Comment: Chinese cities in captivity of coronavirus

The Chinese authorities, although initially suppressing the facts about the coronavirus, are taking more effective measures than in 2003.

But China still has to fully pass this test, says German journalist Frank Zieren. (02/01/2020) Funds will be withdrawn through reverse repo transactions. This is a transaction in which securities are purchased and at the same time an agreement is made to resell them at a pre-agreed price. The day before, the Central Bank of China announced that it intends to ensure stability in the country's currency and financial market amid the coronavirus epidemic.

The number of people infected with the virus and the death toll in China is growing

In China, according to authorities, the number of patients who died from pulmonary disease caused by coronavirus has reached 304 people. In total, signs of infection were detected in 14,300 patients in China. In just one day from January 31 to February 1, 45 patients died from pneumonia in the crisis province of Hubei, and more than 2,500 became infected with the virus.

On February 2, the first death of a coronavirus-infected patient outside China was recorded. The victim of the infection was a 44-year-old Chinese man from the city of Wuhan, who died in the Philippines. More than 14,500 thousand cases of the disease have been recorded in the world, 178 of them outside of China.

See also:

Express hospitals in Wuhan for those infected with coronavirus

Governor of the People's Bank of China

Zhou Xiaochuan - Chinese economist and banker; Since December 2002, he has held the post of head of the People's Bank of China and in this capacity controls the entire monetary policy of the country.

Zhou Xiaochuan photography

Zhou was born in Yixing, Jiangsu;

his father served as head of the industrial bureau of the northeastern region, and later became vice minister of the first department of machine development. During the Cultural Revolution, Father Zhou had a hard time; Xiaochuan himself worked in the construction and industrial corps in Hei Long Jiang Province during this period. In 1973, Zhou's father regained his former influence, and the family's affairs went uphill again. Advertisement:

In 1975, Zhou Xiaochuan graduated from the Beijing Institute of Chemical Technology; in 1985, he received his PhD (specializing in automation and systems engineering) from Tsinghua University. After graduating in 1976, Zhou was transferred to the Beijing Automation Research Center; here he performed the duties of an engineer and studied large automatic systems.

Zhou Xiaochuan photography

In 1986, Zhou Xiaochuan began working at the State Council for Economic Restructuring, as a member of the State Council's economic policy group and deputy director of the Institute for Research on Chinese Economic Reform.

From 1986 to 1989, Xiaochuan served as assistant minister of foreign trade; from 1986 to 1991, he was also on the National Committee for Economic Reform. Before the Tiananmen Square events in 1989, Zhou was an assistant and protégé of Zhao Ziyang.

Zhou Xiaochuan photography

From 1991 to 1995, Zhou was listed as executive director and vice president of the Bank of China.

In 1995, he got a job in the state administration for foreign currencies.

Zhou Xiaochuan photography

From 1996 to 1998, Xiaochuan also served as deputy governor of the People's Bank of China.

Best of the day

| Hieronymus of Stridonsky. Biography Visited:100 | Steve Martin: The Smartest Hollywood Star Visited:78 | Suptel's novel. Biography Visits:77 |

In 1998, Zhou Xiaochuan became president of the China Construction Bank; under his leadership, several companies were created to solve the problems of existing bank debts, which by that time had reached a completely indecent level. Zhou played a significant role in managing China's foreign exchange reserves.

Zhou Xiaochuan photography

From 2000 to 2002, Zhou headed the China Securities Commission; It was then that he earned the nickname 'Flenser Zhou'. With his war on corruption, Xiaochuan angered many small shareholders, whose shares fell noticeably in price; in June 2001, Zhou worsened the situation by declaring his intention to reduce the percentage of government ownership in the stock market. The market reacted to this so painfully that in October Zhou had to abandon his plans.

In December 2002, Zhou became head of the People's Bank of China; This is his second (and final) term in this position. Among other things, during this time Zhou managed to solve the problem of bad loans in the Chinese banking system totaling 865 billion.

At the moment, Zhou Xiaochuan is rightfully considered one of the smartest representatives of the country's ruling elite; he is known both as a good scientist and as 'China's most capable technocrat'. What best speaks about Zhou's scientific achievements is that he is, to this day, the only high-ranking Chinese politician who can boast of publication in a Western scientific journal. In March 2013, Zhou was reappointed as governor of the People's Bank of China, making his tenure at the central bank the longest in Chinese history.

Zhou Xiaochuan photography

Best weeks

| Evdokia Lopukhina: The first wife of Peter I Visited: 364 | Quintus Fabius Pictor. Biography Visited:20760 | Nikita Rudakov. Biography Visits:490 |

Two hospitals in two weeks

Two weeks ago there was bare ground here. Now one of the two new hospitals, with a total capacity of more than 2,500 beds, is ready to receive patients, the other will be completed in the coming days. The new complexes, built in less than two weeks, will only treat coronavirus patients. Other clinics in the isolated metropolis are overcrowded.

Express hospitals in Wuhan for those infected with coronavirus

People's Bank of China before leadership change

The internationalization of the yuan is designed to make the People's Bank of China a real competitor to the US Federal Reserve

On May 9, on the sidelines of the session of the National People's Congress (NPC) in Beijing, a press conference was held by the head of the People's Bank of China (PBOC), Zhou Xiaochuan. Many people paid attention to this event. The head of the Chinese Central Bank made several significant statements, unusually frank for an official of this rank - about the attitude towards private cryptocurrencies, about the internationalization of the yuan, about China's public debt.

A bright intellectual in the party and state leadership of the People's Republic of China

Zhou Xiaochuan will leave his post soon. In January, he turned 70 years old, according to Chinese law, this is the age limit for holding the post of chairman of the PBOC. Zhou Xiaochuan has held this post for more than 15 years, which is a lot by any standards (for example, for more than a hundred years, only two bankers managed to hold the post of chairman of the US Federal Reserve for a longer period of time: William M. Martin - from 1951 to 1970 and Alan Greenspan - from 1987 to 2006).

Zhou Xiaochuan is one of the most prominent intellectuals in the Chinese party and state leadership. As chairman of the NBK, he not only dealt with current issues of managing the Central Bank, but also prepared and then implemented the reform of China's monetary system. Comrade Zhou Xiaochuan is a global thinker. In March 2009, he published an article entitled "Reform of the International Monetary System", which created a sensation in economic circles. According to the head of the NBK, special drawing rights (SDRs), which were once issued in small quantities by the International Monetary Fund, should in the future replace the US dollar as the world reserve currency. That is, Zhou Xiaochuan is a supporter of preserving the IMF, which has been experiencing a crisis in recent years. And also a supporter of strengthening China’s position in this international financial organization. Zhou Xiaochuan was in close contact with Dominique Strauss-Kahn, who served as executive director of the IMF from 2007-2011. The current head of the NBK is considered one of the most influential economists in the world. In 2010, the American magazine Foreign Policy ranked him 4th in its ranking of “leading world thinkers.” He is classified as a member of the so-called Shanghai faction in the party and state leadership of the PRC.

Bitcoin verdict

Many Russian media reported the following excerpt from the Central Bank Governor's speech at his press conference on March 9: “China may reduce its dependence on broad financial support for economic growth as the country strives for high-quality development... There is no need to make liquidity conditions tight as China increases the efficiency of using the broad money supply.” Here, in a rather florid form, the idea is expressed that it is necessary to abandon the pursuit of high rates of economic growth and focus on the qualitative side of economic development. Moreover, high growth rates should not be achieved by injecting a lot of money into the economy. The focus must be on efficiency.

In addition, Zhou Xiaochuan effectively announced the death warrant for Bitcoin and other private cryptocurrencies and confirmed that the NBU continues to work on the introduction of an official digital currency. It will be the yuan, but its use will be based on the most advanced technologies. “Bitcoin and other digital currencies,” said Zhou Xiaochuan, “are entering the market too quickly and they are not reliable enough. If they spread too quickly, they could have a negative impact on consumers. In addition, they can lead to the most unpredictable consequences in the financial market... Virtual money like Bitcoin is currently not recognized by the People's Bank of China and the banking system as a means of payment like cash.” But China must develop official digital currencies based on new technologies. Zhou Xiaochuan said the PBOC is developing a digital currency for electronic payments that will be based on existing Chinese banknotes and coins without changing the position of the central bank and commercial banks in the financial system. According to the head of the PBOC, the official digital currency in China “should ensure smooth monetary and financial stability and at the same time protect consumers... We do not want to create products for speculation... The illusion of getting rich overnight is not good.”

Internationalization of the Yuan

And the most important statement by Zhou Xiaochuan was the recognition that Beijing’s strategic task is the internationalization of the yuan. He confirmed that the internationalization of the yuan can be achieved through the further opening of the Chinese economy and the removal of barriers to foreign investors. The Chairman of the NBK did not fail to remind that a lot has already been done here, in particular, in 2020 the IMF included the Chinese currency in the basket of reserve currencies. The yuan's achievement of reserve currency status is largely due to Zhou Xiaochuan personally. Although, he stipulates, “something can still be done in establishing interaction between domestic and international capital markets.”

In terms of establishing such interaction, the Stock Connect project should play an important role. The goal of the project is to connect the Chinese stock market with a similar market in Hong Kong and, in the longer term, create a single trading platform that could compete with the world's leading stock exchanges. The first stage of the project started in November 2014, it included connecting the Hong Kong exchange with the Shanghai exchange. At the end of 2016, the second phase of the project was launched, which involves connecting the Hong Kong exchange with the Shenzhen exchange. The project provides for the opportunity for Chinese investors to purchase shares of those Chinese and Hong Kong companies that are listed on the Hong Kong Stock Exchange, and for foreign investors to purchase shares traded on the Shanghai and Shenzhen stock exchanges.

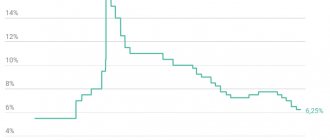

Now the situation on the world financial and currency markets is such that the wind is blowing in the sails of the Chinese ship. In particular, throughout last year there was a steady increase in the exchange rate of the yuan against the US dollar. January 2020 also ended with a record (on a monthly basis) increase in the yuan exchange rate. Trading partners are again ready to use the yuan as a settlement currency in trade with China. The volume of offshore yuan in 2020, according to expert forecasts, will increase.

JPMorgan Chase as a clearing center for working with yuan

It is known that Donald Trump does not like the yuan. And he is a clear opponent of America trading with China in yuan. However, even the US President cannot prohibit private American companies from doing this. So, last month the PBOC announced that it would operate a clearing center for transactions in yuan in the United States. And the function of a clearing bank will be performed by one of the largest American banks - JPMorgan Chase. Such clearing centers for transactions with the yuan have already been created in many countries, but they all operate on the basis of branches or subsidiaries of Chinese state-owned banks. JPMorgan Chase Bank is the first non-Chinese credit institution to act as a clearing center for dealing with the yuan. So the communist Zhou Xiaochuan showed extraordinary ability to negotiate with the toughest capitalists.

Love and fantasy: what did H.G. Wells promise Russia?

Another topic that Zhou Xiaochuan could not ignore was China's national debt. He admitted that the risks associated with high levels of debt (according to Western estimates, at least 300% of GDP and even according to official Chinese statistics - 260% of GDP) are very serious. Last year, for this reason, the top three global rating agencies even downgraded China's rating. The PBOC chairman expressed hope that China will “get its debt under control.” True, he did not provide specifics on this matter.

At the end of the NPC session, everyone expects that there will be a change in leadership at the Central Bank. There are several contenders for the position of NBU Chairman Zhou Xiaochuan. Among them are Chairman of the China Banking Regulatory Commission (CBRC) Guo Shuqing, Secretary of the Hubei Provincial CPC Committee Jiang Chaoliang, Deputy Chairman of the People's Bank of China Yi Gang, and Head of the China Securities Regulatory Commission (CSRC) Liu Shiyu. However, according to experts, Liu He, adviser to Chinese President Xi Jinping on economic issues, has the greatest chance. Liu, 66, a Harvard-educated technocrat, is also expected to become vice premier for economic and financial affairs in March. If Liu He combines the positions of vice-premier and chairman of the PBOC, the Chinese Central Bank may be able to take over some of the responsibilities of the National Development and Reform Commission, as well as the Ministry of Finance.

The change of leadership of the Chinese Central Bank is a serious event not only for China, but for the whole world. The People's Bank of China is considered the largest in the world: its assets are estimated at 5.5 trillion. Doll.; and the assets of the US Federal Reserve in the fall of last year, when they were at their maximum, amounted to 4.5 trillion. dollars. And, nevertheless, although the US Federal Reserve System is inferior in assets to the Chinese Central Bank, it is still in a higher weight category than the NBK in terms of the degree of influence on world finance. Probably, the internationalization of the yuan is intended to make the PBOC a real competitor to the Federal Reserve.

Strategic Culture Foundation

Follow us on VKontakte, Odnoklassniki

Ballet of colorful excavators

It all started on January 23 with construction work in Wuhan. Live broadcasts from the construction site have become a hit on the Internet. Although the video featured a static image and was filmed from a great distance, it received millions of views, Chinese media reported. Users have even come up with names for some excavators, depending on their color.

Express hospitals in Wuhan for those infected with coronavirus

Rubber boots and protective masks

Construction does not stop even at night and in the rain. Workers must wear protective masks. All construction workers have their temperatures taken periodically. As of February 2, 304 people have died from coronavirus in China, and there are more than 14.3 thousand confirmed cases of infection in this country.

Express hospitals in Wuhan for those infected with coronavirus

The banking world of China. Records and challenges

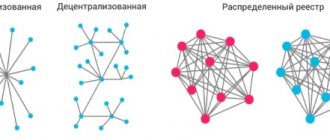

In October, at the 19th Congress of the Communist Party of China (CPC), it was said that the financial and banking sector of the Chinese economy will undergo significant reform. No specifics were given, but we will try to understand what may await the Chinese banking system in the future. Until now, it has been the locomotive that has driven the Chinese economy and ensured unprecedentedly high rates of GDP growth. The system itself has a three-tier structure and is completely under the control of the state.

The first level is formed by the People's Bank of China and the so-called political banks, or development banks. It is noteworthy that the People's Bank, as the Central Bank of the People's Republic of China, is an emission, credit and payment and settlement center, and does not supervise banks. It is carried out by the All-China Banking Regulatory Commission (ACBR), which is subordinate to the State Council. The three policy development banks are the State Development Bank of China, the Agricultural Development Bank of China, and the Export-Import Bank of China, which are responsible for implementing government programs in the industrial, agricultural and foreign trade fields, respectively.

The basis of the banking system is made up of second-tier state commercial banks, among which the big four are in the lead: Bank of China, Industrial and Commercial Bank of China, Construction Bank of China, Agricultural Bank of China. They are allocated in a special category, and it is the prerogative of the government to modernize and improve the efficiency of their activities. Also at the second level are financial companies that carry out banking operations: asset management corporations, trust investment companies, leasing financial companies. Here, the International Corporation of China for Trust Transactions and Investments, subordinate to the State Council, stands out. Has the right to establish financial and other organizations abroad together with foreign companies in order to attract foreign loans.

The third level is a network of agricultural and urban credit cooperatives, as well as numerous post offices. They are the basis for financing small and medium-sized businesses.

The banking sector of the economy in China has developed at a faster pace than many other sectors. In 2020, in terms of assets (the bulk of banks' assets are loans), China's banking system came out on top in the world. Here are the data on the assets of the leading banking systems at the end of 2020 (trillion dollars): China - 33; Eurozone countries – 31; USA – 16; Japan – 7. (For comparison: according to the Bank of Russia, the assets of the Russian banking system at the end of 2020 amounted to 80 trillion rubles, or approximately 1.3 trillion dollars). If in the United States the total assets of the banking sector are comparable to annual GDP, in the eurozone countries banking assets exceed GDP by 2.8 times, then in China this excess is 3.1 times.

In addition, shadow banking (illegal transactions outside the control of banking regulators) is very developed in China, taking into account which the Chinese banking sector is even more ahead of the rest. In the last few years, China has also begun to set world records for such an indicator as the number of banks included in the ranking lists of leaders in the global banking business. Last year, in the top five banks in the world in terms of assets, four banks were from China. Here's what the top 5 list looked like in 2020 (in trillion dollars):

1. Industrial and Commercial Bank of China (ICBC) – 3.62;

2. China Construction Bank Corporation - CCB - 2.94;

3. Chinese Agricultural Bank (Agricultural Bank of China - AboC) - 2.82;

4. Bank of China – 2.63;

5. HSBC Bank (HSBC Holdings plc) – 2.50.

Only the last of the five banks is not Chinese. For reference: the top 5 are followed by such famous banks as JPMorgan Chase (USA), BNP Paribas (France), Mitsubishi UFJ Financial Group (Japan), Bank of America (USA), Crédit Agricole (France).

Of course, according to some other indicators, Chinese banks are not yet leaders in world rankings. For example, in terms of market capitalization (as of April 2020, billion dollars), Chinese banks occupied third, fourth, sixth and seventh places. However, the trend is important: at the beginning of this decade, there was not a single Chinese credit organization in the world ratings of banks in terms of capitalization.

Chinese party and government leaders are forced to admit that the debt burden on the real sector of the economy caused by bank lending is prohibitive. In the portfolios of Chinese banks, the share of “bad”, “problematic”, “overdue” and “bad” loans is growing (repayment of the principal debt and even servicing in the form of interest payments has ceased or is carried out in violation of schedules). Over the past two years, the NBK and the VKBR have tried to tighten the screws by tightening the rules for banks, including increasing reserve payments for loans issued. The reaction of bank clients (companies in the real sector of the economy) was an increase in demand for cheaper shadow banking loans. As a result, the debt bubble in the Chinese economy continued to grow. It can be expected that in the near future the authorities will be forced to seriously engage in shadow banking, the credit operations of which, according to experts, have already exceeded the operations of “white banking”.

In order to prevent a sharp cut in the access of “monetary oxygen” to the Chinese economy, the Chinese authorities will have to seriously think about the development of the stock market. According to Chinese business, the rules for working on stock exchanges (primarily the initial public offering of securities - IPO) are overly strict, which is why there has been a bias towards bank lending. There are many supporters in China of the American model of business financing, which emphasizes companies raising money in the stock market rather than in the bank loan market. And it seems that this decade the authorities began to turn Chinese companies towards the stock market. However, unexpectedly in the summer of 2020, signs of a sharp collapse appeared on the Chinese stock market; the exchanges even had to be closed for a while. Apparently, the authorities will have to restore order also on the stock exchanges, tightening the screws even more. The construction of the American model in China is delayed.

Until the end of 2014, there was an absolute ban on the creation of private banks in China. The last three years have seen a relaxation of this ban. In 2014, the VKBR decided to create several private banks as a pilot project for credit support for small businesses, and five licenses were issued. The first of them is the Wenzhou Minshang Bank in Wenzhou (Zhejiang Province). The total assets of the first five private banks amounted to 133 billion yuan (about 19 billion dollars) in September 2020. Later, the All-China Banking Regulatory Commission issued several more similar licenses. The new banks will begin (or have already begun) operations in Beijing, Jiangsu, Jilin, Liaoning and Shandong. It is expected that by the end of this year, 16 private banks will already be operating in China.

Love and fantasy: what did H.G. Wells promise Russia?

Another new trend in the banking sector of the Chinese economy may be the liberalization of the regime for foreign capital. Before China's accession to the WTO, there was not a single foreign bank in the country, and not a single foreigner participated in the capital of Chinese banks. In December 2003, the VKBR issued a document allowing a non-resident to acquire up to 20% of the capital of a Chinese commercial bank. In general, Beijing pursued a clearly protectionist policy in this area. There were strict restrictions for foreign investors. According to the VKBR, at the end of last year the total assets of those banks classified as “foreign” amounted to 2.93 trillion. yuan, which is approximately equivalent to 442 billion dollars. In the total volume of assets of the banking sector, this is 1.29%. By the way, at the end of 2012 this figure was equal to 1.82%, that is, the position of foreign capital in the Chinese banking sector of the country was weakening. However, at the 19th CPC Congress, among the speakers was the head of the All-China Banking Regulatory Commission, Guo Shuqing, a professional banker who is said to be a man of a new generation. So, the new chairman of the VKBR in his speech stated the need to liberalize the regime for foreigners in the banking sector. It is noteworthy that this year (in January and August) the State Council of China has already issued two circulars providing for measures to be taken by ministries and subordinate organizations to liberalize the regime for foreigners in the insurance business, in the securities markets, and in the banking sector.

Apparently, new winds have blown in the country, which will affect the sphere of banks, money circulation and financial markets. This is also reflected in personnel changes. Rumors are circulating that before the end of the year, the head of the People's Bank of China, Zhou Xiaochuan, who has been in office for fifteen years, will resign. They say it is outdated in a political sense. There are now two contenders for Zhou’s place - the new head of the VKBR VKBR Guo Shuqing and Jiang Chaoliang.

The former previously headed the China Securities Regulatory Commission (CSRC), served as chairman of the China Construction Bank of China, and headed the State Administration of Foreign Exchange (SAFE). The second contender also has a solid track record. Jiang Chaoliang was appointed secretary of the CCP in Hubei Province in October 2020, and is also chairman of the state-owned Bank of Communications, Agricultural Bank of China and China Development Bank. What is especially noteworthy in his biography is that at the end of the last century, when he headed the branch of the People's Bank of China in Guangzhou, the largest bankruptcy in the history of the PRC at that time occurred: in 1999, the Guangdong International Trust and Investment Corporation collapsed. Jiang Chaoliang was tasked with organizing the bankruptcy procedure and minimizing its consequences. He did it successfully. Some experts hint that Jiang Chaoliang's experience will be in great demand in the near future, since the financial and banking sector of the PRC has approached a pre-crisis line.

Strategic Culture Foundation

Follow us on VKontakte, Odnoklassniki

Shoulder to shoulder

The key to successful work on construction sites is good organization. China already has experience with similar express clinics. In 2003, during the SARS epidemic, a 1,000-bed hospital was built in Beijing in six days. Every seventh Chinese patient with SARS was treated there. This experience became an example for two current construction projects.

Express hospitals in Wuhan for those infected with coronavirus

Story

The bank was founded on December 1, 1948, as a result of the merger of 3 banks: Huabei Bank, Beihai Bank and Xibei Agricultural Bank. The bank's head office was first located in Shijiazhuang, but was relocated to Beijing in 1949. From 1949 to 1978, the NBK performed the functions of both the Central and commercial banks. As a result of the economic reform carried out in 1980, the commercial functions of the bank were distributed among 4 independent but state-owned banks and in 1983 the State Council decided that the NBK would function only as a central bank. The legal position was finally established on March 18, 1995. In 1998, as a result of structural reform, all local and provincial branches were closed and the NBK opened 9 regional branches, whose powers do not correspond to the local administrative division. In 2003, the Standing Committee of the National People's Congress adopted amendments to the law, according to which the bank received a number of additional powers to ensure overall financial stability and conduct the country's monetary policy. The People's Bank of China is the largest financial institution in the world in terms of its reserves, amounting to $3.201 trillion.[3]

In record time

Hospital construction is proceeding at lightning speed. Some state media reported that the first building was completed 16 hours later. As evidence, they used a photo of a house in Qingdao, a city more than 800 km from Wuhan. But this turned out to be a typical example of fake news. In fact, back on January 30, the construction site looked like the photo above.

Express hospitals in Wuhan for those infected with coronavirus

The new governor can use cryptography and leave his mark on history

This means that more “anti-crypto” legislation will likely be introduced in the near future, and the new governor may want to show his strength by wielding the cudgel against cryptocurrencies.

This brings us back to the topic of the latest rumors out of China, which suggest a major announcement is expected "around March 15th" that could be "catastrophic" for Bitcoin by banning miners across the country. However, March 15th has already ended in the East, and no statements have yet been received.

This suggests that this latest rumor is a repeat of the January events, which also came to nothing, but they do have some truth to them. There was no “expulsion” of miners in January, but miners became tense after hearing these rumors and began to quickly travel to other countries.

This time, the rumors coming from Huobi were most likely about a document from the People's Bank of China, suggesting that from this day on, things will be much more serious.

It will no longer be possible to get by with lighter regulatory measures when local authorities restrict miners in the use of electricity. Now the situation is much more serious, and the changes will affect the entire country. We can only wait to find out what will come of it all in the end. Great article 0

Construction is being completed

On Sunday, February 2, authorities announced that the first of two express hospitals was ready. The urgent construction of the hospital, called "Fire God Mountain", took 10 days. A second similar hospital in Wuhan with 1,600 beds, called Thunder God Mountain, is scheduled to begin accepting patients on February 6.

Express hospitals in Wuhan for those infected with coronavirus

Notes

- China's Cash Position Swells To Record High - Forbes

- Law of the People's Republic of China on The People's Bank of China

- https://www.forbes.com/sites/kenrapoza/2011/10/15/chinas-cash-position-swells-to-record-high/ Article in Forbes magazine

- Large Chinese banks limit the issuance of loans Interfax

, November 24, 2010 - People's Bank of China Former Governors English.

- Calendar, Abacus Help Determine Size of Chinese Rate Increases - Bloomberg

- Viewpoint: The “divisible by nine” rule

The interior of the hospital is spartan.

A field hospital for 1,000 patients for the treatment of coronavirus is ready to receive patients. 1,400 military doctors have been sent there, and the first people infected with the new coronavirus will begin to arrive on Monday, February 3. Due to the coronavirus epidemic in Wuhan, a city of 11 million, there are not enough places for sick people, hospitals are overcrowded and residents complain about hours-long queues to see a doctor.

Express hospitals in Wuhan for those infected with coronavirus

The new head of the People's Bank of China promises quick changes

BEIJING, March 19 — PRIME. And Gan, who was named the new governor of the People's Bank of China on Monday, said he intends to implement a series of reforms in the next few weeks, although he did not say what they would be, Dow Jones reports.

Beijing is working on a plan to increase the share of foreign participation in China's financial sector, particularly in insurance, according to people familiar with the matter. Chinese President Xi Jinping is expected to announce details of the plan next month at the Boao Forum for Asia, which will be held on Hainan Island.

Thus, Beijing intends to show its commitment to financial liberalization amid growing pressure from the administration of US President Donald Trump, who is calling for a significant reduction in the US foreign trade deficit with China.

Yi Gang is part of Xi Jinping's new team, which should help the Chinese leader carry out economic reforms, fight poverty and environmental pollution, and strengthen China's position in the international arena. A key role will be played by a team of economists led by Liu He, who was recently promoted to vice premier.

Chinese Central Bank Governor Zhou Xiaochuan resigns >>

A surprise was the appointment of Liu Kun, who was in charge of financial and budgetary issues in the Guangdong provincial government, but does not have much experience in the central government, to the post of Finance Minister. The appointment may indicate that officials see controlling local government spending as a priority over the next few years.

The appointment of Yi Gang as the new head of the central bank is also a surprise to many in the government and market, partly because he did not become a full member of the Central Committee of the Communist Party of China following the fall of a new generation of Chinese leaders.

Some believe that the patronage of Zhou Xiaochuan, who headed the People's Bank of China for the past 15 years, played a role. The plan to transform financial regulators, published last week, includes greater responsibilities for the NBK. Now the central bank will not only determine monetary policy, but also set rules for the banking sector and the securities market. This will require the experience that Yi Gan has.

Through this appointment, the Chinese authorities are signaling their desire to continue to adhere to policies aimed at maintaining financial stability, analysts believe. And Gan, along with Zhou Xiaochuan, has been pushing for years for the Chinese yuan to become a more freely traded currency, hinting at Beijing's desire to resume financial liberalization.

And Gan in his new post will face challenges such as rising debt levels of Chinese companies and local governments, the dominance of state-owned banks in the financial sector, insufficient openness of financial markets and a trade conflict with the United States.

“The Chinese authorities will continue efforts to deleverage the financial sector and try to channel the freed-up resources into developing the real economy,” said Zhu Chaoping of JPMorgan Asset Management.