A Bitcoin futures is a contract between two parties to sell or buy cryptocurrency at a specific date and time at a specific price. Futures have been used in the investment world for many years, but have recently entered the crypto sphere. Many exchanges have expressed their interest in launching this type of trading product.

In this review, we will analyze in detail what Bitcoin futures are, what they are used for, the principle of their operation, and the basic concepts from the specification. Here is a list and overview of 15 crypto exchanges, including regulated ones, where trading in futures contracts is available. The most liquid of them is Bitmex. It offers quarterly, weekly and perpetual contracts for cryptocurrency derivatives.

In continuation: the best exchanges for margin trading.

What is Bitcoin futures?

The peculiarity of futures is that upon expiration of the period specified in the contract, the cryptocurrency is bought/sold at a given price, even if the real exchange rate has changed. Each futures contract is for a certain amount of assets.

Bitcoin futures allow you to speculate on the expected price of a coin without actually owning it. The operating principle is the same as that of traditional investment assets. A trader can take a “long” position if he expects Bitcoin to rise; if there is already BTC and the exchange rate is expected to fall, then you can take a “short” position to mitigate potential losses (hedging).

One of the benefits of Bitcoin futures is the ability to trade them on select regulated exchanges. This is a good opportunity for those people who are worried about the legality of working with crypto exchanges. Another important advantage is that you can make money on changes in the price of Bitcoin without having to store the coins.

What are futures for?

Futures are used to make money on speculation and for hedging.

Speculation is making a profit from changes in the value of Bitcoin, and hedging is reducing the risks associated with currency volatility. During hedging, a trader takes a position that, in the event of a sharp drop in value, would compensate for losses. This ensures a balance between profits and losses. As for speculation, their main goal is to generate income from bets on the direction in which the Bitcoin rate will move.

Key points:

- Hedgers reduce their risks, but also significantly limit their profits.

- Speculators trade based on their guesses about where they think the market will go. For example, if a trader believes that the value of an asset is currently overvalued, he can place a futures contract at a lower price, and after a decrease, buy back the asset and thereby make a profit.

- Speculation is extremely risky and vulnerable to market declines and rises.

Hedgers attempt to reduce the risks associated with volatility and uncertainty, while speculators bet against market movements to try to profit from fluctuations in cryptocurrency prices.

Types of futures contracts

There are two types of Bitcoin futures:

- Deliverable. This is a contract, under the terms of which, after expiration (execution), the buyer is obliged to purchase, and the seller is obliged to give away, a specified number of coins. The price for delivery is the one set at the last moment of trading. If the buyer does not receive his assets on time, the exchange imposes fines.

- Settlement. This is a financial instrument that does not involve the transfer of cryptocurrency directly. Used for speculative purposes only. The calculation is carried out in relation to the difference between the value specified in the contract and the real one, which occurs at the time of expiration.

Both options have common features: their parameters are outlined in the contract specifications established by the exchange, and both parties involved are obligated to the exchange until the expiration of the futures.

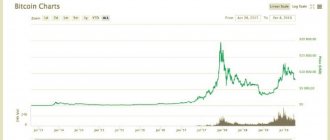

It's too early to rest on your laurels

Such a rush has not been observed for many months. The last time Bitcoin futures trading volumes on the CME exceeded $1 billion was in May 2020. For comparison, in December this average daily figure on the CME mostly did not even reach $300 million.

However, it appears that Bitcoin futures are coming back into vogue in the financial world. The graph provided by Skew shows a steady increase in the indicator over the past two months. This dynamics directly correlates with the Bitcoin exchange rate. If on January 1 the currency was trading around $7,300, then in February it was already testing areas above the psychological mark of $10,000.

In this regard, we have to admit that the rosy picture was greatly spoiled by the unexpected collapse in prices. Now it will be interesting to see how the recent Bitcoin flash crash affects players' interest in Bitcoin futures.

In addition, it should be remembered that an increase in futures trading volumes does not necessarily guarantee an increase in prices. It is possible that traders are betting on the currency falling. However, in any case, this indicator positively characterizes market activity and demand. It means that more and more people have begun to pay attention to Bitcoin.

Earlier, the editors of BeInCrypto already wrote about another indicator. Recently, the number of search queries with the wording “buy bitcoin” has increased on Google. This could also be a potential indication of an influx of new investors into the industry.

How Bitcoin futures contracts work

Bitcoin futures represent an obligation to sell or buy BTC in the future. Here's an example of how it works:

Let's assume that the current Bitcoin rate is $10,000. A trader believes that in the future the price will increase to $12,000. He buys perpetual or quarterly contracts in anticipation of an increase in the rate. Thus, he acquired the obligation to buy BTC at the market price at the end of the contract.

If the rate reaches the level set by the trader, then he will make a profit from the sale of contracts (he can also hold the perpetual futures for some more time if it is obvious that the price will rise further). However, if the rate does not reach the target and falls below the purchase price, the trader receives a loss.

You can buy and sell BTC futures at any time and make money on both downward and upward trends.

How does the future of bitcoin

A futures contract on the bitcoin — is a commitment to sell or buy a certain amount of bitcoins at a certain price before the expiration of the term of the contract.

Collateral, which is considered to be the price of the futures, may be only 10-15% of the transaction amount. In this case, there is an effect “leverage”, and the market appears possible for a small investment to get a relatively high income.

Derivative financial instruments are investments with high risks, as incorrectly predicting the price of the underlying asset, a market participant will rotheram much more, what he initially invested in the purchase of a futures. The performance of the obligations futures contracts is guaranteed by the exchange on the basis of legislation, in which it works.

Example:

For example, the price for one bitcoin is $1,000. You, as a trader, in the hope of a price increase to $2,000, buy 10 futures contracts on the bitcoin price $2,000 for a period 2 months at 10% ensuring, leaving as security $2,000. Actually, you have purchased obligation to buy 10 bitcoins at the market price at the time of expiry of the contract. Leverage in this case is 1000/200 = 5.

When the price reaches the $2000 you sell the contract to another market participant, making a profit $2,000 over invested in the purchase of funds, minus various fees and commissions, or leave the contract before the end of the term, if you think, that the price will go even higher.

However, if within two months the price did not reach $2,000, your contracts are automatically closed at market price. The bad news: the difference between the exercise price ($2,000) and the actual closing of the transaction is deducted from your security, that is, you run the risk of losing $2,000. Relatively good news: you will not lose more than your deposited collateral.

During the term of the contract you can sell or buy futures, their prices may differ significantly from the price of the underlying asset. Depending on the price of the underlying asset in a futures contract and the price of the asset on the market, you can earn not only on prices, but their fall. Any change with the right approach and analysis can bring to trader income, while in the market there are buyers and sellers need he futures contracts.

It is important: Taxes on investments

Major exchanges, such as the CME, set a fairly high threshold of entry into the market; smaller amounts can be traded, by signing a contract with one of the brokers. For example, in the specification for expected futures bitcoin, CME establishes the amount of the one contract in 5 BTC (now it is about $40,000). The minimum number of contracts for transactions and collateral for the contract is not yet established.

Exchanges for trading Bitcoin futures contracts

Let's consider cryptocurrency exchanges that provide the opportunity to trade Bitcoin futures.

Bitmex

BitMEX is a trading platform that provides traders with access to Bitcoin futures contracts: perpetual, weekly and quarterly.

Provides many supporting trading tools and a comprehensive API. Developed by financial professionals with many years of experience. Bitcoin perpetual contracts are a derivative product similar to traditional futures, but with slightly different specifications. The main difference is the absence of an expiration date.

- Contract symbol - XBTUSD

- Type – executed in XBT, quoted in USD

- Expiration date - unlimited

- Initial and maintenance margin – 1%; 0.5%

- Margin leverage – up to 100x

- Contract size - $1

- Financing interval - 8 hours

- Commission – maker -0.025%, taker 0.075%

BitMEX also supports quarterly futures for the Bitcoin cryptocurrency, the expiration date of which is three months. Currently, two such types of futures are open: XBTU19 (expiration September 27, 2019) and XBTZ19 (December 27).

The next type is weekly futures. XBT7D_D95 (down contract) is adjusted every 7 days. Its opposite is XBT7D_U105 (up contract), which is also updated once a week. Allows the owner to participate in the potential appreciation of the underlying trading asset. Up contracts can only be long.

Bybit

Bybit is a cryptocurrency derivatives trading platform with 24/7 multilingual customer service, an advanced order system and high-speed transactions.

Supports BTCUSD perpetual contract.

- Contract symbol: BTCUSD

- Type – executed in BTC, quoted in USD

- Expiration date - unlimited

- Initial and maintenance margin – 1%; 0.5%

- Margin leverage – 100x

- Contract size - $1

- Financing interval - 8 hours

- Commission – maker -0.025%, taker 0.075%

Deribit

The Deribit platform specializes in Bitcoin futures and the development of various options trading strategies.

Powered by the ultra-fast TRADE MATCHING ENGINE via a mobile or desktop interface. BTC Perpetual Contract Specifications:

- Contract symbol - Deribit BTC

- Expiration date - unlimited

- Initial and maintenance margin – from 1%; from 0.575%

- Margin leverage – 100x

- Contract size – $10

- Financing interval - 24 hours

- Commission – maker -0.025%, taker 0.075%

As for monthly contracts, for example, BTC Options BTC-25OCT19, their expiration date is on the last Friday at 8:00 UTC.

Binance

The Binance exchange plans to soon open trading in Bitcoin futures.

Two test trading platforms will be launched at once, and then management will monitor the progress of trading on both for several days. The maximum leverage size will be up to 20x with the prospect of increasing in the future.

Kraken

Kraken offers futures contracts for Bitcoin and a number of other cryptocurrencies (quarterly, monthly and perpetual).

Specification:

- Contract symbol: BTCUSD

- Expiration date – unlimited, monthly, quarterly

- Margin leverage – 50x

- Contract size - $1

- Commission – maker -0.02%, taker 0.075%

Bitforex

Bitforex is one of the top ten world leaders among crypto exchanges offering users safe and convenient cryptocurrency trading services.

It is distinguished by constant adaptation to market conditions and the introduction of new functions. On Bitforex, Bitcoin perpetual contracts are designated BTC/USD. Their specification:

- Contract symbol - BTC/USD

- Expiration date - unlimited

- Initial and maintenance margin – from 1%; 0.5%

- Contract size - $1

- Financing interval - 8 hours

- Commission – maker 0.04%, taker 0.06%

Xena Exchange

Xena Exchange - this platform from a Russian developer allows you to buy and sell both cryptocurrency and derivative contracts for it.

In particular, it was the first to integrate contract trading for the GRAM token from Telegram. Perpetual Contract Specification:

- Contract symbol - XBTUSD

- Type – executed in XBT, quoted in USD

- Expiration date - unlimited

- Initial and maintenance margin – from 5%; from 1.25%

- Margin leverage – up to 20x

- Contract size - $1

- Commission – maker -0.025%, taker 0.07%

Gate

Gate is a crypto exchange that has been operating since 2013 and offers all the basic functionality that is of interest to traders and investors in one way or another.

Perpetual Bitcoin futures have the following specifications:

- Contract symbol - BTC/USD

- Type – executed in BTC, quoted in USD

- Expiration date - unlimited

- Maintenance margin – 0.5%

- Margin leverage – 3x

- Contract size - $1

- Financing interval - 8 hours

- Commission – maker -0.025%, taker 0.075%

Delta.Exchange

The exchange allows you to trade quarterly futures and perpetual contracts for Bitcoin and the most popular altcoins with high leverage. Guarantees high liquidity in any market conditions.

- Contract symbol: BTCUSD

- Type – executed in BTC, quoted in USD

- Expiration date - unlimited

- Initial and maintenance margin – 1%; 0.5%

- Margin leverage – 100x

- Contract size - $1

- Funding interval – 1 minute

- Commission – maker -0.025%, taker 0.075%

Quarterly contracts BTCUSD_27Sep and BTCUSD_27Dec are available for trading.

Kumex

A trading platform from the Kucoin exchange that allows you to sell or buy contracts on BTC with leverage.

- Contract designation - XBTUSDM

- Type – executed in XBT, quoted in USD

- Expiration date - unlimited

- Initial and maintenance margin – 1%; 0.5%

- Margin leverage – 20x

- Contract size - $1

- Financing interval – 8 hours

- Commission – maker -0.025%, taker 0.06%

BaseFex

BaseFEX is a platform for trading professional perpetual contracts for Bitcoin, Ethereum and other cryptocurrencies. Offers Bitcoin futures against USD and USDT.

- Contract symbol: BTCUSD

- Type – executed in BTC, quoted in USD

- Expiration date - unlimited

- Initial and maintenance margin – 1%; 0.5%

- Margin leverage – 100x

- Contract size - $1

- Financing interval – 8 hours

- Commission – maker -0.02%, taker 0.07%

To Tether:

- Contract symbol: BTCUSDT

- Type – executed in USDT, quoted in USDT

- Expiration date - unlimited

- Initial and maintenance margin – 1%; 0.5%

- Margin leverage – 100x

- Contract size – 0.01 BTC

- Financing interval – 8 hours

- Commission – maker -0.02%, taker 0.07%

FTX

FTX is a cryptocurrency derivatives exchange developed “by traders for traders.”

The creators strive to make a platform powerful enough for professional trading corporations, but at the same time intuitive enough for beginners. Offers a maximum leverage of 20x. Supports perpetual and quarterly contracts:

- perpetual BTC-PERL;

- quarterly BTC-0927;

- quarterly BTC-1227 (for the next quarter).

FTX futures are different from others in that they are stable: stablecoins are used as collateral. Positions are easy to move due to the use of the same collateral currency.

Quarterly futures always expire on the last Friday of the quarter. Financing interval – 1 hour. Contract size is 0.001 BTC.

CME Group will launch Bitcoin futures trading

On Tuesday, CME announced that it plans to launch Bitcoin futures in the fourth quarter while awaiting compliance reviews.

CME Group (Chicago Mercantile Exchange Group) is the largest North American financial derivatives market, built by combining the leading exchanges in Chicago and New York. The group was formed in 2007 through the merger of the Chicago Mercantile Exchange and the Chicago Board of Trade. The organization's headquarters is located in downtown Chicago.

“Given growing customer interest in emerging cryptocurrency markets, we decided to introduce Bitcoin futures contracts,” said Terry Duffy, Chairman and CEO of CME Group.

The world's leading options and futures trading exchange is the latest entrant into the business of offering derivatives on Bitcoin, a volatile digital currency that is not listed on a major exchange.

Bitcoin futures contracts will be issued on a cash-settled basis and will be based on the CME Bitcoin Futures Reference Rate (BRR), which was launched in November 2016 in conjunction with London-based trading platform Crypto Facilities. The base rate is the daily settlement price published at 4 pm London time (noon Eastern time).

In 9 years, Bitcoin has come a long way, starting from home mining and becoming a means for illegally purchasing goods on the Internet. A whole industry of Bitcoin mining, production and sale of digital equipment for it, as well as services for the sale of cryptocurrency have emerged.

The emergence of Bitcoin derivatives is another step towards the development of digital currency as a more developed asset class. Tom Lee of Fundstrat said that his statement that Bitcoin would reach $20,000 in 2022 also assumed the presence of Bitcoin derivatives.

Some exchange-traded fund sellers have also filed for Bitcoin ETFs that would track Bitcoin futures contracts.

In August, the Chicago Board Options Exchange said its CBOE Futures Exchange plans to offer cash-settled Bitcoin futures by early 2020, pending review by the Commodity Futures Trading Commission (CFTC). CBOE is also working with Gemini Trust, a digital currency exchange founded by brothers Cameron and Tyler Winklevos, to use Gemini's market data to create Bitcoin derivatives and indices.

As BlockTower Capital Managing Partner Ari Paul told CNBC:

“The addition of CFTC-regulated Bitcoin derivatives will bring greater liquidity and legitimacy to the entire cryptocurrency ecosystem.”

Paul pointed out that since many institutional investors are unable to invest directly in Bitcoin, the launch of derivatives by a major exchange gives investors an entry point into the digital currency market.

New York-based digital currency trading platform LedgerX received CFTC approval to clear derivatives in July and began offering institutional clients the ability to trade Bitcoin options two weeks ago. LedgerX CEO Paul Zhou told CNBC via email that the company cleared $1 million in the first week and $2 million in the second week. He also said he expects new exchanges to start releasing similar products. It should be noted that despite its rapid growth, the volume of transactions is still relatively small.

Want more news? Facebook. Fastest? Telegram and Twitter. Subscribe!

#BlockTower Capital #CBOE Futures Exchange #ceo #Cftc #CME Group #CNBC #Fundstrat #ledgerx #Ari Paul #bitcoin #Winklevos #Paul Zhou #Terry Duffy #Tom Lee

- https://plus.google.com/+Roman Devyatov Roman Devyatov

Hmm...

American regulated exchanges with Bitcoin futures

In the United States, the cryptocurrency industry is viewed very warily. Therefore, the use of exchanges approved by regulators and operating completely legally is gaining relevance.

CME (Chicago Mercantile Exchange Group)

The platform is considered one of the widest and most diverse derivatives markets in the world.

Provides the ability to trade futures, options, currencies and over-the-counter market assets. Provides access to effective risk management in each of the major asset groups. At the Chicago Mercantile Exchange Group (CME), Bitcoin futures trading is currently breaking all records. Tim McCourt, the company's CEO, notes that now is generally the optimal period for working with futures and crypto assets in general.

Bakkt

The Bakkt cryptocurrency platform, based on the results of negotiations with interested partners, is launching the opportunity to trade Bitcoin futures from September 23, 2020. Two types of contracts will be offered:

- with daily settlements;

- with monthly payments.

Futures contracts will be margined by ICE Clear US, including initial and variation margin. This approach makes risk management very effective; it is used in the world markets of gold and oil, as well as stock indices.

LedgerX

At the end of July 2020, the cryptocurrency derivatives platform became the first American project in the world to launch the ability to trade options and futures.

For this purpose, they opened a special platform – Omni. We are talking specifically about deliverable futures: therefore, after the contracts expire, traders receive not fiat money, but real Bitcoins. You can also make purchases using cryptocurrency.

The impact of futures on the rate and market of bitcoin

Why analysts believe, the emergence of futures contracts for bitcoin will cause the price increase of bitcoin itself? Mainly, the case in the interest of large traditional financial institutions, acting solely in the framework of current legislation and having a strong analytical Department, that would not be allowed to make decisions about the launch of futures on bitcoin, not having considered the financial, reputational and other risks.

The presence of futures contracts on bitcoin on the traditional exchanges will actually make the situation bitcoin “lawful” within the existing financial and legal system. Bitcoin, and later, possible, and other cryptocurrencies, will become one of traded on global exchanges asset classes, taking place among the precious metals, energy, agricultural products, government bonds and many other commodities and securities, which are futures contracts.

The existence of financial guarantees for transactions in derivatives bitcoin is certainly able to increase the investment attractiveness, and hence the demand for the underlying asset and its price. This means, the global demand for bitcoin and the market liquidity will increase significantly. Given the limited resource and predictable emissions “digital gold”, these factors should significantly increase the price while reducing its volatility. And this will make bitcoin even more attractive long-term investment.

However, every medal has two sides, and out of bitcoin on “adults” markets bears significant risks for its future. Indeed, in contrast to the classic trade, that is, the direct exchange of bitcoins for dollars and other currencies, derivatives can move the price up, and down. This opens a wide scope for market manipulation and may not only raise, but to drop the price of bitcoin.

It is important: Develop the cryptocurrency

For example, if large traders on the same CME will open up contracts for billions of dollars on the drop of bitcoin, on the cryptocurrency exchanges, there will be panic and traders will drop massively bitcoins, and there, where the opening of trading on margin – open “short” the transaction, or “shorts”. This will cause an uncontrollable collapse in prices – after all, bitcoin does not “bottom” and its participation in the real economy very slightly.

Despite the optimism of large holders of bitcoin, speculators, armed with derivatives, and large reserves of liquidity, can easily derail the price many times, even for a short time. This means that the introduction of bitcoin futures on major exchanges should be treated with caution and not expect the explosive and continuous growth. Bitcoin has yet to gain a reputation among institutional investors.

History: how futures appeared

Traces of futures trading can be seen as early as 1750 BC in Mesopotamia. King Hammurabi's legal code stated that goods and assets must be delivered at an agreed price at a future date, based on a written contract.

If we talk specifically about financial exchange futures, they have been actively used since the 1970s. Previously, their trade was mainly associated with agricultural products, but in 1971 there was a turning point in the industry - the abolition of the gold standard for currencies. Market leaders immediately realized that the principles of trading currencies were now no different from trading commodities. Therefore, futures can also be used here.

The concept received support from economists, and they were not mistaken - currency futures soon became an integral part of international finance.

Basic Concepts

Key terms related to the topic of Bitcoin futures:

- The contract specification is a document approved by the crypto exchange, which covers most of the contract parameters that are important for traders.

- Expiration – completion of the validity period of derivatives contracts (futures and options) on a crypto exchange, fulfillment by both parties of obligations under the derivatives contracts.

- Initial margin is the amount that the exchange wants to see in the trader’s account at the time of opening a position for each futures contract he opens.

- Maintenance margin is the minimum amount placed in a trader's account to maintain an open position for each contract after the first clearing.

- Funding is a concept common in peer-to-peer (peer-to-peer) exchanges that helps support both shorts and longs. Once every certain period of time (usually 8 hours), a redistribution of funds occurs, during which finances are transferred to the weaker side from the strong one. For example, if the shorts dominate, then they pay the longs and vice versa.

- Margin leverage - shows how many times the exchange is willing to increase your available funds so that you make a larger transaction. Leverage is a loan and you have to pay interest while you use it.

- Marking price. All contracts created on the exchange are marked depending on the PNL (profit/income ratio) and liquidity level. The marking price helps in determining the listed parameters.