Bitcoin is called “digital gold”. It was this electronic coin that became the first popular cryptocurrency. The key principle of the platform is decentralization. However, at the moment the currency has every chance of losing this important quality.

There are two scenarios for Bitcoin centralization. The first option involves establishing control of one company over most of the equipment produced, and the second - over most of the hashrate.

By the way: Bitmain's power is approaching 51% of Bitcoin's hashrate

Already, Bitcoin mining is largely carried out at the expense of large mining pools. For ordinary users, Bitcoin mining is almost unprofitable. Add to this the limited emission, most of which has already been done, and the picture is complete. She is unlikely to make you happy.

Bitcoin is a cryptocurrency with limited emission

The release of coins occurs when new blocks are created in the chain. They contain all the necessary information about the transactions being carried out. The more blocks are formed, the greater the amount of information that needs to be recorded, and the larger the Bitcoin coins themselves become.

The cue ball emission is fixed. It is limited to 21 million tokens. This volume cannot be changed. It is “hardwired” into the platform’s program code. The last BTC will be mined by 2140. Moreover, 99% of the coins from the planned issue will be mined within the first twenty-eight years from the founding of the cryptocurrency. The remaining period of more than a hundred years is left for the last 1% to mine.

How many Bitcoins have been mined today?

Currency generation is a special area of online earnings. It is carried out not only by private individuals, but also by fairly large enterprises that combine their forces in pools. This process is called mining or coin mining through the generation of new blocks. The process of obtaining cryptocurrency is based on complex tasks and actions in mathematics.

Huge modern resources are involved in solving them, innovative technical devices are involved.

Knowing that the number of Bitcoins is limited, the “miners” throw all their resources into mining, spend the money they earn, and make full use of the capabilities of mining organizations.

Approximately 3,600 coins are added to the overall currency network every day. New arrivals are increasingly costing users more and more complexity. According to certain data, users have already received 13 million coins. Users will be able to reach the upper limit around 2140. This decline in speed is based on two main reasons:

- The requirements for the devices used to produce currency are constantly growing.

- The time required to mine one Bitcoin increases significantly.

The situation is further complicated by the fact that modern mining companies, focused on the extraction of new coins, invest large sums on the purchase of new expensive equipment. Such organizations calculate as accurately as possible how many coins they need and how long it will take to return the invested funds.

What is the difference between limited and unlimited issue coins?

The most striking example of a currency with unlimited emission is ETH. The main risk associated with this coin feature is inflation. Currently, the consensus level on the acceptable amount of cryptocurrency is one hundred million. At the same time, the authors of the project have repeatedly stated that the size of the issue will be limited, and some of the coins will be “burned” to prevent depreciation.

Unlike ETH, BTC is not at risk of inflation due to excessive emission. On the contrary, the high rate of “digital gold” is largely due to the limited release of coins. This aspect is the main difference between electronic currencies with different emission principles.

Why is the number of BTC coins limited?

As you have already learned, limiting the release of Bitcoin prevents the cryptocurrency from depreciating. However, many are interested in where the figure of 21 million coins came from? This limitation is associated with miner remuneration formulas, which are created based on the law of inverse geometric progression.

Simply put, the existing principles for forming bonuses for token miners do not allow them to mathematically step over the line of 21 million BTC. The maximum emission is 20,999,999.9769 BTC.

There is an opinion that the creators of the cue ball limited themselves to this size of issue for a reason. The number of coins was chosen for the prospect of full integration of BTC into the global economy. At the time of the creation of the cryptocurrency, the total amount of money that existed in the world was 50 trillion USD.

Compared to this figure, 21 million seems like a small number. However, such an issue would be enough even to completely replace fiat money. If you directly exchange 50 trillion USD for the issue of Bitcoin, you will get 2,381,000 BTC. In this case, one satoshi would be equal to 2.381 cents. This means that the selected emission would be quite sufficient to service the global economy.

How many Bitcoins are lost?

Paradoxically, digital money can be lost just as easily as fiat money. According to the latest data, permanent losses of Bitcoins range from 2.8 to 3.8 million BTC. In other words, about twenty percent of the final currency issue is lost forever. Experts arrived at these figures after conducting a detailed empirical analysis of the platform.

The reasons for losing funds vary. This is mainly due to the loss of private keys or an incorrectly entered recipient address. The lion's share of BTC was lost in the first years after the emergence of the cryptocurrency. Then the value of the coin was low, and the prospects were too vague. Therefore, many users did not pay enough attention to security issues and maintaining access to their wallet.

Why does the difficulty of Bitcoin mining increase every year?

The complexity of BTC mining is growing every day. This is a problem for many miners.

Technically, the increase in the complexity of cue ball mining is due to:

- Network hashrate;

- Mining speed of 2020 blocks.

The difficulty of mining coins is increasing due to the constant expansion of the mining community. Every day, more and more users are looking to use their excess computing power to mine coins.

The more miners there are, the less time it takes to find one block. After passing the milestone of 2020 blocks, the mining difficulty indicator changes. According to the following formula:

Advantages and disadvantages of cryptocurrency

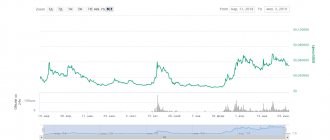

The Bitcoin rate is growing every day, as is the number of people wishing to receive it. It is worth considering whether the hopes of miners are justified, and whether such a rapid growth of the currency should be trusted. What is the advantage of Bitcoin?

- Independence. Cryptocurrency is not tied to anything and, in fact, no one owns it, therefore it is not subject to depreciation.

- Anonymity. When registering in the program, you will not need to enter personal data; when transferring funds, you also do not need to fill out the standard “first name-last name” columns. Therefore, users can be sure that they will remain completely anonymous.

- High rate of currency growth: Bitcoin has only crashed once so far, in 2011, and has continued to rise since then.

- No intermediaries. When paying for services using Bitcoin, you do not need to pay commissions or, after going through a series of procedures, open a savings account. Simplicity and security are the main symbols of btc success.

But with all the positive aspects, bitcoins also have many disadvantages.

- First of all, it is the instability of the exchange rate that frightens financial analysts. After all, what grows quickly usually collapses just as quickly. In this regard, cryptocurrency does not inspire much confidence.

- Lack of legal status. The governments of many countries are suspicious of Bitcoin. Some even consider cryptocurrency to be another money pyramid like MMM. This happens because the status of Bitcoin is largely unclear, as is its impact on the economy.

- Lack of mass use. Only a few stores and companies accept coins like Bitcoin for payment. Because of this, it is difficult to pay for services using cryptocurrency, and it often just lies idle in the accounts of its owners.

What happens when the last Bitcoin is mined?

There are fears that after the last BTC is mined, the system will stop working properly. After all, miners will be deprived of their main motivation - the reward for the block. However, this is unlikely to happen.

Miners not only make money by calculating hashes, but also receive a small reward for processing user transactions. Currently the size of this bonus is small. It is less than one percent. However, in the future, this figure is likely to increase, due to which the performance of the system will be maintained at the proper level.

When will the last token be mined?

According to calculations - how many Bitcoins are left to be mined, you need to multiply by 10 minutes - it turns out that the number 21 million will be reached in 2140, that is, more than a century from now. What will happen next with the first cryptocurrency is a simple question - although new coins will stop appearing, the old ones will not go away and will continue to be in circulation.

In addition to the reward issued during the mining process for finding a hash, the system also charges commission fees. Fees are currently extremely low, but as the number of Bitcoins left decreases, fees are expected to increase. This is also due to the potential increase in the exchange rate, which is inevitable.

Miners will receive rewards from the commissions. That is, mining as a way to support Bitcoin will not stop. The question is how profitable this is, given the growing energy consumption of heavy-duty equipment.

Prospects for Bitcoin mining in the coming years

In the foreseeable future, it is expected that mining will continue to become more difficult and rewards for new blocks will decrease. Already today, profitable coin mining is possible only through ASIC. According to many experts, the future of BTC mining lies in large mining pools.

The forecast is disappointing for “loners” - they will have to leave the market, since mining coins using small computing power will become unprofitable. An increase in remuneration for processing transactions can partially change the situation.

This is the most pessimistic scenario, but there are other opinions. You can find some of them below.

The scale of mining in China

The scale of mining in China

So, which country mines the most bitcoins has become clear. This is China with its bitcoin mining factories. They are also called farms, and photos on the Internet confirm the scale of mining. By the way, these capacities do not belong to a specific audience of miners, but to individual Chinese companies:

- B.W.

- AntPool.

- F2Pool.

- BTCC and others

Research has shown that there are less than two dozen of them in the world. They are the ones who mine the most bitcoins. That is, in fact, the bitcoin mining market is concentrated in a few hands - the owners of large companies.

One of the mining farms in China

This suggests some conclusions. Bitcoin itself has a completely decentralized technology - independent of anyone. But with mining everything is a little different. Here all the cards are concentrated in those who have the largest amount of equipment (capacity). The more video cards, servers, processors you have, the more you can get. And when Chinese companies build entire farms like factories, then, of course, they account for the largest volume of production.

It turns out that mining is already decentralized, that is, controlled by a certain group of companies from China. But don’t worry that there will be no space left on the market. It will always be there, but it’s becoming more and more difficult to mine bitcoins, and the reward is decreasing. If Chinese companies leave the market, others will come. There will be a replacement, but for now it is China that is leading in bitcoin mining.