A PAMM account is a specialized trading deposit with PAMM brokers for trust management of both the own money of the PAMM account managing trader and his investors in the Forex market.

The only difference from a regular trading account is that a PAMM account

- becomes public with online monitoring on the PAMM broker’s website;

- can be regularly replenished with investor money (which means the managing trader must regularly change the trading lot);

- The calculation of the trader's profit changes: instead of 100% of the profit on a regular account, the trader receives 10%-50% of the profit of investors' invested funds and 100% of the share of their own capital.

General and differences between PAMM broker accounts and other investment funds

PAMM accounts are a type of trust management service for investors for short-term and long-term investment of free funds for those people who do not trade in the market themselves, but want to entrust their finances to managing traders, receiving 50%-90% of the profit of their investment.

Those. de facto, PAMM accounts since 2008. have become an IT service for investors, along with investment funds, trust funds, investment funds, exchange-traded funds (ETFs) and hedge funds.

Similarities and differences between PAMM accounts and investing in hedge funds

PAMM accounts of forex brokers are most similar to hedge funds , which appeared much earlier in the USA, Europe and Asia. So, both organizational structures for investments:

- Not limited by the place of registration (hence most hedge funds and PAMM brokers are registered offshore to “optimize taxation”);

- They often have “symbolic” licenses from island or African financial regulators (for example, PAMM broker Forex4you is “controlled by the regulator” FSC (from Mauritius), the “Belize regulator” IFSC “monitors” the legality of Admiral Markets transactions, and the “African Botswana regulator” IFSC - for the PAMM broker ForexTime (FXTM).According to the Masterforex-V wiki, investors themselves must make a conclusion about how much they can trust such “regulation” of these and a number of other PAMM brokers in the world.

- They can trade with high leverage using any strategy and trading system , ranging from Elliott wave analysis, risky Scalping and Day trading to the world's popular Swing trading, long-term and positional trading, trading strategies of Charles Dow, Robert Prechter, Bill Williams, John Meriwether, Alexander Elder, Ken Griffin, William Gunn, Hetty Grinn, Rubikon, Ingeborg Mootz, Alexander Gerchik, Itriad, Eric Nyman and others.

- Those. PAMM brokers do not bear any responsibility for profit or loss on PAMM accounts , opening them to any traders (even market newcomers), incl. using 100% losing martingale and anti-martingale strategies.

Conclusion: the main similarity between PAMM and hedge accounts is that their managers are not limited by anything (from margin to the selected time frame, traded lot and set Stop Loss) to obtain maximum profit and are not responsible for the loss of investor funds.

The difference between PAMM accounts and hedge funds for investors

- Hedge funds are opened, as a rule, under ONE successful and well-known trader , to whom investors consciously give funds for management.

For example, George Soros, Larry Williams, Paul Tudor Jones II, John Meriwether, and Case Cynthia have such funds. It is clear that each of them has their own team (traders, analysts, brokers, IT specialists, marketers, PR managers, secretaries, administrators, accountants, etc.), but investors care about ONE name of the trader (as the team leader), who they entrust their finances. In the ratings of PAMM accounts we see only anonymous nicknames of traders, knowing practically nothing about them. It is not surprising that single traders trade on PAMM accounts - potential victims, and not “predators” of the market. - Hedge funds, unlike PAMM broker accounts, do not work with CFDs, and having huge capital (often billions of dollars) directly invest in exchange-traded instruments, influencing the market through increasing the capitalization of purchased instruments. The most popular investment instruments for hedge funds are

- IPO is an issue of securities when shares of new issuers are listed on the stock exchange (when hedge funds receive new shares at a discount of 10%-25% before they are listed on the stock exchange);

Dividends from blue chips and derivatives to fixed interest investments in bonds and treasury bills;

- income from warrants and stock options (not to be confused with binary options with which no PAMM account or hedge fund in the world will ever cooperate).

- direct purchases of commodity, stock, cryptocurrency and currency futures on the largest specialized exchanges in the world.

- Hedge funds operate (and actively influence) the stock, cryptocurrency and commodity markets ; for PAMM brokers, Forex remains the main focus.

Not a single PAMM account with brokers has such capabilities.

How to make money on a PAMM account?

Investment instruments with equity participation are increasingly proving to be more profitable in comparison with classical methods of private investment. And among all the options for investing funds on a share basis, PAMM accounts are the most attractive, allowing the investor to entrust the management of their capital to a specialist who is able to manage them much more efficiently.

What is a PAMM account?

A PAMM account is a type of Forex trading account that provides for external investment - with the participation of private investors. Such an account is created by a trader-manager who also takes part in the formation of the total amount of capital. The funds received as part of equity financing are subsequently used for Forex trading. And the profit or loss from trading operations performed is distributed among all investors in accordance with the volume of their equity participation.

The very concept of PAMM is just an abbreviation (PAMM - Percentage Allocation Managemant Module), which stands for percentage distribution management module. Simply put, it is the structure of the PAMM account that allows for equity participation in investing on relatively safe terms for the investor. Namely, the formation of capital on the main trading account occurs through the opening of individual accounts. And investors open them, getting the opportunity to independently monitor changes in the account status and withdraw funds if necessary.

Work within the PAMM account is carried out on the basis of an offer - an agreement defining the rights and obligations of the parties. In particular, the following points are regulated:

- percentage distribution of income/losses between investors and trader-manager;

- investment terms;

- conditions for withdrawing funds from the account (including early withdrawal).

It is important to take into account that in addition to the investor and manager, a third party always appears in the operation of a PAMM account - a PAMM service or a platform owned by a broker, within which all operations for crediting/debiting funds are carried out.

How to make money on a PAMM account?

The investment attractiveness of PAMM accounts is undeniable - they demonstrate high returns and are available even to investors who do not have significant amounts of funds to purchase shares. But, of course, the prospect of higher income comes at the price of increased risk. In particular, when investing money in a PAMM account, an investor must understand that from that moment on he will bear joint losses with other owners of units/shares of investment capital and receive income only if the trader-manager is successful.

Investing in PAMM accounts cannot be successful if the work is carried out through an unreliable broker or company that provides a PAMM platform for traders. As a matter of fact, finding a broker who will guarantee the transparency and reliability of a trader’s work is the first thing a novice investor who wants to place funds in trust management should do.

And only after you choose a brokerage organization that you are ready to trust, you should begin choosing a trader who will manage your capital within the PAMM account. It is worth noting that each company has its own ratings of managers, which are available for study and analysis by everyone. Pay attention not only to the profitability of accounts managed by a particular trader, but also to the overall dynamics of his trading. Instability of indicators is a sure sign that the manager is prone to choosing risky investment tactics. And this, in turn, increases the risks of investors.

How to make money on a PAMM account? Remember the golden rule, which warns about the dangers of placing capital in one “basket”. Diversify your risks by distributing funds between several accounts. In this way, you will protect yourself from global losses and have the opportunity to increase the total return on investment.

Before you start earning money, it is important to learn not to lose. Do you want to reduce trading risks? Don't be afraid to set loss limits for a trader. Determine the level of risk you are willing to take in advance, and you will protect yourself from the risk associated with managerial mistakes.

You can read more about methods of reducing trading risk in the article 10 ways to manage risks in Forex

Before investing real money, try your luck in virtual reality. A demo account on the selected PAMM platform will help you understand all the intricacies of trust investing. And it will protect you from mistakes that many investors make out of ignorance, due to lack of experience, necessary skills or a simple lack of information.

How to choose a PAMM account?

When choosing a PAMM account, it is best to follow the following rules:

1) The first thing you should know: in the Forex market there are both large brokerage companies that provide support and access to work for hundreds and thousands of traders, and small agencies that provide trust management services within their own PAMM accounts opened directly by company representatives.

At first glance, in the case of a private company, an investor can count on the personal liability of its employees. In practice, limited choice can lead to the manager not having enough trading experience. By paying attention to large brokerage agencies, you can play it safe by choosing a trader-manager based on ratings and objective data on his activities within the chosen PAMM platform.

2) Stability is a sign of mastery. This simple rule perfectly illustrates the situation in the investment market. When choosing between a manager who has worked stably for a long time and a market “star” who demonstrates both ups and downs in his work, you should give preference to the first option. Simply because the main principle of any Forex investor is the ability not to lose where you can save.

3) Profitability is the main thing that attracts investors. Refuse to consider overly tempting offers in favor of more realistic prospects. If we talk about numbers, a return of 100% per annum for a PAMM account is a completely acceptable value. Ultra-conservative traders offer about 40 - 50% per annum. Anything that exceeds these indicators requires separate consideration. Remember that high returns always go hand in hand with an increased risk of losing all your invested funds.

4) Account drawdown is another important indicator that should be taken into account when choosing a PAMM account. If a trader-manager is inclined to enter into risky transactions and is not ready to stop even after receiving significant losses, then this is a reason for refusing to cooperate with him. But moderate indicators of the riskiness of transactions indicate that the trader works with a certain degree of caution, which means that the risk of unjustified losses in this case will be much lower.

5) The share of participation of the manager is an indicator of his self-confidence. A share participation of 30 - 50% of the total invested funds is considered normal. Lower rates demonstrate an unwillingness to take risks with one's own funds. And if the trader himself is not confident in himself, how can he be trusted at all? Find out more about choosing a trader in the article How to choose a PAMM account manager?

How to create an investment portfolio?

Every investor sooner or later comes across the concept of “investment portfolio”. What does it include and why is it needed at all? In fact, this “portfolio”, in the case of Forex, is very conditional in nature and represents the totality of all investments that generate or can generate passive income.

The investment portfolio can be:

- aggressive, with a return of 150% per annum and more than 60% of the riskiness of investments;

- conservative, with risk indicators of no more than 30% and profitability not exceeding 50% per annum;

- moderate, with returns ranging from 60 to 100% per annum and risk indicators not exceeding 50%.

In accordance with the choice of investment portfolio, it is worth choosing PAMM accounts for placing funds. For an aggressive portfolio, it would be appropriate to place 60 percent or more of funds in accounts with a fairly risky investment management style. The remaining 40% is distributed among less risky options, serving as a kind of loss stabilizers.

The ideal scheme for forming a portfolio in the field of PAMM investing involves the distribution of funds between several accounts in the following proportion:

- 40% in conservative PAMM accounts (two or three);

- 30 - 50% in moderate (medium-risk PAMM accounts, funds, indices);

- 10 - 30% - in aggressive PAMM accounts.

Why is it so important to maintain a reasonable balance when building an investment portfolio? Because it is precisely this approach that allows you to guarantee stable income from the conservative part of the portfolio. And high-risk investments provide the opportunity to earn money not only on minor market fluctuations, but also on serious changes in trends and other circumstances that can be regarded as promising for obtaining high returns on investments.

The difference between PAMM accounts and mutual funds for investors

Mutual funds, unlike PAMM accounts, have very strict restrictions . They are almost the exact opposite of each other. In particular

- Mutual fund managers (legal entities or private (individual) entrepreneurs) must obtain a license from the Bank of Russia (until 2013 - FSFM). A PAMM account can be managed by... any “Vasya Pupkin” without opening a private enterprise (IP).

- Mutual funds have the right to invest funds only in highly liquid securities, of them

- 35% in Russian government bonds;

the rest in municipal securities, bonds and blue chip shares of the Moscow Exchange (i.e. shares of Gazprom, Rosneft, Surgutneftegaz, NOVATEK, Tatneft, etc.)

- Mutual funds are prohibited from investing more than 15% of their assets in the securities of one issuer. On PAMM accounts you can trade even one financial instrument (for example, USD JPY or EUR CHF);

- You can only invest in mutual funds in Russian rubles (RUB) . PAMM accounts are usually in USD, EUR, CHF, GBP or cryptocurrency (Bitcoin BTC or Ethereum ETH);

- All the largest mutual funds in the Russian Federation, as a rule, belong to banks (for example, Sberbank owns 21 mutual funds worth RUB 786.9 billion (as of December 31, 2018), VTB - 32 mutual funds worth RUB 752.6 billion, etc.)

Conclusion: Mutual funds are 1-2 orders of magnitude more reliable than the most conservative PAMM account , which in turn are just as much more profitable with the right choice of managing Forex trader.

Therefore, the investor needs to INDEPENDENTLY and consciously make a choice between

- a patriotic impulse to invest capital in a “domestic” company with VERY low returns or in a risky offshore PAMM account project with potentially very high returns on investment.

Is it really that simple?

Of course there are pitfalls. After all, pamma managers are ordinary people who also make mistakes. And a PAMM account with high profitability may become unprofitable after some time. Also, some of the managers trade actively, while others, on the contrary, rarely open transactions, choosing the moment. There are aggressive accounts with high returns and high risks, and there are also conservative pammas. How to choose a PAMM account? How to minimize risks? When to enter and exit investments? We will also talk about other aspects of investing in PAMMs in the lessons of the PAMM Investing , which you can view online below.

1. Introduction

2) Analysis of PAMM account ratings

Analysis of the rating of Alpari PAMM accounts

-> Go to rating

3) Analysis of PAMM account monitoring

4) When to enter and exit Pamma

5) How to determine the use of martingale

6) “Declaration” parameter

PAMM Investing: Declaration parameter

7) Portfolio investing

Portfolios of PAMM accounts in Alpari

-> Full list of PAMM portfolios

Social information

Social information

9) Alpari Invest smartphone application

10) Aggressive Investing

11) Conservative Investing

12) Defensive strategy

Protective strategy for investing in PAMM accounts

13) Jack Singer Strategy

Jack Singer's PAMM account investment strategy

14) Investment tactics - The Investor's Path

15) Risk management

Risk management in PAMM accounts

How to open a PAMM account or invest in PAMM?

Very, very simple, within half an hour maximum.

- Register on the broker's website , entering your personal data without errors (last name, first name, citizenship, registration address, phone number, etc.), receiving a login and password to enter your account;

- Top up your personal account in your account through one of the payment systems - WebMoney, Visa, Skrill, Mastercard, QIWI, RoboKassa, Yandex Dengi, RBK Money, Z-Payment, etc.

- Invest money from a personal account or

- to a new (personal) PAMM account that you open in your account;

or into existing PAMM accounts of other managing traders by clicking the “invest in PAMM” button (see the “green button” on the right).

We invest in PAMM accounts

Such investing in PAMM is suitable for people who do not want to delve into and understand Forex trading, but who want to take part in making money at this “money factory”.

An investor is a person who opens a deposit in the Forex market, but does not independently conduct any operations. This method of investing your own funds allows you to receive good profits, exceeding bank interest by several times.

At the same time, the features of the work allow the investor to control his account and take certain actions aimed at protecting his funds.

There are several factors that ensure reliable protection of investor interests, namely:

- the trader cannot withdraw money at his own discretion, which completely eliminates the possibility of theft;

- every manager strives to show the best results, because the number of investors who trust him depends on this;

- the investor has the opportunity to independently monitor profit indicators;

- you can start investing with a minimum deposit;

- the possibility of reducing losses, which some brokers offer, by closing the account if a critical level of financial loss is reached.

Most of all, any investor is interested in the correct choice of a trader to whom he could entrust his savings.

Ratings are always published online and are publicly available. Anyone can have such information at their disposal without any problems. This allows you to choose the best PAMM accounts. As a result, investment risks will be significantly reduced.

Investment risks

It should be noted that investing, like trading itself, is relatively risky.

Nevertheless, it is possible to reduce all risks to a minimum by following a few simple rules:

- it is better to invest in several traders at once in order to diversify risks;

- use a strategy when investing;

- It is important to select managers carefully.

Select a PAMM account

The person who manages the invested money is a trader. He conducts various trading operations and makes money from it. The more successful the trader, the less risky the investment will be.

Expert opinion

Eleanor Klemer

Financial analyst.

When choosing a trader, you should pay attention not only to his profit, but also to the risks associated with his activities.

How much minimum do you need to invest?

You can start investing with a minimum amount of funds. However, in order not to risk your own capital, you need to choose the right manager who shows high success in trading.

It is also worth keeping in mind that the conditions of each PAMM account are individual. We have already spoken above about the variety of trading durations, minimum deposits, etc. A wide range of parameters allows you to choose the most suitable option for each person.

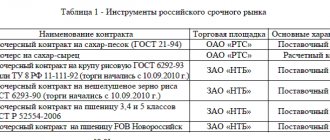

What financial instruments are traded on PAMM accounts of forex brokers?

All trading instruments of PAMM brokers are almost identical and can be divided into

- forex currency pairs on trading platforms MT-4 and MT-5 - USD CHF, PLN CAD, USD HKD, NZD MXN, USD CAD, GBP NZD, EUR USD, USD MXN, NOK DKK, GBP USD, EUR CHF, CZK CAD, USD JPY, USD ILS, HUF NOK, NZD USD, CZK DKK, AUD USD, CZK ZAR, USD RUB, EUR CZK, EUR RUB, EUR MXN, USD UAH, EUR CZK, USD BYN, ZAR JPY, USD SEK, CZK PLN USD NOK, CZK SEK, USD CNY, CZK CHF, EUR JPY, CZK CNY, EUR GBP, PLN MXN, EUR NZD, CZK CHF, EUR AUD, CZK DKK, EUR CAD, NOK SEK, EUR NOK, HUF CZK, EUR SEK , CNY CHF, GBP CHF, ZAR CHF, GBP AUD, CZK UAN, GBP CAD, USD HUF, GBP NZD, PLV UAN, GBP JPY, CZK RUB, GBP SEK, NOK RUB, GBP NOK, CHF JPY, PLN NOK, AUD CHF, CZK INR, AUD JPY, NOK MXN, NZD JPY, CAD INR, CAD JPY, AUD CNY, NZD CHF, AUD THB, CAD CHF, NOK HUF, USD SGD, PLN UAN, USD ZAR, HUF MFN, USD PLN, HUF INR, USD TRY, USD THB, USD INR,

- cryptocurrencies to the US dollar and euro: Bitcoin BTC USD, BTC EUR, ETH USD, ETH EUR, LTC USD, LTC EUR, BCH USD, BCH EUR, EOS USD, EOS EUR, OMG USD, OMG EUR, ETC USD, XMR, Ripple , BNB, NEO, IOT, BSV, TRX, Dashcoin DSH, XLM, ZEC, ADA, DASH, XTZ, NEM, LINK

- CFD commodity futures from popular commodity exchanges of the world - CBOT, MGEX, DGCX, ODE, LME, Safex, Comex, DME, CZCE, Nadex, NTB, CME, ROFEX, MATba, FORTS, MCX, LIFFE, TOCOM. Incl. platinum, gold, palladium, Brent, URALS, aluminum, cobalt, natural gas, nickel, electricity, oats, silver, barley, tin, steel, coal, gasoline, lithium, wheat, coffee, cocoa, cotton, jute, oil, ethylene , iron ore, potatoes, etc.

- CFD shares of stock exchanges: NASDAQ, HKE, LSE, MOEX, Euronext, TSX, SZSE, NYSE, BME, NSE, GPW, SSE, TSE, WBAG, SWX, BSE;

- CFD stock indices - Dow Jones 30, BIST 30, SMI20, TASI, SAR, S&P/ASX 20, FTSE 100, ATX, WIG20, S&P/NZX 50, QE index, JTOPI, S&P 500, NASDAQ-100, TA-35, Euronext100, CAC40, IMOEX, RTS, KOSPI, etc.

How to make or lose money on a PAMM account?

Having invested, for example, $100 in a PAMM account he likes with $900, you become his investor according to the principle of a “shareholder” of mutual funds. From this moment on, the managing trader trades a total amount of, for example, $1000 (of which $900 is the trader’s personal capital and your investment is $100).

The distribution of profits on a PAMM account occurs weekly (or monthly) depending on the public offer of the managing PAMM trader, who keeps 25% of the profits earned, and 75% goes to investors.

If the profit was 12% per month ($120), then the investor's earnings will be equal to $9 or 9% per month ($100 x 12% x 0.75). The investor has the right to withdraw profits to his personal account or reinvest them, then his share in the PAMM account will increase from $100 to $109.

If the loss from trading on a PAMM account was the same 12% per month ($120), then the investor’s loss will be $12 or 12% per month ($100 x 12%). Naturally, no remuneration is paid to the managing trader.

PAMM accounts

A PAMM account is an investment method in which funds are transferred to the trader for trust management, and if the transaction is successfully completed, the managing trader receives a certain percentage of the profit.

How PAMM accounts work

Investors fund the managing trader's account. The managing trader concludes transactions using his personal capital, and all transactions are proportionally transferred to the accounts of investors. In case of profit, it is distributed between investors and the managing trader depending on the amount of deposits. The managing trader also receives a percentage of the profit.

Risk level

Investments in PAMM accounts are an excellent, highly profitable method of working in the Forex market, especially if the trader does not have the opportunity to devote all his free time to trading. Also, PAMM accounts can bring good additional income if you combine your main job with trading on the foreign exchange market. However, it should be borne in mind that investments in PAMM accounts certainly have some degree of risk. A transaction made by a managing trader using investor funds can bring not only profits, but also losses. Therefore, it is advisable to be careful when choosing a managing trader.

As a rule, before investing in PAMM accounts, the professional characteristics of possible managing traders are studied. First of all, attention is focused on the number of transactions completed and their results, experience in the foreign exchange market and experience in managing PAMM accounts. The professionalism of the managing trader is the key to making a profit from investing.

Safety

There are certain rules aimed at ensuring the security of PAMM accounts. First, the managing trader can only use investors' capital to carry out trading operations. Any other actions with depositor accounts are not available to the managing trader.

Since the PAMM account includes the funds of the managing trader, a successful outcome of the transaction is, first of all, in his interests.

All actions of the managing trader are transparent, you can track them at any time, as well as withdraw your own funds from your PAMM account. In addition, the investor independently determines the degree of risk, limiting possible losses.

In order not to lose funds and receive stable high profits, future investors in PAMM accounts should adhere to the basic safety rule: it is necessary to work with a managing trader only through a brokerage company. Otherwise, the investor risks losing all of his investments.

Why do we need PAMM portfolios?

A PAMM portfolio is an analogue of an investment portfolio in which an exchange investor evenly distributes his investment capital between different stocks, stock indices, ETFs, bonds, etc.). The only difference with a PAMM portfolio is that the Forex investor is asked to distribute his investments between three (five, seven, ten) PAMM accounts.

Example of an investment of $1000 for 1 month in 5 PAMM accounts

- $350 with an income of 25% per month (20% / 80% distribution of the profit of the manager and investor)

- $250 with an income of 7% per month (20%/80% to the manager)

- $200 with a loss of 10% per month (20% to the manager)

- $100 with a loss of 15% per month (20% to the manager)

- $100 with a loss of 20% per month (20% to the manager)

Thus, the PAMM portfolio will help balance investments, reducing the risks of your investments.

What is PAMM index?

A PAMM index is a “balanced” investment PAMM portfolio compiled by a broker or an experienced investor from 3-5 (or more) conservative and aggressive PAMM accounts with “experienced” managing traders . Are analogues

“PAMM indices” were first introduced by PAMM brokers Forex Trend and MMCIS in 2010.

PAMM indices gained enormous popularity in 2010-2014. thanks to their widespread advertising on TV “PAMM index TOP-20 know-how” of PAMM indices, claiming on the Internet about the “reliability”, “transparency” and “success for investors” of the PAMM indices.

The best PAMM forex brokers according to the Masterforex-V Academy rating

According to the rating of Forex brokers, 12 brokerage companies are included in the “recommended” list, half of which (6 brokers) represent the PAMM service . These are Alpari (Alpari), Nord FX, OANDA, Dukascopy Bank SA, FXPro and FIBO Group,

The remaining PAMM brokers are represented from the 2nd and 3rd leagues of the rating, having a huge number of complaints from Masterforex-V traders. These are FXOpen, AMarkets, Forex club, TeleTrade, HotForex, TrioMarkets, Admiral Markets, Larson&Holz, GKFX, Vantage FX, FXTSwiss, FortFS, AvaFX, ICE FX, FXTM (ForexTime), ICM Capital, InstaForex, ETX Capital, Forex4you, ForexMart, X-Trade Brokers , Synergy FX, Forex ee, FX Primus, STForex.

Read more in the main article: PAMM brokers: rating and reviews Masterforex-V.

How a trader lost $30 million on PAMM accounts, and investors... trust him

Brokerage ]Alpari[/anchor] has been operating since 2008. founder of PAMM accounts, the world's first PAMM broker and official owner of the PAMM trademark . It is not surprising that this particular broker

- has the largest number of PAMM accounts and PAMM investors in its rating;

- has received the “best PAMM broker in the world” Cup from the Masterforex-V Academy for many years in a row by unanimous decision of the Rectorate of the MF Academy.

As of December 5, 2019 There are more than 3.5 thousand accounts for investors in Alpari's PAMM rating . Let’s analyze them in detail to understand the strengths and “traps” (sometimes “traps”) for PAMM investors.

- First, we set the filter “PAMM account age” from 3 years and find that the number of PAMM accounts has decreased 14 times to 286. Taking into account that Alpari constantly has 3-4 thousand PAMM accounts in the rating, we conclude that after About 7% of them “survive” for 3 years. The rest go bankrupt.

- At first glance, in the current rating, there are many successful PAMM accounts from which the investor has “what to choose”.

- We choose for a detailed analysis the undisputed leader - Moriarti (paymaster). Excellent results:

- income for 4 years and 11 months: 127426.9%;

smooth schedule of profitability growth;

- a record number of investors in his PAMM - 4306 people who invested $2.287 million in him with his personal capital being $22.76 thousand;

- What is confusing about the PAMM account Moriarti (paymaster):

a) 22 lost or abandoned accounts in the “archive” of this trader

b) errors in mathematics: the rating indicates that for 4 years and 11 months

- Moriarti (paymaster) initially invested $1 thousand and earned... $1,273,451 (the rating does not take into account investors' money, although the profit of $1.273 million from a $2.287 million deposit is only 55.6% for these 4 years and 11 months, i.e. about 11 % in year).

it becomes clear why the trader abandoned one of the 22 accounts from October 7, 2015 without trading for almost 5 years (probably in order to then launch it, bypassing the “filter from 3 or 5 years of PAMM account life”).

- it becomes clear how the remaining 21 out of 22 accounts were lost - see the smooth growth and... instant ruin of the PAMM account. This is what happens with martingales or anti-martingales, when they select 21 currency pairs and, on different accounts, try to find a reversal of the LONG-term trend for each currency in order to “catch” a new trend. In one case, it was successful and received $2.2 million in investments.

- Alpari's PAMM rating statistics do not say what financial instrument Moriarti (paymaster) is trading in order to check when the trend ENDS and the leading account for $2.2 million dollars will be completely ruined, like the previous 21 trading deposits of the trader.

Why is the Masterforex-V wiki team confident that this PAMM account will be ruined?

- use logic or common sense: if 21 out of 21 traded accounts are lost (one “lies” mothballed), what should happen to the next deposit?

- This trading method guarantees 100% loss of the deposit. Read more: Step 1 of selecting a managing trader: how to identify the main danger for investors - Martingale followers.

c) why doesn't Moriarti (paymaster) reinvest the earnings into his account? His earnings amounted to about $382 thousand (30% of $1.273 million), of which he left only $22.976 (only 6%) in the account, and quickly withdrew the remaining 94% from his PAMM . Would you entrust your money to a managing PAMM trader who does not believe in his trading? We don't.

What surprised us?

a) the manager’s capital is only $3 thousand out of $4.055 million on PAMM;

b) trader nickname Trustoff. Has he really been forgotten? This is still the same Moriarti (paymaster) - see the third line in the list of accounts he lost.

Six months later, in December 2020, all $4 million of investor funds were lost by Moriarti (Trustoff / paymaster) 100%.

Question from wiki Masterforex-V: do you still have doubts about whether or not to invest in the PAMM account Moriarti (Trustoff / paymaster) with “yield of 127426.9%”?

Then congratulations, you have taken the first step towards avoiding the same rake that only (!!) Moriarti (Trustoff / paymaster) lost tens (!) of millions of dollars to PAMM investors.

What is investing in a PAMM account?

Today there are a huge number of different ways to make a profit passively on the Internet. One of the most popular is investing money in PAMM accounts. It was decided to devote this article to consideration of the issue of investing in PAMM accounts. I would like to believe that reading this article on investing in PAMM accounts will help even novice traders understand the main intricacies of this process. First, let's look at what PAMM accounts are and what the nature of their origin is.

| Start trading Forex with the trusted brokers listed below |

What are PAMM accounts?

PAMM accounts are a service – a percentage distribution module. With the help of this system, income is distributed, as well as drawdowns between the participants in the process. In simpler terms, this is a type of managed account for trading existing in Forex. Here the trader is given the opportunity to use investment assets in the trading process.

Investing money in PAMM accounts is carried out automatically. At the same time, both income and losses are divided between the participants in the process according to the percentage set in the offer. In simpler terms, an offer is a kind of contract where all the working aspects of cooperation between the parties are spelled out. The income, as well as the losses, received as a result of management by the managing trader, depending on the exact amount invested.

An example of investing money in PAMM accounts for beginners

To understand the issue of investing in PAMM as deeply as possible, let’s consider a special situation. Let's assume that a trader carrying out the trading process has at his disposal a deposit equal to $1000. The average profitability level is 5% per month. In this situation, the amount of income is $50. The Forex market is created in such a way that the trading process can be carried out using one trading strategy and at the same time trading completely different volumes. Here we can conclude that with the same level of profitability and a large deposit, a trader has the opportunity to receive much greater income. At one point, the trader decides for himself that he will open a PAMM account and will trade using the funds of depositors, that is, investors. Initially, imagine a situation in which several investors simultaneously invested their own funds in a given account. One of the traders invested 1000 dollars, and the second 3000. As a result, the total amount of the account was 5000 dollars, because in addition to the investors’ money, the manager himself also had 1000.

If the average return is about 5 percent, then the total income on PAMM is equal to $250. During the process of registering an account, the trader set the percentage of remuneration for the leader of the trading process, that is, the manager is 40%. Here we note that while conducting the trading process, the manager receives about 40% of commissions from the total income of investors. Below is an example of income distribution on the above PAMM account.

| Personal funds, dollars | Income of PAMM participants before distribution, dollars | Income of PAMM participants as a result, dollars | |

| Manager | 1000 | 50 | 130 |

| 1 depositor | 1000 | 50 | 30 |

| 2 contributor | 3000 | 150 | 90 |

| General | 5000 | 250 | 250 |

Probably, there is no point in commenting on the data given in the table, since it is already clear that the use of PAMM platforms brings benefits not only to the manager, but also to the investor himself. The amount of drawdown is distributed among the participants in the process in exactly the same terms as the amount of income. In this case, in the event of a loss, the manager receives nothing.

Until the moment when PAMM platforms appeared, Forex investors traded directly with the trader himself, by obtaining the passwords necessary for access to the investor’s account. There was also a scheme for the absolute transfer of invested money to the trader. It is immediately necessary that the investor has large funds, because a professional trader will not want to manage an account with a very small balance.

In the second case of investing money in PAMM, there is a huge risk of being deceived and left with nothing. This is exactly the algorithm of work that was used by such fraudulent projects as VladimirFX, Gamma IC and the like.

If we talk about PAMM accounts, it would be most correct to focus on the main advantages due to which this type of trading is significantly successful compared to others:

- The brokerage company providing the PAMM account guarantees compliance with all prescribed obligations on the part of both the trader and the investor. Based on this, we can say the following advantage.

- On brokerage platforms that provide this type of account, you may be able to view the actual account history. It must be said that the broker, who provides access to the manager’s performance statistics, plays the role of monitoring, independent of anyone.

- The manager is deprived of the ability to appropriate the personal funds of investors and simply disappear. Despite the fact that the funds are at the disposal of the trader himself, he cannot withdraw them to his account.

- Comfort of investing money in PAMM accounts of various managers in one platform. The depositor is given the opportunity to deposit funds into his account only once, and then distribute them to different managers.

- In this method of trading, risks concern both the capital of investors and the funds belonging to the manager himself. PAMM brokers provide their clients with the opportunity to familiarize themselves with information regarding the amount of funds of the manager. Managers who have a small amount in their own account are of no interest to experienced investors. Professionals consider it best not to work with such people.

- The convenience of selecting a PAMM account from the list of the most successful. Selecting the optimal manager option does not take much time and effort from investors, since brokers have taken the trouble to create a convenient interface and a set of filters.

- It is also possible to significantly save time on the process of approving the main details of investing money in PAMM. There is no need for the investor to correspond with the managing trader and negotiate the basic investment terms. All this is done by pressing just one key.

PAMM brokers on Forex

Since 2008, the Alpari broker has launched a program for investing in PAMM. In this regard, it was recognized as the first PAMM broker. Only after this did the most successful companies begin to copy this investment system. Let's look at the most promising brokerage platforms that professionals prefer to work with:

- PAMM account for Alpari broker. This company was the first to create and launch PAMM accounts for its own clients. On the Internet, there are completely different reviews regarding this company. In general, if you evaluate on a 5-point scale, the score will be somewhere around 4. Regarding my personal views, I think that investments bring decent income if the portfolio is actively used.

- Brokerage company Amarkets. This service of PAMM accounts in Amarkets has begun to function; it is young, since it has only been operating since 2013. Even so, for a given period of time, the list of PAMMs can highlight the main ones that are promising for investment.

TOP 10 BROKER RATING

How to choose the optimal PAMM accounts from the list of leading traders

It is quite natural that after considering the concept of PAMM accounts, the question arises about how to correctly choose the most suitable option from such a large abundance of PAMM accounts.

Difficulties may arise here due to the fact that the interfaces of all PAMM sites are different from each other. In addition, there are parameters that are general and with which you can filter the best PAMM accounts. We will consider all the information regarding where exactly you can get acquainted with these indicators in the final part of the article in the section on PAMM monitoring. Let's make a list taking into account the degree of significance:

- Terms of operation of the account. Initially, in the process of selecting PAMM accounts from the list of brokerage companies, the list of managers is filtered depending on how long they have been operating. This moment can be called one of the most important in the choice, since the exception is that the manager was simply lucky. In addition, those accounts that have been operating for a long time undergo in-depth analysis. I would like to note that it is best to give preference to PAMM accounts that have been valid for at least six months. The only exception to the rule is a PAMM account, which is opened by a good manager, but it is important to pay attention to his previous transactions and their performance.

- The level of the largest drawdown. Once sorted by account expiration date, you need to filter according to the largest drawdown. It is thanks to this indicator that it is possible to create a picture regarding the risks related to invested funds. Investment professionals recommend choosing accounts where the drawdown does not exceed 40 percent.

- PAMM profitability level. When the rating of PAMM accounts has already been sorted by the period of their activity, as well as the data of the largest drawdown, the potential profitability should be considered. In this case, the choice absolutely depends on the investor’s own preferences. It is worth noting that the level of profitability should be studied together with data on the highest drawdown, since if the level of profitability is very large, then the risks will also be very large. From personal experience I can conclude that accounts on which the ratio of high drawdown in relation to profitability does not go beyond 1:3, in other words, 5% per month, function better. In this case, the highest drawdown value is no more than 15%. Not many PAMM accounts fit these criteria, but those that do have attractive prospects in terms of attracting investors.

- The capital indicator of the trader managing the account. When choosing PAMM accounts, it is necessary to take into account the volume of the manager’s personal funds. Quite naturally, the higher this indicator, the more the manager risks personal money in the process of conducting the trading process. This indicator should be considered together with the main balance of PAMM accounts. It is worth noting that it is better when equity capital is not less than 10% of the total account amount.

- Investors' capital indicator. In this case, everything is quite simple and clear, with a high indicator of funds that are entrusted to the management of traders, which indicates that they are very much trusted. Details about this point were discussed in more detail in the previous paragraph.

| Read useful sections of the site for successful trading: |

The most effective and high-quality PAMM accounts

To save your free time for those who are just starting to work in this direction, I will tell you about the most profitable PAMM accounts that investors should take a closer look at. First of all, let’s take a closer look at the most attractive brokerage company accounts in terms of investing money in PAMM accounts.

- Optimal PAMM accounts Alpari

Afterword of investing money in PAMM accounts

Summing up the process of investing money in PAMM accounts, I would like to note that this is an excellent system, thought out to the smallest detail. At the same time, it is nothing more than an investment instrument. The level of success in using this type of instrument directly depends on how exactly the investor himself will act. Experts recommend that beginners do not set themselves the task of achieving a high income in the shortest possible time.

Initially, it is best to give preference to managers who fall into the conservative category. Moreover, their degree of profitability may not exceed 100% per annum. The thing is that it is at this level of indicators that the risks do not go beyond what is permitted. In addition, it is necessary to strictly follow the basic rules of investors, and also always take into account that the profitability indicator that the manager had before cannot give any guarantees that this indicator will be achieved in the future.

I personally have been investing my own money in PAMM accounts for more than 2 years, and during this period this system has allowed me to achieve an income that exceeds all the instruments I use in my investment portfolio. Today, investing in PAMM accounts is a very effective method of achieving profit in a passive way, but even despite this, you need to remember that there are risks. It is imperative that you carefully read the articles on the topic of investment risks. When you read these lines, you have made the right decision and are moving in the right direction, that is, becoming financially independent.

Similar articles:

How to choose a reliable Forex broker? Tips for choosing a Forex broker for beginners!

Executing orders on Forex. What is an order?

Price Action system for Forex. What it is?

What is the difference between Forex trading and binary options trading?

Scalping on Forex - a path to bankruptcy?

Forex trading without a strategy: the right decision or a huge risk?

Total Page Visits: 4854 — Today Page Visits: 5

Is it possible to become a successful investor on PAMM / LAMM (autocopy), etc.?

You can if you understand the basic truths for successful investments.

- The problem with PAMM accounts is not in the broker, but in successful traders, of whom (stably earning) no more than 3% .

Alas. If we analyzed another dozen “managing traders” of PAMM, following Moriarti (Trustoff / paymaster) in the ranking of PAMM accounts, the picture for the majority would not be so “bright”, but similar. Why? The current generation of “Forex investors” intuitively looks for a “scam” (give me a trader who will make 30%-50% profit per month!). Demand always creates supply . If you want, you will get them, such as Moriarti (Trustoff / paymaster) or “smaller caliber. - Why don’t “PAMM investment portfolios” and “PAMM indices” work? If you create an “investment portfolio” from 5 martingale accounts and they lose all 5 PAMMs to you, will “indices” or “PAMM portfolios” help you a lot?

- You cannot invest in Forex or stock exchange instruments WITHOUT understanding the algorithms of financial markets . Study Masterforex-V: Unmistakable points for a trader to open Forex trades and you will take the next step towards understanding the markets by coming to study at the Masterforex-V Academy to learn how to TRADE or find those who trade STABLE and accurately weed out people like Moriarti (Trustoff / paymaster), at least through tips from more experienced traders with whom you will work in the same team.

- The prospects for investing in financial markets will remain very, very promising for investors in the coming years . If, of course, you avoid people like Moriarti (Trustoff / paymaster), having learned to spot scammers in a couple of minutes.

What is a PAMM account

The concept of “PAMM account” comes from the English word “PAMM”; it is a trading account. With the help of such an account in financial markets, trustees can manage not only their own financial funds, but also the funds of investors in the aggregate.

This is a kind of “piggy bank” in which funds are collected from those who want to make money on speculative operations on the stock exchange, but do not have the special skills and knowledge for this. People who want to earn income are called investors who invest their available funds in the financial markets.

Then the investors' capital is managed by a trader who has the necessary knowledge and experience in trading in the foreign exchange markets. Traders are called managers, the best of them have their own trading system, with the help of which they can bring profit not only to themselves, but also to others.

IMPORTANT:. a trader can take control of an investor’s capital only if he himself has invested his own funds from a PAMM account. Taking this into account, the trader himself is interested in ensuring that trading is as successful as possible, and therefore does not allow unreasonably risky transactions.