The task is to create legal cryptocurrency exchanger

, through which you can receive crypto from an individual and pay him funds in rubles to a card/account in a Russian bank. At the same time, it is necessary to have legal grounds for this, provide supporting documents and not withhold personal income tax.

Potentially, the project may be of interest to operators of exchangers from the “gray” zone, projects for settlements with freelancers, international companies for implementing salary projects in Russia, financial consultants (including managers of premium banking), traders - any individuals and teams, who needs to partially or fully legalize income in cryptocurrency. Technically, it is possible to implement the project now; the scheme is working despite possible gaps and risks. In fact, nothing will change with the adoption of the law on the regulation of digital assets, which may be adopted in the near future. In the draft law available at the moment, the cryptocurrency market remains virtually unregulated; all exchange requirements apply only to tokens with a single issuer. Therefore, in light of the adoption of this law, we are likely to see changes in the tax, administrative and criminal codes, as well as some other laws and regulations, which will be designed to limit cryptocurrency transactions as much as possible. However, this is not yet a tangible prospect.

Disclaimer

. The project should not be considered as a business plan or a guide to action. This is a study in which the authors are interested in a possible legal framework for the interaction of participants.

Working cases

Exchanger as an advertising tool

The fact of launching an exchanger in itself is an excellent information source.

The main advantage of working through a legal exchanger is that the end client does not have to have accounts in payment systems and exchanges, does not have to delve into the nuances of currency legislation and does not have to fight with banking services, he always has supporting documents and can legalize income from the sale of cryptocurrency. The exchanger can work as a channel for attracting audiences and converting to other sites. Under certain conditions, it becomes possible to legally advertise the service on Facebook and Google.

Exchanger as a private club

An exchanger initiated by a single investor or a group of investors in order to meet the needs of a limited circle of people will make it possible to partially or fully legalize income - i.e.

receive the necessary supporting documents, submit a 3-NDFL declaration and pay the tax. This can be your own scheme with full control over companies, assets, accounts and chains of transactions. Risks associated with the human factor can be worked out and reduced to a reasonable minimum.

Thanks to a foreign company, the purchase and sale of cryptocurrencies is carried out at favorable rates directly on connected exchanges, where corporate accounts are opened with extended transaction limits.

How to choose a good exchanger

Profinvestment.com portal expert Sergey Vorobey first recommends finding monitoring - a site that collects information about all verified working services indicating exchange rates for selected currencies. Examples of such monitoring are BestChange, Kurs Expert, Okchanger, etc. They will help you do the initial screening - find sites with the most favorable rates. In addition, only truly honest services are listed on good monitoring sites; for this purpose, they are checked according to many criteria before being added to the list. Having selected 2-3 options you like from the list, you need to go to them and study them in more detail - information, exchange conditions, duration of work, reserves, contacts. The more information a service provides, the more trust it has. You should not contact sites that do not have sufficient funds in reserves, since in this case exchanges will occur slowly, waiting until someone replenishes the account with the required currency. By looking at the “Frequently Asked Questions” section, you can find out what to do in case of problems, how long operations take on average, and what the technical support schedule is. Finally, you can try to transfer the minimum possible amount to see from personal experience that everything is fine.

Scheme participants and their activities

1. The client initiates a transaction and sends the crypt to the Operator

- registers on the website of a foreign operating company;

- uploads documents for KYC;

- agrees with the transaction price and commission, creates an exchange request;

- transfers cryptocurrency to the company’s wallet;

- receives a loan agreement electronically.

2. The Operator issues a loan agreement to the Client

with an obligation on its part to repay the debt upon demand and the right to assign the debt.

3. The client sells the loan to the Partner

- The Partner contacts the Client and offers to repurchase the loan with a discount - a predetermined commission for the transaction;

- The client provides loan agreement data, goes through simplified identification (KYC) again, and provides bank card or account details;

- receives and signs the assignment agreement and the certificate of services rendered, according to which the loan and the right of claim are completely assigned to the Partner

4. The Partner pays the Client money

in rubles to a card or account in a Russian bank.

5. The Partner issues supporting documents to the Client

, sends documents on the transaction electronically, instructions to the bank in case of any questions, recommendations for filling out a tax return - everything that is necessary for legalizing income and filing 3-NDFL at the end of the year.

6. The Partner presents the loan to the Operator for repayment

– sends the loan agreement, assignment agreement and the Client’s data with a request to repay the debt.

7. The Operator pays the Partner money

to a foreign currency account in a Russian bank.

End client

Individual, cryptocurrency seller, resident of the Russian Federation.

Foreign company (Operator)

Legal entity in a crypto-friendly jurisdiction (Estonia, Malta, etc.). Has several accounts in banks and payment systems for settlements with partners and corporate accounts on exchanges for buying and selling cryptocurrencies. According to the laws of its jurisdiction, it can freely buy and sell cryptocurrencies and reflect all transactions in accounting. To carry out operations of exchanging crypto for fiat and providing services to individuals, it has the appropriate license or accreditation (for example, Providing services of exchanging a virtual currency against a fiat currency

- for Estonia). The company buys cryptocurrency from end clients and subsequently sells it on the exchange at the most favorable rate.

The Operator’s website has a client’s personal account, in which end clients register, upload documents for KYC, see the current exchange rate, create exchange requests and download the necessary documents. The exchange rate is generated manually or automatically taking into account expenses (exchange rates, fees for transactions in the blockchain, bank commissions, exchange rate differences) and the built-in margin.

After creating an application, the client transfers cryptocurrency to the company’s wallet and receives a loan agreement. The operating company is ready to repay the loan agreement at any time immediately after the transaction is confirmed in the blockchain. Payment can be made either in a foreign office or through a partner in Russia. It is possible to implement the terms of the scheme and loan agreement in such a way that payment is made only after the entire chain of transactions has gone through and the money has been received by the Russian company.

Russian company (Partner)

One or more legal entities in the Russian Federation, ordinary LLCs without any special licenses, permits or accreditations.

The main activity is the provision of information and consulting services on financial intermediation. Has several accounts in banks and payment systems for settlements with the operating company and payments to individuals. The partner buys loans from end clients at a discount and repays them to a foreign company at full cost. Payment of funds to the end client occurs by non-cash method to the account/card of an individual in a Russian bank or payment system. Payment in cash requires separate consideration due to legislative risks, risks of blocking bank accounts as part of AML/CFT procedures, etc. security and collection costs.

The partner company does not necessarily have to have a website or even a public office. If a meeting with a client is necessary, for the purpose of identifying the client, as well as for the purpose of exchanging documents, it can be carried out by a visiting specialist by agreement.

A partner can provide consulting services and help with the preparation of a 3-NDFL tax return and, for example, help restore documents for the purchase of cryptocurrency so that you do not have to pay 13% tax on the entire sale amount, but only on the difference between the sale price and the purchase price.

Cryptocurrencies: where to get them and how to choose an exchanger

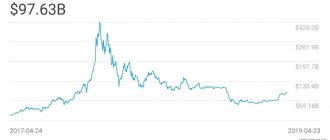

Cryptocurrency and electronic money - these terms are on everyone’s lips. Their appearance has produced a real revolution in the financial world - the era of dishonest businessmen is becoming a thing of the past. It is much more difficult to carry out a fraudulent scheme with electronic currencies than with cash.

The popularity of cryptocurrencies has led to an increase in the number of exchangers on the network. So that you don’t have to look through many sites, https://kursoff.com/ monitored them all and chose the most profitable options for you. All exchangers presented on the page have been thoroughly checked - their reputation is impeccable. Any unscrupulous exchange offices that have received complaints from customers are blocked in the system.

How to become the owner of cryptocurrencies

Those wishing to join the ranks of cryptocurrency asset owners have several options:

- mining;

- purchase on a stock exchange or crypto exchanger;

- receiving bonuses during an ICO or fork.

What is an exchanger and how does it work?

A cryptocurrency exchanger is a service that allows you to convert one currency into another. Most of these platforms operate online and allow you to withdraw funds to bank cards or popular payment systems. Applications can be processed:

- in manual mode - the money will be credited to your account, wallet or payment system after the data is verified by an employee. The processing speed depends on the staffing level and workload of the service. Such exchangers rarely work 24/7, so be prepared for the fact that an application sent at the end of a work shift may hang until the next morning;

- automatic - the client will be able to receive funds in the desired currency in the shortest possible time. The delay can only occur on the part of payment systems or banks. Such exchangers work around the clock;

- semi-automatic - the process is partially automated, but is under the control of company employees.

How to choose a reliable exchanger

Exchange rate

Pay attention to the exchange rate - the exchanger cannot work to its detriment. If you see an overly tempting offer, be wary. The resource may be fraudulent.

Commission

The commission level for different exchangers may be different. Look for the most profitable option.

Duration and reputation

If the service has only recently been launched and there are no reviews online, do not rush to exchange large sums there.

Monitoring service

Kursoff.com will help you choose a good exchanger. You can profitably exchange Bitcoins, Ethereums and other currencies.

Legal description of the scheme

When an individual (citizen of the Russian Federation) sells cryptocurrency to a foreign company, he receives a loan agreement under which this company becomes his debtor for the cryptocurrencies (cryptoassets) transferred on loan with the condition of repaying the debt at any time in fiat money.

A bill or bond will not work because... According to Russian law, a bill of exchange can only be expressed in documentary, that is, paper form, and to issue bonds it is necessary to obtain a license.

Further, an individual assigns his rights of claim under a loan agreement to a Russian company on the basis of an assignment agreement (optionally assignment of a future right of claim, Article 388.1 of the Civil Code of the Russian Federation), receiving for this an amount in rubles at the exchange rate, for example, of the Central Bank of the Russian Federation at the time of payment.

In order to finance its own activities, a Russian legal entity submits a loan agreement to a foreign company for reimbursement, and the foreign company repays such a loan.

At the same time, no cryptocurrency transactions take place in the Russian Federation. The parties determine the applicable law and place of the transaction in a foreign jurisdiction, because the borrower (purchaser) is a foreign legal entity.

Formally, the Russian company pays the individual the cost of assigning rights, without the risk of running into misunderstandings from banks and the tax office, despite the fact that the subject of the loan was cryptocurrency, the loan is repaid in understandable fiat foreign currency. Even recharacterizing the loan agreement into an agreement for the purchase and sale of digital assets (in the terminology of the draft new law) will not make the Russian legal entity the final beneficiary of the transaction, since the cryptocurrency wallet does not belong to the Russian company.

The provisions of 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism” are not applicable to this scheme, since a Russian legal entity is not an organization that carries out transactions with funds or other property in accordance with Art. 5 of the said law. In addition, the individual who is the recipient of funds under the assignment agreement is identified by all parties and must independently pay taxes.

The question may arise whether in such a scheme the Russian company is a tax agent. No, because according to Art. 226 of the Tax Code of the Russian Federation, tax agents are required to withhold tax only from income, and since an individual under a loan agreement incurs expenses that are not repaid by the amount received for the assignment of the right of claim, there is nothing to calculate the tax on.

Requirements for foreign and Russian companies:

- All participants in the scheme must be unaffiliated

with each other; - Both companies must be full-fledged businesses, have an economic meaning

for their existence, i.e. generate profit from each transaction, pay taxes (industry average, according to the arm's length rule), employee salaries and dividends to beneficiaries; - Both companies must have substance

, i.e. physical presence in their countries, office, telephone, address, real directors and competent employees; - A foreign operating company must have a license

or accreditation for cryptocurrency exchange operations in its jurisdiction, conduct internal and external

compliance

, implement and apply

KYC/AML policies

; - A partner in the Russian Federation should not explicitly position its services as a cryptocurrency exchange. The company must carry out customer identification (KYC) and constantly update the risk model

.

Choosing a crypto-friendly jurisdiction for a foreign company

We considered several jurisdictions, in particular Estonia, Malta, Cyprus, Gibraltar, as well as Belarus, Switzerland, Poland, Finland and Slovenia. In fact, if you need the most comfortable way to create and manage a legal entity on a limited budget, Estonia is ideal. Apart from certain difficulties with local banks, this is a country with a developed digital economy and clear legislation. Malta and Gibraltar are also good, with significant “buts” in the form of the cost of a license and the general perception of jurisdictions as offshores. In this article, we will not touch upon the specifics of choosing a jurisdiction; this can be done if there is a substantive interest.

Main risks

Sanctions against a Russian legal entity

The status of cryptocurrency in the Russian Federation is not defined, which leads to sanctions imposed by the courts on the proposal of the prosecutor’s office without any trial on the merits.

Currently, courts and tax authorities consider crypto as property, and this is an attempt to bring cryptocurrency savings to some existing basis and bring them into the scope of the tax code, but not an accurate description of the legal nature of the phenomenon. The Central Bank, Rosfinmonitoring, the prosecutor's office and security officials consider crypto as a money surrogate in accordance with Art. 27 of Law No. 86-FZ “On the Central Bank of the Russian Federation”, recognize the circulation of cryptocurrencies as a means of laundering criminal proceeds and are trying to lead to violation of laws No. 115-FZ “On combating the legalization of income...” and No. 395-1 “On banks and banking activities”. No liability has been established for the circulation of cryptocurrencies, and although attempts to introduce it do not stop, none of the laws yet stipulate any obligations for persons carrying out transactions with cryptocurrency. Sites that openly offer exchange services are blocked by a court decision; it is almost impossible to place advertisements in large networks on the subject of cryptocurrencies.

In the scheme under consideration, the main risks fall on the Russian legal entity, but five of these risks are not related to criminal prosecution. There will be no complaints against a company abroad, if its activities are properly registered. As soon as there are no claims against end clients, provided they submit reports and correctly calculate the tax base.

Russian legal entity the person will also not have anything to do with the management of cryptocurrency, will not provide relevant advertising, which means that the risk of checks, blocking of the site and accounts, although quite tangible, is still significantly reduced compared to other schemes currently existing. As an example, we can recall the case of Lavka Lavka (as well as their joint action with UAZ) on the sale of products for bitcoins, when the prosecutor’s office demanded an explanation and warned that payments on the territory of the Russian Federation were only possible in rubles, but found no violations. Although, in fact, an even less obvious scheme was used, when the buyer transferred bitcoins to the cooperative’s account, and the employees deposited money for it directly into the cash register.

Sham and invalidity of transactions

Obviously, transactions using such a scheme may be considered sham.

But in order to invalidate the transaction, this still needs to be proven. Due to sham, only a transaction that is aimed at achieving other legal consequences and covers up the different will of all participants in the transaction can be declared invalid. The intention of one participant to make a sham transaction is not enough for the application of legal norms. In our case, there is a counter provision that is actually received by the parties and which cannot be disputed, that is, neither the subject, nor the price of the transaction (and therefore the tax base), nor its subject composition changes. The prosecutor's office may demand that transactions made for a purpose that is obviously contrary to the foundations of law and order and morality, or that violate the requirements of legislative acts, be declared invalid. However, at present the transactions described do not fit any of these criteria.

Problems with banks regardless of jurisdiction

Banks are “black boxes” and the weakest link in the scheme.

Russian banks, in accordance with the recommendations of the Central Bank of the Russian Federation, will likely request additional documents for each incoming currency transaction, which will force compliance not from time to time, but as a process. Service failures are likely, which will require you to have several accounts and constantly search for adequate banks. The picture is similar with foreign banks, but to a greater extent due to the Russian citizenship of the final beneficiaries of the company and participants in the transaction.

How do cryptocurrency exchangers work?

Cryptocurrency exchanges are suitable for anyone who has that kind of money. But even without them, you can register and purchase currency for real money. The bottom line is that there are several offers from individuals and legal entities who offer to exchange their currency for yours at a certain rate. You need to choose the best one for you.

Information is updated in real time, so new offers appear every second. The system also takes a percentage for completing a transaction. After processing the transaction, the parties to the transaction receive the monetary units they need to an account linked to the online platform.

The system's commission can reach up to 5%, but usually does not exceed 3%. It is necessary to choose it wisely, because sometimes there is a chance of being deceived and losing your savings. There is a list of the most trusted exchangers on the Internet that are used all over the world.

Key benefits for the end client

Legal protection of the transaction

Unlike 'gray' schemes based on classic exchangers and p2p platforms, in a legal exchanger the end client will have some kind of legal protection, and therefore can take fewer risks and incur fewer security costs.

Better proof of source of income

In a legal transaction with a Russian legal entity, the client will receive supporting documents, and therefore will be able to more easily and cheaper legalize all or part of the funds from the sale of cryptocurrency - submit a 3-NDFL declaration, pay taxes and have better confirmation of the source of income.

Competitive fees and high limits

Exchange of cryptocurrencies through exchanges and payment systems that support input and output of Qiwi, Yandex.Money and bank cards (for example, Exmo, Cex, Advcash) is associated with high commissions and low limits. Naturally, along with the 'tax component', the cost of exchange will be significantly higher than on the black market. However, already on average exchange volumes the commission component will be comparable. Commissions of a foreign company will be optimized through exchange at favorable exchange rates and bank transfers in EUR via SEPA. The commissions of the Russian company for currency control are optimized by selecting banks focused on foreign trade activities, and for the payment of funds to physicists, developing co-branded banking products.

If you need to play by your own rules -

the proposed scheme allows you to carry out exchanges according to any of your own rules and have full control of all companies, assets in accounts and chains of transactions.

No need to delve into the nuances of currency legislation

Until 2020, Russian currency legislation does not allow individuals to fully work with foreign accounts. Starting from 2020, this will become possible, but only for 42 countries. Data as of September 2020 presented in Google Spreadsheet. This does not eliminate the need to submit a notification about opening a foreign account and monitor all legislative changes. Receiving funds into an account in a Russian bank according to our scheme will allow you not to deal with this issue in principle.

The risks of holding funds and blocking an account are minimal

When working with large exchanges (for example, Bitfinex and Bitstamp) and making deposits and withdrawals through individual bank accounts in both a Russian and foreign bank, there are risks of holding funds.

Banks comply with anti-money laundering legislation: Russian banks are interested in transactions with cryptocurrencies, foreign banks are interested in transactions of non-resident beneficiaries. When exchanging cryptocurrency through a legal exchanger, the end client (individual) may not have accounts at all in foreign banks, payment systems and exchanges, not delve into the nuances of currency legislation and not fight with the currency control, security and AML/CFT services of banks. Payment under an assignment agreement from the account of a Russian organization to the account of a Russian individual significantly reduces the risks of a bank requesting documents. But even in case of a request, the client has a full set of documents in Russian, certified by a Russian organization, and without mentioning the keyword 'cryptocurrency'. The original article is posted on lite.legal

Features of cryptocurrency exchangers

Currently, mainly two methods are used to carry out various operations with cryptocurrencies: using exchangers or exchanges. Each option has its own pros and cons. Characteristic features of using exchangers are:

- There is no need to register on the site and open a separate account;

- Efficiency of financial transactions;

- Possibility of making transactions with small amounts;

- Round-the-clock operation of this type of Internet resource;

- Regular appearance of new exchangers on the Internet, which provides the opportunity to choose transaction terms from a variety of options;

- As a rule, the conditions for exchanging cryptocurrency are less favorable compared to the exchange rate;

- A lower level of reliability of exchangers, noticeably inferior to a similar parameter of cryptocurrency exchanges.