Cryptocurrencies in Japan: laws and features

Just a few years ago, the Japanese authorities did not even think about what cryptocurrency is – why it is needed and how to regulate this market. The head of the country's Central Bank considered virtual money a dummy and, possibly, a financial bubble that was about to burst. But time passed, the bubble did not burst, and the cryptocurrency market grew by leaps and bounds, and this forced the Japanese authorities to take a closer look at the new financial instrument and decide what to do with it - execute or pardon.

When did Japan legalize cryptocurrencies?

The main reason for the revision of Japanese officials’ attitude towards the new financial instrument was the collapse of the MtGox cryptocurrency exchange, which until 2013 was actually a monopolist in this market, through which up to 80% of all Bitcoin trading transactions took place. The collapse took place at the beginning of 2014 due to bankruptcy - the exchange eventually discovered the loss of 850 thousand bitcoins, 200 thousand of which were eventually found (or returned by the owner of the site, according to one version). This theft of cryptocurrency in Japan caused panic in the market and led to a fall in the Bitcoin rate.

In addition, this event and subsequent legal proceedings that lasted throughout 2020 showed that virtual money has a real objective value that can be measured in fiat currency, and the market itself needs regulation and control by the state in order to protect its participants from fraud or force majeure circumstances (at least through insurance).

As a result, Japan legalized cryptocurrencies - Bitcoin and Ethereum were recognized as legal means of payment that can be used when making purchases and sales of goods or services on the Internet or offline. However, in fairness, it is worth emphasizing that this was a partial legalization, since normal regulation of cryptocurrencies in Japan appeared only in April 2017, when laws changing the fiscal, financial and civil legal framework of the country came into force. But this is not yet a complete victory for virtual money in the Land of the Rising Sun.

Regulation of cryptocurrencies in Japan

Although the new Japanese legislation on cryptocurrencies recognized their “functions similar to money,” they never received the status of “currency.” Thus, cryptocurrencies in Japan can be used for mutual settlements, and in addition, fiat money can be invested in them to preserve their value and/or receive investment profit, but all such transactions are not considered foreign exchange and are regulated by separate legislation.

In addition to determining the legal status, the regulation of cryptocurrencies in Japan has affected crypto exchanges. Mandatory licensing has been introduced for them, which is the responsibility of the Japanese Financial Services Agency (FSA). Moreover, in order to obtain a license, a cryptocurrency exchange must comply with KYC/AML (Know Your Customer and Anti-Money Laundering) standards and be transparent, i.e. show their owners and ultimate beneficiaries.

Only Japanese resident companies can apply for a license. The decision is made within two months. If a refusal is received, the exchange must cease its activities in the country. In the first months after the regulation of cryptocurrencies was introduced in Japan, more than 11 sites received a license to be a crypto exchange (in September last year) and somewhere around a couple of hundred applicants stood in the FSA queue to receive this status.

As for fiscal legislation, cryptocurrency owners in Japan were exempted from having to pay consumption tax (JCT) - an analogue of the usual value added tax (VAT). However, at the same time, Japanese cryptocurrencies and their foreign analogues fell under fiscal obligations to pay income tax if any use of virtual money brought profit to their owner or associated person.

Regulation of cryptocurrencies in Japan in matters related to ICOs is carried out without specialized legislation. The initial issue/allocation of coins here is subject to the Payment Services Law: the issuer must register properly with the Japanese financial bureau at the place of business. If the ICO is used for investment, then such activity falls under the Law on Exchanges and Financial Instruments.

The largest cryptocurrency theft in the world occurred in Japan

On January 26, 2020, one of the largest cryptocurrency exchanges, CoinCheck, registered in the Land of the Rising Sun, suddenly suspended the withdrawal of funds due to a series of suspicious events. First, all requests for the withdrawal of NEM coins (abbreviated on the exchange - XEM) were frozen, then this affected the rest of the cryptocurrencies, and in the end the withdrawal of fiat money was stopped. After another short period of time, trading in all currencies except Bitcoin was stopped. Transactions with cards and deposits also became unavailable.

As it turned out, the reason for the “freeze” was the largest theft of cryptocurrency in Japan, due to which 260 thousand people lost a total of about 400 million dollars (at the exchange rate at the time of the hack). This theft was the largest in the new millennium, and it once again showed that despite all the security, cryptocurrency can be stolen if you hack not the blockchain, but third-party services where the owners of the coins store data to access their accounts.

According to the president of NEM. io Foundation by Lon Wong, the NEM platform code is not compromised in any way, and CoinCheck's mistake is that they did not use multi-signature smart contracts. Lon Wong urged Japanese cryptocurrency exchanges not to repeat the mistakes of CoinCheck, neglecting security tools due to their own laziness or desire to save money.

Interestingly, as a result of the scandal, it turned out that the largest Japanese exchange, CoinCheck, was never registered with the FSA. Now this site will definitely get a license, if only it can recover from the hacker attack and not join the ranks of bankrupts.

Note: Japanese cryptocurrency NEM is the seventh largest in the world by capitalization; after the theft, its rate continues to fall, despite the general rise of the market.

What makes the Japanese cryptocurrency group stand out?

The main feature that sets Japanese cryptocurrencies apart from other virtual money is their support by the local population. Probably, in no other country are domestic coins as popular as in Japan, despite the fact that their price and capitalization are significantly lower than the main mastodons of this market (Bitcoin, Ethereum, Dash and others).

In all other respects, the Japanese group of cryptocurrencies corresponds to their foreign counterparts. The Japanese have not yet come up with any blockchain innovations. Their payment platforms are analogues of foreign projects without any significant changes in their technologies. There are even “funny” coins in them.

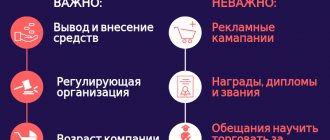

Criterias of choice

It is known that on the Russian Internet today there are a large number of cryptocurrency platforms for exchanging virtual money. Therefore, some novice users who are just starting to explore the interesting world of blockchain face many difficulties. To avoid them, you need to learn a few simple rules that will help you avoid making mistakes in choosing a trading platform.

To carry out successful operations, you need to pay special attention to some factors:

- Daily trading volume. This indicator is among the most important in terms of the operation of a cryptocurrency exchange, as it shows users the level of its activity. In addition, it helps to determine the prospects of a particular digital currency.

- Transfers and withdrawals of funds. Before registering on the site, you need to familiarize yourself with the terms of input/output, and also find out which payment instruments are supported by this service. Large commissions will not make operations profitable. This also applies to mining digital money.

- Wide range of cryptocurrency pairs. Some trading platforms only work with popular electronic money. Paradoxical as it may seem, in 2020 there are still operating sites that specialize only in transactions with Bitcoin.

- Ability to monitor courses. As a rule, experienced investors create accounts using several platforms at once. This helps not only in finding the best conditions for buying/selling, but also gives a chance to earn money through arbitrage.

- Installation of additional software. As a rule, most cryptocurrency exchanges that are firmly on their feet do not provide for this need. There is no need to download software from a little-known site. An alternative way to convert real currency is through terminals. Of course, there is one drawback here - many resources only support transactions with Bitcoin, and the exchange rate in this case is not profitable for users.

More recently, sites have begun to be launched that combine the functionality of trading portals and mining resources. However, some of the presented platforms are blocked for Russian clients. You need to use special applications to open access to them.

When choosing a cryptocurrency exchange, you need to take several important criteria as a basis:

- what tokens are mined;

- the ability to exchange earned funds for rubles;

- the presence of hidden commissions;

- what currency is used for the purchase;

- whether there are execution delays on a given platform and how often they occur.

The resource must be selected so that it corresponds, if not to all, but at least to several of the above points.

Japanese cryptocurrencies – list and review

Japanese programmers joined the race to conquer the market for cryptographic payment systems quite late, despite the fact that Japan was one of the first countries where crypto exchanges appeared, and the fact that the creator of Bitcoin, Satoshi Nakamoto, may have been Japanese himself. Next, we will review the most popular Japanese cryptocurrencies, the list of which is constantly updated with new items.

The first Japanese cryptocurrency MONACOIN, Monacoin (MONA)

Monacoin is considered the first Japanese cryptocurrency, which appeared in 2013 based on the Litecoin blockchain. According to its creator (or creators), the MONACOIN payment platform is designed to become an alternative to fiat money with a decentralized management system and maximum anonymity.

Key features of MONACOIN:

- the Script algorithm is used for encryption;

- to increase the difficulty of mining, the DGW algorithm is used;

- the speed of creating a block of the blockchain chain is about 2 minutes;

- the maximum volume of money supply is about 100 million coins;

- reward for creating a block – 30 coins (as of January 5, 2018);

- total coins mined – 15,790,763 XMR coins;

- The average transaction fee is $5.68.

In general, MONACOIN does not stand out among other cryptocurrencies, and its popularity is explained by the fact that it is the first Japanese coin.

Japanese analogue of Ethereum – CARDANO, Karnado (ADA)

The Japanese cryptocurrency CARDANO was launched not so long ago – on September 29, 2020. Although fundraising for this project was launched back in 2020. Carnado was created by Blockchain Development Output Hong Kong (IOHK) led by Charles Hoskinson, former co-founder of BitShares and Ethereum. This project aims to leverage user decentralized application smart contracts using blockchain sidechains, multi-party computing, and metadata.

The creators of CARDANO intend to develop their platform around the Recursive InterNetwork Architecture (RINA), which will use a consensus algorithm called Ouroboros proof of stake. In this protocol, full nodes elected by the community generate new blocks on the blockchain and verify transactions. Any slot that has an ADA coin can become such a full node. Cardano uses Haskell, a highly fault-tolerant programming language.

Features of the Carnado platform:

- the maximum size of the money supply is 45 billion coins;

- coins mined – 25927070538 ADA;

- availability of ample opportunities for creating smart contracts and custom blockchain applications;

- collective management of the platform, carried out through consensus of the majority of participants;

- Three structures (IOHK, Cardano Foundation, Emurgo) are working on the development of the project independently of each other;

- market capitalization – $8066146924.

This Japanese cryptocurrency is notable for the fact that its creator once had a hand in the launch of the second coin in the world – Ethereum. Therefore, after its release, CARDANO received great support both among ordinary people and among large investors and DAps developers.

Forgotten coin for fast transfers FUJICOIN, Fujicoin (FJC)

This project was launched back in the summer of 2014, and it was planned that it would occupy the niche of a fast, anonymous, reliable and cheap means of payment for purchasing goods and services on the Internet, i.e. will be the Japanese equivalent of Dash. But this money platform did not gain fame and was practically forgotten by the world almost immediately after its launch. FUJICOIN survived only thanks to the Japanese commitment to domestic projects.

Features of Fujicoin:

- achieving consensus via PoW with Script-N11 add-on;

- blockchain block creation speed – 1 minute;

- increasing difficulty: with each new block (using Kimoto's gravity well);

- The maximum size of the money supply is 10 trillion coins.

Only Japanese cryptocurrency exchanges trade FJC coins, and only in the Land of the Rising Sun have people even heard anything about this project. In the West and in Russia, no one is interested in these tokens, either from an investment or from a technical point of view - there are thousands of more promising platforms.

Lonely tree SAKURACOIN, Sakurakoin (SKR)

The SAKURACOIN coin is a virtual currency that can process the block chain of the old Monarchy coin, which lasted approximately 8 hours in 2013/12/23. Almost nothing more is known about this coin, since its official website exists in the form of a Japanese-language forum, where there is almost no useful information. Except for the information about where to download the wallet and how to mine SKR.

SAKURACOIN Specifications:

- block creation time – 1.5 minutes;

- the maximum size of the money supply is 105.1 coins;

- consensus algorithm – PoW.

Cute cat cryptocurrency NYANCOIN, NYAN

You may not believe it, but there is a Japanese group of cryptocurrencies that were created just to glorify everyone’s favorite cute, fluffy, meowing cats (or to laugh at it) - the Japanese are funny people. This particular currency was created in honor of the cartoon character “Nyan Cat”, who became popular thanks to a 10-hour video on YouTube.

It’s funny, but this coin did not disappear immediately after its creation, but even acquired an objective value.

They also want to make this cryptocurrency the first licensed cryptocurrency in the world, so that it can then be used for some commercial and/or marketing purposes.

Not quite a cryptocurrency COMSA, Komsa (CMS)

After Japan legalized cryptocurrencies, projects began to appear on this market that use blockchain technologies, but are not cryptocurrency payment systems in the usual sense of the term. The COMSA platform is one of them. In fact, this is a private platform on the basis of which an entire ecosystem of user applications will be created with its own branches of the blockchain chain. Including, perhaps, to create new Japanese cryptocurrencies.

However, it is worth emphasizing right away that COMSA does not have any decentralization, anonymity or other features of crypto money. This platform is being created on the basis of 9 servers (the number will grow with the growth of the project), which will play the role of masternodes in this system, i.e. will create blocks and maintain the functionality of the platform. They can be easily hacked, disabled or simply destroyed, so this platform is obviously not very reliable.

Now the Komsa project is at the stage of initial coin issue (ICO), which should have been completed in November last year. But it seems that the required amount has not yet been collected, and therefore the collection of money to launch the project continues.

Once the COMSA platform goes live, its clients will be offered the following list of services:

- release and sale of tokens through ICO based on the COMSA platform;

- development and launch of applications based on blockchain technologies;

- asset tokenization;

- preparation of technical documentation to support ICO (multilingual);

- legal support for ICO;

- withdrawal of tokens through the Zaif cryptocurrency exchange;

- development of smart contracts based on the blockchain chains of NEM and Ethereum cryptocurrencies.

You can invest in COMSA using XEM, BTC and ETH coins.

The world's first YAJUCOIN, Jaucoin (YAJU)

YAJU SENPAI is a famous Japanese Internet meme. Just like Pepe and Doge, only in the 18+ theme (a parody of “adult” content). This coin was created in honor of this meme, and in fact does not stand out in any other way.

YAJUCOIN Specification:

- consensus is achieved via PoS + PoW with Scrypt add-on;

- the maximum size of the money supply is 81 million coins;

- block creation time – 64 seconds;

- the number of blocks to confirm a transaction is 6 blocks.

The YAJUCOIN project is at the ICO stage and is most likely closed or forgotten.

Crypto exchange coin – ZAIF, Zeive (ZAIF)

ZAIF is a Japanese cryptocurrency exchange that became famous because at the end of February 2020 its user discovered a bug that allowed him to buy coins for free. The lucky guy bought $20 trillion worth of coins. True, his happiness was short-lived, as he overdid the amount and attracted the attention of both the technical service of the exchange and those platforms through which he wanted to withdraw free coins. As a result, the system was rolled back before the failure occurred and everyone was left alone.

The ZAIF cryptocurrency is an attempt by this site to create its own coin, which will probably fail soon. The site shows a 404 error, trading volume has dropped to zero. And there is no news regarding this money platform.

Japanese cryptocurrency NEM, Nem (XEM)

Initially, NEM (short for “New Economy Movement”) was planned to be created on the basis of a cryptocurrency under the designation NXT (short for exchanges – XEM), but the changes conceived by the developers were so far from the original that in the end In the end, it was decided to write my own blockchain code using the Java and JavaScript programming languages. The key feature of this project is that consensus is achieved through a non-standard algorithm called POI (Proof-of-Importance).

It takes into account 3 characteristics of the user account:

- total time the account was active on the NEM network;

- wallet denomination (number of coins);

- user activity (total number of transactions).

In addition, the Japanese cryptocurrency NEM uses the Eigentrust++ network user reputation system, an in-platform messaging and multi-signature system.

In terms of the purpose of creation and scope of application, the Japanese cryptocurrency NEM was launched to use its blockchain as a platform for managing databases in various communities and organizations. In particular, to take financial and accounting reporting to a new level or to manage inventories. And it’s worth saying that this idea was quite successful and in demand, since the project will receive enormous support from the community.

New Japanese cryptocurrencies: TOP 3 promising projects

The above describes projects that have either already been launched or are at the ICO stage. Now let's look at those projects that are about to be launched, and at the same time have a great chance of success, since they are supported by large players or companies. There are not very many of them, but making a small rating “Japanese cryptocurrencies TOP-3” will be enough.

The brainchild of bankers – J Coin

On September 26, 2020, a consortium of major Japanese banks, consisting of Japan Post Bank Company, Limited and Mizuho Financial Group, Inc., announced that they intend to create their own Japanese cryptocurrency called “J Coin”. The launch of the platform is scheduled for 2020, right in time for the end of the Olympic Games.

It is assumed that the value of this virtual currency will be strictly tied to the yen and that a centralized platform will be used, and not a decentralized one, as is usually the case. In other words, J Coin will be used to service online banking transactions built on blockchain technology. Similar to how WebMoney, Qiwi or Yandex.Money work now, only based on cryptography and blockchain.

Crypto coin instead of points and bonuses – Rakuten Coin

One of the largest IT companies in Japan, Rakuten, intends to create its own crypto-coin based on the currently operating Rakuten Super Points ecosystem (reputation and customer loyalty). Company representatives did not announce any specific details, dates or specifications. It is only known that the new Japanese cryptocurrency will be called “Rakuten Coin” and its tokens will somehow replace points in the Rakuten Super Points loyalty program.

Crypto coin for online banking MUFG Coin

Back in early 2020, the largest Japanese bank Mitsubishi UFJ Financial Group, Inc. (capitalization 2.141 billion yen) unveiled its plans to create a cryptographic money platform based on the blockchain. According to the bankers, the new coin will be called “MUFG Coin” and will be the virtual equivalent of the yen with a 1:1 ratio. They plan to launch the project 100% in 10 years.

It is assumed that this coin will serve:

- consumers and private business;

- investment banking and corporate capital;

- real estate investments;

- asset Management.

As is obvious, this coin is included in the list of digital platforms for servicing bank payments. Similar Japanese cryptocurrencies, the list of which is constantly growing, apparently will soon appear like mushrooms after the autumn rain. At least until a national digital payment system using blockchain appears in this country.

Advantages and disadvantages of a cryptocurrency exchange

Software

Working on a cryptocurrency exchange involves using a standard set for analyzing the price chart. This contributes to certain inconveniences in the trading process. For example, if in programs offered by stock market companies, transactions are managed in literally a couple of clicks, then in a cryptocurrency exchange a special calculator or Excel tables are used to carry out a similar calculation. However, the complete information provided by such exchanges completely covers this shortcoming.

Regulation

Companies registered in the USA or the European Union offer their clients deposit insurance in the event of an unexpected bankruptcy or some other unexpected situation. Accordingly, the safety of funds in this case is the prerogative of the state, not the company. As for cryptocurrency exchanges, they cannot offer such a service to their clients, at least today. Attacks by hackers or the work of unscrupulous employees are problems associated with risk, which, unfortunately, does exist. This is exactly how Mount Gox failed. Until a regulatory system or protection is created, such risks on cryptocurrency exchanges will not go away. However, the lack of regulation allows anyone to become a client of the exchange with only an email address. In order to trade on the stock market, the user must confirm his identity and place of residence by providing a package of relevant documents.

The trader's profession is full of risks that the player tries to minimize. Especially when trading is the main source of income. Therefore, it is unlikely that investors will start investing in a new business before they have some guarantees.

Volatility

Volatility is one of the main advantages of cryptocurrency. Every day it shows its growth, which has never been seen in the stock market. Even when the UK announced its exit from the European Union in 2020, the quote of the GBP/USD currency pair fell by more than 12% in just one day, which cannot be compared with cryptocurrency. It is capable of falling by 90% at once. And all this is due to the same regulation. As long as there is no regulation on the cryptocurrency exchange, liquidity will be correspondingly low, which will contribute to sharp jumps.

Trading bots

Writing a trading robot without trading through centralized exchanges is another advantage of cryptocurrency. This provides a kind of protection for users when access to their funds is not available to third parties.

A trading bot significantly simplifies the trading process, since the user will not need to sit at the monitor for hours. At the same time, there are not very many truly profitable robots, and they, as a rule, are not distributed. And this is no coincidence. Massive use will lead to the fact that the entire strategy of such a bot will simply come to naught, and it will no longer bring good profits.

Instead of a total

If we compare a cryptocurrency exchange with the stock market or Forex, the former has an undeniable advantage - access to data, high volatility, easy access to trading. However, due to the fact that there is no regulatory system on such sites, making a deposit is accompanied by certain risks associated with its complete loss. However, no insurance is provided on cryptocurrency exchanges.

Popular cryptocurrencies in Japan TOP-5

Despite the fact that there was another major cryptocurrency theft in Japan not long ago, the popularity of virtual money in this country is growing by leaps and bounds. More and more people are joining the blockchain community by purchasing or creating their own cryptocurrencies. And if the latter were mentioned above, now it’s time to talk about the most popular cryptocurrencies in Japan.

TOP-1 | BITCOIN | No matter what country you look at, the first cryptocurrency in the world remains so in any country, since it is the most expensive, the most famous and it brings the most profit from mining, investment and trading. The Land of the Rising Sun is no exception here: if you look at Japanese cryptocurrency exchanges, their statistics will show that the Japanese, like investors from other countries, prefer to buy bitcoins. At the same time, the most transactions are for the BTC/JPY pair. |

TOP 2 | RIPPLE | This coin is popular in this country for the same reasons as Bitcoin. I trade it on almost all local crypto exchanges, and mostly only with the help of yen. But there are exceptions when Ripple (abbreviated on exchanges as XRP) is changed to Bitcoin, Ethereum or JPY. It is interesting that many local exchanges trade exclusively Ripple, without paying attention to other virtual coins. |

TOP 3 | ETHEREUM | Another place in the ranking that will not surprise anyone. Yes Ethereum is popular in Japan, and that's to be expected. Especially considering the interest of local companies in smart contracts. Most often, ether is purchased for bitcoins or yen. |

TOP 4 | NEM (XEM) | This platform is supported by a local development team and has great support among the Japanese, as they can directly participate in its development. In addition, this project is interesting in itself, which is proven by its 13th place among all cryptocurrencies in the world in terms of capitalization. |

TOP 5 | MONACOIN | Our ranking of the most popular cryptocurrencies in Japan is completed by another local project – MONACOIN. This coin is not spoiled by its popularity on world platforms, but it is highly respected by the local population. |

How to trade on the stock exchange?

Once you decide on the choice of a suitable platform, the most important question for you will be - how is trading carried out? If you have already had to trade something in your life, then you will not have any difficulties in this endeavor. Despite the specificity of the product, the principle here is extremely transparent - buy low, sell high.

Analytical tools

This is the basic principle of trading. It doesn’t matter what you intend to sell – potatoes on the market or cryptocurrency on the stock exchange. In the latter option, it is easy to adhere to this algorithm, since coin rates are dynamic and constantly “jump” in different directions. Therefore, purchasing crypto money in conditions of a declining exchange rate is not a difficult matter. It is undeniable that every user wants to invest the minimum and earn the maximum. If in the case of the sale of stable goods - gold, oil, dollars - all the necessary information is presented in special news, then with crypto everything is completely different. By the time the news reaches the recipient, the market will have time to change its trajectory 10 times, and the user may simply miss out on profit. An experienced trader must analyze the market independently, and each platform provides its own tools for this purpose:

- Charts. They will show how the value of coins changed over a certain time period.

- Depth of trading. It will allow you to understand what the difference is between current offers to buy/sell, and will also allow you to make a thorough analysis of which direction the price will rush in the future.

- Trading history. Knowing the trading volumes of a particular pair, you can easily determine how popular this direction is on a particular exchange. The most popular pair will rapidly gain value.

It is best to analyze all this data comprehensively. This will significantly increase the likelihood that the situation will be correctly interpreted, which means the user will be able to timely enter and exit the market before the trend changes.

Trading instruments

Another important feature that every trader should be familiar with is orders. They represent a kind of user request to perform operations. There are two types of orders:

- BUY – purchase;

- SELL – sale.

They are ideal for simple buying/selling transactions, regardless of whether market price will be used or not. Unfortunately, not all platforms have a stop order. It helps well in the process of earning money in conditions of reduced risks.

Trading principles

Trading on the stock exchange is a real art that you cannot master even if you read a whole library of relevant literature. Most of the knowledge comes to the user with experience, as in any other endeavor. During the trading process, the user will develop his own strategy and learn the algorithm for correct trading. Although, you should not neglect the general rules:

- Do not panic under any circumstances. As soon as the user gets confused and sells the coins that have gone into drawdown, he will immediately go to a loss.

- Half of the funds should be stored in Bitcoin, as it is the basis of the market.

- Part of the funds must be left in fiat. Even if the market collapses, fiat will help buy coins at a cheap price.

- Do not store large amounts on the exchange. If you purchased currency for a long period of time, then it is better to withdraw it to hardware or software wallets.

Japanese cryptocurrency exchanges

| Site name | Registration date | Interface language |

| Bitbank | 2015.06.23 | Japanese |

| Zaif Exchange | 28.05.2014 | Japanese, English |

| CoinCheck | 17.07.2014 | Japanese, English |

| Queen | 13.01.2014 | Japanese, English, Indonesian |

| Fisco Cryptocurrency | 2016.06.29 | Japanese |

| Bitpoint Japan | June 2016 | Japanese |

| Btc Box | 13.02.2014 | Japanese, Chinese, English |

| Tokyo Bitcoin | – | Japanese |

| GMO-Z.com Coin | October 2020 | Japanese, Russian |

| Campfire Corporation | – | Japanese |

| Minnano Bitcoin | – | Japanese |

| Bitcrement Bitcoin | year 2013 | Japanese, Chinese, Korean, English |

| Bitpoint Japan | – | Japanese |

| Bit Trade | – | Japanese- |

| Bitbank Inc. Exchange | 2015.06.23 | Japanese |