For any speculator, work begins with studying the basics of trading financial assets, becoming familiar with the basic principles of a fundamental, technical approach that allows for an analysis of the market situation. To get a positive result in the form of profit on your balance sheet, you have to learn how to use different methods and tools.

After a speculator has mastered this knowledge and used different approaches at the terminal for a long time, there is a need to develop his own strategy. This is a kind of element confirming the proper level of professionalism.

Do you need a trading system?

It is the use of the system that allows and helps the investor to make a profit. The method of speculative trading is an algorithm, a sequence of meaningful actions, according to which you need to act at the moment of completion of transactions.

A speculator can, if desired, formulate a unique tactic. The second option is to use a technique developed by someone. There is a third approach - to develop your own tactics, but using previously used approaches and indicators.

It is important that the chosen strategy is effective, and this means completed transactions are a plus. The goal of any system is to increase profits and reduce losses. To do this, one should take into account the basic principles of developing a methodology, the effectiveness of which has been confirmed by an impressive number of financial market participants.

Time-out

In the work of any trader, so-called black streaks occur. A series of unprofitable trades have a very negative impact on the psyche, which in turn can be fraught with further losses. In such cases, the trader needs to interrupt trading for a certain period of time and take a timeout. This timeout can last from one day to a week (it all depends on the individual trader).

The rules of the trading strategy must clearly state after which series of losing trades a timeout should be taken. Here, as you understand, everything again depends on the psychological characteristics of the trader. Some people panic after every losing trade, while others don’t care about ten stop losses in a row.

Rules for determining a place to enter the market

Constant analysis and observation of the market will allow the speculator to establish certain patterns of exchange rate fluctuations. How to determine the conditions for opening an operation?

For example, at the moment of observing the market, it is clear that there is a certain level of value, at the moment of reaching which the market, moving downwards or being in a flat, begins to change the direction of movement in the opposite direction.

This circumstance indicates an increase in buyer interest in this asset during periods when the rate reached its maximum value. It turns out that the approach of the downward market to this value mark acts as a condition for a reversal.

We should not discount the situation that the bearish trend will overcome the price that corresponds to the support level. As a result, it will not move in the opposite direction. But, more often, at the moment this level is reached, the asset’s rate begins to reverse, thereby overcoming the level, this indicates the presence of a specific pattern. This allows us to consider this mark (support level) as a point for entering the market for purchase.

Trading is a business, not a game

You won't be able to succeed in trading with a reverse position. Compare how many successful businessmen and gamblers you know.

How to turn a hobby and entertainment into a business

- Set up your workplace. You can work from wherever you want. But that doesn't mean you can watch movies or shows while working. Trading should be separate from personal matters. Create a workplace where you can get things done without being distracted by external factors.

- Strategy is your business plan. Decide which strategy to work with and become a master at it. In your business plan, write down a clause about disciplined work and never violate it.

- Take time to analyze the market. From 15 to 60 minutes a day is enough. At this time, do only analysis. Do not open trades and do not be distracted by non-work matters.

- Control your emotions. A businessman cannot afford unnecessary emotions at an important meeting. You are a businessman, and instead of partners, the schedule similarly prefers peace.

- Manage your capital. Business does not forgive waste. Enter the market if you see setups that match your personal strategy.

The first rule of a trader for successful Forex trading is to become a businessman, and entertainment is a serious matter that generates income.

Exit from the market

According to the rules described above, the conditions for completing the transaction are determined. For example, when observing movements in the market for a long time, you can set a value mark when the market reaches it, moving up, or at the moment of flat, turning down, this indicates an increase in the activity of sellers. This is the resistance level.

It turns out that the strategy is based on guidelines guided by two laws, considered as conditions for opening or completing a transaction:

- the acquisition is carried out close to the support level;

- sell when the rate reaches resistance.

Strategy Recommendations

- If the price does not capture your order for a long time and the trend begins to change in the other direction, then this order must be deleted. In this case, you need to wait for the right moment on a new trend;

- Stop loss is set at the nearest local minimum/maximum. I usually add 50 points to the extreme to be on the safe side;

- Take profit – activated manually when the oscillator moves into the overbought/oversold zone. Or when the stop loss is triggered, tightened to fix part of the profit.

This strategy is a time-tested tool. I recommend that you use it to learn trading, and in the future you will be able to add your own filters to it for more convenient work.

Recommended reading: Forex signal providers

Tools are best used in a trading system

Strategy is also a combination of indicators that generate market signals. There is an opinion that the more tools are used, the more accurate the signals. This is wrong. You should not saturate tactics with an impressive number of indicators, especially if we are talking about a beginner who finds it difficult to react to a cluttered chart.

A small number of tools is also bad, as there may not be enough justification for entry.

The trader must find his own indicator or several indicators that show stability at the time of connection. To do this, it is recommended to familiarize yourself with different tactics, reviews, video tutorials, then test the tools yourself on a demo account.

Don't trust indicators 100%

Technical indicators can help assess the market situation. But this is only a mathematical algorithm that is not capable of giving accurate forecasts all the time.

Most professional speculators use a minimum set of technical tools. indicators or do without them. After trying to find the Grail in the form of an indicator, they use Price Action strategies.

Beginners can use indicators, but in moderation. Otherwise, the analysis will become more complicated, and the results and understanding of the market will deteriorate.

Strategy check

Please note that the methodology is not a dogma, it is only a guide to specific actions to achieve success in the market. Any system is initially a crude design; it needs testing and development. Therefore, the investor’s task is to test the system on a demo account. This will allow you to protect yourself from possible force majeure situations.

Perhaps, during testing, the speculator will find shortcomings and correct them without putting real capital at risk.

There are times when combined indicators give inaccurate signals, so you have to make changes to the parameters and select a different asset for trading.

Also, the created tactics need statistical accounting. An investor needs to keep a diary and monitor the history of transactions, this will allow him to take into account errors in the trading process.

Conclusion

A strategy is an opportunity to conclude transactions on the financial market without turning trading into gambling. Which is the key success factor. Remember that intuitive trading is the first step to draining capital. You must always analyze the market, get acquainted with the behavior of its participants using different tools, and only then can you rely on a good result.

Interesting material:

- 01/20/2019 Trading strategy for binary options “Line Beam” Successful work in the field of online trading requires a thorough knowledge of the basics of technical analysis. Mostly all profitable strategies are based on the use of indicators. Now […]

- 11/30/2018 What is the “Ema macd” indicator and how to use it correctly MACD is considered one of the frequently used technical tools in the world of indicators. This instrument is very often found in strategies on the financial market. The developer of MACD is […]

- 12/02/2018 Strategy for binary options, new for 2020 “Ultra Profit” (video) “Ultra Profit” is an indicator strategy for binary options, which is considered new for 2020. This technique was originally intended for scalping in the Forex market, but […]

- 02/20/2019 Drake Delay Stochastic strategy for binary options The Drake Delay Stochastic strategy is used in two directions at once with binary options and in the Forex market. It must be said that the system is based on the readings of a pair of indicators, [...]

- 12/20/2018 Safari strategy for binary options: rules for concluding transactions Modern investors have the opportunity to choose the optimal tactics for themselves among a wide range of methods. There are systems based on indicators, while non-indicator tactics […]

Binary options trader – who is he? and what is trading.

The concept of “trader” migrated to us from the English language. It sounds like “trader”, which literally means “trader”. Here we mean a person who does not trade bread or clothes in a store, but enters into purchase or sale transactions in the financial market.

Despite the fact that traders carry out their trading activities on a variety of platforms, one of the most successful today is the Forex company. This broker managed to unite millions of traders into a single whole, regardless of their nationality and religious affiliation. It was not possible to determine exactly how many traders there are, but the Central Bank of the Russian Federation was able to present the number of traders in Russia; it is more than 460 thousand. Throughout the year, transactions totaling $330 billion are made. This amount is more than the GDP of the Russian Federation. People who trade in financial markets are usually called traders .

| Start trading Binary Options with the trusted brokers listed below |

Binary options trader and his scope of activity

Knowing the definition of the concept of “trader,” we can conclude that his main activity is the acquisition of various assets. This could be currencies, stocks, precious metals, and so on. All this is done in order to increase your own capital with the help of profit.

In fact, the work is not easy and requires a lot of time, effort and perseverance. It is necessary to predict future changes, analyze existing charts, and regularly monitor economic and political news. After processing all the necessary data, a decision is made in favor of purchasing or, conversely, selling. While most activities can be divided into groups and categories, this cannot be done in the case of trading. The only thing that can be done is to divide all existing traders into those who work for themselves and those who work for an employer.

Those who work for an employer can safely be called professionals in their field. Often this is not only the main, but also the only opportunity to earn money. Those who trade for their own benefit trade when they have free time. Sometimes among such traders there are traders who live off this particular type of income.

Which binary options trader is considered a professional?

Professionals in any field of activity are distinguished by their high eagerness to please their superiors. They sit in the office all day, wear sharp suits and constantly put on a smart appearance. Do not confuse a trader with an analyst, since these are completely different professions. The trader is looking for the most optimal conditions to enter the market.

Key Traits of an Amateur Trader

Traders who work for themselves do not need to fulfill someone else's whims. He has the right to decide for himself exactly how he will manage his money. Such a trader trades using his personal PC, on which a special trading terminal is installed, without leaving his home.

Top reliable and proven binary options brokers

Trader trading volumes

Many successful brokers provide their clients with the opportunity to use leverage. In this regard, there are no restrictions on the minimum deposit amount. There are cent accounts where the deposit amount is calculated not in dollars, but in cents. Thus, you can deposit $10 and start learning the basic intricacies of trading. It should be noted that transactions conducted in the foreign exchange market can be transferred to the interbank level if the amount is $100,000 or more. If we consider the volume of Forex trading around the world, then it is trillions of dollars and this amount is increasing every year.

It is impossible to count exactly how many people work in the trading direction in Russia, as well as in other countries. Many brokers are registered in countries with offshore jurisdiction. This is due to the excessive requirements of regulators. Thus, some information is distorted. People who analyze the market situation resort to the use of technical and fundamental analysis.

Technical analysis

The construction of technical analysis is carried out on the basis of the assertion that all future price fluctuations are already recorded on the chart.

By examining this chart in detail, you can predict exactly how quotes will behave over a certain period of time. In the process of technical analysis, such popular tools as Japanese candlesticks, Fibonacci sequence, Elliott wave theory, indicators, and so on are used. The resulting forecast has a moment of probability. In this regard, in order to obtain the most approximate trading signal, it is necessary to use the optimal number of effective tools during the analysis. The trader opens a transaction when the existing forecast is confirmed by several factors.

Fundamental Analysis

This type of analysis is carried out taking into account the economic and political situation. In the forecasting process, the following are taken into account:

- news;

- ministerial financial reports in different countries;

- decisions of the Central Bank;

- US Federal Reserve minutes;

- analytical and economic forecasts;

- exchange information regarding trading volume.

It is very important to take into account emerging rumors during analysis. Practice has repeatedly shown that the market tends to move completely in the wrong direction where it should move. This happens under the influence of the situation. The main impetus for the start of movement is the reaction of the mass. Experienced analysts are guided by the statement that you need to buy based on rumors, and sell based on facts.

Trading intervals

Each experienced trader has his own strategy and, accordingly, his own trading interval maintained between the conclusion of a transaction and its closure. It can be completely different from minutes up to 2 years or more:

- Speculators (scalpers) who open and close transactions within very short periods of time manage to earn income in just a few minutes. They catch the moment when there are small price differences and remove about 20 points of income. Of course, this is a fairly small income, but if you make many such quick transactions throughout the day, the result will be a fairly good amount.

- Work time. Many traders strive to close all their trades by the end of the business day. This is done even if at the time of closing the price indicator did not move in the predicted direction, but rather went in the opposite direction and brought a loss.

- Position trading involves opening transactions for a period of 7 to 60 days.

- Long-term trading means closing existing transactions no earlier than a couple of months from the moment they were opened.

Don't forget about choosing the right binary options broker! The trader’s entire journey depends on this!

Psychological aspects in binary options trading

It will not be a revelation to anyone that in the process of work a trader experiences a very high psychological influence. The excessive cost of a miss in addition to the difference in the result causes the majority of beginners to trade in the stock market to simply become disappointed.

According to psychiatrist and part-time trader Alexander Elder, a trader is constantly accompanied by fear and a thirst for profit. The thirst for profit pushes the seller into pointless attempts to make a profit from a losing transaction. Thus, completely spontaneous transactions are opened. Fear pushes you to complete a transaction with a minimal move or, on the contrary, to make a loss if the price has moved in the right direction. Successful financial companies resort to using certain principles to increase the performance of their subordinates. The list of such principles includes the rule of three mistakes. If a trader makes three trades that bring a loss, he gives up his position to another employee. It is the psychological aspects of a person that have become the main reason why the Forex market is considered a scam. Initially, it may seem that the trader is doing nothing and attracting money from nowhere. No one knows what labor-intensive market research work is carried out behind the scenes. Exchange terminals are publicly accessible and this attracts a large number of people who want to get rich easily. Unfortunately, this approach to business leads to an absolute waste of funds. As a result, various negative reviews regarding the work of dealing centers appear.

Trading binary options with robots

Those who use the MetaTrader program in the trading process will confirm the presence of the advisor function. It provides for opening transactions automatically, that is, without human effort. Professional traders call this program not an advisor, but a robot. Robot trading is very popular among scalpers because it can make about 10 trades within 60 seconds. This makes a trader's life much easier.

There are many publicly available advisor programs, as well as paid ones created by special companies. Their cost can range from $100 to $100,000.

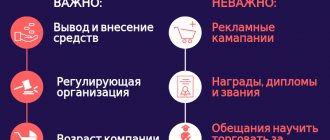

Legislation of the Russian Federation in the field of trading

In the United States, trading became popular in the 70s. It appeared in Russia almost 20 years later. Back in 2010, new traders could not legally display their profits. The thing is that the legislation was not thorough in this regard; in the process of calculating the tax, transactions that resulted in a loss were not considered. It was required to pay 13% of the transaction profits, and it did not matter at all whether the trader received income or suffered losses. Only in 2020 was a law regulating the Forex trading process adopted, and then in 2016, the three most promising brokers were granted Licenses from the Central Bank of the Russian Federation. Some successful brokers have still not been able to obtain a license due to legal issues. In view of this, they are forced to work under offshore companies.

Basic trading concepts

Traders, just like representatives of other professions, have their own specific sleight of hand, which is practically incomprehensible to those who are not familiar with this field of activity. Traders need to have a good understanding of basic slang concepts in order to communicate freely on forums and the like.

- Bear market – the majority of trends are moving downwards.

- Bull market – there is a gradual increase in price.

- Catching a moose means completing a deal with losses.

- A short position is a position in which income growth occurs at a small market value.

- A long position is the opposite.

- Flat is a horizontal price movement.

- Channel – lines displayed on a chart. There is a price movement between them.

- Lock – two reverse trades.

- Turkey is a technical indicator necessary for analyzing the market situation.

- Cross is a currency pair that does not include the US dollar.

- Drain - remain with a zero deposit.

- Deposit is an account opened on a brokerage platform, necessary for the trading process.

- Rollback is the return of the price to its original position after a jump.

- Piping is a strategy that allows you to earn only a couple of points.

How to start trading binary options?

Anyone can work in the financial market. There are no specific requirements regarding education and status. You just need to install a terminal and top up your deposit. Based on practice, we were able to draw conclusions that a trader can achieve success regardless of how old he is and where he lives. The main thing here is the level of psychological preparation. In fact, a lot depends on psychology.

Today, there is a huge amount of diverse information and data needed for learning. Many brokerage companies offer to open a demo account, with which you can understand the basic principles of trading. Purposeful people who know how to learn and adapt to new conditions can achieve success. If, in addition to all this, a person is very disciplined, then the level of success increases several times.

Trading binary options from scratch

A person who has a desire to become a professional trader must be patient. The psychological factor is very important in this profession. After psychology, discipline is important. A future trader should always approach business with a sober mindset. There is no place for negative emotions and excitement.

| Start trading Binary Options with the trusted brokers listed below |

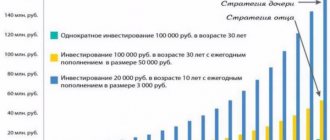

Binary options trader and investor are different concepts

It is probably necessary to pay attention to the fact that a trader and an investor are not the same concept. A trader conducts trading activities in the financial market using his own and other people’s money. The investor does not trade, but only invests his own money. He seeks to invest money for a long period of time in order to receive as much more profit in the future. A trader resorts to speculation because even the smallest amount of income is important to him. An investor prefers to invest money in assets on the basis of a loan at a certain interest rate. This percentage will be received if everything goes well. A large trader cannot independently influence the value of assets by conducting market transactions with them. An investor, before investing money, first analyzes whether the asset is so promising. In this option, the trader does not care at all about the moment of growth, since he has the opportunity to make money both on the growth and decline of assets.

Learn more about binary options trading and Forex trading.

Related posts:

Support and resistance levels in Binary trading...

Problems of novice binary options traders.

Who is this fraudulent broker? How to recognize a fake broker and lo...

How not to lose your money within 3 days...

Binary options training for beginners. Where did we start...

Total Page Visits: 5350 — Today Page Visits: 7

Choose the BEST broker:

| Olymp Trade | |

| Deposit from 5$ | |

| Bet from 1$ | |

| FinaCom PLC | |

| There is a demo account | |

| START TRADE | |

| FULL REVIEW | |

| Binary | |

| Deposit from 5$ | |

| Bet from 2$ | |

| MFSA | |

| There is a demo account | |

| START TRADE | |

| FULL REVIEW | |

| FiNMAX | |

| Deposit from 100$ | |

| Bet from 5$ | |

| TsROFR | |

| There is a demo account | |

| START TRADE | |

| FULL REVIEW | |