Regarding the Ripple cryptocurrency, the experts’ forecast is more than optimistic. The project stands out from other digital competitors and is worthy of all praise for its phenomenal leap in development in 2020. While the community is actively discussing on forums the future victories of Ripple (Ripple, XRP), the size of the cryptocurrency’s capitalization has reached $12.6 billion, which ensured the coin 2nd place in the ranking of top cryptocurrencies of the authoritative resource coinmarketcap.com . The process does not affect the value of coins.

Analytics

Cryptocurrency experts agree that the reason for the sharp rise in the value of Ripple lies in the strong support from world banks and the largest popular corporations. Influential investors include Western Union, Google, Royal Bank (Canada), etc. The developers claim that Ripple technology is extremely beneficial for financial institutions. Now banks have the right to offer clients expedited and low-cost transactions without additional fees for currency conversion.

The Ripple cryptocurrency is not 100% altcoin, since it does not use a blockchain. The Ripple token is based on special payment gateways. The main task of the platform is to ensure fast international transfers with low commission fees. Innovation attracts the attention of the entire banking system.

The largest financial institutions have already entered into agreements with Ripple. The technology has been successfully tested and put into operation. Expanding interbank cooperation with other partners helps to increase the excitement around the Ripple coin and increase the value of the tokens.

buy Ripple

Along with the common features of its competitors (low commission fees, decentralization, transaction security, etc.), the Ripple coin has fundamental differences:

- no mining - 100 billion XRP tokens launched.

- reduction in the number of crypto coins - during the operation, a commission fee (0.00001 XRP) is charged, the commission is instantly burned, which ensures a natural increase in the value of Ripple tokens.

The decentralized network Ripple was launched in 2012. The distribution of tokens is carried out according to the deflationary model. The payment confirmation speed (1500 transactions per second) is significantly higher than Bitcoin (7 units/s).

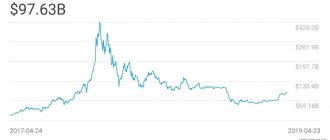

Recent forecasts confirm a stable increase in the market capitalization of the XRP cryptocurrency without major changes in value.

Ripple (XRP) expects strong growth - analyst

The XRP token rose 16% in October, surpassing the similar growth of Bitcoin.

According to the Whale Alert bot, another billion XRP was unlocked on November 1st.

Ripple froze 55 billion of its XRP in December 2020 to support the cryptocurrency's price. Since then, the company has been unfreezing 1 billion coins every month.

Unfreezing Ripple's tokens could lead to a decrease in the value of the cryptocurrency, writes RBC. However, analyst СryptoWelson is confident that the cryptocurrency has been in the accumulation stage for more than a year and is expected to grow strongly.

“I expect huge growth in XRP. Over the past year, the token has been quite stable and was in an accumulation phase. With so much news and new partnerships, this coin is ready to take off. The fear of missing out will be like we have never seen before,” the analyst wrote on Twitter.

Analyst MoonOverlord also predicts a sharp increase in XRP. A well-known trader predicted that Ripple (XRP) could “soar to an all-time high” of $3.8 after some time. The expert associates the reasons for the increase in the value of the token with the development of Ripple’s partnerships, including the involvement of XRP in MoneyGram.

Last week, Ripple published a study claiming that using the XRP token for international transfers is 10 times more reliable and secure than the SWIFT international interbank transfer system.

Ripple CEO Brad Garlinghouse believes that the interbank system is so slow that it exacerbates the risk of losing money due to exchange rate volatility during the transfer. Cross-border bank transfer via SWIFT takes from 1 to 14 days.

“If you multiply 270,000 seconds (just over 3 days) by a low volatility asset and compare it to XRP, which takes 3 or 4 seconds to complete a transfer, you will see that XRP is less susceptible to fluctuations during a transfer,” explained Garlinghouse.

The risk of capital loss due to volatility when transferring XRP only appears if you hold the asset on the exchange for more than a few hours. Because transaction speeds using xCurrent are high, the risk of fluctuations during a transfer is negligible, Garlinghouse concluded.

A report from the Association of Financial Professionals (AFP) on cross-border payments shows that Ripple's XRP could take over 80% of SWIFT's market share in the industry. The main reason for the future success of Ripple XRP is its high transaction speed.

“Many people in the crypto market dream of seeing XRP grow, especially those who entered at a price of a few dollars at the end of 2017-2018. However, the truth is that Ripple management may have other plans and vision for the future. If they do not need sharp rises and falls, then the centralized nature of the token and large reserves in the hands of management will allow the price of the coin to be maintained at the desired level. Moreover, the community has already accused Ripple of not allowing their cryptocurrency to grow. Given the desire to enter the banking sector, which disavows its competitor SWIFT, citing likely price fluctuations, price stability would be welcome for XRP. If you take a 3-month chart of the coin, you can really see an upward trend since the end of September, but before that the coin fell sharply to 24 cents,” notes the FxPro analyst team.

To quickly monitor the markets and always be prepared, just open a demo account and download the trading platform.

FxTeam Analytics on Telegram – read news and analytics first!

On topic: 08/14/2020 Declining Bitcoin dominance: positive or negative? 08/14/2020 Authorities will begin monitoring transactions with cryptocurrencies 08/13/2020 Kraken predicts Bitcoin will soar by 200% in the near future 08/13/2020 Bit comment: The crypto market has returned to growth 08/12/2020 Bit comment: Bitcoin has pushed off from 11,000. Will they buy it or not?

Analysts' opinion on the forecast

Analysts do not rule out that the cost of Ripple crypto coins could reach $1000 by 2020. Bold statements require the presence of powerful preconditions that can dramatically influence the rapid increase in the value of XRP. The degree of popularity of a cryptocurrency project, as well as the price of tokens, is not always influenced by objective factors (the relevance of solutions, the experience of the creators, the technological base of the site, etc.). The appearance of positive crypto news sharply increases the value of virtual assets, and negative rumors can significantly derail the exchange rate.

Regarding the Ripple cryptocurrency, the forecast is as follows: when comparing the project with leading competitors Bitcoin and Ethereum, with Litecoin and Bitcoin Cash following on the heels, the XRP cryptocurrency has more significant prospects for future growth due to the fact that it is not considered a “pure” digital coin. This is a powerful tool that has changed the understanding of the mechanism of international interbank transfers.

Unlike SWIFT, using the Ripple system is more profitable and comfortable: transactions are safe, there are no delays. SWIFT has a standard transfer period of 3 days.

Ripple’s expert forecast for today, tomorrow and the whole of 2020 indicates the high prospects of the cryptocurrency. The asset is present on 40 different online exchange services, and the number of trading pairs has exceeded 140.

buy Ripple

Prerequisites for subsequent strengthening of positions:

- The low commission fee within the system (0.00001 XRP) has a positive impact on the XRP forecast.

- High speed of Ripple transactions. The operation is carried out in 3-10 seconds, in the Bitcoin network - 1-5 hours. Transfers are carried out in a short time, since transactions do not require confirmation.

- No intermediaries.

- An impressive list of supported assets: gold, oil, rubles, dollars, cryptocurrency, etc., which helps expand the client circle and strengthen trust.

- Possibility of urgent payment refund in case of force majeure situations.

- Ripple’s desire to adapt to the traditional banking system and become a full-fledged part of it. Other cryptocurrency projects have a different goal.

In such circumstances, Ripple’s growth forecast for 2020 looks more than worthy. Experts predict an increase in exchange rate value and a possible trend reversal in the near future.

The Ripple Corporation has secured the support of serious companies and banks. Organizations not only invest millions of dollars in the development of the project, but also actively cooperate with the platform.

How Ripple [XRP] Will Force the SEC to Find Another Path

When it comes to the SEC, Ripple is playing the long game. While most token issuers can take a plea deal following the examples of Airfox and Paragon, there is another option for digital assets. By quickly pushing their cryptocurrencies toward full functionality, crypto companies like Ripple can create enough “facts on the ground” to avoid security classification altogether.

The pulsation may be too much, too unfortunate. But in case that's not enough, the company quickly becomes a prey that is simply... too much of a problem.

Hinman's paradox

The possibility of "decentralizing" the organization for security reasons was outlined in Yahoo! Financial Summit, when the SEC's William Hinman publicly stated that treating Ether or Bitcoin as securities "appears to do no good."

“Over time,” Hinman added, “other sufficiently decentralized networks and systems may emerge where regulation of tokens or the coins that act as securities may not be necessary.”

The SEC director is not sworn in when he entertains a paying audience, and a footnote to the speech makes clear that he was not speaking in an official capacity. Still, with other SEC officers repeating the same themes, Hinman's speech is as close as we're going to get to regulatory clarity right now.

And this speech suggests that a few advanced cryptocurrencies can escape security classification by becoming sufficiently mature and distributed that they are no longer dependent on central efforts. James Park, in a report from the Lowell Milken Institute, calls it the "Hinman Paradox":

F or utility token, distributed freely without regulation under securities laws, it must be functional. But many utility tokens only work if they are distributed widely enough so that a decentralized system emerges.

Park assumes that very few initial coin offerings will be decentralized enough to avoid the Hinman Paradox, and the Ripple issue is not addressed. But based on what is publicly known about the SEC's enforcement strategy, XRP is among the best to become decentralized enough to pass the Howey Test.

Read also: Bitcoin Analytics: We are in the early stages of a Bitcoin Bull Run that will shock people

XRP: a functional utility?

The words “utility token” have taken on a sour taste, and for good reason. Over the past year, ICOs have brutally abused them in search of easy money.

The mistake, as SEC officials have made clear since 2020, is that in almost all cases the “utility” is on a non-existent platform. While regulators like Hinman and Valerie Szczepanik allow for the possibility of utility tokens that are not securities, the vast majority of ERC-20 certainly are.

But unlike most supposed “utility tokens,” XRP already has almost all the necessary features.

Unlike most ICOs, XRP is not intended to be anything other than a payment and settlement system - the platform is already operational. Anyone can use XRP for purchases or payments, and - with the launch of xRapid - XRP is also used for cross-border liquidity.

Share weight

Then there is the issue of “decentralization,” a heated debate between Ripple and other cryptocurrencies. Decentralization is one of those words that has almost as many different definitions as users, but when the SEC uses it, it's clear they mean governance.

Read also: FINRA announced the dangers of Pump & Dump schemes

In his speech, Hinman noted that both Bitcoin and Ethereum are large communities with many companies that work (and compete) together. The same cannot be said about Ripple - no matter how much the company insists, the fate of XRP largely depends on the company’s “management” efforts.

It's important to note that this is already starting to change with the announcement earlier this year that Omni and Coil would be facilitating payments in XRP. Both companies have close ties to Ripple Labs, but are nonetheless separate and independent entities, which makes it better to argue that XRP is dependent on a market ecosystem rather than a single company.

Dollars and cents

The final aspect of this strategy comes down to taking the case and paying the attorney's fees. While the SEC isn't ruling anything out, all of its recent actions have applied to tokens issued since the 2020 DAO report—when the body first warned that tokens could be securities. According to Coinsource Deputy General Counsel Max Rich, they are "fighting current fires, not dealing with the charred remains of old fires."

That's not to say there's forgiveness in the Ripple letter, but it does offer respite as regulators reach for low-hanging fruit—both to develop a stronger body of case law and (perhaps cynically) take advantage of limited SEC resources.

Read also: Thailand's first domestic bank joins RippleNet to use Multi-Hop technology

This should not be taken as an argument that XRP is not secure. On the contrary, the fact that many investors consider Ripple Labs to be the central player in XRP, not to mention the massive centralization of the token in Ripple's hands, makes things very bad indeed.

But that doesn't mean the game is over. As stated in the Hinman Paradox, starting a decentralized project from scratch requires a certain amount of centralized effort. Depending on how high Ripple is on the SEC's priority list, Ripple may have enough time and resources to convincingly transform XRP into a truly decentralized asset.

Ripple forecast by month

Ripple’s forecast from experts for 2020 is gradually coming true: in terms of market capitalization, XRP has overtaken the Ethereum crypto coin and now occupies an honorable second place. The token rate has undergone many fluctuations and has been trading at $0.3-0.5 in recent months. Whether Ripple will grow in 2020 depends on a number of conditions. Positive dynamics are observed.

Such serious tools as analytical forecasts and analytics allow us to predict the likely picture of events in 2020 month by month, taking into account the current situation:

| Name of the month | Exchange rate in dollars |

| January | 4−4,2 |

| February | 4−4,5 |

| March | 4.5−5 |

| April | 5−5,2 |

| May | 5−5,5 |

| June | 4,5−5,5 |

| July | 4,5−5 |

| August | 5−5,5 |

| September | 5,5−6 |

| October | 5,5−6 |

| November | 6−6,5 |

| December | 6−6,5 |

The given forecast is approximate. Expert data was compiled according to an analysis of exchange rate dynamics over past years. In fact, indicators are prone to change, being influenced by factors: the activity of introducing Ripple into the banking sector, the position of government authorities, the success of the company.

Latest XRP News

The nearest Ripple forecast for the week can be found on our website. In most situations, news and media publications have a decisive influence on the upcoming crypto forecast. Often the publications are “fake” (lies), but users cannot always distinguish between rumors and reality, so they unconditionally believe in the news announced. For example, after the appearance of fake rumors about the death of Vitalik Buterin, the founder of Ethereum, there was a sharp drop in the price of ETH.

Regarding the Ripple cryptocurrency, analysts’ forecasts and recent news about the coin are positive. Events of 2018 that had an indirect impact on the value of the crypto asset:

| date | Event |

| January 11 | Launch of Ripple testing by MoneyGram in order to speed up transfers. |

| 28 January | The Ripple cryptocurrency is included in the list of the BitOasis crypto exchange. On January 30, the first transactions were completed. Users have the right to place sell and buy orders within the site and conduct transactions with XRP. |

| The 14th of February | Launch of XRP testing at Western Union. |

| February 21 | Connecting the large Brazilian bank Itai Unibanco to the Ripple system. The bank is able to cooperate with Canadian and Chinese banks. |

| March 7 | A Japanese consortium (61 banking organizations) announced their desire to create a mobile application based on Ripple. A program with the prospect of instant transfers is being developed not only for banks, but also for ordinary users. |

| March 29 | The cryptocurrency is listed on the LBX crypto exchange and the Uphold crypto wallet. News was published about the planned use of Ripple in 8 thousand South Korean supermarkets immediately after the execution of an agreement between the Bithumb trading platform and Korea Pay (transfer operator) |

September of this year was marked by the fact that the largest bank in Saudi Arabia joined the number of Ripple partners. On September 5-7, at the large California Crypto Finance conference, it was announced that Ripple has more than 100 agreements for the use of its own payment services. Experts’ forecasts do not rule out the imminent inclusion of XRP on the list of the largest Western exchange Coinbase, where the top cryptocurrencies (Bitcoin, Litecoin, Bitcoin Cash, Ethereum) are firmly entrenched. If this happens, the price of Ripple could rise by up to 500%. A similar outcome is not excluded, because Litecoin was able to rise in price from $2 to $20 thanks to its appearance on Coinbase.

Quite recently, unconfirmed information appeared on the Internet about the likely restriction of the functions of the SWIFT payment system on Russian territory within the boundaries of international sanctions. This is great news for Ripple, a direct competitor of SWIFT. With the introduction of a ban, a large sector of the Russian market will begin to use the more democratic and mobile Ripple system.

Ripple coin is fundamentally different from other pools. Today, Ripple is considered the “black sheep” in the field of cryptocurrencies, but despite this fact, it is very stable and has every chance of rapid growth in price and popularity, since it already ranks third in the ranking of well-known pools.

The total issue of this promising cryptocurrency today is about 100 billion coins. Capitalization volume – 30 billion dollars.

History of the founding of Ripple

The founder of the coin is considered to be a man named McCaleb, who in early 2000 created a file sharing service called eDonkey. 6 years later, the MtGox project was developed, which the developer liked, and he took it as the basis for creating an exchange for selling Bitcoin.

In 2013, the OpenCoin project was completed, which was considered the best cryptocurrency exchange, but the creator handed it over to the Ripple company, which began to actively develop this area in the right direction. It was after this event that miners and exchange users were able to get acquainted with the completely new Ripple coin, which shocked users with its practicality and dynamic growth in relation to other coins.

Initially, it was planned to simply create a store where you could pay with cryptocurrency, but after much thought, the owners came to the conclusion that it was time to create their own digital coin, which should literally blow up the Internet, which is what happened.

Distinctive characteristics of Ripple

Each currency has its own characteristics and features. Ripple was able to gain unprecedented popularity thanks to the following features:

- All codes of this coin are absolutely free and available for public use, so it began to develop rapidly. The internal coin is called (XRP).

- Translated into Russian, Ripple means “Ripples on the water.” This is a coin that can unconditionally accept any valuable equivalent. The algorithm of this cryptocurrency differs significantly from the famous Bitcoin, so you can be confident that the level of security and protection will not allow hacking into users’ personal wallets and taking away their coins.

- At the moment, the total number of available coins is about 100 billion.

- Each participant in the system can unconditionally and without any problems create their own point of exchange for goods, services and currency. All transactions in the system are carried out only on a contractual basis between two or more users, so there is absolutely no need for arbitration. Transfer of funds between participants is carried out only after their consent to the transaction.

- All cryptocurrency transactions that have been carried out can be returned at any time, which significantly distinguishes this coin from other leaders and makes it more promising.

- No commission for exchange or transactions is charged from system participants, unlike other services, where interest can simply be a real robbery.

- All transaction histories are saved on the participants’ wallets, so money transfer operations can be tracked at any time, which, of course, has a positive effect on the popularity of the coin as a whole.

- You cannot mine Ripple directly. How to get a coin? This can be done in two ways - by participating in the calculation process or through exchange. Ripple pays remuneration for renting capacity.

The principle of operation of this coin is very similar to ordinary monetary transactions based on an agreement and without any commissions charged. The example is very interesting, because if one person needs to transfer money to a relative in another city, but he cannot go there on his own, then you can always use the transaction. This is a kind of mutual assistance, which is very profitable and does not require a lengthy operation or payment of commissions.

Benefits of Ripple

This currency has a whole lot of positive features:

- there is no physical transportation of money;

- the possibility of loss of finances or theft from third parties is completely eliminated;

- complete anonymity, which significantly helps when paying taxes and filling out reporting declarations;

- For this coin you can buy almost any goods or services, which will be an excellent investment.

All Ripple transactions and transfers are displayed in the wallets of their owners, but the system does not charge any commissions, which, of course, attracts new audiences every day. Each participant who has completed the registration procedure has the opportunity to access any recorded data and invest in XRP.

Where and how to buy Ripple?

You can purchase coins using fiat funds or by exchanging other altcoins. To purchase Ripple, you can use online exchangers and trading platforms that offer transactions involving this coin.

The most popular exchangers where you can purchase Ripple:

- BestChange is one of the most popular services, it offers purchases for fiat and electronic money, as well as through the exchange of other coins, just indicate the details of your wallet and card;

- 100Btc – allows you to buy Ripple for Advanced Cash, Payeer, Perfect Money;

- Bit-exchanger – offers the exchange of other digital coins for Ripple, supports Bitcoin, Ethereum, Litecoin, Zcash, Dash and Monero, here you can also purchase Ripple for OKPay.

Another way to buy Ripple is to use trading platforms that provide transactions with this coin. As a rule, the rate on cryptocurrency exchanges is more profitable than on exchangers, by about 1-1.5%.

If you decide to buy Ripple on a crypto exchange, but do not have a single account on trading platforms, we suggest using the Crosslytics service. It displays the rate of the coin you are interested in on all exchanges. This way you can choose the most suitable service for yourself.

Today you can buy Ripple on the following cryptocurrency exchanges:

- YObit – here you can not only exchange other altcoins for Ripple, but also buy them for fiat – rubles, euros, dollars;

- Binance is one of the most popular exchanges, it has a Russian interface, you can buy coins by exchanging another cryptocurrency, you will first need to purchase an internal token, Bitcoin or Ethereum;

- Bitflip - here you can exchange some crypto coins for others, only residents of the European Union can buy digital coins for fiat funds on this site, it is distinguished by fast transaction processing;

- BITSANE – offers moderate fees and various payment methods, in particular via bank transfers, Advcash and Okpay, does not accept debit or credit cards;

- KuCoin is the most popular exchange among traders, here you can buy Ripple using a debit or credit card, and transfer from Paypal is also available.

You can also sell coins using these services. Before you buy coins, you should take care of creating a wallet in which you will store them.

Wallets for Ripple

You can store cryptocurrency in special wallets or directly on the exchange where you buy Ripple. The last method is not the best, as it has a low level of security. In fact, you do not manage private keys, which means you cannot control the movement of your funds, and in the event of a hacker attack, you risk losing everything.

There are several wallet options to store Ripple:

- desktop - Toast, Rippex - they require downloading and installation on a PC, but have a high level of data protection;

- hardware – Trezor, Ledger Nano S;

- browser-based – Toast;

- online wallets – GateHub, Cryptonator.

As for online services, they are convenient to use, but they do not have the best level of protection, so we do not recommend storing a large number of coins in such wallets due to the possibility of hacking.

The most reliable are desktop and hardware wallets. They provide a high level of protection and are easy to use. The official Ripple website recommends using the Rippex desktop wallet to store coins. It must be installed on your computer. It is supported by Windows, Linux and Mac OS. To use the Rippex wallet, you first need to install it on your PC by following these steps:

- Find the appropriate version for your OS, download it and after installation, click the “Create new account” button.

- Next, you will need to register a new account - you will not need an email, but you will have to come up with a complex password that contains lower and upper case letters.

- After entering your password, a button will open, clicking on which you will see your security key. It must be copied and stored in a safe place, and under no circumstances disclosed to others. Once the secret key has been saved, you can confirm it by clicking on the button that appears below.

- Next, the system will redirect you to your personal account. In the upper right corner you will find the address of your Ripple wallet, which must be indicated when purchasing or redirecting coins from another service.

The system also offers cryptocurrency storage on the online version of the Rippex wallet.

Another wallet recommended by the developers for storing Ripple is Toast Wallet. It offers both mobile (iOS and Android) and browser versions. The service can also be installed on a PC running Linux, Windows or Mac OSX.

Registering a wallet is simple and straightforward. After installation on your smartphone or computer, you will need to come up with a 6-digit PIN code. Next, you will be taken to your personal account, where you can see the wallet address and the number of coins.

Ripple development forecasts

Experts expect that the cryptocurrency rate will grow steadily, especially if it is supported by new investors. Ripple is considered not only as a tool for simple transfer of money, but also anything else. This platform is also valuable for banking institutions and can be used to make payments.

Positive growth forecasts for Ripple are due to the fact that in 2017 the system signed a cooperation agreement with the large bank National Bank of Abu Dhabi (UAE), as well as with six Japanese financial institutions, including Mizuho Bank, ORIX Bank and Nomura Trust.

Also, the developers recently introduced an additional service that supports transactions with precious metals. This significantly increased the credibility of the platform and attracted the attention of not only investors, but also trust funds.

Taken together, such news makes Ripple a promising and sought-after coin, which is of interest to both private investors and large financial institutions. In general, the forecast depends on the level of investment in this cryptocurrency, the further development of the platform and the presentation of value to society.

Best Exchanges to Buy Ripple

Speaking about the forecast of trading prospects for Ripple, you need to know that you can make money here in two ways: investing and making a profit from buying and selling. List of the best top 9 exchanges with comfortable conditions for investing in XRP for 2019−2020 :

| Name of the trading platform | Trading volume per day (in dollars) | Exchange launch date | Couples | Languages |

| Binance | 464 187249 | 01.04.2017 | 249 | Rus/Chn/Eng |

| YoBit | 10 263 030 | 25.08.2014 | 586 | Rus/Chn/Eng |

| HitBTC | 209 793 532 | 28.09.2011 | 455 | Chn/Eng |

| EXMO | 20 576 358 | 18.09.2001 | 46 | Rus/Eng/Fr/Pol/It/Esp/Chn |

| Poloniex | 18 835 503 | 10.01.2014 | 99 | Eng |

| Livecoin | 9 709 770 | 04.03.2014 | 488 | Rus/Eng/Fr/Chn/It/Esp |

| Kraken | 126 987 145 | 03.04.2010 | 47 | Eng/Jpn |

| Bitfinex | 189 346 753 | 11.10.2012 | 105 | Rus/Eng/Chn |

| Bittrex | 31 406 508 | 25.01.2014 | 263 | Eng |

If the user plans to make a profit from the difference in the Ripple rate, you should visit Forex brokers (InstaForex, Forex Club, AMarkets, etc.) who work with XRP. The Ripple cryptocurrency has great growth prospects, so buying and storing XRP/USD is the simplest and most profitable forex strategy.

It is recommended to wait for sharp pullbacks and buy back coins, and sell tokens on a new wave of growth. Ripple followers have a unique chance to enter into long positions, as quotes tend to go beyond the boundaries of a long-term “trading” and begin to restore positions.