The Internet provides many opportunities to earn money. Investment instruments that allow you to receive passive income are becoming increasingly used. The essence of making money from various investments on the Internet comes down mainly to the fact that the investor invests free money in promising online projects, and if they are successful, he makes a profit.

Is it possible to make money from online investments?

The choice of financial instruments is constantly expanding, offering more and more options for investing money. It is important to study all available tools and directions in order to choose the most interesting and suitable one.

Features of investing on the Internet

The main feature of online investing is the absence of physical movement of assets. All operations can be carried out using a computer with an Internet connection.

For active network users who want their income not to depend on the number of hours worked, receiving passive income from investments is the easiest, fastest, most effective way. Proper use of temporarily free money allows you to increase its quantity and become a financially independent person.

Features of investing online:

- makes it possible to receive a stable income without labor costs;

- requires time, study of direction;

- does not accept investing money “for luck”, only a competent approach and careful analysis;

- always involves certain risks.

The earning method is suitable for investors who meet the minimum requirements:

- Have constant access to the Internet.

- Understand or are willing to learn the basics of investing.

- They are able to analyze and evaluate projects, as well as their own strengths.

- Morally prepared for the risks of material losses.

Myths and reality of online investing

An investor does not need to have an IQ of 190 or graduate from the Faculty of Economics of a prestigious university; it is enough to learn the basics for searching for projects and understand the investment procedure. You can become an investor by investing just $10. Of course, you shouldn’t expect big returns from such investments, but it’s better to invest a minimum in a promising area than to invest nothing.

Investment projects can become a stable source of income. Among their other advantages are a large selection of tools and projects, lack of geographic location and the ability to start activities with minimal capital. The main disadvantage, which can outweigh all the advantages, is the risks.

Types of investment risks

The risk of losing funds is typical for any investment activity, and for online investments it is even more relevant. Fear of losing money is one of the main deterrents before starting investment activity.

All existing risks in the field of online investments can be divided into several types:

- Outstanding risks are important circumstances that can affect the organization’s activities, such as changes in management, bankruptcy risks, changes in consumer preferences.

- Market – risks of economic crisis, decreased return on investment.

- Liquidity risks. A beginner should start with large companies, since such investments are less risky.

- Legal political – risks of changes in legislation.

- Currency risks – sudden changes in the exchange rate.

Qualification of investor risks

Investment risks can also be divided into trading and non-trading. The first type is factors that an investor can influence by analyzing financial instruments and projects. This category includes ineffective fund management.

Even the most experienced investors cannot influence non-trading risks. These include hacker attacks, various force majeure events, bankruptcy, and mistakes by investors themselves.

It is important to consider all potential risks, analyze them and take preventive measures to the extent possible.

How and where to start investing on the Internet

Online investing is not the easiest area where the average user can make some money. Beginners are required not only to have consolidated funds for investments, but also a certain level of knowledge and skills.

To understand how to make money by investing on the Internet, it is important to have a certain level of training and skills in working with financial instruments. Potential investors must meet several criteria that will allow them to succeed in this direction.

Having at least minimal knowledge of economics

Without understanding basic economic terms, it is not recommended to get involved with investment projects at all. The investor must understand how the main financial instruments work and what they are intended for.

Where to begin

This does not mean that only people with higher economic education can make money from investments. No, you can learn how to invest money effectively, but you need to spend time on self-education. There is enough freely available information on the Internet that will help you understand all the nuances of online investments.

Recommended sources to help you study the topic:

- thematic forums;

- blogs of successful investors;

- special literature.

It is not necessary to study economic encyclopedias and textbooks; there is a lot of modern literature on financial topics, described in a language understandable to most.

High-quality Internet access

It is impossible to invest in online projects without access to the Internet. This criterion is more about the fact that the connection must be stable and as fast as possible so that the investor can quickly respond to various situations.

High-speed Internet is the main condition for getting started

Investors care about both the quality of the connection and its security. The activity involves the non-cash movement of your own assets through various payment systems, wallets, accounts, so it is extremely important that all these channels are protected.

Resistance to stress

Before you start investing your own money, it is important to set yourself up correctly psychologically. Any investment is a risk, and you need to be mentally prepared for the situation not to develop in the best way.

If a potential investor becomes depressed from the slightest failure or is not ready to wait long for a return on investment, he should look for another way to earn money that is safer for his mental and physical health.

It's important to be objective

Earning income from investing takes time and effort. The investor must objectively assess his financial capabilities, set specific goals and take into account the payback period of investments.

It is not recommended to invest other people's money and choose long-term projects if you cannot afford to wait that long for a return.

Objectivity and willingness to fail

The investor must be prepared for financial losses

Even the most promising projects can fail, and the investor must be prepared for this, both morally and financially. The main thing is to react calmly, not make hasty decisions (very important for stock market players), analyze your actions and draw the right conclusions.

US Treasuries

10-year Treasuries are the dream of any conservative investor. The yield on them is about 1-2%, but this is a very stable asset. Given that treasury bonds are sold in dollars, Russian investors also receive protection from ruble devaluation.

And here’s another interesting article: Gazprom dividends in 2020: payment with sparkle!

It is not possible to buy these securities directly (that is, it is possible, but it is very expensive and is intended only for qualified investors), but you can invest in treasury bonds through mutual funds and ETFs.

Internet investment rules

Most people, especially beginners, perceive online investing as a source of additional income. And the main mistake of all beginners is the reluctance to learn, understand the topic deeper, or at least become familiar with the basic rules that will help you avoid financial losses and start making money.

Don't invest money that doesn't belong to you

The main problem for novice investors is the lack of start-up capital. And often, having found a promising project, they borrow and open loans. It is strictly not recommended to invest other people's funds, no matter how promising and profitable the investment option under consideration is.

As mentioned above, in the investment field there are risks that cannot be foreseen and influenced. Accordingly, even the choice of the most reliable and promising financial instruments cannot guarantee the success of investments and cannot protect against the usual mistakes of the investor himself. As a result, he not only loses the invested funds, but is also obliged to repay the loan.

Don't invest your last money

For the same reason, you should not invest your last savings. You should always leave a certain amount, which in case of failure of the project will help pay for the most important payments and livelihoods.

Develop an investment plan

Strategic planning is an important part of investing. A clearly formed action plan helps the investor protect himself from spontaneous decisions and momentary emotions.

Developing an Action Plan and Expectations

This does not mean that you need to strictly follow the developed plan. The strategy can be changed and supplemented, but only after a thorough study of the issue and analysis of your previous actions.

Continuously increase the amount of invested funds

The main purpose of investment is to make a profit. To constantly increase the amount of income, it is necessary to increase the volume of investments. An investor can use 2 sources for this:

- part of the income received from previous investments;

- free savings of the investor.

The investor must determine the amount of increase in investments independently, based on his capabilities and moral side.

Excitement and emotional content should be minimized

The worst enemy of any investor is excitement. You can successfully invest money in a project, decide that it is even more promising, and re-invest much more money into it. But the emotional component in such activities is unacceptable, since most often it leads to rash actions and the risk of losing investments.

An investor must analyze his every step and invest money gradually.

The assessment of possible income and risks must be correct

When investing money in online projects, it is important to realistically assess the risks and possibilities of losses. The investor must be prepared to lose money and that the return on investment takes time.

Competent assessment of results

Diversify risks

An effective method of minimizing risks during investing is diversification. An investor should invest money in several projects, then he will protect himself from the risk of losing all his savings.

Popular methods of investing on the Internet

The popularity of investing funds via the Internet is constantly growing, new financial instruments are appearing, and the number of new projects is growing. It is difficult for a potential investor new to this industry to immediately understand which methods work and which ones bring losses.

Below are time-tested ways to invest. But almost all of them require the active participation of the investor.

Forex currency market

Perhaps the most well-known method of generating remote income at the moment, which is also suitable for beginners. Forex is an ordinary exchange, a trading platform on which currency is bought and sold.

Although in practice it is not enough for a participant to simply guess the situation on the market, he must be able to analyze and understand basic statistical terms and indicators.

You should constantly monitor the market, since fluctuations in exchange rates are associated with various factors:

- conducting large banking operations;

- decisions of central banks of different countries;

- world events;

- changes in legislation;

- other issues that may affect the economy.

Features of making money on Forex

Trading can hardly be called a source of passive income, since the investor must constantly monitor the situation on the foreign exchange market in order to buy assets and then sell them at a higher price, making money on the difference in exchange rates. It's more like a daily job than an investment. If the investor is still more interested in the second option, he can invest the money in a long-term deal, but they are very risky.

Binary options

This method is easier for beginners. The participant is not required to track the value of currencies, he only needs to determine how it will change: it will increase or decrease. But this does not mean that simply guessing is enough; you will need to think analytically.

The advantages of this method are the ability to invest small amounts (from 5-10 dollars). Another important advantage is that possible losses or the amount of income are known to the investor in advance, since they are fixed at the conclusion of the transaction.

PAMM accounts

If an investor is not confident in his abilities and is not ready to make decisions on his own on Forex or other exchanges, he can entrust the management of his funds to a professional trader. The manager will independently manage the money and receive a certain remuneration for this.

Among the disadvantages are:

- the presence of a large amount of free funds, since a professional trader is not interested in managing small investments;

- transferring money to a third party is always a risk;

- Even the most experienced manager cannot give a 100% guarantee of profit.

Generating profit on a PAMM account

This method is an option for passive income. All that is required from the investor is to choose the manager wisely.

Investing in precious metals through an impersonal metal account

You can trade precious metals online in the same way as you trade currencies. This method is quite reliable and reasonable when it comes to long-term investments. If an investor wants to make a profit within a year, it is better to consider other investment methods, since the rate of precious metals is quite stable.

You can invest in two ways:

- Buying and selling physical assets (real gold, silver, which is stored in banks in unallocated metal accounts in cash equivalent).

- Trade ownership rights in precious metals.

The metal account is tax-free and opens for 12 months with the possibility of extension.

Earning money from HYIPs

HYIPs are promising investment projects that can bring big profits, but are very risky. Most often in this area you can stumble upon scammers, so you need to choose the most open and well-known company.

In order not to lose your own savings, you should follow several recommendations when choosing a suitable project:

- contributions should be made only at the initial stage of the existence of HYIPs, since they are all limited in time;

- no need to invest all your free money in one project;

- It is better to withdraw profits in parts;

- Be sure to study and analyze the company’s activities.

Principles of making money on HYIPs

HYIPs are not always a scam; you can actually make good money on some projects. The main thing is to play by certain rules.

Contribution to microfinance organizations

Microfinance organizations issue loans to their clients every day. But to operate fully, they need to attract capital. The main way to attract additional funds is through deposits. Anyone can open a deposit account with an MFO.

The benefits of earning money are high interest rates. Disadvantage: high risks.

Investments in an online store

Online stores are becoming increasingly used trading platforms. They are open for trading in almost any product. To develop an online store, you need funds that the owner does not always have at his disposal. To attract investors, the seller offers them a certain percentage of the profits.

Joint stock companies and shares

The traditional way of investing is to buy shares of various companies. The main feature of such investments is their long-term nature. After the global financial crisis, even the shares of the largest joint stock companies lost ground, and therefore the way to earn money became more risky.

Opportunities to make money on shares of large companies

There are two ways to make money on stocks:

- Investments in large corporations for the purpose of receiving dividends.

- Speculation in stocks, buying cheap securities and selling them at a higher price.

To trade shares, you will need to obtain an electronic digital signature.

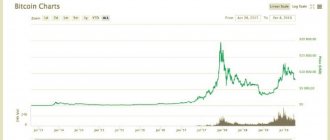

Investments in cryptocurrency

One of the most difficult ways of investing, which is becoming more and more promising and profitable in terms of making a profit. It is recommended to invest in several types of cryptocurrency at once.

The essence of making money comes down to buying Bitcoin or another currency at the moment of a drop in the rate and selling it a few months or years later at a higher rate. To begin with, an investor should study the types of cryptocurrencies, their exchange rate statistics, and purchasing features.

Where you shouldn't invest in 2020

And now about where you shouldn’t invest your money in 2019.

- Cryptocurrency - Bitcoin once again updates anti-records, plus the stranglehold of bans in various countries is tightening around its neck. Moreover, the cost of energy consumption to produce 1 bitcoin exceeded its market value. I would not invest in other cryptocurrencies, since it is not clear how it all works and how it will be regulated. You can be left without your money at all.

- ICO is from the same series of crypto fever. In 2020, the ICO mechanism discredited itself - it turned out that there are many opportunities for fraud. I don't think the situation will change in 2020. It's better to invest in startups.

- Gold seems to be a defensive asset, but I am disappointed in it. Not growing. And it doesn't fulfill its function. The maximum that is possible is to invest in “gold” mutual funds or ETFs.

- The American stock market is overheated. It’s not a fact that it will collapse in 2020, but I would be careful about stocking up on American stocks: the end of winter is coming. Sooner or later, overbought will take its toll. If you are collecting a portfolio for old age, you should not buy only US stocks. Consider other options - European or Asian stocks. Or funds.

- MFC – too high risks plus no insurance. You need to invest in microcredit companies from 1.5 million rubles and even without guarantees - what for is it necessary, to be honest. Considering that the Central Bank of the Russian Federation will tighten requirements for them, we can expect a wave of IFC bankruptcies. And these are unnecessary risks - do you need it?

And here’s another interesting article: Mosenergo dividends in 2020: is it worth buying company shares

I won’t say anything at all about HYIPs (highly profitable investment projects) - there is nothing for a normal investor to catch here at all. This is a casino, nothing more, like binary options. Or financial pyramids like MMM.

Where do you think it’s worth investing in 2019?

How much can you earn on investments?

The amount of annual income from investing online depends on the choice of financial instrument and the competent actions of the investor. To guarantee a profit of 10% per annum, it is worth choosing investments in shares.

How much does investment really bring?

If you do not make typical mistakes and analyze the market situation, a beginner is quite capable of earning 5-25% per year. It is impossible to name the maximum amount of income, since everything depends on the amount of investments and the skill of their management.

Bonds of Russian companies

The situation here is the same as with stocks. Debt securities of Russian companies have fallen in price - but not because of a bad financial situation, but because of external factors.

But you need to choose for purchase not undervalued securities, as is the case with shares, but, on the contrary, highly valued ones by the market - i.e. reliable. Best rated AAA or higher. Or at least from BBB- and higher, since we don’t have very many high-quality bonds.

You can view the ratings, for example, on the website of the Expert rating agency.

If you don’t want to bother with calculating coupon income and taking into account other subtleties, just buy a bond mutual fund. Seriously.

And here’s another interesting article: How to calculate the dividend and total return of a stock: formulas and coefficients