Hello, dear readers. The topic of today's article: investing in cryptocurrency.

Do you have available funds? Quite a bit - at least 10-20 thousand rubles? You've probably thought more than once about investing it somewhere, but each time you chose not to.

This is understandable: banks give too low a percentage, playing in the stock markets requires knowledge and instinct, the rest may turn out to be ordinary “scammers”.

What to do if you have very little savings, but want to have a good return?

There is a great way to invest a very small amount, but get significant income after just a few months. This method is investing in cryptocurrency. Today I want to talk about what it is, as well as what cryptocurrency to invest in in 2020.

What is cryptocurrency?

Let's start with simple things, namely, let's find out once again what cryptocurrency is for an investor.

Cryptocurrency is a digital asset (something like money, only expressed not in paper or gold, but in the form of a code), the accounting of which is completely decentralized. This means that there is no “center” that would mass issue Bitcoins or other cryptocurrencies. Because of this, no states or courts can control their circulation.

Why is he so popular?

Of course, this approach could not but affect the popularity (and, as a result, the exchange rate) of Bitcoin.

As soon as people began to understand what cryptocurrency is, the rate of its very first type (bitcoin) began to rise sharply. Even today, almost 10 years after the appearance of the most popular cryptocurrency, investing in Bitcoin is very profitable - its rate increased by more than 300% in 2016.

Are there any other reasons?

The popularity of Bitcoin led to the emergence of other cryptocurrencies.

Some time later, after the appearance of Bitcoin, other similar systems began to appear. Nowadays, people who want to invest in non-traditional assets have a large choice in this market, because now on exchanges you can find a good dozen strong and fast-growing competitors to Bitcoin.

Especially among altcoins (as all cryptocurrencies other than Bitcoin are called today), I would like to highlight DASH and ETH. In 2020, the rates of this “digital money” increased 12 and 8 times, respectively. The difference compared even to Bitcoin is huge: probably no asset in the world brought the same profit last year as altcoins.

Is it really that simple?

However, I would not rejoice at the opportunity to get rich quickly - there are plenty of pitfalls here, as in other areas of investment.

Investing in a cryptocurrency, especially an alternative one, is always dangerous: if ordinary assets always have some prospects for a protracted decline or long-term growth, then for bitcoins and other “digital money” they practically do not exist.

Raising or lowering the rate in just a few hours is within the power of a large group of speculators who will act in a coordinated manner.

Over the almost 10-year history of the existence of bitcoins, there have been several cases when the rate fell very sharply and for almost no reason. Thus, on January 1-2, 2020, the Bitcoin rate was $1,153, and on January 5 it dropped to $850.

Altcoins are a good alternative to Bitcoin: their profitability is even higher than that of the most popular cryptocurrency, and the risks are not much greater. However, this will not always continue: for other “digital currencies”, market analysts predict a transition to stagnation in 2-3 years.

Ways to Invest in Bitcoin

With the development of the crypto industry, the number of opportunities for profitable investments in Bitcoin and alcoins is increasing. Among the main methods of crypto investing in 2020, the following should be noted:

1. Buying coins is the most common method, which involves purchasing an asset at a favorable price with the prospect of a further increase in its value. Bitcoin remains the most popular coin for investment today. Altcoins can bring significant income. When choosing an asset, experts recommend taking into account the totality of its characteristics - such as market capitalization, dynamics of price changes, innovativeness and usefulness of the product.

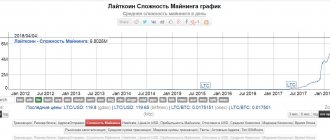

2. Investing in mining is a method that ensures participation in the creation of cryptocurrency. The initial investment in equipment pays off within 1-2 years (taking into account the existing complexity of the network). A miner can reduce costs by connecting to one of the cryptocurrency pools or receive passive income from purchased capacities in a cloud crypto mining service.

3. Participation in ICO is one of the most profitable, fastest and riskiest ways to invest. According to statistics, the average income from investments in blockchain startups, taking into account failed projects, in 2020 was about 1300%. However, the investor needs to carefully study all the information about the product - starting from the idea, the possibilities for its implementation and ending with the development team.

4. Investing in cryptocurrency funds is an opportunity to invest in Bitcoin or other coins at a certain percentage, without having to independently assess the prospects and risks. Such investments require trust management carried out by a team of professional traders and analysts. The most famous funds: The Token Fund, Draper Associates, Digital Currency Group, Blockchain Capital, Andreessen Horowitz.

Advantages and risks of bitcoins

Next, we will get acquainted with the main prospects and risks that await those who are going to invest in Bitcoin at interest.

To decide whether to invest your own money in cryptocurrency or not, you need to understand what financial benefits it will bring and what risks you will have to face. Here I will try to describe everything in as much detail as possible, but you will need to make a decision about investing in Bitcoin yourself.

Pros of investing in Bitcoin

- Quite stable growth. Throughout the history of Bitcoin, there have, of course, been big drops, but this happened infrequently: on average, once every 2-3 years. The fourfold growth in 2020 significantly outweighs the declines: a successful investor can, having invested in the most popular cryptocurrency, not experience a drop in its value over the course of a year.

- User trust. Bitcoin managed to become popular: even while declining, it subsequently grew sharply. Today, a huge number of Bitcoin users act as a kind of “guarantor” of its stability: several million literate people cannot trust an unreliable asset, right?

- High liquidity. Selling Bitcoin today is not a problem: Bitcoin ATMs are opening all over the world, the number of Bitcoin exchanges is increasing every year, and even some retail outlets accept the most popular cryptocurrency.

- Independence from external events. Probably only failures in computer systems can have a negative impact on Bitcoin. Political, economic, social “squabbles” - Bitcoin doesn’t care about all this: it is completely decentralized, and events in any country or region, in fact, do not affect it in any way.

- Low control. Bitcoin today is one of two means of payment (the other is cash), the circulation of which is almost impossible to control. This is very convenient: supervisory authorities do not know how much money you have, where you keep it and what you spend it on.

- Low commissions. Maybe not the most important advantage of Bitcoin, but I decided to talk about it. Today, although commissions are charged for storage, exchange and other operations with the most popular cryptocurrency, they are small, which distinguishes them favorably from money stored in banks. As financial institutions charge more and more for their services, this advantage of Bitcoin will come to the fore.

Risks and Disadvantages

- Scaling problem. The Bitcoin network grows over time as the number of Bitcoins increases. However, the throughput of the cryptocurrency network does not change, which is why problems with transfers are already arising today. The most important negative consequence is the increase in the time it takes to transfer bitcoins from the sender to the recipient. Often they simply get stuck in the network. In addition, limited bandwidth made small-scale bitcoin transactions unprofitable. The problem is being addressed by both Segregated Witness and Bitcoin Unlimited today, but they have still not been able to completely eliminate it. This means that if the protocol remains old, the system will pass through less and less bitcoins, which will lead to a decrease in the attractiveness of bitcoin for investors. Those bitcoin owners who suffer the most from the problem are those who prefer to store their funds not on exchanges, but on local wallets: in order for their bitcoins to get into the system, they need to be transferred from their own storage, and today this takes a lot of time and takes a lot of nerves.

- Possibility of a “bubble” formation. Many investors have serious doubts about whether to invest in Bitcoin in 2020. The thing is that in less than five months the exchange rate has almost doubled (January - $1,000, mid-May - $2,050). Of course, there are also objective reasons for Bitcoin, of which there are also many, so the current growth does not necessarily need to be viewed as a “bubble” that will definitely burst. Of course, the volatility of Bitcoin is very high (however, one should not expect anything else from an asset with such profitability), however, many analysts predict its rapid decrease due to the stabilization of the development of the most popular cryptocurrency.

Classic investment strategies

Mining is one of the investment options that requires considerable expenses for the purchase of equipment. We will look at the main strategies used by investors with different amounts of available funds: investing in Bitcoin (bitcoin - BTC) for growth and trading cryptocurrency.

Regularly monitor the bitcoin rate in order to sell it on time and make a profit

For growth

Suitable for everyone, even beginners.

Required:

- Get a wallet.

- Select a trading platform.

- Purchase cryptocurrency and transfer it to a wallet for storage during the period of currency growth.

- Wait for the price to go up.

- Transfer from wallet to balance.

- Sell.

Features of such investments:

- Patience is required. As the history of falling and rising prices shows, you will have to wait 1 or even 2 years for a significant increase.

- To protect your Bitcoin investment, it is recommended to store your wallet on a flash card. The main thing is not to lose it, since it is not possible to restore it.

We make money thanks to these investment platforms:

CryptoCards.Plus reviews and review of the Crypto Cards Plus project with an average daily yield of 0.8%

ComexTrades.com reviews and review of the investment platform with a yield of 1.5% per day

8bit.ltd - review of 8 bit ltd and review of the project with daily earnings from 0.5%

Exchange trading

It is desirable to have experience in trading Forex and/or binary options, since the principle of earning money is similar.

Necessary:

- Find an Internet service.

- Top up your balance.

- Decide on a strategy.

- Buy and sell cryptocurrency.

Among the disadvantages of this method, in addition to having experience, it is worth noting:

- to achieve a good profit you will need to invest a fairly large amount in bitcoin;

- time spent on trading, as well as studying the basics and nuances of the cryptocurrency market;

- there is a high probability of losing all funds due to price fluctuations and all responsibility lies on the shoulders of the trader.

Special exchanges can be found in the public domain on the Internet

How to choose an exchange for trading

To select a site, you must follow the following rules:

- Please pay attention to the trading volume. This indicator indicates the popularity of the site. The more traders trade on it, the higher the turnover, which means you can trust your money.

- Reputation for Bitcoin investment. You should read the reviews, paying attention to the withdrawal speed, sudden changes in the schedule leading to a drain, and other performance indicators.

- Commission size. Less is better.

- Restriction for traders from certain countries.

- Conversion rate. Study this indicator, since the difference in site offers can reach 11% or more.

Some sites refuse to serve users from some countries

Contribution

In addition to the classic strategies for making money on Bitcoin, an option similar to a bank deposit has recently become increasingly popular. HYIP projects offer to invest in Bitcoin and receive interest. The storage period can reach several years, and the interest rate directly depends on the amount invested.

Minuses:

- Short lifespan of many projects.

- Delays in payment of funds.

- Account blocking for various reasons with balance reset.

Due to the high risk of losing investments, you need to take a responsible approach to choosing a project and trust money to companies:

- We have been working in this direction for a long time.

- Having good reviews on the Internet.

- Paying profits within the agreed time frame.

- Returning the deposit to the investor upon request.

Along with high profits, investments in HYIPs are characterized by high risk

How else can you invest money in bitcoins at interest and earn money? Offers come not only from hype projects - highly profitable investment options with a very high possibility of losing money.

Many sites offer deposit programs where interest is accrued depending on the term and amount. For example, when placing for 2 weeks, up to 1% per annum , for 1 month – 3% , and for a year – 5% .

How to invest money in Bitcoin:

- Register using your BTC wallet number.

- Open an account.

- List bitcoins.

At the end of the deposit period, the funds will be listed on the balance, from where they can be withdrawn to the wallet or re-invested.

Advantages of deposits:

- Passive income generated from the difference between the purchase and sale of currency, as well as the interest accrued by the project.

- No knowledge of the cryptocurrency market or exchange trading experience is required.

- Save time.

- Use the deposit at your discretion: withdraw, cash out, reinvest, etc.

Do not forget about the risks of investing in Bitcoin through an exchange. They relate to non-trading types, namely the possibility of closing the exchange at any time.

Some exchanges have money back guarantees in case of a site hack, as well as prompt payments and refunds

Lending

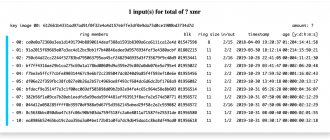

To borrow tokens you need:

- Register on a special exchange.

- Find an offer that meets the conditions among the advertisements.

- Take out a loan.

Let's figure out how to invest in Bitcoin through lending:

- Register on the exchange.

- Transfer currency to your account.

- Place an ad.

- Approve the application.

- Wait until the end of the loan term,

- Get your tokens back with interest.

The required amount can be borrowed from one lender or several, collecting it in parts

Benefits and risks of altcoins

Altcoins are all digital currencies other than Bitcoin. Investments in them today are also profitable, but there are plenty of risks here.

Let's look at the main features of altcoins.

Growth prospects

Altcoins are young cryptocurrencies: most of them are not even five years old. As I said at the beginning, DASH and ETH saw 12x and 8x increases in value in 2020 (Bitcoin “only” increased 4x in value in comparison). Other digital currencies also have the potential for almost unlimited growth: very few people know about them yet.

"Low Base"

The “low base” effect is something that can ruin inexperienced altcoin investors: knowledgeable players take it into account, but those who began investing in an alternative cryptocurrency after its multiple growth may face great disappointment.

What is the “low base effect”? I won’t bog you down with theory, but will go straight to an example.

So, imagine a situation in which some cryptocurrency costs $2. Its popularity is not yet very high - investors do not consider such a digital currency a highly profitable asset and do not pay attention to it.

“Boost” players take advantage of this, starting to massively increase the rate of the cryptocurrency, and after a month its rate is already $32.

An increase of 5 times is huge, but it was not supported by any fundamental reasons, but only by the activities of the players, which tomorrow could turn completely in the opposite direction.

In addition, although in relative terms the increase was 5 times, in absolute terms the price of the altcoin increased by only $30. If the price of such a currency increases by 30 dollars again, then its price will be 62 dollars. Not to mention that it will be much more difficult to “warm up” such growth; the relative increase will be much smaller: 62:32 ≈ 2.

A twofold increase, of course, is also not bad, but inexperienced investors are counting on a fivefold increase!

That is why the “low base” effect should definitely be taken into account when paying attention to the positions from which the altcoin began to grow.

Speculation and what you need to know about it

This factor mostly applies to those alternative cryptocurrencies that have weak capitalization, however, more stable altcoins can suffer significantly.

The smaller the capitalization (total volume) of an alternative digital currency, the more opportunities manipulators have to “play” with their rate, sharply raising or lowering it depending on their desires. Sometimes it is impossible to identify speculation even based on an analysis of long-term changes in the cryptocurrency rate: sometimes it can artificially rise or fall for several months or even years, and then return to its real values.

As a result, those investors who suffer are those who, having discovered the promise of cryptocurrency, invested a significant part of their funds in it, and then “burned out” when the rate returned to its fundamental values.

It is possible to escape from the influence of speculators only through a comprehensive analysis of the technology on which the altcoin is based: if it is truly promising (for example, ETH), then even the combined efforts of many manipulators will not be able to stop the reasonable growth of the rate.

Trends and interesting characteristics of cryptocurrencies

The next thing I must tell you about is the trends that exist in the world of cryptocurrencies today.

Reducing the "importance" of Bitcoin

The first (and probably the most important) is the reduction in the “importance” of Bitcoin.

What I mean?

At the beginning of 2020, Bitcoin accounted for more than 80% of the mass of all cryptocurrencies, but today this figure only slightly exceeds the 50% mark. The capitalization of all altcoins increased to $28 billion (for comparison, in 2020 it was $1.7 billion).

This is a trend you should definitely pay attention to when deciding where to invest in 2020 - it is quite possible that the most profitable investment will be buying an alternative digital currency rather than Bitcoin.

Income from storing cryptocurrency units

The next interesting feature of altcoins is income from storing cryptocurrency units.

For example, DASH masternodes bring income to their owners (provided they maintain “online” status) from coins mined by miners. If the formation of new altcoin units occurs through POS mining, then if the investor has funds in the local wallet and there are no transactions with them during a certain period, interest “drips” onto them.

The presence of “voting rights” for the investor

Another characteristic of an altcoin that can play a decisive role in deciding which cryptocurrency to invest in is whether the investor has “voting rights.”

What is it?

If the owner of altcoins accumulates a certain percentage of all units of a given digital currency, then he acquires a certain influence when deciding where to “move next.” Of course, the percentage to be able to make decisions must be quite high, and not all cryptocurrencies have such an opportunity.

Different views of legislation

The final feature of cryptocurrencies is the different views of legislation. So, for example, Bitcoin today can already be used in Japan as an official means of payment on a par with the state currency.

For altcoins, such an opportunity has not yet been provided in any country, but their legalization is also not far off.

Financial pyramids.

Apart from the operational issues of trading cryptocurrencies, there is also a high risk of fraud. Amid the misinformation and lack of clarity in Bitcoin trading, there have been many scammers building financial pyramids.

They “guarantee high returns” to early investors at the expense of new investors’ money. Some such companies claim that they can double the initial investment in no time.

IFIF Business School Professor Rajendra Sinha warns:

“The growing use of virtual currencies in the global market makes it easier to attract investors to financial pyramids. Investors should be careful not to be fooled by promises of unrealistic profits."

Even Bitcoin supporters agree. Hasem Rehman from Bitxoxo emphasized:

“Keep in mind that Bitcoin is highly volatile, so it is impossible to promise guaranteed returns.”

Where is the best place to trade currencies?

There are several exchanges operating on the Internet today, where after registration you can buy both bitcoins and popular altcoins. Funds can be sold (exchanged for another cryptocurrency) or withdrawn from the system to a bank account or e-wallet at any time.

Exchanges show users up-to-date information on the rates of all digital currencies, which means that the investor has time to react to changes and maximize his profit.

Among others, I would like to highlight two:

- Exmo.me is a Russian-language exchange operating since 2013. It integrates many payment systems convenient for Russian citizens. It presents only popular cryptocurrencies: Bitcoin, Latcoin, Dogecoin, Dash, Ethereum

- Poloniex.com is a global giant that is a more serious and functional tool for real speculators. Sony altcoins are presented here