History of the exchange

Coinbase began its journey as a digital wallet back in 2012. Being one of the first in the nascent market, the creators of the platform, Brian Armstrong and Fred Ehrsam, quickly achieved recognition. In 2013, the startup attracted investments from Andreessen Horowitz and other large investors, and in 2014 it grew into a stock exchange and began investing in other promising projects.

That same year, Coinbase established partnerships with leading US retailer Overstock, electronics manufacturer Dell and others, which began accepting payments in Bitcoin.

In 2020, the exchange was one of the first to receive a BitLicense in New York, strengthening its position as a legal exchange platform.

So what could possibly go wrong?

In 2020, Coinbase made a very bad deal by acquiring cybersecurity startup Neutrino. The public soon learned that some of Neutrino's employees were previously part of the Hacking Team, a team that provided tools for governments to spy on citizens and were even suspected of being involved in murders.

The #DeleteCoinbase campaign swept the cryptocurrency community, and the exchange's explanation that the purchase of Neutrino was necessary because the previous service provider was selling Coinbase user data only made the situation worse.

Coinbase Wallet

It was opened relatively recently - in 2012. Today, Coinbase is one of the main competitors of another famous wallet. It's called Blockchain. Coinbase is headquartered in San Francisco, California, USA. To date, both of these wallets can boast approximately the same number of users.

The official Coinbase website has been assigned a domain name, and in addition, several language interfaces. But, unfortunately, there is no Russian among them. This fact immediately catches the eye of my compatriots. Many people conclude that Coinbase does not work in Russia. This is not entirely true. It is quite possible to use wallet services through intermediaries. Therefore, Russians actively register on the site, and choose the easiest language to understand – English – as their main language.

At the moment, the Coinbase cryptocurrency exchange is quite convenient. But, according to most users, it is not perfect. First of all, because it sorely lacks the diversity of cryptocurrencies.

At the beginning of autumn of this year, the total number of users of the Coinbase exchange reached its record high and exceeded ten million people. Recently, the wallet's client base has begun to increase significantly. On average, it grows by one million users every month. And this, according to experts, is not the limit. There are over thirty million cryptocurrency wallets registered on this platform.

Just recently, Coinbase introduced a new service for users, in which customer support began to be provided over the phone. Thanks to it, via telephone, company employees help users in matters of verification, blocking access to personal accounts if there are suspicions that they have been hacked, and also provide advice on increasing limits. To solve other problems, there is a ticket system.

The great interest and popularity of the service is confirmed by the attention of attackers who regularly attack Coinbase, stealing funds from its clients through Trojan programs.

Main characteristics

| Official site | https://www.coinbase.com |

| Social media | |

| Location | USA |

| Founder | Brian Armstrong |

| Year of foundation | 2014 |

| Deposit/withdrawal method | Cryptocurrency, fiat |

| Available cryptocurrencies and tokens | BTC, BAT, ETH, 0x, USDC (about 20 in total) |

| Number of trading pairs | Around 20 for crypto-crypto pairs, around 10 for crypto-fiat pairs (depending on region) |

| Own token | USDC |

| Commissions | 0.25% (taker) 0.15% (maker) |

| Languages | |

| Verification | Mandatory |

| Mobile app | Google Play, App Store |

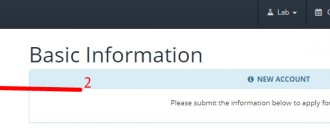

Exchange registration process

Exchange trading on Coinbase is not available to residents of Russia, Ukraine, Belarus and a number of other countries. It is possible to register on the exchange, but in this case trading remains closed. More details in the Supported Countries section.

To register on coinbase.com:

- On the home page, click Get Started or follow the link: https://www.coinbase.com/signup

- Fill out the form: first and last name, email; Create a password.

- Create Account. You may be required to complete a captcha during the process.

- After this, all that remains is to check the activation letter in the mail with the link you need to follow.

Now you can take Coinbase Earn courses; like other services, it can be easily found in the Products section. In these courses, you will not only learn how to handle cryptocurrency, but also receive a pleasant reward for successful completion.

Coinbase crypto exchange: registration and verification

The interface of the Coinbase cryptocurrency exchange is in English. Therefore, the editors of RuscoinsInfo have compiled detailed instructions on how to register on the Coinbase exchange. In the upper right corner of the page you need to click on the “Sing up” button.

A form appears that must be filled out to register on the Coinbase crypto exchange.

Fill in all available fields. Check the box next to the box indicating that you are over eighteen years old. Cryptocurrency exchange Coinbase may require you to enter a captcha.

After confirming the entry, click on the “Sign up” button. You will see the following message:

Please check the email provided. The Coinbase crypto exchange sends a message to verify your account. Click on the appropriate button inside the message.

In the page that opens, you must indicate your country (automatically set according to the user’s IP address) and phone number. After filling out the available fields, click on “Send Code”

Within a short period of time, you should receive an SMS message from Coinbase with code 7 on your phone. Enter it in the window that appears.

If everything is done correctly, then registration on coinbase will be completed.

Account verification

Verification on Coinbase is required:

- Settings - Personal Details.

- Fill out the form, indicating your name, date of birth, and place of residence.

- Click Save.

- Specify the payment method - usually Visa, MasterCard.

- Make a few test transactions.

- After this, verification is completed.

When operating large amounts (from $25,000), you will need to go through an additional verification step. If you are not a US resident, we recommend contacting support.

Replenishment and withdrawal of funds

- In your profile, select Accounts.

- Select the desired currency.

- Click Send if you want to withdraw cryptocurrency from the exchange or Receive if you want to fund your Coinbase account.

- When withdrawing, indicate the number of coins to withdraw and the address of your wallet to which you want to send the amount.

- When you fund your account on Coinbase, the exchange will generate an address to which you need to transfer funds from your wallet.

You can top up your Coinbase account in fiat, that is, with regular money - by credit card, bank transfer, and so on. Conditions differ for different regions.

Rules for using Coinbase-Wallet, depositing and withdrawing money

To see the contents of your wallets for all types of digital currencies that are supported by the service, you should enter the “Account” section. Then select the desired crypt and click the “Get Bitcoin (or Litecoin, Ethereum) Address” button located on the right. The system will issue the generated code in alphanumeric and QR form.

After each transaction performed, the wallet number may change. The user also has the opportunity to create new cryptocurrency wallets, give them different names, and, if necessary, quickly transfer all the bitcoins from one account to another.

To send a coin to another user, you need to perform the following sequence of actions:

- enter the “Send/Request” section and select “Send”;

- enter the recipient's (recipient's) address, email address and code in the field;

- indicate the amount of currency to be sent;

- select the desired wallet to send from the list provided;

- write a note (if necessary);

- Click on “Send Funds”.

Coinbass clients will receive funds very quickly, others will have to wait a little, but not too long. To receive crypto, the request looks almost the same.

Residents of Russia and all CIS countries should remember that trading on the stock exchange is not officially available to them. Some people use Opera browsers with built-in VPN or Tor, but this may cause problems with verification. It is better to trade on other sites, and you can transfer crypto without problems through Coinbass. The affiliate program offered by the service provides for receiving passive income in the amount of $10 for transferring money by your referral. However, this function is also available only to users from 32 countries that are partners of the resource.

Now very briefly about how to enter and how to withdraw money from Coinbass. Coinbase-Wallet allows you to work only with digital currencies, so you can top up your account from a card only by using the services of exchangers. For example, exchange fiat currency at any exchanger presented on the Bestchange resource. Withdrawing funds to a bank account or credit card is also possible only through exchangers.

Deposit and withdrawal fees

Coinbase waives deposit and withdrawal fees that vary by region and payment method, ranging from 0% to 4%.

| A country | Payment method | Commission |

| Australia | Purchase with credit/debit card | 3.99% |

| Canada | Purchase with credit/debit card | 3.99% |

| Singapore | Buying/selling Buying with credit/debit cards | 1.49% 3.99% |

| Great Britain | Standard buy/sell Instant buy (credit and debit cards only) Bank transfer | 1.49% 3.99% 0% deposit £1 withdrawal |

| USA (base rate 4% for all transactions) | US Bank Account USD Wallet Coinbase Credit/Debit Card ACH Transfer Wire Transfer | 1.49% 1.49% 3.99% 0% $10 ($25 withdrawal) |

| Europe | Standard buy/sell Instant buy (credit and debit cards only) SEPA bank transfers | 1.49% 3.99% 0% deposit €0.15 withdrawal |

Briefly about the Coinbase service

So let's figure out what Coinbase is?

This service was founded in 2012 in San Francisco (USA). At first it only provided wallet services, but over time, the GDAX cryptocurrency exchange for professionals was created on its basis. There are currently over 10 million registered clients on this trading platform, more than any other exchange. However, as a full-fledged exchange, Coinbase does not work in Russia, since Russia, like other states of the post-Soviet space, does not have appropriate agreements with the owners of the resource. As a full-fledged trading platform, it is available to residents of only 32 countries. The rest of the service can only be used as a Bitcoin wallet. To date, more than 30 million users have taken advantage of this opportunity, and the amount of currency exchanged exceeds $20 billion.

The service works with three digital coins: Bitcoin, Litecoin and Ethereum; since the end of 2020, information has appeared that the exchange has started working with Bitcoin Cash; in the future, this list is planned to be expanded. The main difference from other exchangers is that users are encouraged to buy coins directly from the service at the current market price, rather than trade on the market. This approach allows you to significantly speed up the acquisition of digital coins and allows you to use, in addition to bank transfers, also credit cards. This service is not provided by all sites, although it is not unique. Coinbas' competitors in this area are CEX.IO and Coinmama.

Depending on the method, withdrawal of funds is subject to an appropriate commission. Its value is higher when using credit cards (3.99%), while the commission for transactions with bank transfers is estimated to be much cheaper (1.49%). Withdraw your bitcoins to a bank account and save money, but you will have to go through a number of additional procedures.

Coinbase also has a Shift debit card that takes bitcoins directly from the coinbase wallet with each transaction. Shift is popular because there is no need to keep a separate Bitcoin wallet and transfer the required amount of funds from it to a card-wallet before each payment.

Trading commissions

On coinbase.com you can only buy and sell cryptocurrency from the exchange itself. Trading is conducted on Coinbase Pro.

Commissions on Coinbase Pro depend on the type of participant (taker or maker) and its turnover: from 0% to 0.25%, which corresponds to market practice.

| Trade turnover | Taker commission | Maker commission |

| 0.25% | 0.15% | |

| 100K - 1M | 0.20% | 0.10% |

| 1- 10M | 0.18% | 0.08% |

| 10 -50M | 0.15% | 0.05% |

| 50 - 100M | 0.10% | 0.00% |

| 100 – 300M | 0.08% | 0.00% |

| 300 – 500M | 0.07% | 0.00% |

| 500M - 1B | 0.06% | 0.00% |

| $1B+ | 0.05% | 0.00% |

A trading commission of 0.25% is also available on the following exchanges:

- Bittrex;

- Bitsdaq;

- Hotbit;

- Upbit.

List of tradable tokens

Popular coins on Coinbase and trading pairs with the highest turnover:

| Cryptocurrency | Trading pair |

| Bitcoin | BTC/USD BTC/EUR BTC/GBP |

| Ethereum | ETH/USD ETH/EUR ETH/BTC |

| Bitcoin Cash | BCH/USD BCH/BTC BCH/EUR |

| Litecoin | LTC/USD LTC/BTC LTC/EUR |

| XRP | XRP/USD XRP/EUR XRP/BTC |

| EOS | EOS/USD |

| Ethereum Classic | ETC/USD |

| Stellar | XLM/USD |

| Basic Attention Token | BAT/USDC |

How to trade on the stock exchange

On coinbase.com, users can simply purchase at a fixed price from the exchange using fiat through bank transfers or credit cards.

For example, to purchase:

- In your profile, select Buy/Sell.

- In the form that opens, select Buy.

- Fill out the form (the desired cryptocurrency, purchase method, amount).

- Click Buy and in the new form - Confirm.

For selling, the steps are the same.

For full trading you need to go to pro.coinbase.com. And this is beneficial, since commissions and other conditions are more attractive here.

Interface, menu, features

The Coinbase Pro trading interface is located in the View Exchange section. The interface is generally familiar, although the blocks are arranged somewhat differently and there are additional options:

- Selecting a trading pair.

- Information on the selected pair.

- Wallet: balance, replenishment, withdrawal.

- Form for placing orders (orders).

- Order book, or order book.

- Price movement chart.

- Your open orders.

- Trading history of the exchange.

Placing orders

In the order form:

- Select whether you are going to buy or sell currency.

- Select the order type: market, limit, stop.

- Enter the price and number of coins to buy/sell.

- Select an ordering option, such as Post Only*.

- Configure additional settings if desired.

- Click Place Buy/Sell Order.

*Choosing Post Only ensures that you pay the commission as a maker and not as a taker.

Taker orders are filled instantly, while maker orders can be filled later. That is, makers create liquidity on the exchange, and often their commissions are lower.

Order types:

- Market (market) - performed immediately at average exchange prices.

- Limit - the user sets the price for his orders, which may require the system time to select a suitable counter-offer and complete the order.

- Stop - when the exchange reaches the “stop price” you set, a limit order is immediately published on your behalf. However, the price in this limit order may not match the stop price.

How to trade

As we have already noted, trading on the platform is only possible for residents of certain countries. But is it possible to bypass the blocking?

One of the most obvious options is to install a VPN with a country selection. This will allow you to access trading instruments on the cryptocurrency exchange only if you can pass verification.

One piece of advice from users on various forums is to find someone in the US or any other country where Coinbase trading is available to help verify your residential address to complete verification.

If you do get access to trading options on the exchange, placing orders will be quite simple:

- Go to the “Buy/Sell” section to place an order;

- First, you should select the “Buy” section to buy cryptocurrency or “Sell” to sell it;

- The next step is the method of payment for the operation (choose a convenient option);

- Below are the limits on transactions per week;

- Enter the amount to purchase or the amount you are willing to spend on the transaction;

- On the right you will see all the information on the transaction on Coinbase - commission amounts, amount received, costs for the payment method used;

- Press the blue button to complete the operation.

As you can see, the Coinbase exchange is not ideal for making money on cryptocurrency exchanges (the section does not even have basic charts and order tables). The service is more like a regular exchanger.

Margin trading

Margin trading may be launched again on Coinbase, which was confirmed in May 2020 by the company's vice president, Emily Choi. So far, the exchange team is not satisfied with the lack of regulatory regulation of the segment.

In 2020, the margin trading option was available on GDAX (now Coinbase Pro), but was disabled. It is assumed that the reason was the same legal uncertainty.

Margin trading allows traders to raise funds from the exchange to carry out their operations.

Exchange services

The exchange supports several services:

- Coinbase Wallet is a Coinbase wallet available in all countries and regions.

- Coinbase Pro is an exchange for professional traders.

- Coinbase Custody is an exchange for large companies.

Users can transfer funds between their Coinbase and Coinbase Pro accounts.

To transfer from Coinbase to Coinbase Pro:

- Go to Coinbase Pro.

- Click Deposit.

- In the form, select the desired cryptocurrency and your Coinbase wallet, and enter the amount you want to transfer TO Pro.

- Click the Deposit button.

To transfer from Coinbase Pro to Coinbase:

- Also upgrade to Coinbase Pro.

- Click Withdraw.

- In the form, select the desired cryptocurrency and your Coinbase wallet, and enter the amount you want to transfer FROM Pro.

- Click the Withdraw button.

Safety

From time to time, reports appear in the media about hacking of Coinbase, but there is no real evidence of this. But hacking of individual accounts is not uncommon and they are quite real, so it is recommended to connect 2fa in your profile settings and take other steps.

At the beginning of 2019, Coinbase confirmed that the previous security team was trading the data of its users. The solution to the problem caused even more indignation among the community: Coinbase hired Neutrino (formerly Hacking Team), which was involved in spying scandals and was even accused of complicity in murder.

For this reason, Coinbase is not recommended for those looking for at least relative security.

Coinbase cryptocurrency exchange forecast for 2020

At the beginning of 2020, the Coinbase crypto exchange became the reason for a number of news: new contracts, payment and withdrawal methods (PayPal), applications mainly aimed at American users. Therefore, it is clear that in the first 2 months a lot of work was done to review priorities and improve the functionality of the platform.

However, the exchange itself is not very high in the ranking of cryptocurrency exchanges for daily trading in February 2020: only 40th place.

Trading volume and currency pairs on the Coinbase cryptocurrency exchange 02/20/2019

What problems can you encounter on the stock exchange?

For residents of Ukraine, Russia and many other countries, the most obvious problem is the lack of support for full-fledged trading services for their countries. Yes, the Coinbase exchange does not operate in Russia and has no plans to change this.

Another problem is the unreasonable blocking of accounts and the inability to get a response from technical support.

And finally, there is a chance that you will find your documents somewhere on the Darknet.

However, all this applies not only to Coinbase.

Reviews of coinbase.com: what traders are complaining about

Since this exchange does not operate in Russia, the Russian-speaking community is indignant. Strict controls, identity disclosure requirements and other heavy-handed measures have been criticized.

But Coinbase has its share of dissatisfied users from other countries. The main reason for complaints is the blocking and freezing of accounts. They can ban you at any time without giving any reason.

Most often, funds are frozen when a trader tries to withdraw them from his account. Thousands of people wait weeks and sometimes months for permission to withdraw their money.

Another target of criticism in Coinbase reviews is support. He occasionally responds within 48–72 hours. And more often than not, he doesn’t get in touch at all. In general, technical support staff ignore individuals involved in speculative trading. They don't allow themselves to do this with large institutional clients.