Let's understand in detail what Bitcoin is, how it works and what are its main advantages.

Views: 2352

Comments: 0

More expensive than oil and gold... Money that cannot be touched with your hands, it does not exist in the real world. This is the designation for the Bitcoin (BTC) cryptocurrency, valued at 7,506 USD at the time of writing. This is a decentralized currency created on the Internet and functioning only on it. Every day Bitcoin is mentioned more and more often in paper and electronic sources. This is no longer the realm of geeks. Almost all people know about this cryptocurrency, just in different ways. Some make money with the help of “digital gold”, others are still getting into the swing of things, and others treat Bitcoin with distrust: they know what it is, they just wonder why many are willing to pay thousands of dollars for a crypto coin. This article will help you understand the value of the Bitcoin currency.

What is Bitcoin in simple words

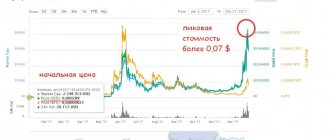

This is digital money that cannot be held in your hand like traditional currency. There are only special registries - blockchain. They keep records of transactions carried out with 100% accuracy. The operating principle is reminiscent of a non-cash bank payment. When you pay by card, you do not use physical money, but the transaction is recorded. Although the essence of Bitcoin is that the ledgers are not located in banks, they are stored in a decentralized manner - simultaneously on all computers associated with BTC. Anyone can view them: the history of Bitcoin transactions is saved. An important feature of cryptocurrencies is that the registries are cryptographically protected. They can be viewed, but cannot be faked or rewritten in blocks. Bitcoins are virtual, highly secure money, but what is absolute security? Even with “digital gold” it is not one hundred percent. After all, there is a 51% risk of attack. However, compared to traditional money, it is almost impossible to steal BTC. Bitcoin appeared in 2009, but it did not immediately gain popularity and high value. Remember the story about the most expensive pizza? Just for fun, American Laszlo tried to buy two regular pizzas for 10,000 BTC. The service was provided. At the current exchange rate, Laszlo paid 75,060,000 USD. Today there are many transactions involving bitcoins. To the question “what is it and why are they needed”, we will answer - cryptographic virtual money with its own exchange rate, which does not have a physical expression, but allows for various transactions, as well as providing earnings on exchange rate fluctuations. Look, just a few days ago Bitcoin cost 8990 USD, and now it has “grown” by almost a thousand dollars.

The number of Bitcoins is limited. There will never be more than 21,000,000 coins.

Currently, more than 18,000,000 coins have already been mined and every day there are fewer and fewer of them. In addition, every 4 years the emission is halved, as a result of which, as a rule, Bitcoin begins to rise in price. In 2020, a new rise in the cryptocurrency market is expected, so it is worth taking a closer look at investing in cryptocurrencies, in particular Bitcoin. It is always worth remembering that the cryptocurrency exchange rate is very volatile. It can either grow in a couple of minutes or fall. This attracts most investors who constantly monitor the price of cryptocurrency in order to buy at the lowest price and then sell at the highest.

You can buy and sell Bitcoin on the Matbi online exchange website. This exchanger has been operating since 2014 and is one of the most reliable Russian-language services on the cryptocurrency market. The complete process: registration, depositing funds into the account, purchasing cryptocurrency and sending it takes no more than 10-15 minutes. Matby can also be used as an online wallet for storing cryptocurrencies. In addition to Bitcoin, the service supports Litecoin, Dash and Zcash. To reliably protect user funds, all cryptocurrency is stored in “cold” wallets.

Working principle of Blockchain chain

Key Factors Affecting the Value of Cryptocurrencies

Since most cryptocurrencies are not physically backed, their value is determined by supply and demand based on several important factors.

- One of the main advantages of cryptocurrency is scarcity . Most cryptocurrencies have a fixed supply and, unlike traditional currencies, no one can issue more than the maximum limit. This means that cryptocurrencies are, by their nature, deflationary.

- Another key factor is divisibility . Thus, any cryptocurrency can be divided into smaller units.

- Additionally, the transfer (transaction) of cryptocurrencies can be extremely fast and cheap compared to traditional methods. Rates are somewhat fixed regardless of the amount sent. So, theoretically, if you send 1 million BTC, the transfer cost will be $1 (or even less).

In a sense, Bitcoin and cryptocurrencies are supported by the public's faith in them, thanks to the realization that the current monetary system is not that reliable.

How Bitcoin works

Rubles, dollars, euros and other traditional money are issued by states, but where do virtual coins - bitcoins - come from? Nobody issues BTC. Cryptocurrency appears as a result of a computer servicing the needs of the payment network. Let's take an example of how the Bitcoin currency works. Let's say a person in China bought a phone and paid with bitcoins. This operation is immediately recorded on all computers connected to the blockchain network. To record the transaction performed, a special cryptographic signature is required, which is a complex computer task. It is calculated, for example, by a computer located in Russia. If successful, its owner receives a reward - BTC coins. The process is called mining. The computer produces currency using a cipher. It seals transactions, earning the owner digital money. This is the principle of operation of the Bitcoin cryptocurrency. Its mining is carried out on specialized ASICs or GPU farms. They mine BTC both on their own mining devices and through cloud services.

What other principles are embedded in Bitcoin?

- This is a virtual currency represented in the form of numbers generated by an algorithm.

- The growth of the rate is due to the potential of the blockchain - a database that stores encrypted information about all transactions carried out.

- The issue is limited: the number of bitcoins is equal to 21 million coins worldwide, so “digital gold” is valuable. As BTC decreases, its value will only increase. Why “digital gold”? Because BTC cannot be printed or devalued. Bitcoin is mined or bought. Just like gold. Thanks to this principle, cryptocurrency is protected from inflation.

Schematic representation of how Bitcoin transactions work

At the moment, more bitcoins have already been mined. Currently the Bitcoin rate is 9900 USD. According to expert forecasts, by the end of this year it will grow to $30,000. Some crypto enthusiasts are expecting the price to rise to $1 million. This is unlikely, although the latest BTC coin (they say it will be mined in 2140) can and will be valued at that amount. Why is Bitcoin in strong demand? What sparked interest in this cryptocurrency? The reason is its decentralization and anonymity. What are anonymous bitcoins for? To be able to carry out transactions between users from different countries without the participation of banks and regardless of legal requirements. Many operate under a pseudonym. Thanks to decentralization, it is impossible to track transactions. There is no control at all. No one dictates terms to the owners of digital currencies. Why else are bitcoins needed? With BTC you can buy almost any product or pay for a service. They are traded on cryptocurrency exchanges and invested in. Early success stories may repeat themselves. Remember when Norwegian Christopher Koch bought $24 worth of coins in 2009? After 4 years, they brought him 885 thousand dollars. Now Bitcoin costs 9.9 thousand dollars and who knows, maybe the rate will rise to a figure with six zeros.

Bitcoin - a Ponzi pyramid or a new economic tool?

Some believe that bitcoins, and all cryptocurrencies, are the biggest scam, or financial pyramids based on the Ponzi principle.

The economic essence of cryptocurrency differs from previously known financial instruments.

Even now, when it is known about Bitcoin that about 21 million coins have been issued, many believe that very soon this number will be exhausted and the entire system will collapse.

Nothing of the kind, even if up to 80% of bitcoins are in circulation now, and miners will extract the latest bitcoin only in 2149 (this is according to preliminary calculations). So our descendants will decide the entire fate of cryptocurrencies.

Many people hear that Bitcoin, and all altcoins, is a bubble that is about to burst. But if you turn to trading tools, you can also come across such concepts as short-term or long-term prospects, the fall and growth of stocks, bonds, capitalization, overvaluation or undervaluation of assets and the market as a whole, etc. Exactly the same concepts are typical for Bitcoin and other cryptocurrencies.

go

History of Bitcoin creation

The Bitcoin system is a breakthrough in computer technology based on twenty years of careful research. The first versions of the virtual currency protocol were proposed back in 1983 by scientists David Chaum and Stefan Brands. In May 1987, Hashcash was developed to resist spam and DoS attacks. After some time, this slightly differently implemented system became an important component in the creation of new blocks in the Bitcoin network. In 2008, a document was published that described the Bitcoin protocol and how it works. The innovative currency appeared in 2009. Then Satoshi Nakamoto showed the code from its client program, completing work on the protocol.

Who created Bitcoin?

Satoshi Nakamoto. But this is a pseudonym under which one person or a group of specialists hides. The specific identity has not yet been established. Using his work and the experience of his predecessors, Satoshi created digital money. This is how the Bitcoin cryptocurrency appeared - a decentralized virtual currency. The first BTC was generated in January 2009. In the same month, the first transaction occurred: Nakamoto transferred 10 BTC to Hela Finney. Hel Finney is the second participant in the Bitcoin network, but the main glory went to Satoshi: the fractional part of the crypto coin (0.000 00001 BTC) was named in his part.

What is Bitcoin backed by?

The total number of bitcoins is 21 million coins. The emission of BTC is limited, so it is not possible to mine, for example, a billion of these cryptocoins. 21 million is the maximum amount of “digital gold”. Most of the bitcoins have already been mined. The “progenitor” of cryptocurrencies has had its ups and downs. However, recently the rate has begun to rise and, perhaps, the optimistic forecast “the cost of Bitcoin in 2020 will reach 30 thousand USD” will come true. Why are people willing to pay so much money for virtual money? What are these bitcoins backed by? For example, traditional currency is backed by GDP. Dollars, euros, rubles, etc. can be exchanged for gold. But Bitcoin – what is it? Set of complex numbers, mathematics. Bitcoin is like an undeveloped gold mine. Is there a demand for it? This means they will mine. Similarly, we find out what the value of the popular Bitcoin is: its price is determined by people’s trust in this system. An anonymous decentralized currency with which you can make a profit - there will never be a loss of interest in this.

What does the cue ball provide?

There is no state behind the cue ball, which would be responsible for its price with its reserves. The only way to calculate its true value is to look for other schemes for calculating the price of an asset. One of them is the accounting of expensive materials: this method allows you to determine the approximate cost of graphene. It is worth noting that there are two grams of this matter on Earth. Many may say that graphene has no price, but in reality everything is different.

- Market price;

- Production cost;

- Estimated price.

The price of graphene depends on the above components.

For example, the rarest material, painite, costs $9,000. A lot of effort was spent searching for him, but why? After all, this material is not used anywhere. How much are collectors willing to pay for painite? Billion or three? We will never know, since the model is in a private collection. What determines its value? There is only one answer - only supply and demand.

When studying what Bitcoin is backed by, you need to take into account:

- Digital currency is a collection of numbers that is the result of precise calculations. When mining Bitcoin, a lot of money is spent, we take it as a cost price. At the moment it is small, but over time the cost will increase. As the production process becomes more complex;

- The number of cue balls is limited. By 2034, it is planned to mine 21 million coins. Further, mining will end, and the number of coins will decrease. This process is inevitable, since each user can “sow” the key. There are no plans to issue additional coins, so over time this fact will affect the value of the cryptocurrency;

- Demand increases value - the rule of trade. Now one coin can be purchased for $13,000, and due to the popularity of Bitcoin, the quote promises to increase. Of course, this procedure will end someday, but for now it is still far from the finish line. The determination to provide any other fiat currency for the cue ball gives it real weight;

- In some countries, cue ball is already accepted along with other assets: for coins you can buy products in regular and online markets. Well-known payment systems Paypal and Webmoney conduct transactions in Bitcoin. The latest system invites users to create a Bitcoin wallet.

Differences between Bitcoin and classic fiat money

There are several differences:

- Bitcoin has no physical expression.

- The rate of “digital gold” is independent of the economic development of countries. Most traditional money is tied to the dollar, but what are all cryptocurrencies, including bitcoins, backed by? Their price is determined by demand.

- Limited emissions. Unlike fiat, BTC cannot be printed: the Bitcoin system contains only 21 million coins.

- Transactions are carried out directly (P2P), without the participation of a third party.

- Decentralization of the system.

How is the price of Bitcoin formed?

To understand what the cryptocurrency Bitcoin is backed by and find out its real price, look at the following factors:

- Digital money is formed as a result of the calculation of complex cryptographic problems. The cost of mining Bitcoin forms its cost price. Fixed costs are energy costs. But here it is also worth considering constantly updated equipment. But this is a reasonable expenditure, since Bitcoin will only grow in the future;

- all crypto miners will be able to mine all bitcoins by 2140;

- the price of any product always rose or fell depending on the demand for it. Every experienced stock speculator knows about this. The price of Bitcoin will rise if there is demand for it. As soon as they start selling it en masse, it will immediately collapse;

- You can now buy almost any product with the first crypt – Bitcoin. In some countries, payment in BTC is available for transport, food and even real estate. Quite a long time ago, the WebMoney payment system developed its own wallet based on it and began to conduct transactions between its participants.

Where can I get Bitcoin?

BTC is mined using ASICs and GPU farms. This process is called mining. It's quite expensive. Given the complexity of the Bitcoin network, several ASICs or powerful video cards will be required. There are other ways to purchase BTC:

- Exchange services.

- Cryptocurrency exchanges.

- Bitcoin faucets. These services give out coins for free. To receive BTC you need to click on ads, solve captchas, etc.

- Trading platforms.

- Regular self-service terminals.

- Bitcoin ATMs. They offer a favorable exchange rate, but are not yet particularly widespread in the CIS countries.

Main technical characteristics and features

Bitcoin is a digital unit of information. Expressed as a set of numbers, rather than a gold coin with a unique logo, which we are used to seeing in pictures. This unit is self-sufficient, with an independent economy. Other cryptocurrencies and fiat, as well as payment systems, do not affect it.

The technical characteristics of Bitcoin are as follows:

- A new block is created every 10 minutes.

- The complexity of the structure changes every two weeks (every 2016 blocks).

- The block reward is 25 crypto coins.

- Total BTC: 21 million

Let's look at how the complex Bitcoin system works:

Blockchain technology

The entire ecosystem is based on the blockchain - a continuous block chain of transactions containing information. When a digital signature is selected, one block is closed and after it a new block can be generated. This chain is constantly growing, performing the distribution function and classifying the database. Without it, Bitcoin transfers and exchanges are impossible. How are blocks formed? Using a large number of miners at the same time. The generated blocks form a block chain or blockchain, containing information about transactions and owners of the crypt.

Decentralization

What it is? Equality of all network participants and their independence from each other. A breath of freedom compared to the traditional financial system - there is no central authority that controls all monetary transactions. The Bitcoin network is evenly distributed among participants whose computers mine “digital gold.” No one dictates terms or sets rules. Transactions are carried out without the participation of a third party, but directly, according to the P2P principle.

Anonymity

To ensure this, use one crypto wallet for one transaction. This way you will maintain your anonymity. You can create a huge number of wallets without providing personal information. Only the Bitcoin address of the wallet will be known. It is possible to find out about your transactions and the amount of BTC in your account if your crypto wallet is publicly advertised.

Open source

Bitcoin was introduced as open source. What does it mean?

- Almost all users can make changes to the structure of Bitcoin.

- This code allows PC users to mine digital money.

How does this benefit the Bitcoin system? This way, errors are eliminated, a network of crypto exchanges is developed, and, naturally, expensive crypto is mined.

Transparency

The blockchain stores information about all completed transactions. If you publicly use a Bitcoin address, then each network participant can, if desired, find out about the transactions carried out and the amount of BTC in your account.

Easy to use

What is required to work with Bitcoin? A computer and a crypto wallet, which takes about five minutes to create. The “hot” wallet is immediately ready for use. Tax authorities and banks have nothing to do with this. Of course, if you plan to keep a lot of BTC in your crypto wallet, take care of purchasing a “cold” wallet. It will be more reliable this way.

Irrevocable transactions

You cannot recall or block completed transactions. They are irreversible. If the recipient of the bitcoins does not want to return the BTC, you will not be able to do this yourself. Unless you roll back the entire blockchain...

Secure transactions using electronic signatures

An electronic signature is a password assigned to an account. When you register on the Bitcoin network, you are provided with a signature key, which allows you to carry out future transactions from your account.