About the broker

| Name | eToro (UK) Ltd eToro (Europe) Ltd |

| Year of foundation | 2007 |

| Regulator | CySEC, FCA |

| Licenses | No. 109/10 CFTC (CySEC) and FRN 583263 (FCA) |

| Requisites | Not listed on the official website |

| Reliability rating | No data |

| Trading platforms | Markets: precious metals, stock, American, futures, foreign exchange |

| Trading platform | Online trading on the website |

| Minimum deposit | $50 |

| Authorized capital | No data |

| Head office address | Kanika Business centre, 7th Floor, 4 Profiti ilias street, Germasogia, Limassol |

| Official site | etoro.com/en |

| Hotline number | 8-800-500-43-80, +7-495-648-64-43 |

| Free demo account | Yes |

| Minimum commission | 1.5% of the transaction amount |

| Rating | 9.1 out of 10 |

Story

The eToro company began its activities in 2006, registering in the capital of Cyprus - Limassol, from where the organization is still managed. In 2008, the official website eToro com was launched, by visiting which you can get acquainted with the services offered, open a trading account or your own investment portfolio. Also, from this period, reviews from the first clients began to appear, which help form an opinion about the eToro broker.

The main idea of creating the company was to introduce its own trading platform based on the formation of a large trading community. Here there is clearly a bias more towards investing through subscribing to the accounts of successful traders and using a transaction copying service. But at the same time, the eToro trading platform has a number of advantages that will especially appeal to beginners, and the broker itself offers comfortable trading conditions and fast execution, which professional traders cannot help but appreciate.

Such a successful fusion of profitable offers has led to the fact that today the eToro community unites over 4.5 million traders from 140 countries!

Terms of service and tariffs

| Account types | “Standard” and “Premium” (over $20,000). A personal manager and accelerated withdrawals are available for premium clients |

| Broker commission | 1.5–2.5% of the transaction amount |

| Exchange commission | No data |

| Depository commission | eToro does not provide custody services |

| Terminal fee | For free |

| Fee for withdrawal of funds | $5–25 |

| Deposit and withdrawal methods | Replenishment: electronic payment systems, bank cards Withdrawal: bank account, electronic payment systems, bank cards |

Commissions and tariffs

* we update the information, but commissions and tariffs may change, check the latest information on the broker’s website

Transactions

| Foreign exchange market, Derivatives market | |

| Currencies (not available for Russian citizens) | Spread on Currency pairs depending on the pair, for example: USDEUR = 3 pips Transfer of a position overnight (rollover) according to the formula: (quantity * price) * (1%/365) + (units of measurement * market rate for tomorrow) Stocks and ETFs spreads and rollovers are only applied if they are contracts for difference (CFDs). There are no spreads or rollovers on real stocks. |

| Stock and ETF Price Contracts | spread between buy and sell prices = 0.09% rollover to buy = 6.4% + 1 month LIBOR rate (~1.55%) (for example rollover of $1000 per day = $0.22) rollover to sell = 2.9% + 1 month LIBOR (for example, transferring $1000 per day = $0.22) |

| Contracts for differences in commodity prices and indices | Spreads depending on the contract, for example: oil = 5 pips gold = 45 pips S&P500 = 75pips Rolling over a position overnight using the formula: (quantity * price)*(1%/365)+(units*market rate for tomorrow) |

Storage and account management

| Storage | free, because assets are not stored |

| Account management | for free |

Additional fees

| Margin lending | Leverage: 1:1 – 1:50 |

| Terminal | Web, iOS, Android - free |

| Withdrawal of funds | All withdrawals = $5 Club Platinum and above clients receive free payouts |

Tariff plans on the broker's website

Broker Products

eToro has a range of basic and advanced tools.

Structured Products

eToro offers clients the following products:

- Margin trading (“with leverage” of 1:25 for CFD contracts and 1:100 for other transactions). The client uses his own and borrowed funds when working.

- CopyFunds. Investment portfolios with profitable assets have been formed. To use, you must have a minimum of $5,000 in your account. Yield up to 40% per year. The most popular portfolio is BigTech (shares of Apple, Google, Microsoft, etc.).

IPO

eToro does not offer clients participation in the IPO.

More

The broker maintains a blog about social trading on the official website, which is constantly updated with new and useful information.

What is social trading with eToro

Social trading (trade copying service) is the main feature of the broker; most eToro client reviews are about it.

Social trading tools:

- CopyTrader transaction copying system. Own patented technology that allows you to copy transactions of other investors automatically. The investor finds a trader from the list and selects the amount of capital to invest. After which all positions and orders will be instantly copied to the investor’s account;

- People Discovery. The number of traders in the eToro network is just over 5 million. This system is a convenient mechanism for finding the right investor based on the criteria and needs specified in the advanced search;

- Top Traders' Insights. A widget that is located in the “Trading Tools” of the trading platform. It is a sentiment indicator that displays traders' sentiments. This is a kind of hint for the investor, showing the most actively traded instruments with quotes. Activity statistics are based on trading of the 1000 most successful eToro traders;

- economic calendar, stock news, pips calculator - a classic set of tools that many brokers have.

I also recommend reading:

The Central Bank of the Russian Federation canceled the licenses of the Forex club, Teletrade and Alpari

Why Alpari, Forex Club and Teletrade lost their license from the Central Bank

Not long ago, the broker acquired a new tool - the CopyFunds investment fund, which is an analogue of trust management. The investor is encouraged to make a deposit, select a portfolio in accordance with the strategy and trust the professionals from the eToro investment committee. The minimum investment amount is $5,000. USA. Strategies are predominantly medium- or long-term, assets are ETF funds and other instruments inherent in hedge funds.

And another interesting offer for traders from eToro is the opportunity to obtain Popular Investor status. This service allows the investor to receive a discount on the spread and commissions from the amount of managed assets.

The social trading service turned out to be so interesting that large corporations decided to invest in it. In November 2014, Sberbank and Ping An (China) invested about $27 million in the broker’s technological developments. USA, later Commerzbank joined the strategic partnership. Then a joint venture with eToro and Sberbank was created in Russia specifically for the Russian market, offering services as a social trading platform. Today, the broker's offer is being actively promoted on the Sberbank website.

additional services

eToro does not boast a wide range of additional services.

| additional services | Availability |

| Help from managers | No |

| Trust asset management | No |

| Share insurance | No |

| Bonuses and discounts | No |

| Competitions | No |

| affiliate program | Yes (for owners of websites, blogs, channels, communities) |

Working with a broker

The procedures for interaction with the intermediary are clearly regulated and maximally optimized.

Registration on the official website

You can only register with eToro online. The following information is indicated:

- Name;

- Email;

- password;

- telephone.

It is necessary to agree with the terms and policies for the processing of personal data. Simplified registration via Facebook and Google is available.

Instructions for opening an account

Opening an account with eToro is free. After registration, an email will be sent to you. Follow the link there to activate your account.

In your personal account on the official website you should indicate the following information:

- real full name (otherwise it is impossible to pass verification);

- age;

- floor;

- address;

- stock exchange experience;

- level of familiarity with trading;

- preferred assets and strategies;

- investment goals;

- acceptable level of risk (1–4 low, 5–7 medium, 8–10 high);

- earnings for the year.

The information is confidential and is not passed on to third parties.

You can choose a trader on eToro by rating or a set of parameters. It is advisable to focus on the best investors (low daily drawdown rates, risk level up to 4), those who are in the trend (the number of copiers has sharply increased), and the most copied. At any time, you can write a message to the trader through the form on the official website.

Personal pages display information about trading history and profitability, risk level, open positions, and author's analytical reviews. There is a profitability calculator. When repeating transactions, the amount of loss at which copying stops must be established.

Demo account

Demo account at eToro with 100,000 virtual dollars - imitation of trading on the exchange. Helps you acquire trading skills without the risk of losing real money, understand the nuances of eToro software and learn how to make investment decisions. Available to clients after registration.

Account replenishment and withdrawal of funds

You can fund your eToro brokerage account in the following ways:

- bank cards;

- electronic payment systems (Yandex.Money, WebMoney, Neteller, PayPal).

The minimum deposit amount is $50, for working with shares $100. The maximum amount for the first deposit is $4000. After verification, it is permissible to deposit $50,000 at a time. To form an investment portfolio, a minimum of $300–500 is required.

Withdrawing funds to electronic wallets (Yandex.Money, WebMoney, Neteller, PayPal), cards or bank account takes several days. An application submitted on the official website can be canceled before confirmation.

Standard commission:

- $20–200 – $5;

- $200–500 – $10;

- over $500 – $25.

Technical support

You can get technical support from eToro in the following ways:

- By phone +7-495-648-64-43 or 8-800-500-43-80 (from 10.00 to 19.00 Moscow time).

- through a special form on the official website.

- Ask for help in groups on Facebook and VKontakte.

- In online chat.

How to get started with eToro?

When you first start working with eToro, you will need to go through the process of registering a trading account. This procedure is standard for all platforms, so there should be no difficulties. So, to get started with eToro you need:

1.

Go to the eToro website and select “Join eToro ”

It is absolutely free and does not take much time. It is possible to register through Facebook and Google accounts. To do this, you need to enter your email address, username and password. After this, the registration procedure can be considered complete. Now you have discovered the world of online investing! Of course, there will be no money in the account, since you have not yet started copying traders’ transactions.

Registration with eToro:

2.

Deposit

If you do not want to open a deposit at the initial stage, then such an opportunity is available. You can leave everything as is and start working in trial mode. But to get real profit in the investment process, you will need to open a deposit in any case.

To do this, click on the “Open deposit” button located in the upper right corner of your personal account page. The minimum deposit amount is $50. You can deposit funds into your account either using a credit card or through the PayPal electronic payment system. I recommend opening accounts with at least $200, since in order to copy the trades of one trader you will need $100. You shouldn’t put all your eggs in one basket; it’s advisable to copy at least two traders at once.

Important: The main currency of the eToro trading platform is the US dollar $USD, but you can also invest in euros, rubles and other base currencies. All of them are ultimately converted into dollars upon crediting to a personal account.

3.

Getting to know the platform

I will give a brief overview of the main sections of the eToro platform. A more detailed excursion into the features of the platform will be made later. Next, I will also talk about how to choose the “right” trader and how to trade on your own.

a.

News Feed / News Feed

This is something like a news feed on the famous Facebook, only the topic, of course, is financial and stock exchange. Also, the structure of the feed receives signals about any activity of traders who are subscribed to.

b.

Portfolio / Portfolio

This is the “center of the universe” of your journey into the world of investment. Here you can monitor all open trades in real time with real quote data. It is in the “Portfolio” section that the statistics of your trading and completed transactions are analyzed.

c.

Watchlist / List of watched users

You can personally select those trading accounts that are interesting to you, invest your funds in them or copy their transactions. It is possible to create multifunctional lists.

d.

Community / Community

The heart of the eToro trading platform, which in all respects corresponds to a traditional social network. It is possible to monitor individual traders, search for interesting people using filters, etc.

e.

Markets / Markets

A place where you can realize your potential in market research, analysis of stock exchanges, currencies, commodities, indices and ETFs.

Now that you are a full part of the community, I want to tell you the top three ways to invest in eToro.

Pros and cons of the company

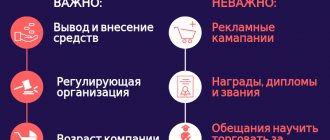

eToro Benefits:

- 12 years on the market;

- licenses from renowned European regulators;

- reliable partners (Sberbank, Commerz Ventures, PINGAN, etc.);

- many active clients;

- various instruments;

- professional traders from all over the world;

- Russian-language interface of the official website;

- independent level of risk.

Disadvantages of eToro:

- high commission fees;

- poor technical support;

- there is little information on the official website and on the Internet;

- The opening price on the account may differ from the trader's opening price due to high volatility.

Real reviews

There are a lot of eToro reviews online, mostly from customers.

Traders

It was not possible to find traders' opinions about eToro on the Internet.

Clients

Reviews online vary. eToro appeals to clients with no stock trading experience. Extended statistics on traders on the official website allows you to make the right choice. Copying trades is convenient and execution is fast. Many people mention good specialists in selecting investment portfolios.

There are also negative reviews. The main problems of eTopo are unpredictable commissions (do not correspond to the stated conditions) and wide spreads (much more than the stated 0.18 points).

Employees

We couldn't find any employee reviews of eToro.

Trading with broker Etoro

Etoro offers a wide selection of assets to trade. Here users can work with cryptocurrencies, stock indices, stocks, commodities, fiat currencies.

The company offers 9 types of cryptocurrencies, including:

- Bitcoin.

- Ethereum.

- Bitcoin cash.

- Ripple.

- Dash.

- Litecoin.

- Ethereum classic.

- Stellar.

- Neo.

Having selected the appropriate asset, the trader can open the chart window and see the dynamics of price movement.

Statistics on the selected instrument are also presented here - the previous closing price, daily price range, extreme points for the period, profitability for the year.

The news feed promptly updates current information on the asset.

Like any Forex broker, Etoro does not provide services for buying or selling digital assets, but provides the opportunity to trade CFD contracts - contracts for difference. That is, having chosen a pair, for example BTC/USD, a trader buys an asset if he assumes that its price will rise.

Let's say the purchase is made at a Bitcoin price of $7,500. If his forecast is correct and the transaction is closed at a higher price, then the difference between the sale price and the purchase price will be the profit on the transaction.

Let's say the trade was closed at a price of $10,000. The difference between the opening and closing prices is $2,500.

The profit in the transaction will depend on the lot, i.e. traded volume and commission.

The sale of assets is carried out in a similar way. At the same time, the client, making a short sale, is not the owner of the asset.

By selling at a higher price and closing the deal at a lower price, the trader earns income.

The advantage of this approach is that the user can sell, for example, bitcoin at a time when its price decreases and, at the same time, not actually have the cryptocurrency in his wallet. When purchasing, the trader will also not receive cryptocurrency and will not be able to withdraw it. Another advantage of this approach to trading is that Forex brokers are not of interest to hackers. They do not have internal wallets; money is kept in banks.

The platform also provides the ability to select a trader whom the user will “follow” (copy his trades).

A simple filter is offered that allows you to determine the country of registration of the trader, the markets with which he works, as well as the percentage of profit he receives over a given period of time.

Not long ago, the Etoro broker offered its clients a new feature - CopyFunds . This product is designed for those who want to engage in portfolio investing. The ability to build an investment portfolio according to the strategy used by a particular fund helps to use funds effectively and diversify risks.

For professional traders, the platform offers the opportunity to receive additional income from subscribers.

Etoro offers several types of platforms. The basic option is WebTrader. This terminal loads directly in the browser and does not require installation, like MetaTrader.

Another option is OpenBook. The platform was developed specifically for social trading. Since 2015, both platforms have been merged into one to provide traders with additional options.

Finally, the broker has a mobile version for full operation. Moreover, it combines OpenBook and WebTrader. Supported by iOS and Android operating systems.

go