How can I withdraw an overpaid bank card without a passport and do I need it again?

Photo: thumbs.dreamstime.com

The first overpaid card has appeared in the USA to simplify access to unprepared distributions, and today it is spreading in many countries around the world. Considering the main capabilities of a regular bank card, its main advantage is preserving the anonymity of the cardholder. About the advantages and disadvantages of prepaid cards, as well as why they are issued in Ukraine, - further in the statistics.

What are prepaid cards, their advantages and disadvantages

Prepaid card (English: Prepaid card) – a bank card, for registration of which you do not need a passport or IPN. A prepaid card can be plastic or virtual, and for its registration it often requires a phone number. Dads issue a prepaid card for their children. In addition, they can be used as a gift instead of cooking.

Prepaid cards of Oschadbank

Advantages of a bank card without a passport:

1. Availability . To issue a prepaid card, you do not need to be a client of the bank, and you can buy it in a store or at a gas station instead of a regular card. Card activation is available 24/7; this card does not require an ATM or terminal

2. Protection and confidentiality . Since the card is not linked to a bank account, customers will not be able to quickly access the card’s special data. This will ensure the confidentiality of all financial transactions.

Shortages of prepaid- “plastic”:

1. Service fee. Commissions may be charged both for servicing the card itself and for carrying out operations, including withdrawals and transfers of funds, checking the balance and rendering the card inactive

2. Obrezhennia at vikoristanny. A prepaid card issued in Ukraine cannot be processed beyond the border: you will not be able to cancel the payment, transfer money or pay on a foreign website

3. Limit on financial transactions. A number of costs can be removed from the cards. In addition, there is a limit on carrying out operations in the river, and there is also a limit on the amount that can be used for storage.

4. Subject to credit. Since the card is not linked to a bank account, the owner cannot get a loan quickly.

5. Unreliability. Bones can be lost as soon as the card is spent or the term is completed. Issuers of prepaid bank cards have already found a way to steal the client’s “plastic”, for example, the Uplata card, which will be presented in cash, can be blocked directly in the add-on. And koshti are transferred to another level.

6. Problems with Internet banking. Some banks offer the ability to manage a card via Internet banking, although for this you need to create a separate account account

Why is verification necessary?

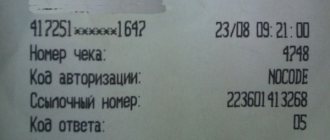

To consider this issue, let’s immediately imagine a possible situation in the process of cooperation with the company. So, the user transfers funds to the balance and begins to enter into transactions. Profit increases, capital grows. On one of the working days, after going to your personal account, your balance is 0.

Where did the funds go? The first steps are to contact technical support. Where the manager reports that last night you withdrew all the funds yourself. But you know that you did not carry out this kind of operation at night. In this case, there are checks confirming the transaction. It turns out the account was hacked and the money was withdrawn.

Who should worry about financial security? First of all, the user himself:

- Create a strong password (numbers, lowercase and uppercase letters, symbols).

- After completing the trade, log out of your personal account, even when working on your home PC.

- Forget about autosaving your password in your browser.

Each trader can use all these methods independently. The brokerage company is able to protect clients from possible hacking by undergoing a mandatory identity verification procedure.

Therefore, it is stupid to have a negative attitude towards the request of a company consultant to provide documents and additional receipts.

Also, most often, in order to obtain a license from a trusted regulator, the company undertakes to fulfill all the conditions prescribed by the auditor. So, verification is considered one of them. Since the broker undertakes to provide documentation on trading turnover, waste, profits, losses, etc.

Cooperating with a company that does not have a license is a risk.

How prepaid cards appeared in Ukraine: History of the first prepaid card

The first Ukrainian prepaid card Stuka

Analogues of prepaid cards - gift cards - appeared in the USA back in the 70s. At the beginning of the 2000s, VISA and American Express presented their first project, in which fathers could more effectively control the expenses of their children. Even before 2009, the number of transactions for prepaid cards amounted to $1.3 billion.

In Ukraine, the first overpaid “Stuka” card was issued in 2013. Having submitted the liquidation data to Fidobank. The card was issued in a mobile app and sold in bank branches, at gas stations and in stores. In 2020, Bank Mykhailivsky released “Electronic Gamanets”. The card did not have a mobile card, and no documents were required for its registration. Rick then Wallet Card and Teen Card introducing Unison Bank. In 2020, FUIB issued a card in the form of a sticker, which could be glued to the phone for any ready-made payment with a smartphone.

In 2013, the first festival card appeared, issued by Alfa Bank for the Alfa Jazz Fest (also Leopolis Jazz Fest). With this help, additional workers could carry out unprepared work on the festival grounds.

The trend of prepaid cards in Ukraine is obvious – new branded “plastic” for festivals and not only appears. Companies that issue such cards recognize that they have an important social mission.

At what stage of development Ukraine needs such maps. According to various data, 30% to 52% of Ukrainians in their prime century do not have bank accounts... Quickly, safely and comfortably, this problem can only be solved with the help of prepaid cards. Banks won't fit in. They need our help. This is the path Europe has taken, and we need to take a new path.

Valery Skrypnyk, CEO of Uplata

Anonymous bank cards: PrivatBank, Oschadbank, Alfa-Bank and others

Map of another type Uplata

Map of Zruchny Pripad Banka Vostok

Alfa-Bank Festival Card

Virtual prepaid card for PrivatBank

Dityach's card was overpaid to Oschad

Festival prepaid card for Oschadbank

“Hospital map” FUIB

A further expansion of prepaid cards in Ukraine will follow the launch of Apple Pay and Google Pay. PrivatBank and Oschadbank issued virtual cards that allowed access to contactless payment services to those people who do not yet have a bank account. With the help of these cards, you can make NFC payments with your smartphone, as well as make purchases on the Internet. In addition, the Oschadbank card can be used for the Oschad Pay system. Oschadbank also has physical Visa Prepaid cards for children and special festivals, as well as other bonuses.

Another reason for the active introduction of prepayment cards was the need for unprepared distribution at mass calls. Thus, in addition to the well-known festival card from Alfa Bank, later analogues were issued by Oschadbank (for Atlas Weekend, VDNKh, Ulichnaya Eda and Eurobachennya), TAScombank (for the Odessa International Film Festival), PrivatBank (for the BeLive festival), FUIB (for Eurobachenya suppliers, Westland, Ostrov, UPark, MRPL City and “Patient Card” for fans of FC “Shakhtar”). The electronic payment service Uplata also prepares its prepayment card before issue. Now the “plastic” has to undergo further testing.

We held an intimate presentation of the card at iForum 2020 (with the option of purchase). We expect that in June 2020 the card will be available to a wide audience; it can be purchased on the website uplata.ua. Also, the card will begin to appear in stores starting in June. People will be able to find out in which stores it will be available in the Uplata application.

Valery Skripnik, CEO of Uplata

What services can be obtained after mandatory verification?

Each Forex dealer has its own conditions for registration. For example, it is impossible for Finam to even open a personal account online without documents. To do this, you will definitely have to visit the forex dealer’s office with a full package of personal documents, passport and identification code.

As for other brokers, you can use the following services without going through the verification procedure:

- Some companies provide the opportunity to top up your account and trade on the real market, and provide documents only before submitting an application to withdraw your profit.

- Almost all DCs allow you to trade on demo accounts without verification.

- Unverified clients have access to analytical and training services of companies.

- Some brokers give a no deposit bonus or a bonus on the first deposit, even if the client has not yet provided his passport in the application form.

- Unverified traders can also take part in various competitions held by the DC.

- Clients of brokerage companies can start investing in trust management services without providing a passport. Although, when withdrawing profits, the DC will require verification.

That is, traders can safely use most of the broker’s services without verification, but only until the withdrawal of funds.

There is no need to worry that the documents will be used in any fraud. Despite the fact that when downloading copies, the user consents to the processing of personal data, this information will be used only for its intended purpose. To be sure of the security of your personal data, you should choose trusted brokers who have licenses and have been working in the market for a long time.

Where and how to get a bank card without a passport in Ukraine

Festivalna prepaid card to Taskombank. Photo: oiff.com.ua

In Ukraine, prepayment cards will continue to be actively used for unprepared use. Thus, in 2020, Oschadbank sold more than 5,700 such cards at the Atlas Weekend festival. Successful sales are not forced to pay expensive tariffs to the bank, including paid issuance, paid SMS information and the unpopular commission “fee for unsuccessful transactions”.

The right to issue prepaid cards is available to 15 active financial institutions in Ukraine. Aside from the fact (not during the festival or otherwise), today in Ukraine you can issue physical prepaid cards for Oschadbank, Bank Vostok and Uplata (for now only after advance payment).

How to issue plastic prepayment cards

| Oschadbank | Bank Vostok | Uplata | |

| Name of prepaid card format | “Dityacha” prepaid card, MasterCard payment system | “Zruchniy Prepaid” card, MasterCard payment system | “Insha” card, Visa payment system |

| De formalize | In the meantime, you can select or remotely on the website a bank with immediate delivery | At a branch of Bank Skhid in Kharkov | order on the website uplata.ua, given - sales in the network of partner stores |

| Need documents for registration | No, just a mobile number | No, just a mobile number | No, just a mobile number |

| Release date | 75 UAH | 15 UAH | 100 UAH *insure on balance |

| Term dii | 3 rocks | 3 rocks | 3 rocks |

| Variety of service | Inactive card (with cash per month, or without operations for 3 months) – 10 UAH per month. If the surplus is less than 10 UAH - the amount is collected one-time, without the appearance of debt | 4 months after the card expires, if the balance on the card is less than 200 UAH, a monthly fee is set in the amount of the balance on the card | For free |

| Release term | 7 days | Maximum 14 days | Mitevo |

| Yak activate | For additional help, voice menu via the contact center | SMS for further help | SMS for further help |

| Options Wikoristannya | For a special gift, for transfer to other treasurers (children, friends or acquaintances as a gift) | For a special gift, for transfer to other treasurers (children, friends or acquaintances as a gift) | For a special gift, for transfer to other treasurers (children, friends or acquaintances as a gift) |

| Why do Vikoristovate? | For payments in stores and online sites registered in Ukraine For transferring funds to other cards | For payments in stores and online sites registered in Ukraine For transferring funds to other cards | For payments in stores and online sites registered in Ukraine For transferring funds to other cards |

| NFC payment tips | є | є | є |

| How to top up your card | At Oschadbank branches, ATMs and self-service terminals without commissions On the Oschadbank website and through Oschadbank 24/7 | Through Internet banking, through additional self-service terminals for Bank Vostok, in the cash register of Bank Vostok | Prepared in PrivatBank and Uplata terminals, in partner stores. Cost-free replenishment through the website and Uplata add-on |

| Limit on cash withdrawals | 500 UAH per day, up to 4 thousand UAH per month, 62 thousand UAH per month | 500 UAH per day, up to 4 thousand UAH per month, 62 thousand UAH per month | 500 UAH per day, up to 4 thousand UAH per month, 62 thousand UAH per month |

| Renewal limit | 14 thousand UAH | 14 thousand UAH | 14 thousand UAH |

| ATM bank commission for withdrawal of funds | 2% | 1% | 10 UAH |

| Commission of ATMs of other banks for withdrawal of funds | 1.5% + 5 UAH | 1% | 10 UAH |

| Commission at the bank's cash desk for withdrawal of funds | 2% | 1% | 2% |

| Commission in the cash register of another bank for withdrawal of funds | 1.5% + 5 UAH | 1% | 10 UAH |

| Commission for additional preparation | 0 UAH | 0 UAH | view 10 UAH |

| Commission for replenishment of unprepared goods | 2% min 50 UAH | 0 UAH | 0 UAH *via Uplata.ua service |

| Commission for transferring funds to cards of other banks | – | 5 UAH | 1% |

| Additional possibilities | access to internet banking | access to internet banking | Control via add-on for iOS and Android |

Client verification: when will the data from a bank card fail to be verified?

All these bank card verification steps seem simple and easy to follow. Moreover, this whole process takes about 10 minutes. However, there are several common mistakes that can prevent you from successfully verifying and completing your application.

| Inactive bank card. The first reason will arise if you received a new card or reissued it and did not have time to activate it. In this situation, you need to contact the bank and find out how to activate it. The second reason may be the expiration of the card. In this case, you should look for a loan without a bank card. |

| Limit on the card. When issuing a card at the bank, a monetary limit is set for the client. This will be the maximum amount you can receive by transfer. For example, the limit on the card is 10,000 hryvnia, but from a credit company you take out 15,000 hryvnia. The bank will analyze this information and reject the verification. Before taking out a loan online, you should additionally check the limit of your bank card. |

| Errors when entering the card number. This situation seems strange, but often applicants make mistakes when writing the long code that is located on the front of the card or when indicating the CCV code. Therefore, it is worth checking this data several times so that verification is successful the first time. |

The verification procedure is done only during the first loan application. This data remains in the financial institution’s system and will not be requested when you apply again, and you will be able to get a loan without calls even faster. However, if you want to change the account in your personal account to another, you need to verify the added card again.

This entire process is automated and verified through special systems. Therefore, it is worth checking in detail the correctness of the personal data provided in the application. If the bank card on which the loan was issued was stolen, you must immediately contact the bank to have it blocked and report this to the credit company.

How to get a virtual card

| “Instant” Oschadbank card | PrivatBank virtual card | |

| How to apply | Through the bank's contact center | Through the Privat24 application |

| Release date | Bezkoshtovno | Bezkoshtovno |

| Availability of service at rik | Only for SMS information, if this function has been activated | Card servicing (with a fee for storage, or without operations for 12 months) – 10 UAH per month |

| Yak activate | The chatbot sends an SMS when it arrives | You need to confirm your registration with Privat24 via e-mail or Facebook account and then follow the instructions that you receive in the list by mail |

| How to become a vikorist | For payments in stores and Internet sites registered in Ukraine, For payments for services through Internet banking Oschad 24/7 For payments for services through Google Pay and Apple Pay | For payments in stores and Internet sites registered in Ukraine, For payments for services through Internet banking Oschad 24/7 For payments for services through Google Pay and Apple Pay |

| NFC payment tips | є | є |

| How to recall the map | From cards to any bank on the Oschadbank website From other cards to Oschad 24/7 (add-on or web-banking) At terminals and cash registers you are assigned to Oschadbank | From cards to any bank on the Oschadbank website From other cards to Oschad 24/7 (add-on or web-banking) At terminals and cash registers you are assigned to Oschadbank |

| Limit on salary | 500 UAH per day | 500 UAH per day |

| Commission for additional preparation | 0 UAH | 0 UAH |

| Commission for replenishment of unprepared goods | 2% | 0 UAH |

| Commission for transfer of funds | To a credit card to Oschadbank – 3 UAH; To Oschadbank card for Wi-Pay – 3 UAH; To a prepaid card – 3 UAH | On a PrivatBank credit card – 0%; To PrivatBank card for Wi-Pay – 1%; On a prepaid card – 0% On cards from other banks – 1% (min 5 UAH) |

The issuance of festival cards for Alfa Bank, Oschadbank, TAScombank, PrivatBank, FUIB is carried out directly on the territory of entry.

READ ALSO - Cashless in Ukraine: TOP-3 festival cards of the summer