The world of cryptocurrencies does not end with just one digital coin – Bitcoin. There are also so-called altcoins. But not everyone knows what they are. That is why we will try to give a clear explanation that this is an altcoin.

In principle, those who are familiar with the world of cryptocurrencies will easily understand what altcoins are. These are all the other coins that appeared after Bitcoin. Essentially, altcoins are alternative coins, that is, coins. This is the name of almost all cryptocurrencies that compete with Bitcoin. But this is a very generalized statement that does not quite reflect the essence of what is happening. However, even if most people no longer freak out at the mention of Bitcoin, the word “altcoins” still raises eyebrows. In fact, this is not just another cryptocurrency, but a variety of them. So altcoins are everything that is not Bitcoin. But let's take a closer look.

What is an altcoin and what is the alternative?

As already mentioned, the word “altcoin” is an abbreviation for “Bitcoin alternatives”. Simply put, this is what all cryptocurrencies are called, with the exception of Bitcoin. The fact is that most or even all cryptocurrencies were created in order to replace, improve or complement Bitcoin. Many of these attempts were unsuccessful, but there are also examples of truly successful solutions. After time, one secret of success can be identified - the main thing is not to try to copy Bitcoin by making some small amendment; original cryptocurrencies that are distinguished by serious changes or are even original become successful.

In addition, cryptocurrencies are often called alts. Today there are thousands of cryptocurrencies, and new, unique altcoins are being developed every day. Some of them are little more than Bitcoin clones, changing only one or two small features, but others are original. As a rule, their originality concerns such characteristics as:

- The speed at which transactions take place on the network . This allows users to significantly improve the main purpose of the parent blockchain - to speed up transactions. Today, Bitcoin users are forced to wait too long for a transaction to occur. In particular, the waiting period sometimes ranges from two to three hours to a whole day. And sometimes the transaction does not go through at all. Often this problem is due to the fact that Bitcoin is only designed for seven transactions per second. He simply cannot process any more. When the popularity of Bitcoin was small, this suited everyone, but today, when the needs of the network are much greater, even the recent attempt to correct the situation has not had a significant effect.

- Hash algorithm . This is one of the most important components of cryptocoins. Many of them operate on an algorithm identical to that of Bitcoin (SHA-256). But there are other coins. Among the alternatives there are many cryptocoins that work on scrypt. Among the most famous are Litecoin. Block generation in this system occurs in two and a half minutes, which is four times faster than Bitcoin. Thanks to this, the transaction speed increases. In addition, there are coins that work on X11, X13, X15, NIST5. Among the most famous altcoins of this type is Ethereum. This digital currency is open source, which greatly simplifies the implementation and improvement of blockchain technologies,

- A method that distributes coins on a network . The main way to receive altcoins is to accept them as payment. In addition, they are distributed on cryptocurrency exchanges. You can get more coins from the developer. That is, when a new altcoin is created, the developers give them away completely free of charge. This is necessary so that as many users as possible learn about cryptocurrency and new investors are attracted. In addition, coins can simply be purchased when they are at the development stage,

- Mining algorithm . Bitcoins are mined, which means mining altcoins is possible. To do this, you will need to buy special equipment, in particular, several powerful processors and video cards. In addition, special miner programs will be required. Each cryptocurrency has its own equipment and program, which is why it is so important to choose them correctly. But there are coins that cannot be mined. The fact is that the creators released all the money into the network at once, so mining as a mining option is not required,

- Many altcoins have their own principles of operation . But in almost all cases, altcoins operate on a decentralized blockchain. However, they have their own characteristics that differ from the parent principle of Bitcoin.

Most of these coins disappear almost immediately after they appear. But there are still successful altcoins. An example of such a successful project is Litecoin. It was he who became one of the first altcoins. In particular, compared to Bitcoin, Litecoin has a different mining algorithm, and the number of coins is significantly larger than that of its parent system. Therefore, Litecoin was given the title of “silver”, and Bitcoin was given the “gold” of the cryptocurrency world.

And if you are looking for an altcoin that has significant differences from its parent coin, then there are many of them too. During their creation, significant changes were made to the Bitcoin source code.

Among these coins we can highlight Darkcoin. This altcoin was created with the goal of providing the Bitcoin platform with technology that ensures complete anonymity of transactions. Interestingly, there is also Bitshares, which positions itself as something similar to Wall Street, but only for digital currencies. There is also Ripple. This cryptocurrency was created to enable simple currency payments within the banking network.

Despite the fact that not all Bitcoin fans consider altcoins a necessary phenomenon, they exist, and we must accept this as a fact. They believe that altcoins are absolutely unnecessary, since they will not be able to compete with the developed Bitcoin infrastructure. Nevertheless, it is impossible to deny that today alternative cryptocurrencies make up a significant part of the market. In particular, thanks to alternative coins, the decentralization of Bitcoin itself is improved, and it is possible to experiment with various developments without affecting expensive currencies.

Historical reference

After the emergence of the world's first cryptocurrency, the appearance of altcoins was only a matter of time. What are alts in cryptocurrency? As already mentioned, these are coins that are something like daughter money. Simply put, these are alternative currencies that were made based on Bitcoin, but with the goal of replacing it, improving it, or using it in another area.

Among the wide variety of altcoins that have appeared throughout the history of cryptocurrencies, there are several of the most famous. Let's look at the very first and brightest representatives of alternative currencies:

- Namecoin . Since this is the first alt, we couldn’t help but think about it. It was created in 2011 to serve as the basis for the creation of the DNS (Domain Name System). The main property of DNS is that this system cannot be controlled. To mine these alts, you do not need anything other than the devices used for mining BTS. These two processes take place in parallel.

- Litecoin . If you are looking for the most successful altcoin, this is in front of you. The coin works thanks to Scrypt. It is distinguished by properties that allow transactions to be carried out with amazing speed. In addition, the block has a limited database. And finally, the system produces no more than 84 million coins. But the infrastructure in Litecoin is not sufficiently developed, which is probably why the cryptocurrency is inferior to Bitcoin. However, LTC coins are already accepted in a small number of stores, although there is no ATM network at all. But given the huge exchange rate and high capitalization, this is temporary.

- DOGE or Dogecoin . Another coin that uses the Scrypt algorithm for its operation. What is especially interesting is that this currency was created as a joke. But despite this, the dog coin quickly gained popularity not only among users, but also among serious investors. Therefore, it is not surprising that altcoins spread quite quickly on the network. Probably, as many believe, the popularity of this cryptocurrency is that it has a rather original logo. Users see a picture: a cute Shiba Inu dog (breed). Today there are more than one hundred billion coins and the issue continues to this day. The system has a low transaction price, in addition, financial transactions receive instant confirmation. And users who mine coins also receive LTC along with doggies.

There are indeed a lot of coins, making it very difficult to see everything. There are more than three thousand cryptocurrencies, but these are the most popular altcoins created a long time ago or relatively recently.

The difference between alternative coins and Bitcoin

Among the alternative digital coins, there are already several hundred truly popular or promising altcoins. Of course, there are many similarities between Bitcoin and its alternatives, but there are just as many differences.

The first is a hard fork. When a hard fork occurs, Bitcoin maintains its current distribution of coins, as it was at the very beginning of the creation of the network. Simply put, users will not lose money. Modern altcoins can make new coins in the same way. Although a hard fork is not the only option, because most often everything happens through mining. And if mining is not suitable for the coin, then a crowdsale or any other mining mechanism will do. By the way, a hard fork that occurs on a certain block arouses much more interest among users than other methods of coin distribution.

Principle of operation. This means that the consensus process for Bitcoin and other cryptocurrencies that appeared later may be quite different. Let's look at them in order:

- Proof-of-Work or PoW . Many have heard of it as proof of work done. Proof-of-Work is a principle that protects the system from DDoS attacks and spam. Its basis is the execution of complex mathematical problems. But thanks to it, it is possible to quickly and relatively correctly draw conclusions about the result of the transaction. According to it, each block has a hash from the previous block that forms a chain. It is impossible to change or adjust blocks, but it is possible to create a new one. Thanks to this, the blockchain is considered very secure. This scheme works on Bitcoin and not only, but many altcoins use an alternative.

- Such an alternative, or rather, one of them, is PoS (Proof-of-Stake) - proof of ownership. This consensus mechanism was implemented in 2012. This was done in the PeerCoin cryptocurrency. Its essence is that special shares, the so-called stake, are used as a resource, which makes it possible to find out who has the right to the next block. Using this algorithm, in order to confirm the next block, you need to have as much money in your account as possible. This allows you to avoid an attack, since it requires a lot of resources to carry out it. But there is also a drawback, namely the threat of decentralization of the network.

- Delegated Proof-of-Stake is delegated proof of ownership. Unlike PoS, the DPoS protocol is considered more efficient due to its decentralization. The peculiarity of the method is that if someone behaves incorrectly online, breaks the rules, or something like that, then they can simply be excluded.

- Proof-of-Activity is proof of activity. This system is of a hybrid type, including PoW and PoS.

- Proof-of-Burn , or confirmation by burning. This process involves sending coins to an address from which they cannot be withdrawn or otherwise spent. This is called "burning".

- Proof-of-Capacity , or proof of resources. The principle of this process is to exchange megabytes for resources. Altcoins that work on this principle, unlike Bitcoin, are mined only after a sufficient amount of disk space has been freed up.

Crypto-master strategy on Binomo

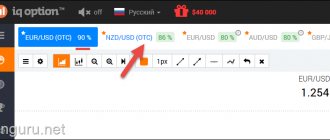

Since this system is an indicator system, for trading you will need not only the presence of crypto assets on your broker’s platform, but also a set of technical indicators that can be installed directly on the price chart and configure the parameters of their operation. As such a trading platform, for the most correct examples of determining trading signals, I will use the platform from the Binomo broker - it is equipped with the proper functionality and ensures the most profitable use of this strategy.

So, in order to build the “Crypto-master” TS template on the chart, you need to select a digital asset in the market of which there is a pronounced trend - this will increase the cyclicality of the strategy signals. In my example, I will use BTC/USD (Bitcoin paired with the dollar). Then you should apply a set of indicators to the chart, the settings of which are specially selected taking into account the specifics of the crypto market:

- MA - Exponential type, period 20

- MACD - settings unchanged

- RSI - extremes - 70/30, standard frequency

This strategy will work perfectly both on the M1 and M5 chart intervals, but it is highly not recommended to trade the system on second time frames - in this case, the accuracy of the strategy signals is significantly reduced. In my example I'm using the M1 interval.

After all the necessary settings, markings will appear on the chart, which will be displayed as follows:

Points for and against"

Everything new is always met with distrust, even if it contains something good. This happened with cryptocurrencies that appeared after the founder of this trend - Bitcoin. But this does not mean that, due to prejudice, altcoins should be abandoned altogether.

Bitcoin fans believe that it is more than enough, and nothing else needs to be done. But apparently, they do not quite understand the essence of cryptocurrency and the features of working with Bitcoin. The need for altcoins has been long overdue. The point is the BTC community, which is expanding every day.

Based on this, the load on the Bitcoin network also increases. Blockchain can no longer cope with the load that has fallen on it due to the increased number of users. In this regard, the number of complaints from users who are dissatisfied with the speed of transaction processing is also growing. We want transactions to happen instantly, but the Bitcoin blockchain simply can't handle the challenges that quickly. Developers do not have time to react, and meanwhile problems continue to accumulate.

In this regard, it is easier to create something new than to transform Bitcoin for the millionth time. So let's look at the pros of altcoins:

- First of all, it is important to consider that Bitcoin is the first decentralized cryptocurrency. But the principles of decentralization embedded in it are not the best option. So so far the goal set for Bitcoin has not been achieved. But altcoins have a chance to improve the subsequent process of decentralization of the community formed by the cryptocurrency.

- The second fact “pro” of altcoins is that they allow you to conduct various experiments with cryptocurrency in order to assess how it will behave under certain circumstances. New coins are given unique characteristics to see whether they will work as the developers expected or not. It is at least unwise to conduct such experiments on Bitcoin, which is why alternatives are being created. If something takes root, Bitcoin can copy the innovation, of course, if the community and developers agree to it. So, full-fledged altcoins are something like a laboratory for Bitcoin, even if they have now become an independent unit with a very real price.

- Well, the last pro factor is that thanks to altcoins, healthy competition appears on the market. Of course, for now it is impossible to compare even the second most popular coins with Bitcoin. But over time, experts say, that could change. And there are strong preconditions that this will happen in the coming years. This encourages Bitcoin developers to work more actively on the cryptocurrency so that it does not become outdated and does not leave the list of current digital money, pushed out by younger and more sophisticated competitors. It is already common for users, considering Bitcoin to be not good enough, to switch to altcoins.

But there are also arguments against altcoins. In particular, the following stand out most clearly:

- Most altcoins do not have such a wide infrastructure as Bitcoin, which is the main argument against this money among people who do not recognize alternative coins. But the fact that many cryptocurrencies operate exclusively in the virtual world is only a temporary phenomenon. Bitcoin is older and has already gained trust. Besides, he had no competitors when it all started. Today there are more than a thousand different cryptocurrencies. Naturally, it is more difficult to create an infrastructure for each of them.

- Many altcoins, and even Bitcoin is no exception, are accused of illegal transactions. In particular, for maintaining secret accounting. For example, Dash and Monera cannot be traced even through the blockchain, so transactions on them can pose a threat. Criminals can sometimes be smart, too, and they quickly realized the benefits of complete anonymity and relative accessibility of cryptocurrency transactions.

In addition, there are many more absurd arguments, but we will not give them. Of course, all cryptocurrencies have certain risks, but we cannot refuse a competitive market.

Benefits of Trading Crypto IDX

In addition to the already mentioned liquidity and high profitability ratio, be sure to note:

- Resistance to sharp volatility caused by fundamental factors . Cryptocurrencies, unlike any other asset, do not have regulatory authorities and are not tied to the economic situation of a particular country. Thus, there are no and cannot be publications in the economic calendar that affect the quote of a particular crypto asset.

- Crypto index trading is also available on weekends . Trading and calculating the value of crypto coins does not stop on weekends. And accordingly, the index value will also change, opening up opportunities for trading.

- Ease of analysis due to the homogeneity of assets included in the calculation . At first glance, it seems that due to the large number of factors used in calculating the index, chart analysis is greatly complicated. But in fact, the correlation between cryptocurrency charts is obvious. For example, Bitcoin and Litecoin are influenced in a similar way by the same factors, which means the movement of the charts will be similar. We can say that Crypto IDX is an average situation in the cryptocurrency market.

- A large number of auxiliary tools . Cryptocurrencies, as a group of assets, are extremely popular among traders and investors. Almost any website for traders has regular analytics of the cryptocurrency market, as well as informative statistical widgets that can also be used for analysis.

The uniqueness and limited access to the crypto index are also worth noting as important advantages. Crypto IDX is only available on the Binomo platform, which means its value cannot be affected by large positions of banks and hedge funds.

Investments in altcoins

The cryptocurrency market is very unstable. All this is because the first coins appeared only recently and simply did not have time to stabilize. In addition, most coins are not backed by anything, just like their progenitor - Bitcoin. But the market is emerging, and people are increasingly thinking about investing fiat money in digital money.

But it should be remembered that a wrong investment can cost the investor huge losses. Even Bitcoin, the most stable cryptocurrency at the moment, has problems with price fluctuations. However, the high volatility of altcoins is their main distinguishing feature. You can play on this to make money, which is what traders do.

Although, by studying certain trends, it is possible to identify altcoins that are more or less stable. To make the right choice, the following factors must be taken into account:

- Market capitalization . If a coin has a low price, the altcoin is more subject to speculative influences, so the rate can often jump. With Bitcoin, it is much more difficult to speculatively carry out an artificial price jump due to its record high capitalization. But we are not saying that this is impossible. Today, fluctuations in the Bitcoin exchange rate are a common occurrence, and cryptocurrencies with large capitalization may be subject to exchange rate fluctuations, as they are affected by other factors,

- Availability of large coin holders . If someone has 1% or more of the total number of altcoin crypto coins, he can really influence the rate. That is, if an altcoin has many wealthy cryptocurrency holders - “Whales”, they can have a significant influence on trading platforms. The way it works is that when “Whales” buy a lot of coins, they create a hype around the currency and its price rises. And when the rate soars, the “Whales” sell a large number of coins, due to which their price falls, and the “Whales” make a profit. This is how the Pump and Dump of the cryptocurrency rate are formed,

- Possibility of long-term investment . To avoid the risk of Pump and Dump, you can look for coins that are favorable for long-term investments. That is, they must demonstrate a positive trend in the market for a long time. Of course, this is very risky, because cryptocurrencies are generally unstable, but it is possible to find alts with positive dynamics,

- Community . It is desirable for a cryptocurrency to have a large community that can influence the decisions made by developers,

- High liquidity on exchanges. The more and more actively exchanges work with altcoins, the better.

- Developers . Of course, all cryptocurrencies have developers, but now we are not talking about their actual presence, but about the actions of developers to improve the functionality of coins.

For a clear example of how to choose a cryptocurrency, here is a table on the CoinGecko website. Here you can see already ranked altcoins, taking into account all the above parameters, and select a coin for investment:

In addition, when investing in cryptocurrencies, you need to know a few rules:

- Avoid hype that is promoted by some communities.

- Investments should only be made in coins that are familiar to you. If you don't understand what an altcoin is, investing in it is unwise.

- Never make an investment if you can't afford it. Be smart about how much you can invest so you don't lose all your money.

- If possible, invest in multiple currencies.

How to make money by trading an asset?

To make money by trading cryptocurrency with Binomo, you need to open the platform and select an asset from the list. Next, the quotes will display a price chart on which you can find the moments to enter the market with a certain position. There are quite a few profitable strategies for trading cryptocurrencies.

However, it is easier not to conduct experiments, but to use simple oscillators that are available on the broker’s trading platform.

First you need to set the M1 timeframe, and then use two indicators:

- MA with period 5;

- RSI (overbought/oversold - 50, period - 5).

Next, you can analyze the value curve and try to find entry points into the market with a certain position. Even a beginner can do this, because the tools are easy to use. Even a beginner will notice their signals. It is enough not to leave the monitor, carefully watching the price chart and tracking the signals.

Important! With MA it is easy to notice price fluctuations. RSI makes it possible to identify a pullback, as well as the duration of a trend. Thanks to this, you can enter the market and also close contracts with profit.

It is recommended to enter the market when a stable trend has formed, a MA candlestick breakout appears on the quotes, and the scale crosses the value of 50. Contracts should be opened with a duration of five minutes.

The strategy for trading the crypto index on Binomo is completely simple. It allows you to close more than 85% of contracts with a profit. Naturally, false signals will appear on the quote chart, because constant positive trading is unrealistic. All instruments operate using historical data, so losses cannot be excluded. To reduce them, it is advisable to work for some time in the demo mode of the trading platform.

On the educational version of the platform you can try out the best CT or develop your own methodology. In any case, you will get to know the new contract and then evaluate its pros and cons. This will help you quickly navigate the market situation, closing more positions with profit.

Which altcoins are the most popular today and why

Even though altcoins are the little brothers of Bitcoin, this does not mean that the coins do not have the opportunity to become popular. Some coins are rapidly gaining popularity and, if you believe the forecasts of experts, soon some of the alts listed below will push Bitcoin from its heated place.

- Ethereum (Ether) . It is currently the second most popular cryptocurrency, which is important considering that Ether is only three years old. The rate of this altcoin is $1.404, and its capitalization is $136,182,098,641. It is not surprising that this altcoin has received the status of the most dangerous competitor to Bitcoin. Experts point out that the reason for this popularity is that this altcoin can be exchanged for dollars without first converting them into bitcoins, as is necessary with many other cryptocurrencies. In addition, the demand for Ethereum can be associated with the fact that it does not have a limited emission. So mining is not hindered by anything.

- Litecoin . Despite the fact that this cryptocurrency now ranks only sixth in terms of capitalization, since it is the first altcoin in history, we could not help but use it in the list. At the moment, the Litecoin rate is $248, which is noticeably cheaper than Ethereum or Bitcoin, which is its main advantage. The fact is that a potential investor will be forced to pay much less than if he were buying something more expensive. In addition, we must not forget about the constantly growing capitalization of Litecoin. Today it is already $13,587,615,764.

- Monero . Most altcoins hope to one day surpass Bitcoin, and Monero is taking decisive steps in this direction. Why should you choose it? Because it is the safest cryptocurrency. It is an ideal option for those users who believe that anonymity is not needed for cryptocurrencies. So far, Monero has been relatively quiet. Its exchange rate is $411.82, and its capitalization is more than 6 billion. But the altcoin’s prospects are amazing, since it is safe, it has no limited emission and sufficient capitalization.

- Dash . Among the advantages of Dash are a high level of security, well-structured operation and capitalization, which is in 12th position in the overall ranking ($8,623,503,000) of cryptocurrencies. In 2020, it is likely that the coin will explode, especially since it is already worth $1,103.

- Ripple . This coin currently ranks third in terms of capitalization ($77,075,785,928). This can be explained by the fact that it works very quickly, due to which its popularity among users is growing. But the Ripley rate is not particularly encouraging yet; it is only $1.99. In addition, the currency cannot be mined; it has already been issued, and its authenticity can be confirmed by consensus of system participants.

As you can see, most altcoins have promise, but the ones listed above stand out from the crowd. In particular, they are distinguished by the speed of transactions, a high level of security, original and useful features, as well as a relatively high exchange rate against the dollar (except Ripley). But don’t rush – the cryptocurrency market is not stable, so the situation can change even in a few hours.

conclusions

Each cryptocurrency has its own advantages and disadvantages. It will not work to draw conclusions that altcoins are good or bad. But the fact that altcoins exist is a fact that you need to come to terms with. In addition, more and more alternatives to Bitcoin appear every year, and some of them look very promising. They allow you to get rid of the shortcomings of the original blockchain and create conditions for healthy competition in the market.

Therefore, modern users should not be afraid of altcoins. As a rule, they are better attuned to the current needs of the market than the old-timers. Moreover, no one has any guarantees that Bitcoin will continue to grow, and that young cryptocurrencies will be able to repeat its success over time. There is an element of luck here in addition to the professional instincts of the developers. Follow the news and work exclusively with proven altcoins.

How to trade with an uncertain trend

There are days and times when the trends of the three largest cryptocurrencies go in different directions. Usually, this happens when a really large investor enters (or leaves) one of them, or when some serious news has come out on a specific cryptocurrency.

For example, this happened when the Bitcoin fork was announced. But specific news is not important to us, the charts themselves are important to us. What to do in these cases? Let's take a closer look...

- Bitcoin and one of the currencies go in one direction, and the third cryptocurrency goes in the opposite direction. In this case, it is always worth remembering that Bitcoin is still the number one currency in the crypto world and it itself occupies the lion’s share in terms of capitalization. Thus, we pay attention to the Bitcoin trend;

- Bitcoin goes in one direction, while Litecoin and Ethereum go in the opposite direction. In this case, it is worth taking a closer look at the chart and, perhaps, paying attention not to the daily, but to the weekly charts. Over time, as you gain experience, you will be able to navigate this situation, and for beginners I advise you not to enter the market during these periods and just watch it, since I cannot give specific advice - you need to study the charts in detail at a specific point in time;

- The trend has just reversed. In fact, these are the best hours and minutes to enter the market, trade with the current trend (after flipping the chart);

- Bitcoin's chart is approximately flat, Ethereum and Litecoin have an up or down trend. We focus on the trend of Ethereum and Litecoin, they are the ones who influence Crypto IDX when Bitcoin is “sleeping”;

- The graphs of Ethereum and Litecoin are approximately even, Bitcoin goes up or down. Let’s look at the Bitcoin rate; after all, its capitalization on the cryptocurrency market is still more than 50% and at such moments it “rules the roost” on the Crypto IDX rate;

- Bitcoin’s chart is approximately flat, Litecoin and Ethereum are “directed” in different directions, or all three cryptocurrencies have approximately flat charts without a trend. In this case, I would advise not to enter the market, or to trade with the smallest rates or even on a demo account to study the current situation.