The year 2017 will be remembered by cryptocurrency users primarily for the rise in the Bitcoin rate to $20,000, the capitalization of the cryptocurrency market at $570 billion, and record fundraising in the framework of large ICO projects. According to CoinSchedule, in 2020, 235 ICO projects raised a total of $3.7 billion. During the same period, the amount of funds raised by the ten largest public companies amounted to $1.360 billion.

The prospects for cryptocurrencies still raise a number of questions. There is no clear opinion yet about the fate of the most popular cryptocurrency, Bitcoin. A variety of opinions continue to spread among experts, which often contradict each other. Thus, Jeffrey Sachs, an American economist, calls Bitcoin a “bubble,” and Pavel Matveev, co-founder of the Wirechain Wirex payment service, believes that the coin will repeat its price record of $20,000 and even reach $50,000,000 by the end of 2020.

So what should we expect from the situation in the cryptocurrency sector in the near future?

Blockchain technology and cryptocurrencies. Fast start

Get the book and learn all the basics of blockchain technology and cryptocurrency in one evening

For example, in Russia, at the end of the first - beginning of the second quarter, a draft law on cryptocurrencies should be submitted to the State Duma for consideration. The document is being developed by the Ministry of Finance of the Russian Federation, which intends to discuss this issue with the Central Bank of the Russian Federation.

The latter opposes the legalization of digital money in the country. At the same time, he emphasizes the danger of uncontrolled growth of this market and sees it as a threat to the global economy. In this regard, the ministry is looking for another trading platform that will agree to act as an intermediary in monitoring financial activities in this area.

The Russian government is also considering introducing measures to regulate ICOs. The concept of the draft law of the Ministry of Finance of the Russian Federation provides for fundraising campaigns as a kind of investment activity. In this case, all digital assets are proposed to be considered as a separate type of property.

Among the CIS countries, the most positive attitude towards cryptocurrencies has developed in the Republic of Belarus.

President Alexander Lukashenko officially authorized the mining, storage, sale and purchase of coins. The corresponding decree has already been signed and stipulates that any activity related to cryptocurrencies is not considered entrepreneurial. Mining, trading and other operations with digital coins are exempt from income tax, VAT and other applicable taxes.

EU member states also decided to regulate the cryptocurrency market by banning anonymous transfers. To do this, trading platforms require their clients to undergo a verification procedure (identity confirmation). In the next 1.5-2 years, the EU authorities intend to develop a legislative framework to regulate this area.

Some representatives of European financial institutions oppose this move. For example, Karl-Ludwig Thiele, a member of the Board of Directors of the Bundesbank, completely ruled out the possibility of legalizing cryptocurrencies in the EU.

Some countries insist on a complete ban on cryptocurrencies, as they are often used for fraudulent and criminal purposes. However, cash on the “black market” is also prohibited in many countries, but no country in the world has yet been able to cope with it. How the ban on the use of cryptocurrencies will be implemented is not yet entirely clear. However, the authorities of most countries in the world are no longer able to ignore the ever-expanding cryptocurrency market. In any case, they will have to meet its users halfway and look for ways of regulation that will suit all participants.

State cryptocurrencies

In some countries, ideas have arisen to create national digital money. In Russia, they are actively discussing the possibility of introducing a crypto-ruble, but so far this idea remains only at the concept stage, which the Russian authorities are in no hurry to give the green light.

On October 10, 2020, during a government meeting, Russian President Vladimir Putin noted the need to control the proposal to introduce a crypto-ruble. At the same time, he warned against creating unnecessary, artificial barriers to the implementation of this idea, which was met with hostility at the Central Bank.

Russia is not the only country where they are talking about a national digital coin. In January 2020, Venezuelan President Nicolas Maduro announced the release of 100,000,000 El Petro cryptocurrency coins. It is provided by Venezuelan oil, and its starting price will be equal to the price of one barrel of oil.

Mining of this coin is impossible, and control over it will be in the hands of the government of the country. However, so far the Venezuelan parliament has not supported the idea of its president and will oppose the national cryptocurrency.

The Bank of England also announced plans to create its own cryptocurrency. The English digital coin will most likely be pegged to the pound sterling. Its exact name is still unknown. At the current stage it is proposed to call it RSCoin.

In 2020, we can expect similar statements about the development of state-owned cryptocurrencies in other countries. But their release is still unlikely. The authorities are unlikely to advance beyond discussions and drafting legislation.

Price to Earnings Ratio

The price-to-earnings ratio is calculated by dividing the current price by the annual earnings per share (EPS). For example, Amazon stock was trading at around $1,500 on December 31, 2020, and had an EPS of around $20 for the year, giving it a P/E ratio of 75.

The price/earnings ratio shows how many dollars investors are willing to pay today in exchange for one dollar of annualized EPS in the future. In the Amazon stock example, investors were willing to pay $75 in annual EPS.

Price/Utility Ratio = Share Price/EPS

= share price / (annual return/shares outstanding)

= market capitalization / annual return

The P/E ratio measures a company's market capitalization relative to its annual earnings and sheds light on the company's stock valuation. Typically, analysts compare price/earnings ratios for different stocks and recommend buying when the ratio is low and selling when the ratio is high.

While the price/earnings ratio is a widely accepted tool that has long helped investors navigate financial markets, it has its limitations.

EPS is calculated based on a company's earnings over the past 12 months, but a company's historical earnings are not indicative of future earnings. That is, this metric does not affect the growth of the company. A high P/E ratio (that is, a high stock price relative to its earnings) does not necessarily mean the stock is overvalued. This may also be due to market participants' expectation of rapid growth for the company.

Some analysts rely on forecast earnings (i.e. expected EPS), but this approach is subject to uncertainty and is subject to earnings manipulation.

However, the P/E ratio is a simple but practical metric for quickly assessing a stock's value.

In the cryptocurrency space, the price/earnings ratio model generally does not work. Unlike companies, most blockchain projects do not pay dividends. Although it is worth noting that airdrops (for example, the distribution of new tokens between ether holders during the period of general ICO craze) and hard forks with the formation of new tokens - such as Bitcoin Cash, Bitcoin Gold, Bitcoin Diamond, etc. – can be considered as a kind of dividend to token holders. But such profits are neither predictable nor sustainable.

The researchers suggested using transaction fees as a proxy variable for profitability. However, using transaction fees as a substitute is misleading because these fees are received by miners, not token holders.

Additionally, using transaction fees can lead to ridiculous results. For example, an increase in commissions leads to a decrease in the price/yield ratio and, therefore, to the conclusion that the token is undervalued. In other words, when transaction fees rise rapidly, Bitcoin appears to be undervalued by this metric. That being said, it is no secret that high fees are a barrier to more widespread adoption of Bitcoin.

The figure below on the left is a graph of the price/return ratio for Bitcoin over the last five years using transaction fees as a proxy for BTC returns. Taking into account newly created (as a mining reward) bitcoins, the P/E ratio is in the range of 5-125 (see the graph on the right in the figure below). Again, it is important to keep in mind that the price/yield ratio is meaningless for BTC buyers and sellers since they do not profit from transaction fees and block rewards.

Left: BTC price/return (with transaction fees as return). Right: BTC price/return (return proxied through transaction fees + block reward).

Blockchain projects are different from public companies that distribute net profits among shareholders. Therefore, the traditional price/earnings ratio is not applicable to token valuation.

However, there are several exceptions to this rule. Among them, a notable example is Binance Coin (BNB). The cryptocurrency exchange platform Binance spends 20% of its net profit for the quarter on buying back its own tokens, which it then burns. This buyback and burn program is equivalent to a dividend distribution to BNB holders.

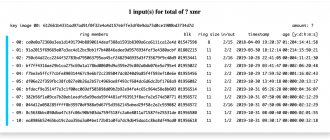

The table below shows the price/return values for BNB as of the token burn dates.

The total supply of BNB was 200 million tokens and 136 million tokens in circulation were issued when the project launched in the summer of 2017. The 64 million locked BNB were to be released over the next four years (16 million BNB per year).

Note the significant increase in the price/earnings ratio in the first quarter of 2020 when calculated using both metrics (tokens in circulation and total supply). The rise indicates that the value of the BNB token is overvalued compared to its all-time high. However, as mentioned above, the P/E ratio has no impact on expected growth. In fact, the rise in price/earnings ratio can be attributed to the introduction of Initial Exchange Offerings (IEOs) and Launchpad on the Binance platform, as well as the launch of the Binance blockchain and decentralized exchange (DEX) in the first half of 2019.

The price-earnings ratio may work well for the stock market, but in the case of the crypto market, it is either completely inapplicable or leads to false conclusions due to the fundamental differences between public companies and blockchain projects.

Blockchain technology and cryptocurrencies. Fast start

Get the book and learn all the basics of blockchain technology and cryptocurrency in one evening.

Japan is considering introducing cryptocurrency into the popular local instant messaging system, which currently uses the Line Pay payment service. The number of its users is more than 168,000,000 people.

Fast food chain KFC launched a hamburger sale to promote Bitcoin in Canada. Participants were required to transfer the equivalent of 20 Canadian dollars in cryptocurrency through the BitPay platform to receive their order delivered to their home.

Attempts to introduce cryptocurrency into everyday life are associated not only with new projects and opportunities, but also with prohibitions. Thus, at the beginning of January 2020, Visa blocked debit cards of the WaveCrest project, which allowed making purchases with digital money. Representatives of the payment system claim that WaveCrest violated the terms of the agreement.

The number of new startups aimed at removing barriers to the adoption of digital coins in everyday life will grow exponentially. In the coming months, we can expect the emergence of new products, such as bank cards and applications that will allow cryptocurrency payments. The list of companies that will offer goods and services for Bitcoin and other coins will also expand. However, one should not expect a complete transition of the global financial system to cryptocurrency even in the medium term.

Market correction is a chance to make money

However, after such rapid growth, according to the law of any market, a correction always occurs. During the correction period, the prices of all digital assets roll back. This phenomenon is typical for the entire economy, which is why many analysts predicted a deep downward trend after such market growth. But no one could have imagined that it would be so deep and last for such a long period of time. At the beginning of 2020, the market had fallen to a capitalization of less than $300 billion, and the Bitcoin cryptocurrency was worth just over $6,000.

Many crypto investors are now experiencing doubts and even panic. Their investment portfolios sank in deposits by almost 200-400% or more. However, some people, even during this downward market trend, when coin prices completely stagnate or fall, were able to make money on their investments in cryptocurrency or at least not lose their initial capital. The whole secret of this type of investor is that they found Blockchain projects that were undervalued in the past and cost relatively little money.

Finding a promising cryptocurrency is a rather difficult task, but it is precisely such assets that generate the most income.

“So, what are these cryptocurrencies that were able to outpace Bitcoin and the entire digital market in growth in 2020,” many will ask. This article will answer this question.

From it you will learn about the TOP 3 little-known digital assets that, during the severe market correction of 2020, were able to either significantly outpace Bitcoin in growth and grow several times, or keep their price unchanged.

Development of cryptocurrency mining

The business sector is actively discussing the current market need for the development of cryptocurrency mining infrastructure. Companies specializing in the sale of mining equipment have already appeared in many countries, including Russia. Recently, the ex-head of the Committee of Natural Resources of Tatarstan, Alexey Kolesnik, said that he bought such a device.

In Novosibirsk, landlords began offering premises for miners to save themselves and their neighbors from exposure to high temperatures and noise. Alexey Noskov, head of the Xelent Mining data center project, believes that the time has come for the development of mining hotels, where private miners can place their equipment.

The development of payment infrastructure also continues. For example, the Monaco project is going to issue Visa cards that support payments in cryptocurrency. Digital money can be bought, sold and exchanged through a mobile application. In addition, the project has its own token provided to clients for financial transactions.

Profitable business niches will continue to be open to entrepreneurs in the coming years. The main demand will concern the development of platforms for mining and payment services with cryptocurrency support.

Changes in the ICO market

Investors are gradually becoming more and more disillusioned with ICOs. Recently in the United States, the founders of the startup PlexCoin were accused of fraud, and the funds they raised were blocked. Investors in the Confido project lost $375,000 after its founder deleted all data and went into hiding. The founder of the Fantasy Market project also disappeared, having collected more than $4.4 million.

However, major players have begun to show interest in ICOs. For example, Kodak, a manufacturer of photographic equipment and consumables, announced the creation of the KODAKOne blockchain platform. Its purpose is to protect copyrights to photographic materials.

Telegram has also shown interest in this fundraising method. Its founders announced the development of the Telegram Open Network (TON) platform, a next-generation blockchain project. It is planned that TON will become a platform for the development and launch of applications and smart contracts, as well as the infrastructure of a blockchain-based payment system.

Mikhail Brusov, co-founder of Cindicator, believes that despite the ever-increasing growth, new ICOs will have to fight for investors. As supply exceeds demand, projects will be forced to adhere to transparent rules of the game.

Dmitry Matsuk, founder of Blockchain.ru Group, in turn, believes that ICO participants will strive to publish their income and expenses, supported by detailed data about the company, road maps and step-by-step reports on the progress of the project, in order to increase their transparency.

In the near future, the ICO market will remain a popular place for new projects, allowing them to attract investors. But there will be much fewer record ICOs, and investors themselves will be more careful in choosing startups. Moreover, the popularity of ICOs will decrease with the development of infrastructure for using cryptocurrency for everyday purposes. Investors are now investing in ICOs because the everyday use of digital money is still limited.