What's on sale

The stock market is the definition of an exchange of financial services, instruments and participants. They sell here:

- Shares are monetary securities that are purchased for cash capital, close in price to shares, to the total capital of companies. After purchasing a share, the owner receives a legal right to a portion of the income from it. The organization's earnings, which the owner takes for himself, are dividends - they are paid every year. By decision of the directors (the board meets), the annual profit can be canceled in order to reinvest assets and increase the profitability of the instrument in the future.

- Bonds are obligations in accordance with which the issuer must issue specified amounts of money to the bearer. The issuer can be the state or an individual company - accordingly, the securities will be corporate or state (the second option is not subject to tax). Since bonds are much more stable than stocks in terms of their financial indicators, it is recommended to start trading with them.

- Options - this instrument involves constructing a proposal regarding a change in the value of a financial instrument for a certain time period, then the option is purchased, the named value is considered a premium. After 24 hours or another period of time, previous results are canceled. If the forecast was correct, the invested amount of money is paid out with a profit; if not, the investment is withdrawn.

- Futures are obligations of one party to provide a second specified product under certain conditions (volumes, prices). Futures trading on the exchange is free.

The stock market, in simple terms, is a platform for trading, but you can make money here only if the price of an instrument rises, unlike Forex, where traders play on both an increase and a decrease in value.

What is the stock market

Without citing the definition from Wikipedia, which the reader can read on his own, the stock market, in simple words, is a place where people invest money in three main types of assets:

- stock;

- bonds;

- fund units.

The first exchange where it was possible to buy debt securities (analogous to bills) arose in 1556 in Antwerp. Shares first became available for trading in the 17th century. In Russia, before the revolution of 1917, the stock market also developed. Its formation in the modern history of the country began in 1991. At that time, there were 800 small exchanges in the Russian Federation - more than in the rest of the world. Now the main trading platform, the Moscow Exchange, ranks 22nd in the global ranking.

In addition to the stock market, there are also futures, money, foreign exchange, and commodity markets. The main difference between the stock and derivatives markets comes down to the fact that when working on the first of them, the investor becomes the owner of the acquired asset and can own it for as long as desired. In the urgent case, he simply reserves for himself the right to buy or sell something at the price established at the time of the transaction. In the foreign exchange market, the currencies of some countries are exchanged for the money of others; in the commodity market, contracts for the supply of goods, mainly raw materials, are concluded.

I also recommend reading:

Latest news on the trade war between the US and China

China still lost to the US in the trade war?!

Types of markets

There are two main types of stock markets – secondary and primary. The primary uses new securities, that is, those that were issued for the first time, while the secondary uses previously issued ones. In the first case, the goods are supplied by the issuer, in the second by an intermediary.

What are the features of the stock market can be said taking into account all the criteria. For example:

- issuer – private company, state;

- territorial affiliation - national, international, regional structure;

- type of securities - futures, bonds, shares;

- exchange criterion – exchange, over-the-counter transactions;

- terms – short, medium, long, unlimited;

- industries and other parameters.

Who works in the stock market

Stock market participants are:

- Issuers are producers of securities.

- Investors are people who make investments in the purchase of securities.

- Professional players are companies and individuals who trade on stock markets in the interests of third parties.

Professional participants are intermediaries who take part in surety trading. The goal of the work is to increase the capital invested by the client; they take a certain percentage of the transaction as payment. The level of work of brokers can be very different - carefully choose the one to whom you plan to entrust your savings. A license to conduct relevant activities is required.

Practical recommendations

We recommend that you remember and consider several important points:

- The stock market requires preliminary preparation. It should take you at least 15 hours to study – in the case of options trading. If you are attracted, for example, to stocks or futures, you will need even more time to study. But keep in mind that the hours spent will be fully repaid in the future - by the financial profit received day after day;

- Investing is always associated with risks; this cannot be avoided, either now or in the future. If you expect that all transactions will generate income, it is in vain. Defeats occur even to experienced professionals. But a competent investor is always distinguished by the fact that the number of his profitable transactions is much higher than the number of unprofitable transactions;

- Don't give up keeping an investor diary. Even if you think it's a waste of time. How to use this tool? Write down in your diary all the features of the operations performed - it does not matter whether the transaction brought losses or income. Subsequently, thanks to the analysis of records, you will be able to understand where you are making mistakes and which trading strategies are not profitable for you personally. You will gain experience and practical knowledge. Even the most experienced and successful market players keep investor diaries;

- Look for a strategy that will allow you to receive not only high, but also stable income. Once such a strategy is found, do not deviate from its rules, even if at some point you suffer losses. There will be losses in any case, and they must be treated calmly;

- Chat with successful traders who are ready to share their experience with you. Don't miss a single opportunity that can lead to self-improvement. Read books on the stock market, register on online forums, watch videos on stock trading. In addition, we advise you to share your personal experience and knowledge with your colleagues. The good thing about the stock market is that there is absolutely no competition on it. “Give away” your own secrets of success, and they will trust you. You will make useful contacts;

- While working, forget about worries and emotions. They can only lead to mistakes. It doesn't matter whether you're dealing with options or deciding to stick with stocks and other securities, emotions will cause failure. By the way, this is why experts around the world strongly advise working according to clear rules of strategy. In this simple way, rash impulses can be eliminated;

- Be prudent and don’t be greedy, remember that you can’t earn all the money in the world. If we talk about traditional professions, then, as a rule, the more time a worker devotes to them, the more profit he can make. For example, if you take an extra shift, a taxi driver or baker will receive double pay.

But in the case of the stock market, the situation is the opposite.

Spending many hours and days at work without a break, you begin to make mistakes, cannot assess the state of affairs objectively and succumb to emotions. There is no need to carry out numerous operations in a short period of time. So, for options trading, the recommended limit per day is 8 positions maximum. If you are a participant in the stock market, the number of daily transactions should be completely reduced to one. Weekends for a trader (Saturday and Sunday) are rest time, since the exchange is closed. The only exception is the work schedule of options traders. Due to the fact that they can make money on minor exchange rate fluctuations, they also have the opportunity to work on weekends.

How the auction works

The main link of the stock market is the trading organizer, without whom the purchase and sale of securities would be impossible. The largest Russian players are RTS (options, futures), MICEX (stocks). To conclude transactions, the investor must have a license - it is issued after completing training. You will also need to make an entry fee of 3 million rubles and pay for the software. Such requirements are explained by the seriousness of the platform and exclude the participation of random persons in trading. You can also trade through a broker. In this case, you will pay subscription service and commission for each transaction. After the start of trading is announced, bets are placed and indices are evaluated.

How to start trading in the stock market yourself

Trading in stock markets begins with choosing the field of activity and instruments for trading. Further:

- Choose a broker - the person through whom you will enter into transactions.

- Open an account in your chosen currency.

- Deposit money for it.

- Open trades.

Without the appropriate knowledge and skills, effective trading is almost impossible. It is highly advisable to undergo specialized training - this can be done at any specialized organization, at a brokerage company, for free online. The more you know about how the market works, the more likely you are to win and the less likely you are to fail.

Features of the stock market

The stock market has a number of features:

- Full transparency of stock market operations. All transactions on securities on the stock market can be viewed in real access, you can find out who bought shares and at what price, for example, or sold them. This is necessary in order to maintain the trust of potential and actual market participants; the more transparent the information on transactions, the greater the trust in the market;

- Regulation of the stock market by the state. Control and regulation of all transactions occurring within the stock market occurs under the supervision of the Federal Service for Financial Markets. This is necessary so that the market client, in the event of an unforeseen or unusual situation, can remain under the protection of the state and, with the help of this service, resolve the conflict. In addition to the Federal Finance Service, the stock market is also regulated by the Civil Code of the Russian Federation in the Law “On the Securities Market”;

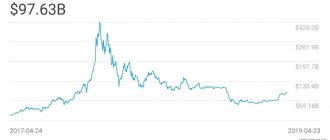

- Constant development of the stock market. In the current economic conditions, the stock market is constantly growing and developing. If you look back a few years, you will also notice that there were not as many transactions with securities as there are today, and the amount of assets on the market has also increased significantly. In terms of the composition of assets, one should also note the trend of foreign capital in the stock market, it is growing. Foreign investors are actively interested in securities transactions on the Russian market and monitor the progress of changing economic and political events within the stock market;

- The stock market is more likely to generate income than other markets. Many experts note that stock markets are a good source of income with fairly minimal risks. Most also say that working with securities is much more convenient and enjoyable than working with real currency or long-term investments;

- A single price for securities on the market. Many stock market players talk about such an advantage as the cost of securities, it is uniform, so you can buy the same share from different sellers, but at the same cost, which has a good effect on the players’ transactions on securities;

- All stock market transactions are legal. All transactions with securities on the market are subject to state control, and, therefore, all income from transactions is completely legal. It is worth noting that the state is also responsible, like the stock market itself, to market participants. Usually, players do not have any questions or problems regarding all procedures related to tax authorities, banks, since all responsibilities for these issues are assumed by the broker together with market managers.

Finished works on a similar topic

- Coursework Features and functions of the stock market 400 rub.

- Abstract Features and functions of the stock market 270 rub.

- Test work Features and functions of the stock market 250 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Thus, the main features of the stock market give a general idea of how to work in the market, what guarantees the stock market gives to its players, what transactions are subject to control, the advantages and disadvantages of securities transactions.

Tips for stock market participants

For beginners, trading on the stock exchange is not an easy task, but if you act wisely, you will not lose money:

- Know what you're investing in - if you understand what you're dealing with, how the field works, it will be much easier to achieve the required results.

- Diversify your funds - if you have a lot of money, you need to divide it into different deposits and baskets. Luck cannot always be with you, and this way you won’t lose everything.

- Be disciplined - this is the basis for success. Set goals and create a plan to achieve them.

- Spend less than you earn - life at the limit is exhausting and encourages you to do unreasonable things.

- Don’t give in to emotions - calculation and a strict sequence of actions will help increase your financial portfolio.

Be sure to undergo training - without it it is difficult to understand what's what. There are many short-term programs that will be enough to get you started.