If you are planning to engage in trading, then you, as a trader, should definitely know what Forex CFDs are. In addition, it will be useful to understand how CFD contracts are traded and everything connected with it. After all, for truly profitable trading of other assets (not currency pairs), it is important to understand CFD trading.

CFD contracts: what are they?

Let's assume that you are now standing on the premises of the New York Stock Exchange, where millions, if not billions of US dollars worth of assets are being bought and sold every second. Around you you see large monitors with constantly changing numbers and dates. You are observing the work of traders who constantly carry out transactions with purchases and sales of futures, options or government bonds.

By the way, securities transactions can have different purposes: dividends in the form of a stable but long-term investment, or short-term profit from speculative transactions. Despite this, all exchange participants are primarily interested in making a profit.

So, we come to the most interesting part. Looking to buy Google stock or sell Facebook stock? No problem, you don't have to be in London or New York to do this. All exchange transactions can be carried out right at home. This is possible through contracts for difference , or as they are also called CFD contracts (Contract For Difference).

CFD contracts in Russia

The activities of brokers working with CFD contracts in our country are currently not regulated. We only allow currency pairs traded on Forex for trading. Some dealers of this exchange want to ask for CFDs to be included in the list of permitted ones.

Thus, these contracts have restrictions in our country, but if they are concluded with Forex dealers, the client can rely on protection from the state.

Some traders provide the opportunity to earn money using these transactions on such underlying assets as oil, gold, silver, futures on stock exchanges, and shares on the New York Stock Exchange.

Stock CFDs: what are they?

In other words, contracts for difference CFDs are nothing more than a contract between the buyer and the seller on the transfer of the difference at the time of the transaction (opening an order) and its value at the end of the contract , that is, closing the Forex order.

Suppose a trader bought 20 Facebook shares at a price of 127.85 USD per share, and after some time sold it at a price of 129.85 USD. It turns out that the buying company undertakes to pay the trader the price difference using the formula 20 (shares) x 2 (price difference at the time of purchase and sale) = 40 US dollars. If the price of a stock falls for some reason, then the financial obligations to pay this difference will be assigned to the Forex trader himself. Now you understand that cfd contracts are the difference in price at which a certain exchange asset was bought and sold.

What are CFDs?

CFD (Contract for Difference) is an innovative financial instrument that is becoming very popular among independent traders and investors.

CFDs simplify the investing process by allowing you to invest in a specific asset without actually buying it. The main advantages of CFDs are their transparency, convenience and the high level of control that traders have in each specific transaction. By opening a CFD transaction in relation to any asset, you seek to make a profit due to fluctuations in the market price of this asset. If you open a position when an asset is trading at a low price and then close it when the asset has risen in price, the difference between the two prices will determine your profit.

TradingTeck offers traders up to 1:200 leverage on your initial investment amount. Opening a leveraged trade allows you to increase your trade size using TradingTeck tools. A successful trade will generate profits in proportion to the amount of leverage used.

CFD contracts are a simple and straightforward form of investment. You can open a CFD transaction regarding an asset for either BUY or SELL.

PURCHASE.

If your analysis shows that the price of an asset will rise, you should open a BUY position.

SALE.

If your analysis shows that the asset will fall in price, you should open a SELL position.

Benefits of CFD Trading

- Favorable collateral requirements. The deposit of the actual contract value is 10%.

- Ubiquity and accessibility. You can trade assets from anywhere on planet Earth, as long as the Internet is available.

- Low Forex commission. The commission fee for the transaction is from 0.05%.

- Guarantees for execution of orders. You always have access to opening or closing orders, regardless of what price a particular asset has reached.

- Possibility of diversification. Emerging risks can always be diversified thanks to a wide range of financial assets.

- Providing leverage. CFD contracts for difference provide the opportunity to obtain leverage or, as it is also called, credit. With the help of leverage, a trader can count on the execution of transactions whose amounts significantly exceed the trader’s collateral deposit. However, for this advantage, you will have to pay a certain percentage. Thus, a certain commission will be debited from the client’s account with each new trading session. This is a kind of payment to the Forex broker for expenses aimed at lending to its clients.

Benefits of CFD trading

CFD trading is ideal for 21st century investors looking for fast, convenient and low-cost investing opportunities. When you open a CFD position, you do not purchase the underlying asset, so there is no transfer of ownership of the asset, no paperwork required, and no additional obligations. If the trade is successful, the profit will be immediately credited to your trading account.

You can become a TradingTeck trader in three simple steps. 1. Provide your details 2. Fund your trading account 3. Start trading

Leverage

Leverage allows you to increase your initial investment when making any CFD trade using TradingTeck funds. As long as you have sufficient margin in your trading account, you can take advantage of up to 1:200 leverage in just one click. If your trade is successful, your profit increases in direct proportion to the amount of leverage used.

Diversification

Many traders try not to limit their trading to just one asset class. They prefer to have a diversified portfolio consisting of different types of assets traded on different markets. If any market falls, their overall risk exposure is not absolute.

Management of risks

TradingTeck's risk management tools are easy to use and can be activated with one click. Stop loss/take profit orders and pending orders allow you to define clear parameters for each trade without the need to constantly monitor the progress of the trade.

Trade under any market conditions

CFD trading is flexible enough to give you access to both rising (bear markets) and rising (bull markets) markets. If you predict that asset prices will fall, you can open a SELL position. If you predict that asset prices will rise, you can open a BUY position. If your analysis was correct, you will profit from the difference between the price when you opened a trade on an asset and the price when you closed that trade.

Disadvantages of CFD Forex

The main disadvantage when trading CFDs on Forex is huge spreads . Those traders who use Forex trading strategies based on scalping as a working strategy, or simply close short positions, are not recommended to use CFD contracts. After all, a large spread will eat up a significant part of the profit points. And the unprofitable trades with it will be much greater. On the stock exchange, when trading stocks, options or indices, a commission is paid as swaps, and on Forex this commission is replaced by a large Forex spread.

What is CFD Trading

CFD Trading Principles

A CFD simulates the profit and loss of a real transaction to buy or sell an asset.

The contract provides the opportunity to trade on the underlying market and make a profit without actually owning the asset itself. Let's say you expect oil prices to continue to soar and want to buy 1,000 shares of Exxon Mobil Corporation (XOM), the largest publicly traded oil company in the world. You can buy these shares through a broker, pay a significant portion (according to Federal Reserve regulations, the initial margin in the US is currently 50%) of the full price of these shares, borrow from the broker for the rest, and on top of that , pay a commission to the broker.

Instead, you can buy a CFD contract of 1,000 FCX shares. To purchase the contract, you will have to put down a much lower deposit (2.5% of the full value of the shares from IFC Markets).

CFD trading

The most common question among new traders with no online trading experience is “what is CFD trading?” CFDs are a flexible investment instrument and are traded similarly to currencies.

Along with these instruments, IFC Markets has developed a new type of CFD - continuous CFDs, that is, contracts without expiration dates. These instruments allow investors to choose the date for closing the contract and recording profit/loss. Moreover, a number of the features mentioned below make CFDs ideal tools for online trading.

Margin trading

Margin trading allows you to take a larger position on the market with a small amount of invested capital. When the market moves in the direction you expect, the profit with the leverage provided increases, since you contributed only a portion of the total value of the contract, and the profit will be received from the change in the total value. Of course, with margin trading, losses can also increase significantly if the market goes against the movement you were counting on. Therefore, due care must be taken when trading with leverage: risk management becomes a particularly important aspect.

Day trading

Day trading is the process of buying and selling various assets within a single trading day. This means that during this day, a trader or investor can make any number of trading transactions at his discretion. Since margin trading allows you to increase your position with a limited amount of invested funds, it is possible to trade CFDs even with small fluctuations in the price of an asset within one day.

Trading stocks, commodities, indices and currencies

CFD (Contract for Difference) is a universal trading instrument that has gained particular popularity in recent years. With the help of CFDs, it became possible to play on the price movements of various financial instruments without the need to physically own them. CFDs allow you to trade not only stocks, but also major stock indices, currencies and commodities.

Ability to trade both when prices rise and fall

CFD is a flexible investment instrument. If you are confident in a growing market, then earn income by opening a position to buy CFDs. You can also speculate on price declines by selling CFDs. Holders of open positions for the purchase of CFDs on shares receive a dividend adjustment equal to the amount of the dividend announced for payment, if at the time of opening of trading on the day of payment of the amendment (coinciding with the ex-dividend date) a long position is open on the instrument. In contrast, the dividend adjustment is deducted from the client's account if a CFD sell position is opened.

Investment portfolio hedging

If you expect that the purchased shares will become cheaper, but you do not want to sell them, then you can use strategies to hedge your portfolio against risks by opening a position to sell CFDs on your share portfolio. Thus, the profit from a short CFD position will compensate for the losses from the fall in the value of assets in the portfolio. You will incur lower costs compared to hedging when selling real assets in order to then buy them back cheaper.

CFDs on stock indices

There are also CFD contracts for stock indices on the market. They are practically no different from contracts for difference on shares. However, this type of contract is a rather specific financial instrument for a trader. A trader can make a profit depending on changes in the numerical values of stock indices.

Any stock index can act as an underlying asset. Each item is equated to a certain numerical value (sum). For example, let one point of the NASDAQ index be 0.01, then its lot will be equal to twice the value of the instrument itself and valued at $0.02. The same rule applies to foreign currency accounts. It is important to consider that the stock index on average during a trading session can change its value by several thousand pips. Thus, with the right approach, a trader can make good money by opening CFD contracts on stock indices . But there is also a flip side to the coin; if the analysis is incorrect, the losses will be significant.

The movement of stock indices in one direction or another depends on the movement of a number of financial instruments (stocks, currencies) included in the calculation of the stock index. Therefore, knowing how the price of a certain stock index is formed, you can always diversify your risks.

Contracts for difference (CFDs). What are the advantages?

CFDs are derivative financial instruments. Although CFDs have been around for over 20 years, they have only recently begun to gain popularity due to features such as:

- Availability. Trading CFDs is easier than, for example, shares or gold, etc. There is no need to physically transfer the asset (i.e. shares, gold). The investor receives income from the difference in asset prices over different periods of time.

- Margin trading. In CFD trading, the so-called leverage (credit) is used, which allows the client to make transactions with amounts several times greater than the size of his security deposit. The use of leverage allows investors to receive income with a relatively low initial deposit. Thus, working with CFDs can provide a very high level of return on investment. For using the loan, the client pays a certain percentage (a fee is debited from the client’s account when the position is transferred to the next trading session), which reimburses the broker for his costs of lending.

- Short positions. Using CFDs, you can open not only long (buy) positions, but also short positions, that is, sell an asset that the client does not have in stock. Previously, such an opportunity was available only to large professional investors.

- Diversification of investments. The more instruments available for trading you use to form your investment portfolio, the lower the risk of loss in the event of unfavorable changes in prices for individual assets.

How to set up a terminal for CFD trading on Forex?

After some time, CFD contracts became available on the Forex market. There are certain Forex brokers that provide the opportunity to trade all exchange-traded assets present on the stock exchange.

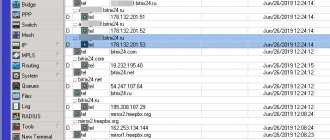

If a broker provides CFD trading on Forex, then you need to familiarize yourself with its terms and conditions, since they are different for everyone. For example, in the Russian Federation there are Forex brokers who allow trading on CFD contracts with a minimum deposit of $10 thousand and a small trading lot. Also, some DCs provide the opportunity to find out what CFDs on Forex are on a demo account. In the conditions you might see something like this:

Figure 1. Conditions for trading CFD contracts on Forex.

Let’s assume that you are satisfied with the terms of the broker that provides CFD services. You have downloaded the MT4 terminal, but it initially displays only currency pairs and there are no exchange assets in sight. What to do?

Right-click in the “Market Watch” window and a context menu will pop up. Then you need to select "Symbols".

Next, a window will open in which you need to select the “CFD” section and click on the “Show” button.

Figure 2. Setting up CFD contracts in the MT4 terminal and selecting the CFD section.

That's all, in our “Market Watch” window we can observe stock shares, indices and other symbols.

Figure 5. Exchange assets in the MT4 terminal window.

What are CFD contracts - a guide to using them in Forex trading.

Good afternoon, my dear readers! In the text of today’s article we will focus on a rather complex trading instrument – CFD. This abbreviation stands for contract for difference. This tool is very popular in the process of trading precious metals, oil, cryptocurrency and the like. The main advantage of CFD contracts is that all transactions carried out do not require ownership of the rights to the product used for trading. For example, if you buy shares in the stock market, then they become your property, and if you bought flour on the commodity exchange, then you need to additionally ensure that there is a place to store it. When purchasing CFD shares or commodities, you are not purchasing a physical asset and are not the owner of the purchased item. Immediately there is a purchase, and then the sale of CFD contracts for the difference in the value of the asset, deriving a good income from this. Thanks to the possibility of using leverage, there is a chance to significantly increase the amount of income.

Start trading with Amarkets. With a deposit of 10$

What is CFD?

The trading process based on CFD does not have any significant differences from the currency trading we know. Here you can also purchase and sell CFD contracts using the popular trading terminal, that is, MT4. But here the trader is given the opportunity to use a huge number of trading instruments, or rather precious metals, oil, shares of large companies, indices, cryptocurrency and much more. In general, the number of instruments is close to 10,000 types. Such a wide variety of services can be found on the trading platform of only one brokerage company. There is absolutely no need to go through the difficult registration procedure on exchanges or engage in lengthy searches for a suitable brokerage company that provides intermediary services between the trader and the exchange. It is also not at all necessary to have a lot of money to trade.

Main advantages of CFD contracts

- Leverage. Due to the availability of such a convenient service as leverage in CFDs, it is possible to receive a large income with a small deposit amount. It is worth paying attention to the fact that in the stock market conditions the trading process is carried out without the use of such a service or with a minimum amount of leverage.

- Flexibility. In the process of conducting the trading process with CFD contacts, it is possible to pre-set stop loss lines, as well as take profit lines. This makes it possible to understand the amount of potential income and set a limit on losses.

- Minimum investment. Investments in CFDs are profitable even when the amount is not large.

- A significant number of trading instruments. When trading CFD contracts, it is possible to select stocks, indices, commodities, precious metals, and the like.

- Trading process in two directions. In comparison with the trading process carried out in the conditions of the stock market, as well as a cryptocurrency exchange, it is possible to open short positions in addition to long ones.

- Validity. CFDs do not have an expiration date like options do. In this regard, you have the opportunity to keep them open for the desired period of time.

| Start trading Forex with the trusted brokers listed below |

How does investing in CFDs work?

Let's look in more detail at how CFD contracts operate. Let's imagine a situation where an investor decided to sign a CFD contract with a brokerage company to purchase 1 ounce of gold. In the case of purchasing precious metal on a commodity exchange, the investor would need to shell out at least 1,300 euros. To purchase a CFD, an investor must pay 1,300 euros. He needs to have a certain amount of money to cover the margin. Let's imagine a situation where the brokerage company's margin is 15 percent. The investor needs to have 15 percent of the amount equal to $1,300, which is 195 euros. This money must be in the account in order to complete the transaction. If the price of the precious metal increases by 195 euros and amounts to 1495 per ounce, then in this case the investor who purchased gold on the commodity exchange will have an income equal to 195 euros. It turns out that he received 15 percent of his own investments. The investor who purchased a CFD on a precious metal, or rather gold, receives the difference in cost per ounce of gold between the beginning and end of the transaction. This will be equal to 195 euros. It turns out that the profit is equal to 100% of the investment amount.

We can conclude that a trader can enter into transactions with CFDs for small amounts and receive the same income as in the case of a commodity exchange. At the same time, you do not have the right to own the product and, accordingly, there is no opportunity to sell it on the exchange. Despite this, you can sell CFDs and receive your income, which is equal to the difference between the acquisition cost and the sales cost at any time.

Let's look at one more example. You have decided to purchase 100 shares of Facebook because you are convinced that their value will increase in the future. The share price is $150. In the case of the stock exchange, you will need to pay 15 thousand dollars for 100 shares.

CFD brokerage company providing a leverage of 1:20, to purchase Facebook shares you only need $750. This amount is calculated using the following formula. First of all, we determine the amount of margin, or rather, divide 100 percent by 20 and get 5%. The % margin on CFDs is directly dependent on the degree and volatility of the underlying stock. For example, in the case of oil, there is a difference that differs from the margin on Facebook. Next comes the determination of the amount required to purchase shares, 15,000 * 5% and we get $750.

Let's assume that the price of the shares in question increases by $10 and is equal to $160, and a decision is made to close the position. Based on this, the amount is equal to 16 thousand dollars for 100 shares. If you do not take into account the commission, then the profit in this situation will be equal to $1000. It turns out that by investing $750, an income was received equal to $1000.

How to conduct a trading process with CFD?

Investing in CFDs has some features compared to classical investing. CFD makes it possible to carry out the trading process without having large amounts of money. A huge number of brokerage companies provide the opportunity to take advantage of leverage.

Start trading with Amarkets. With leverage 1:500 and deposit from $10

This point can be attributed to both advantages and negative points. From one point of view, a trader needs little money to start trading. On the other hand, if the price goes in the opposite direction to the forecast, the losses will be much greater compared to if the trade were carried out without the use of leverage. It is for this simple reason that CFDs are called risky. There are very big risks for those who are just starting to work in this direction and do not have enough experience. To avoid negative consequences, we have collected basic recommendations, the observance of which will allow you not to lose your money and gain experience making money by investing in CFDs.

- Invest only those funds, the loss of which will not lead to serious consequences. Simply put, it is highly undesirable to trade with your last money. Only in this case will it be possible to look at the situation clearly and act correctly.

- The desired deposit amount should not be less than $500.

- It is worth starting with the insignificant; positions are opened that are equal to only 2.5 percent of the investment amount. Thus, when you deposited $500 into your account, the transaction should not exceed $12.5. It is quite natural that the income is not significant, but there is a limit on the loss. In the future, when you become more confident in your knowledge and actions, you can increase the risk to 15 percent of the deposit amount. It is worth remembering that it is best to increase the deposit amount, but not the CA percentage of risk; only in this case will you be able to make a profit without worrying about the safety of your own investments.

- Setting stop loss. This must always be done. This is the key to a successful trading process. It provides guarantees that there will be no significant losses. This will prevent you from losing all your money in just one transaction.

- Control over your own emotions. In the process of trading in the financial market, a large number of people succumb to emotions, or rather fear, excitement, and so on. All this makes it impossible to concentrate and traders lose their money very quickly. We need to control this moment.

- We set a goal every day. As soon as the planned income is achieved, you need to stop trading. It's better to get 50 dollars than to lose 500.

- We strictly follow the strategy used, as well as the trading plan. Trading shouldn't be chaotic. Everything you do should be done measuredly and very thoughtfully. Before creating a deal, you need to first conduct a technical analysis, and also familiarize yourself with the data that is in the calendar.

| Start trading Forex with the trusted brokers listed below |

Summarizing

Based on vast experience, we can say that in the case when a trading strategy is first created and specific goals are set, then over a short period of time you can make a profit from CFD investments. Very soon you will be able to leave your full-time job and start doing only inversions. You will have enough time for yourself, as well as additional funds. Vacations will be more frequent and brighter. You will be able to buy what you have dreamed of for so long. The main thing is to set yourself achievable goals.

TOP FOREX BROKERS

Similar articles:

Top rating of reliable forex brokers 2020.

Basic aspects of margin trading on Forex.

What is the “Cross Rate” of currencies in the Forex market

Advanced Forex trading methods.

Psychological and technical mistakes of Forex traders.

Strategies in the Forex market. How to choose and create a Forex trading strategy.

Total Page Visits: 209 — Today Page Visits: 1