Money of the future: programmable currency and the end of the banking system

Without bills and plastic

Science fiction writer Edward Bellamy envisioned a cashless society in his utopian novel Looking Back in 1888.

In his book, he wrote that cards would “completely eliminate” ordinary business transactions and the transfer of money between customers and store owners. The future has arrived, paper money is becoming an atavism. By 2030, the Scandinavian countries plan to abandon physical money at the state level. Between 2000 and 2020, the share of cash payments in this region decreased from 62 to 25%. In Sweden and Norway their turnover is only 3–5% of GDP. According to the Swedish Central Bank, cash transactions will decrease to 0.5% of the total by 2020. South Korea also plans to abandon metal money by 2020, and Eurozone countries are gradually withdrawing large banknotes from circulation. In India, large denomination cash has already been withdrawn from circulation.

Until recently, the main defender and user of cash remained the shadow economy. But even this sector is crumbling under the pressure of new financial technologies. It is he who is now the main customer of cryptocurrency turnover. So cash is definitely doomed; coins and banknotes will soon take their place in historical museums and will remain only with collectors.

The same fate may befall plastic bank cards. The first ATM, which appeared in 1967 in London, exchanged special bank checks for small amounts of cash. Since then, nothing has changed, only bank checks now store information about the entire amount in the client’s accounts. ATMs have also appeared that dispense gold bars.

Modern technologies make plastic cards obsolete and simply redundant. The future lies in digital certificates, which store a client's financial information in the form of a code and can be placed in any device connected to the Internet - a smartphone or a microchip sewn under the skin. The security of storing such data is exceptional.

In September 2020, Alipay launched a new payment technology at KFC restaurants - smile-to-pay. To pay the bill, customers simply have to smile at the 3D camera. The image is matched to an Alipay account and verified with a phone number. For the 2020 Winter Olympics in Pyeongchang, Visa created gloves, stickers and pins with contactless payment functionality. Thus, with the help of ordinary items, fans and athletes paid for goods and services in the Olympic Village. In January 2018, Adidas released sneakers that double as a pass for public transport in Berlin. The Anglican Church in the UK recently introduced a digital, contactless donation mug that can be donated by tapping your phone. During testing of the gadget, collections immediately almost doubled compared to a traditional church donation box.

Programmable money

Nowadays, digital media is an advanced technological tool for all elements of life. Digital is the main technology that penetrates everywhere. On its basis, data is born. Usage can be tracked: install sensors, take various readings from them, build a neural network and combine a huge number of devices in it - what is called the Internet of Things.

Something has already become a reality. For example, digital signatures, keys, shares and smart homes. Soon the purchase of household goods will be done by the appliances themselves. The refrigerator will be able to analyze the availability of products and order your usual grocery set, paying for goods directly from the account, and the TV will offer to subscribe only to those cable channels that you watch. This will save a lot of resources. Humanity will come close to the era of programmable money, which is based on a personalized approach to the selection of goods and services and allows saving on routine payments.

Even the protocols of modern cryptocurrencies allow them to be programmed for specific purposes. For example, you can transfer a certain amount to your child to buy markers and notebooks and program it so that this money cannot be spent on anything else. Likewise, digital money can be assigned new security levels, places, times and purposes for which it can be spent. So far, these functions are almost never used, but with the spread of cryptocurrencies, programmable money capabilities will be in demand in all areas of business.

But this does not mean that people will be deprived of the right to choice and spontaneous purchases. Today, the Internet of Things is actively developing in retail. For example, Amazon recently opened several Amazon Go smart stores in Seattle and Chicago. Products, shelves and carts are equipped with cameras and sensors. The selected items are instantly reflected in the virtual cart of the mobile application, and the item, which the buyer then returned to the shelf, automatically disappears from the shopping list. At the exit, money for purchases is automatically debited from your account.

Decline of the era of banks

The current monetary system has created significant obstacles for people and nations. The monetary system of the future, based on electronic currencies and payments, will be independent of politicians or bankers and will be driven by communities and private lending platforms.

Financial market analysts do not exclude the possibility of the emergence of some kind of single world currency. The evolution of electronic money provides all the prerequisites for this. Perhaps only a few regional physical units will remain. By the way, over the past 30 years, about 600 regional currencies have disappeared. At the same time, the Internet itself makes it possible to develop completely different forms of exchange of goods and services, so the number of different types of currencies may increase.

Already today, alternative digital currencies are gaining popularity around the world, used in certain communities or among clients of individual companies. Their advantage is that people can exchange such money for goods and services without intermediaries such as banks. For example, in Israel there are 87 different types of “currencies” alternative to the shekel, which can be used to pay for groceries, books, rent, and much more. In Kenya, with the support of the Bancor crypto exchange, a community money network was created last year to combat poverty, which should increase the purchasing power of the population, improve the local economy and provide funds for the development of small businesses.

In addition, information can be considered a new type of currency. To date, many services have accumulated a sufficient amount of unique and useful data for use in various fields, including machine learning and artificial intelligence. It is quite possible that big data exchange will soon be on a par with monetary transactions. An analogue today is various barter programs in the media: this is an exchange of advertising opportunities for goods, services or arrays of information from advertisers without monetary payment.

The evolution of cryptocurrencies

Many experts are optimistic about the rise of cryptocurrencies due to the possibility of giving up the protection of our transfers by banks, because we can get the same protection with the help of a good cryptographic application.

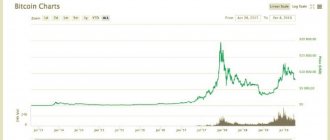

The key benefits of tokens lie in their nature: security, trust and low transaction costs. But here is their key drawback: due to their decentralized nature, cryptocurrencies cannot be tied to the real metric on which our centralized financial world is based. In fact, each unit of any cryptocurrency represents a complex mathematical problem, in which out of a million solutions, only one is correct. She is self-sufficient. Hence the colossal volatility of the exchange rate. This puts off many pragmatic payment professionals, and cryptocurrencies themselves have for some time turned from a financial instrument into a subject of speculation. But very soon the situation will change.

Cryptocurrency is as revolutionary an invention in the world of finance as a car is in the world of transport. And humanity is not yet physically able to understand the full value and prospects of this invention, which as a result will revolutionize the entire world economy. Money that is available to everyone and does not need to be backed by banks and governments is the financial world's equivalent of clean energy.

The emergence of such financial energy was also predicted by science fiction writers. According to Arthur C. Clarke's predictions, in 2020 all world currencies were to be replaced by a single equivalent equivalent to a megawatt-hour.

Nowadays, cryptocurrencies are becoming fashionable, in which the difficult-to-understand backing of anything physical is eliminated - stablecoins. These are tokens tied to precious metals or national currencies. Today, many countries are developing their own stablecoins, including Russia.

It is possible that the introduction of cryptocurrencies into everyday life will begin with them. Tokens, which are issued not by individuals, but by states, will simplify all types of payments and remove artificial barriers between countries in the form of political and economic sanctions, banking transfer systems like SWIFT and other obstacles. At the same time, the transparency and audit capabilities of such financial transactions will increase by many orders of magnitude.

Humanity today has entered an era when money can really change the world for the better, increasing the availability of financial technologies, but it can also do harm, simplifying, for example, the trade in weapons or drugs. And here a lot will depend on society and fintech companies, which are now at the forefront of technological development and determine trends for the coming decades. The professional dream of any modern financier is to contribute to the formation of new convenient means of payment and instruments, which in 10–20 years will be in demand all over the world.

Money of the Future: A Futuristic View by Chris Skinner

In the series The Six Million Dollar Man, the main character, astronaut Steve Austin, who lost his arm and both legs, was fitted with bionic prosthetics. For a minute, the picture is from 1974. Only a little over forty years have passed. Today, organs and limbs are grown in test tubes and printed on 3D printers. I believe that in another 20-30 years, the Olympics and Paralympics may disappear altogether in the form in which they are held now, due to the widespread use of technological prosthetics.

By the way, modern biotechnologies make it possible to grow not only individual organs, but also a person in an artificial womb. A child can be born without any mother or father involved at all and has the potential to live forever. Welcome. This is hi-tech.

Why am I doing all this? To understand how such colossal changes can affect the financial and insurance services industry. What will the financial landscape be like? A few questions that immediately come to mind:

- What financial policies will be needed to ensure pensions are paid to people whose average lifespan is, say, 150 years?

- How much work will a person do over these years and what will the new retirement age be?

- What types of work will be available to humans if we automate everything, everywhere?

The Earth's population doubles approximately every 30 years.

They will certainly confuse many policyholders. How to insure health? How to form pension savings? After all, today the traditional retirement age is 65 years. It was established by Otto von Bismarck at the end of the 19th century. By the way, the average human life expectancy at that time was 40 years versus 80 years today. That is why we observe imbalances in modern pension systems in many countries.

The world's population doubles approximately every 30 years. With major efforts to fight poverty (Bill & Melinda Gates Foundation) and disease (Mark and Priscilla Zuckerberg), the planet is at risk of becoming overpopulated. What will all these people do? How will they earn money in conditions of widespread labor optimization? How will value be determined and what will the money of the future be like? How to solve the problem of excess population of the planet? Some believe that increasing wealth will no longer be an end in itself, as, for example, it is reflected in the fiction of Star Trek. There is also the opposite opinion, according to which the whole world will become slums in which 99% of the poor population will live, and marvelous cities will appear in the oceans and on other planets for the rich 1% (“Metropolis” by Fritz Lang, 1927).

Of course, these are extremes. I think Star Trek would choose a universe without banks, governments, or money. The world would function as a single whole without a control superstructure. It would include self-regulatory units. I generally like this model, but I don’t really believe in it. Even Bitcoin fits poorly into it. If we have democratic money without governments, who will control the risks of terrorist financing, drug trafficking and contract killings, how will this work within the framework of a self-regulatory model.

My personal email ID will be represented in some kind of distributed ledger, and if so, who will manage this ledger?

For these reasons, there must be some kind of external governance that is superior to democracy—a metropolitan scenario in which leaders rule the weak, accumulate wealth, and exploit others simply because they set the rules of the game. This option seems quite viable to me, but I still believe that we will have democratic, fair currencies that perform the function of exchanging value, and electronic identifiers that are issued by a governing structure, but to which we control access ourselves. Who will be this governing structure? The UN, the EU or the government of any country, I don’t even know. Let's just say that my personal email ID will be represented in some kind of distributed ledger, and if so, who will manage this ledger?

Internet of Things, Internet of Everything

If we talk about the Internet of things, there are few examples yet. If you live in the US, you have and.

Nest allows you to partially automate smart home systems: components are connected to the Internet. What will happen when all home devices go online and start ordering, paying for food and performing other financial transactions? The refrigerator was ordered and paid for, then the autonomous drone delivered and accepted payment. The TV bought a new season of your favorite series.

In Steven Spielberg's 2002 film Minority Report, Tom Cruise's character drives a self-driving car. 14 years ago it seemed fantastic. Today Tesla and Google can do this. Tomorrow they will pay for charging and parking themselves.

Who needs insurance if smart cars don't get into accidents?

The banking system must be ready for this. It will need the ability to instantly and inexpensively process huge numbers of transactions carried out by smart devices, regardless of their size, be it 1 cent or a billion.

Insurance companies also have something to think about. Who needs insurance if smart cars don't get into accidents? If the house is always under the control of a smart system, why do you need burglary insurance?

In addition, it is worth reconsidering approaches to assessing client processes. Until now, the bank was chosen for a long time, insurance was purchased for a year or more. Today things are no longer the same. The client changes banks instantly as soon as a more advantageous offer from a competitor appears. Processes are accelerated, cycles are shortened. We no longer like to pay for long periods of services. I paid for a month and am using it. If I don't like it, I refuse. Even 20 years ago, we chose a job and could stay in one place all our lives. Today there is no longer a job for life. Rather, this option is seen not as an advantage, but as a punishment.

Space

I would like to dwell on the topic of conquering outer space. The point is that there are no more boundaries. We roam the expanses of the universe and are rapidly mastering them: exploring Mars and taking magnificent photographs of Pluto, although only 100 years ago we mostly rode horses on the streets. A car was a novelty back then.

Today, space flight is available to few people. In 100 years it will be possible for everyone

It seems surprising, but the world was then explored by a small group of people, and only rich people could afford to travel. The rest, as a rule, did not leave the place in which they were born throughout their lives. Today we all try to get out at least once a year for a couple of weeks in warm countries. We just get on the plane and cross the space as if on a bicycle.

What I'm getting at is that space flight is accessible to few people today. In 100 years it will be possible for everyone. Therefore, you should not consider Elon Musk crazy when he calmly talks about moving to Mars. Moreover, he has already realized the possibility of returning the spacecraft to Earth.

Space money

By 2035, the earth will be inhabited by 8.7 billion people, up from 7 billion today.

Now I would like to evaluate all of the above from the position of financial organizations. According to Elon Musk, by 2040 we will explore Mars and consider this planet as another home. Why? Because the world's population is increasing. Some might argue that growth is slowing as the number of poor people falls. However, life expectancy continues to rise. Today it is 80 years old. Tomorrow it could be 100 years. In addition, if the level of technology makes it possible to create people with a programmed set of characteristics without the participation of parents, the birth rate may rise again. It is estimated that by 2035, the earth will be inhabited by 8.7 billion people, up from 7 billion today. By 2065, this figure could reach 14 billion inhabitants. If there are so many of us, someone will have to be sent into space one way or another.

There is an opinion that in the future there will be no work, since all work will become automated. I do not think so. There will be a need for space stewards, spacecraft safety specialists, as well as developers of systems and applications for them, engineers for servicing robots, creators of virtual reality systems and many others.

Many people agree that there will be a money problem in the future. Lots of people, not enough work. What to do if the proportion of the elderly population is significantly higher than the young? The young pay taxes to take care of the old - this paradigm will be turned upside down. In addition, young people will find it very difficult to earn decent money. And this will become a problem for those who have money.

Can technology make the pursuit of wealth unnecessary?

What, exactly, will happen to the money? In real life, the pursuit of profitability leads to high levels of productivity. In a free market and respect for private property rights, the only way to get rich is to serve others: to satisfy their wants and needs. Gaining wealth involves creating wealth. Thieves and criminals in such a system are punished, the rest work and earn money.

Can technology make the pursuit of wealth unnecessary? Let's say that we can produce food and other goods directly from thin air with minimal energy consumption using a replicator. Of course, there will be things that money cannot buy, as well as goods that cannot be produced using a replicator. Like, for example, the dilithium crystals from Star Trek, which are used as a power source for spaceships and can only be mined. How this will affect the natural craving for enrichment is not entirely clear. In addition, difficulties will arise with the calculation of economic indicators. Even the Soviet Union could not completely abandon money, although it put a lot of effort into this and achieved considerable success (however, this led to catastrophic consequences).

Excessive pursuit of wealth has been condemned by many from Plato to Thomas Moore and Karl Marx. These ideas captivate many people. However, we still won’t be able to refuse money. But we will need a new model of a truly free society, in which wealth creation is encouraged rather than criticized.