Bitcoin - the cryptocurrency of our time, presentation for an economics lesson (grades 10, 11) on the topic

Slide 1

Bitcoin is the cryptocurrency of our time Olga Nikolaevna Buzilova Teacher of economics and financial literacy St. Petersburg State Budget Educational Institution School No. 174

Slide 2

plan Cryptocurrency What is Bitcoin? Features of bitcoin that distinguish it from other types of electronic and paper money The principle of operation of bitcoin using the blockchain system Bitcoin wallet How to earn or receive bitcoins? Bitcoin mining Bitcoin faucets Disadvantages of Bitcoin

Slide 3

Cryptocurrency – what is it? The term “cryptocurrency” is a direct translation of the English “cryptocurrency”, that is, a virtual currency protected by cryptography. First of all, cryptocurrency is a fast and reliable system of payments and money transfers, based on the latest technologies and not controlled by any government. Cryptography is the science of mathematical methods of ensuring confidentiality (impossibility of reading information by outsiders) and authenticity (integrity and authenticity of authorship, as well as the impossibility of refusing authorship) of information. Cryptography is one of the oldest sciences, dating back several thousand years. Moreover, writing itself was originally a cryptographic system, since in ancient societies only a select few mastered it. The sacred books of Ancient Egypt and Ancient India are examples of this. With the widespread use of writing, cryptography began to emerge as an independent science. The first cryptosystems are found already at the beginning of our era. Cryptographic systems developed rapidly during the years of the First and Second World Wars. From the post-war period to the present day, the advent of computing has accelerated the development and improvement of cryptographic methods.

Slide 4

It is believed that the foundations of cryptography were laid by Aeneas Tacticus. Attempts to encrypt data were made back in ancient India and Mesopotamia. But they were not very successful. The first reliable defense system was developed in Ancient China. Cryptography also became widespread in the countries of Antiquity. Then it was used for military purposes. Cryptography methods found their use in the Middle Ages, but they were already adopted by merchants and diplomats. The Renaissance is called the golden age of this science. At the same time, a binary encryption method was proposed, similar to which is used in computer technology today. During the First World War, it was recognized as a full-fledged combat tool. All you had to do was unravel the enemy’s messages and you could get a stunning result. An example is the interception of a telegram sent by the German ambassador Arthur Zimmerman by American intelligence services. The end result of this was that the United States entered hostilities on the side of the Entente. The Second World War became a kind of crystallizer for the development of computer networks. And cryptography made a significant contribution to this. What is it and what were the practical results of its use? Some governments are so frightened by the possibilities that they have imposed a moratorium on the use of data encryption.

Slide 5

Cryptographic Protocols A cryptographic protocol is an abstract or concrete protocol that includes a set of cryptographic algorithms. A protocol is a sequence of steps that two or more parties take to jointly solve some problem. It should be noted that all steps are taken in strict order and none of them can be done before the previous one is completed. The problems that Bitcoin needs to solve are mainly about ensuring the security of transactions - making sure that people can't steal from each other, or impersonate each other, and so on. In the world of atoms, we achieve such security with devices such as locks, safes, signatures and bank vaults. In the world of bits, we achieve this kind of security through cryptography. And that’s why Bitcoin is a cryptographic protocol at heart.

Slide 6

What is Bitcoin? The word "Bitcoin" is formed in English from "bit" - the minimum unit of information and "coin" - coin. Bitcoin is a digital currency created in 2009. This is a new generation of decentralized digital currency, created and operating only on the Internet. No one controls it; currency is issued through the work of millions of computers around the world, using a program to calculate mathematical algorithms. This is precisely the essence of Bitcoin. What is the most significant feature of Bitcoin from an economic perspective? It is a digital commodity with a limited supply, its algorithm is designed in such a way that a maximum of 21 million units can exist in the system, each of which is also called “bitcoin”. The emission schedule is determined programmatically and is known in advance. After the last coins are generated, their number will not change. As of 2020, about 17 million bitcoins have been generated; the end of currency generation will come around 2040. Bitcoin is a cryptocurrency, i.e. virtual money, which has no material equivalent and is simply an entry in a special database.

Slide 7

We already know that there can be a maximum of 21 million bitcoins in the system, but in fact, such a relatively small number of coins is quite enough for everyday calculations, since 1 bitcoin is divided into 100,000,000 parts, which are called “Satoshi”, in honor to the creator of the system. Sometimes the terms “millibitcoin” (mBTC, one thousandth) and “microbitcoin” (uBTC, one millionth) are used. 1 Bitcoin = 100,000,000 Satoshi Bitcoin began as a concept document published on October 31, 2008 by a mysterious person working under the pseudonym Satoshi Nakamoto. Who the real developer is, one person or a group, is still unknown, despite numerous journalistic investigations. On January 3, 2009, the practical implementation of this concept in program code began. At 18:45 GMT (22:45 Moscow time) on 01/03/2009, the first block in the network, the so-called genesis block, was generated. This day is considered Bitcoin's birthday and is celebrated by communities around the world. Initially, bitcoins were in demand only among mathematicians, cryptographers, and people very passionate about computer and network technologies. Back then, bitcoins simply served as proof that unsecured electronic money was possible. Rather, they can be called an electronic analogue of gold - like gold, bitcoin is difficult to mine, its quantity is limited, and the labor intensity of mining only increases over time. In the fall of 2009, 1 BTC could already be bought for 0.8 cents. Now the cost of 1 bitcoin is about $5,000.

Slide 8

From the life of Bitcoin Florida resident Laszlo Hanecz went down in history as the buyer of the most expensive pizza in the world. He is also known as the first person in the world to make a purchase with Bitcoin. The 10,000 bitcoins he used to buy two pizzas from Papa John's in June 2010 were worth about $30 at the time. Now the cost of this pizza is estimated at $50,000,000. James Howells from Wales accidentally threw away a hard drive containing the private key to 7,500 bitcoins. It is impossible to restore this key; today the amount of loss is $37,500,000. Sometimes “forgetting” about bitcoins is very useful (if you haven’t lost them!). A man from Norway named Christopher Koch suddenly bought 5,000 bitcoins for $27 in 2009. And I forgot about them. I only remembered in 2020. Today the amount is $25,000,000. Roger Ver Number of Bitcoins: 300 thousand Estimated value: 1 billion 500 million dollars Roger Ver was inspired by the idea of cryptocurrency from the very beginning. He is called the "Bitcoin Jesus". In 2011, when Bitcoin was trading at around $10, he predicted that digital money would outperform any other asset class by a factor of 100 over the next two years. And then I watched the prediction come true. Ver has invested in various startups based on the idea of digital money. He is now the head of Bitcoin.com.

Slide 9

Features of Bitcoin Decentralization and accessibility Full transparency of payments Free choice of the degree of participation Lack of control over the network Possibility of anonymous payments Reward for network support Unsurpassed protection Decentralization and accessibility. The Bitcoin network is a combination of all client programs (wallets) and a distributed blockchain database (blockchain, block chain), which is stored on each computer where the complete content is installed. The blockchain is a completely open and viewable register of all transactions in the system. Connecting to this registry is possible using your own wallet or the web interface of special monitoring services from anywhere in the world, without passwords or any other authorization. Full transparency of payments. The history of any payment can (theoretically) be tracked back to the very moment of coin generation and it will never be deleted from the database. Knowing only a Bitcoin address, you can find out at any time all transactions received by or sent from that address. Free choice of degree of participation. You can install the official Bitcoin Core client, which stores your entire transaction history. If you don't need offline operation and blockchain analysis, you can install one of the light or mobile wallets that require significantly fewer resources. If you are only going to pay for small purchases on the go or just try the technology, a mobile or online wallet will be enough. For maximum security, there are hardware wallets with additional degrees of protection. Lack of network control. Since the blockchain is a distributed database created on the basis of peer nodes, the Bitcoin network does not have a control center that can freeze any account, change the number of monetary units in the system, block or cancel a payment. There are small commissions, the size of which is almost imperceptible in practice and does not depend on the amount of the transfer. Transactions in the system are irrevocable, just like cash transactions. Possibility of anonymous payments. Bitcoin provides a convenient and, if desired, anonymous means of payment; the address—the account number in the system—is not associated with its owner, and no documents are required to open it. This is a string of about 34 characters of numbers and letters of the Latin alphabet in different cases. The address looks, for example, like this: 1BQ9qza7fn9snSCyJQB3ZcN46biBtkt4ee. It can be converted into the form of a QR code or other two-dimensional code for ease of calculation, and can also be transmitted as is. Reward for network support. New bitcoins enter circulation as a reward for those who perform the computing operations that enable the transfer of transactions. The calculations are called “mining”, from the English word “mining” - mining. Those who do these calculations are called "miners". Their task is to record in one block all the transactions that have occurred on the network since the previous one was issued (on average 10 minutes), and “seal” it with a complex cryptographic signature. The next block is calculated based on the signature of the previous one, which guarantees the irrevocability of transactions and also prevents “fake” banknotes from entering the system. This is how the blocks are linked together, forming a chain - blockchain. Unrivaled protection. With each new block, the computing power needed by miners to calculate the entire chain from scratch increases, and the longer the chain, the more difficult it is to “hack” the network. Today, Bitcoin is a decentralized computing network, the performance of which is more than 8 times (in terms of the speed of calculating SHA-256 hashes) greater than the total computing power of all supercomputers in the world. In order to seize even limited control over it, enormous resources and expenses of hundreds of millions of dollars are needed.

Slide 11

We looked at the blockchain system diagram, and the question immediately arises - “Why should users connect to the new system?” Then the developers inserted an incentive reward into transaction processing. The reward is used to encourage people on the network to try to help verify trades, despite having to spend computing power on the process. This leads to the second question: “If a reward is paid for such a simple job, which is carried out by a computer, why not all users of the Internet and computers do this?” The second idea is paradoxical, but the whole system rests on it - to make confirmation of transactions costly for network users in the form of computer calculations. That is, without having a certain power, it is impossible to unpack and create a new block. The benefit of making transaction verification costly is to avoid dependence on the number of identities (network users) controlled by someone. Thus, only the total computing power can put pressure on the verification. Using some clever design, it is possible to make it so that the fraudster requires enormous computing resources to deceive, making it impractical. Bitcoin gains a fairly good level of control over the difficulty of the problem by using a slight variation of the proof-of-work puzzle. At this stage, solving one block is rewarded with 12.5 bitcoins, until recently this amount was equal to 25 bitcoins, but soon it will be equal to 6.75 bitcoins. That is, it is clear that the amount of reward decreases over time, and the complexity of the task increases. The complexity of the problem and the speed of its calculation require ever-increasing power. Bitcoin uses the well-known hash function SHA-256. The solution to this problem is called mining

Slide 12

In order to use bitcoins, you need to create a bitcoin wallet. So-called “light” wallets can be installed on both a PC and a mobile device. They are ready to go in a few minutes, but do not store a complete database and must request information from other nodes that make up the global network. If you need maximum reliability and independence, install the full client. For this you will have to pay several tens of gigabytes on your hard drive, and the initial synchronization will take at least three hours. The choice between speed and reliability is yours. To master the technology, you can use one of the online wallet services, which are ordinary sites where you can manage your balance and make transactions through a web interface. Very similar to the already familiar Internet banking. But in this case, bitcoins may be lost not only by you, but also by the wallet operator. Therefore, it is better not to store large amounts there. Bitcoin - wallet

Slide 13

How to earn or receive bitcoins? Just two years ago, the main method of obtaining Bitcoin was mining. The work of miners is paid with cryptocurrency, but the period of simple and profitable mining is long over. Now only owners of large “farms” with cheap or free electricity can mine effectively, and the entry threshold is getting higher. Business owners can earn bitcoins by accepting payment for their goods and services. For example, the American retail giant Overstock, when summing up the results of the first year of such integration, confirmed the emergence of a large number of new customers. In some countries it is possible to receive BTC as salary. For example, there are already sites offering employers and job seekers the opportunity to post a job ad for cryptocurrency. Popular and most frequently offered options include paying developers, journalists, photographers, designers and other freelancers. Bitcoin as a gift There are ways to get BTC completely free of charge. So-called Satoshi faucets are sites that offer free bitcoins, but in very small quantities. Purchase You can buy bitcoins at exchangers, on stock exchanges, through terminals and ATMs that support their purchase.

Slide 14

Exchange services The simplest, but at the same time not always profitable way is to buy bitcoins through exchangers. Exchange services allow you to convert regular money into BTC and back at the internal rate. Whether the proposed exchange price will suit you is a completely different matter. Keep in mind that the price at a particular time is determined by the owners of these services themselves, plus add fees for bank or electronic transfers. Cryptocurrency exchanges The exchange is a platform for trading cryptocurrencies, where both professional traders and investors meet, as well as amateurs who came to buy their first bitcoin and stayed, carried away by the exchange game. The number of exchanges amounts to several dozen and is constantly increasing. Any exchange participant can top up their internal account and offer others to buy or sell the required amount of cryptocurrency at a certain price. Direct purchase If you want to exchange a large amount for cryptocurrency, you will probably want to look into the honest eyes of the seller, ask tricky questions and get some additional information or guarantees. This option is quite possible. If for some reason a one-on-one meeting is inconvenient for you, there are also mass events. In cities around the world, Bitcoin enthusiasts are holding “Satoshi Squares” open air events.

Slide 15

Bitcoin ATMs and terminals For a person inexperienced in online trading, it may be easier to purchase coins using an already familiar banking or payment terminal. Operations with such a device are quite simple. The buyer deposits cash and receives a check with a code to replenish the wallet, or enters his Bitcoin address into the device and can check the receipt of coins on the balance without leaving the terminal. Bitcoin ATMs (bitcoin ATMs) are installed in many countries and cities around the world. Some of them allow you to make a reverse exchange - that is, receive cash currency for your bitcoins. The Coindesk website has a map that shows all Bitcoin ATMs installed in the world. Unfortunately, there are only two Bitcoin ATMs operating in the territory of the former USSR - in Kyiv and Bishkek. But in Europe, North America, Southeast Asia and Australia their number is in the hundreds. You can also buy cryptocurrency in the terminals of several international money transfer systems, the largest of which is ZipZap.

Slide 16

Bitcoin - mining Mining bitcoins is the first and only way to mine cryptocurrency. He is unique. But we should immediately disappoint lovers of easy money who are thinking about how to earn bitcoins on a computer: even 1 bitcoin is not so easy to get. The vast majority of miners are forced to limit themselves to the so-called satoshi - these are a kind of virtual cents and pennies. But even they can get up to 1 thousand per hour for the simplest tasks. In fact, this is not such a large amount: 1 thousand satoshi is equal to only 0.05 dollars. Mining at home ceased to be considered an extremely profitable activity immediately after specific devices began to appear on the cryptocurrency market. Bitcoin mining has turned into a real profession, in which desktop computers and their owners have nothing to do, and almost everyone has learned what Bitcoin mining is. To carry out Bitcoin mining on your computer, it is best to use the power from the ASIC manufacturer. It is the equipment from this company that is capable of generating approximately 2.5 GB of hash per second, with its help you can mine bitcoins. And the electricity consumption is quite insignificant - about 2.5 watts. For example, mining on a home PC with a Radeon HD 7990 card will produce a maximum of 1.2 GB of hash, while consuming as much as 200 Watts. In this case, home mining will not be able to compete with seasoned players. What internet speed is needed for mining? Naturally, the highest to date.

Slide 17

Cloud mining: how to mine bitcoins with it? The attractiveness of such mining is that there is no need to purchase equipment. How to mine in this case? The miner simply invests in the purchase or rental of the necessary capacities. What is needed to mine bitcoins? The following scheme is relevant: find a suitable site to understand how to mine bitcoins on your computer; register there to deposit the required amount of cryptocurrency into your account; purchase as much power as you can afford and start mining bitcoin. In this case, bitcoins will be mined by you together with other miners, and the trick to how to mine cryptocurrency on your computer will no longer be a secret. And the winnings are divided among everyone, taking into account the invested funds. Of course, given the method of mining cryptocurrency, the profit will be much less than the classic mining algorithms allow, but the chance of winning will be several hundred times higher.

Slide 18

Bitcoin faucets What is a “bitcoin faucet” (in English - bitcoin faucet)? Initially, Bitcoin faucets were created to popularize cryptocurrency, in particular Bitcoin. These sites usually offered general information about the possibilities of cryptocurrency, making payments and creating a wallet, as a bonus and for testing, after entering the Captcha, a small amount was allocated to replenish the newly created wallet, usually several tens or hundreds of Satoshi (1 Satoshi = 0.00000001 BTC). There are also Bitcoin faucets without entering captcha. They can still be found today. Enterprising website owners adopted this idea and saw Bitcoin faucets as a wonderful opportunity to make money. It is enough to create a small website, run a script on it, place advertising, invest a small amount of money and share the income from displaying advertising with site visitors. Everyone is happy and everyone has income! And if we also assume that the dynamics of the Bitcoin exchange rate only increases over time, since it is not subject to inflation and government control, then perhaps by accumulating your first Bitcoin and leaving it to your children or grandchildren, you will be able to provide him with, say, education or housing. It all depends on how widespread cryptocurrencies will become and how they will be able to change our world in the future.

Slide 19

Disadvantages of Bitcoin If a virus erases your Bitcoin wallet file (this applies to accounts that are located on local devices) or is able to track your password, your money will not be returned. And this also includes a fairly large amount of space taken up: the entire block of transactions (early 2017) already occupies more than 100 GB. This is a consequence of how the Bitcoin cryptocurrency is structured. Secure synchronization (database update) will also take some time, which will affect ease of use. If you figure out why Bitcoin is needed and decide to invest money, you may experience a drop in price due to lack of demand. The value of a cryptocurrency is determined by capitalization and demand (and only by them) - this is a consequence of how Bitcoin works. Bitcoin virtual money does not support refunds in case of password theft or fraud. No one has sufficient power and authority to carry out a reverse Bitcoin transaction unless the person who appropriated it returns it to you.

Slide 20

Today Bitcoin is a modern digital currency that is perfect for payments on the Internet. More and more stores are accepting Bitcoin as a payment option. The simplicity and convenience of opening a Bitcoin account is attracting more and more people from developing countries to this digital currency. In many countries in Asia and Africa, the Bitcoin network is replacing people with difficult and expensive banking services. In developed countries, POS terminals for paying with Bitcoin in stores, ATMs for cryptocurrencies, and hardware wallets for Bitcoin have become widespread. There has been a real boom in startups that use Bitcoin. It turned out that blockchain technology is suitable not only for financial calculations, but also for distributed storage of data about various assets. There are already several thousand other cryptocurrencies created on the basis of Bitcoin or from scratch. The attitude of states towards cryptocurrencies is very different. There is both clear encouragement - in Australia, Germany, the Netherlands, New Zealand, Singapore, some US states, various offshores - and serious restrictions that can develop into prohibitive measures - these are Indonesia, China, Russia, Ukraine. Only ardent Latin Americans in Bolivia and Ecuador decided to implement direct bans. Many governments have chosen the observation line with cautious optimism - most of the European Union, the UK and Switzerland, the US federal government, Canada, Japan and countries in Southeast Asia. In most developed countries, financial legislation is being adapted to regulate cryptocurrencies, and this issue will soon be resolved.

Slide 21

Sources of information https://ru.science.wikia.com/wiki/%D0%9A%D1%80%D0%B8%D0%BF%D1%82%D0%BE%D0%B3%D1%80%D0 %B0%D1%84%D0%B8%D1%8F https://ru.wikipedia.org/wiki/%D0%9A%D1%80%D0%B8%D0%BF%D1%82%D0%BE %D0%B3%D1%80%D0%B0%D1%84%D0%B8%D1%8F https://dic.academic.ru/dic.nsf/ruwiki/1383518 https://nabiraem.ru/blogs /internet/41761/ https://fb.ru/article/167304/bitkoinyi—chto-eto-bitkoin-koshelek-kurs-bitkoina https://bits.media/chto-takoe-bitcoin/ https://mining- bitcoin.ru https://coinspot.io

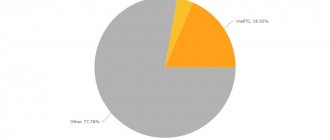

Main types of cryptocurrencies

Bitcoin

The oldest and most widespread cryptocurrency is the above-mentioned Bitcoin. is named after the creator, who is Satoshi Nakamoto . The identity of this person has not yet been established; some believe that this is the name of a collective of anonymous cryptocurrency creators. Due to its sudden (but quite expected) popularity, the value of Bitcoin has increased many times in recent years and is still growing. (despite cyclical depreciation)

This system differs from other similar ones in its transparency in transactions, which last on average about ten minutes. The maximum number of digital coins is more than 20 million (this relatively small number of coins is determined by their very high denomination). Despite this, every day there are more and more cryptocurrency miners, which also affects the further increase in the value of Bitcoin.

One of the convenient and reliable methods of becoming the owner of the Bitcoin cryptocurrency is to make a purchase in an online exchanger. The presented method is the simplest and safest. As an example, we can highlight the multi-currency online exchanger Matbi, in which you can also store cryptocurrency. To purchase cryptocurrency, you need to go through a simple registration on the Matby website, top up your balance with rubles, and in the “Exchange” section, exchange rubles for Bitcoin. A detailed and detailed description of the process of purchasing cryptocurrency on the Matbi website is displayed here. (there is a YouTube link to the word here). In addition to Bitcoin, you can buy Litecoin, Dash and Zcash in Matbi. |

Litecoin

The second, no less popular cryptocurrency is Litecoin, its author is Charles Lee. This is a branch of Bitcoin, which exists as a separate system and is distinguished by the speed at which blocks appear in the network. Thanks to this, the speed of transactions has increased, funds can be transferred and received faster, which is often a determining factor in popularity. The maximum electronic coins that can be transferred is four times that of Bitcoin, amounting to 84 million. It is the first cryptocurrency to use Scrypt.

Ripple

Ripple. A completely new cryptocurrency, which is fundamentally different from its predecessors, was developed in 2012 by a company called Ripple. This is the first platform that allows you to exchange currencies in almost any direction with minimal commissions. It is an improved system for transferring money between banks and works much faster than them. The cost of one coin depends on the quantity transferred and how often it is used. The maximum number of coins that have been issued since the creation of the cryptocurrency is 100 billion.

Ethereum

Ethereum is in second place in terms of capitalization after Bitcoin. This cryptocurrency was developed by Vitaly Buterin in 2015, and it serves as the main currency for developers of a wide variety of applications. To work with this cryptocurrency, you need to know a special programming language – Solidity. Bitcoin and Ethereum are very similar to each other, since the first idea of the author of “ether” was to improve Bitcoin. But there are still many differences between them; an example would be that in Ethereum, ether, or, in other words, a token, is used to carry out “smart contracts”. Bitcoin, in turn, is a cryptocurrency that is used for exchanging currencies.

Monero

Monero is a new type of cryptocurrency that differs from others in that it allows for a high level of anonymity. Monero is also different in that this platform does not have a maximum of electronic coins. This means that after the bulk of them are released, the cryptocurrency will be supported by its users - the more users there are, the more coins will be in circulation. Such a system allows its users to control the ability to access information about addresses and the amount of funds that were transferred through the transaction.

Dash

Dash is another cryptocurrency that has the highest level of anonymity. This money was developed in 2014 by programmer Evan Duffield, and already in 2017 it was already among the top ten top currencies. The system does not allow tracking of transactions, sender and recipient, and its main function is to be a payment system on the so-called “dark” Internet (Darknet). This digital currency is mined and almost entirely distributed among miners.

IOTA

In 2015, the electronic currency IOTA was developed, the main function of which is to make free and fast payments in the Internet of Things, regardless of the amount. Like Ripple, this cryptocurrency has a whole set of coins, so mining is not needed here, all coins have long been distributed among the participants in the system. Iota is its smallest unit. The peculiarity of IOTA is that it combines a large number of devices in its network to manage the exchange process.

Cardano

Cardano – maximum security for transactions. The developer of this system was Charles Hoskinson (he is also one of the co-authors of Ethereum). In this project, he corrected the mistakes that he made earlier when developing other cryptocurrencies. The company has developed its own wallet, in which it is recommended to store currency, since only in them it will be completely safe. The network allows for quick currency exchange without commission; the maximum coins that can be transferred is 45 billion.

Two in one

To combine the two projects, it was decided to launch a new company called ERA.

“Marty and I discussed that governments could continue to blacklist the IP addresses of Bitcoin miners. Telcos, Google, Amazon or others can jam or redirect traffic without net neutrality,” said ERA and GUN CEO Mark Nadal.

“This is a huge vulnerability that can affect everyone, and that's why we're creating AX,” he explained.

The GUN Project used simple comics to explain how the technology worked. He received $1.5 million in funding in a round led by Draper Associates earlier this year and has already built decentralized Reddit and YouTube. While these services are a little slower than their centralized counterparts, Nadal says they are starting to become "crazy popular." And as Malmi says, Identifi can help decentralize the system even further by offering a censorship-resistant level of identity.

For ERA, Identifi plays a key role.

“Users will be able to digitally sign all their records and use Identifi to obtain a profile identity (name, avatar, reviews, etc.) corresponding to the public key,” Malmi said. “You will be able to use your Identifi trust network to filter out spam, trolls and other types of unwanted content without resorting to central censorship. This is convenient for decentralized social networks.”

But to achieve true decentralization, ERA needs people from all over the world to run the database system. This is exactly what a token is for.

ERA and AX should encourage network users to store data. At the same time, the project takes a slightly different approach than earlier blockchain projects like Filecoin and Storj - it pays servers not for storing, but for moving encrypted data.

Because the data is encrypted, the servers moving it will not be able to read it.