4,000, the certificate is useless - it does not provide any protection and does not guarantee anything;

- CySEC is a government regulator. The founding company is located in Cyprus, with jurisdiction extending to all EU countries. A complaint to this company will give results, and the compensation fund will solve the problem and protect you from a dishonest broker. The maximum amount payable upon bankruptcy is 20,000 euros, which protects large bets from fraudsters;

- FCA certificate from the British regulator - has the highest degree of influence. The presence of such a certificate is the maximum rating for a binary organization. A broker with FCA is the best choice.

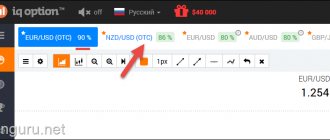

Platform

It is a program inside the server where trading takes place. Choosing the right platform is as important as finding a reliable broker. If a few years ago the financial market had several standard platforms on which trading took place, modern brokers develop them independently. As a result, they have an adapted tool that is convenient and pleasant to work with.

The platform influences the following indicators:

- speed of transactions;

- percentage of quote accuracy;

- the presence of “slips”.

Note! The platform’s tendency to “glitch and freeze” at the most inopportune moment can deprive not only a beginner, but also an experienced trader of income.

The best option is self-written platforms. The most reliable:

- Binomo;

- Binary;

- Intrade.

The advantage of self-written platforms is high speed. The disadvantage is possible problems during the running-in stage.”

Managers It is important to understand here that the behavior of a manager depends on the degree of awareness of the trader. Newcomers to binary trading are more likely to be scammed than those who already have experience with them. What managers do:

- offer webinars;

- give strategies;

- provide signals;

- give recommendations when to make purchases.

As you gain experience in trading, communication with the manager is reduced to a minimum.

Cash payments The most important aspect of the process. How to understand that the broker will not deceive you? The most common tricks that novice traders fall for:

- money is transferred only after several transactions are made with the client;

- they come up with reasons for delaying payment deadlines - for example, poorly organized accounting or technical reasons;

- a third-party company is involved in the money transfer procedure, and it is they who are slowing down the payment;

- You can receive funds only after the operation is approved by the manager.

To avoid falling for these tricks, just filter brokers and study ratings. There are not so many people who commit fraud. The company’s desire to gain a foothold in the modern financial market obliges it to value its reputation and fulfill its obligations to partners.

Reputation and reliability of the broker

As a rule, professionals pay special attention to this point. And it’s not surprising, because they most often invest significant sums in trading, so they count on some kind of guarantees.

Beginners in most cases look at this more superficially. Often they are even annoyed by the broker’s requirement to provide identification documents, place of residence, and ownership of a certain credit card. A person who has come to work seriously will not be against such authorization in order to receive additional reliability in return. Serious brokers may not allow “unknown people” to trade at all. It is important for them that every trader can be identified and be aware of responsibility for their actions.

At the same time, it is very important for a trader to be able to prove that it was he who performed specific transactions at a certain time. All this makes it possible to protect your rights in case of disagreement, so do not neglect the broker’s requirement to identify your identity.

As for reputation, you should pay attention, first of all, to reliable brokers who have been working for several years. They do not offer instant enrichment, but they do talk about the possibility of calm and comfortable work. A real trader doesn't need anything else.

TOP 4 reliable and modern platforms with minimal investment

TOP 1: Intrade bar - a popular and affordable broker

The Scottish INTRADE BAR service was launched in 2020 and is in consistently high demand among residents of the CIS countries. Customer reviews are overwhelmingly positive: it’s really easy and safe to make money here, even for a beginner.

The platform works well in any browser, is clearly configured and is one of the leaders in binary options with conditions requiring minimal investment. This service values, first of all, its reputation as an honest broker and adheres to a policy of maximum transparency.

Features of INTRADE BAR

It works under good conditions, so even novice users can practice in the demo version. Fast withdrawal of funds – up to 15 minutes – will allow you to trade quickly and productively. Sometimes withdrawals may be delayed, but this is usually due to weekends or night hours. INTRADE BAR strives to be the best in their business: they rarely block accounts. The platform is simple and loyal to each client. Fixed payments do not change: for 3 minutes - 80%, over 3 minutes - 77%, random asset - stable 97%. The service does not send spam or call. If problems arise, 24-hour technical support is available on the site, where specialists usually respond within 1 minute on weekdays from 9 a.m. to 5 p.m. Moscow time.

Bonuses are not provided to avoid them being repulsed. When registering, confirmation of personal data is not required: this request can only be received if you plan to withdraw funds to a previously unused card.

Risk management is available: at the start of the working day, the trader independently sets the levels of earnings and losses, the parameters of which remain unchanged until the end of the day's session. This protects “hot” traders from losing money. Registration is simple: you just need to enter your name and email address. After opening an account, you will receive a confirmation email with your password and login. You can change the password yourself. No additional verification is required.

Trading platform

Today, work is carried out on the TradingView charting platform with a built-in live chart and FXCM quotes. When starting binary options daily, a window pops up where the user independently enters risks, after which the operation of the system will be automatically stopped.

The following trading modes are available:

- Classic (the contract expires every 5 minutes, the payout is 77%).

- Sprint (contract expiration - from 3 to 500 minutes, payment - 80% for 3 minutes, over 3 minutes payment is 77%).

- Random (contract expiration - from 5 seconds to 500 minutes, works daily 24/7, payout is 97%).

In order to carry out a transaction, you must complete the following points:

- determine the transaction amount,

- as well as a currency pair,

- expiration date of the contract

- and direction.

Next, the transaction will automatically go to “open”, and after completion – to “closed”.

It is easy to carry out analysis on the chart and use various tools: here we build support and resistance levels. This can be done using the options in the panel on the left side of the terminal.

For the convenience of users, the platform has minimized the chart so that the trader can not interrupt his work. The creators recommend that the free space be filled with instant access to frequently used assets.

We recommend: Review + reviews of the INTRADE bar platform

Reviews and recommendations for the best brokers today

TOP 2: PocketOption - one of the best brokers in Russia with minimal investment

Owned by the offshore Gembell Limited, it has been working with CIS countries since 2020, when they received a Russian certificate of conformity. English and Russian versions of public offer agreements are available.

PocketOption on the binary options market is on the list of favorites, with minimal investment.

Important details:

- The starting deposit is $50,

- The lowest bet is $1.

- Depositing money is done automatically.

If problems arise, the service may ask the user for translation details. Withdrawal under the terms of a public offer from the Pocketoption website is carried out manually. Enrollment occurs within 3 working days. If difficulties arise, the platform may notify the user to extend the withdrawal of funds up to two weeks.

When withdrawing, it is necessary to use the same system as when depositing money, while the starting threshold for depositing funds is $50, the minimum withdrawal is $10.

The possibilities for withdrawal and replenishment are extensive: you can use both cryptocurrency methods and all kinds of payment systems, any bank cards without restrictions and mobile transfers.

BEST FOREX BROKERS, ACCORDING TO THE RUSSIAN RATING FOR 2020:

1998

FCA, NAUFOR. DOUBLE BONUSES x2 | review / reviews 2007.

FinaCom. CASHBACK 16$ PER LOT! | review / reviews 2007. 260 representative offices. STARTUP BONUS $1500 | review / reviews 1997. National Bank of the Republic of Belarus. FROM $50 TO $5,000 | review / reviews AND ALSO THE BEST BINARY OPTIONS BROKERS FOR TODAY:

The most favorable conditions!

TRADE WITHOUT VERIFICATION | review/feedback Updated platforms. OPEN AN ACCOUNT IN BINARY |

review / reviews Recommended: Review + reviews of the PocketOption platform

Minimum deposit and option amounts

The minimum deposit amount, again, is of great concern to beginners. I would like to start playing by depositing as little money as possible into my account, for example, one dollar. But in any case, almost any broker gives you the opportunity to start with a deposit of 100 dollars or euros. This is not too much money, and if you decide to play seriously, you can always find it.

If you are just trying, then you don’t need any money at all - trade on a demo account. This is a great opportunity to learn without losing.

As for trading with real money, the minimum cost of an option is much more important. Why?

Some brokers offer to start playing with a deposit of ten dollars, despite the fact that the minimum option costs five dollars, if not ten. Naturally, it is completely unacceptable to start playing under such conditions. After all, one or two failures and all your money is gone. This fundamentally contradicts the principles of competent deposit management. According to these rules, the maximum loss at one time cannot exceed 10% of the entire deposit amount.

Binary options, by the way, are good because they allow you to regulate risks and profits like no other type of trading. Therefore, if the minimum option costs ten dollars, then you need at least a hundred to get started. If the minimum lot is $25, then you need at least $250. In other words, an experienced trader looks not so much at the minimum deposit, but at the minimum lot to calculate his deposit management strategy.

Reliable investments on the Internet

Views: 819

What reliable Russian binary options brokers are there and why should you cooperate only with them?

First of all, dear friends, let's figure out what binary options actually are, where they come from and what they are actually used for.

Often ordinary people associate binary options with Forex, which is deeply mistaken. But what exactly is an option? Let's say there is some kind of asset and we assume that it will cost some amount of money.

As a result, if a given asset is bought at the same price or higher, then we as traders receive approximately 15% of this asset, but if the asset is bought at a lower price that we named, then we receive nothing.

There are more and more people in our country who want to make money on binary options The size and stability of profits depends on the broker, so you need to choose it carefully and without haste.

binary options brokers are trustworthy , but is this really true, and how do they differ from each other? You will find answers to these questions by reading this post.

But first, let's define who a broker is and what he can offer a trader. Without going into details, this is an intermediary that provides a binary options trading participant with the opportunity to make transactions.

At the same time, the range of brokerage services may also include the provision of leverage (a certain amount of money as collateral to obtain greater profits), as well as depositary services and provision of a workplace for successful investment.

Such companies receive income in the form of commissions that traders pay on each transaction, so it is beneficial for them that you earn more. Brokerage organizations differ from each other not only in the amount of commission, but also in their experience, reputation, number of bonuses and promotions, level of technical support, etc.

Which intermediaries can you trust?

The growing popularity of binary options has stimulated the emergence of a huge number of brokerage companies and high competition among them.

However, this does not mean that any intermediary can be trusted - there are many who deceive clients or provide insufficient quality service. Traders also have complaints about the accuracy of forecasting, the speed of the trading platform, as well as the speed of troubleshooting technical problems.

The convenience of trading and the legality of the broker’s activities also play a big role - and this is what encourages Russians to choose “native” intermediaries, that is, those who have Russian-speaking support and an official permit to work in the Russian Federation.

In fact, there are very few reputable brokerage companies founded in Russia, although there are those who have been working in the domestic binary options market for a long time, have a license and can boast of positive customer reviews.

Let me make a reservation in advance that there is no advertising here and all companies are represented here, solely from my own experience.

So, here are the most reliable Russian binary options brokers - this list is compiled based on the number of traders and popularity ratings:

-Binex;

— Grand Capital (one of the few brokers headquartered in the Russian Federation);

—Binomo;

Deciding on a broker: key selection criteria

Finding a good partner is not an easy task, but it can be done. There are many options, so you shouldn’t make a decision in a hurry; it’s better to carefully analyze all the “contenders” according to the following parameters:

- confidentiality of personal information and level of security;

-convenience of the trading platform interface (if using the platform is uncomfortable, then there is no point in working with a broker);

-availability of professional support service – a reputable company has a technical support service that works around the clock and is always “in touch” with clients;

-amount of commission (everything is clear here);

- speed and ease of withdrawing funds and replenishing a trading account.

Of course, these are only the basic criteria for selecting a broker, but if you are just discovering the world of binary options , this is the minimum requirement that you need to focus on :)

(Visited 9 times, 1 visits today)

Please rate the article and leave your opinion in the comments

[Total: 0 Average: 0]

This might be interesting:

How much can you earn on binary options?

Sap Corporation shares are a profitable asset for investment

Technical analysis for binary options and how to use it?

Virtual money world of the foreign exchange market

Mistakes to Avoid When Trading Binary Options

The most profitable Martingale strategy for binary options

Binary options 1 minute

Binary options trading platforms with minimum deposit

- 1

Share

Rating of the best binary options brokers

First in place

The ProfitPlay broker is in first place in our rating.

It has a convenient platform and an understandable website entirely in Russian.

ProfitPlay is a Russian options broker operating in the financial trading environment since 2020. This trading platform offers modern services for making money on binary options, which the company is constantly modernizing.

Second place

Next comes 24 Option.

It collects many reviews as a reliable binary options broker.

For trading: it is possible to buy contracts with an expiration date of 5 minutes. You can trade from mobile devices. Trades can be closed early, reducing losses or fixing profits.

By deposit: in order to trade, you need to top up your account with an amount of $200 or more, with transactions starting from $24. The broker accepts almost all types of payments popular in Russia.

For training: You will be able to access special training materials that will help you master the necessary knowledge, such as webinars.

Third place

The broker IQ Option took third place in the ranking.

Users like it because it allows them to receive a refund to their account in case of unsuccessful transactions.

For trading: up to 45% of the money can be returned to your account if you lose. There is access to many underlying assets and options types. The platform itself is bright and fast.

On a deposit: when you top up, you receive a bonus of up to 100% of the amount deposited into the account.

For training: the platform offers a demo account with no time limit. Webinars are also available.

Fourth place

Binomo is firmly established here. The peculiarity of this operator is its very high maximum profitability.

On trading: if you win, you can get up to 650% profit, although such profitability always comes with a lot of risk. There is a possibility of doubling and extending contracts. You can trade not only individual types of assets, but also pairs.

By deposit: when you replenish your balance, you receive up to 100% bonus to your account.

For training: a standard set of training materials - several videos and an e-book on the topic of options trading.

Fifth place

OlympTrade closes our top five.

You can make transactions with it from just 1 US dollar.

For trading: it is possible to purchase contracts with an expiration date of only 1 minute.

By deposit: In order to start trading with this operator, it is enough to top up your account with 10 US dollars. This is one of the leaders in terms of the minimum deposit amount. When you top up, you will receive a deposit bonus ranging from 30 to 100% of the amount you deposited. Reviews can be read both on our website and here - https://www.olymptradeotzivy.com

We hope that this rating will help you choose the best binary options broker to trade successfully.

How do you deposit and withdraw money from the trading platform?

This is one of the most painful issues for traders. Because you will only be willing to work if you can deposit and withdraw money quickly and without difficulty.

The concept of “simplicity” has several components.

- Input and output options. The more there are, the better. For example, this could be bank cards, electronic money (for example, WebMoney). As a rule, this is more attractive than postal or bank transfers. Therefore, it is worth paying attention to what the system accepts and where it allows you to transfer earnings.

- Speed. Ideally, this should be 1 second, but in practice (especially with output) things are not so rosy. Some brokers make withdrawals once a week or month, others can guarantee the receipt of money on your card or account only after a few days.

- Commission. Not all brokers have it, but it is common. So it’s also better to think about this when making a choice.

Minimum deposit with which you will be allowed to work

It may also differ: one broker has tens of dollars, another has hundreds. Brokers of the first type are more popular because they are more accessible to traders. For beginners, the opportunity to start trading with just one dollar is especially attractive.

Terms of transactions

This concept also includes a lot. For example, the minimum lot that you can play. In the case of binary options, there are a few more points worth noting.

The minimum and maximum validity period of the option (several minutes, hours, days).

Refund of part of the funds in case of loss. For example, some brokers return 10% of the option price if the forecast does not come true.

The ability to indicate not only the direction of price movement, but also the range of its movement, depending on which earnings will change.

Trading platform

Many brokers rely on the fact that their trading platform does not require downloading, but is available online. However, for 90% of users this does not matter, because they work from the same computer and, if anything happens, they can install the necessary program.

Another important thing is how convenient this platform is. And, first of all, for technical analysis. Absolutely any platform of any broker is suitable for making a transaction, because to do this you just need to select the price direction, the amount and click the “Buy” button. But not every broker makes its platform high enough and suitable for conducting serious technical analysis. It requires using a sufficient number of different tools and indicators.

Please note that you can use other platforms and programs for research; analytics can also always be viewed on third-party sites. Experienced traders have their own base of sources for forecasts and news, so they are unlikely to be interested in what the broker offers. This can certainly help newbies.

However, if a broker offers its information about the market, this does not prevent you from looking for other options “on the side”. After all, the more sources, the more accurate the information. And in any case, there is never too much data, and the trader’s task is to find those experts and analysts who make mistakes as rarely as possible.

Is free training and demo account available?

For a beginner, it is very important to receive training from a broker. Many people come and immediately want to trade. But this is tantamount to coming to a construction site and immediately working, without experience or understanding of what and how to do.

Therefore, if you are a beginner, then look for a broker that offers educational materials. The best thing, of course, is not just links to videos that are freely available, but the opportunity to chat with an expert online, ask questions, and get advice. A broker who cares so much about new traders is really good.

Having a demo account is also a very good indicator of attentive attitude towards your clients.

Is there technical support?

Being willing to answer any questions is extremely important for a trader. Make sure you can get a detailed answer to a specific question in a language you speak well.

Do not hesitate to ask technical support a lot of questions from the very beginning to evaluate the speed and information content of the answer. From this it will be possible to draw a conclusion about how much assistance you can count on from the broker.

Rating of binary options brokers

When choosing the best broker, each trader is guided by his own preferences and requirements. Ratings that are presented on the Internet are also compiled based on specific criteria, for example, the entry threshold. An objective assessment of the company and assistance in finding the ideal broker can be provided by your own analysis of the most popular options.

Binary

This is one of the best offers at the moment. An experienced bidder is ready to offer users conditions that have no analogues from competing companies.

The platform is based on open source. Thanks to this, experienced traders create a personal client via the websocket API. At the service of traders is a store of current offers, there are additional modules - for example, the ability to create your own trading robots in an easy-to-understand constructor. Those who do not plan to reinvent the wheel work on the standard menu.

WForex

A user-friendly interface, help and friendly attitude of managers are an ideal broker for beginners who are just trying their hand at trading. Money is withdrawn quickly, and for those who are ready to keep a deposit, they offer interest on the balance - subject to an annual deposit. The server has its own unique platform.

INTRADE.BAR

Representative of a new generation of brokers. Has a well-functioning working model. There is no aggressive marketing - there are no free offers, bonuses or call centers. Loyal working conditions for traders:

- payment percentage is fixed;

- there is risk management;

- money can be withdrawn within 60 minutes.

Alpari

In the post-Soviet space, Alpari is the company with the largest capital. Includes two platforms - classic and updated beta version. Designed for large deposits, suitable for searching for sources of investment.