Today we will talk in which countries Bitcoin is allowed and the peculiarities of how this technology works in them, as well as about those states that, on the contrary, consider cryptocurrencies to be something illegal and associated exclusively with crime. In addition, you can find out which country was the first to legalize Bitcoin, and what awaits it in Russia, as well as other countries.

Legal status of cryptocurrency in Russia

Today, the Ministry of Finance of the Russian Federation in Russia is only discussing the idea of legalizing cryptocurrencies. At the moment, a bill on their regulation is expected at the end of 2020, but whether this will go beyond talk is unknown. Most likely, the main draft laws will appear only in 2020.

At the same time, the Central Bank, as well as its head, advocate a ban on cryptocurrencies and speak rather negatively about legalizing this “cash surrogate”. However, officials, the Ministry of Finance, as well as ordinary people believe that blockchain, as well as digital currencies and cryptocurrency exchanges where they are mined, can become a very effective and promising tool that will serve for the development of the state’s economy.

Cryptocurrency in Russia and CIS countries

Cryptocurrency laws in Russia

In Eastern Europe, the situation with regulation of the cryptocurrency industry cannot be called unambiguous either. Most countries in this region have not legally established the legal status of cryptocurrency and do not take a clear hostile or friendly position towards the industry. An attempt to regulate the crypto-asset market in the Russian Federation failed, but more on that below.

Bitcoin in Russia

How are Bitcoins regulated and allowed in Russia:

- February 2014 — The Prosecutor General’s Office of the Russian Federation assigned the status of “money surrogates” to cryptocurrencies.

- June 2020 - The Ministry of Finance proposed to assign the status of “other property” to cryptocurrencies.

- December 2020 — The Ministry of Finance of the Russian Federation and the Central Bank of Russia developed a bill regulating ICOs.

- January 2020 - The Ministry of Finance of the Russian Federation presented a bill on the regulation of cryptocurrency, which envisaged transactions with cryptocurrencies by individuals only on exchanges.

- March 2020 — The State Duma adopted the bill “On Digital Rights” in the third reading.

- November 2020 - the law “On Digital Financial Assets” has been developed and is ready for adoption, but has not yet been adopted (as of November 21, 2020).

- November 2020 - The Ministry of Internal Affairs was instructed to develop a law on the confiscation of cryptocurrencies by the end of 2021.

This is a brief chronology of the regulation of cryptocurrencies and Bitcoin in Russia, below you will find all the details.

☝️

Read the full article: Cryptocurrencies in Russia: regulation of the crypto industry in the Russian Federation

Bitcoin in Russia

The history of cryptocurrency in the Russian Federation began on September 18, 2015, when the Central Bank announced the creation of a working group to study the prospects and capabilities of blockchain technology and Bitcoin in particular.

It is not entirely clear how the study ended, but until 2017, cryptocurrency in Russia was defined as a “cash surrogate” and any transactions with it were considered illegal. In the summer of 2016, the authorities even planned to introduce criminal penalties for using Bitcoin, but later abandoned this measure.

☝️

Read the full article: Bitcoin ban in Russia: myths and truth

In April 2017, the Central Bank proposed considering cryptocurrency a “digital good,” and Dmitry Medvedev ordered to analyze the possibility of using blockchain in the public sector. In fact, cryptocurrencies are no longer illegal, and on August 28, the Moscow Exchange announced the preparation of infrastructure for processing transactions with digital assets.

On September 22, 2017, the State Duma of the Russian Federation orders a comprehensive study of the cryptocurrency market to prepare a regulatory framework, and the Central Bank and the Ministry of Finance are preparing a bill “On digital financial assets.” On December 28, the first version of the document was submitted to the Duma, and in January 2018, the second, revised version. According to the project, regulation comes down to the following theses:

- Cryptocurrency is not a means of payment;

- Bitcoin and other coins can be legally exchanged for fiat;

- Exchanges are carried out only by specialized platforms;

- Mining is considered a business activity;

- ICOs are carried out in a strictly prescribed manner by law.

Ban of cryptocurrencies in Russia

In parallel, on October 13, the Ministry of Finance confirmed that cryptocurrency transactions are subject to personal income tax, that is, the legal status of cryptocurrencies is confirmed.

On October 19, 2018, the Duma adopted the law “On Digital Financial Assets” in the first reading, but it turns out that there is neither the concept of cryptocurrency nor provisions on the regulation of cryptocurrency transactions in the final version of the document.

In 2019, the law was adopted in the second reading, but changed its name (“On Digital Rights”) and underwent significant changes. The law legalizes “smart contracts” and defines the procedure for concluding transactions between participants in decentralized platforms, but there is still no section on cryptocurrencies. That is, Bitcoin and other coins remain without official legal status.

Meanwhile, such uncertainty did not prevent the Supreme Court of the Russian Federation, in its decision of February 26, 2019, from extending the anti-money laundering legislation to cryptocurrency. Sberbank of Russia, in turn, requires depositors to confirm in writing the legal basis of their cryptocurrency transactions.

Thus, de facto, some aspects of cryptocurrencies are regulated by by-laws of government agencies, which makes them legal, but de jure, neither the general concept of regulation nor even the concept of “cryptocurrency” is enshrined at the legal level.

☝️

Read the full article: Cryptocurrency ban in Russia - true or false

We recommend watching a useful video on how to work with cryptocurrencies in Russia in an environment of real regulation:

Cryptocurrencies in Russia

Legal status of cryptocurrencies in Belarus

Regulation of cryptocurrencies in Belarus

On March 28, 2018, Presidential Decree No. 8 “On the development of the digital economy,” developed and signed in the second half of 2017, came into force in Belarus.

This document was supposed to turn Belarus into a land inhabited by blockchain projects, ICOs and crypto exchanges, because guaranteed full legalization for the circulation, exchange and production of cryptocurrency.

☝️

Moreover, all cryptocurrency operations and mining are exempt from taxes until 2023, and blockchain companies in the Hi-Tech Park (local Silicon Valley) pay only 1% of turnover as tax until 2049.

It would seem that live and be happy, but the problem of Decree No. 8 is that it is a framework document that, together with the crypto industry, regulates half a dozen issues regarding the implementation of IT and modern digital technologies. Clear rules for the registration and operation of crypto companies and ICOs had yet to be developed.

On November 30, 2018, the HTP administration, together with the National Bank, presented these same rules that will truly turn Belarus into a crypto-paradise, albeit of an authoritarian type. To get started, operators of crypto exchanges and ICOs need:

- Obtain HTP residency (non-HTP residents will also be able to conduct ICOs, but only through a resident intermediary);

- Provide full monitoring of customer transactions;

- Report illegal transactions and refuse to process them;

- Conduct full verification of clients;

- Control transactions during ICO;

- Prevent “suspicious” tokens from entering the market.

Cryptocurrency laws in Belarus

It is easy to understand that these requirements significantly limit the number of companies that can apply to open crypto exchanges and conduct ICOs, and such complete control is unusual for the industry even in those countries where it is regulated at the legislative level.

However, already on January 15, 2019, the first Belarusian crypto exchange, Currency.com, opened in Minsk, and at the moment the second one, iExchange, is at the final stage of testing. It is too early to judge the impact of a strict regulatory framework on their work, but, as sellers of fake Rolexes say, “time will tell.”

Legal regulation of cryptocurrencies in Ukraine

Regulation of cryptocurrencies in Ukraine

Ukraine is one of the few countries in Eastern Europe that, by 2019, had made virtually no attempts to regulate the cryptocurrency industry.

The first document in this direction was a letter from the National Bank of 2014, in which Bitcoin and cryptocurrencies are recognized as “monetary surrogates,” that is, excluded from circulation. However, not a single court decision on the use of these same “surrogates” was made, so in 2018 the National Bank recognized this letter as irrelevant and again transferred the cryptocurrency to an uncertain position.

All actions of the legislative branch come down to the submission of two bills to the Verkhovna Rada:

- No. 7183 dated October 6, 2017 “On the circulation of cryptocurrencies in Ukraine” - equates cryptocurrency to intangible property, and all operations involving its exchange to barter.

- No. 7183-1 dated October 10, 2017 “On stimulating the market for cryptocurrencies and their derivatives in Ukraine” - proposes to grant cryptocurrency the status of a financial asset that is traded only on licensed exchanges, whose work is regulated by the National Financial Services Commission.

Cryptocurrencies and blockchain in Ukraine

It is still pointless to argue about the effectiveness of a specific model, because The bills have been lying in the Rada committee for almost two years and have not even reached the stage of consideration in the first reading.

The Ministry of Finance and the DFS are working much faster, having already established taxation of the positive difference between the sale and purchase of cryptocurrency at the time of withdrawal of funds to a bank account.

☝️

This amount will be subject to 18% personal income tax + 1.5% military duty.

Not the most pleasant news for crypto holders, but taxation makes it possible to legalize profits from trading and mining, which is already good.

A more specific model for regulating the work of companies and ICOs, the circulation of coins in the country and taxation can be expected only after the adoption of one of these bills.

Japan

Japan is one of those countries where cryptocurrencies are not prohibited for use. The regulatory framework, thanks to which the legalization of cryptocurrencies will occur, has now been developed, but so far minor amendments have been made to it. After everything is ready. Japan is about to begin actively introducing digital currency into the economy.

If we take into account the size of this country, then, most likely, they will be able to become leaders in the production and use of bitcoins in a fairly short period of time.

Bitcoin is currently fully or partially legalized in 111 countries

According to the Coin Dance service, to date, 111 states have legalized Bitcoin to one degree or another.

Resource analysts emphasize that Nigeria occupies a special place in the ranking, where transactions with Bitcoin can be carried out, but such transactions do not comply with local legislation.

According to the latest data, over the past 24 hours, the total volume of transactions using BTC paired with the Nigerian naira amounted to about 0.03% of the total volume of transactions with the largest digital currency.

In Indonesia, Bitcoin transactions are not formally prohibited, but they are “limited” in nature.

In Vietnam, it is completely legal to invest in Bitcoin and store savings in such an asset, but it is prohibited to use the coin as a payment instrument.

Bitcoin transactions are completely prohibited in Muslim countries such as Afghanistan, Algeria, Bangladesh, Pakistan, Saudi Arabia and Qatar. In addition, the use of Bitcoin is prohibited in Bolivia, Macedonia and Vanuatu.

Researchers note that transactions with the main cryptocurrency in India and China have a limited status.

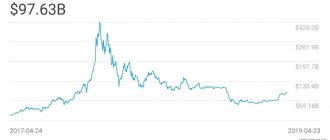

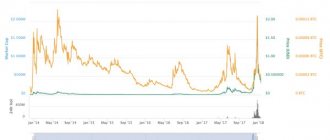

At the time of publication of this review, the BTC rate had dropped to $3,635, but some analysts believe that the coin is preparing for a rally that we can see in the near future.

Publication date 02/12/2019 Share this material on social networks and leave your opinion in the comments below.

Rate this publication

The latest news on the cryptocurrency market and mining:

Cloud mining of Bitcoin in 2020 - how to choose a reliable and profitable service?

Kraken Report: Bitcoin on the verge of “great adoption”, BTC price will rise by 50-200%

Bitcoin enters mega bull phase with over 93% of BTC addresses showing profits

Anatoly Aksakov commented on the adopted law on cryptocurrency in Russia

Platform for centralized management of the cryptocurrency mining process CoinFly

The following two tabs change content below.

- Author of the material

- Latest news from the world of cryptocurrencies

Mining-Cryptocurrency.ru

The material was prepared by the editors of the website “Mining Cryptocurrency”, consisting of: Editor-in-Chief - Anton Sizov, Journalists - Igor Losev, Vitaly Voronov, Dmitry Markov, Elena Karpina. We provide the most up-to-date information about the cryptocurrency market, mining and blockchain technology.

News Mining-Cryptocurrency.ru (go to all news feed)

- Cloud mining of Bitcoin in 2020 - how to choose a reliable and profitable service? — 08/14/2020

- Kraken Report: Bitcoin is on the verge of “great adoption”, BTC price will rise by 50-200% - 08/14/2020

- Bitcoin Enters Mega Bullish Phase, Over 93% of BTC Addresses Show Profit - 08/14/2020

- Anatoly Aksakov commented on the adopted law on cryptocurrency in Russia - 08/14/2020

- Platform for centralized management of the cryptocurrency mining process CoinFly - 08/14/2020

BitcoinRegulation and legislation

USA

This is where the largest number of cryptocurrency users are located and this is not surprising.

Bitcoins have become so integrated into the lives of ordinary Americans that almost all startups related to innovative technologies are immediately tied to the blockchain. In addition, you can find a large number of Bitcoin ATMs throughout America. I think it is already clear that the use of cryptocurrency in the USA is legal. There are even several institutions that at the state level ensure that virtual money is used only for legal purposes.

The United States of America has defined Bitcoin as a company that provides financial services. Due to this, the company must file reports, keep records and be registered, as stated in a series of laws. At the same time, despite the fact that Bitcoin has become one of the official financial instruments used in the US economy, it is not considered a currency. The law classifies Bitcoin as property on which taxes are levied.

It is impossible to do without the help of the United States, a country that has legalized or is just about to legalize Bitcoin. No one has such experience in working with digital currency and therefore they are always ready to provide information and give advice on creating a regulatory framework, as well as determining the legal status of Bitcoin.

Denmark

Transactions with cryptocurrencies in Denmark are not subject to official regulation. Because of this, any transactions involving Bitcoin and altcoins are effectively tax-exempt. Some Danish companies accept Bitcoin to pay for goods and services. The experiment of Jack Nikoghosyan, an economist from Copenhagen, who lived in his hometown for several months, paying exclusively with bitcoins, became widely known. Denmark also became the first country to sell a city apartment for Bitcoin.

Canada

Canada, like its neighbor to the south, has long legalized cryptocurrency. This is where a large number of Bitcoin startups originate and then spread throughout the world. In Canada, there are 2 cities that are considered Bitcoin hubs - Toronto and Vancouver, known to most people thanks to the Winter Olympics.

Such popularity and spread of cryptocurrencies here is not something strange. The climate of the country is quite conducive to the development of this area. Bitcoin is regulated by anti-terrorist financing and anti-money laundering laws.

The Canada Revenue Agency has classified Bitcoin as a commodity. That is, the transaction is barter, and the income received is profit from doing business. At the same time, taxes will depend on whether you bought cryptocurrency or invested money in it. Exchanges are considered companies engaged in financial transactions, which means, as in America, they must register and provide all the necessary documentation.

What is the legal status of cryptocurrencies in 2020?

For 10 years now, debates about the legal status of cryptocurrencies in general and Bitcoin, as the main cryptocurrency, in particular, have not subsided. What is it: money, goods, assets, property or something else? Should free trading of crypto assets be allowed or should any circulation of cryptocurrencies be prohibited? It would seem that the problem has long gone away - Bitcoin derivatives are traded on classic exchanges, regulators are issuing legislative norms for the crypto market, and Central Banks are going to launch their own cryptocurrencies. However, even a cursory glance at the problem shows how the understanding of cryptocurrencies and the regulation of their circulation differs in each country. Thus, just in the last month in France, Germany and Australia, authorities have made decisions with three different interpretations of the nature of Bitcoin: as a currency, a financial instrument and a security. Meanwhile, the tax system, complexity of regulation and reporting depend on the classification of cryptocurrencies. Thus, commodity markets operate under conditions of relatively weak regulatory oversight. Securities, in contrast, are generally subject to more onerous rules regarding price transparency, trading reporting and market abuse. In this article, we look at the main legal regimes for cryptocurrencies and what they mean for holders of such assets.

Why regulators do not have a common understanding of the nature of cryptocurrencies

Let's consider the main interpretations of the nature of Bitcoin and other cryptocurrencies.

Currency

Satoshi himself clearly intended Bitcoin as a currency. The majority of his supporters share the same point of view.

Pros: Bitcoin and other cryptocurrencies are accepted as payment. For example, they can be used to pay at online retailers such as Overstock and Amazon, as well as in the Microsoft Store. Cryptocurrencies share some of the traditional criteria of currencies: a medium of exchange, a unit of account, and a store of value, and they are fungible, divisible, transferable, portable, and scarce.

Arguments against: Digital assets do not fully meet the traditional criteria of a currency. They are not backed by the Central Bank, which means that no one is responsible for them. In addition, their exchange rate is too unstable (high volatility makes it inconvenient and impractical to denominate goods or services in Bitcoin), the transaction processing speed is too slow, and conducting the transactions themselves is inconvenient. In addition, the same Bitcoin is energy-consuming, uncontrollable, its emission is limited - and the “gold standard” is no longer suitable for the modern economy. Therefore, for 10 years it has not become widespread as a means of payment. Most holders take it only in the hope that the price will rise.

Product

Another popular approach to cryptocurrencies is to view them as a commodity that can be traded on a market or exchange (like precious metals, for example).

Arguments for: cryptocurrencies have a market price, they are fungible, they can be traded, which means they are digital goods. For example, Jeff Currie, head of commodity research at Goldman Sachs, qualified Bitcoin as a commodity because it has “no liabilities.” In this regard, Bitcoin is similar to gold or oil, which can be bought and sold on markets or through derivatives such as futures. The US Commodity Futures Trading Commission (CFTC) stated back in 2020 that cryptocurrencies are “an underlying commodity used in trading that is fungible with other commodities of the same type.” This approach to the nature of Bitcoin was reinforced in Bitcoin futures.

Arguments against: cryptocurrencies are not goods because they do not have a use value (for example, a commodity such as steel is used in industry, but Bitcoin cannot be used anywhere) and a physical embodiment. It only has a price. Supporters of this position believe that people buy crypto-assets in the hope of an increase in the exchange rate or access to some services (utility-tokens), and not because of its internal properties - no one needs Bitcoin itself.

Security, asset or financial instrument

Cryptocurrencies can also be considered as a security, financial instrument or asset. The broadest definition of a financial instrument is a document of title to tangible or intangible assets that can be sold. This includes securities, futures, options, the Dow Jones index and the MICEX index, among others.

Arguments for: Cryptocurrencies are an analogue of securities, since they are interchangeable, negotiable financial instruments with monetary value. Tokens of companies that launched ICOs and security-tokens meet the criteria of securities: they are issued by one company and function similarly to shares. This view is shared by most regulators. Therefore, they require ICO organizers to comply with the disclosure rules applicable to securities.

Arguments against: asset implies property that generates income. Most cryptocurrencies do not create any kind of stable cash flow. Decentralized coins have no guarantee of future income. Even traders do not invest in Bitcoin, but only trade it.

In this regard, decentralized coins like BTC and ETH are, of course, not securities or financial assets - there is no single issuer that can be obliged to comply with the rules, because these cryptocurrencies are not backed by anything other than the trust of the crypto community. This point of view is shared, for example, by the US Securities and Exchange Commission (SEC), which loves to find signs of securities in crypto projects (hello, Libra and Gram). In October 2020, she officially stated that Bitcoin is not a security. The SEC staff argued against it - Bitcoin does not meet the criteria for a security under the Howey Test and the 2020 Digital Asset Analysis Guide. The main one is that Bitcoin holders “do not rely on the management skills and entrepreneurial efforts of third parties” to make a profit.

Property and digital rights

Since cryptocurrencies are difficult to unambiguously attribute to any class of assets, but they still exist, this means that they are property or property.

Arguments for: this interpretation of Bitcoin was given by the US Internal Revenue Service (IRS) back in 2014. The position of the Russian court in 2020 is also indicative: Bitcoin cannot be classified as electronic money, since its holder does not have the opportunity to contact the Bitcoin issuer. But cryptocurrency can be classified as an object of civil rights, since it is “capable of isolation and has a property value recognized by circulation,” and also “can be the subject of obligations, ... the object of protection by the rules of tort law. In this regard, cryptocurrency can be classified as “other property.”

Arguments against: In some jurisdictions, such as the UK, the law does not recognize ownership of intangible assets.

Countries according to the level of legalization of Bitcoin transactions: green - completely legal, light green - status not defined by law, orange - limited permitted, red - prohibited, gray - status unknown. Countries where Bitcoin and other cryptocurrencies are prohibited: Afghanistan, Algeria, Bangladesh, Bolivia, Pakistan, Qatar, Republic of Macedonia, Saudi Arabia, Vanuatu and Vietnam. Source.

USA and Canada

USA. The US approach to cryptocurrencies is not consistent. Laws governing the crypto industry vary from state to state, and the five federal governments also interpret and regulate them differently. The Financial Crimes Enforcement Network (FinCEN) does not consider cryptocurrencies to be legal tender, but since 2013 has viewed exchanges as operators of financial services and tokens as “other property” that replaces currency. For the same reason, exchanges must comply with FATF recommendations and comply with bank secrecy laws. The IRS, on the other hand, views cryptocurrencies as property and has issued tax guidance accordingly.

Several federal regulators are also vying for oversight of crypto exchanges. The Securities and Exchange Commission (SEC) considers cryptocurrencies to be securities. And the Commodity Futures Trading Commission (CFTC) views Bitcoin as a commodity and supports the cryptocurrency derivatives market.

Canada. The Canada Revenue Agency (CRA) defines Bitcoin as a commodity, cryptocurrency trading is regulated as barter transactions, and the income received is treated as business income. Therefore, taxation is appropriate - on the share of profit. However, the Canadian securities regulator (CSA) and the head of the country’s Central Bank consider cryptocurrencies to be securities. However, crypto exchanges are largely regulated in the same way as money services businesses - in addition to meeting FATF requirements, as of June 1, 2020, they will also be required to register with Canada's Financial Crime Analysis Center (FinTRAC).

European Union

Cryptocurrencies are legal throughout the European Union, but specific regulations and taxation vary widely. In matters of taxes, most EU countries are guided by the decision of the Court of Justice of the European Union in 2020, according to which cryptocurrency exchanges should be exempt from VAT, and the holder of coins should pay capital gains tax.

Gradually, all countries are adjusting their regulatory standards to the FATF recommendations on the regulation of cryptocurrencies dated June 21, 2019. According to them, by June of this year, crypto-platforms must begin to comply with strict KYC/AML standards, as well as exchange data of users who have made transactions with each other and the regulator. In January 2020, the Fifth EU Anti-Money Laundering Directive (AMLD5) came into force, requiring mandatory registration of crypto exchanges with financial regulators and the transfer of customer wallet addresses to them. In general, the EU is gradually tightening regulation of the crypto market.

Malta. Malta has taken a very progressive approach to cryptocurrencies, positioning itself as a global leader in crypto regulation. Although cryptocurrencies are not legal tender in the country, they are recognized by the government as a “medium of exchange, unit of account, or store of value.” This sounds similar to the definition of a currency, but VAT does not apply to fiat and cryptocurrency exchange transactions, meaning that crypto assets are not actually recognized as currencies. In the Financial Services Authority's (MFSA) strategic plan for 2019-2021, the regulator views cryptocurrencies as virtual assets.

France. One of the few countries in the European Union that still does not have direct legislative regulation of cryptocurrencies. Bitcoin is not banned in the country. In addition, this year more than 25,000 merchants across the country will begin accepting Bitcoin as payment. However, its legal status is uncertain. Therefore, the circulation of both Bitcoin and all cryptocurrencies in general is not regulated by law, and citizens bear all the risks of owning them. Previously, representatives of regulators have repeatedly stated that Bitcoin is not a currency. At the same time, France adhered to the 2015 advisory decision of the European Court of Justice on the abolition of VAT on exchange transactions between BTC and fiat currencies.

Against this background, the media attention to the recent decision becomes clear - on February 26, the Nanterre Arbitration Court recognized the military-technical cooperation as a currency. According to the court, Bitcoin is a fungible intangible (digital) asset - all coins are created the same, but they can be identified. This allows it to be defined as a form of currency. Although there is no case law in the country, the court's decision can serve as an example for other courts.

The ruling comes as part of a dispute between French crypto exchange Paymium and alternative asset investment firm BitSpread. In 2014, Paymium lent 1,000 BTC (about $400,000 at the average rate in 2014 and $9.1 million at today's price) to BitSpread. However, in August 2020, a Bitcoin Cash (BCH) hard fork occurred. All BTC holders, including BitSpread, received a similar number of BCH coins - in this case, 1000 BCH ($350,000 at the then exchange rate). Paymium decided that the BCH should also belong to it and went to court.

To resolve the dispute, the court had to consider the legal nature of Bitcoin. As a result, he established that the first cryptocurrency is a fungible asset - the same as fiat money. And if so, then it is subject to the general principles of lending and borrowing. Based on this, the court ruled that BitSpread would keep the resulting BCH, just as borrowers keep the profits from borrowed funds—they are only obligated to pay back what they borrowed.

Germany. The German Federal Financial Supervisory Authority (BaFin) considers cryptocurrencies to be financial instruments. Therefore, exchanges and coin issuers must obtain permission from BaFin to operate in advance. At the same time, ICO tokens and similar projects can be considered as securities and subject to appropriate regulation. The country's tax department believes that cryptocurrency should be subject to VAT, as well as capital gains tax. The first tax may not be paid if cryptocurrencies are used as a means of payment. The second is if the user sold the asset for less than €600 or earlier than a year after purchase.

On March 2, Germany's Federal Financial Supervisory Authority (BaFin) issued a statement officially redefining cryptocurrencies as financial instruments. The text notes that in this regard the agency’s position coincides with other regulators in the country and FATF recommendations. According to the regulator’s definition, cryptocurrencies as a financial instrument meet five characteristics:

- Not issued or backed by any Central Bank or government authority;

- Does not have the legal status of currency or money;

- Can be used by individuals or legal entities as a means of exchange or payment;

- May serve investment purposes;

- May be transmitted, stored and sold electronically.

Such a broad definition was adopted in order to take into account all crypto-assets related to the financial market, including digital coins, which are not considered units of account. BaFin also emphasized that cryptocurrencies should not be confused with different types of electronic money - they are regulated by separate legislation. Let us recall that in November last year, the German authorities passed a law allowing banks to buy and sell cryptocurrencies on behalf of their clients. 40 financial institutions have already expressed interest in the offer.

Great Britain. The country does not have specific legislation on cryptocurrencies, but they are not prohibited. Crypto exchanges must register with the Financial Conduct Authority (FCA) and comply with FATF and 5AMLD regulations. The British Revenue Authority (HMRC) believes that cryptocurrencies are a unique type of asset that is not similar to traditional investments or means of payment. Gains or losses from cryptocurrencies are, however, subject to capital gains tax.

Switzerland. In Switzerland, cryptocurrencies and exchanges are legal, and the country has taken a surprisingly progressive stance on cryptocurrency regulation: the authorities are going to make the country a “crypto-nation.”

The Swiss Federal Tax Administration (SFTA) treats cryptocurrencies as assets: they are subject to Swiss wealth tax and must be reported on annual tax returns. To start operating, crypto exchanges must obtain a license from the Financial Market Supervisory Authority (FINMA). Similar rules apply to ICOs.

Estonia . Estonia is also among the crypto leaders. Authorities view cryptocurrencies as digital assets that can be used as a payment instrument, but are not legal tender. As in other European countries, crypto exchanges in Estonia must obtain two licenses: from a virtual currency exchange operator and from a virtual currency wallet operator. In January 2020, the country's authorities announced that virtual currency service providers would be treated the same as financial institutions under the Estonian Anti-Money Laundering and Anti-Terrorism Financing Law.

Russia and Ukraine

Russia. In our country they still can’t decide what cryptocurrency is. So far, the courts consider it other property. Thus, for the first time, the Ninth Arbitration Court of Appeal recognized cryptocurrency as “other property” in May 2020. Then he obliged the debtor to transfer access to the crypto-wallet to the bankruptcy trustee. In February of this year, the court repeated its decision, again recognizing Bitcoin as “other property” in another case. Since cryptocurrency is property, it means that you can conduct transactions with it, sell/buy, and even impose penalties in cryptocoins. True, a property deduction cannot be applied to cryptocurrencies. However, in the adopted law on crowdfunding and in the upcoming bill “On Digital Financial Assets” there is a different interpretation of the nature of cryptocurrencies - “digital rights”, close in meaning to securities.

Ukraine. In November 2020, the country's regulators said that cryptocurrencies cannot be classified as money, foreign currency, a means of payment, electronic money, securities or a money substitute. Until now, cryptocoins as an asset class are not defined by Ukrainian legislation.

At the end of December 2020, the Verkhovna Rada adopted a law on the implementation of FATF recommendations. And finally, in March of this year, the Ukrainian National Agency for the Prevention of Corruption (NACP) published rules for the declaration of cryptocurrencies, which define them as one of the “intangible assets”, similar to intellectual property or licenses for the extraction of natural resources (the definition is copied from FATF regulations). At the same time, since the end of January, the Ukrainian Financial Service has been monitoring crypto transactions worth over $1,200.

Asia and Australia

China. After several years of de facto ban, in July 2020, a Chinese court recognized Bitcoin as digital property. This is an important milestone for a country where cryptocurrencies have been effectively banned since 2020. The court's decision marked a shift in the adoption of cryptocurrencies. In October, Chinese President Xi Jinping called for increased efforts in blockchain development, and the National Bank of China is rumored to be planning to launch its own national cryptocurrency this year.

Singapore. Cryptocurrency exchanges and crypto trading are legal in the country, and the city-state has taken a friendlier stance on the issue than its neighboring countries. The tax department considers cryptocurrencies as goods and applies the local equivalent of VAT to them. Crypto exchanges fall under the jurisdiction of the Monetary Authority of Singapore (MAS), which takes a relatively lax approach to regulating them, applying existing legal frameworks where possible.

Japan. One of the most progressive crypto countries. Cryptocurrencies are considered property in the country; taxes on income from cryptocurrencies are classified as “other income” and are subject to rates of 15-55%. Cryptocurrency exchanges must register with the Financial Services Agency (FSA). In May 2019, amendments to the laws “On Payments” were adopted, which will come into force in April of this year. They introduce the term “crypto-assets”, which places more restrictions on the management of cryptocurrencies and cryptocurrency derivatives.

South Korea. Cryptocurrencies are not prohibited in the country, but their circulation and regulation are treated carefully. You can legally trade cryptocurrencies only from bank accounts. Therefore, crypto platforms enter into agreements with them. Financial institutions are prohibited from trading Bitcoin futures. The status of cryptocurrencies in the country has not been determined. Therefore, cryptocurrency transactions are not yet subject to tax. However, this year the authorities are considering introducing a tax on income from crypto transactions.

Australia. Australia is one of the leading countries when it comes to cryptocurrencies. For the next 5 years, the government of the country has developed a roadmap for integrating blockchain into the economy. Since 2020, cryptocurrencies like Bitcoin are considered property in Australia and are subject to capital gains tax (previously they were subject to VAT - a change in the tax regime indicates the progressive approach of the Australian authorities to the industry). Exchanges must register with the local regulator - AUSTRAC, exchange user data and comply with KYC-AML requirements.

Let's look at a recent case in point. In late February this year, Judge Judith Gibson in New South Wales allowed a plaintiff to use a cryptocurrency account as security to pay legal costs in a libel case. If the plaintiff loses the case or facilitates withdrawal, those funds will be used to cover some of the defendant's legal costs. When the defendant's lawyer argued that the price of BTC was too volatile, the judge noted that the volatile nature of decentralized digital assets does not change the fact that cryptocurrency is an accepted form of investment in these uncertain financial times. In an attempt to mitigate asset concerns, she also accepted the plaintiff's undertaking to provide the defendant's attorney with monthly crypto account statements. The plaintiff will also be required to notify the defendant's lawyer if the account's crypto balance falls below the equivalent of 20,000 Australian dollars (about $13,000). The local crypto community is confident that this incident will contribute to even greater acceptance of cryptocurrency in the country.

Latin America

There is no unified approach to regulating cryptocurrencies in Latin America.

Bolivia and Ecuador: in these countries, the circulation of cryptocurrencies and the operation of crypto exchanges is prohibited.

In other countries there is no ban, cryptocoins are treated primarily as assets and are subject to capital gains tax throughout the region, and in Brazil, Argentina and Chile they are also subject to income tax.

Mexico, Argentina, Venezuela, Colombia. In Mexico, cryptocurrencies were initially considered as commodities, although they are now classified as virtual assets, in Venezuela - financial assets, in Colombia - as “high-risk investments”, in Argentina, the Civil Code defines them as goods, and the tax department - as an analogue of valuables papers Crypto exchanges in the region are almost unregulated: only in Mexico the legislation on financial technology companies obliges crypto platforms to register and submit reports. The Central Bank of Mexico may prohibit the circulation of a particular cryptocurrency in the country, as well as set conditions and restrictions on transactions with cryptocurrencies.

Finally

Cryptocurrencies are universal. They can act as money during transfers, as a security or commodity for an investor, or as simple code for a programmer.

The experience of regulators around the world shows that cryptocurrencies are difficult to classify as any existing asset class. Mechanical transfer of traditional regulation to cryptocurrencies does not work well. More and more regulators are coming around to the obvious idea that they should be treated as a unique alternative asset class, different from all others, with its own advantages, risks and its own legal framework. And given that cryptocurrencies are very different from each other - take, for example, decentralized and centralized projects - then, most likely, they need to be divided into several more categories. Ultimately, how cryptocurrencies are classified largely determines the fate of the market.

Stay in touch! Subscribe to Cryptocurrency.Tech on Telegram. Discuss current news and events at the Forum

Great Britain

Today, the UK is a leading innovation and financial center. There are a huge number of projects related to Bitcoin mining and blockchains. The state is gradually preparing for cryptocurrencies to become a global currency and is already implementing this at home. Today at

In some bars in London you can pay using bitcoins, and that already says a lot

In England, bitcoins are considered private money, meaning VAT is charged only to those who provide any services or sell goods for bitcoins. Profit is taxed according to the same scheme as in America.

Other countries

In addition to the above countries, Bitcoin has been recognized and legalized in the following countries:

- Australia;

- Estonia;

- Denmark;

- South Korea;

- Sweden;

- Netherlands;

- Finland.

In addition, some countries have taken a position where they do not officially give it legal status, but do not prohibit their use. Besides Russia and Japan, the following countries are considering whether to accept Bitcoin as a new legal digital currency or not:

- Belgium;

- Colombia;

- Czech Republic;

- Germany;

- New Zealand;

- Israel;

- Ukraine;

- France;

- Croatia;

- Belgium;

- Poland;

- Hong Kong;

- Slovenia;

- Türkiye;

- Singapore;

- Switzerland;

- Spain and many others.

From this list, some countries have recognized Bitcoin, that is, at the state level, the use of cryptocurrency is legalized, although it does not have a legal status.

However, taxes will be different for miners, companies, exchanges and ordinary users. Also, in some countries, although bitcoins and other digital currencies are taxed, they are not regulated in any way.

Countries Opposing Cryptocurrency

Despite the fact that many states have long legalized and used cryptocurrency everywhere, in some countries they are trying to limit it. Moreover, in some countries Bitcoin is completely prohibited, and in others it is simply considered illegal.

So, the countries that have banned Bitcoin are:

- China;

- Bangladesh;

- Iceland;

- Lebanon;

- Vietnam;

- Thailand;

- Bolivia;

- Ecuador;

- Kyrgyzstan;

- Indonesia.

The funny thing is that in some of these countries, despite all the bans, there are data centers that rent out capacity for cloud mining and more.

Forecast for further legalization in Russia and the world

According to the latest trends and Forex forecasts, everything is moving towards the gradual legalization of cryptocurrencies both in Russia and in the world as a whole.

As we have already said, in Russia this is planned for 2020. The legalization of virtual currency will make it impossible to make anonymous payments. At the same time, Russia plans to create its own cryptocurrency exchanges, which are planned to be located in Crimea. This idea was proposed by Dmitry Marinichev. Moreover, according to him, Crimea will become the first territory where the legal use of Bitcoin will be tried.