How is portfolio liquidity formed and ensured? What is the principle of conservatism in an investment portfolio? What are the features of portfolio optimization by diversification?

There is no investment without risk. Every novice investor should learn this rule. There are no assets with a 100% guarantee of profit, otherwise every investor would become Henry Ford and Warren Buffett. Even a bank deposit is not as reliable an instrument as financial institutions position it to be.

The level of profitability is influenced by thousands of reasons - economic crises, inflation, financial illiteracy, exchange rate fluctuations, stock exchange disasters. However, the investor has an effective way, if not to eliminate risks completely, then to minimize them. This method is called an “investment portfolio”.

When creating a portfolio, you do not invest money in one instrument, but use several investment areas. I, Denis Kuderin, an investment specialist, will talk about how this is done and what types of investment portfolios there are in a new article.

You will also find an overview of reliable professional companies that will help you form a portfolio and manage it competently.

Go ahead, friends!

The Wealth Gene: 4-Day Free Online Training

In 4 days you will learn the millionaire thinking method, which will help you increase your income, close your debts, and find a business you like.

Participate

What is an investment portfolio

Why do experienced investors earn more than newbies? Do you think it's because the latter have less money? The answer is obvious, but not entirely correct. Of course, the amount of investment directly affects profitability, but completely different factors play a decisive role.

Experienced financiers know how to correctly apply investment instruments and know how to manage them as efficiently as possible. They are aware that the more investment areas are involved, the lower the risks of ruin and the higher the likelihood of receiving stable and long-term income.

The newcomer is looking for the most profitable and promising asset, just as the knights were looking for the Holy Grail. And when he finds it, he rushes to invest all his cash in it. This method can work, or it can ruin the investor. If you are a player by nature and want to play and not earn money, then this path is for you.

Smart investors do things differently. They are not looking for the highest yielding instruments. They combine conservative investments with moderate and high-risk investments. If one option does not work, ten other instruments cover possible losses.

The totality of an investor's assets constitutes his investment portfolio . This portfolio contains securities or other types of investments that allow the owner to earn income through interest, dividends, or speculation.

Unlike real investments, portfolio investments do not require the investor to actively participate in the management of projects and companies in which he invests money.

How are assets selected for an investment portfolio? The principle of this choice is simple: focusing on stable profitability with minimal risks.

In order not to be unfounded, I will give an example of a correct investment portfolio:

Part of the money (approximately 30%) is placed on deposits in reliable banks. It is advisable to choose several institutions - for example, Sberbank, Alfa-Bank, Tinkoff.

We invest half of our assets in government and corporate bonds and shares of large, steadily growing Russian and foreign corporations - Gazprom, Google, Yandex, Surgutneftegaz, Lukoil, etc.

We place the remaining finances in high-risk instruments - shares of “undervalued” companies, startups, options.

The main advantage of portfolio investments is their high liquidity. The investor has the right at any time to convert securities and other assets into real money and leave the market. With direct investments, such a procedure is not easy to carry out, and sometimes it is impossible before the end of the project implementation period.

A professional always keeps part of his money in instruments that are resistant to internal and global market fluctuations. For example, government bonds with a fixed price cannot fall in price and generate profits regardless of market conditions. The presence of such assets in a portfolio ensures its liquidity.

However, as I already said, it is impossible to completely eliminate investment risks.

It is worth listing the most common risks:

- incorrect choice of instruments (most of the assets are invested in shares of unstable companies with dubious prospects);

- inflation - be sure to take this indicator into account when planning future income;

- poor timing of investments - experienced investors buy shares when everyone else is selling, and not vice versa.

Each investor has his own approach to building an investment portfolio. The most successful investor of our time, Warren Buffett, invested money in companies that, from the point of view of other market participants, were unpromising.

Not only securities are included in the portfolio of a forward-thinking investor. The choice of areas is almost limitless - gold and other precious metals, real estate, insurance savings funds, PAMM accounts and much more.

To learn how to manage your investments wisely, read the article “Investment Management.”

Stages of forming an investor's portfolio

I will list the main stages of portfolio formation, as happens when ordering a service on a blog:

1. Analysis of the investor's long-term goals and limitations.

Here we determine the risk profile and profitability goals in percentage per annum. An important condition: the task must be realistic. At this stage, we already approximately know your investment time horizon. It is better to immediately calculate the potential profitability taking into account taxes and brokerage commissions.

2. Selecting the right tools for your purposes.

At this stage, we will determine the composition of high-yield and conservative assets. Your risk profile will determine which instruments - stocks, OFZs, corporate bonds, mutual funds or ETFs and others - will be included in the portfolio, what issuers they may be and in what currency the investments are denominated. An important point here is the liquidity of the purchased instruments, that is, the ability, if necessary, to sell them quickly and without high costs.

3. Distribution of investments by shares within the portfolio.

This is the key point of diversification as a way to manage risk. Its degree and nature depend on your personal profile and goals (see paragraph 1). We will also turn to the Markowitz portfolio theory, which, in addition to “don’t put all your eggs in one basket,” also says that the results of all individual parts of the portfolio may be worse than a balanced portfolio.

Ideally, the assets in your portfolio should have little or no correlation with each other. This allows you to smooth out the amplitude of market fluctuations. At the same time, efforts should be made to ensure country and currency diversification. But this issue should be approached creatively, focusing on your goals, their horizon and the amount of capital. In asset allocation, you also need to know when to stop, since excessive diversification, which W. Buffett called “protection against ignorance,” reduces potential profitability.

4. Opening accounts, purchasing assets, monitoring and planning periodic portfolio rebalancing.

I also recommend reading:

Investments in marijuana and prospects for their growth

We invest in marijuana, hemp and cannabis

Working with a portfolio does not end once it is formed. You still need to complete technical steps to select the optimal broker and tariff plans, open accounts and purchase assets. Often these actions cause difficulties for novice investors, so the portfolio formation service includes information support right up to the purchase of assets.

When creating a portfolio, you should calculate the basic scenarios for the development of events and investor behavior. In particular, it is required to draw up a plan for regular portfolio rebalancing due to changes in the value of assets, as well as new additions.

One way or another, a compiled portfolio is an investment plan. The investor must be able to assess the state of the portfolio and monitor its dynamics every week/month/quarter, depending on the volatility of the assets included in it. In fact, my entire blog is dedicated to investment valuation.

What are the types of investment portfolios - TOP 7 main types

The classification of investment portfolios is quite arbitrary. Professional investors try to combine different investment strategies. It happens that one half of their portfolio is profitable, the other is made up of growth investments.

However, every investor needs to know what types of portfolios there are.

Type 1. Income portfolio

From the name it is clear that such a portfolio is designed for high investment returns with minimal risk and is preferable for conservative investors.

It includes bonds (government and corporate) with small regular payments, shares of large companies in the raw materials or energy industries. Income from such a portfolio is generated mainly from interest and dividends. If we talk about indicators, then this is 10-25% per annum.

View 2. Growth portfolio

The profit of a growth portfolio is ensured by an increase in the value of securities. This tool is used by investors who want to make significant profits. Investment areas: shares of rapidly growing companies, startups.

The risks of a growth portfolio are quite high, but if the investor sells his assets on time, the profits will also be significant. Profitability indicators are not limited.

Type 3. Balanced portfolio

The moderate investor's portfolio. It is formed from securities of well-known companies and has a stable composition. The owner of such a portfolio is focused on long terms and capital preservation. However, a small part of the assets may also consist of shares with rapidly changing values, but such a risk is always justified and is under strict control.

Type 4. Risk capital portfolio

Portfolio of an exchange player aimed at maximum capital growth. Such an investor knows that the highest returns come from the highest-risk investments. The assets include shares of new and fast-growing enterprises, as well as companies developing new technologies.

Type 5. Portfolio of long-term securities

Conservative portfolio designed for long periods. The owner acts on the “buy and forget” principle. To engage in such investing, you need to have a solid budget, because the invested money will not be available for several years.

Typical example

Five-year federal loan bonds issued in 2012 by the Central Bank are repaid in the spring of 2020. All owners of such securities will return their money in full. They had already received income through coupons, which were paid every six months during the entire term of the bonds.

Let's return again to Warren Buffett - a clear supporter of long-term investments. He said: “If you don't plan to hold the stock for 10 years, then don't even think about buying it for 10 minutes. Stable profitability is a long-term matter.”

See the article “Long-term investments”.

Type 6. Portfolio of short-term securities

The opposite of a long-term portfolio. This package includes investments with maximum liquidity and quick return of funds. Example - investments in stock and currency speculation on the Forex market, investments in microfinance organizations.

Type 7. Portfolios with regional or foreign securities

Portfolios for patriots of their region or entrepreneurs who thoroughly know the domestic market of their own region. Varieties of a specialized portfolio are sets of industry-specific securities (for example, oil refining companies), shares of foreign companies.

The table of investment portfolios will clearly demonstrate the characteristic features of all varieties:

| № | Portfolio type | Tools | Profitability |

| 1 | Income Portfolio | Securities with high interest and dividends | Moderate |

| 2 | Growth Portfolio | High appreciation securities | High |

| 3 | Balanced | Income and growth papers are divided approximately equally | Moderate |

| 4 | Risk capital | Shares of fast-growing companies, startups | High |

| 5 | Long term | Bonds, shares of large companies | Low but stable |

| 6 | Short | Securities of undervalued and young companies | High |

How to build an investment portfolio

Forming an investment portfolio is not an easy task. Especially considering the availability of global investment instruments here in Russia. I myself didn’t understand this right away: I put together a structure, and then it had to be adjusted to what was available to us.

The most important thing in this matter is to clearly and consistently go through all 5 stages. Skipping any of them puts your financial goal in doubt.

Step one. We determine our investment resources

Just ask yourself: “What do I have today?” You need to sit down and carefully understand your situation. Especially if you have never kept track of your finances or done a personal balance sheet before.

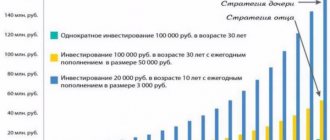

The most important thing now is to decide how much money you have for a one-time investment and where you will get it for planned capital replenishments. This could be salary, income from business, rental property, or any other income in your budget.

My resources are funds from the sale of a car (initial capital), plus every month I will save 10,000 rubles. to replenish the portfolio

Step two. Determining your investment goals

Answer the questions: “What do I want? Why should I invest money? Moreover, you need to answer in terms of the amount you will need. For example, how much do you want to receive per month in retirement or how much does your dream house cost, or the yacht for which you started all this.

A properly set goal should always have a cost and a time frame in which you want to achieve it. Here are a couple of examples that are correct from the point of view of setting goals:

- I want to retire in 25 years and have a passive income of 60,000 rubles. per month

- I want to buy a house in Miami in 10 years for $450,000

- I want to send my children to study at Cambridge in 6 years, tuition fee is $280,000

By the way, it would be a good idea to first check your goal to see if it is achievable. To do this, you don’t even have to have your own physical therapist (although I think it’s very important!). You can simply sketch out a small plan in Excel.

If the goal is unattainable with current resources, you will have to either lower the “wants” bar (as a last resort, never do that!), or increase the time frame for achieving it. Or (my favorite option) work on increasing your income.

Another trick is to make your portfolio more aggressive. This works great on long horizons.

My investment goal is a minimum of $1,500 monthly retirement capital income by 2044

Step three. Determining the investment horizon

Everything is simple here: you need to answer the question “When do I want it?” In fact, you have already done this in the previous paragraph.

My horizon is 27 years before I start withdrawing my pension savings. In general, it is much longer than 27 years, because in 1944 I will begin to regularly withdraw only a small part of what I have accumulated. I would like to pass on something else to my descendants

Step four. Determining your attitude to risk

Useful articles

What is a personal investment plan and how to draw it up correctly?

How to save for retirement, and not rely on the country and beg for alms from the transition?

How to create a personal financial plan and why are you doomed to failure without it?

How to do home accounting and financial accounting in 3 minutes a day?

But this is a truly difficult stage. It is unlikely that you will be able to understand your attitude to risk correctly the first time. But first, try to imagine: the loss of what part of your capital would be a hard blow for you?

It is best to calculate the initial capital in numbers. Let's say you decide to make a portfolio for 100,000 rubles. What does this amount mean to you? How much can you afford to lose while remaining in emotional balance?

I'm not saying that you will definitely lose money, but there will be drawdowns on your account. And quite often. You have to take it for granted and just ignore them. It's like waves on the sea, they just exist and that's it. There is an ebb and flow and there is nothing you can do about it. Your task is simply to sit out the unfavorable moments. And this is perhaps the main difference between passive investments and active ones. Remember: no stops!

I assume that now you are objecting - what will happen if the market falls like in 2008? Nothing bad will happen. For a passive investor, any crisis is positive, because many assets will go down and we will be able to buy them cheaply from those who panicked, and then sell them to those who will soon be buying in euphoria at the very top. Remember what I wrote about rebalancing? She is the one who will help us.

Think about it: because there is a crisis in the market right now, have your shares become worthless? A share is a part, a share in a business. Let's say you own shares of Toyota. That because of the crisis, Toyota began to make bad cars and no one needs them? Or, for example, you own shares in Gazprom. That because of the crisis people will stop using gas?

Hardly. This means that sooner or later the panic will subside and these shares will not only return their value, but will also show impressive growth.

If I still haven’t reached you, here’s an example at the everyday level.

Imagine that stocks are buckwheat. You have some buckwheat at home. But the store across the street suddenly started selling it. Buckwheat fell in price by 50%. Are you going to start selling your buckwheat too? No, you'll probably run to the store on sale to buy more while it's cheap. So why is everyone doing things differently with stocks?

My regular readers know that I like risk assets. I have no illusions and even before entering an investment I consider this money spent or lost. To achieve my investment goals, I need high returns and I have a lot of time on my hands. That's why I prefer risky investments.

Step five. Selecting a Portfolio Structure

In the previous paragraphs, we brought everything together. Now, based on your initial data, you need to put together a portfolio that 100% matches them. And believe me, it will not be as easy as it might seem at first glance. On the one hand, you need to take into account all individual factors, on the other hand, you need to choose the tools wisely.

Here are the asset classes we will need:

Equity securities (shares or equities)

Shares give the right to own part of the company and receive part of its (the company's) profits in the form of dividends. Everyone wants to own shares of good companies. Hence the constantly growing price charts for these securities. Historically, US stocks have returned an average of 9.5% per annum excluding inflation.

Moreover, this is a fairly broad class of assets. In turn, they can be divided into subclasses:

- By country: Developed markets, Emerging markets

- By region: Americas, Europe, Asia, Pacific, Africa, Latin America

- By capitalization: Large companies (Blue chips), Medium companies, Small companies, Micro companies

- You can even connect fundamental analysis and break it down by style: growth stocks and value stocks

Each of these species has historical statistics. Moreover, the longer the story, the more accurate the result. For stocks, 10 years, and sometimes 20, is not yet an indicator. In the table below I will provide data for some of them.

Debt securities

This includes mainly bonds. Unlike shares, such securities do not give you the right to participate in the life of the company. By purchasing it, you thereby lend to the issuer - a company or even an entire country. Here you can already count on a pre-agreed percentage. Bonds yield an average of 4.9% per year in the US.

Bonds are also divided into subtypes:

- By issuer: corporate, state, municipal

- By reliability rating: reliable, highly profitable, junk

- By duration: long-term or short-term

Here are their returns:

Money Market Instruments (Cash)

These are deposits, certificates of deposit or Treasury bills in the United States (short-term debt securities with a maturity of up to 30 days). Their yield is at the level of 3.7% per annum.

Commodity assets (Metals, Oil, Grain)

Yes, there are such assets, although they are not included in the classic Asset Allocation, since they do not show long-term growth in the value of the asset. As an exception, gold and silver are sometimes added to portfolios due to their low correlation with the stock market.

Real estate

The cost per square meter itself is not growing in the long term. The only option to make a profit is to rent out the property. However, this is an extremely illiquid asset, so it is also not very suitable for our purposes. The only exception is real estate REITs.

Just above I will show a picture of the real returns of asset classes over 100 years. As you can see, only stocks allow you to consistently beat inflation and increase capital. These are the ones you need to focus on.

The procedure for forming an investment portfolio - 5 main stages

So, you have firmly decided to form your investment portfolio. Let's consider what is needed for this.

I recommend that all beginners follow the principle of conservatism. This means that the basis for the portfolio should be conservative and reliable financial instruments. You will take risks later when you increase your assets by 50-100%. In the meantime, be prudent, patient and consistent.

And strictly follow the expert guidance.

Stage 1. Setting investment goals

The more specific the investor’s goals, the more effective his financial activities will be. If a person comes to the market with vague intentions, the result will also be vague and uncertain. The goal of “earning a little extra money if you can” will not work. Set realistic and specific goals for yourself.

A pro works for results. He comes to the exchange prepared and ready to win. At the same time, he does not forget about safety for a minute. His capital is invulnerable to external shocks, and he himself is protected from impulsive decisions by a correctly chosen strategy.

Decide in advance how much and why you want to earn on investments. The right goals are to increase your capital by 50% in a year, save for a car, and earn more on the stock exchange than at your main job.

I would advise new investors to work with a professional advisor. Many brokerage companies perform such functions even for free. Do not neglect qualified help, listen to wise advice and follow it.

Stage 2. Selecting an investment strategy

The choice of strategy depends on the investor’s personal preferences and his ultimate goals.

Essentially, there are only 3 investment strategies:

- aggressive;

- conservative;

- moderate.

An aggressive (also known as active) strategy involves constant monitoring of market changes. An active investor is constantly acting – buying, selling, reinvesting. His goal is to increase capital in the shortest possible time. This strategy requires time, knowledge and money.

A passive strategy is waiting. The investor does not participate in intermediate processes and counts only on long-term results. Or receives profit from dividends, interest and coupons. This is exactly the strategy I would recommend to beginners. A little boring, but reliable.

Stage 3. Analysis of the securities market

Based on your investment goals, analyze the securities market and determine for yourself the instruments that are most suitable for your strategy. At this stage, I recommend choosing a reliable broker - a guide in the endless financial maze.

Investing on the stock exchange is certainly more difficult than making bank deposits, but much easier than earning money through daily work in a factory or office. The main thing is to take responsibility for financial decisions and understand exchange mechanisms at least at the amateur level.

But you shouldn’t rush headlong into the pool. First, read blogs, articles, books for beginners. Once you understand how bonds differ from stocks and what ETFs are, gradually move on to practice. Study company quotes for the current and last year, see how much certain securities have grown, and what income this has brought to their owners.

Another option is to open a demo brokerage account, which every professional company has, and trade virtual shares for a while. This will help you get comfortable in the market and understand the basic principles of trading.

Some newbies choose the strategy of following experienced investors. Sometimes brokers allow you to study the portfolios of successful players and invest money on the “do as I do” principle.

Stage 4. Selecting assets for the portfolio

Stock investing is unpredictable, but it is not a lottery or a casino game. Here you yourself have the right to control the situation and balance the risks. It is impossible to predict the exact profit, especially for shares of the domestic Russian market, but the approximate growth of income according to a conservative strategy is a very definite value.

Distribute assets in areas in which you have at least minimal knowledge. For example, you shouldn't invest money in futures if you don't know how they work. It is better to put the balance of undistributed funds in foreign currency. Let there be free money in the brokerage account.

Stage 5. Purchase of securities and start monitoring the formed portfolio

Securities on the stock exchange are purchased through a broker. People rarely invest money directly in stocks. This is done mainly by experienced investors with a lot of money.

Buying assets and forgetting about them is the wrong tactic. Even if you are the most conservative investor in the world, you need to regularly review your portfolio and conduct an audit at least once every quarter or six months. You will have to get rid of some papers, and some, on the contrary, you will have to buy in addition.

A useful link is “Investing in shares.”

Investment portfolio formation service

I decided to set the cost of the service for creating a long-term (without active trading!) investment portfolio for the Russian market at the level of average market prices - 12,000 rubles. If you are interested in a portfolio through foreign brokers, then 16,000 rubles.

If you would like to order a service:

1. Write by email, VK chat or telegram @antonvesna: “I want to order a briefcase, send me a form.”

2. In response, I will send you a form to fill out and payment instructions.

3. After payment, within 5-7 business days you will receive a ready-made investment portfolio with comments and answers to questions.

4. Feedback is provided within a week in order to resolve any issues that may arise. If you don't like something, I will return your money within two weeks.

The service does not imply a guarantee of profitability; there should be no illusions here. Profit depends on many factors, including those beyond the control of neither me nor you. The idea to launch the service arose from regular questions about where to invest money. As you already understand, it is impossible to answer this question in a fleeting correspondence. By and large, you should go through the Lazy Investor Marathon, after which you will be able to form a portfolio and manage it yourself. The service only saves your time and money, but does not eliminate the need for knowledge.

If you are interested in building a long-term portfolio with a horizon of 2–3 years, then its support, which includes consultations, answers to questions, assistance in filling out declarations, etc., will probably be useful. The service involves personal consultation over a long period, so it can only be ordered after an interview. In fact, you will always have someone to turn to with any financial issue. Within the framework of common sense, of course.

Consulting support for a lazy investor implies that your capital must be at least 3–6 million rubles so that the total costs are adequate to the results with a completely passive investment strategy, without speculation. The cost of support for one year is 0.5% of the capital, but not less than 50,000 rubles.

Please note that I do not accept money in trust. You will perform all actions yourself on your personal accounts; I only provide information support, which should be taken as an independent opinion from the outside.

I also recommend reading:

Ekaterinburg Exchange Forum of Private Investors

The most important things from the exchange forum of private investors

Professional assistance in portfolio investing - review of the TOP 3 brokerage companies

I have already said that without a broker, a beginner has nothing to do in the securities market. A broker is not only an intermediary who receives a percentage for his services, he is your eyes and ears. The more reliable the conductor, the higher the profits.

On some exchanges, brokers combine the duties of a financial advisor. Sometimes even at no additional cost.

Study the review of the most reliable brokerage companies in Russia and use their services.

1) FINAM

The oldest broker in Russia (the company was founded in 1994). In addition to brokerage services, he is engaged in capital management, training, foreign exchange transactions, direct investments in production and the economy. Maintains a course for constant development and implementation of the latest information technologies and customer services.

FINAM specialists will help the client form an investment portfolio and will choose the most profitable and promising areas in accordance with the goals and financial capabilities of the investor.

Open a demo account or a real brokerage account directly on the company’s website. The procedure takes a few minutes. Almost immediately you get access to exchange transactions with securities and currencies. The company promises returns of 18% per year even with a passive investment strategy.

2) GoldMan Capital

The firm provides consulting services in the field of private and corporate investments. These guys will not only tell you what an effective investment portfolio is, but will also help you create one.

Each client is assigned an individual portfolio manager who manages assets in order to extract maximum profit from them. The intermediary's income depends on your income, so consultants have a vested interest in the client's well-being.

3) FMC

Another intermediary company with a long history of work and an impeccable reputation. Clients get access to investments in shares of the world's largest and Russian corporations. Do you want to become a co-owner of Microsoft, Gazprom, Coca-Cola or Apple? There is nothing simpler - register with FMC and get a personal consultant who will manage your investment portfolio throughout the entire investment period.

Why do you need a diversified portfolio?

It is impossible to cover the entire variety of assets - a private investor simply does not have enough capital for this, and choosing just one means taking on a huge risk. A well-known study by Brinson, Hood, and Brian D. Singer (BHB) at the end of the last century showed that investment success depends 90% on the correct distribution of assets, and only 10% on which assets were selected for the portfolio.

To avoid fatal mistakes, I propose to use the proven idea of an investment portfolio, in which assets of different types, with different ratios of return and risk, from different industries and in different currencies will be presented in certain proportions. If some part of these assets “sags,” others will act as a protective component of the portfolio and either partially compensate for the losses, or at least will not fall accordingly. This distribution is called diversification (from the Latin diversus - different).

At first glance, the idea is simple: spread your investments across several assets, and that’s it. However, forming such a balanced portfolio requires, at a minimum, knowledge and time - exactly what a novice investor usually lacks. Without many years of experience behind you, it is very difficult not only to identify suitable assets, but also to correctly distribute their shares.

You can copy someone else’s portfolio, but even here you will most likely be disappointed: each person, his psychotype, risk profile, investment horizon, family situation and set of professional skills are unique. Templates don't work here; sooner or later they can lead to disappointment.

I also recommend reading:

How the Chinese virus could affect markets

Chinese coronavirus: how to make money or at least not lose money

Therefore, before suggesting anything to blog readers, I always bore and ask for as much information as possible about the individual’s individual characteristics, financial situation, goals and life experience.

What are the ways to optimize an investment portfolio - 3 main ways

A lazy person will always find a reason why he will not invest. He would rather trust Sergei Mavrodi than himself, or will buy household appliances when the dollar starts to rise in price.

An active and far-sighted individual who thinks about the future does not engage in such nonsense. He is looking for ways to optimize his personal investment portfolio. With him, he is not afraid of internal crises, currency fluctuations and ruble falls.

There are many ways to optimize a portfolio, but I will look at the most effective ones.

Method 1. Portfolio diversification

The first and most important rule of an investor. In simple language it sounds like this: “Many eggs, many baskets.” The more tools you choose, the lower the risks. But income must also be calculated in such a way as to cover inflation.

Classic diversification looks like this:

- 50-70% invests in low-risk investments;

- up to 20% is placed in highly profitable areas with a high degree of risk;

- the rest goes to reserve needs and is placed on bank deposits or, for example, unallocated metal accounts.

It is not necessary to adhere to exactly this ratio. The main thing is not to upset the balance by investing too much in one asset.

Method 2. Bank deposits

Another method for people who value reliability above all in investments. Distribute the money among the largest banks in the country. But make sure that the amount of deposits does not exceed the amount of state insurance. At the time of writing, it is equal to 1.4 million rubles.

Banks, by the way, also offer individual investment programs. For example, Sberbank has a protected program for individuals with a guaranteed return of the down payment. In this case, the investor himself chooses 1 of 5 possible investment directions.

Method 3. Investments in real estate

If you live in a large populated area, then investing in residential and commercial real estate will help not only preserve, but also increase your initial capital. At the very least, you will definitely beat inflation, and if you invest in a property at the construction stage, you will definitely receive an income of 30-70% in the future.

Let's expand our horizons by watching an interesting video on the topic of the publication.