- 7508

- 0

- 3 years ago

Walton cryptocurrency is a Chinese project whose main goal is to implement an item tracking mechanism. For this, RFID technology is used - specialized tags that transmit information about the current location of an object.

Thanks to the use of this technology, it is possible to significantly facilitate obtaining information about the route of a particular object. All information is transmitted autonomously and does not require manual scanning.

History of origin

Walton is partly created by California native Charlie Walton. It was he who developed RFID. The first patent related to it was registered back in 1973. In total, the American patented over fifty different developments that formed the basis of this technology.

The creator of the technology died in 2011, but his idea attracted Asian developers. They decided to combine the technology with the now popular principles of cryptocurrency. The launch of the corresponding ICO was dedicated to the fifth anniversary of the developer’s death. It is in his honor that a new type of digital currency is named.

Walton's main goal is to combine the capabilities of technology with the concept of electronic money. Moreover, the project is based on the principles of ICO and implies a kind of investment in the development of the project. Thus, WTC is not so much money as it is a kind of electronic shares of a specific development.

What makes an RFID system different from others?

Walton chain company specialists have invented a special RFID system. It is used in many areas. This cryptocurrency is capable of operating within its own flow, and is also used in any production, no matter whether it is light or heavy industry. You can also use Walton for multifunctional warehouse accounting. This will allow you to easily track the products in stock. In addition, this RFID capability is also used in logistics. This will simplify the issue of route planning. For such purposes, new technologies will be used. There is a practice of using RFID systems in hypermarkets to keep track of goods.

It should be noted that the RFID scheme is also used in the clothing industry, which allows this production to show good results. The Walton team does everything to ensure that their cryptocurrency meets the needs of each client. Walton employees always support their regular partners.

Features and principle of operation of the Walton cryptocurrency

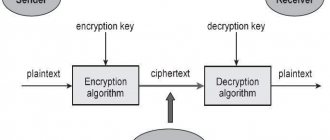

The main chain of the Walton cryptocurrency is called waltonchain, and it is based on the principles of RFID. This is radio frequency identification - unique small-sized tags that can be embedded in almost any product. Moreover, they can be used on clothing to track the movements of a specific person.

Information is obtained through special sensors that must be located near the object. This allows you to easily determine your location even when viewed from the air.

The technology has found application in production: using RFID, you can quickly track the movement of products along the conveyor. To do this, blocks are located along the tape that identify and read data from the beacons.

At the moment, such tags are used not only to determine the location of objects, but also to control animals, make automatic payments and monitor inventory. The small size of the chip allows it to be embedded in almost any material, including clothing.

RFID has an obvious advantage over barcode identification - such tags are much easier to read and can be detected over a much greater distance. Moreover, there is no need for direct visual contact, since the data is transmitted electronically and not through an image.

At the same time, the contents of the chip are stable and cannot be changed. Thus, an anti-counterfeit mechanism has been implemented.

What is the Walton ecosystem

The operating principle of the Charlie Walton system is quite simple to understand. All payments on the network are made using the WTC coin, which can be bought, sold, and converted into other crypto assets. These coins were issued in the amount of 100 million; further issue is not planned. This means that with a high degree of probability the value of this currency will increase.

Advantages of WTC cryptocurrency:

- safety;

- high liquidity;

- reliable protection against counterfeiting;

- transparent generation system.

This asset can be used for trading, exchanging for goods, and working with the Internet of Things.

Walton can be used in completely different industries around the world

Difference between WTC and BTC

The main difference of this system is the intended purpose of the Walton cryptocurrency, aimed at application. WTC is not just virtual money, it is a specific product provided to users. If the Bitcoin system simply offers a set of data and a tool for performing mathematical operations, then Walton tokens carry their own functionality for monitoring the movement of objects.

Otherwise, the principles of operation are very similar, these are:

- anonymity;

- information security;

- decentralization;

- application of blockchains.

Comparison of Walton cryptocurrency with Bitcoin

Walton cryptocurrency is based on the same principles as Bitcoin. Among similar principles, the following deserve special attention:

- High level of anonymity.

- Ensuring a high level of protection for users' personal data.

- High level of decentralization.

- Both cryptocurrencies operate on the basis of their own unique blockchain.

The difference is that Bitcoin is a type of digital money, the main purpose of which is to pay for various goods and services. Walton cryptocurrency is essentially an investment vehicle that allows investors to invest their existing savings in RFID tag technology.

Walton exchange rate forecasts

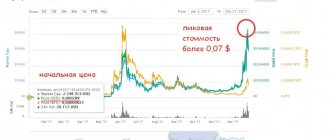

Chart: current exchange rate of Walton (WTC) to the dollar:

The rise in currency value is caused by two factors. Firstly, the ICO principle always implies an increase in price when moving to the second stage of sales. Secondly, the use of a unique methodology at the heart of the WTC cryptocurrency makes it special and is a distinctive feature.

Any cryptocurrency that offers any innovation has every chance of becoming a leader in the electronic money market. Of course, now there is a process of smooth transition of business into the digital world, which can become much easier with the use of RFID technologies.

Therefore, it is most likely that the Walton rate will constantly increase. Many experts agree that the cost of one token over the next year could easily reach $30.

There is another factor that suggests good prospects for Walton and further growth in value - the possibility of creating your own blockchains using this cryptocurrency. This is easily explained by the classical principles of economics - the more enterprises join the project, the more tokens they will need. Accordingly, demand will increase, and with it the Walton rate.

The main obstacle to Walton's positive outlook is the issue of safety. On the one hand, the RFID of a specific item is kept secret. On the other hand, it is the presence of a mark on an object that allows it to be identified. Until the developers resolve this issue, the growth of the WTC cryptocurrency will be restrained.

List of rates and quotes of Cryptocurrencies with charts

| Tool | Exchange Rates | Spread | Price |

| Qtum | Qtum to US Dollar exchange rate | 3.4(USD) | 1.55 |

| Electroneum | Electroneum Factom to US Dollar exchange rate | 4.06 (USD) | 0.00394035 |

| ByteCoin | ByteCoin to US Dollar exchange rate | 1.05 (USD) | 0.00041553 |

| KuCoin Shares | KuCoin Shares to US Dollar exchange rate | 0.66 (USD) | 1.16 |

| Bitcoin Gold | Bitcoin Gold to US Dollar exchange rate | 4 (USD) | 7.78 |

| Status | Status to US Dollar | 0.73 (USD) | 0.0123616 |

| MonaCoin | MonaCoin to US Dollar exchange rate | 0.95 (USD) | 1.13 |

| Zcash | Zcash to US Dollar exchange rate | 7 (USD) | 85.285 |

| AION | AION to US Dollar exchange rate | 1.54 (USD) | 0.063764 |

| Veritaseum | Veritaseum to American Dollar exchange rate | 0.54 (USD) | 11.25 |

| Dragonchain | Dragonchain to US Dollar exchange rate | 0.72 (USD) | 0.0314586 |

| Ethereum Classic | Ethereum Classic to US Dollar rate | 1.1 (USD) | 6.725 |

| Ardor | Ardor to American Dollar exchange rate | 23.05 (USD) | 0.0516089 |

| Golem Network Token | Golem Network Token to US Dollar exchange rate | 0.77 (USD) | 0.0449498 |

| Waves | Waves to US Dollar exchange rate | 0.22 (USD) | 0.836172 |

| Altcoin Index | Altcoin Index to US Dollar | 32 (USD) | 1091.77 |

| WaltonChain | WaltonChain to US Dollar exchange rate | 0.04 (USD) | 0.718452 |

| RChain | RChain to US Dollar exchange rate | 7.26 (USD) | 0.0316205 |

| OMISEGO | OMISEGO to US Dollar exchange rate | 0.6 (USD) | 1.6327 |

| Lisk | Lisk to American Dollar exchange rate | 33 (USD) | 0.905249 |

| Cyber Network | Kyber Network to US Dollar exchange rate | 16 (USD) | 0.17576 |

| Basic Attention Token | Basic Attention Token to American Dollar exchange rate | 0.04 (USD) | 0.17506 |

| VeChain | VeChain to US Dollar exchange rate | 0.99 (USD) | 0.00330356 |

| NEO | NEO to US Dollar exchange rate | 5 (USD) | 8.086 |

| ZClassic | ZClassic to US Dollar exchange rate | 1.03 (USD) | 0.241794 |

How to get WTC and where you can buy it

WTC can be bought, sold and exchanged for other cryptocurrencies. You can also use Walton to pay for goods or services.

Walton cryptocurrency is based on the principles of ICO, so the entire process of coin distribution is divided into two stages. The first, pre-sale, involves the purchase of a limited amount of digital money at a fixed cost.

The next stage is the purchase of tokens in auction mode. The cost is significantly higher than during the first stage. This, first of all, determines the protection of the interests of users who managed to purchase WTC at the first stage.

Initially, you can only purchase currency using Ethereum coins. Partner sites also offer purchases using Bitcoin coins. Most likely, this list will not be replenished.

You can also purchase Walton tokens on third-party sites called exchanges. Of course, such an acquisition is associated with speculation on the value of the Walton cryptocurrency. Exchanges not only set the exchange rate themselves, but also earn money from commissions. However, this method is an effective way if you need to purchase WTC with cash or by exchanging with any other electronic currency that is not supported by the official website.

A similar situation exists with cashing out tokens. The developers offer exchange for ETC, however, using the services of exchanges, you can immediately withdraw them to a card or exchange them for almost any currency. Most often, such direct transfers are much more profitable than step-by-step conversion into ether, and then into other necessary money.

Jonas Schnelli: the Bitcoin exchange rate will increase after the transformation of cryptocurrency into a global payment system

09/13/2018 Nick Schteringard

#Bitcoin Core#anonymity#bitcoin#privacy

What is privacy? Is this our right or privilege? If it is ours by right, then should we fight for it? That is the question.

Most people are accustomed to following the path of least resistance, so for a long time only a small group of cypherpunks tried to develop technologies that would ensure everyone's privacy in conditions of strict government control.

Thus, although Bitcoin as a means of payment has not yet been established, there is already a clear vision for the further development of second-order solutions and a micropayment system that will transform the network of the first cryptocurrency into a global peer-to-peer payment system that does not require trust between participants, in which the human right to privacy will be realized.

Yes, this may sound like a utopia or even a threat to the established world order, but digital money without intermediaries was once considered science fiction.

However, technology has already radically changed the information and financial spheres. It is likely that the implementation of total confidentiality is within the power of the program code.

However, an important role in this will also be played by the evolution of the worldview of society, which for the most part still agrees that our data does not belong to us, but that our money is managed by various third parties.

ForkLog talked with the leading developer of Bitcoin Core, one of the most ardent supporters of privacy ideas and a prominent representative of the cypherpunk community, Jonas Schnelli, about the nature of privacy, the possible abandonment of Proof-Of-Work, the next milestones in the development of Bitcoin and its unreadiness for widespread adoption.

ForkLog: Hello Jonas! Let's start right away with the sore point. Blockstream CEO Adam Back recently clashed with a man calling himself Cobra over Bitcoin Cash and the objectivity of Bitcoin.org. This led to the creation of btcinformation.org.

Jonas: Hello! I have been in the Bitcoin industry for a very long time, and during this time I have closely followed the development of Bitcoin.org. I remember when Cobra came into the scene. This was in 2020. His first proposal was to implement Google Analytics to broadcast advertising on the site. He then denied it, but his pull request history suggests otherwise. I believe this is an extremely dubious proposition for any Bitcoin related site.

He is likely the owner of the Bitcoin.org domain, so he is quite influential, but his actions are extremely controversial. The desire to make money on Bitcoin.org was met with hostility by some community members.

Overall, he is a controversial and aggressive figure. And it's not a matter of whether he likes Bitcoin Cash or not, since that's his personal business. However, its volatility regarding some things greatly complicates the situation and raises doubts about the fate of Bitcoin.org.

If he wanted to add advertising to the site, he could probably agree to paid promotion of Bitcoin Cash, since everything looks as if he is interested in making money.

ForkLog: Cobra has long called for abandoning the current Proof-Of-Work and switching to a hybrid consensus algorithm in order to deprive Bitmain of its dominant position in mining. Do you agree with him? Do you think he might be right in the context of the Bitmain monopoly?

Jonas: Abandoning PoW is a very aggressive and tough move, and also difficult to implement. But I doubt that owning a neutral Bitcoin news site should give you any position in the political debate. Your job is to educate people. I absolutely understand why some in the community decided to create a fork of Bitcoin.org: they wanted to make the resource more neutral and non-aggressive.

ForkLog: Can Bitmain control 51% of the hashrate on the Bitcoin network?

Jonas: It depends what you mean by control. If we talk about the pools operated by this company, then it may well be.

ForkLog: No, I specifically mean the capacity of the company itself. Can she single-handedly control the network?

Jonas: It is difficult to say how much of the hashrate is controlled by different entities, but theoretically it is possible. The problem of mining centralization is one of the most pressing for Bitcoin today.

ForkLog: And how can we solve it?

Jonas: Now new players are entering the market, including chip manufacturers. I think this suggests that the market is moving toward greater hashrate decentralization. Personally, I think that eliminating PoW will not change things much since you can always get an advantage if you invest a tidy sum.

With the algorithm change, you may be able to hurt Bitmain, but then another major player will appear if market incentives do not require extensive distribution.

ForkLog: Mining has become a huge multi-billion dollar business. Has this become a problem?

Jonas: It's hard to say whether this is good or bad. Many talk about the harm to the environment, some are dissatisfied with the size of the hashrate: they say that the complexity of the Bitcoin network is excessively high and there is no need for this.

But at the same time, it proves that the incentives built into the protocol work, and there is stiff competition. Yes, we are seeing centralization in the mining industry, especially with Bitmain, but the real question is whether we can safely move to an algorithm that allows for greater decentralization. And is this even possible?

ForkLog: Sia's David Warwick claims that Bitmain may have influenced Chinese manufacturing players to prevent Obelisk from entering the market.

Jonas: I think Bitmain and the Chinese government have a lot of influence over Bitcoin, but it's unlikely that they can just kick the company out. Although anything is possible. If this is true, then Bitmain's behavior leaves much to be desired.

ForkLog: You have been a Bitcoin Core developer for three years now. Should we expect the implementation of Schnorr signatures or Confidential Transactions in upcoming releases?

Jonas: To be honest, Bitcoin Core has no such thing as a roadmap. This is an opensource project, and each developer is free to decide in which direction to move. However, the more developers work on one thing, the sooner the innovation will be released. Nevertheless, everything indicates that Schnorr signatures will be implemented in the near future. Apparently, this is the next large-scale soft fork in the Bitcoin network.

Bitcoin Core has a six-month update cycle. Version 0.17 will be released soon. It will not have a soft fork, but will improve performance, add low-level functions and improve software stability.

Version 0.18 will be released in January or February next year. It is likely that it will already have Schnorr signatures, but it is currently impossible to predict when the soft fork will be activated on the main network.

ForkLog: What about Confidential Transactions?

Jonas: I think that for Bitcoin it is more realistic to implement the Bulletproofs zero-knowledge protocol, which is actually part of the Confidential Transactions technology. Right now it [the Bulletproofs protocol] is at the concept stage.

Confidential Transactions according to Gregory Maxwell involves hiding the amount of funds sent and received, which requires significant computational costs and raises the problem of scaling.

I don't think we'll see the introduction of any Bitcoin fungibility proposals, including Confidential Transactions, in the next year and a half to two years. In my opinion, the protocol is not ready for this.

ForkLog: What is the difference between Confidential Transactions and the technology used, for example, by Wasabi Wallet?

Jonas: Wasabi Wallet uses the so-called Chaumian CoinJoin method, which consists of mixing coins using Chaum's blind signatures (see Genesis Archives: David Chaum's eCash and the Birth of a Cypherpunk Dream). This is different from Confidential Transactions and Bulletproofs, where all amounts are generally hidden. The fundamental difference is also that mixing does not have basic privacy built into the protocol.

The level of anonymity will only be high enough if privacy technologies are implemented at the code level so that network participants use them by default. When a method is used only by a certain group of people, it always has its pitfalls.

ForkLog: It is unlikely that regulators will like such ideas.

Jonas: Of course, they are not very big fans of such technological solutions. Just look at the attitude towards CoinShuffle, Monero or ZCash. We must be prepared for the fact that regulators, states or individual groups within states will try to stop the implementation of proposals for the interchangeability of Bitcoin, because this will make it extremely difficult for tax authorities to track transactions on the blockchain. I think it will take us another two to three years to implement the necessary changes to the protocol.

ForkLog: Is it worth compromising with states? They will say that such things will be used by criminals.

Jonas: The whole question comes down to the nature of privacy. Do only bad people need it? Could it be that the good ones also need it? In some countries, financial privacy is a matter of life and death.

I believe there is nothing to talk about with regulators. Privacy is what we want at the technological level, regardless of the use cases.

ForkLog: It turns out that this does not imply any compromise?

Jonas: Absolutely right, none!

ForkLog: How would you explain Schnorr signatures to a person without the appropriate education? Why do we even need them in Bitcoin?

Jonas: Schnorr signatures are a more efficient cryptographic scheme than the one we currently use in Bitcoin, namely ECDSA. This technology was previously patented, but the patent has now expired.

The Schnorr scheme is significantly superior to ECDSA in the context of aggregating public keys and signatures. This allows you to create a complex multi-signature, from 100-200 elements, with just one signature. The introduction of this technology will allow us to move towards implementing the MimbleWimble Bitcoin scaling solution.

ForkLog: How would you assess the progress of Segregated Witness on the Bitcoin network?

Jonas: Well, the acceptance of the protocol is at a fairly high level. Of course, I wish SegWit had been implemented in Bitcoin from the very beginning, since signatures are completely useless for light clients. If you use an SPV wallet (Wasabi, Samourai and others), then the whole signature is of absolutely no use to you, since without the downloaded blockchain you cannot verify it. Before activating SegWit, light clients downloaded large amounts of data they didn't need, wasting resources.

There was also the issue of transaction malleability, which is actually the main obstacle to the Lightning Network. This means that the signature is part of the transaction hash, and you can repeat the same transaction using a different hash, which was the main vulnerability that caused the fall of the Mt.Gox exchange. The activation of SegWit helped eliminate these problems and paved the way for the implementation of Schnorr signatures.

ForkLog: Do we need to increase the block size?

Jonas: I don’t see any need for it yet. The blocks are not completely filled, the volume of SegWit transactions is somewhere around 30%. The larger the blocks, the higher the cost of decentralization, so you should only increase the block size when necessary.

ForkLog: Some skeptics argue that SegWit contradicts Satoshi Nakamoto's white paper.

Jonas: I do not believe that the SegWit protocol in any way contradicts the provisions of the white paper, which, in principle, can be interpreted in different ways. This is usually an argument made by Bitcoin Cash proponents, but it doesn't seem valid to me. Besides, even if it does, does that mean we have to adhere to white paper dogma forever?

Let's imagine that Bitcoin's cryptographic scheme is compromised. Then we shouldn't implement Schnorr signatures just because they aren't in the white paper? Come on, it's just a text document, and the development of Bitcoin is a completely different matter.

The white paper was a good start, we should look at the origins, but its author (or authors) was a person who did not know everything. We must be open to innovation and always question the truth of white papers. There is no one person who makes decisions in the community. We are a group of technology experts and we can question whatever we want. I am convinced that this is one of the most important advantages of Bitcoin.

ForkLog: Let's talk about the triangle of “privacy, trust and security” in the context of Bitcoin wallets. It seems that no one has yet solved this problem.

Jonas: In my understanding, there are three main elements when it comes to Bitcoin wallets: privacy, trust and the security of private keys. To ensure your privacy, for now you need to install a full node. This requires significant bandwidth and computation. All of this is overly complicated for the average user who just needs to complete a transaction. He will not download gigabytes of data, but will simply use the services of Coinbase.

A similar problem has arisen with trust. If you want to do without third parties, which is the idea behind Bitcoin, then you need to validate your own chain. And this is again downloading the full node.

Security of private keys is another fundamental element, but using hardware wallets provides a high level of security.

Ensuring privacy and trustlessness is much more difficult, and no wallet, in my opinion, has yet solved this problem. Of course you can do this, but it requires configuration and experience.

If you use an SPV wallet, you trust the remote server with your transactions. It can show you non-existent transactions, hold your transactions and analyze your financial activity. What if this server is hacked or is already controlled by the state or your ill-wisher? This does not correspond to the ideas of Bitcoin.

ForkLog: What about Bitcoin Core?

Jonas: From a privacy perspective, Bitcoin Core is secure because no one can see your transaction history. You download all the blocks and no one can determine what information you were interested in.

However, you must broadcast your transactions online. At the same time, a lot of analytics are carried out at the peer-to-peer level in order to identify senders. I think that the privacy problem in Bitcoin Core will finally be solved by the Dandelion proposal, which should be launched in about a year.

ForkLog: It seems that Coinbase, for example, does not provide a single element of the triangle.

Jonas: Exactly. When you use Coinbase, you do not own any Bitcoin. You own a login that allows you to access a Bitcoin address. If Coinbase doesn't allow you to complete the transaction, you won't spend your bitcoins. In addition, you do not validate your chain, so you simply trust the company, which can transfer your data to government agencies at any time. You have no control over anything at all.

ForkLog: Doesn’t this contradict the concept of Bitcoin?

Jonas: Yes, absolutely.

ForkLog: And why do so many people choose this wrong path?

Jonas: Because it's simpler. Much work needs to be done to achieve privacy and eliminate the need to trust third parties.

ForkLog: What do you think about the user experience (UX) problem in Bitcoin?

Jonas: I'm glad that using Bitcoin is not so easy at the moment, because I think that the technology is not yet ready for mass adoption. UX in Bitcoin is far from ideal, it is extremely difficult for people outside the geek crowd. And I'm glad about this, because we don't have Lightning or instant payments, and the problem of commissions has not gone away.

The current level of UX gives us time to solve technological problems, after which we will focus specifically on user experience, making Bitcoin as accessible as Whatsapp.

If everyone comes to Bitcoin right now, it probably won't survive. We're not ready yet.

ForkLog: Do you believe that Bitcoin is a payment system? Now it looks more like a store of value.

Jonas: Yes, maybe now, but I am a strong supporter of the payment system. I want to pay with bitcoins anywhere and with anyone without anyone knowing about it. A peer-to-peer payment system is our goal. This is my vision.

ForkLog: So Bitcoin should be a means of payment?

Jonas: Rather, we are not talking about the Bitcoin network itself, but about Lightning and micropayments. I think it will happen. If second-order decisions make Bitcoin the world's payment system, the price of Bitcoin will increase significantly.

ForkLog: Do you think there is anything unhackable in this world?

Jonas: No. Of course not.

ForkLog: Even blockchain?

Jonas: The Bitcoin blockchain is protected using the ECDSA scheme, which can probably be hacked by a quantum computer. The question is whether such computers will appear. Personally, I think so. The only problem is that we find out about it after the fact.

Theoretically, the Bitcoin blockchain can be hacked, it all depends on the amount of computing power. However, if you use a new Bitcoin address every time, then you are safe even in the era of quantum computing.

Interviewed by Nick Schteringard

Subscribe to ForkLog news in Telegram: ForkLog Live - the entire news feed, ForkLog - the most important news and polls.

Found an error in the text? Select it and press CTRL+ENTER

Ways to earn Waltons

Walton's capitalization is equal to one hundred million tokens, and there will be no more emission. At the moment, the pre-sale has been completed and the second stage of token sales is underway.

The system refers to ICO projects, and therefore does not imply Walton mining. You can only mine Ethereum or Bitcoin for further exchange for tokens. The only obvious way to earn Walton associated with the system is to sell the user’s tokens to interested parties.

This is due to the fact that the WTC cryptocurrency is more of a tool than a method of speculation. It is primarily focused on the implementation of a specific technical mechanism, and not on the creation of another type of money. Therefore, the Waltons' earnings differ significantly from most known coins.

However, there is a very real way to earn Walton - the investment method. That is, the opportunity to increase your capital due to the growth in the value of the WTC cryptocurrency. As already written above, it is most likely that the price of WTC will rise and, consequently, the capital of its owners will increase.

This statement is true for almost all existing tokens. Therefore, many users purchase coins precisely in the expectation that their rate will rise as the emission reserves are depleted.

Prospects for cryptocurrencies

For example, Ethereum comes second in terms of capitalization after Bitcoin, whose price has increased from $220 to $470 over the past 90 days. And even if you pay attention to Litecoin, which is initially considered a very conservative digital currency with fairly low volatility, then over the last 3 months the cost of 1 LTC has increased from 48 to 103 $. Which, you see, is a pretty good result.

If you think that this is where the successful examples of cryptocurrency growth end, you are very mistaken. So, pay attention to the digital coin IOTA, which at the beginning of December confidently took 4th place in the capitalization ranking of all cryptocurrencies. So, in just 2 weeks its cost increased sharply from $0.8 to an impressive $4.5, that is, more than 5 times! It is likely that many other digital assets that are not yet included in the “TOP 10” cryptocurrencies will soon show no less impressive results.

Don’t forget about the well-known crypto coin Monero – from October to December 2020, the price of 1 XMR increased from $84 to $280. What can you say about the digital currency Dash, which in November 2017 alone increased from $270 to $750? As you can see, you can find many more similar examples that relate not only to the Bitcoin exchange rate.