R3 largest consortium of banks abandons blockchain technology

R3CEV, a major blockchain consortium of banks and technology firms that includes Barclays, Credit Suisse, Bank of America, Citibank and HSBC, appears to have suffered a setback with its developments.

Over the past couple of years, many consortia and bank-funded blockchain startups have emerged. In total, they have already invested billions of dollars in projects that promise to use blockchain to optimize the global financial system. Although most developers and cryptographers involved in Bitcoin and Monero warn against using centralized networks on the blockchain, as it is not secure.

More importantly, blockchain technology is not designed to handle large amounts of data. In fact, it is this limitation that prevents Bitcoin from growing as a digital currency. In the R3 Corda presentation, R3CEV developers and researchers stated, “we will not use blockchain,” explaining that implementations of the technology do not fit into their vision.

Global finance, as a network and ecosystem, is in urgent need of renewal. This applies not only to banks, but also to organizations regulating banking activities.

R3CEV runs a team of experienced developers who are well-versed in Bitcoin and blockchain. Thanks to this, the R3 consortium can create the software part of the financial network that everyone needs most. However, blockchain technology is not what the consortium needs because it is not compatible with banking standards.

Over the next few months, changes will be made to R3 Corda and the R3 development team will redesign the platform so that it supports existing AMQP, JDBC and PKIX standards, and fully meets all regulatory requirements.

Since its launch, the R3 consortium has emphasized its willingness to process large amounts of data while maintaining records that are transparent and free from tampering. After the consortium failed to commercialize the blockchain or simply did not want to share transparency with its partners, they decided to move away from blockchain technology before it was too late to do so.

Peter Todd, a Bitcoin core developer and well-known cryptographer, has constantly criticized the effectiveness of the R3 Corda system, which has squandered everything that is good about the blockchain. “It's like Bitcoin without the blockchain,” Todd says. However, now the R3 consortium and its developers have the freedom to choose the software and technologies that will be used.

It's actually more like Bitcoin without blockchain.

— Peter Todd (@peterktodd) November 30, 2016

Want more news? Facebook. Fastest? Telegram and Twitter. Subscribe!

#corda #R3 #R3CEV

Why Consortium Blockchains Fail

Consortium blockchains have shown their failures throughout recent history. From R3 Corda's rocky banking partnerships to Hyperledger's painfully slow development timelines, consortium chains have shown that they currently lack the economic models, partnerships and projects to remain viable in the current blockchain environment.

BLOCKCHAIN CONSORTIUM: LIMITED POTENTIAL

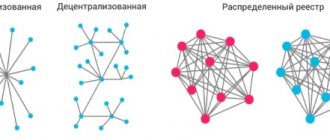

Consortium chains are permissioned blockchains that are available to specific organizational groups. Consortiums are intended for use primarily in banking and related industries.

As the name suggests, a consortium chain is essentially a group of related institutions, each with their own node on the same blockchain network. Working together, the consortium's goal is to offer lower operating and maintenance costs as well as high transaction speeds.

As an example, consider the network of consortia used by banks and other financial institutions. (For example, BRICS). Trading, settlement times and clearing can be matched to a consortium as a private or semi-private network. Since all of a company's nodes in the network are connected and reach consensus on transactions, this model can significantly reduce fraud, transaction fees, settlement time, etc.

Unfortunately for consortiums, they have so far been far less successful than their (disparate) public chain counterparts - and most of these problems come down to business rather than technical issues.

The four main chains of the consortium are Rord's Corda, Hyperledger Fabric, Enterprise Ethereum and Microsoft Azure, which recently announced their Azure Blockchain service.

Read also: Main misconceptions about blockchain

Despite their promising and logical premise, consortium chains of significant size or significance have yet to materialize.

LACK OF ECONOMIC MODEL

The first problem comes down to money. Consortium chains lack enough tokens to motivate developers and entrepreneurs to develop and use their blockchains and therefore lack a viable economic model. Simply put, creating a consortium is expensive and not profitable like launching an ICO. The website devteam.space estimates that hiring a single Hyperledger Fabric developer costs "$700 per day."

Due in part to the lack of an economic model, the adoption rate of these consortia has been very slow compared to the user bases of public networks such as Bitcoin and Ethereum.

Noting an issue in its economic model, Hyperledger Fabric added support for developers to create their own FabTokens as an alpha feature in Hyperledger Fabric 2.0.

UNSTABLE RELATIONSHIPS

However, the key fact that undermines the legitimacy of consortium blockchains is the instability of the past and the failure of business relationships. Simply put, if companies of different sizes, intentions and expectations cannot work together, then how can consortia even begin to form and collaborate?

The next issue is that many consortia are formed by competing groups such as the Mobility Open Blockchain Initiative (MOBI), which of course raises concerns about data privacy and protecting sensitive company assets.

In other words, trust is returned to the system. So why not just use a database or launch your own profit token?

But to cite some specific shortcomings in recent history. R3 lost partnerships with two large banks: JPMorgan and Goldman Sachs. The overwhelming desire to launch your own digital token may have something to do with it since the discovery of your own “coin”.

Ripple's CEO, for example, says that this "JPM Coin" missed the boat by calling it the "AOL launch" of cryptocurrencies after Netscape. Although the CEO will declare his startup's XRP token as the standard protocol for transferring value online.

Read also: India: Government Policy Commission Calls Blockchain “New Trust Paradigm”

So who will become the Internet? Who will be the intranet? Will this internet of virtual money be backed by a tech startup, a bank, a government, or will it be something entirely different, like the public utility Bitcoin?

Well, the banking consortium's approach is not very good. Others to leave the R3 group far away include Morgan Stanley, Banco Santander SA and National Australia Bank. To make matters worse for R3, the company reports that it is running out of money; despite reports of raising $103 million to create its own consortium between banking institutions.

The Hyperledger project has also faced funding and partnership challenges. Last December, fifteen members either reduced their financial support for the project or decided to leave entirely.

INTRANET TO INTERNET HOW JPMORGAN COIN TO BITCOIN

Consortium chains are not as good as their public counterparts. The reasons for this are nuanced and complex, but largely come down to funding and a lack of cooperation among consortium members, whose interests and incentives may differ.

While consortium chains are unlikely to disappear, we can expect much slower development times and progress than what we have seen with Bitcoin and Ethereum.

The first, in particular, has more than a decade of open access effects that accumulate over time. This has special meaning. Because the latest network effect, security and fundamentals cannot simply be turned on with the flick of a switch by multiple companies. Otherwise, trust is restored.

On the other hand, exclusive consortium projects do create something similar to an intranet of value. Whether transaction costs will be offset by other costs of decentralization remains to be seen.

At the same time, however, investor interest in the JPM Coin listing is waning.

Consortium

The consortium was created on September 15, 2020 by nine financial companies[4][5][6][7]: Barclays, BBVA, Commonwealth Bank of Australia, Credit Suisse, Goldman Sachs, JP Morgan & Co., Royal Bank of Scotland, State Street Corporation, UBS.

On September 29, 2020, 13 more financial companies joined the consortium[8]: Bank of America, BNY Mellon, Citigroup, Commerzbank, Deutsche Bank, HSBC, Mitsubishi UFJ Financial Group, Morgan Stanley, National Australia Bank, Royal Bank of Canada, Skandinaviska Enskilda Banken , Société Générale, Toronto-Dominion Bank.

On October 28, 2020, 3 more financial companies[9] joined: Bank Mizuho, Nordea, UniCredit.

On November 19, 2020, 5 more financial companies[10] joined: BNP Paribas, Wells Fargo, Ing Group, Macquarie Group, Canadian Imperial Bank of Commerce.

On December 17, 2020, 12 more financial companies[11] joined: Bank of Montreal, Danske Bank, Intesa Sanpaolo, Natixis, Nomura Group, Northern Trust, OP-Pohjola, Banco Santander, Scotiabank, Sumitomo Mitsui Banking Corporation, US Bancorp, Westpac.

As of April 25, 2020, three more financial companies[12] joined: SBI Holdings of Japan, Hana Financial of South Korea, Bank Itau of Brazil.

The first company from Eastern Europe and Russia to join the consortium was the QIWI group. On October 13, 2020, QIWI announced its accession to R3[13] (in 2020, a subsidiary company, QIWI Blockchain Technologies, was created to focus on blockchain and DLT technologies).

Sberbank of Russia planned to join the project[14][15][16][17], but was refused. In September 2020, Sberbank joined another blockchain consortium - the open and non-profit association Hyperledger from the Linux Foundation.[18]

In November 2020, Goldman Sachs, Santander and Morgan Stanley withdrew from the consortium.[19] In April 2020, R3 left JPMorgan Chase & Co.[20]