Good day, ladies and gentlemen, forex traders! We continue our in-depth study of indicators that have become classic. Those indicators that brought millions to exchange players and are still used by thousands of traders around the world. Today we will talk about an indicator such as Bollinger Bands (hereinafter referred to as BB), or the Bollinger Standard Deviation Range (also known as Bands or Bollinger Bands). Let's figure out what it shows, strategies for using it in trading and... some other interesting things)

Bollinger Bands all about the Bollinger Bands indicator

Introduction

This indicator was first described by Perry Kaufman in 1987 in his book “The New Commodity Trading Systems and Methods”. Later, the indicator became widespread thanks to the American technical analyst from California and the author of this wonderful indicator, John Bollinger.

John Bollinger was born in Montpellier, France. Later, his family decides to move to New York. John was interested in cinematography and photography since childhood, so he entered the School of Visual Arts in New York, where he received the profession of a lighting operator. By the way, the profession of a cameraman was very easy for him, so he expectedly moved to West Hollywood in 1976. But his life's meaning and interests took a different direction from the moment his mother asked to look at her investment portfolio. He completely forgot about the profession of an operator, although it still helped him get a job at the Financial News TV channel as a cameraman, where he was able to personally observe the work of financial analysts and absorb important information. After completing courses in analytics and obtaining the necessary knowledge, he gets a job as a trading analyst on a TV channel. His career on the television channel did not last long; in 1991, the rights to the television channel were bought by CNBC, although analytical news from John Bollinger is published there once a week. It was during the period from 1984 to 1991 that he developed his own system of rational and effective analysis, later called “Bollinger Bands”.

This analysis tool has not lost its relevance even now. His book Bollinger on Bollinger Bands is a detailed guide to using this tool both individually and in conjunction with other indicators. And in 1996 he was recognized as the best software developer for financial analysis.

History of the Bollinger Bands indicator and calculation

The author of the method, John Bollinger, is a man with an unusual biography for a trader. Born in France and moving with his family to New York, he ended up in Hollywood as a photographer and cameraman, a profession he had dreamed of since childhood. The Financial News television channel he joined gave him plenty of opportunities to watch financial analysts at work. As a result, the author of the theory, which took on its final form in the early 1990s, became an analyst and trader. Now D. Bollinger owns a large exchange-traded fund, Bollinger Capital Management, is engaged in consulting and continues to host a weekly television section on technical analysis. Among traders, especially those professing technical trading, the book “Bollinger on Bollinger Bands” has become famous, which, if desired, can be downloaded online in translation into Russian.

The most common definition of an indicator is the range of deviation (usually X2) of the price of a stock, commodity or currency from a simple moving average (SMA, Simple Moving Average). The indicator allows you to determine how much prices deviate from their standard range, within which they are considered normal. The width of the range (in our case, the trading corridor) is not static, it changes in proportion to the deviation. In addition to the deviation, the time period of the moving average is also taken to calculate BB. It ranges from 13 to 24 days and depends on the trader’s strategy, but D. Bolinger’s recommendations refer to the 20-day moving average.

He came to this indicator experimentally: as the number of candles decreases, the price begins to break through the channel boundaries more often, which leads to false signals; as the length of the envelope increases, the channel expands and the indicator loses sensitivity to price movements. The same thing happens when changing the deviation settings: with a value less than twofold, the signal frequency increases, with a deviation of more than twofold, vice versa. A trader is unlikely to need formulas for calculating BB “in ordinary life”, since everything is included in the automatic settings. But, for completeness of description, I will give them here.

I also recommend reading:

RAMM trades copying service from AMarkets

What is the RAMM service and how to copy trades in it

Where D is the number of standard deviations; N – the number of unit time periods for calculating the moving average (for example, 20).

The method is most widespread in trend trading systems. This is understandable: the shift of the lines allows you to predict the trend in the direction in which the price will most likely move. This is the main value of the BB indicator: it does not just record events that have already taken place, but shows how the price is behaving now, and where it most likely intends to move. The picture on the chart, on which the stripes are superimposed, allows you to see not only the beginning and end of the trend, but also local impulses, both true and false.

Bollinger Bands are similar in appearance and in essence to another popular tool - Moving Average Envelopes (MAE). Both indicators reflect the range of price fluctuations and have similar support and resistance levels. However, the envelope boundaries, which define the position of the upper and lower curves, have a fixed value and are calculated as a percentage. The higher the percentage, the wider the MAE envelope. In the Forex market, different recommended envelope widths have historically developed for different currency pairs. Thus, for EUR/USD, which usually does not have a large fluctuation amplitude, a 2% envelope is most often used.

In the case of BB, the bands are lined up at distances that are not calculated as percentages, they are equal to the number of standard price deviations and depend on market volatility. The width of the corridor is proportional to the standard deviation (the term is taken from statistics) from the moving average over the analyzed time period. The bottom line is shifted down by a certain number of standard deviations. When the price reaches this line and “punctures” it downwards, it can serve as a signal to buy. The top line is shifted upward according to the same principle. Its breaking may serve as a signal to open a sell position.

The simplest signal is considered to be a breakthrough from the bottom up (signal to buy) or from the top down (signal to sell) of the moving average line. Typically, BBs are superimposed on the main price chart, less often on additional ones (for example, on a stochastic oscillator). The indicator takes into account transactions in the Close status, i.e. closing the candle. The BB indicator is one of the basic instruments and is set by the trader when setting up the chart. The option is free and included in the basic package of most well-known terminals. The system settings look something like this:

I also recommend reading:

The Central Bank of the Russian Federation canceled the licenses of the Forex club, Teletrade and Alpari

Why Alpari, Forex Club and Teletrade lost their license from the Central Bank

John Bollinger formulated the basic rule by which BBs are built and which is embedded in the automatic algorithm of trading platforms: approximately 95% of prices should be inside the corridor determined by the bands, about 5% should be outside it. It is logical to assume that the larger the standard deviation, the higher the likelihood that the price will remain within the wide range limited by the bands.

Description of the indicator

Graphically, Bollinger Bands represent two lines that limit price dynamics from above and below, respectively. These are original support and resistance lines, which most of the time are located at levels remote from the price.

Bollinger Bands are similar to moving average envelopes. The difference between the two is that the boundaries of the envelopes are located above and below the moving average curve at a fixed distance, expressed as a percentage, while the boundaries of the Bollinger Bands are plotted at distances equal to a certain number of standard deviations. Because the standard deviation varies with volatility, the bands adjust their width, increasing when the market is volatile and decreasing during more stable periods.

The basic rule when constructing Bollinger lines is the following statement - about 5% of prices should be outside these lines, and 95% inside. Bollinger Bands are formed from three lines. The middle line is a regular moving average. The top line is the same average line shifted upward by a certain number of standard deviations (for example, two). The bottom line is the mean line shifted down by the same number of standard deviations.

What's unique about Bollinger Bands is that their width changes in response to changes in market volatility. The Bollinger Band is constructed like a band around an average, but the width of the band is proportional to the standard deviation from the moving average for the analyzed period. When there is high volatility in the market, for example during a news release, the band widens; when there is a lull in the market, it narrows.

As with all other indicators, I recommend analyzing BB in conjunction with other indicators. The purpose of the BB indicator is to determine sharp deviations from the average rate of the current trend of a currency pair. If the BB is chosen correctly, then its moving average (central line) is a good support/resistance level, and the boundaries of the BB channel can serve as targets when opening positions. Typically, BB bands are applied to a price chart, but they can also be applied to any indicator that is drawn in a separate window, for example, an oscillator.

Bollinger bands determine natural extremes in a developing trend. If Bollinger moves upward, the price rebounds until some sufficiently powerful force stops the price movement. A stagnation zone forms below the upper or above the lower Bollinger. The state of stagnation may continue until Bollinger reverses and begins to open up and move away from the price bar, which will indicate that the resistance has been overcome. The price may shoot towards the current trend and stick to the Bollinger Band. However, one should not lose sight of the fact that the final price movement depends on all support/resistance levels, and not just those with which BB is associated.

Do not try to find ideal conditions for opening/closing positions. Learn to work in imperfect conditions when you receive false signals.

Bollinger Line (band) indicator

Bollinger Bands (this indicator is also called Bollinger Bands, Bollinger Bands or Bollinger bands) is one of the computer technical analysis tools for making decisions when trading in the stock market. The indicator was developed by John Bollinger, one of the most famous investors and analysts of his time.

Bollinger Bands look like an expanding and contracting envelope, the boundaries of which are drawn two standard deviations above and below the 20th simple moving average. I prefer to build this indicator on an exponential moving average - EMA 21.

The Bollinger Band indicator detects an abnormally sharp price deviation from the current trend

, which is indicated by the moving average. The lines above and below the moving average serve as a kind of support or resistance for the price chart.

Bollinger Bands Trading Strategy

The Bollinger Bands trading strategy involves following certain patterns.

1. If the bands narrow, this means that the market is calming down and price consolidation begins...

But

if the bands have become very narrow, then this means that volatility has decreased significantly and, perhaps, a strong price movement is coming...

2. If the bands widen, this may mean the trend is strengthening or the beginning of a new trend

But

if the lines have widened significantly, it means that volatility is too high and is expected to decrease, and since the direction of the trend is known, the direction of the expected reversal is also clear.

3. If the price chart goes beyond the line, this may mean a reversal of the existing trend...

But

going beyond the line can also mean only a possibly small correction to the moving average as part of the further continuation of the current trend...

I hope you have already concluded that such uncertain analysis is very difficult to use as a signal to buy or sell shares...

Bollinger Bands always help me see a more accurate picture of the market and possible changes in it, but I rarely use this indicator as a signal to enter the market without additional confirmation. This does not mean that experienced traders do not trade Bollinger signals, but I want to emphasize that the key word here is experience. After all, it turns out that following this indicator, positions are opened against the trend, and this is always a risky step.

However, even if you do not risk opening positions against the trend, the signals from the Bollinger lines at least warn that it is undesirable to continue playing along the trend - perhaps it has already run out of steam and prices need to return to the average. Eric Nyman, Small Trader's Encyclopedia.

If we take this chart as an example, which I built on my broker’s website, overlaying EMA 21 and Bollinger Bands on it, then as a signal from a bollinger I would probably only use this one - a breakout of the EMA price, which followed the price going beyond the lower line Bollinger

But here it is important to take profits in time, since such movements against the trend are often harbingers of its end.

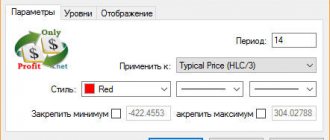

How to set up the Bollinger Band indicator in Transac

Setting up Bollinger Bands in Transac is a simple task that every novice trader can easily handle.

1. While in the window with the chart you need, right-click to open the context menu and click on the first item Add indicator.

2. From the full list, select Bollinger Bands .

3. In the window with parameters, mark the type of moving average and its period, deviation 20 and coefficient 2 should be the default (20 can be adjusted to 21 if you chose EMA 21).

4.If there are other indicators superimposed on your chart, for example, moving averages with different periods, then it would be better to design the Bollinger Bands in a different color. To do this, click on the Design

and select a color.

5.Next press ok

and get your Bollinger Bands superimposed on the chart.

Successful trading and profitable investments to you!

Calculation of the BB indicator

Bollinger Bands are formed from three lines. The middle line is a regular moving average. In the following expression, “n” denotes the number of unit time periods that make up the period for calculating the moving average (eg 20 days).

The top line is the same average line shifted upward by a certain number of standard deviations (for example, two). In the following formula, "D" stands for the number of standard deviations.

The bottom line is the mean line shifted down by the same number of standard deviations (i.e., "D").

J. Bollinger recommends using a 20-period simple moving average as the center line and 2 standard deviations to calculate band limits. He also found that moving averages shorter than 10 periods were ineffective. Let's take a closer look at the indicator settings.

Conditions for the formation of the M signal:

- The chart touched or broke through the upper line of the indicator (formed the first top);

- Then the graph moved towards the middle line;

- Afterwards, the chart formed a second peak, which is below the first peak;

- Then the chart broke through the middle band.

I buy a put option when the middle Bollinger band breaks out.

The second reversal pattern (called a double bottom) is a mirror image of the first. A double bottom is a signal of the beginning of an uptrend; this pattern is similar to the Latin letter W.

Indicator settings

Period For Bollinger Bands, it is recommended to set the period from 13 to 24, the most common is 20, and the deviation is from 2 to 5, the recommended value is 2 or 3. You can also use Fibonacci numbers, round numbers 50, 100, 150, 200, number days in a trading and calendar year – 240, 365. It should be understood that setting large periods reduces the sensitivity of the indicator, which is unacceptable in markets with low volatility. Most of the time the price is in the channel, but during a sharp movement, the intersection of Bollinger Bands is the norm. However, if the price crosses the upper or lower band too often, then it is worth increasing the period, and if the price rarely reaches the outer bands, then it is worth reducing the period. Price Closing prices are most often used to calculate Bollinger Bands. Other varieties such as typical and weighted prices may also be used. Timeframe Bollinger Bands work equally well on any timeframe, but, as a rule, they are used for intraday trading.

It is worth remembering that for different currency pairs and different timeframes, indicator settings should be selected separately.

Bollinger settings

To trade using Bollinger Bands, you need to be able to configure the indicator correctly.

First of all, set the input data:

- Period. The most common – 20 (it is set by default), but at your discretion you can assign it in the range from 13 to 24. Bollinger derived the value for the moving average empirically based on many years of analysis. With a shorter period there will be many false signals, with a longer period there will be a strong delay, that is, the trader will not be able to act effectively.

- Standard deviation. To calculate the stripe boundaries, the recommended value is 2-5. You can use Fibonacci numbers or even values of 50, 100, etc. If the volatility of the instrument is low, such settings make using the indicator pointless.

- Source. Select from the drop-down list which data to take from the candle – low, close, open, etc. The most common choice for Bollinger Bands is closing prices, but you can use weighted or typical asset prices.

Bollinger Bands have been proven to be suitable for trading on a wide range of time frames, but traders typically use them primarily for intraday trading, especially on five- and fifteen-minute timeframes

When choosing an indicator, keep in mind that you need to specifically configure it for each currency pair and each time frame.

Next, choose the style of the background and the lines themselves: set the line thickness and stripe color that is comfortable for you.

In the Properties menu, you can choose whether the bar numeric values will be displayed on the graph.

Methods of application

The developer himself notes the following features of Bollinger Bands:

- Sharp price changes usually occur after the band narrows, corresponding to a decrease in volatility.

- If prices move outside the band, expect a continuation of the current trend.

- If peaks and troughs outside the band are followed by peaks and troughs inside the band, a trend reversal is possible.

- A price movement that starts from one of the band boundaries usually reaches the opposite boundary. This last observation is useful for predicting price targets.

So, what options for using the BB indicator can I recommend?

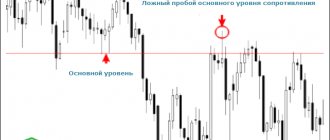

Prices going beyond the indicator boundaries

As a rule, going beyond the BB border means the beginning or continuation of a trend. This way you can judge the direction of the market - as long as prices touch and break through the upper limit, the trend is upward. As long as prices break through the lower border, it is downward.

Sometimes going beyond the Bollinger line means a “false breakout,” that is, when prices just tried a new level and immediately returned back. In this case, you also have the opportunity to work against the trend, but carefully evaluate whether the “breakout” is really “false”. However, it must be taken into account that transactions against the trend are a game of professionals. And if you don’t feel like that yet, then it’s better to abstain.

The figure above shows just such possibilities. Please note that such countertrend opportunities appear infrequently, and they are usually characterized by a strong departure beyond the boundaries of the indicator. Such situations are usually very visible.

Price rebound from the BB middle line and its intersection

As I already said, the correct selection of the indicator period turns the BB middle line into a dynamic support/resistance level, which works perfectly on a confirmed trend. Crossing the indicator's midline often means a trend change. In the figure above, at point 1 the trend was crossed, at point 2 the trend change was confirmed (prices touched the upper border of the indicator). At point 3, prices again touched the upper border until at point 4 they touched the middle line. When the point is confirmed by candlestick formations, other indicators or graphical analysis (levels, trend), this gives us a reliable entry point towards a new trend.

Please note that after the trend change at point 1 of the figure above, the price returned to and bounced from the BB center line many times. However, at points 2 and 3 there were also approaches to the midline. At the same time, it was broken, but the trend did not change; these were false breakouts. That is why it is recommended that when making trading decisions you should never rely on one indicator, but filter all incoming signals using oscillators, candles, and graphical analysis. At point 4, a breakdown of the middle line took place again, which led to another interesting phenomenon (point 5), which we will talk about below.

The slope of the Bollinger lines and the location of the price relative to the BB lines

Everything is simple here. By using the Bollinger slope, as well as by finding the price relative to the middle line, you can judge the current direction of the trend - an upward trend when the BB slopes up, a downward trend when the BB slopes down. If the price is below the middle line, it indicates a downward trend; if prices are above the middle line, we can speak of an uptrend.

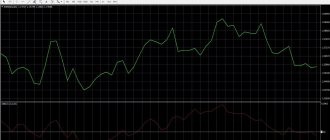

Narrowing and expanding the range of Bollinger bands

As you know, the market tends to move from a trend phase to a stagnation phase, and constantly. And when we see that the market has been quiet for quite a long time, we should wait for a storm. Bollinger Bands become wider when market volatility rises and narrower when market volatility falls. A narrow Bollinger Band indicates a sleepy, calm market.

The strongest market movements usually start from a flat bottom (called a “shelf”). The Bollinger Band helps determine the moment of transition from a calm to an active market. When prices rise from a very narrow Bollinger Band, it gives a buy signal. When prices fall from a very narrow Bollinger Band, it gives a sell signal. If prices return back to the range, you need to close the position. BB divergence is observed when an existing trend strengthens or a new one begins. The longer the rate trades within the narrow boundaries of the price channel (flat), the stronger and faster the exit from it will be. In response to price awakening, the BB bands open. If, as the price approaches the BB border, it begins to rise, the movement will most likely continue.

By observing the stripes in real time with a trained eye, you can catch the beginning of a new trend. Bollinger Bands work especially well during the second testing at the cost of important highs or lows. When the market eventually breaks out, the expanding price bars reach the boundaries of the Bollinger Bands, then the bands narrow around the narrowing price bars in a sideways range, followed by a breakout or bounce from the level.

Continuation and reversal of the trend

Powerful buying and selling can push the price beyond the Bollinger Bands. Experience shows that in most cases no more than four candles in a row go beyond the Bollinger Band, after which a correction or reversal occurs. However, trading against these moves is very risky as the market may go through a short series of highly volatile swings before a reversal occurs and take out your stops. But, in general, such price behavior is observed quite rarely, usually during the London session, on the news.

As mentioned earlier, the indicator directly depends on the volatility in the market. If the boundaries of the channel diverge, this indicates a continuation of the existing trend, and if the outer Bollinger Bands narrow, this may indicate a fading trend and a possible reversal. The breakthrough of the central explosive band strengthens the directional impulse. If, as the price approaches the BB border, the angle of inclination of the border decreases, then, most likely, the price will break through the border and then make a reversal. Very often this means the end of the current trend. Watch carefully to see if the price slowly bounces back and if the Bollinger Band opens at the same time. If yes, then this will be a signal for the upcoming breakthrough of the BB border and continuation of the movement.

Recognizing patterns with Bollinger Bands

For example, let's take the double bottom pattern, which consists of a decline to a low, followed by a recovery and a subsequent decline to the previous low, followed by a reversal, which is accompanied by a rise or at least a termination of the previous trend. The relationship between these two lows was at one time a topic of considerable debate among technical analysts. Should the first minimum be higher than the second, or should the minimums be equal, or should the second be higher? and so on... I believe that the process of identifying these patterns becomes much easier and the patterns themselves become more obvious if you consider the lows in relation to Bollinger Bands and ignore issues of absolute price values.

If the first low is below the lower band and the second low is at or above the lower band, then we have a potentially interesting setup - a divergence, where the second low is relatively above the first, regardless of their absolute price levels. Combine this with confirmation and appropriate discipline, and you have a valuable trading tool.

Using Bollinger Bands with Other Indicators

As a rule, BB is used in trend systems, where entry is made in the direction of the trend after some rollback. In addition to relying on the middle line of the BB, it is logical to also use an oscillator to confirm the end of the retracement.

Stochastic oscillator or WPR are good for this task.

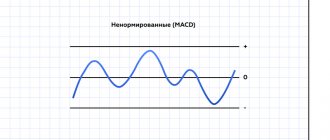

A very interesting field for experimentation is the use of the Bollinger Bands indicator on oscillators.

Moreover, such a combination usually greatly expands the capabilities of standard oscillators - in particular, it adds dynamic overbought/oversold levels that easily adapt to changing market conditions. In particular, you can base your analysis on the BB applied to the price chart and the RSI oscillator chart.

Many signals come first from the RSI-BB pair and are only later confirmed by the BB-price pair. The proposed method of using explosive bands is a huge field for experimentation.

Some features of Bollinger Bands

- If the price moves outside the Bollinger Bands, this can serve as a signal for trend continuation:

- A price movement started from one of the Bollinger bands most often reaches the opposite band:

- If, after a price fall or rise, a new minimum (or maximum) has formed outside the Bollinger bands, and the following minimum (maximum) has formed inside the bands, then this may signal a possible trend reversal.

- After the Bollinger Bands narrow and the price moves for some time within this corridor, volatility increases and directional price movement occurs.

- There is an opinion in various sources that, most often, no more than 4 candles go beyond the boundaries of the bands, and then a correction begins. This is a very dubious judgment with which I fundamentally disagree. I'll show you with an example:

Advantages and disadvantages of explosive bands

The attractiveness of Bollinger Bands for traders lies in two very important characteristics. First, Bollinger Bands (BB) demonstrate the major axes of trends/sideways ranges, much like price or moving averages do. Secondly, as they move, they either narrow or expand. And the interaction of the mentioned properties of Bollinger Bands determines unique patterns as price bars, developing their movement, pass through certain boundaries. Japanese candlesticks work especially well with Bollinger Bands. For example, dojis colliding with narrowing bands provide an effective signal for a short-term price reversal.

Bollinger Bands (BB) react to price movements with their bends and turns. These wave-like movements predict how far a trend can spread before distributional forces bring it back to the central axis. A complex set of interactions develops between price/band direction and price/band narrowing. A great deal of practical experience is required to determine the ultimate effect of these stripes on price. But, after sitting for many tens, or even hundreds of hours, watching this indicator, you will not regret the efforts made. Bollinger Bands indicate the hidden nature of price fluctuations much better than many other tools do, and immediately let you know whether the very treasured door behind which profits are hidden is ajar or locked.

The disadvantage of the indicator is the same as that of the standard moving average - lag. And the higher the BB period, the more significant it is. However, many traders use BB in their trading, having learned to level out its weaknesses and make the most of its strengths.

By the way, if you decide to use BB in your Forex trading, an oscillator such as CCI can be safely thrown out of the chart. It is based on the same principles as ranges and measures deviations from the MA. Ranges are better because they keep you visually closer to the prices.