Bank of Korea through monitoring of Masterforex-V traders

| National Bank through Masterforex-V monitoring | |||||

| 1. | countries | South Korea | |||

| 2. | National currency | Won (South Korean won) | |||

| 3. | ISO 4217 code | 410 | |||

| 4. | Forex ticker | KRW | |||

| 5. | Change coin (1/100) | Chon | |||

| 6. | Currency banknotes | 1000, 5000, 10000, 50000 won | |||

| 7. | Coin denomination | — | |||

| 8. | Central Bank payment system | Bank of Korea Financial Wire Network (BOK-Wire+), Korea Financial Telecommunications & Clearings Institute (KFTC) | |||

| 9. | Goals of the Central Bank | Ensuring price stability in agreement with the government. Development and publication of the main provisions of the state's monetary policy. Supervision of the activities of financial institutions and the Forex market. | |||

| 10. | Activities of the Central Bank | Issue of money and securities. Performing the functions of a state bank. Supervision of payment and settlement systems. Management of national foreign exchange reserves. Compilation of statistics. | |||

| 11. | Central Bank governing bodies | The bank is managed by the Monetary Policy Council, headed by the manager. The council also includes its deputies. The management involves an advisor to the manager and an auditor, who is appointed by the President of South Korea on the recommendation of the Minister of Finance and Economy for 3 years. The auditor examines the bank's operations and reports the findings to the Monetary Policy Committee as well as to the government. | |||

| 12. | Chairman of the Central Bank | Since April 2014, the Governor of the Bank of Korea has been Lee Jueol. | |||

| Financial and economic state of the country, assets and liabilities of the Central Bank | |||||

| 13. | Gold reserves | 104 tons of gold and $409.65 billion (January 2020) | |||

| 14. | GDP | $1.630 trillion - 12th place in the world (2019) | |||

| 15. | GDP growth rate | 3,1% (2017), 2,8% (2018), 2,7% (2019) | |||

| 16. | GDP per capita | $44,740 (PPP), 29th in the world (2019) | |||

| 17. | Inflation | 1,5% (2018), 0,7% (2019) | |||

| 18. | External debt | $598.9 billion (2018) or 38.2% of GDP | |||

| 19. | Budget | $418 billion (2019) | |||

| 20. | Budget deficit | $16.15 billion (2019) | |||

| 21. | Average salary in the country | $31,400 per year (2018) | |||

| 22. | Unemployment rate | 4% (October 2019) | |||

| Credit policy of the Central Bank | |||||

| 23. | Central Bank key rate | 1,25% | |||

| 24. | Devaluation/revaluation | On the MN timeframe, a flat has been forming since July 2014, i.e. The won is trading against the dollar in the range of 1007-1244 won per dollar. On the w1 chart, there has been a long-term bullish trend since April 2020, i.e. devaluation of the won | |||

| 25. | Basic deposit rate | 1,75-2% | |||

| 26. | Largest banks | Woori Finance Holdings, KB Financial Group, Shinhan Financial Group, Korea Development Bank, Hana Financial Group, Industrial Bank of Korea, Korea Exchange Bank, Busan Bank, Daegu Bank, etc. | |||

| 27. | Interest on loans from commercial banks | Mortgage 3%, business development loan - 2% | |||

| 28. | Interest on deposits in commercial banks | 1,55% | |||

| 29. | Standard Poor's credit rating | AA, like New Zealand, Kuwait, Belgium, UAE, France, UK | |||

| 30. | Moody's credit rating | Aa2, like Hong Kong, Kuwait, UAE, France, UK | |||

| 31. | Payment systems | Mastercard, American Express, Samsung Pay, Discover, Scrill, Neteller, Western Union, Visa, Kakao Pay, E-Bullion, Naver, Authorize.net, Amazon Payments, Google Checkout, etc. | |||

| Central Bank policy on the country's stock and foreign exchange markets | |||||

| 32. | Stock Exchange | KRX (Korea Stock Exchange) | |||

| 33. | Stock indices | KOSPI, KOSPI 50, KOSPI 100, KOSPI 200, KTOR 30, KOSDAQ, KOSDAQ 150, LargeCap, MIDCAP, SmallCap, KRX 300 | |||

| 34. | Stock market | more than 2030 ordinary shares, 225 ETFs, as well as stock indices, bonds, investment funds, depositary receipts, currency pairs, warrants, certificates, options, derivatives, etc. | |||

| 35. | Common shares - blue chips | Samsung, Hynix, Hyundai Motor, Shinhan Financial Group, POSCO, Naver Corporation, Korea Electric Power, Samsung Life Insurance, etc. | |||

| 36. | Commodity exchanges | — | |||

| 37. | Commodity futures | Export semiconductors, petrochemicals, auto and auto parts, ships, wireless communication equipment, flat panel displays, steel, electronics, polypropylene, computers, import oil, natural gas, liquefied gas, gasoline, diesel, kerosene, semiconductors, coal, steel, computers, wireless communications equipment, automobiles, ethanol, benzene, ethylene, methanol, rubber, fine chemicals, textiles | |||

| 38. | Investment funds | Woori High Plus Feeder Bond, Kb Retirement Pension Dividend 40 Feeder Bond Balanced Cf, Miraeasset Dividend Premium Feeder Equity Balanced Ae, etc. | |||

| 39. | Famous traders | — | |||

| 40. | Famous investors | — | |||

| 41. | Major Forex currency pairs | USD KRW, JPY KRW, EUR KRW, RUB KRW, SGD KRW, etc. | |||

| 42. | Forex brokers | FreshForex, Forex club, Tickmill, Forex4you, InstaForex, NPBFX, Nord FX, XM.com, Grand Capital, FortFS, ActivTrades, RoboForex, TeleTrade (Teletrade), Alpari, Dukascopy Bank SA, Swissquote Bank SA, etc. | |||

| 43. | Cryptocurrencies | not prohibited, not regulated, not taxed. Popular cryptos: Bitcoin Cash, Tezos, NEM, Ripple, OmiseGO, Litecoin, BTC, Ethereum, EOS, Ethereum Classic, Monero, Binance Coin, Bitcoin Satoshi Vision, IOT, TRON, NEO, Zcash, Dashcoin, Stellar, Cardano, DASH. | |||

| 44. | Binary options | Olymp Trade, Unioption, World Forex, Binary.com, Dotoption, World Forex, CitiTrader, OptionsClick, Binarium, MarketOptions, IQ Option, Binomo, FINMAX | |||

| 45. | Financial regulator | FSC | |||

| Central Bank address | |||||

| 46. | Web site | www.bok.or.kr | |||

South Korean money. Story

Until the 19th century, barter in kind prevailed in Korean markets. Banknotes appeared and disappeared. Rice and pieces of fabric were used for barter.

During large trade transactions, eastern merchants paid in silver. For convenience, they used silver bars. Afterwards, this state adopted the experience of its Chinese neighbors, because in China coins have been in circulation since the first millennium BC.

Coins in South Korea were originally copper and three-gram coins. They had a square hole in the middle. On the sides there were hieroglyphs indicating belonging to the country. These coins cost the same as they weighed. For transportation, they were strung on a thread, and when calculated, beads made from coins weighed quite impressively.

The people of Korea did not appreciate the innovation. Soon, all townspeople and villagers returned to their usual natural exchange. In 1633, coins were reintroduced, but now they were minted from silver, giving the products real value.

Despite the fact that the new money took root in society, it was still constantly changed. South Korea has a long history of borrowing money from Mexico, Japan and China.

In the 20th century, money with an eagle engraving was in circulation. They were often compared to Russian rubles. After the end of Japan's colonial takeover, the Korean central bank printed the first banknotes featuring the current president, Syngman Rhee.

After the reform in 1953, people used coins with English and Korean symbols to pay. They were called "khwans". Then in 1962 the entire currency was converted into the current current format. Now it only has inscriptions in Korean. The name “won” itself originates from ancient Chinese characters for money. The same sign is pronounced differently in China and South Korea.

Loans from commercial banks in South Korea

In 2020, mortgage rates in South Korea fell to a minimum of 3%. This phenomenon is associated with a decrease in the long-term interest rate, which is the base rate for mortgage lending. But rates on loans up to 5 million won (up to $4,305) increased by several percentage points.

The reduction in loan rates for self-employed and small businesses is due to government assistance. Such loans are issued primarily through the Industrial Bank of Korea. The country's government intends to act as a guarantor for business loans totaling $550 million. This measure is aimed at stimulating entrepreneurs to hire new workers, increase salaries and reduce operating costs

Deposit rates are also falling. Until recently, the average rate was 1.75%; by the end of 2020, deposits were placed at an average rate of 1.55%.

Employment of the population of South Korea

The results for 2019 released by the National Statistical Office indicate that the total number of employed people was 26.82 million people. Compared to 2020, this is 97 thousand more.

The article “Work for foreigners in South Korea” will tell you how you can get a job in South Korea and what the wages are.

This growth is the lowest since 2009. Employment of the population of South Korea amounted to 60.7% of the total number of working-age residents and decreased by 0.1% over the previous year. The number of unemployed reached 1.73 million people or 3.8% of the working population. This is the highest value of this indicator since 2000.

In the last month of 2020 alone, the number of jobs in retail trade fell by 63 thousand, and in the manufacturing sector, due to the restructuring of a number of automotive enterprises and the decline in the shipbuilding industry, by 127 thousand. Against this background, the fact that unemployment among young people under 30 years of age decreased by 0.6% compared to 2020 and amounted to 8.6% is cause for cautious optimism.

According to government forecasts, the country's population will begin to decline in the next 7 years. And taking into account the fact that the labor resources of the eleventh economy in the world will become smaller every year, the prospects for the development of South Korea are not so rosy. Actually, this problem is relevant for 80% of the G20 countries.

Let us note one interesting point. It was said above that Japan has limited the supply of rare materials for the electronics industry to the Republic of Korea. The reaction of Korean residents to these measures was immediate: they called on their compatriots not only to boycott Japanese manufacturers, but also to refuse tourist trips to Japan.

But there are also examples of South Korea's trade relations with neighboring countries improving. Thus, in 2020, an increase in South Korean-Chinese trade turnover was recorded by 13.7%. At the same time, the volume of exports from the Republic of Korea to China amounted to $50.3 billion.

The best and largest banks in South Korea

The best and most reliable banks in South Korea are:

- Woori Finance Holdings is a holding company specializing in banking and financial services. It is the country's largest bank in terms of assets. The financial institution has existed since 2001; it was formed as a result of the merger of four commercial banks. Has more than 1100 branches. Website: www.woorifg.com/kor/main/index.do

- KB Financial Group is a Korean financial group that includes KB Kookmin Bank. Together with its subsidiaries, it provides commercial banking services to individuals, small and medium-sized enterprises. Clients have access to demand deposits, time deposits, corporate loans, consumer loans, credit cards, as well as brokerage services for futures transactions. Website: www.kbstar.com/

- Shinhan Financial Group is the first bank in Korea, established in 1897 as Hanseong Bank. Provides corporate, retail, investment banking, insurance, and brokerage services. It has 9 subsidiary banks and more than 1000 branches. Website: www.shinhan.com/

National banks

- Citigroup Korea

- Citibank Korea (027)

- Hana Financial Group

- Hana Bank (081)

- Korea Exchange Bank (005)

- KB Financial Group

- KB Kookmin Bank (004)

- Standard Graduate

- Standard Certified Korea (023)

- Shinhan Financial Group

- Shinhan Bank (088)

- Woori Financial Group

- Bank Woori (020)

Comparison of the key rate of 1.35% of the Bank of South Korea with the Central Banks of other countries of the world

| Key rates of the Central Bank of the world on Forex currencies | |||||

| A country | central bank | Currency and its ticker | Central Bank key rate | Date of entry | Financial regulator |

| Australia | RB Australia | Australian dollar (AUD) | 0.75% | 01.10.2019 | ASIC |

| Great Britain | Bank of England | pound sterling (GBP) | 0.75% | 02.08.2018 | FCA |

| Hong Kong | Hong Kong Monetary Authority | Hong Kong dollar (HKD) | 2% | November 2019 | SFC |

| European Union | European Central Bank | euro (EUR) | 0% | 12.12.2019 | MiFID (EU requirements), ACPR and AMF (France), BaFin (Germany), Consob (Italy), CySEC (Cyprus), MFSA (Malta), AFM (Netherlands), FSAEE (Estonia), CMVM (Portugal), FSMA ( Belgium), CNMV (Spain), FCMC (Latvia) |

| Canada | Bank of Canada | Canadian dollar (CAD) | 1.75% | 4.12.2019 | IIROC |

| China | People's Bank of China | Yuan (CNY) | 4.15% | 20.11.2019 | CSRC, FinCom |

| New Zealand | Reserve Bank of New Zealand | New Zealand dollar (NZD) | 2% | 11.08.2016 | FSCL |

| Singapore | Monetary Authority of Singapore | Singapore dollar (SGD) | 1.63% | November 2019 | M.A.S. |

| USA | US Federal Reserve | US dollar (USD) | 1.75% | 11.12.2019 | NFA, CFTC, SEC |

| Switzerland | National Library of Switzerland | Swiss franc (CHF) | -0.75% | 15.01.2015 | FINMA |

| Japan | Bank of Japan | Japanese yen (JPY) | -0.1% | 03.08.2016 | JFSA |

| Other forex currencies in Europe | |||||

| Belarus | National Library of the Republic of Belarus | Belarusian ruble (BYN) | 9% | November 2019 | ARFIN |

| Bulgaria | Bulgarian People's Bank | Bulgarian Lev (BGN) | 0% | 2.12.2019 | FSC |

| Hungary | National Library of Hungary | Hungarian forint (HUF) | 0.9% | 17.12.2019 | HFSA Hungary |

| Denmark | National Bank of Denmark | Danish krone (DKK) | 0.05% | 19.01.2015 | DFSA Denmark |

| Moldova | National Bank of Moldova | Moldovan leu (MDL) | 5.5% | 11.12.2019 | Licensing Chamber |

| Norway | Norwegian bank | Norwegian krone (NOK) | 1.5% | 19.12.2019 | NFSA |

| Poland | National Bank of Poland | Polish zloty (PLN) | 1.5% | 4.12.2019 | PFSA/KNF |

| Russia | Bank of Russia | Russian ruble (RUB) | 6% | 07.02.2020 | Bank of Russia (until 2013 FSFM) |

| Romania | National Bank of Romania | Romanian leu (RON) | 2.5% | 07.02.2020 | A.S.F. |

| Ukraine | National Bank of Ukraine | Ukrainian hryvnia (UAH) | 11.0% | 30.01.2020 | NCCPF |

| Croatia | Croatian People's Bank | Croatian kuna (HRK) | 2.5% | October 2019 | HANFA |

| Czech | National Bank of the Czech Republic | Czech crown (CZK) | 2% | 18.12.2019 | CNB |

| Sweden | Bank of Sweden | Swedish krona (SEK) | 0% | 19.12.2019 | (FSA Sweden) |

| Forex currencies in Asia | |||||

| Azerbaijan | Central Bank of the Azerbaijan Republic | Azerbaijani manat (AZN) | 7.5% | December 2019 | MBA |

| Armenia | Central Bank of the Republic of Armenia | Armenian dram (AMD) | 5.5% | 10.12.2019 | Ministry of Finance |

| Vietnam | GB of Vietnam | Vietnamese dong (VND) | 6% | October 2019 | SSC |

| Georgia | National Library of Georgia | Georgian lari (GEL) | 9% | 11.12.2019 | National Library of Georgia |

| Israel | Bank of Israel | Israeli shekel (ILS) | 0.25% | 10.12.2019 | ISA |

| India | Reserve Bank of India | Indian Rupee (INR) | 5.15% | 04.10.2019 | SEBI |

| Kazakhstan | National Bank of the Republic of Kazakhstan | Kazakhstan tenge (KZT) | 9.25% | December 2019 | AFSA |

| Korea | Bank of Korea | won (KRW) | 1.25% | 29.11.2019 | FSC |

| UAE | Central Bank of the UAE | UAE dirham | 2% | November 2019 | Dubai FSA |

| Thailand | Bank of Thailand | Thai baht (THB) | 1.25% | 18.12.2019 | Bank of Thailand |

| Türkiye | Central Bank of Turkey | Turkish lira (TRY) | 12% | 12.12.2019 | C.M.B. |

| Uzbekistan | Central Bank of Uzbekistan | soum (UZS) | 16% | December 2019 | Central Bank of the Republic of Uzbekistan |

The table shows that the Bank of South Korea's key interest rate of 1.25% is the same as in Thailand, higher than in the European Union (0%), but lower than in Hong Kong and New Zealand (2%).

South Korean won denomination

The monetary equivalent of Korea is as follows:

- Paper banknotes;

- Coins.

Banknotes are issued in 1000, 5000, 10,000 and 50,000 won. Coins are presented in the form of 1, 5, 10, 50, 100, and 500 won.

1 and 5 won coins are considered rare. To solve the problem, South Korea allows you to round up to the nearest 10 won. Soon these won will go out of circulation altogether, since they are no longer needed. And they only interfere with calculations.

Living and working in South Korea

Since October 2000, your humble servant has been living and working in South Korea. And every day more and more people pester me on ICQ and by mail with the same questions about working in South Korea. To be honest, I’m a little tired of answering the same thing every day several times. In this regard, I decided to write this wonderful document. Now I have where to send everyone with these questions =)

This document is in the writing stage and does not claim to be complete, objective or 100% truthful.

Information about the Korean Won (KRW)

The South Korean won is the official currency of the Republic of Korea.

In South Korea, the won currency appeared at the beginning of the twentieth century. Subsequently, it was exchanged for the Korean yen (Japanese banknotes with the stamp of the occupation authorities), and then for hwana. It was not until 1962 that the Korean won was reapproved. Previously, 1 won was equivalent to 10 hwan, which were withdrawn from circulation after some time. Now 1 won is equal to 100 chon, but the latter, being units of exchange, are not used in monetary circulation due to the depreciation of the Korean currency. The letter currency symbol is KRW. The digital code is 410. Currently, banknotes in circulation are 1,000, 5,000, 10,000, 50,000 won. In addition to them, there are also coins in denominations of 1, 5, 10, 50, 100, 500 won.

In 1997, after reaching an agreement with the IMF, the country adopted a free exchange rate regime. The aftermath of the major Asian financial crisis negatively impacted the won, devaluing it by half. The issuance policy is controlled by the Bank of Korea. The issue of banknotes and coins is carried out in the capital's National Mint.

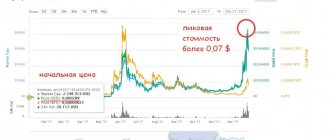

The South Korean currency is one of the Forex instruments. Since the state has demonstrated stable economic growth for many years (with the exception of global crises), the monetary unit of the Republic of Korea is attractive to investors. This is clearly evidenced by the dynamics of the won exchange rate shown on the website alpari.com.

How to get a loan in South Korea

HIGHER EDUCATION SYSTEM IN SOUTH KOREA

Korea is one of the first places in the world in terms of the number of students among the population. Under the Education Law, all universities, both public and private, are supervised by the Ministry of Education and the Workforce Development Service. Regarding other matters, universities should be guided by the principles of the Korean Council of University Education. In Korea, there are the following types of educational institutions: colleges and universities (national, public and private); industrial universities; pedagogical institutes (national).