On August 2, Russian President Vladimir Putin signed a law on crowdfunding, which will come into force on January 1, 2020. This document is included in a package of laws on the “digital economy”, which, in particular, should become a tool for regulating the fintech industry and cryptocurrencies in Russia. Although the law on digital financial assets, which is still being considered, is considered the main one for the crypto industry, the new law on crowdfunding has provisions that allow the sale of certain types of tokens. However, the issue of their further circulation, for example, with trading operations through other platforms, has not yet been resolved. Some details of the law on crowdfunding that crowdfunding platforms, token issuers and investors in projects need to know about were explained especially for DeCenter by legal expert in the field of IT, advisor to Health Graphix, Maria Andrianova.

In Russia, crowdfunding is taking root slowly. Due to its insignificant popularity, it would not have aroused the interest of the authorities if not for the story of the “ICO boom” and other activities related to receiving investments in exchange for project tokens.

Theoretically, tokens solved one of the problems of crowdfunding. Previously, investments through a crowdfunding platform in most cases did not give the investor anything other than a “nice thank you,” including no guarantees of a return on the invested funds (unless we talk about charity, but this is a separate category). Accordingly, the motivation to invest was not always sufficient for real action. Now the investor has begun to receive a certain digital object with a certain functionality, a set of rights, as well as with the hope that the value of such an object will increase. As a result, hundreds of projects (including unworthy ones) received huge investments.

In my opinion, the law on crowdfunding was adopted primarily in order to control and regulate the attraction of investments in exchange for tokens under the crowdfunding scheme - in other words, the bulk of ICOs.

It’s interesting that the draft law on crowdfunding lay “on the shelf” for more than a year from the moment it was adopted in the first reading, until the cryptocurrency market took off. And then the document quickly passed two readings with an interval of one day. This fact, in my opinion, is indirect evidence that the purpose of the crowdfunding law is still to control activities related to cryptocurrencies and tokens. In addition, the law provides for the category of “digital utilitarian rights,” which apparently refers to utility tokens (tokens that provide their owner with a set of certain rights, usually related to the issuer’s business and not having the characteristics of an “investment contract”).

Legal uncertainty

Was a separate law needed to regulate crowdfunding? In my opinion, yes. I had the opportunity to work with several projects operating crowdfunding platforms. We have repeatedly faced the question of the legal essence of the project and what norms, in the absence of a separate law, should be applied to such projects.

On the one hand, Russia already had a regulatory framework to ensure the legal operation of a crowdfunding project. On the other hand, we should not forget that officials are not always ready to accommodate the operator of a crowdfunding site and agree to apply rules by analogy in favor of such a site, especially in the case of complaints from investors.

When developing crowdfunding schemes and any other joint investment schemes, you should always keep Art. 172.2 of the Criminal Code of the Russian Federation, according to which financial pyramids that pay income to new investors at the expense of the deposits of previous ones are punishable. Sanctions are applied if the money raised is not spent in the required amount directly on the investment object.

If we consider the same crowdlending (mass attraction of borrowed funds for issuing loans), then, if desired, it is quite possible to attract Federal Law 395-1 to this activity. Yes, issuing loans is not prohibited, since it does not relate to banking activities - as long as we are talking about own funds. If someone else's funds are used, then this is already a banking operation; accordingly, the systematic issuance of loans is possible only on the basis of a banking license.

Sanctions for conducting illegal banking activities are provided for in Art. 172 of the Criminal Code of the Russian Federation. In addition, there is a risk of recognition as a microfinance organization in accordance with Federal Law 151 if the size of loans does not exceed 500,000 rubles.

Some lawyers express the opinion that tokens have the characteristics of an investment share. But not every project can organize its activities as a mutual investment fund. Creating it and providing legal infrastructure is expensive and time-consuming, not to mention obtaining a license. Therefore, if the court equates a project to a mutual investment fund, such a project will have to bear responsibility for conducting activities without a license.

Some crowdfunding projects use the vocabulary of the Law “On the Securities Market” in their activities. And, again, they risk falling under its requirements when applying them by analogy.

The law on crowdfunding performs a very important function - it excludes the application of the above rules, which are unprofitable and dangerous for a startup, and also establishes the rules of the game, subject to which the risks of being held accountable can be minimized.

Foreign experience

In developed countries, there is a practice of developing special regulations dedicated to the phenomenon of crowdfunding.

For example, in the UK, regulations will come into force in December 2020 that will complement and detail existing regulations governing P2P crowdfunding platforms.

In the USA, the field of crowdfunding is also regulated by a separate set of rules and the JOBS Act of 2012 is in force, which limits the maximum investment amount and the number of investors for one project.

In many countries of the European Union, separate sets of regulations dedicated to crowdfunding have also been in force for quite a long time (since 2015). For example, in Germany or Austria.

New classification of investors and ways to protect them

Another purpose of crowdfunding law is to protect the unqualified investor from losing money.

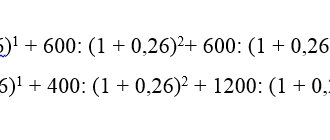

Crowdfunding law divides investors into qualified and unqualified. The amount of investment from one unqualified investor (individual) is limited to 600,000 rubles for one year. Monitoring the achievement of the limit and the status of the investor falls on the shoulders of the operator of the crowdfunding platform.

In my opinion, this limitation on the amount of investment does not greatly impact the micro-investment market, especially considering the general trends towards a decline in real incomes and purchasing power of the population. Another interesting thing is how the provision on the status of investors in the law on crowdfunding will be combined with the upcoming changes to the legislation on securities.

For quite some time now there has been talk of dividing all investors into four groups:

Unqualified, especially protected. All who are not included in other categories;

Simple. An individual whose amount of funds or the value of securities is 400,000 rubles or more;

Simple qualified. Investors with assets of 10 million rubles or more, or with experience in financial markets;

Professional. Persons with a special international certificate, extensive experience in the securities markets or assets of at least 50 million rubles.

It is important to understand that specially protected unqualified investors will not be allowed to participate in the lion's share of investment instruments. It seems to me that the risks for the micro-investment market lie precisely in these changes to the Securities Market Law, and not in the restrictions provided for in the law on crowdfunding.

If we talk about large investors, then in my practice, large transactions for the acquisition of tokens were always structured and carried out “manually” and under special conditions: with increased discounts, a large number of additional documents, with special conditions on corporate control, transfer of shares/shares, exit from project and so on, with special manipulations associated with “cold” wallets. Moving large assets obviously requires increased attention.

There are probably investors who are ready to spend a couple of million dollars in cryptocurrency through a little-known platform and buy tokens of a little-known project without observing additional security measures, but I have not yet encountered such situations.

In any case, the law on crowdfunding does not prohibit the participation of a large investor. After being verified as a qualified investor through the operator of the investment platform, a large investor will not be limited in the amount of investment in the projects he likes.

The law on regulation of the crowdfunding market in Russia passed the second reading

The State Duma of the Russian Federation adopted in the second reading a bill on regulation of the crowdfunding market. The document, initiated by a group of State Duma deputies and members of the Federation Council led by Anatoly Aksakov, chairman of the lower house of parliament committee on the financial market, talks about requirements for investment platform operators. For example, they must have their own funds (capital) in the amount of at least 5 million rubles and register in a special register of the Central Bank of Russia.

At the same time, the bill states that an investor who uses the services of such platforms can be either an individual or a legal entity. And the investment itself can be carried out in several ways: through the provision of loans, the acquisition of equity securities placed on the platform (except for securities of credit and non-credit financial organizations, structured bonds and securities intended for qualified investors) and the acquisition of utilitarian digital rights.

The bill “On attracting investments using investment platforms” also states that when investing through the acquisition of securities placed on such platforms, it is necessary to use a closed subscription mechanism. Among other things, the document provides for such a type of securities as a digital certificate.

To protect investors, the authors of the document proposed to oblige persons attracting investments to indicate the minimum target amount of funds raised. If it is not possible to achieve the specified target within the time allotted for raising funds, the offer must be withdrawn and the money returned to investors. The investor also has the right to withdraw the invested funds during the “cooling off period,” that is, within five business days from the date of transfer of funds.

At the same time, for unqualified investors there is a limit on the size of investments: up to 600 thousand rubles within one calendar year within the framework of all investment platforms in Russia. However, such a limit does not limit citizens registered as individual entrepreneurs and qualified investors.

Let us recall that the day before Anatoly Aksakov also announced that the law on digital financial assets (DFA) in Russia could be adopted before October 1.

Publication date 07/24/2019 Share this material on social networks and leave your opinion in the comments below.

5 / 5 ( 1 voice )

The latest news on the cryptocurrency market and mining:

Cloud mining of Bitcoin in 2020 - how to choose a reliable and profitable service?

Kraken Report: Bitcoin on the verge of “great adoption”, BTC price will rise by 50-200%

Bitcoin enters mega bull phase with over 93% of BTC addresses showing profits

Anatoly Aksakov commented on the adopted law on cryptocurrency in Russia

Platform for centralized management of the cryptocurrency mining process CoinFly

The following two tabs change content below.

- Author of the material

- Latest news from the world of cryptocurrencies

Mining-Cryptocurrency.ru

The material was prepared by the editors of the website “Mining Cryptocurrency”, consisting of: Editor-in-Chief - Anton Sizov, Journalists - Igor Losev, Vitaly Voronov, Dmitry Markov, Elena Karpina. We provide the most up-to-date information about the cryptocurrency market, mining and blockchain technology.

News Mining-Cryptocurrency.ru (go to all news feed)

- Cloud mining of Bitcoin in 2020 - how to choose a reliable and profitable service? — 08/14/2020

- Kraken Report: Bitcoin is on the verge of “great adoption”, BTC price will rise by 50-200% - 08/14/2020

- Bitcoin Enters Mega Bullish Phase, Over 93% of BTC Addresses Show Profit - 08/14/2020

- Anatoly Aksakov commented on the adopted law on cryptocurrency in Russia - 08/14/2020

- Platform for centralized management of the cryptocurrency mining process CoinFly - 08/14/2020

Cryptocurrency in RussiaRegulation and legislation

What tokens can be sold legally in Russia

The law on crowdfunding contains a sufficient basis for conducting ICOs or other ways to attract investment in exchange for project tokens.

For example, there is the concept of utilitarian digital rights, their types, restrictions on content, requirements for the descriptive part, rules for accounting and disclosure of information. Article 9 of the law provides for the possibility of issuing digital certificates certifying that the certificate belongs to the owner of a utilitarian digital right. Most likely, it will be necessary to introduce the institution of specialized depositories that service the circulation of digital certificates.

However, there is also an unpleasant limitation - the disposal of utilitarian digital rights will be carried out only through an investment platform, the operator of which must be included in the register of the Bank of Russia. In the future, this will create serious restrictions for projects planning not only the release of tokens through the platform, but also listing on foreign exchanges.

Restrictions on the circulation of tokens, it seems to me, will inevitably lead to a decrease in interest in them, unless some qualitatively new monetary model associated with them is proposed. For example, on the basis of the law on crowdfunding, it will be possible to carry out some adapted options for the legal issue of tokens.

The law on crowdfunding practically does not apply to cryptocurrencies and the further circulation of tokens. They will be regulated by the Digital Assets Law (DAL), but it has not yet been adopted. It will describe the activities of crypto exchangers, the issuance of security tokens (if they are allowed at all), and circulation features.

In my opinion, the existing bill on DFA needs to be finalized, since it contains contradictions and unjustified restrictions, and, on the contrary, the proper level of “permissive” detail is not enough.

Permitting standards are now generally not in trend in Russia, judging by the laws being adopted - for example, the latest amendments to the laws “On the National Payment System” and on the Bank of Russia, according to which control over the work of foreign payment services has been tightened. In particular, they are now required to register in a special register.

In addition, the State Duma is considering a draft law “On transactions using an electronic platform”, which will regulate the so-called “marketplaces” - electronic platforms created to provide brokerage, insurance and financial services with many organizations within one platform. A legal entity with a minimum turnover of 100 million rubles can become a marketplace operator. The document has already been adopted in the first reading.

Crowdfunding is regulated in Russian legislation

On August 2, the President of the Russian Federation signed a law on crowdfunding regulating investment relations using special platforms on the Internet

According to the law, the movement of non-cash funds in the form of investments occurs within the framework of special investment platforms on the Internet on the basis of relevant agreements. Its operator can be a Russian economic company engaged in organizing the attraction of investments and included in the relevant register of the Bank of Russia. Investments can be attracted by organizations or individual entrepreneurs to whom the organizer of the investment platform provides services to attract investments. Investors, in turn, can be individuals or legal entities who are provided with appropriate assistance. Investment can be carried out in three ways: providing loans; acquisition of securities or utilitarian digital rights.

The law regulates in detail not only the algorithm for the functioning of the investment platform, but also the activities of its operators. Thus, the size of its capital must be at least 5 million rubles. These persons can simultaneously engage only in specific types of financial activities (in particular, brokerage, dealer, depository). They are required to approve an internal document on managing conflicts of interest, as well as disclose information about identified conflicts and measures taken to manage them. In cases specified by law, such persons are liable for damages caused. However, the operator of the investment platform is not responsible for the obligations of the persons attracting investments.

The law also lists the rules for investing funds and requirements for persons attracting investments. In particular, it is prohibited to attract investments to persons in respect of whom bankruptcy proceedings have been introduced or who are included in the list of persons involved in terrorism or extremism. In addition, the powers of the Bank of Russia in this area are defined.

The law comes into force on January 1, 2020.